- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Is Natural Death Covered In Term Insurance?

- Does a Term Life Insurance Plan Cover Natural Death?

- Common Causes of Natural Death Covered by Term Life Insurance

- When Might a Claim Be Denied

- Why the Right-Term Life Insurance Brokers Matter

- How to Buy Term Life Insurance Online

- Understanding Term Life Insurance Rates

- Why Getting Term Life Insurance with Canadian LIC is a Smart Choice

- More on Term Life Insurance

Is Natural Death Covered In Term Insurance?

By Harpreet Puri

CEO & Founder

- 11 min read

- February 3rd, 2025

SUMMARY

Term Life Insurance benefits various individuals, including families, business owners, and policyholders seeking financial protection. The blog explains how Term Life Insurance provides security for loved ones, covers debts, and supports future financial goals. It highlights its affordability, coverage flexibility, and tax-free payouts. The content also explores key factors influencing Term Life Insurance costs and why it’s a smart financial choice.

Understanding Coverage in a Term Life Insurance Plan

Most people ask whether a Term Life Insurance Policy pays for natural death. This is because most people assume that term insurance pays only for accidental deaths. It is essential to understand what the policy covers when the family relies on it for financial security. Most people do not know this, and it worries them if their loved ones will be taken care of financially in case of their natural death.

In Canada, one of the most reputable Term Life Insurance Brokers is frequently faced with the dilemma of hesitancy of clients who express doubts over whether their families would benefit from a policy if an illness or age-related complications cause it. This necessitates the knowledge of how term insurance works and what it comprises.

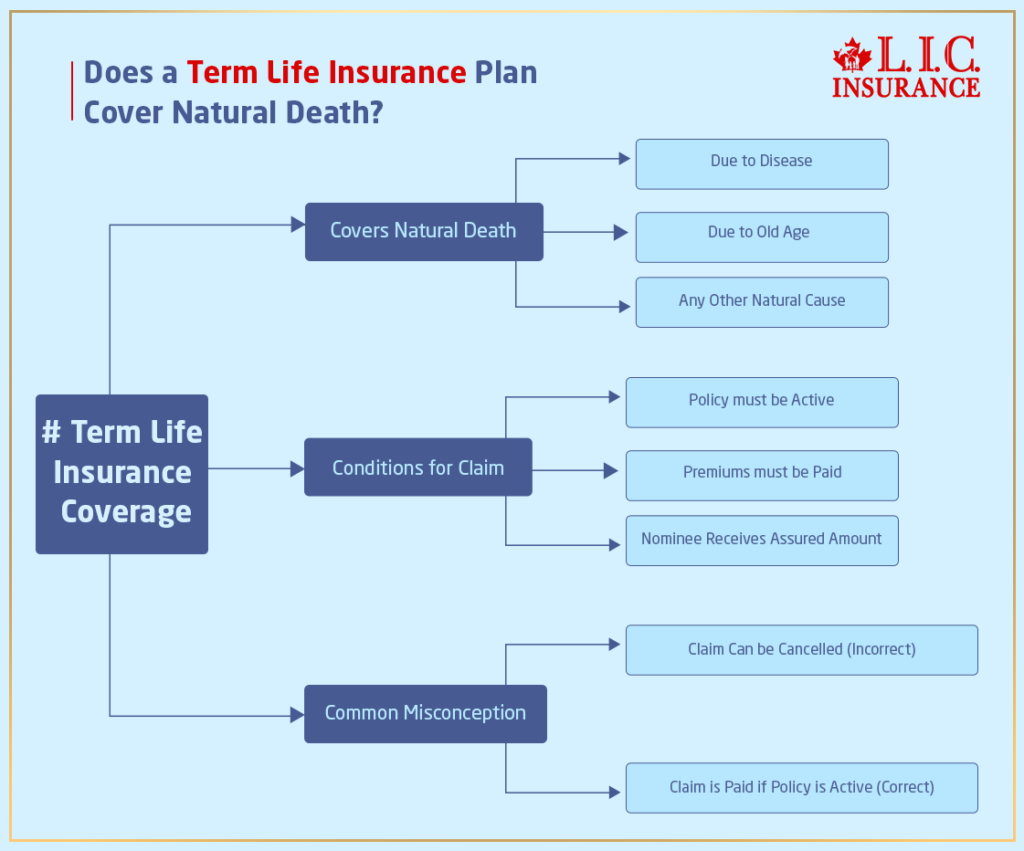

Does a Term Life Insurance Plan Cover Natural Death?

Yes, the natural death of an insured person is covered by Term Life Insurance. If a policyholder dies of a disease or old age-related illness or of any other cause that may be termed natural, the nominees will receive the amount assured. This is a life insurance policy specifically designed to make available money in case the life insured dies within the period the policy has been taken.

Many people think that an insurance company can cancel the claim in case of natural death, which is not correct. The money gets paid out as long as the policy is in force and premiums are paid, and that’s how it maintains the stability of the beneficiary.

Common Causes of Natural Death Covered by Term Life Insurance

It helps to know the meaning of a natural death while examining Term Life Insurance Rates. Some common causes of death included are as follows:

- Heart disease: Heart disease is one of the leading causes of death in Canada; so long as the person does not misrepresent any part of the medical history involved, heart disease is covered by term insurance.

- Cancer: Individuals are concerned that a pre-existing illness may impact their coverage. If the policyholder had been truthful about the present medical conditions at the time of purchase, the death benefit is paid.

- Respiratory Conditions: Chronic and long-standing conditions like COPD or pneumonia are covered with term insurance.

- Stroke: Any individual who dies because of a stroke shall have his or her claim processed as long as the policy is kept active.

- Complications from Diabetes: In case diabetes causes fatal complications, the benefits are paid out to the recipients.

- Age: Provided that the policy is active at the time of death from any form of aging, the family of the deceased receives the Life Insurance benefits.

When Might a Claim Be Denied

Term Life Insurance covers natural death; however, some reasons may exist where a claim is denied. Canadian LIC normally teaches its customers these aspects to avoid committing mistakes that will lead to denial. Some key reasons include:

1. Misrepresentation of Information

Most of the claims get rejected as submitting the application; wrong information is provided. In case a person does not mention any pre-existing medical condition and later dies of that, their insurance company will refuse to pay the death benefit.

2. Lapse in Policy

A Term Life Insurance Policy is in effect only so long as the policyholder pays premiums. The beneficiaries will receive no payout if the policy lapses because the policyholder stops paying premiums.

3. Death During the Contestability Period

Most insurance policies have a contestability period, usually the first two years of coverage. In this case, the insurer might take more time to investigate the claim if the insured dies during that period. If everything were indeed disclosed properly, the claim would still be honoured.

4. Exclusions in the Policy

Some policies will exclude deaths due to drug overdose or suicidal injuries. Read the terms before buying a policy.

Why the Right-Term Life Insurance Brokers Matter

Term Life Insurance Brokers may be the find of a lifetime when making a crucial decision about getting a policy selected. Many people become confused by the variety of coverage options and premium rates along with exclusions. A knowledgeable broker helps clients compare Term Life Insurance quotes in Canada and select the best-suited plan to their needs.

With a Canadian LIC, thousands of families have gotten the right coverage; they know everything about their policy. With the help of a seasoned broker, the process becomes much easier, and doubts over coverage are dispelled.

How to Buy Term Life Insurance Online

Digital means have made Term Life Insurance relatively easier to buy. Many appreciate sitting at home, comparing the policies, and making an application for such insurance. This is how it can be done in step-by-step detail:

- Assess Your Coverage Needs: Determine what your family may need in coverage in the event of your passing.

- Compare Term Life Insurance Quotes Canada: Compare different insurers and their quotes to determine the best premium.

- Choose a Reputable Insurer: Use the services of well-known insurance companies that experienced brokers recommend.

- Fill in the Application Form: Give accurate health and lifestyle information.

- Undergo Medical Checkup: Some policies require a medical checkup before final approval.

- Read the Terms – Read through policy exclusions and benefits to ensure they meet your expectations.

- Pay the First Premium: Once approved, pay the first premium to activate the policy.

Understanding Term Life Insurance Rates

Several factors influence Term Life Insurance Rates. Some of them are:

- Age: Younger people generally pay lesser rates since they are considered a lower risk.

- Health Condition: People suffering from chronic illnesses often have higher rates.

- Policy Term Length: A 10-year term policy would have lesser rates than a 30-year term.

- Coverage Amount: Higher coverage amounts attract higher premiums.

- Smoking Habits: Smokers generally pay more because of higher health risks.

A broker assists one in comparing different Term Life Insurance Quotes in Canada so that one can find cheap options.

Why Getting Term Life Insurance with Canadian LIC is a Smart Choice

Many individuals tend to delay their acquisition of a Term Life Insurance Plan, assuming they have ample time. However, such delay can culminate in expensive higher premiums or complete disqualification resulting from some health conditions. There are quite a few clients Canadian LIC has had who wished they’d gotten the policy earlier. Their team is always sure to communicate coverage details with the clients and guides them through everything.

Term insurance offers protection for loved ones’ finances after death, and the term covers natural death. That means if it’s illness or age-related complications, unexpectedly falling ill, then term insurance takes care of giving that assurance that families are secured financially.

For the online Term Life Insurance purchase, Canadian LIC offers expert advice, guiding clients in finding the best coverage at competitive rates.

Start today by contacting Canadian LIC, the best Term Life Insurance Brokers, and secure a reliable policy that suits your needs.

More on Term Life Insurance

- Who Is The Largest Provider Of Term Life Insurance?

- What Happens After 15-Year Term Life Insurance?

- What is a 5-Year Term Life Insurance Policy?

- What Is The Expiry Date On Term Life Insurance?

- What Is The Short Term Policy Rate?

- Can I Change My Nominee In Term Insurance?

- The Evolution Of Term Life Insurance: Past, Present, And Future

- From Confusion To Clarity: How Harpreet Puri Guided A Client Through Complex Term Life Insurance Decisions

- Do Rich People Have Term Life Insurance?

- What Are The Common Term Life Insurance Clauses?

- What Are The Disadvantages Of Joint Term Insurance?

- What Is The Oldest Age At Which You Can Get Term Life Insurance?

- How Do You Choose The Right Claim Payout Option For Your Term Insurance?

- Is There a Medical Exam for Term Life Insurance?

- Limited Pay vs Regular Pay Term Insurance

- When To Cancel Term Life Insurance?

- Best Term Life Insurance Plans For Couples

- Joint Term Insurance VS. Two Separate Term Plans

- Which Is Better – Term Insurance Or Health Insurance?

- Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

- Why Are Term Life Insurance Claims Rejected

- What Type Of Risk Is Covered By Short Term Insurance?

- What Happens If You Can’t Pay Your Term Life Insurance?

- What Will Disqualify You From Term Life Insurance?

- Can Riders Be Added To Term Life Insurance?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Insurance Policy?

Frequently Asked Questions: Is Natural Death Covered in Term Insurance?

Yes, the Term Life Insurance covers natural death. Suppose the insured dies of any medical condition, old age, or any other cause, irrespective of its accidental nature. In that case, the policy is continued by paying the sum assured to his or her nominated beneficiaries. A lot of families survive these payouts alone and live financially secure lives.

For any Term Life Insurance quotes in Canada, comparison is key before buying a policy. One way to do this is by soliciting quotes from different insurers while taking into account the coverage, term length, and premium rates. Most Canadian LIC clients prefer the work of brokers who make the comparison process easier and pick the cheapest quotation available.

Yes, you can buy Term Life Insurance easily online. Actually, many people would rather have their applications done online because they save much time and can compare the policies easily. Canadian LIC assists clients each day in choosing their right policy and ensuring they understand all the coverage details before purchasing.

Failure to disclose a pre-existing condition may make a claim decline. Most clients do not like revealing their health conditions due to the fear that they will increase Term Life Insurance Rates. The truth, however, is very important. Most Canadian LIC usually advise most of their clients to reveal all that may happen nothing wrong later.

Indeed, Term Life Insurance Brokers are an important part of finding the correct coverage. Most people find policy details and exclusions too complicated. Brokers like Canadian LIC make it simple, ensuring the client understands everything before making a decision.

Yes, Term Life Insurance provides coverage for age-related ailments, provided the plan is active during that time. Most families question whether their claims will be valid in case their loved one succumbs to unnatural causes such as heart attack and stroke. To the relief of most clients, Canadian LIC assisted in ensuring various policies remained current to ensure claims were paid off.

Term Life Insurance premiums rise with age. Young applicants receive lower rates because they pose less risk to the insurer. Many clients of Canadian LIC wish they had applied sooner since delaying means higher rates.

If the premium payment is missed, it can cause a policy to lapse. Then, the policy would be covered no more, and the beneficiaries wouldn’t get paid out. Lots of clients seek Canadian LIC to reinstate their policy. Grace periods exist in some firms, but of course, payment is always preferred to be timely.

Yes, most policies renew; however, Term Life Insurance Rates will be higher because of age and possible health concerns. The Canadian LIC always suggests its clients check for renewal options beforehand so they do not have any shock on their rates.

In the case where all the required documents are presented, most insurance companies will pay their claims in a few weeks. Over time, Canadian LIC has assisted thousands of families in navigating this process towards quick processing and payout.

Some Term Life Insurance Policies allow for conversion into a Permanent Policy without medical underwriting. Many clients choose this option if they need lifelong coverage. Canadian LIC frequently assists clients in finding conversion options before the expiration of their term policy.

Beneficiaries need a death certificate, policy documents, and identification to file a claim. The Canadian LIC has been known to regularly help families prepare the paperwork to ensure the claims process goes as smoothly as possible.

The major cause of death Term Life Insurance Plans cover. However, certain exclusions do apply. These include suicides during the first two years after contracting the policy, self-inflicted injuries, or fraudulent claims. Canadian LIC ensures that its clients understand all of these exclusions before entering a policy commitment.

Canadian LIC is there to assist clients in comparing Term Life Insurance quotes in Canada, understanding the terms of the policy, and selecting the best coverage. Many feel overwhelmed when making a choice; however, through experienced brokers, they are guaranteed the right protection for their loved ones.

To get cheaper Term Life Insurance, keep your body fit and smoke-free and apply at an earlier age. The Canadian LIC advises clients from time to time to make changes in their lifestyles so that they can gain affordable premiums.

Some insurers offer clients the option of increasing coverage with no medical examinations at specific ages. Canadian LIC assists clients in selecting policies whose options are versatile, thereby easily adjusting coverage whenever their financial burdens increase.

If your coverage lapses and you have to reapply again, your Term Life Insurance Rates again increase due to this age and changes in health-related factors. Canadian LIC makes every effort not to let any of its clients’ policies lapse by reinstatement if possible.

To keep the Term Life Insurance Plan active, pay premiums on time and review policy details from time to time. Canadian LIC suggests auto-payments or reminders to prevent accidental lapses.

Yes, they can be used to fulfill any of their financial requirements like repaying loans, regular expenditures, and financing education. Canadian LIC has seen that these payouts were long-term money stabilizers for families.

The best Term Life Insurance to buy online is through comparison, reading the details of policies, and employing brokers like Canadian LIC. Most clients opt for professional advice to prevent failure to comply with necessary measures that will deny claims.

Choosing the right Term Life Insurance Plan ensures financial security for loved ones. Working with experienced Term Life Insurance Brokers like Canadian LIC makes the process easier, helping clients secure the best coverage at competitive rates.

Sources and Further Reading

- Aflac: Provides an overview of Term Life Insurance, its features, and types, including fixed, increasing, decreasing, and annual renewable term policies.

aflac.com - Guardian Life: Explains the basics of Term Life Insurance, how it works, and key considerations when choosing a policy.

guardianlife.com - Investopedia: Offers a comprehensive guide on Term Life Insurance, detailing its definition, cost factors, and comparisons with permanent life insurance.

investopedia.com - New York Life: Discusses the benefits of Term Life Insurance, including short-term death benefit protection and policy features.

newyorklife.com - Allstate: Provides insights into what Term Life Insurance is and how it can help beneficiaries replace income in the event of the policyholder’s death.

allstate.com

Key Takeaways

- Financial Protection for Families – Term Life Insurance provides financial security for dependents, ensuring they can maintain their standard of living if the policyholder passes away.

- Affordable Coverage – Compared to permanent life insurance, term policies offer lower premiums, making them accessible for individuals seeking cost-effective protection.

- Debt Coverage – Helps cover outstanding debts such as mortgages, loans, and credit card balances, preventing financial burdens on loved ones.

- Income Replacement – Replaces lost income, allowing beneficiaries to manage daily expenses, education costs, and future financial goals.

- Business Protection – Business owners can use Term Life Insurance to protect their enterprises by covering key employees or securing business loans.

- Customizable Policy Terms – Policies are available for fixed durations (10, 20, 30 years), allowing individuals to choose coverage based on their financial situation and responsibilities.

- Tax-Free Death Benefit – The payout is typically tax-free, ensuring beneficiaries receive the full benefit amount without deductions.

- Peace of Mind for Parents – Parents can ensure their children’s financial stability, including funding education expenses and essential needs.

- Convertible Options – Some policies allow conversion to permanent life insurance without undergoing a new medical exam, providing long-term security.

- Ideal for Young Adults and New Families – Young individuals and new parents benefit from lower premiums and extensive coverage to safeguard their family’s future.

Your Feedback Is Very Important To Us

We appreciate your taking the time to share your thoughts. Your responses will help us understand the challenges people face regarding natural death coverage in term insurance.

IN THIS ARTICLE

- Is Natural Death Covered In Term Insurance?

- Does a Term Life Insurance Plan Cover Natural Death?

- Common Causes of Natural Death Covered by Term Life Insurance

- When Might a Claim Be Denied

- Why the Right-Term Life Insurance Brokers Matter

- How to Buy Term Life Insurance Online

- Understanding Term Life Insurance Rates

- Why Getting Term Life Insurance with Canadian LIC is a Smart Choice

- More on Term Life Insurance