You have just moved into your dream home in Canada—the paint is still fresh, and everything feels right with the furniture. A very important choice is hidden in all that excitement: how should you protect this valuable asset and secure your family? Will it be through Mortgage Protection Insurance—many people would find this an easy option—or will Life Insurance be the main protection many people use? There could not be a more important choice for Canadians than this.

At Canadian LIC, being the best insurance brokerage, we see those dilemmas every day. Let’s look at the story of Sarah and Tom, a young couple who just bought their first house. They were overwhelmed by choices for “Mortgage Protection Insurance Canada” and different “Mortgage Insurance Quotes.” There were so many options, but they knew it was important to pick the right one. This is just one story, but it shows some very real problems and questions that far too many Canadians face every day: Which type of insurance covers my family and home the best?

Here, we’ll delve deep into the world of Mortgage Insurance vs. Life Insurance in Canada and find out which may be better for your needs. We want to take you through these complex choices, using engaging and relevant scenarios from our everyday experience here at Canadian LIC to make them more accessible and familiar. Let us walk this journey together. Discover how you can protect your family’s future by understanding the details of each choice.

What is Mortgage Protection Insurance?

Mortgage Protection Insurance in Canada is a protection designed only to pay off the outstanding balance on your mortgage in case of death. Sarah and John are clients of Canadian LIC who just purchased their dream home in Vancouver. When John unexpectedly fell ill and passed away, their Mortgage Life Insurance Policy paid off their remaining mortgage balance so that Sarah was able to retain the home without the crushing burden of monthly mortgage payments. These are not uncommon stories; they are meant to show one crucial benefit of MPI: security that keeps your family’s home safe.

Notice that when seeking a ‘Mortgage Insurance Quote,’ the amount you pay each month for Mortgage Life Insurance is generally structured to align with your mortgage balance and goes down over time. This kind of insurance is conveniently applied for at banks or other lenders when you finally secure your mortgage, and the insurance, in this case, is easy to apply for.

How Does Life Insurance Compare?

On the other hand, Life Insurance offers broader coverage and is not limited to your mortgage only. It pays a lump sum, which your beneficiaries can then use in a way they feel is necessary for them to cope with the loss, be it in the form of paying off your mortgage, covering their living expenses, or investing in your child’s education. Take, for instance, Melissa from Ottawa, another Canadian LIC client whose Life Insurance allowed her family to pay off the mortgage and face the son’s university tuition after her sudden death.

There are many types of Life Insurance Policies, including Whole Life and Term Life, and each has different benefits. They can be tailored to suit your family and financial goals, offering flexibility that Mortgage Life Insurance can’t offer.

The Impact of Choice

Canadian LIC has seen firsthand how the choice between these two insurance types affects families. Take the case of the Thompson family in Calgary—they made up their mind to acquire a Term Life Insurance Policy. It happened after months of consideration and the need for a safety net that could do a little more than just pay off the mortgage. Their story is a testament to the peace of mind that a well-chosen Life Insurance Policy can bring.

Conversely, the Petersons from Edmonton opted for Mortgage Life Insurance, drawn by its simplicity and direct correlation to their mortgage obligations. Their story would take a different turn when they realized that while their mortgage was covered, other debts and living expenses still posed a financial challenge after the main breadwinner’s death.

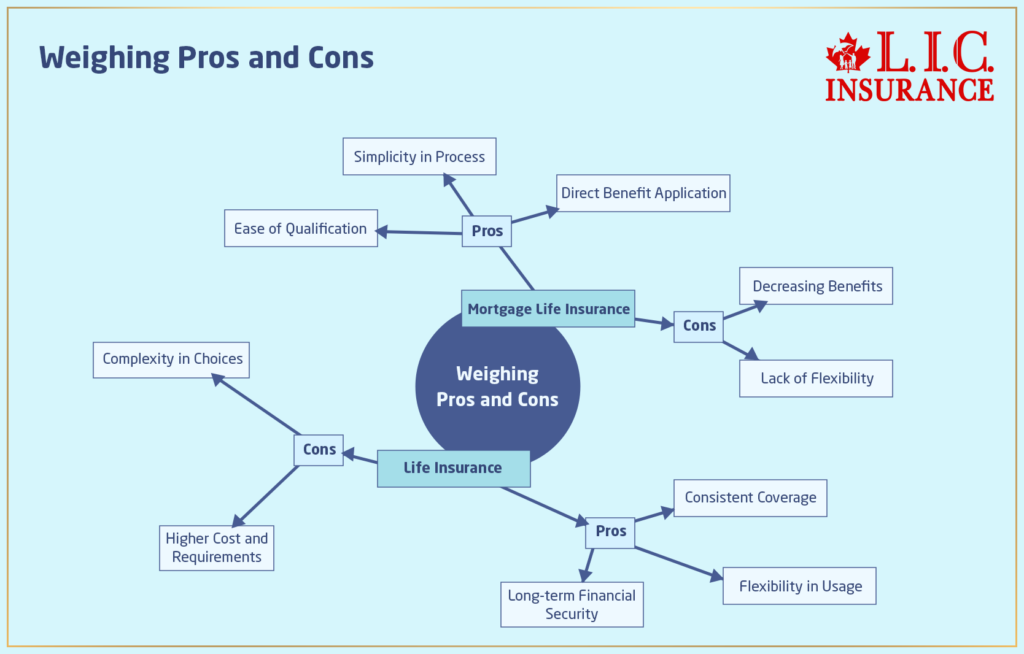

Weighing Pros and Cons

When considering Mortgage Life Insurance and traditional Life Insurance in Canada, it is all about weighing the pros and cons between them. There’s a lot to learn in terms of what is best for you and your family’s financial security. Let’s get to know this in further detail.

Pros of Mortgage Protection Insurance

Ease of Qualification

Mark from Winnipeg was relieved when he qualified for Mortgage Life Insurance without a medical exam. Given his medical history, this was a pivotal factor in his choice.

Mortgage Life Insurance often does not require a medical exam, making it a straightforward option for those with health concerns, if they will qualify for it or not.

Simplicity in Process

When the Chen family purchased their first home in Toronto, they found the process of adding Mortgage Life Insurance through their mortgage lender incredibly simple and integrated into their mortgage setup.

The process of obtaining Mortgage Protection Insurance is often streamlined with your mortgage application, simplifying the steps you need to take.

Direct Benefit Application

After the unexpected passing of Alicia in Cambridge, her Mortgage Life Insurance Policy covered the remaining balance of her home loan, ensuring her children could remain in their family home.

The payout from Mortgage Life Insurance is directly used to pay off your mortgage, ensuring your family’s housing security.

Cons of Mortgage Protection Insurance

Decreasing Benefits

The Simons in Calgary noticed that as they paid down their mortgage, the potential payout from their Mortgage Protection Insurance decreased, which limited their coverage over time.

As you pay down your mortgage, the coverage amount decreases, which may not align with your family’s growing financial needs.

Lack of Flexibility

When the Patel family from Vancouver needed to redirect funds to urgent medical bills, they realized their Mortgage Protection Insurance could not be adjusted to cover these expenses.

Mortgage Life Insurance is rigid, offering no flexibility in how the benefits can be used or adjusted.

Pros of Life Insurance

Consistent Coverage

Even after paying off half of their mortgage, the Robinsons from Edmonton enjoyed the same level of coverage from their Life Insurance Policy.

Life Insurance provides a consistent benefit amount regardless of changes in your mortgage balance.

Flexibility in Usage

When Tom in Windsor passed away, his Life Insurance payout helped his family clear their mortgage and finance their daughter’s education.

Beneficiaries can use the Life Insurance payout for various financial needs, not just the mortgage.

Long-term Financial Security

Nora from Ottawa chose Life Insurance, knowing it would support her children’s future needs long after her mortgage was paid off.

Life Insurance offers a broader financial safety net, which can adapt to your family’s changing financial circumstances.

Cons of Life Insurance

Higher Cost and Requirements

The Lee family found Life Insurance’s initial costs and medical exam requirements daunting but felt reassured by its comprehensive coverage.

Life Insurance typically requires medical exams and comes with higher initial costs, but it provides extensive coverage.

Complexity in Choices

Choosing between Term Life Insurance and Whole Life Insurance options confused Derek from Ottawa initially, requiring him to seek additional advice to make an informed decision.

The variety of Life Insurance products available can be complex to navigate without proper guidance.

Consider these real-life stories from Canadian LIC as you think about ‘Mortgage Protection Insurance Canada’ or getting a ‘Mortgage Insurance Quote.’ Each story makes the point that insurance isn’t something you buy to meet your urgent needs but to help you reach your long-term goals. Now, whether you want something simple and quick to cover you or something flexible and safe in the long term, the choice you make will have a big impact on your family’s finances.

Summary of Pros and Cons

| Insurance Type | Pros | Cons |

|---|---|---|

| Mortgage Protection Insurance | – Ease of qualification (no medical exam) | – Decreasing benefits as mortgage is paid |

| – Simplicity in process (integrated with mortgage) | – Lack of flexibility (only covers mortgage) | |

| – Direct benefit application (covers mortgage directly) | ||

| Life Insurance | – Consistent coverage (fixed benefit amount) | – Higher cost and medical exam requirements |

| – Flexibility in usage (funds can be used freely) | – Complexity in choices (term vs. whole life) | |

| – Long-term financial security (beyond mortgage) |

The Final Wrap Up

The choice between Mortgage Life Insurance and Life Insurance is more about how one wants to protect the future of one’s family rather than a purely financial decision. At Canadian LIC, we understand how difficult these choices can be and remain committed to guiding you at each step.

As we have seen from the real-life stories of our clients, the right decision varies according to individual circumstances. The only constant is the need for a guiding hand, one that can help a person sort through the complexities of insurance options.

If you’re considering securing your home and family’s future, think about what you’ve learned today. Reach out to us at Canadian LIC for a custom’ Mortgage Insurance Quote’ or to discuss how our Life Insurance options might provide the type of protection you need to protect the ones you love. Protection for your family’s dreams and aspirations regarding their future depends on the decision you are going to make today. Your peace of mind is just one consultation away.

Find Out: Who pays for Mortgage Insurance in Canada?

Find Out: The Best Mortgage Rates In Canada

Find Out: How To Save Money On Mortgage Insurance?

Find Out: Know everything about Mortgage Insurance

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions About Mortgage Protection Insurance and Life Insurance in Canada

Mortgage Life Insurance in Canada aims to pay the outstanding balance of your mortgage upon death. In applying for such insurance, you will not have to answer many questions relating to your health, and in most instances, there is no need for a medical checkup. The amount of coverage decreases with a mortgage paydown, so it ensures that your family won’t handle the financial stress resulting from monthly mortgage payments when you die.

Getting a quote for Mortgage Insurance in Canada is simple. You may call Canadian LIC or visit our website to begin with. We will ask you a few easy questions regarding your mortgage amount, any term you expect out of the loan, and some personal details like age, health conditions, if any, etc. Based on this information, we provide you with a quote that fits your needs. Remember, comparing quotes can help you find the best coverage options and rates.

The key differences are, therefore, in flexibility and scope of coverage. Mortgage Life Insurance will bind you to your mortgage so that in case of death, the remainder of your mortgage is paid for. Life Insurance provides money in a lump sum that your beneficiaries can use for any purpose—be it for paying off debts, covering living expenses, or funding education.

Yes, you can change over to Life Insurance from a Mortgage Insurance Policy later in the future if your needs change. At Canadian LIC, we often help clients who initially chose mortgage life because it was straightforward and then later realized they needed more comprehensive coverage to secure their family’s financial future. Transitioning is usually not difficult at all, but renewal may need to be based on a medical examination to ascribe the new terms of the policy.

Generally, the cost of Mortgage Life Insurance might initially be lower, but because the coverage decreases over time, it may not always represent the best long-term value. Life Insurance premiums are based on the coverage amount and can be higher, but the benefit remains consistent throughout the term of the policy.

Consider your financial situation, your family’s needs, and your long-term goals. If you want a simple, no-nonsense policy to cover only your mortgage, then consider Mortgage Life Insurance. On the other hand, if you have personal coverage needs beyond your mortgage, you may want to make provisions for your family’s future; in that case, you may be in need of Life Insurance. Think about what is going to offer the best financial security and the most peace of mind for your family in the end.

Canada’s Mortgage Protection Insurance normally pays out very quickly when the claim is verified. This fast processing helps ensure that your mortgage burden is lifted from your family’s shoulders as soon as possible. For example, a client testified at Canadian LIC that the mortgage was immediately covered after her sudden loss of a partner; this made her reduce her immediate financial stress.

Generally, proceeds from both Mortgage Protection Insurance and Life Insurance in Canada are tax-free. This means your beneficiaries will get to use the full value without worrying about detractions of any amount for tax purposes. Many times, we reassure people, like Paul of Montreal, who thought the amount for tax would eat into what his family would receive, that such benefits are designed to give the full support without adding financial burdens.

Yes, it is very common to have both policies running simultaneously for complete coverage. Many of our clients at Canadian LIC choose to hold Mortgage Protection Insurance specifically to cover the home loan while keeping a Life Insurance Policy to provide broader financial security for the future of the family. This way, no matter what may happen, all possible financial needs are accounted for.

If you refinance your home or switch lenders, you may need to reapply for Mortgage Protection Insurance, as these policies are typically tied to the original mortgage agreement. We have helped many clients through this transition process so they remain covered without interruption and never have a period without protection. This is important to bear in mind when refinancing or changing your mortgage terms—the continuity of protection.

Comparing quotes from many different insurers will ensure the best Mortgage Insurance Quote is given. Canadian LIC can provide this comparison of quotes from our many mortgage providers in order to secure the most competitive rates and ideal coverage options for your particular needs. Comparing quotes is one of the most effective ways to get the right policy.

Whether it is marriage, the addition of a baby, or any sudden change to your financial situation, it may call for adjustments in your insurance policies. One of the things that Canadian LIC does quite regularly is to review and update policies to keep them current with clients’ changing needs. Reviewing your policies will keep them updated for adequate coverage as your life changes.

Filing a claim involves notifying your insurance company about the event (such as a death) and submitting the necessary documentation, which may include a death certificate and proof of identity. Canadian LIC works with clients through this process and makes it easy and hassle-free so that family members can focus on their well-being without additional burdens.

These FAQs have been designed to enlighten you further on ‘Mortgage Protection Insurance Canada’ by making the concepts more communicable and relatable. They share our everyday client stories to help you understand your options in a more easy way that will help you make an informed choice.

Sources and Further Reading

To gain a deeper understanding of Mortgage Protection Insurance and Life Insurance in Canada, consider exploring the following resources:

Financial Consumer Agency of Canada (FCAC) – Provides comprehensive information on insurance products available to Canadians, including guides on choosing the right type of insurance for your needs.

Website: fcac-acfc.gc.ca

Canadian Life and Health Insurance Association (CLHIA) – Offers detailed insights into life and health insurance products, including Mortgage Protection Insurance, with resources tailored to help consumers make informed decisions.

Website: clhia.ca

Insurance Bureau of Canada (IBC) – Features tools and resources for understanding various insurance policies, their benefits, and how to effectively manage them.

Website: insurance-canada.ca

Canada Revenue Agency (CRA) – For tax-related information regarding insurance payouts and benefits in Canada.

Website: cra-arc.gc.ca

Canadian Bankers Association – Provides information on how banks handle insurance, including Mortgage Protection Insurance, which can be useful for understanding the tie-ins with mortgage products.

Website: cba.ca

These resources can provide valuable additional information and help ensure that you are well-informed about your insurance choices in Canada.

Key Takeaways

- Mortgage Protection Insurance is tied to your mortgage and decreases in value, while Life Insurance offers a fixed benefit for any purpose.

- Mortgage Protection Insurance often does not require a medical exam, offering easy access.

- Life Insurance provides more flexibility and comprehensive coverage for long-term financial planning.

- Initially, mortgage protection might seem affordable, but Life Insurance may offer better long-term value as coverage does not decrease.

- Life Insurance Policies can be adjusted to meet changing financial situations and family needs.

- Consulting with professionals like those at Canadian LIC can provide tailored advice to help make the best insurance decision.

Your Feedback Is Very Important To Us

We appreciate your time in helping us understand your struggles and needs when deciding between Mortgage Protection Insurance and Life Insurance. Your feedback will enable us to tailor our services and resources to better assist you and others in making informed decisions.

Thank you for your participation. Your input is invaluable and will help us improve the guidance and services we offer to individuals like you, making crucial financial protection decisions.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]