Dealing with Mortgage Insurance can often feel like trying to find your way in a dense fog. When you buy your first home or refinance a property you already have, it’s important to know the differences between insurance plans and how much they cost. “Is Mortgage Insurance paid monthly or yearly?” is possibly a question that a lot of you have thought about. In this blog, we wanted to answer this question so that everyone could decide what they want to do.

Introduction to Mortgage Insurance

Some people say that Mortgage Insurance is the only thing that can save many first-time homebuyers. This is a form of safety net for the lender—a kind of invisible shield, partly or fully compensating the lender if the borrower defaults on the loan that hasn’t been returned. For many, the concept of Mortgage Insurance is tangled with confusion and a lot of questions. “How does it work? What would it cost me?” Many Canadians are wondering these questions when they lie awake at night, trying to figure out how to make homeownership a reality.

These are some of the difficulties in understanding Mortgage Insurance. Assuming you are going to buy your first house: You saved diligently year after year and worked hard at work, only to discover that your monthly mortgage payment now included an additional cost for Mortgage Insurance. Having unforeseen expenses, confusing insurance plans, and fearing all this, you’ll make the wrong decision, which is quite annoying. We’re going to help you understand all these questions concerning Mortgage Insurance and try to resolve any confusion you might have.

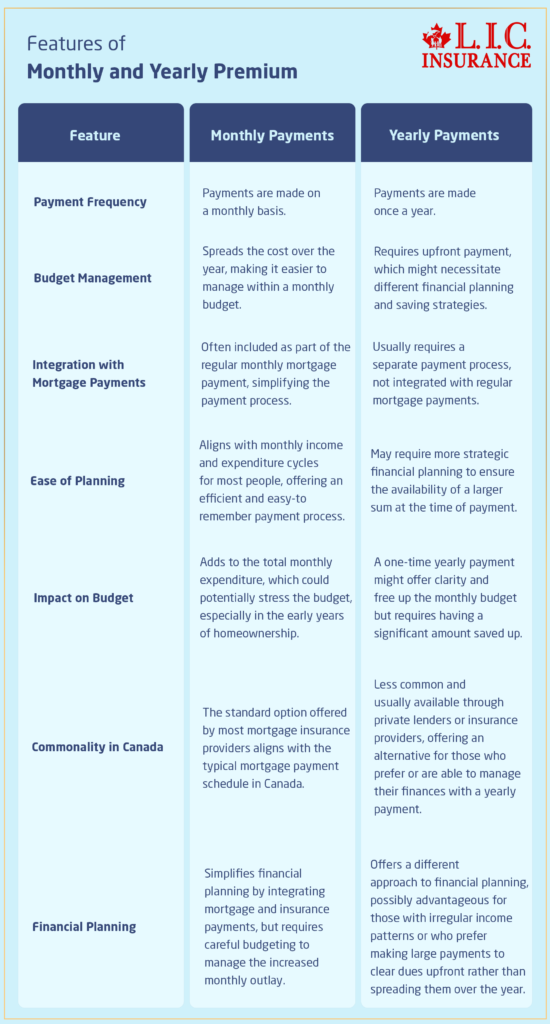

Payment Schedules: Monthly vs. Yearly

Whether you pay Mortgage Insurance on a monthly or annual basis, it is an issue that transcends the timeline and is at the core of any financial planning a homeowner might have. Most plans of Mortgage Insurance include the mortgage payments as added amounts that you pay with your regular monthly Mortgage Insurance premium payment. The arrangement saves most of the work involved; the individual would not have to separately think of making an annual Mortgage Insurance premium payment. It helps him/her focus on effectively managing his monthly budget.

Monthly Payments: A Closer Look

Some of the benefits that come with paying your mortgage amount together with your mortgage monthly are: it is spread over the year, so cumulatively, it adds up within your monthly budget; it aligns with your mortgage payment schedule, so you have an efficient and easy-to-remember one-step payment process.

Of course, this added convenience comes with its own set of challenges. For one, including the insurance expense in your monthly dues necessarily means adding to your total amount paid out every month. This could stress your budget, especially in the earlier years of home ownership. Most importantly, all this adds up to the expense of being a homeowner, and every homeowner should be inculcated with the knowledge of how to go around these things without going over budget.

Yearly Payments: A Rarity in Canada

While most Canadian Mortgage Insurances require monthly payments, there are instances where yearly options may be available—usually through private lenders or insurance providers. However, these are less common and typically will require a different financial arrangement. If you think in this manner, you must get all the pros and cons of your annual budget and financial planning strategies.

Real-Life Solutions

There is no comparison between this and managing Mortgage Insurance payments in real life. For example, let’s take the story of Maria and Raj, who recently moved to Canada and were active in the housing market for the first time. Knowing every little detail about Mortgage Insurance payments is important because it indicates decisions that are critical for a family’s financial future.

Or there’s Alex, a solo parent who’s been on her toes just to give her child a stable home. Adding the cost of Mortgage Insurance to their monthly bills shows that they need to rework their budget, get rid of unnecessary spending, and look for ways to make more money.

These are the stories that remind us of the shared struggles and triumphs with so many Canadians, underlining the importance of clear, accessible information and resources that can help them best work through their Mortgage Insurance Plans.

Understanding Mortgage Insurance Plans

All Mortgage Insurance Plans are not created equal. The cost of the Mortgage Insurance policy will vary, with the down payment and home price just two factors that need mentioning. Most of the time, the lower the down payment, the higher the premium your Mortgage Insurance will incur because the lender takes a higher level of risk since he is lending to those with a smaller down payment.

Besides that, the borrower has to really identify the best Mortgage Insurance plan. Each scheme has its own rules, and those rules may limit the coverage in some way. It can be hard to find your way through the confusing system if you haven’t done a lot of research.

From here, the difficulties of understanding the specifics of complex insurance words and making sense start. However, this is the task you should take on if you want to find the best Mortgage Insurance plan for your needs.

For instance, the problem might be how to figure out how much, in the long run, it’s going to cost to have Mortgage Insurance. How are you going to establish if upfront payments are cheaper than monthly payments in your case? Do you know how painful it is to think about how much cover you might actually need if you didn’t have a calculator to help you along the way? These are not just theoretical examples but real problems that affect your sound financial life.

As a result of hearing from a friend or family member who tried it and lost, they make sure not to pay too much for Mortgage Insurance or buy a plan that doesn’t totally protect their interests. But knowing how Mortgage Insurance works would help you see things clearly. This would then allow you to make smart choices that will protect your future without putting you in debt.

Find Out: How to save money on Mortgage Insurance?

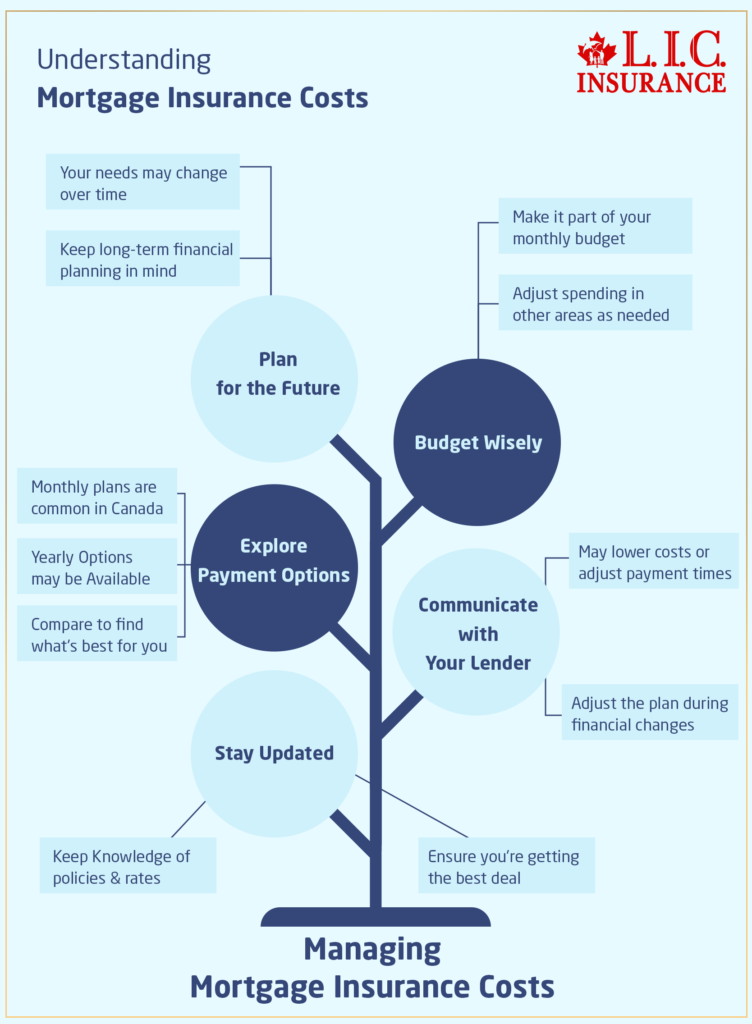

Understanding Mortgage Insurance Costs

Understanding and managing your Mortgage Insurance cost, therefore, becomes an important aspect of staying financially healthy to accomplish your long-term goal of homeownership. The following points will help you deal with costs better:

Budget Wisely: Make the Mortgage Insurance payment part of your monthly budget right from the start. This way, you will never be caught off guard, and your spending in other areas can be adjusted as and when required.

Explore Payment Options: Most of these institutions in Canada have monthly payment plans, although some might offer yearly options. Compare to see which is best for your financial practices and cash flow.

Communicate with Your Lender: Whenever there will come a point in time where there would be financial hardships on your part or when there would be significant improvement in your financial status, try to initiate to your lender to adjust the Mortgage Insurance plan. You may have options to lower your costs or make adjustments to the payment time frame.

Stay updated with Mortgage Insurance policies and rates. Maintain knowledge of your policy and the market to ensure you’re always getting the best deal.

Be ready to pay for it in the future—your Mortgage Insurance needs may very well change with time as you pay down the mortgage and as equity in your home begins to grow. Keep that in mind when pondering long-term financial planning.

The Solution: Simplifying Mortgage Insurance Decisions

This is the key to overcoming this struggle: gaining deep insight into Mortgage Insurance Plans and understanding the different factors that affect the cost of Mortgage Insurance. In the next few lines, we shall elaborate on some of the actions that an individual can take to help ease this decision-making process.

Educate Yourself: Take some time to look more into Mortgage Insurance. Even if one gains an understanding of some of the basic concepts, still it will go a long way in helping demystify things and make it easier to reach some good decisions.

Consult the Experts: Do not hesitate to consult a financial advisor or mortgage broker. He or she will be in a very good position to give personable advice that is in line with the financial situation at hand and will help you go through the details of Mortgage Insurance Plans.

Compare Quotes: Always compare quotes from more than one provider before making your mind up. This way, you should have a clearer picture of the market and be able to identify the best deal that will balance cost with coverage.

Consider Your Long-Term Financial Goals: Weigh in on your long-term financial goals when having to make the decision between paying monthly or yearly for your chosen option. However, if affordable, one should make a lump-sum payment upfront in case one of your priorities is saving money over the life of your mortgage.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Closing Note: The Path Forward

Finding your way around Mortgage Insurance can be hard, but if you have the right information, tools, and resources, you can make smart choices that will help you reach your financial goals. So if you want “Peace of Mind,” you can pick a plan with low monthly premiums on mortgage, or you can choose to pay once a year. It’s your choice.

The most important thing is to start the process of getting your Mortgage Insurance plan right away. Delays will only cause more problems in the future, and the worst thing that could happen is stress over money. Purchasing a home is a very important decision, and you can deal with the complicated processes with the appropriate strategy.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQ's on Mortgage Insurance

Mortgage Insurance protects the lender in case you’re unable to make your mortgage payments. This requirement arises if your down payment is less than 20% of the home’s purchase price. In this way, you can buy a home with less than a full 20% down payment, and hence, you will be able to become a homeowner that much sooner.

Mortgage Insurance can be paid off in two ways: it can be added as part of your mortgage payment every month, or you can pay it once and for all as a single lump sum. Most people will prefer the monthly option to save them from the hassle of managing Mortgage Insurance life over the life of the mortgage.

And how much is Mortgage Insurance? The rate for the Mortgage Insurance will depend on the down payment amount and the total sum for your mortgage. The lower the amount of the down payment, the higher the insurance cost, as this is a risk to the lender.

Usually, the price is decided between the very first agreement. If you choose the monthly payment plan, guess what? Your monthly payments will stay the same for as long as you have the mortgage. However, refinancing your mortgage and making substantial changes to the original mortgage agreement can impact the cost of your Mortgage Insurance.

The most obvious, classical way to cut or avoid Mortgage Insurance is to pay down at least 20%. This implies that with more than 20% down, one is getting the most favourable conditions for mortgage rates and most likely has good chances for negotiations regarding insurance rates.

No, they do provide different kinds of Mortgage Insurance policies, and each one has its own set of terms and conditions, along with costs associated. In such a scenario, these are to be compared in totality, and if possible, then a person should consult an insurance broker or financial advisor to find out which policy fits the requirement within the budget.

Generally, if you pay down or off a mortgage early, you don’t get a refund for some of the premiums you’ve paid for Mortgage Insurance. Mortgage Insurance is calculated and put in at the time of the first mortgage.

There is the issue of, in some cases, the fees or penalties that come with changing your Mortgage Insurance provider or plan after you have already entered into a mortgage. Choose wisely and research the Mortgage Insurance Plans thoroughly to be able to determine the one that will best befit you from the onset in order to avoid this hassle.

The right policy should be chosen only after considering the capacity of the reviewed finances, comparing different Mortgage Insurance policies, and possibly seeking advice from a professional. Consider the options available for coverage, the total Mortgage Insurance cost, and the flexibility provided for the payments in order to meet your financial goals and offer sufficient protection.

For more details and concrete advice, contact a mortgage broker or financial adviser who can better guide you. Further, do your research on the Internet and visit the sites of the different suppliers of Mortgage Insurance.

Your Mortgage Insurance premium is typically fixed, especially after the mortgage agreement is in place. However, there are specific scenarios in which the cost of your Mortgage Insurance may change.

For example, you will pay more in case of borrowing more money when refinancing your mortgage, or in case your insurance provider increases or changes the rates for Mortgage Insurance to be paid. Always read your Mortgage Insurance policy fine print for changes to your premium and under what circumstances, if any, they can change.

The Mortgage Insurance premiums on residential property are generally nondeductible in Canada. Homeowners cannot, therefore, deduct their Mortgage Insurance premiums as part of itemized deduction from their personal tax return to reduce their taxable income.

This, however, has exclusions for those properties that generate rental income. Renting out a part of your home or owning a rental property means that your share of the Mortgage Insurance premium is tax-deductible as part of your daily operating costs. It’s advisable to consult with a tax professional for advice specific to your situation.

Generally, the Mortgage Insurance premiums are not tax-deductible. However, in rental properties where some part of the property is rented out, part of the Mortgage Insurance premiums can be deductible.

The deductible amount would be proportionate to the amount of the home or property that is rented out. For exact computation and how they may apply to you, it would be best to consult a tax advisor or accountant. The tax laws are subject to change periodically and are very complex.

Canada Mortgage Insurance protects the lender from the inherent risk of borrower default in payments. In this case, the insurance doesn’t cover any late payments made by the borrower, nor does it protect the borrower’s personal property. It gives the investor a safety net so they can give mortgages to buyers with smaller down payments, usually less than 20% of the purchase price.

This kind of insurance where they can give mortgages to buyers with smaller down payments can be used to repay a lender for the owed loan amount and any costs that may have been spent if the mortgage went into default. Homeowners should know, though, that this kind of Mortgage Insurance doesn’t help the lender directly. Instead, it gives buyers access to a much larger pool of lenders who will finance their homes.

Sources and Further Reading

To further enrich your understanding of mortgage insurance in Canada, including aspects like payment frequency, costs, and coverage, here are some recommended sources and further reading materials. These resources offer a wealth of information for anyone looking to dive deeper into the world of mortgage insurance, providing clarity and guidance on this complex subject.

Recommended Sources and Further Reading

- Canada Mortgage and Housing Corporation (CMHC): The CMHC provides comprehensive details on mortgage loan insurance, including how it works, eligibility criteria, and costs. It's an excellent starting point for understanding the basics and nuances of mortgage insurance in Canada. Visit the CMHC website.

- Financial Consumer Agency of Canada (FCAC): The FCAC offers information on various financial products, including mortgage insurance. Their resources are designed to help consumers make informed financial decisions. Explore the FCAC resources

- Canadian Bankers Association (CBA): The CBA provides insights into the banking industry, including information on mortgages and mortgage insurance. Their guides can help you understand the financial implications of mortgage insurance. Check out the CBA guides

- Professional Financial Advisors and Mortgage Brokers: Consulting with a professional can provide personalized advice tailored to your financial situation. A financial advisor or mortgage broker can help you navigate the complexities of mortgage insurance and choose the best plan for your needs.

- Books on Canadian Real Estate and Mortgage Planning: Look for books that focus on Canadian real estate and mortgage planning. These can offer in-depth insights into the process of buying a home in Canada, including the role of mortgage insurance.

Personal Finance Blogs and Websites: Websites like MoneySense and RateHub.ca offer articles, guides, and calculators for mortgage insurance and other financial products. These resources can help you compare different mortgage insurance plans and understand their costs. MoneySense and RateHub.ca

By exploring these sources, you can gain a more comprehensive understanding of mortgage insurance in Canada, helping you make informed decisions that align with your financial goals and circumstances. Whether you’re a first-time homebuyer or looking to refine your existing mortgage plan, these resources can provide valuable guidance and support.

Key Takeaways

- Mortgage insurance premiums in Canada can be paid monthly or as a lump sum upfront, with most homeowners preferring monthly payments.

- The total cost of mortgage insurance can vary based on the payment method; monthly payments may increase the overall cost due to interest.

- Choosing the right mortgage insurance plan requires research, comparing quotes, and consulting with professionals.

- Making informed decisions on mortgage insurance is essential for financial stability and achieving homeownership goals.

- The blog encourages readers to share their experiences and questions to build a community of informed consumers.

- Homeowners should educate themselves, seek professional advice, and consider long-term financial goals in their decisions.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]