- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Is Buying a Term Plan Online Safe?

- Understanding the Appeal of Buying Term Life Insurance Online

- Addressing Safety Concerns

- Real-Life Challenges and How Online Term Plans Address Them

- Benefits of Buying Term Life Insurance Online

- Tips for a Safe and Informed Online Purchase

- How Canadian LIC Supports Safe Online Purchases

- Busting Myths About Online Term Life Insurance

- Why Choose Canadian LIC for Your Term Life Insurance Needs

Is Buying A Term Plan Online Safe?

By Harpreet Puri

CEO & Founder

- 11 min read

- December 6th, 2024

SUMMARY

With online platforms, Term Life Insurance purchases have been made an easy and accessible task in today’s digital world. However, a number of Canadians do not prefer to buy Term Life Insurance Online. They fear for safety and authenticity, which may also be the possibility of committing an error during the process. These are very valid and relatable apprehensions because buying insurance online is a major financial decision. Selecting a plan involves not only knowing what the Term Life Insurance Average Cost is but also whether the policy selected satisfies one’s specific needs and delivers the necessary financial security for your family.

At Canadian LIC, we often encounter clients who share their fears about buying a Term Plan online. Some fear that data security would be at risk, while others are worried that online purchases would not offer the same service and support that traditional methods would provide. These concerns are normal, but they shouldn’t be a reason for you not to enjoy the benefits that come with purchasing a policy online.

Let’s tackle the question of “Is buying a Term Plan online safe?” and allay these fears, giving you practical solutions for an informed decision.

Understanding the Appeal of Buying Term Life Insurance Online

When you think of buying Term Life Insurance, you’ll probably be familiar with traditional methods:

- Meeting agents in person

- Reviewing paper documents

- Discussing the Term Life Insurance Average Cost face-to-face

Shifting to the digital version is much easier and more streamlined than ever.

Convenience and Accessibility:

One can compare different Term Life Insurance Policies while sitting in one’s home. Quotations from different Term Life Insurance providers can be compared, and a plan can be found to suit the situation without going for multiple meetings.

Time-Saving:

In the fast-paced world today, time is money. The online platform eliminates the delays that do not count, and you can get Term Life Insurance online in a flash. The process is intuitive and user-friendly, saving hours otherwise spent on paperwork and agent visits.

Cost Transparency:

The greatest benefit when an individual purchases a Term Life Insurance online is how transparent it is. Detailed breakups of what premiums are payable and the average cost of a Term Life Insurance means making a more informed decision based on one’s budget and requirements is possible.

Addressing Safety Concerns

Safety is a natural concern when making online transactions, especially for something as critical as Life Insurance. Here’s how you can ensure your experience remains secure:

Research Credible Providers:

One reliable provider is the Canadian LIC because the services are trusted and have a client-first approach. Security certifications, like HTTPS in the URL, should be checked, along with customer reviews, in order to prove that the website is legit.

Data protection measures:

Insurers encrypt personal and financial information using encryption technologies. Seek for privacy policies and encryption indicators when inputting your information.

Support Availability:

Many people shy away from buying Term Life Insurance online because they fear that their queries will not be handled personally. However, reliable providers offer chat, email, or phone support to address queries throughout the process. As Canadian LIC, we strive to make online clients feel as supported as in-person clients do when choosing their online consultations.

Real-Life Challenges and How Online Term Plans Address Them

Fear of Missing Critical Details:

A client confided in me that they feared they might miss some very critical details on policies by trying to compare them online. That’s what comparison tools on insurance websites are there for. Such tools compare side-by-side the coverage, premium, and exclusions on Term Life Insurance Policies.

Uncertainty About Policy Suitability:

Another challenge that many clients encounter is whether the policy chosen meets their needs. For this reason, most online platforms provide estimators that estimate the amount of coverage based on your income, liabilities, and family needs. These tools will then point you in the direction of finding a plan that gives enough protection at an affordable average cost of Term Life Insurance.

Benefits of Buying Term Life Insurance Online

The advantages of purchasing Term Plans online extend beyond convenience:

Customized Quotes:

Online platforms offer custom Term Life Insurance Quotes, taking into account age, health, and lifestyle. These results help you quickly identify the best plan for you.

24/7 Availability:

With online services, you’re not tied to business hours. You can research and buy Term Life Insurance Online late at night or early in the morning.

Lower Premiums:

Because online platforms eliminate the intermediaries, many providers pass the savings on to you in the form of lower premiums. This can be quite helpful, especially when finding the average cost of Term Life Insurance among providers.

Tips for a Safe and Informed Online Purchase

To ensure your experience is safe and smooth throughout, here’s what to keep in mind:

- Verify the Provider: Ensure you’re dealing with a legitimate company like Canadian LIC. Check for contact information, reviews, and licenses.

- Read the Fine Print: Do not skip the terms and conditions. Look for clauses related to coverage, exclusions, and premium payment options and terms.

- Seek Help: If something seems unclear, call the provider’s support hotline. Candian LIC guarantees quick and clear assistance for all online customers.

How Canadian LIC Supports Safe Online Purchases

At Canadian LIC, we have seen how online platforms make it easier to purchase Term Life Insurance Policies. However, personal support always weighs that out. That’s why we combine the best of both worlds—offering secure online services along with expert guidance.

A couple looking for cheap Term Life Insurance Quotes contacted us after not being able to find time for meetings. Using our online tools, they identified the right Term Insurance Plan and completed the purchase very easily. Our team then followed up with personalized advice, ensuring that their policy was just what they were expecting.

Busting Myths About Online Term Life Insurance

Many misconceptions discourage people from buying Term Plans online. Let’s beat a few:

Myth 1: Online Policies Lack Human Support.

Truth: Reliable providers such as Canadian LIC provide dedicated support for online clients, and your questions will be answered promptly.

Myth 2: Online Purchases Are Risky

Truth: With proper research and security measures, online transactions are as safe as traditional methods.

Myth 3: Online Policies Are Inferior

Truth: Online Term Plans are identical to those purchased through agents, with the added benefit of lower costs and convenience.

Why Choose Canadian LIC for Your Term Life Insurance Needs

Canadian LIC stands committed to helping Canadians secure their future with the best Term Life Insurance Policies. Here’s what really sets us apart:

- Trusted Experience: Clients get advice based on many years of experience designed to meet the needs of the clients.

- Easy on the pocket: We give you the best Term Life Insurance Quotes without compromising on quality.

- Secure Process: Our system uses advanced encryption to protect your data and ensure safe transactions.

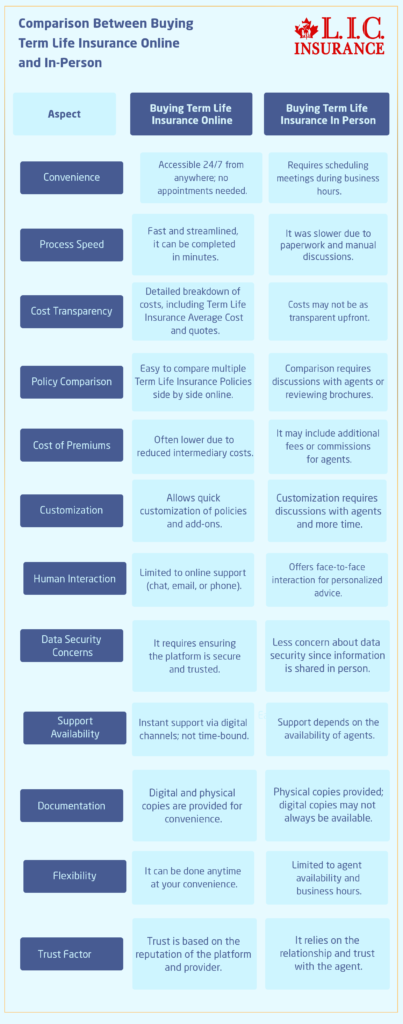

Comparison Between Buying Term Life Insurance Online and In-Person

Final Thoughts

In Canada, purchasing Term Plans online is safe and is a very wise step towards securing the future of your family. Choosing such reputed brokerages as Canadian LIC is convenient as it ensures all benefits, including saving, convenience, and transparency. Thus, research the cost of Term Life Insurance or get ready to buy Term Life Insurance Online from Canadian LIC.

Take that step today — your family’s financial security is just one click away!

More on Term Life Insurance

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs: Is Buying a Term Plan Online Safe?

Actually, buying Term Insurance online is very safe with a trustworthy provider like Canadian LIC. We use secure platforms to protect your personal and financial data while giving an expert approach to the whole process.

You can make use of online calculators offered by reputed companies like Canadian LIC, which allow you to input your information and obtain a clear estimate regarding the premium.

Absolutely. Most companies, including Canadian LIC, allow comparison of Term Life Insurance side-by-side. This helps to compare coverage, premiums, and other add-ons in order to ensure the policy chosen is suitable.

Yes, the quotes about the online term life are correct if you give proper information. The quotes that come are based on such facts as age, health, and other coverage for which a fairly realistic idea of the costs is presented.

Verify the reputation of the provider before you buy Term Life Insurance Online. Read the policy terms carefully, and make sure the platform uses secure payment methods.

In many cases, yes. Online Term Life Insurance Policies often have lower premiums because there are no intermediary costs involved. This makes them more affordable without compromising on coverage.

Most reputable providers, like Canadian LIC, offer dedicated customer support. Whether it’s through chat, email, or phone, you’ll have assistance to guide you through every step.

This is usually fast because it may only take minutes to finish. Once you compare Term Life Insurance Quotes, select your policy, and provide the necessary information, your application can be completed promptly.

Yes, most companies provide both digital and physical copies of your policy. Canadian LIC ensures you get your documents in any format that suits you.

Indeed, details about Term Life Insurance Policies offered online are comprehensive and transparent. Always read them carefully, and don’t hesitate to contact us if need be.

In case a mistake is made, most interfaces allow the correction before the paper is submitted. The Canadian LIC’s team reviews the application for any possible error.

Comparing quotes from various providers with online calculators is crucial for getting the best average cost of Term Life Insurance. Canadian LIC offers some excellent tools to simplify this process.

Indeed, online Term Life Insurance Policies are as reliable and effective as those bought through physical channels. They are legally binding, hence offering financial security for your loved ones.

Yes, you can change if you need to. However, always review the terms and conditions of your current policy before any changes.

People prefer buying Term Life Insurance online because it’s convenient, time-saving, and cost-effective. Platforms like Canadian LIC offer a smooth and secure experience with expert support to address concerns.

Yes, many providers allow customization of Term Life Insurance Policies online. You can add riders like Critical Illness or accidental death coverage to enhance your policy.

You can calculate your premium using online tools. These tools ask for your age, coverage amount, and health to provide accurate Term Life Insurance Quotes.

The risks are minimal when you choose a trusted provider. Ensure the platform is secure, read the terms carefully, and consult with experts like Canadian LIC for guidance.

Yes, most Term Plans offer online renewal options. You can easily extend your coverage without any hassle through Canadian LIC’s platform.

Canadian LIC is known for their expertise, secure processes, and excellent customer support. You can find the average cost of Term Life Insurance or get help deciding on the right plan with our assistance along the way.

Sources and Further Reading

- Canada Life: Term Life Insurance Quotes

Canada Life offers a secure platform for obtaining Term Life Insurance Quotes online, providing insights into policy options and associated costs.

- Blue Cross Canada: Guide to Buying Term Life Insurance

Blue Cross provides a comprehensive guide on purchasing Term Life Insurance in Canada, discussing safety considerations and the benefits of online applications.

- Sun Life Canada: Term Life Insurance

Sun Life provides information on Term Life Insurance options, including the ability to get quotes and apply online, ensuring a secure process.

- MoneySense: Guide to Life Insurance in Canada

MoneySense offers a comprehensive guide to life insurance in Canada, covering various policy types, costs, and considerations for purchasing online.

- Canada Life: Term Life Insurance Quotes

Key Takeaways

- Safety and Security: Buying Term Life Insurance online in Canada is safe when using trusted providers like Canadian LIC, which ensures secure platforms and data protection.

- Convenience: Online purchases save time and effort, allowing you to compare policies and Term Life Insurance Quotes from the comfort of your home.

- Transparency in Costs: Online platforms provide clear insights into the average cost of life insurance, helping you make budget-friendly decisions.

- Lower Premiums: Many online plans offer competitive rates due to reduced intermediary costs, making them affordable and efficient.

- Comprehensive Policy Comparison: You can easily evaluate multiple Term Life Insurance Policies, comparing coverage, exclusions, and premium details side by side.

- 24/7 Access: Online platforms allow you to research and purchase policies anytime, breaking free from traditional business hour constraints.

- Support Availability: Reputable providers like Canadian LIC offer robust customer support to assist you throughout the online application process.

- Reliable and Flexible Options: Policies bought online provide the same coverage and reliability as those purchased offline, with the added benefit of customization options.

- Quick and Seamless Process: The process of buying Term Life Insurance online is simple and user-friendly, often completed within minutes.

- Trusted Guidance: Choosing a provider like Canadian LIC ensures expert advice, secure transactions, and a smooth experience tailored to your needs.

Your Feedback Is Very Important To Us

We value your input! Please share your experiences and concerns about buying a Term Life Insurance plan online. Your feedback helps us understand and address your struggles better.

Thank you for your feedback! Your responses will help us improve everyone’s online Term Life Insurance experience.

IN THIS ARTICLE

- Is Buying a Term Plan Online Safe?

- Understanding the Appeal of Buying Term Life Insurance Online

- Addressing Safety Concerns

- Real-Life Challenges and How Online Term Plans Address Them

- Benefits of Buying Term Life Insurance Online

- Tips for a Safe and Informed Online Purchase

- How Canadian LIC Supports Safe Online Purchases

- Busting Myths About Online Term Life Insurance

- Why Choose Canadian LIC for Your Term Life Insurance Needs