- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

- Understanding the Need for the ATPD Rider

- How Does the ATPD Rider Work?

- Challenges Canadians Face Without an ATPD Rider

- Why Canadians Choose the ATPD Rider

- How to Add an ATPD Rider to Your Term Life Insurance Policy

- Stories That Highlight the ATPD Rider's Importance

- Choosing the Right Term Life Insurance Brokers

- Taking the First Step with Canadian LIC

- The Benefits of an ATPD Rider with Term Life Insurance

Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

By Pushpinder Puri

CEO & Founder

- 11 min read

- December 30th, 2024

SUMMARY

This blog stresses the significance of an ATPD rider on Term Life Insurance in Canada, elaborating on how this rider will protect one in case of permanent disability, complement the Term Life Coverage, and be relatively cheap. It uses the real-life struggles of clients from Canadian LIC clients, outlines benefits like income replacement and debt coverage, and guides readers on choosing the right policy with help from expert brokers.

Introduction

Life is never predictable. It can take a whole turn in one blink of an eye, and things may change for the worse. For most Canadians, having a Term Life Insurance Policy is considered a precautionary measure that would safeguard their loved ones in case of their death. But what about such unforeseen circumstances that did not necessarily kill but also changed the life permanently? Accidents that might lead to total and permanent disability? This is where adding an Accidental Total and Permanent Disability (ATPD) Rider to your Term Life Insurance Policy becomes invaluable.

We will dive here into understanding why this rider is important, how it could enhance your Term Life Insurance Policy, and how Canadian LIC could help families make better-informed decisions. Along the journey, we will tell the stories that show how important these riders are in life – from the daily experience the best brokerage like Canadian LIC has with clients.

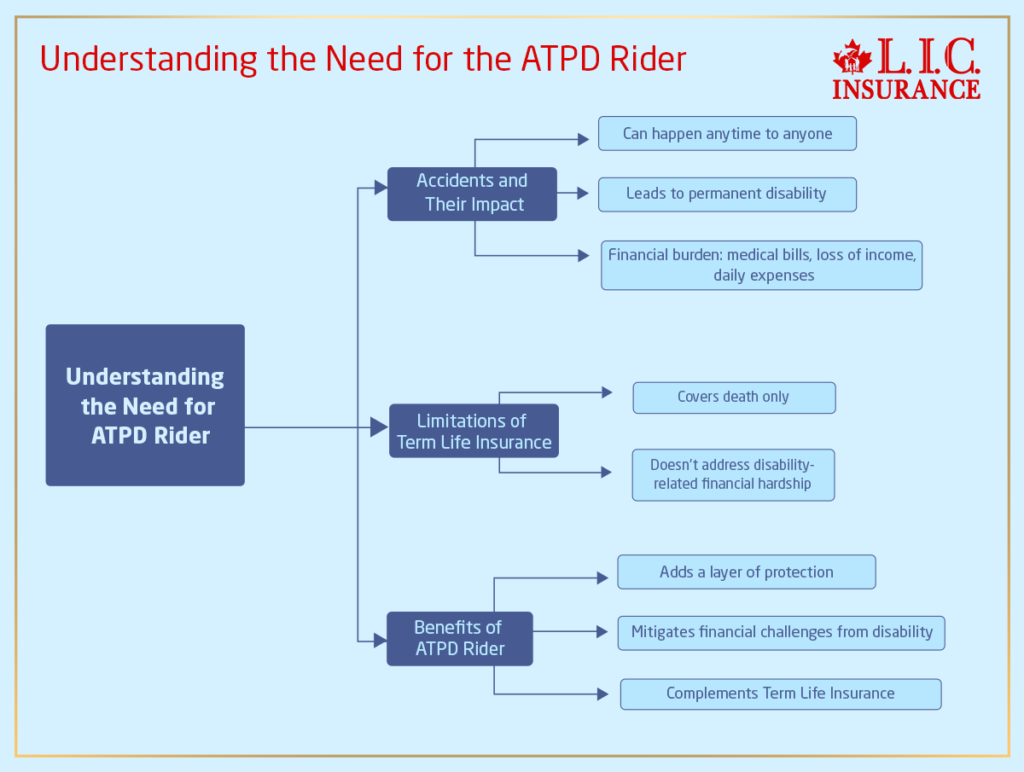

Understanding the Need for the ATPD Rider

Accidents can occur to any person, anytime. Picture yourself as the bread earner in your family; an accident occurs, rendering you permanently unable to work again. There’s the financial burden aside from the psychological one: medical bills, loss of income, and daily living expenses that do not disappear. Of course, your Term Life Insurance provides coverage in case you die; however, that does nothing to mitigate financial hardships based on a disability.

Why a Term Life Insurance Policy Alone May Not Be Enough

A Term Life Insurance Plan can really be a strong underpinning of financial safety. It leaves your beneficiaries enough in case of your death, ensuring the ability to keep their quality of life intact. It doesn’t always go so straight in life, however. Certain accidents may cause disabilities that will prohibit working and, therefore, lead to significant financial burdens for families with respect to their future. Another protection layer is the ATPD rider, which is used to avoid such problems.

How Does the ATPD Rider Work?

The ATPD rider delivers a lump sum benefit where the policyholder suffers totally and permanently due to the accident. The benefit delivers the payment of medical expenditures, household bills, etc., as one cannot provide an income after the medical condition.

Key Features of the ATPD Rider:

- Lump-Sum Payment: Money to cover hospital or doctor bills, rehabilitative or other expenses.

- Comprehensive Coverage: It gives complete coverage of all types of disabilities due to accidents and offers total peace of mind.

- An Affordable Addition: The cost of this rider is often a fraction of the expense when purchasing a separate Disability Insurance.

Challenges Canadians Face Without an ATPD Rider

We frequently encounter individuals and families who learn the hard way about the importance of Disability Coverage at Canadian LIC. For example, imagine a young professional who becomes disabled due to an accident. The Term Life Insurance Policy is there to ensure security for family members in case of their death, but no provision exists for disabilities. Without an ATPD rider, there was no money left to handle daily expenses, rehabilitation costs, and mortgage payments.

Adding this rider to your policy ensures you’re prepared for such unexpected events, providing financial security when it’s needed most.

Why Canadians Choose the ATPD Rider

Financial Independence During Tough Times

An accident that results in permanent disability often means loss of income. With the ATPD rider, you won’t depend on savings or government handouts. The lump-sum payout ensures you can now focus on recovery without ever having to worry about your financial situation.

Support for Long-Term Medical Expenses

Permanent disabilities often require ongoing medical care, therapy, or modifications to your home. The ATPD rider helps cover these costs, easing the financial burden on your family.

Affordable Protection

Most Canadians associate added coverage with sky-rocketing premiums. Nonetheless, the ATPD rider can be a pretty cheap means of improving your Term Life Insurance Policy. Canadian LIC also facilitates the exploration of term life quotes in order to come across options that fit their client’s budget.

How to Add an ATPD Rider to Your Term Life Insurance Policy

Adding the ATPD rider is a straightforward process. Here’s how Canadian LIC simplifies it for their clients:

- Assessment of Needs: Canadian LIC experts review your lifestyle, occupation, and financial goals to determine if the ATPD rider is the appropriate fit for you.

- Customized Recommendations: Their Term Life Insurance Quotes can be customized to make the rider fit your budget.

- Seamless Integration: Be it buying a new policy or updating an already existing one, Canadian LIC’s team ensures a hassle-free experience.

Stories That Highlight the ATPD Rider's Importance

A Parent’s Journey

Canadian LIC advised a single parent following a workplace accident where they were permanently disabled. They had a Term Life Insurance Policy in place; they thought their family was covered. However, since they could not work, they were financially strained. If they had added the ATPD rider earlier, it would have provided the support they needed. Today, they are encouraging people to add this rider to their policy as well.

A Young Professional’s Perspective

A near-miss accident caused a Canadian LIC client, a tech entrepreneur, to add the ATPD rider to their Term Life Insurance Policy. He thought he had a strong Term Life Insurance Policy, but when an accident leaves a person permanently disabled, then his dreams of taking care of his parents and securing the future can be put in danger. The ATPD rider provided him with peace of mind, knowing that no matter what happened, they were prepared.

Choosing the Right Term Life Insurance Brokers

It is crucial to choose the right Term Life Insurance Brokers. Such brokers like Canadian LIC will first understand your unique needs and provide a solution. Here’s why clients trust Canadian LIC:

- Expertise: With years of experience, Canadian LIC offers insights into the best policies and riders.

- Transparency: Clear communication with personal quotes helps clients make good decisions.

- Customer-centric approach: Canadian LIC is very flexible and supportive toward its clients. It helps in making the process relatively easy and hassle-free for them.

Taking the First Step with Canadian LIC

This is an accountable and vision-based step to strengthen the Term Life Insurance you’re carrying by adding the ATPD rider. Canadian LIC will aid you in this procedure, provide quotes for the best competitive Term Life Insurance, and educate you regarding every component that constitutes your policy.

Adding the ATPD rider onto your Term Life Insurance coverage is far from preparing for your worst—this is about empowering and equipping yourself and, more so, your family to face such uncertainties in life head-on with confidence and poise. Contact Canadian LIC today. Knowledgeable brokers make the entire process painless.

The Benefits of an ATPD Rider with Term Life Insurance

The ATPD rider is not an add-on but a strategic investment into long-term security. Even though many Canadians understand the importance of having a Term Life Insurance Policy, the benefits that come with having an ATPD rider are usually only realized when it’s too late. Canadian LIC often deals with clients who wish they had considered this option much earlier, and their stories enlighten its importance.

Protecting Your Loved Ones Beyond Life Insurance

While Term Life Insurance assures the financial security of the dear ones of your family after your death, the ATPD rider provides financial protection in all the other instances wherein life changes, but life does not come to an end. Here are a few important benefits that make this rider indispensable:

Safeguarding Your Income

Accidental total and permanent disability often results in an abrupt stoppage of your ability to earn. This can be a financial blow to families dependent on a single breadwinner. The ATPD rider effectively replaces your income with a lump-sum payment so that your family can continue living their lifestyle and meeting all essential expenses.

Mitigating Long-Term Debt

Most people in Canada have mortgages, car loans or student loans. A permanent disability means that it is almost impossible to pay these bills, and the ATPD rider could help pay for these services to ensure that your family would not have to make those difficult decisions about their home and other essential assets.

Reducing Stress in Challenging Times

Canadian LIC witnesses the reality of financial distress that the process of recovery faces. Because financial support through the ATPD rider is provided to the families, they can divert their minds to recovery without continuous distress from the fear of bills.

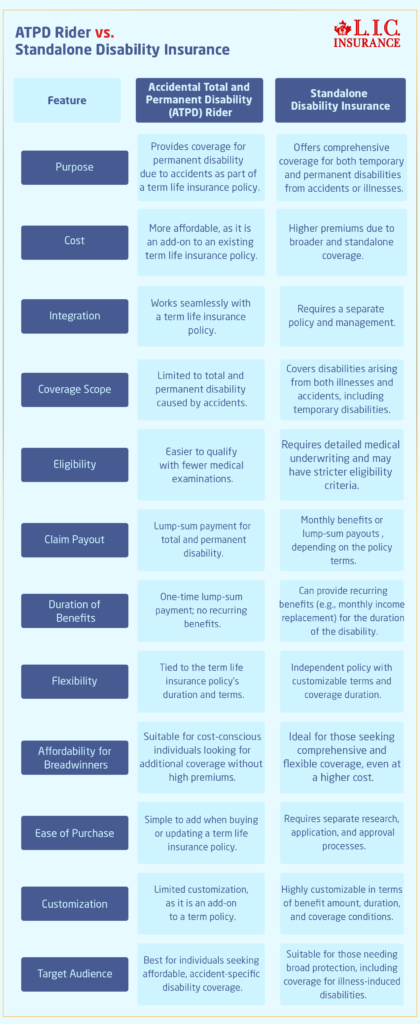

ATPD Rider vs. Standalone Disability Insurance

You may ask, why add an ATPD rider to your Term Life Insurance when you could simply get a separate Disability Insurance Policy? While both are valuable, here are some reasons why adding an ATPD rider makes sense:

- Cost-Effective: It is cheaper to add the ATPD rider to your Term Life Insurance than to buy a separate Disability Insurance Policy.

- Seamless Integration: The ATPD rider integrates harmoniously with your Term Life Insurance Policy, streamlining premium payments and policy management.

- Customizable Coverage: Canadian LIC offers customized Term Life Insurance Quotes with the inclusion of riders like ATPD, and thus, your policy suits your needs.

ATPD Rider vs. Standalone Disability Insurance

Choosing the Right ATPD Rider for Your Needs

Selecting an ATPD rider isn’t a one-size-fits-all decision. Canadian LIC guides its clients through these steps to ensure they make the right choice:

Assessing Your Financial Goals

What are your long-term goals, and how would a disability impact them? Be it for the purpose of saving for a child’s education or clearing out your mortgage, an ATPD rider can be aligned according to what best meets your priorities.

Reviewing Existing Coverage

Are you currently receiving some form of Disability Insurance through your employment or another policy? Canadian LIC will review the client’s existing coverage and identify what the ATPD rider would accomplish for the client.

Calculating the Right Coverage Amount

The payout from an ATPD rider should be good enough to cover major expenditures, such as medical charges and living expenses, while also enabling your family to lead their normal lifestyle. Canadian LIC applies this method when it advises the most suitable Term Life Insurance Policy with a rider that includes an ATPD.

Addressing Common Misconceptions About the ATPD Rider

When discussing Term Life Insurance policies with clients, Canadian LIC often hears misconceptions about ATPD riders. Let’s debunk a few:

“I’m Already Covered Through My Workplace.”

While workplace Disability Insurance is beneficial, it’s often limited in scope and duration. An ATPD rider provides comprehensive coverage that ensures long-term financial stability, regardless of your employment situation.

“It’s Too Expensive to Add Riders.”

Many people are surprised to learn how affordable the ATPD rider can be. Canadian LIC works with clients to compare Term Life Insurance Quotes, showing how small premium adjustments can lead to substantial benefits.

“I’m Healthy and Don’t Need This Coverage.”

Accidents are unpredictable and can happen to anyone, regardless of health or fitness level. The ATPD rider prepares you for unforeseen circumstances, offering peace of mind.

How Canadian LIC Supports Clients in Making Informed Decisions

As the most trusted Term Life Insurance broker in Canada, Canadian LIC believes in client-first approaches when helping people and families secure their future financial lives. Here is what makes them different:

Personalized Consultations

Canadian LIC realizes that every client has a different situation. Their team conducts thorough assessments, enabling them to recommend appropriate Term Life Insurance policies and riders.

Transparent Communication

The Canadian LIC is transparent in their approach, and clients appreciate this. From the clear Term Life Insurance Quotes, with the advantage of ATPD riders, they ensure that every decision is well-informed.

Ongoing Support

Life insurance needs to change over time. This is why Canadian LIC creates long-term relationships with clients, offering policy reviews and updates as circumstances change.

Why Now Is the Best Time to Act

Uncertainty is a part of life, and life doesn’t come with a warning sign. Therefore, preparation for it is of paramount importance. Adding an ATPD rider to your Term Life Insurance Policy today will ensure you and your family are well-protected financially, no matter what the future holds. Experienced brokers at Canadian LIC are ready to help you review your options, give you competitive Term Life Insurance Quotes, and guide you toward the right decision.

ATPD rider is an upgrade on the Term Life Insurance Policy with you. It’s evidence of commitment to protect and care for your family when life comes up with such nasty surprises. Canadian LIC understands this and promises to provide the appropriate coverage for the different life stages. Never let your life take unexpected turns on you. Take the proactive step by adding an ATPD rider to your Term Life Insurance Policy today.

More on Term Life Insurance

- What Happens If You Can’t Pay Your Term Life Insurance?

- What Will Disqualify You From Term Life Insurance?

- Can Riders Be Added To Term Life Insurance?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs: Accidental Total and Permanent Disability Rider with Term Insurance in Canada

The ATPD rider is another coverage you can add to your Term Life Insurance. It offers a lump-sum payout if you get totally and permanently disabled through an accident. This pays for medical costs, lost wages, and other expenses you may incur.

The ATPD rider provides a source of income if you are permanently incapacitated due to an accident. In its absence, your family will be financially hit even though you have a Term Life Insurance Policy. Most clients at Canadian LIC only appreciate the rider after seeing or hearing about what happens to others who don’t have this rider.

A Term Life Insurance Policy covers you in the event of death. The ATPD rider extends this coverage to cover disabilities. You and your family are, therefore, covered whether the challenges that life throws at you come from an accident or loss of life.

Not at all. Adding an ATPD rider is generally inexpensive and is less expensive than purchasing a standalone disability policy. Canadian LIC often assists clients in comparing Term Life Insurance Quotes to identify options that fit within their budget while incorporating valuable riders such as ATPD.

Generally, the term an ATPD rider covers disabilities that permanently prevent you from working because of an accident. Term Life Insurance Brokers at Canadian LICs make sure their clients understand all the terms and conditions applicable to their respective policies.

Yes, many insurers enable the purchase of Term Life Insurance online and offer riders like ATPD. Canadian LIC assists clients in reviewing options available online and helps ensure that they make the best choice with comprehensive coverage.

Workplace disability insurance is helpful but often has limitations. It may not provide long-term or comprehensive coverage. The ATPD rider ensures additional financial security, regardless of your employment situation.

Yes, you can add an ATPD rider to your existing policy; it depends on the rules of the insurer. Canadian LIC helps clients review their policies and determine if this is possible and beneficial.

Start by assessing your financial needs, long-term goals, and existing coverage. The Canadian LIC Term Life Insurance Brokers provide personalized advice and compare policies to help you make the best decision.

The rider in an ATPD provides an avenue of security against unknown incidents. When a calamity renders you unable to work, the single sum ensures your day-to-day needs, medical costs, and even debt repayment. This is how clients describe how this support has lightened their financial burden during their time of crisis.

Although it increases your premium by a small amount, the additional cost is low in comparison to the cost of protection it will deliver. Canadian LIC regularly compares Term Life Insurance Quotes and provides its clients with suitable quotations.

You can purchase an ATPD rider Term Life Insurance through professional Term Life Insurance agents or online at reputable third-party sites that allow you to buy Term Life Insurance Online. Canadian LIC simplifies it and cooperates with a client through each step.

Absolutely. Even if you don’t have dependents, an ATPD rider ensures you’ll stay financially independent in the event of a disabling accident. It helps you in offsetting medical bills, personal expenses, and future planning needs.

Canadian LIC brokers offer customized consultancy, Term Life Insurance Quote comparisons, and how the ATPD rider can be used as part of an overall financial strategy. They enable clients to make informed decisions with confidence.

Start by reviewing your current coverage and discussing your needs with a knowledgeable broker. Term Life Insurance Brokers, including Canadian LIC, specialize in leading the client to the right decision given their unique circumstances.

These FAQs directly target the most critical and serious concerns of clients associated with ATPD riders for Term Life Insurance policies. Given Canadian LIC’s daily interaction scenarios, proactive planning becomes crucial to enhancing individuals’ and families’ capacity to ensure a secure future.

Sources and Further Reading

- Government of Canada – Insurance and Financial Planning

https://www.canada.ca/en/financial-consumer-agency/services/insurance.html

Comprehensive insights into various insurance types and financial planning tips for Canadians. - Canadian Life and Health Insurance Association (CLHIA)

https://www.clhia.ca

Trusted information on life and health insurance options available in Canada. - Insurance Bureau of Canada (IBC)

https://www.ibc.ca

Useful resources about insurance products and advice on protecting your family financially. - Manulife Canada – Term Life Insurance with Riders

https://www.manulife.ca

Information on customizing Term Life Insurance policies with optional riders like ATPD. - Sun Life Canada – Disability Insurance

https://www.sunlife.ca

Details on disability insurance benefits and integration with term life policies. - Financial Consumer Agency of Canada (FCAC)

https://www.canada.ca/en/financial-consumer-agency.html

Tools and resources for understanding and managing insurance needs effectively. - Desjardins Insurance – Term Life Insurance

https://www.desjardinslifeinsurance.com

Guidance on Term Life Insurance and how riders enhance coverage.

Key Takeaways

- Enhanced Financial Protection: Adding an Accidental Total and Permanent Disability (ATPD) rider to your Term Life Insurance Policy provides critical financial support if an accident leaves you permanently disabled.

- Affordable Coverage: The ATPD rider is a cost-effective way to expand your Term Life Insurance Policy’s benefits without significantly increasing premiums.

- Income Replacement: The rider ensures a lump-sum payout to replace lost income and cover expenses like medical bills, debt repayment, and daily living costs.

- Complements Term Insurance: While Term Life Insurance provides death benefits, the ATPD rider addresses financial challenges during life-altering disabilities.

- Customizable Options: Canadian LIC brokers help tailor Term Life Insurance Quotes with ATPD riders to fit individual financial needs and goals.

- Critical for Breadwinners: The ATPD rider is essential for primary earners, safeguarding their family’s financial stability in unforeseen circumstances.

- Expert Guidance: Canadian LIC offers personalized consultations to ensure clients choose the right Term Life Insurance Policy and riders for complete protection.

Your Feedback Is Very Important To Us

Thank you for taking the time to complete this feedback questionnaire. Your responses will help us better understand the challenges and concerns related to the importance of an Accidental Total and Permanent Disability (ATPD) rider with term insurance.

Thank you for sharing your feedback! Your insights are valuable and will help us serve you better. We may follow up with you based on your responses.

IN THIS ARTICLE

- Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

- Understanding the Need for the ATPD Rider

- How Does the ATPD Rider Work?

- Challenges Canadians Face Without an ATPD Rider

- Why Canadians Choose the ATPD Rider

- How to Add an ATPD Rider to Your Term Life Insurance Policy

- Stories That Highlight the ATPD Rider's Importance

- Choosing the Right Term Life Insurance Brokers

- Taking the First Step with Canadian LIC

- The Benefits of an ATPD Rider with Term Life Insurance