- Impact of Changing Mortgage Rates in Canada: How to Protect Your Investment with the Right Mortgage Insurance

- Understanding the Influence of Mortgage Rate or Mortgage Interest Rate

- Mortgage Insurance Costs and Quotes

- Current Trends and Future Projections

- The Ripple Effect on Mortgage Insurance Plans

- Strategies for Homebuyers in a Variable Rate Environment

- Anticipated Market Adjustments

- Understanding Mortgage Rate Fluctuations

- Mortgage Insurance: A Shield Against Uncertainty

- Dealing With Rate Changes with the Right Mortgage Insurance Plan

- The Strategic Advantage of Choosing Canadian LIC

As the year draws to a close, once again, speculation on mortgage rates is one of the hottest topics for homebuyers and existing homeowners alike in Canada. The movement of such rates has traditionally had sharp influences on buying and selling behaviours but, importantly, also on overall market dynamics. But this year, changes to current mortgage rates might reshape everything from the cost of Mortgage Insurance to the affordability of housing within the Canadian real estate market.

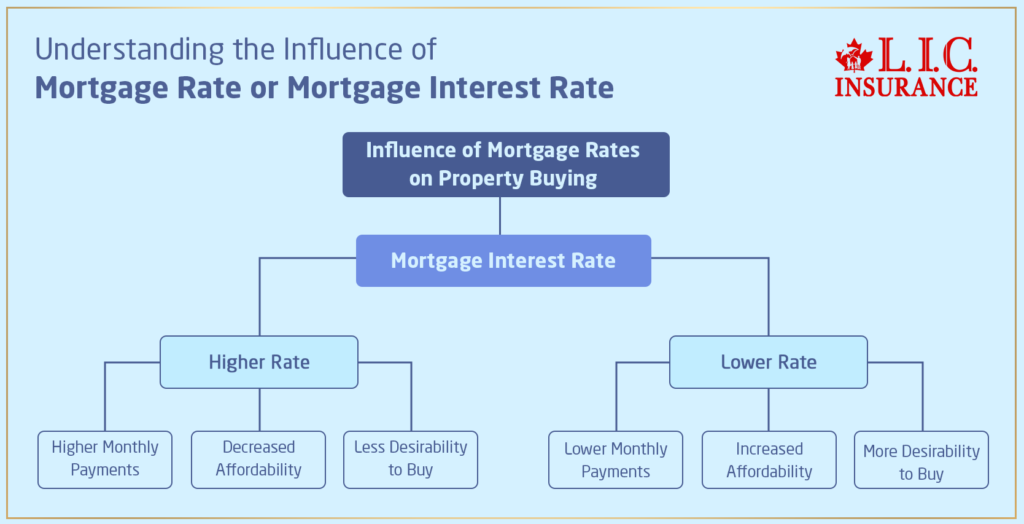

Understanding the Influence of Mortgage Rate or Mortgage Interest Rate

The rates of mortgage refer to interest rates applied for loans taken out to finance the purchase of a property. With these interest rates moving up and down, they determine monthly mortgage payments that a homeowner has to make and, therefore, affect the affordability and desirability of buying property. Whenever they fall, mortgages become more attractive since the lower monthly payments make owning a house more possible for many people.

Mortgage Insurance Costs and Quotes

Understanding how mortgage rates impact consumers involves a close look at Mortgage Insurance Plans. Many times, homebuyers are required to have Mortgage Insurance when they put down less than 20% of the property’s value for security against default to the lender. Changes in the mortgage rates can sometimes drive the cost significantly up or down, given the overall loan amount and the risk perceived by mortgage lenders.

Current Trends and Future Projections

The current economic climate has witnessed a gradual decrease in mortgage rates from their previous highs, reaching a zenith during times when the economic prospects were uncertain. It is this decline that has led to a wave of potential homebuyers reassessing their positions, considering property purchases which previously seemed out of reach only a few years ago. Analysts believe that, with mortgage rates stable at lower rate percentages, there may be more first-time buyers or those trading up/moving to bigger, better, or newer homes.

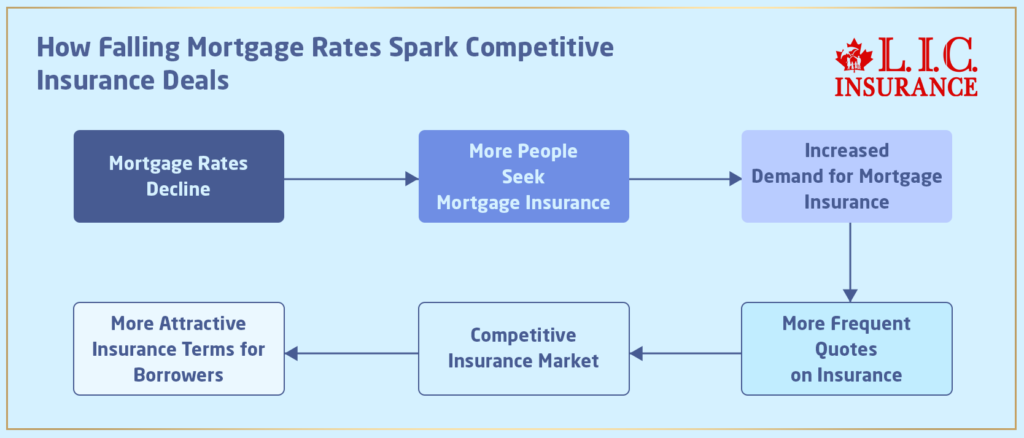

The Ripple Effect on Mortgage Insurance Plans

As the mortgage rates decline, more and more people are encouraged to seek Mortgage Insurance. Prospective homebuyers thus get quotes on Mortgage Insurance more frequently now as they try to maximize the reduced cost. This may bring along a spurt in the demand for insurance, which could lead to an insurance market that is more competitive and might give more attractive terms to borrowers for their insurance.

Strategies for Homebuyers in a Variable Rate Environment

- cure favorable mortgage terms. It’s essential for buyers and homeowners to monitor these trends and anticipate shifts that could affect their repayments.

- Explore Mortgage Insurance Options: With the fluctuation of mortgage rates, exploring different Mortgage Insurance Plans becomes crucial. Securing a Mortgage Insurance Quote at the right time can save considerable money, particularly when rates are favourable.

- Consider Long-term Implications: While low mortgage rates can be enticing, it’s important to consider the long-term implications of any loan agreement. Sometimes, locking in a rate with a fixed-term mortgage can protect against future volatility.

Anticipated Market Adjustments

Analysts said that if the mortgage rates continue sliding, there could be a sharp increase in activity in the market, which may also lead to uncontrollable spiraling of property values as more people get to enter the market. If the rate starts to rise, however, there could be a cool-off, especially in those hot markets. These possible outcomes bring into focus the need for proper strategies and how well-informed one should be about market conditions.

Understanding Mortgage Rate Fluctuations

The other factors that may affect changes in the rate of interest, which has been raised in Canada, include monetary policy by the Bank of Canada, inflationary trends, and global economic conditions. These rates are not just numbers on a piece of paper; they actually determine home affordability and the size of mortgage payments, hence the ultimate price of buying and owning a dream home.

- The Role of the Bank of Canada: The Bank of Canada sets the tone for mortgage rates since its benchmark interest rate largely dictates what lenders give customers. In such situations, if the Bank raises rates to fight inflation, mortgage rates usually tend to go up. On the contrary, when the Bank cuts rates to boost an economic downturn, mortgage rates often fall; hence, borrowing becomes very cheap.

- Inflation and Economic Conditions: Another major influence on mortgage rates is inflation: with high inflation, lenders demand higher mortgage rate to compensate them for the erosion in the purchasing power of money during the period of inflation. Low inflation, on the other hand, is normally good for borrowers as it reduces mortgage rates. Besides, international economic conditions, such as changes in U.S. Federal Reserve policies or geopolitical events, may also affect domestic mortgage rates.

- The Impact on Homebuyers and Homeowners: Fluctuating mortgage rates greatly affect the affordability of homes for potential homebuyers. When rates are low, more people qualify for mortgages, which increases demand for homes and may push up home prices. However, when rates rise, the cost of borrowing increases, which can cool the housing market as fewer buyers can afford to enter.

Mortgage Insurance: A Shield Against Uncertainty

Given that the mortgage rates are so uncertain, Mortgage Loan Insurance becomes an important tool that shields both lenders and borrowers. To many people, Mortgage Insurance is just an additional expense, but it is a very important tool, especially in these economic rollercoaster times.

What is Mortgage Insurance?

It’s a policy that insures the lender against failure on the part of the borrower to pay his mortgage. Most homebuyers in Canada borrow less than 20% of the purchase price and get Mortgage Insurance coverage. The cost of Mortgage Insurance usually added into mortgage payments depends on the size of your down payment and the mortgage amount.

The Cost and Value of Mortgage Insurance

Similar to everything in life, the cost of Mortgage Insurance is offset by the value it provides. In this regard, for homebuyers, especially those putting down smaller earnest money payments, this Mortgage Insurance allows them to enter a house more quickly than perhaps they otherwise could afford. It also provides lenders with the security needed to make such loans at competitive interest rates during times when economic uncertainty may prevail.

Dealing With Rate Changes with the Right Mortgage Insurance Plan

Any time that there is a change in interest rates, it automatically sets the homeowners and prospective buyers in a confusion to reassess their financial situation in relation to the implications on their mortgage. It is here that the right type of Mortgage Insurance becomes an imperative.

- Protecting Your Investment: As mortgage rates rise, the cost of homeownership increases, which can put a financial strain on borrowers. A well-structured Mortgage Insurance Plan can provide a buffer, ensuring that even if financial circumstances change, the home remains protected. Canadian LIC offers a range of Mortgage Insurance Plans designed to meet the diverse needs of Canadian homeowners, helping them deal with the storm of fluctuating rates.

- Obtaining Competitive Mortgage Insurance Quotes: In an environment of changing rates, it’s important to shop around for the best Mortgage Insurance Quote. Canadian LIC provides transparent and competitive quotes tailored to each client’s unique situation. By working with Canadian LIC, homeowners can ensure they are getting the best coverage at a cost that aligns with their budget.

The Strategic Advantage of Choosing Canadian LIC

Canadian LIC is not like other insurance providers; it’s a partner that understands the real estate market in Canada and the challenges which come with this market. In choosing Mortgage Insurance through Canadian LIC, there are a number of strategic benefits that can provide an edge, mainly at a time when interest rates on mortgages can get uncontrollable.

- Expert Guidance and Support: One of the standout benefits of working with Canadian LIC is access to expert advisors who understand the intricacies of Mortgage Insurance and the broader financial landscape. These advisors are committed to helping clients choose the right Mortgage Insurance Plan that not only meets lender requirements but also supports long-term financial goals.

- Flexibility in Coverage: Mortgage Insurance needs can vary greatly depending on factors such as the size of the mortgage, the down payment, and the homeowner’s financial situation. Canadian LIC offers flexible coverage options that can be tailored to fit different needs, ensuring that each client gets the right level of protection.

- Stability in Uncertain Times: In an era where mortgage rates can shift dramatically in a short period, stability is crucial. Canadian LIC’s Mortgage Insurance Plans are designed to offer that stability, giving homeowners the confidence that their home—and their financial future—is protected, regardless of what happens in the broader economy.

Looking Ahead: Preparing for the Future

It’s not possible for anyone to forecast with complete certainty what will occur in the future in regard to mortgage rates. Nonetheless, there are actions that owners and potential buyers can undertake in preparation. Understanding how rate changes will probably affect you and how to obtain proper insurance for your mortgage are two of the best methods for handling any change in the Canadian market.

- Staying Informed and Proactive: This will keep them informed about market trends and economic indicators so that the rate hike of the mortgage period can be estimated in advance and financial planning can accordingly be made. Canadian LIC has resources and tools that can teach the client about the market conditions and enable them to make an educated decision about their mortgage and insurance needs.

- The Long-Term View: For most Canadians, the house is the single most valuable financial asset. Insuring that asset with the right Mortgage Insurance Plan is not about today’s rate; it’s about securing one’s financial future. Canadian LIC’s commitment to quality and reliability means that, for any given homeowner, ensuring a Mortgage Insurance Plan allows them to build their life and wealth without fear of the financial hazards a shifting mortgage rate could bring.

The Bottom Line

Like many other aspects of the Canadian economy, mortgage rates can fluctuate unceasingly. High rates increase the cost of homeownership, whereas low rates make entry into the housing market more accessible and feasible for many people. In whatever direction the rates take, there is one thing that does not change: comprehensive protection through Mortgage Insurance.

Choosing Mortgage Insurance from Canadian LIC provides security and peace of mind. It provides tailored plans, competitive quotes, and expert guidance to protect Canadians’ homes and financial futures. Protection during uncertain times is invaluable.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs About the Impact of Changing Mortgage Rates in Canada

Changing mortgage rates can influence the overall cost of owning a home, but they do not directly change the Mortgage Insurance Cost. In such a case, when a rate increases, the total mortgage payment may go higher and sometimes be beyond what a certain buyer can handle within their budgets. Rather, a lot of our clients face this struggle at Canadian LIC. They feel that getting a competitive quote for Mortgage Insurance strikes a balance in finances, even in the case of volatile mortgage rates. In return, selecting the right Mortgage Insurance Plan might save you from future financial burdens, whatever the direction of the rate.

It always pays to get a quote for Mortgage Insurance beforehand, for indeed, it does give a clear idea of what the costs will be. As many clients of Canadian LIC concern themselves with how upcoming rates can affect a budget, getting an insurance quote can bind you to present-day costs and help you plan your finances better. This way, surprises are avoided, and your investment in your home is well protected.

Yes, a Mortgage Insurance Plan can be so helpful when the rates go up. Quite often, we deal with clients who are troubled by the rise in payments as mortgage rates increase. Mortgage Insurance ensures that even as your mortgage payment rises, you will not lose your home in some financial crisis or another. Here at Canadian LIC, we have plans that will provide our clients with much-needed security, especially when times are economically unstable.

It is important that insurance be taken even when the rates are low. Though at low rates, the buying of a home may present an easily affordable option, one should remember that life is not a bed of roses. We have found cases where our clients had purchased homes at low rates but reached a point in life where it was hard to make such heavy payments. A Mortgage Insurance Plan from Canadian LIC would offer you protection against losing your home because of some change in your situation; instead, it will provide long-term security.

At Canadian LIC, we know that every client is different. We take the time to work closely with you to find the right Mortgage Insurance Plan that fits your budget and goals. Many of our clients feel overwhelmed with options and details, but our wealth of advisors will help you make sense of the process so that you can confidently pick a plan that protects your home and your future.

Yes, you can change your Mortgage Insurance Plan to reflect any changes in your situation. Most of our clients start with one plan and later realize that they will need different coverage as their mortgage rates change or as their personal situation changes. It is very easy for us at Canadian LIC to review and adjust your coverages to ensure they always fit your needs.

Consider the cost, coverage, and benefits of the different plans when comparing Mortgage Insurance Quotes. Sometimes, some of our clients focus solely on the price and later find out they don’t have basic coverage. At Canadian LIC, we help you compare quotes in a manner that balances cost with comprehensive protection. This way, you will always get value for your money and security.

When your Mortgage Insurance Plan is right for you, it needs to be comprehensive and affordable. We have many clients who do not know what is best for them. That’s why we take the time to explain each option clearly, helping you choose a plan that meets your specific needs and gives you confidence in your decision.

The cost of Mortgage Insurance does not relate directly to the mortgage rate but rather to the size of your mortgage and down payment. However, changes in mortgage rates can influence your overall budget. For that reason, it is essential that you understand your insurance costs upfront. At Canadian LIC, we help pre-calculate these costs for our clients accurately so they can make informed decisions. When you get a Mortgage Insurance Quote, you’re going to see how the cost of insurance fits into the mortgage payments if rates fluctuate.

If you refinance your mortgage, your Mortgage Insurance Cost might change, especially if the amount you borrow increases. Quite often, we see clients refinancing when rates drop to take advantage of lower monthly payments. In such cases, it will be important to check how this new loan amount affects your insurance plan. Canadian LIC provides that guidance to ensure your Mortgage Insurance continues to provide the protection you need without unnecessary expense.

In Canada, you will need Mortgage Insurance if your down payment is less than 20% of your home’s purchase price. Many clients that we meet are often surprised to learn that this requirement applies even when rates are high. The good news is that Mortgage Insurance actually helps make qualifying for a mortgage easier in a high-rate environment. At Canadian LIC, we offer plans that make this requirement work in your favour by providing comprehensive coverage at an affordable cost.

Of course, you can. A greater down payment reduces the Mortgage Insurance Cost. We have come across people who save up for a long time and make a large down payment, which in turn reduces the total amount they have to borrow from the bank. Doing so reduces your LTV, or Loan-to-Value ratio, and with the lower LTV, your Mortgage Insurance quotation goes down because now you will be paying less every month to insurance. Canadian LIC offers flexible options to balance down and insurance costs.

When the mortgage rates become too unpredictable, Canadian LIC comes forward to support you with Mortgage Insurance Plans that give you surety. Since changing rates can put a person in a stressful situation, we work very closely with our clients by offering them right coverage, no matter how the rates change. It is our focused team that will help secure a plan fitting your budget and protecting your investment in your home.

It would be best if you considered reviewing options when your Mortgage Insurance Plan no longer suits your needs due to the changes in premiums. Many of our clients come to us when their financial situation has changed, and they are seeking advice on ways to adjust their coverage. At Canadian LIC, we make it easy to modify your plan so that it continues to provide the protection you need, even as your mortgage payments change.

Finding the ideal quote for Mortgage Insurance in fluctuating markets means comparing a few different options, each offering different levels of coverage. Over the years, we have helped many clients who sometimes needed help with where to start. At Canadian LIC, we make it easier for you by providing transparent and competitive quotes that are tailored to your specific needs so you can rest assured that you are getting the best value in spite of market conditions.

Yes, you can cancel your Mortgage Insurance if you pay off your mortgage early. Quite often, our clients have paid off their mortgage faster than they anticipated and asked how to go about cancelling their insurance. At Canadian LIC, we help with that process, so you pay for only the coverage you need when you need it.

Sources and Further Reading

- Bank of Canada

Stay updated with the latest monetary policy decisions and how they influence mortgage rates in Canada.

Bank of Canada - Canada Mortgage and Housing Corporation (CMHC)

A comprehensive resource for understanding Mortgage Insurance, including costs and benefits.

CMHC – Mortgage Insurance - Financial Consumer Agency of Canada (FCAC)

Provides information on mortgage rates, insurance, and financial planning tools for homebuyers in Canada.

FCAC - Canadian Real Estate Association (CREA)

Offers insights into the Canadian housing market, including trends in mortgage rates and their impact on homebuyers.

CREA - Realtor.ca

Get the latest statistics on Canadian mortgage rates, housing market trends, and forecasts.

Realtor.ca

These resources provide valuable information to help you understand the broader context of mortgage rates and insurance in Canada, offering further insights into the topic discussed in the blog.

Key Takeaways

- Impact of Mortgage RatesChanges in mortgage rates significantly affect home affordability, influencing buyers' decisions and overall market dynamics in Canada.

- Importance of Mortgage Insurance: Mortgage Insurance is crucial for protecting your investment, especially in times of economic uncertainty and fluctuating mortgage rates.

- Canadian LIC Advantage:Opting for Mortgage Insurance from Canadian LIC offers stability, expert guidance, and flexible plans tailored to your financial needs.

- Proactive Financial Planning: Staying informed about mortgage rates and securing a competitive Mortgage Insurance Quote early can help you manage costs and protect your home.

- Adjusting to Market Changes: Canadian LIC provides options to adjust your Mortgage Insurance Plan as your financial situation or mortgage rates change, ensuring continuous protection.

Your Feedback Is Very Important To Us

We appreciate your feedback. Your responses will help us understand the challenges Canadians face when purchasing Critical Illness Insurance after retirement.

Thank you for taking the time to share your experiences. Your feedback is invaluable in helping us understand the challenges Canadians face with changing mortgage rates and how we can better assist you.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]