- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Reviews

Common Inquiries

How Travel Insurance Helped an International Student Save Thousands

SUMMARY

The article states the story of saving over $3,000 in unwanted medical bills to a foreign student by Travel Insurance: Basira and her adventure of surviving her studies at the University of Manitoba in Canada. It focuses on explaining that student travel insurance is critical and covers many emergencies, such as an injury or illness, consultation with doctors, and any prescription for Basira or fellow students in universities around the globe. Financial challenges without proper insurance.

- 11 min read

- September 13th, 2024

By Harpreet Puri

CEO & Founder

- 11 min read

- September 19th, 2024

Introduction

Studying abroad can be a fantastic experience. Most of the time, however, there are some surprises that come along the way. Quite often, international students feel that their most pressing concerns, like medical problems and medical emergencies, are not a rarity and would often turn into a nightmare if there is no proper insurance coverage. Algerian student Basira, who came to Hamilton, Ontario, for her studies, knows this reality only too well. She made a wise decision with the purchase of Travel Insurance, saving her over $3,000 in medical expenses.

Many students think, “I’m young and healthy, so I don’t need insurance,” or, “I’ll just pay for medical costs if something happens.” But what happens when “something” does happen? From an unexpected ankle injury to a sinus infection that wouldn’t go away, Basira’s story is a wake-up call about the importance of Travel Insurance for international students studying in Canada.

In this blog, we are going to take you through Basira’s story and how insurance made all the difference for her. This short piece digs into how Travel Insurance works for students, the risks of not having it, and just how choosing the right policy could save one from a similar financial burden.

The Story of Basira: A Real Student Facing Real Medical Emergencies

The story feels very familiar to us here at Canadian LIC, where we provide services for international students daily. Like most, Basira comes to Canada with excitement and focus on studies while rarely thinking about the chance that might arise in case of medical emergencies. Yet not soon after did a series of health issues hit her with unexpected medical bills.

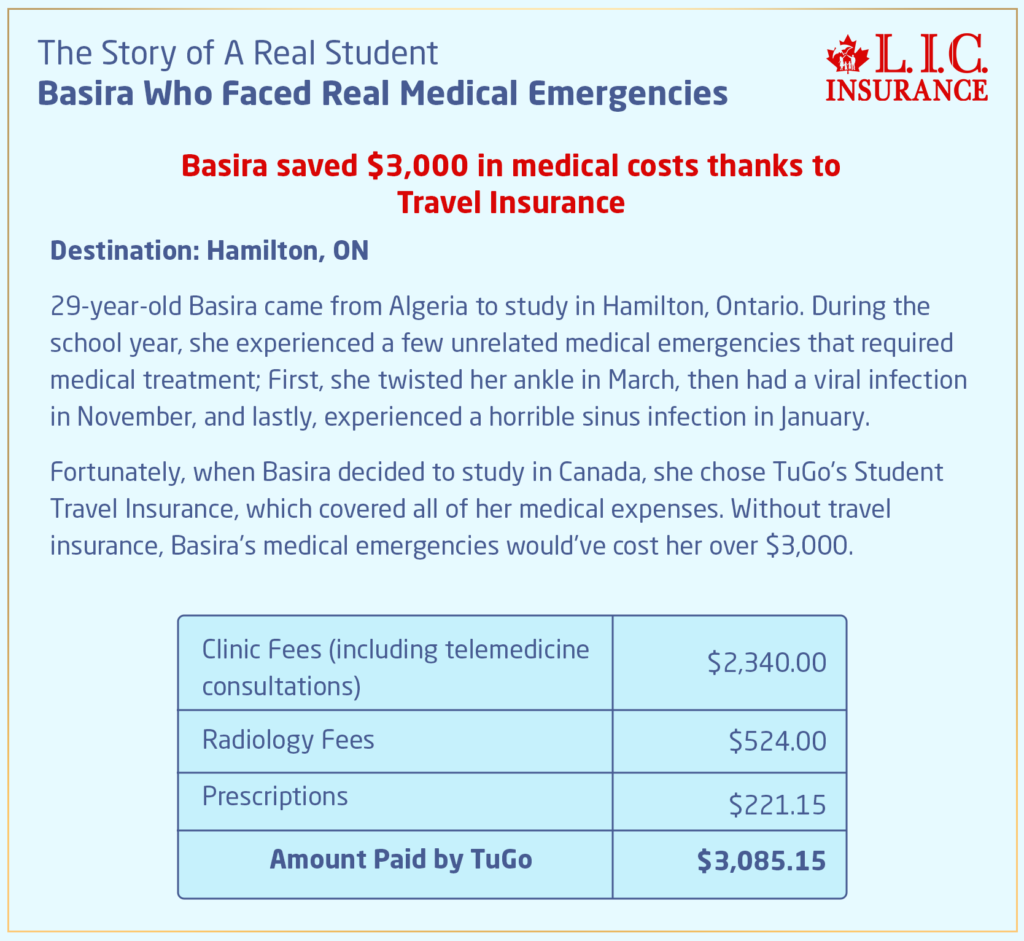

She had twisted her ankle when she was walking to class back in March. What initially looked like a minor problem became a much bigger issue when the ankle swelled, and she found it difficult to walk. So, there was some medical treatment needed on her side; she went to the doctor several times and joined physiotherapy sessions. Then, in November, she caught herself a viral infection that required some more medical care. By January, she was back in the doctor’s office, this time to battle a severe case of sinus infection that left her miserable and in need of medicine and further treatment.

Each of the incidents added up in no time. Without her TuGo Student Travel Insurance Policy, Basira might have been staring at paying more than $3,000 in out-of-pocket medical costs. That kind of financial blow could be disastrous for a student: one that could easily offset tuition payments, rent, or everyday living expenses. Fortunately, though, Basira made the wise decision to purchase student Travel Insurance.

What is Student Travel Insurance, and Why Do You Need It?

Now, you might be wondering, “How can this be prevented, like what happened to Basira?” Well, the solution is simple: through a comprehensive student Travel Insurance plan. Many international students who come to Canada for school are surprised to learn that provincial health care is not available to them on their first day in the country. While some will qualify for plans under provincial health care after having been in the country for a little while, there is always a waiting period. At this time, if something untoward happens- whether that be a serious injury, illness, or even emergency surgery- students will be the sole ones paying expensive medical bills.

It is here that student Travel Insurance comes into play. This international student Travel Insurance is exclusive to medical coverage for students studying abroad. This would take care of all the aspects under one umbrella: doctor visits, hospital stays, medications, and even transportation in an emergency situation if need be. So, the objective is to ensure that the students do not lose their focus on education because of the fear of how they would pay for medical care.

From Canadian LIC, as long as we can remember, we have worked with thousands of international students just like Basira. Every day, we see how Travel Insurance makes a difference. Be it a minor issue, twisted ankle, or major medical condition, every student needs to have Travel Insurance as a financial buffer.

Why is Travel Insurance for International Students Essential?

Let’s get down to it: why should international students in Canada purchase Travel Insurance? Most of the misconception is that nothing will ever happen to me. Indeed, one feels invincible when young, but accidents and illnesses are neither made with exceptions. One might even be more likely to need medical attention being in an unfamiliar country. Unfamiliar weather, a new diet, and worrying about adapting to a new environment can all weigh in on your health.

Without Travel Insurance, one trip to the emergency room can put a cost of thousands in your pocket. For most international students, this kind of expense is a definite no-go. Canadian healthcare is world-class, but it also isn’t cheap without insurance to fall back on. Basira’s expenses surpassed $3,000. But that doesn’t set her medical care apart. Emergency care, medications, and follow-up appointments can quickly add up, leaving you with more than you bargained for.

At Canadian LIC, we regularly assist students who find themselves in situations like Basira’s. The reality is that most international students are on tight budgets, with tuition, rent, and living expenses to manage. Then, one day, an unexpected medical bill can throw everything off track. Travel Insurance prevents incidents like a medical bill from ruining a student’s study experience.

What Does Student Travel Insurance Cover?

You might be thinking, “What does Travel Insurance cover?” A comprehensive policy covers most medical emergencies that students are likely to encounter abroad. Basira’s insurance, for example, covered her doctor’s visits, physiotherapy, medication, and hospital stays when necessary.

Now, let’s break it down into a few key areas of coverage:

- Medical Emergencies: This includes hospital visits, emergency surgeries, and ambulance services. If you’re injured or fall seriously ill, your insurance will cover the necessary medical attention.

- Doctor’s Visits: If you experience non-life-threatening issues, like Basira’s ankle injury or sinus infection, your Travel Insurance will cover visits to the doctor, treatment, and any prescribed medications.

- Physiotherapy: Injuries sometimes require follow-up treatment, such as physiotherapy, to fully recover. Travel Insurance ensures you don’t have to pay out of pocket for ongoing care.

- Emergency Evacuation: If you’re ever in a situation where you need to be transported to a hospital or even sent home for medical treatment, many Travel Insurance policies will cover the cost of evacuation.

- Prescriptions: Medications can be expensive, especially in a new country. Travel Insurance helps cover the cost of prescribed drugs, whether they’re for an illness, injury, or chronic condition.

Usually, the students here at Canadian LIC are reminded to check the details of their Travel Insurance policies and what may or may not be included. It would really save you a lot of hassle and stress if you knew it beforehand.

Basira's Financial Savings: How Travel Insurance Eased Her Burden

Basira’s story really reminds one to get Travel Insurance. If not for this, all the medical emergencies would have cost $3,000. How painful it might have been for a student to pay for that without any other kind of support at that time, considering the tuition, rent, and everyday expenses.

Let’s face it: without insurance, Basira would have had to forgo her medical treatment or education. Most international students don’t have a small pot of money set aside to ward off any unexpected medical bills, so it is a necessity to get a form of insurance.

It not only provided Basira with financial relief but also gave her mental peace to talk about such matters without worrying about how she would pay for her treatment. Instead of time being wasted worrying about treatment costs, she could focus purely on getting better and going back to class.

At Canadian LIC, there have been too many students who, like Basira, thanked God they had Travel Insurance when they needed it most. This is one of the biggest messages we would be teaching our clients: that insurance is an investment in a person’s health and well-being. You may not need it right away, but when you do, then it will make all the difference.

How to Choose the Right Travel Insurance for International Students

So, how are you going to determine the right Travel Insurance? The number of choices is overwhelming and, naturally, is pretty confusing, and selecting the right policy that suits your needs might take a while. Canadian LIC faces hundreds of students every day to help determine the best Travel Insurance coverage for them.

The following are some features you should be looking for:

- Coverage Limits: Make sure your policy covers enough to handle potential medical emergencies. Some policies have caps on how much they will pay for specific treatments, so it’s important to know these limits upfront.

- Pre-Existing Conditions: If you have any ongoing medical issues, ensure your policy covers them. Some Travel Insurance policies exclude pre-existing conditions, while others may offer coverage after a waiting period.

- Emergency Coverage: Look for a policy that includes emergency hospital visits, surgeries, and evacuation.

- Prescription Coverage: If you need medication for any reason—whether it’s a new illness or a chronic condition—you want a policy that will help cover the costs. Prescription drugs can be expensive, especially for international students who are unfamiliar with the local healthcare system.

- Follow-up Care: Some medical issues require follow-up visits, like physiotherapy after an injury. Be sure your insurance plan covers these visits, as they can be an essential part of recovery. Without proper coverage, you could be stuck paying for multiple follow-up appointments out of pocket.

- Dental and Vision: Some policies offer extra benefits like dental and vision care. While this might not be a necessity for everyone, having it as part of your plan can help if you experience sudden dental issues or need new glasses.

Find the best plan at Canadian LIC. Our brokers know your abroad studying students’ needs and can guide you through the options. Choosing the right insurance policy to ensure that you’re properly covered for anything that may come your way is now not such a complicated task.

Common Medical Situations Covered by Travel Insurance for International Students

Let’s return to the story of Basira. All of the medical emergencies she experienced-from her twisted ankle to her viral infection and sinus infection, were all covered by her Travel Insurance Policy. These kinds of situations are actually more common than you might think. International students often find themselves dealing with unexpected health issues, ranging from minor injuries to more serious medical conditions.

Here are a few typical medical cases normally covered by Travel Insurance:

- Injuries: Accidents happen, and they don’t wait for a convenient time. Whether you slip on an icy sidewalk or twist your ankle during a recreational activity, Travel Insurance covers the treatment of injuries like sprains, broken bones, and even more severe injuries that require surgery.

- Illnesses: Many students, like Basira, catch colds or infections during their studies, especially as they adjust to a new climate. Viral infections, flu, and other illnesses that require doctor’s visits and medication are typically covered by student Travel Insurance.

- Hospitalization: In the case of more serious conditions, such as appendicitis or severe injuries, hospitalization might be necessary. Without Travel Insurance, a single night in the hospital could result in a bill of thousands of dollars. However, with the right coverage, you won’t have to worry about these financial burdens.

- Medical Transportation: If you’re ever in a situation where you need to be transported by ambulance or require medical evacuation to a hospital, Travel Insurance typically covers these services. This can be especially crucial in rural areas or during emergencies.

- Emergency Dental: If you experience sudden dental issues, such as a toothache or a broken tooth, Travel Insurance often includes coverage for emergency dental care, ensuring you don’t have to deal with high dental bills.

At Canadian LIC, we regularly see how these kinds of issues arise unexpectedly for students. Basira’s story is just one of many where that minor injury or illness required medical care-and without being insured, the price may have been cripplingly high. The lesson learned here is that even common medical concerns can become financial concerns, as well, unless protection is there to back them up.

Financial Benefits of Travel Insurance for Students: The Cost-Saving Potential

It’s no secret that being a student involves balancing a tight budget. Tuition, textbooks, rent, and daily living expenses already take up a significant portion of a student’s finances. The last thing you want to worry about is how to pay for unexpected medical bills. This is where Travel Insurance becomes a lifesaver—quite literally, sometimes.

In Basira’s case, her Travel Insurance saved her over $3,000. For a student, this kind of expense could have been devastating. Many students would have to borrow money, delay tuition payments, or even drop out of school to deal with such costs. The reality is that many international students face these difficult choices without Travel Insurance.

At Canadian LIC, we always emphasize to our clients that Travel Insurance isn’t just a formality—it’s an investment in your future. While the upfront cost of a Travel Insurance Policy may seem like another expense, it’s far less than what you’d pay if you faced a medical emergency without coverage. In fact, the small cost of a policy can save you thousands in the long run.

How to Get Travel Insurance as an International Student

Getting Travel Insurance as an international student is simpler than you might think. Canadian LIC has helped countless students secure the right policy in just a few steps. Here’s how the process works:

- Talk to a Broker: The first step is to speak with a knowledgeable insurance broker who understands the needs of international students. At Canadian LIC, our brokers are experts in finding the best Travel Insurance plans that offer comprehensive coverage at an affordable price.

- Review Your Options: We’ll walk you through the different types of coverage available. Whether you need a basic plan that covers medical emergencies or a more comprehensive policy with extra benefits, we’ll help you find the right fit for your budget and needs.

- Choose the Right Policy: Once you’ve reviewed your options, you can choose the Travel Insurance Policy that best suits your situation. This ensures that you’re covered from the moment you arrive in Canada and don’t have to worry about unexpected medical costs.

- Stay Covered Throughout Your Studies: Your Travel Insurance Policy will cover you for the entire duration of your studies, giving you peace of mind that you’re protected no matter what happens. If you need to renew or extend your coverage, we’re here to help with that, too.

Why Canadian LIC is the Best Choice for International Students

At Canadian LIC, we pride ourselves on being the best insurance brokerage for international students. We understand the unique challenges that come with studying abroad, and we’re here to make sure you’re fully protected with the right Travel Insurance Policy.

One thing that really sets us apart from anyone else is the assurance of sticking with the student to ensure they understand their coverage and even make sure they are confident enough that they have the right insurance. We realize for many students, this kind of thing can be confusing; it is not something one has ever put their mind to before. So we sit and make sure everything is explained, answer all the questions a student might have, and make sure they are comfortable with whatever decision they are making.

In fact, we are pretty aware of the specific medical risks that international students face while studying in Canada. Now, from weather-related injuries to seasonal illnesses, you can name it- our team has experienced everything. This provides us with an edge: we can make our recommendations accordingly to meet your specific requirements so that you are not caught off guard by the medical bills.

Wrapping Up Basira's Story and the Importance of Travel Insurance

One among the countless motivating stories is that of Basira. It underlines the integral role which Travel Insurance can play for international students. Had it not been for her TuGo Student Travel Insurance, Basira would have had to pay over $3,000 altogether to pay off all of those medical emergencies. For someone facing tuition and everyday living expenses, it is a really burdening loss.

Thank God Basira had made the effort to get Travel Insurance, and she really needed it at that moment. Her experience teaches one that no matter how young a person is, medical emergencies may still come, and in such a case, the best defence against this is a comprehensive travel policy in place.

At Canadian LIC, we’re here to make sure that every international student has access to the best Travel Insurance coverage available. Our brokers are knowledgeable, experienced, and ready to help you get the perfect plan. Do not wait until it is too late. Our insurance will guarantee your coverage so that you may focus on studying and having a good time here without worrying about something else-like the cost of unexpected medical treatment.

If you are an international student who wishes to study in Canada, now is the best time to make your move. Contact Canadian LIC to discuss the Travel Insurance that would best suit you, and thus ensure proper protection in case of any eventuality.

More on Travel Insurance

- Does Travel Insurance Cover Pregnancy?

- Is Visitor Insurance the Same as Travel Insurance?

- What Is the Average Cost of Travel Insurance?

- How Do I Maximize My Travel Insurance Claim?

- How Long Before Traveling Should You Get Travel Insurance?

- What Does Travel Insurance Not Cover?

- Is It Worth Buying Travel Insurance Online?

- Why is Emergency Medical Travel Insurance Important in Canada?

- Myths About Travel Insurance in Canada Debunked

FAQs: Travel Insurance for International Students Studying in Canada

Many international students believe they won’t face medical issues while studying, but accidents and illnesses can happen unexpectedly. Without insurance, even a simple doctor’s visit or minor injury can cost hundreds or thousands of dollars. Canadian LIC often hears from students who didn’t expect medical costs to be so high, especially without provincial health coverage. Travel Insurance helps cover those expenses so you can focus on your studies.

Student Travel Insurance usually covers emergency medical care, hospital stays, doctor’s visits, and even prescription medications. It’s designed to protect you from high medical bills. We’ve seen students like Basira, who needed treatment for multiple medical issues, get their costs fully covered. It’s more than just emergency care—insurance also covers follow-up treatments like physiotherapy or emergency dental care.

Some plans cover pre-existing conditions after a waiting period, but not all do. It’s important to ask about this when choosing your insurance. At Canadian LIC, we recommend looking closely at what’s included in your policy if you have any pre-existing health conditions. We’ve had clients who were glad they checked and ensured their ongoing medical needs were covered.

You can save thousands by having Travel Insurance. Basira’s medical emergencies could have cost her over $3,000, but with her TuGo Student Travel Insurance, she didn’t pay anything out of pocket. We often hear from students who were surprised by how much they saved after an unexpected medical situation.

Yes, you can buy Travel Insurance after arriving, but it’s best to have it before you arrive. We often advise students to get covered as soon as possible to avoid any gap in protection. Sometimes, students delay getting insurance and end up needing medical care during that gap. It’s better to be safe from day one.

Yes, most student Travel Insurance policies cover prescription medications. This can be a big help if you get sick or injured. Basira’s insurance helped cover her medications when she got a sinus infection. Medications in Canada can be expensive, so it’s good to have this part of your coverage.

Health insurance from your home country may not cover you while studying in Canada. Many students assume they’re already covered, but their plans don’t extend to Canada. At Canadian LIC, we recommend checking with your provider, and if it doesn’t cover you here, it’s best to get a Canadian Travel Insurance plan to avoid any surprises.

Yes, student Travel Insurance covers hospital stays for medical emergencies. A single night in a Canadian hospital could cost thousands of dollars. We’ve had clients who needed unexpected surgeries, and their insurance saved them from paying a huge bill.

Yes, most Travel Insurance plans can be renewed or extended if your studies go longer than expected. At Canadian LIC, we always suggest renewing before your policy expires to ensure continuous coverage. We’ve seen students forget to renew and end up uncovered during critical times.

Without Travel Insurance, you’ll be responsible for paying the full cost of medical care in Canada. We’ve seen students face overwhelming bills after a simple medical procedure. That’s why we strongly advise getting Travel Insurance before arriving. Even minor health issues can become financial headaches without it.

Choosing the right policy can be tricky, but it’s important to focus on coverage limits, exclusions, and any extra benefits like dental or vision care. At Canadian LIC, we help students find the best policies based on their individual needs. It’s about finding a balance between what you can afford and what will protect you fully during your time in Canada

Many Travel Insurance policies now include coverage for COVID-19-related medical expenses, but it depends on the policy. We recommend asking about COVID-19 coverage when purchasing your plan, as it’s important in today’s environment. We’ve had students who were relieved to have this coverage when they needed it.

These FAQs should help answer some of your questions about Travel Insurance for international students. If you’re studying in Canada, having insurance can save you from a lot of stress and financial burden. Make sure you’re covered, and don’t wait until it’s too late.

Sources and Further Reading

- Government of Canada – Health Care for International Students

Find detailed information on health care coverage options for international students in Canada, including Travel Insurance requirements.

Link: Government of Canada – International Students Health Care - TuGo Travel Insurance for Students

Learn more about TuGo’s Travel Insurance options designed specifically for students studying abroad, including coverage details and how to apply.

Link: TuGo Student Travel Insurance - Canadian Bureau for International Education (CBIE)

The CBIE provides insights on the importance of health insurance for international students and tips on securing coverage during studies in Canada.

Link: CBIE Health Insurance for International Students - Industrial Alliance Insurance and Financial Services Inc.

Discover the comprehensive insurance solutions offered by Industrial Alliance, including Travel Insurance plans for students studying abroad.

Link: Industrial Alliance Travel Insurance

These sources provide valuable information for international students looking to better understand Travel Insurance and the benefits of having proper medical coverage while studying in Canada.

Key Takeaways

- Travel Insurance is Essential: International students in Canada should have Travel Insurance to avoid costly medical bills in case of emergencies or illnesses.

- Coverage for Common Medical Issues: Travel Insurance covers doctor’s visits, hospital stays, emergency treatments, prescription medications, and even follow-up care like physiotherapy.

- Financial Protection: Insurance can save students thousands in medical costs, helping them avoid financial stress during their studies.

- Customizable Policies: Students can choose policies that fit their needs, including coverage for pre-existing conditions, dental, and vision care.

- Don’t Delay: It’s best to get Travel Insurance before arriving in Canada to ensure immediate coverage and avoid gaps during the waiting period for provincial healthcare.

- Renewal and Extensions: Students can easily renew or extend their Travel Insurance if their studies continue beyond the initial coverage period.

- Peace of Mind: Travel Insurance provides financial security, allowing students to focus on their studies without worrying about unexpected medical expenses.

By Pushpinder Puri

CEO & Founder

Your Feedback Is Very Important To Us

We value your feedback to help us better understand the challenges Canadians encounter when dealing with Travel Insurance for international students. Please take a few moments to answer the following questions.

Thank you for your time! Your feedback will help us improve our services and better meet the needs of Canadians and international students alike.

IN THIS ARTICLE

- How Travel Insurance Helped an International Student Save Thousands

- The Story of Basira: A Real Student Facing Real Medical Emergencies

- What is Student Travel Insurance, and Why Do You Need It?

- Why is Travel Insurance for International Students Essential?

- What Does Student Travel Insurance Cover?

- Basira's Financial Savings: How Travel Insurance Eased Her Burden

- How to Choose the Right Travel Insurance for International Students

- Common Medical Situations Covered by Travel Insurance for International Students

- Financial Benefits of Travel Insurance for Students: The Cost-Saving Potential

- How to Get Travel Insurance as an International Student

- Why Canadian LIC is the Best Choice for International Students

- Wrapping Up Basira's Story and the Importance of Travel Insurance