- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

How To Choose The Best Visitor Insurance For Your Trip To Canada?

Canadian LIC

CEO & Founder

- 11 min read

- February 21th, 2025

SUMMARY

This blog discusses the best ways to contribute to a Registered Education Savings Plan (RESP), including monthly contributions vs. lump-sum payments. It covers the importance of maximizing government grants and choosing the right RESP investment options in Brampton, Canada, and provides tips on how to grow your RESP. Additionally, it explains how to estimate contributions and work with RESP providers in Ontario, Canada, to ensure optimal savings for your child’s future education.

Introduction

The Registered Education Savings Plan (RESP) is one of the best options when it comes to saving for your child’s future education. Parents or guardians want the best for their children, and investing in their education is one of the most impactful decisions you can make. But, working through the intricacies of RESP contributions can be decidedly daunting. How do you know what the best method is, though, with so many options? Should you take one-time lump sums or smaller monthly payments? What investment options do you look for? What are the advantages of working with RESP providers available in Ontario, Canada? These are the questions a lot of families have when they start setting up their RESP accounts.

In this blog, we’ll cover the top methods of contributing to an RESP, their benefits, and how you can make the most of the amount in your RESP through various investment options in Brampton, Canada. Along the way, we’ll share relatable stories and experiences from the Canadian LIC perspective to ensure you make informed decisions on RESP contributions. If you’re unsure of where to begin, you are not alone. Many families like yours have been struggling as well. But fret not — we have you covered with all you need to know here.

The Basics of RESP Contributions

Before getting into the different methods to contribute to an RESP, let’s do a quick recap of how an RESP works, as well as why it’s a very attractive savings option for parents in Canada. The RESP, or Registered Education Savings Plan, is a government-registered savings plan that allows parents to save for their children’s post-secondary education. The reasons include government grant opportunities, tax-deferred growth, and many flexible contribution limits.

Lifetime Contribution Limits:

$50,000 per individual per lifetime. However, the government provides Canada Education Savings Grants (CESG), which match 20% of your annual contributions to a maximum of $500 per child per year and a total of up to $7,200 during the life of the RESP.

The most important piece of advice for making the most of an RESP is consistency. This ensures that the RESP grows significantly over time, especially with regular contributions. But how can you figure out the best way to help? Make monthly payments or a lump sum? Do you need to buy specific RESP investment options? Let’s explore.

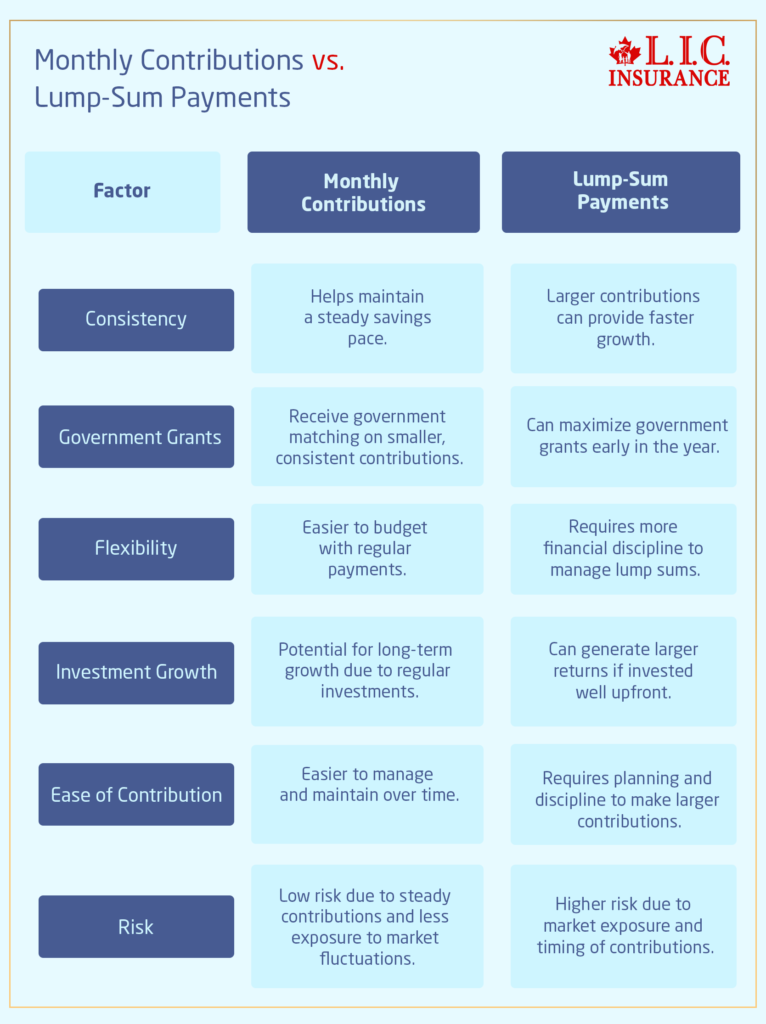

Monthly Contributions vs. Lump-Sum Payments: Which Is Best?

One of the first things you have to decide when setting up an RESP is whether to make monthly contributions or pay lump sums. Each method has its advantages, and the best choice ultimately depends on your current financial situation.

Monthly Contributions:

For many families, a smaller monthly contribution on a recurring basis is a great option. In addition, this way is less burdensome on your finances and puts you in the situation to benefit from dollar-cost averaging. This means that your money is consistently invested, regardless of market conditions, which may reduce the overall impact of short-term market fluctuations.

So, if you decide to contribute $200 a month to your child’s RESP, you’ll be steadily growing their savings. These regular contributions let the RESP grow with compound interest, even when you can’t afford a large chunk of change upfront. In the long run, this method can add up to substantial dollar savings without requiring you to spend a large initial lump sum.

Monthly contributions are easy to budget for and don’t require a hefty upfront investment, so they are often favoured by families. With even online Registered Education Savings Plan quotes, it’s easy to see how much you’ll need to contribute each month to hit your education savings goals.

Lump-Sum Contributions:

Others prefer to make a one-time payment to jump-start their child’s education fund. Suppose you have the financial flexibility to make a larger contribution all at once; a lump sum can be especially advantageous. By contributing more, you might reach the RESP’s maximum contribution limit sooner and maximize the amount of the CESG for which you’d become eligible.

If you were to put $10,000 into your account at the beginning of the year, the government would add 20% of that or an additional $2,000 in CESG contributions. Therefore, if it is possible to make larger one-off contributions, this can lead to a very large contribution from the government to you.

However, while lump-sum payments are ideal for those with more disposable income, families typically find more luck with smaller monthly contributions over time.

Monthly Contributions vs. Lump-Sum Payments

RESP Investment Options in Brampton, Canada

After you have chosen the contribution method that best suits you, it’s time to pick the right investments for your RESP. The investments you choose will directly affect the growth of your RESP. Certain investments carry higher returns but also higher risk, while others are low-risk but low return.

RESP providers in Ontario, Canada, offer several types of investments, some include:

Guaranteed Investment Certificates (GICs):

GICs are a perfect choice for families seeking a safer, lower-risk option. GICs are low-risk investments with a guaranteed return over a set time period. The returns aren’t as high as some other investment products but come with stability, which may matter to parents who want to protect their capital.

Mutual Funds:

It is an excellent option for those who can afford to take on a little more risk for the potential of greater returns. Mutual funds are investment vehicles that gather funds from various investors to purchase a diversified portfolio of stocks, bonds, and other securities. The market usually has ups and downs and is a huge factor in your mutual fund’s investments’ worth, but it has the potential for higher growth for a long time.

ETFs (Exchange-Traded Funds):

ETFs, which stand for exchange-traded funds, are mutual funds that are bought and sold on stock exchanges like individual stocks. They are often more affordable than mutual funds, as management fees are usually lower than that of mutual funds. If you are interested in more actively managing your RESP and are comfortable with the risk of fluctuating markets, then ETFs may be the way to go for you.

Stocks:

For those families comfortable with higher-risk investing, stocks deliver the highest potential returns. Investing in individual stocks is a more volatile and complex undertaking, and it requires more experience to do well. If you decide to buy stocks at all, be sure to educate yourself and remember to diversify to help mitigate risk.

Families in Brampton, Canada, often work with financial advisors to select the right RESP investment options to suit their objectives. Not sure where to start, ask an expert to walk you through the process.

How to Maximize Your RESP's Growth

In order to make the most of your RESP, it’s important to consider several strategies that can boost its growth over time. Here are a few tips for maximizing your RESP:

Contribute Early and Often:

The sooner you start putting money away for an RESP, the more time your money has to compound. Because RESP grows tax-free, starting it early can take advantage of compound interest and government matching grants, significantly increasing the value of your RESP. Even better, do your best to max it out every year so you receive the full CESG you’re entitled to.

Use a Diversity of Investment Strategy:

Do not put all your eggs in one basket. Diversifying your RESP investments can help protect your savings from market volatility. Investments that balance risk and potential upside, like mutual funds and GICs, can help find that happy medium.

Qualify for Government Grants:

Apply for the Canada Education Savings Grant (CESG). This match is 20% of your contributions each year, up to $500 per child. If you have a lower income, the Canada Learning Bond (CLB) is another government benefit where the RESP will receive additional contributions — a great way to set money aside for a child.

Avoid Over-Contributing:

It may be tempting to throw as much money into an RESP as you can afford, but watch out for those RESP contribution limits. Exceeding contribution limits may result in penalties and taxation on excess contributions. The lifetime contribution limit per child is $50,000, so be mindful of how much you contribute.

Ready to Contribute to Your Child’s Future?

Open an RESP and make regular deposits to keep your child’s future education on track. Whether you prefer monthly contributions or lump-sum payments, make sure to take step one today. You have the opportunity to prepare your child for success by making informed decisions about investment options and relying on the expertise of RESP providers in Ontario, Canada.

Here at Canadian LIC, we focus on working with families like yours to explore their Registered Education Savings Plans. Let us assist you in ensuring that you have the best-Registered Education Savings Plan quotes available online so you know exactly how you need to put in monthly contributions to reach your education savings goals. Ready to get started? Reach out to us today and brighten your child’s future!

More on Term Life Insurance

- Can I Contribute to an RESP After My Child Turns 18?

- How Much Are RESP Maintenance Fees in Canada?

- What Is the Impact of Divorce or Separation on an RESP?

- What Are the Differences Between a Family Plan and an Individual Plan RESP?

- What Is the Uptake of RESPs Among Different Communities in Canada?

- What are RESP Rules and Contribution Limits in 2024?

- How Long Can an RESP Remain Open?

- What Happens If I Miss Contributing to an RESP for a Year?

- Can I Open an RESP for a Child Who Is Not My Own?

- Can RESP Be Used for Rent?

- What Are the Disadvantages of RESP?

- What Expenses Are Eligible for RESP in Canada?

- What Is The RESP Limit In Canada?

- How Do I Withdraw Money from RESP Canada?

- Does a RESP Beneficiary Need to Live in Canada?

- Can I Use My RESP Outside Canada?

- How Do I Check My RESP in Canada?

- What Happens to RESP If You Leave Canada?

- Can You Transfer an RESP to an RRSP?

FAQs

There are two common methods to make contributions to an RESP: either you can contribute every month, or you would like to make larger lump-sum payments. Contributing monthly makes it easy for you to budget and take advantage of dollar-cost averaging. Making a lump-sum payment can also maximize the government contribution (if you do it earlier in the year). Both options have advantages, and it depends on your financial circumstances. Check Registered Education Savings Plan Quotes Online. If you do not know which saving plan suits you best, then you can check the Registered Education Savings Plan Quotes Online to calculate your options.

How much you contribute varies based on your needs and budget. But you can also give as much as $2,500 a year to qualify for the maximum government match. All this means that you will get the full amount of the Canada Education Savings Grant (CESG), which is 20% of your contributions. Buy Registered Education Savings Plan Online using online tools and track it for the best monthly or lump-sum contributions.

What are the different RESP Investment Options in Brampton, Canada? You can invest in safer assets like Guaranteed Investment Certificates (GICs) or riskier ones like mutual funds or stocks. In order to maximize capital growth, RESP investments should have a diversified portfolio. If you have no idea what to invest your money in, it’s always best to consult with RESP providers in Ontario, Canada, to help you choose the best investments suitable for you.

Yes, you must have the ability to exchange your RESP investments. As your child ages or as your financial goals shift, you might want to recalibrate your levels of risk. If you are dealing with RESP suppliers in Ontario, Canada, they are capable of producing these changes and guarantee that you are receiving the most out of your RESP.

In order to receive the Canada Education Savings Grant (CESG) and additional government benefits, you have to open an RESP through an accredited provider. These grants will match 20% of your annual contributions, capped at $500 per year per child. If you don’t know how to apply, Ontario, Canada RESP providers can help you with the application process and ensure that you are getting the maximum grant available.

You can also use an online calculator or talk to RESP Providers in Ontario, Canada, about how much RESP you need to contribute. It’s also possible to get registered education savings plan quotes online so you know how much you need to contribute to reach your savings goal. If you’re a beginner, it helps to think of your contributions as a monthly or yearly amount that works for your budget.

RESP funds can be used for virtually all expenses associated with post-secondary education, including tuition, books and living expenses for college, university or trade schools. As long as the program qualifies for the RESP, your child can use the funds to pay for these costs.

So, if our goal is to maximize the growth of our RESP, we want to contribute for as long and at as high a level as we can. Invest your RESP into different kinds of RESP investment products in Brampton, Canada, and ensure that you are maxing out on the government matching grants. For recommendations based on your financial targets, talk to RESP suppliers in Ontario, Canada.

Getting an RESP develops tax means, and the money placed for many in this account features income tax deferral. There is a lifetime contribution limit of $50,000 per child, and exceeding this amount can incur tax penalties. Just remember to stay on top of how much you put in, check with RESP providers in Ontario, Canada, and contribute only to one account to hit the limit.

If your child doesn’t go on to post-secondary education, you can transfer the RESP funds to a sibling or use the money toward your own retirement. If you take out the money without using it for an education, though, there could be tax implications. This blog will help you determine what steps to take in this case. Ontario’s and Canada’s RESP suppliers can help you with this.

We hope this FAQ will help you with some of the most commonly asked questions regarding RESP contributions and the best investment options for RESP in Brampton, Canada. Ready to start contributing to an RESP and get full details on setting up exactly what you need?

Sources and Further Reading

Government of Canada – Registered Education Savings Plan (RESP)

- Learn more about government grants, eligibility, and RESP contribution limits.

- https://www.canada.ca/en/services/education-savings.html

Financial Consumer Agency of Canada (FCAC) – RESP Basics

- A detailed guide on how RESPs work and the benefits of saving early for your child’s education.

- https://www.canada.ca/en/financial-consumer-agency/services/education-savings.html

Investopedia – Understanding RESP Investment Options

- Insight into different investment types within RESP accounts and how to choose the right one.

- https://www.investopedia.com/terms/r/resp.asp

Ontario Securities Commission (OSC) – Investing for Your Child’s Education

- Provides information on planning for education expenses and investment strategies in Canada.

- https://www.getsmarteraboutmoney.ca/

Canada Education Savings Grant (CESG) – Government of Canada

- Further details on how the CESG works and how to apply for government grants.

- https://www.canada.ca/en/services/education-savings.html

Key Takeaways

- RESP Contribution Methods: You can contribute to an RESP either through monthly payments or lump-sum contributions. Both have their benefits, depending on your financial situation and goals.

- Maximizing Government Grants: By contributing up to $2,500 annually, you can earn the full Canada Education Savings Grant (CESG) of 20%, maximizing your RESP’s growth.

- Investment Options: RESP investment options in Brampton, Canada, range from safer choices like GICs to higher-risk options like stocks and mutual funds. Diversification can help balance risk and growth.

- Start Early: The earlier you begin contributing to an RESP, the more time your investments have to grow, taking advantage of compound interest and government matching.

- Work with Professionals: Partnering with RESP providers in Ontario, Canada, can help you make informed decisions and choose the best investment strategy for your child’s education fund.