- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- How Much Term Insurance Can You Get Without a Medical Test?

- Why Choose Term Life Insurance without a Medical Exam?

- How Much Coverage Can You Get Without a Medical Exam?

- Types of Term Life Insurance without a Medical Exam

- Important Considerations Before Choosing Term Life Insurance without a Medical Exam

- Real Stories: How Canadian LIC Clients Benefit from No-Medical-Exam Insurance

- How to Apply for Term Life Insurance without a Medical Exam

- Why Choose Canadian LIC for Your No-Medical-Exam Term Life Insurance?

- Understanding the No-Medical-Exam Insurance Landscape with Expert Guidance

- The Value of Term Life Insurance without a Medical Exam

- Tips for Applicants Considering No-Medical-Exam Term Life Insurance

How Much Term Insurance Can You Get Without a Medical Test?

By Harpreet Puri

CEO & Founder

- 11 min read

- October 28th, 2024

SUMMARY

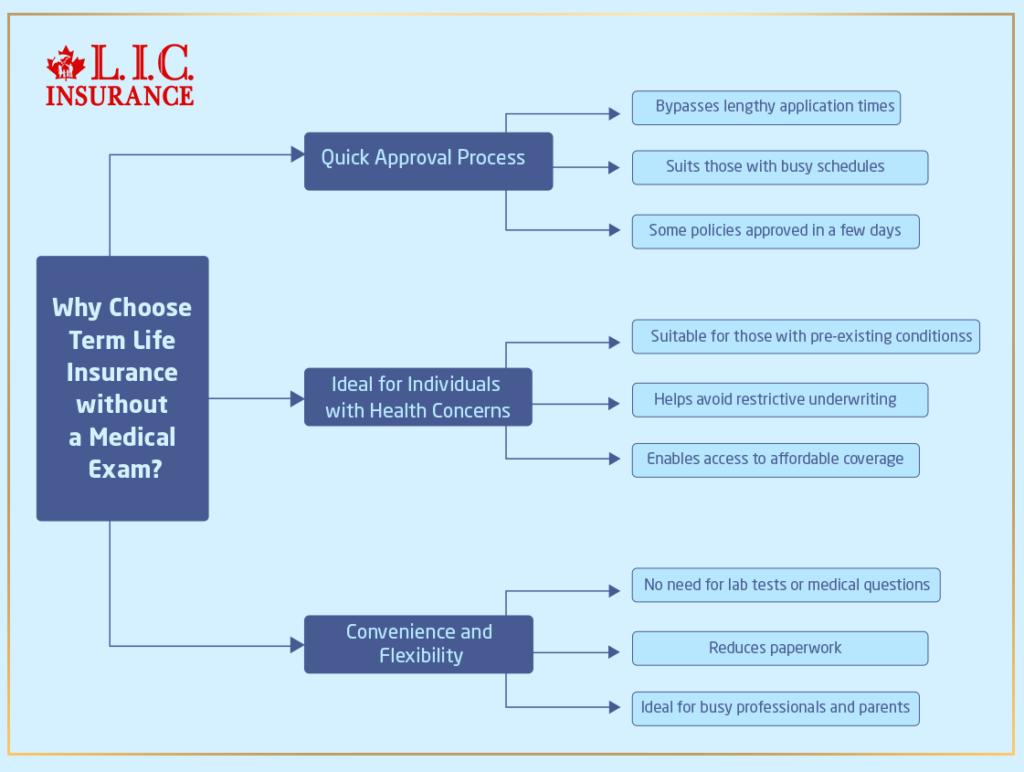

Why Choose Term Life Insurance without a Medical Exam?

The most common reason people opt for Term Life Insurance without a medical test is to avoid lengthy application times. Traditional policies often require a medical exam, which can take weeks from scheduling to processing results. Canadian LIC often sees clients whose busy schedules don’t allow for medical appointments, especially those who prioritize quick access to coverage. For these individuals, getting Term Life Insurance without a Medical Exam can be a valuable alternative, with some policies approved in just a few days.

Another common scenario is for people who have pre-existing health conditions or other factors that might lead to higher insurance premiums or even denied coverage. Avoiding the medical exam might help these individuals obtain coverage without subjecting themselves to potentially restrictive underwriting standards. Canadian LIC has helped many clients secure Term Life Insurance Plans that fit their financial circumstances without the added stress of a medical test that could complicate or prevent coverage.

3. Convenience and Flexibility

Opting for a policy without a medical exam is also appealing to people with time constraints. For many clients, the convenience of not having to arrange for lab tests, answer detailed medical questions, or deal with related paperwork simplifies their insurance journey. This option has been especially popular among busy professionals, parents, and those who value flexibility in managing their insurance.

How Much Coverage Can You Get Without a Medical Exam?

The amount of Term Life Insurance Coverage you can obtain without a medical exam varies widely depending on the insurer, your age, and your general health profile. Here is a review of the typical coverage options available through Canadian LIC and other insurers in Canada:

1. Low-Coverage Policies: Up to $50,000

These smaller coverage policies are the most accessible and available to a wide range of people without stringent requirements. They are ideal for clients who are looking for minimal coverage—perhaps to cover outstanding debts, like a credit card balance or final expenses. People often appreciate this option for its affordability and straightforward application, making it a reasonable choice for those seeking basic life insurance protection without the need for a medical test.

2. Moderate Coverage Policies: Up to $250,000

Coverage up to $250,000 is often available without a medical test, depending on the provider’s specific policy. This range typically suits individuals looking to secure enough coverage to protect their families from mortgage or debt obligations. Canadian LIC frequently helps clients interested in this level of coverage, especially those wanting a Term Life Insurance Quote for moderate-term protection.

Some Life Insurance providers, including options available through Canadian LIC, offer policies without a medical exam with coverage amounts up to $500,000. These are popular among clients who need a more substantial safety net for their loved ones but want the convenience of avoiding a medical exam. However, these high-coverage policies can sometimes come with higher premiums since the insurer takes on more risk without medical underwriting.

Types of Term Life Insurance without a Medical Exam

When looking to buy Term Life Insurance online, you’ll come across several options that provide coverage without a medical test. Each has its own criteria and coverage limits:

Guaranteed issue life insurance is available without any medical questions, making it accessible to virtually anyone. Coverage amounts are usually modest, often in the range of $25,000 to $50,000, but it’s a viable option for those seeking guaranteed approval. While premiums can be higher, Canadian LIC has helped many clients who needed this form of security without restrictions.

2. Simplified Issue Life Insurance

Simplified issue insurance, offered by various providers, requires applicants to answer a few basic health questions, but it does not mandate a physical exam. Coverage can go as high as $250,000 in many cases, making it suitable for individuals who want higher coverage without extensive medical evaluations. Canadian LIC frequently assists clients with obtaining simplified life insurance policies, especially those seeking immediate coverage without detailed health screenings.

3. Accelerated Underwriting Term Life Insurance

Accelerated underwriting policies leverage data analysis and predictive models to determine coverage eligibility without a medical exam. This means you may be able to get coverage up to $500,000 without traditional underwriting methods. Canadian LIC recommends this type of policy for those who want substantial coverage amounts quickly, as it often offers one of the higher coverage limits available without a medical test.

Important Considerations Before Choosing Term Life Insurance without a Medical Exam

1. Higher Premiums

Policies without a medical test generally come with higher premiums compared to those requiring full medical underwriting. This is due to the additional risk the insurer assumes when issuing coverage without in-depth health assessments. Canadian LIC often helps clients understand the cost implications and weighs these against the benefits of immediate coverage.

2. Potential Coverage Limitations

Some policies without medical exams might have specific limitations or exclusions. For example, certain high-risk activities or conditions might not be covered under these plans. Before you buy Term Life Insurance online, it’s essential to understand these coverage details, as Canadian LIC frequently advises clients on the nuances of these exclusions to prevent surprises in the future.

3. Term Length Options

While Term Life Insurance without medical exams is available in different terms, such as 10, 15, or 20 years, the cost and accessibility might vary. Policies with shorter terms might have lower premiums, while longer terms offer more sustained coverage but at a higher cost. Canadian LIC offers Term Life Insurance Plans tailored to different client needs and helps you choose the best term for your goals.

Insurers tend to provide more options for younger applicants seeking no-medical-exam policies. This makes it an attractive option for young professionals or families looking for coverage without delays or complications. Canadian LIC sees significant demand from young clients who want to secure coverage easily.

Real Stories: How Canadian LIC Clients Benefit from No-Medical-Exam Insurance

There have been a number of cases in the Canadian LIC with clients who have differing health and financial backgrounds availing Term Life Insurance Plans without medical tests. There was one who was a young professional, with a full-time job demanding much of his time; thus, he could not spare time to attend a medical appointment. Through guidance from the Canadian LIC, he obtained $250,000 in Term Life Insurance without going through medical tests, which gave him instant peace.

Another client, a single mother with some health concerns, was nervous about applying for Term Insurance due to potential premium surcharges. Canadian LIC helped her find a no-exam policy that offered $100,000 in coverage, which was enough to ensure her children’s well-being in case of the unexpected

How to Apply for Term Life Insurance without a Medical Exam

Securing Term Life Insurance without a Medical Exam is straightforward and begins with a few steps:

1. Assess Your Coverage Needs

Determining how much coverage you need and the term length is crucial. You can reach out to Canadian LIC for a detailed consultation to help assess your current and future obligations, ensuring your chosen coverage matches your needs.

2. Compare Term Life Insurance Plans and Quotes

It’s beneficial to compare quotes from multiple providers. Canadian LIC provides access to a broad range of Term Life Insurance Plans, allowing you to see options side-by-side to make an informed decision.

3. Complete a Simple Health Questionnaire (if Required)

For certain policies, you might need to answer a few health questions. Canadian LIC guides clients through this process, making it easy to find an insurance plan that matches their preferences.

4. Finalize the Application

Once you have selected a policy, the application process is fast and easy. In many cases, approval comes through within days, especially if the insurer offers accelerated underwriting. Canadian LIC makes the entire process smooth, so you can secure your Term Life Insurance without delays.

Why Choose Canadian LIC for Your No-Medical-Exam Term Life Insurance?

Canadian LIC is distinct in that it considers the client first; that is, each of their clients’ needs is made certain and then given the proper coverage. This brokerage has helped numerous individuals with Term Life Insurance options, helping them find which type and what amount of policy best fits their needs whether it be the traditional or the no-medical-exam option. With a reputation that leans toward dependability, Canadian LIC enables the most accessible communication of various Term Life Insurance Policies for its clients and offers the lowest possible quotes.

Therefore, Canadian LIC provides continued support, meaning you will always receive answers to any questions you might have and enable policy adjustments as you go through life. Such a level of service is representative of the commitment that Canadian LIC puts into its clients’ satisfaction, meaning one receives the best possible experience in choosing a life insurance policy.

Timely coverage can then be handled by the capable hands of Canadian LIC, which is prepared to assist in beginning immediately. Its savvy advisors are here to guide you through some options so you can feel confident and find the best possible protection for your loved ones.

Understanding the No-Medical-Exam Insurance Landscape with Expert Guidance

Not only does the Canadian LIC provide its clients with different kinds of Life Insurance products, but it also informs them of their choices. We advise the clients on all kinds of Term Life Insurance plan types, including the benefits and limitations of the no-medical-exam options. This kind of information helps them to make correct decisions based on specific circumstances and coverage requirements.

The Value of Term Life Insurance without a Medical Exam

It is very comforting knowing that you and your family are covered in any eventuality with Term Life Insurance. There is no medical exam Term Life Insurance, so for those who cannot pass the regular checkup, this will be quick and convenient for them.

Tips for Applicants Considering No-Medical-Exam Term Life Insurance

- Understand Your Financial Needs: Before applying, consider your financial situation and how much coverage you need to protect your family adequately. Canadian LIC can help calculate the coverage necessary to cover debts, living expenses, and other financial responsibilities.

- Review Policy Terms Thoroughly: It’s crucial to understand the terms and conditions of your insurance policy. Canadian LIC ensures you know what’s covered and what’s not, helping avoid any surprises in the future.

- Ask About Premium Costs: Premiums for no-medical-exam policies can be higher than those requiring a medical exam. Discuss with Canadian LIC the different premium options available and how they fit into your budget.

- Consider the Future: Life changes, and so do your insurance needs. Canadian LIC advises reviewing your insurance coverage periodically, especially after major life events like marriage, the birth of a child, or buying a home.

Secure Your Policy with Ease: Canadian LIC’s Online Tools

Canadian LIC uses technology to enhance the experience of the client. Using their online platform, it is easy to compare Term Life Insurance Quotes and apply for policies, all at home or in an office. Using these tools offers an easy process through which to buy Term Life Insurance online, therefore making this available to everyone regardless of the schedule or location.

How to Get Started with Canadian LIC

If you want to quote for Term Life Insurance that doesn’t require medical checkups, Canadian LIC is at your service. A free Term Life Insurance Quote awaits you right on their website, or you can simply talk directly to one of the experts. Their team is committed to ensuring that you get the best policy suited to your needs and budget and without a medical checkup.

Conclusion: Act Now for Your Future Security

Securing Term Life Insurance without a Medical Exam is not just a matter of convenience; it’s about making a responsible choice for the future. It’s simply responsible thinking toward the future. Canadian LIC is well aware of that while it continues striving to provide you with the very best insurance option suited to your circumstances. You get yourself a reliable partner who will professionally and patiently ensure your insurance needs are well met once you choose Canadian LIC.

Don’t wait until it is too late to protect your loved ones. Contact Canadian LIC today and discover how effortless it is to obtain a Term Life Insurance Policy tailored to suit your life, with no exam needed. You and your family will thank your future self.

More on Term Life Insurance

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

Frequently Asked Questions: Term Life Insurance without a Medical Exam

Term Life Insurance without a Medical Exam offers coverage without requiring a physical health exam. Canadian LIC frequently assists clients who need fast, hassle-free insurance. This type of Term Life Insurance plan is ideal if you’re looking for coverage without the added steps of medical testing.

Coverage limits for Term Life Insurance without a Medical Exam vary by Life Insurance Company, often ranging from $50,000 to $500,000. Canadian LIC helps clients choose the right coverage for their needs, depending on their goals and budget.

This type of insurance is especially beneficial for people with health concerns, busy professionals, or anyone who wants to avoid the medical exam process. Canadian LIC often works with clients who prefer the convenience of no-exam policies, making it easier to secure coverage quickly.

Typically, yes. Without a medical exam, premiums can be higher since insurers take on more risk. Canadian LIC provides options to help clients find affordable plans and Term Life Insurance Quotes that fit their financial goals.

Yes, many Term Life Insurance Plans without a medical exam are available online. Canadian LIC offers clients the convenience of comparing quotes and purchasing Term Life Insurance online, making it fast and easy to secure coverage.

Some policies, like simplified issue Term Life Insurance, require a few basic health questions but still skip the physical exam. Canadian LIC helps clients find plans that match their preferences, whether they want a completely exam-free policy or are okay with answering a few health-related questions.

Approval times vary, but many no-exam policies provide coverage within days. Canadian LIC often helps clients receive approval quickly, making this a great option for those needing immediate protection.

Yes, policies without medical exams sometimes have restrictions, such as lower maximum coverage or exclusions for certain conditions. Canadian LIC helps clients understand these details to choose a plan that meets their needs.

Simplified issue policies require basic health questions, while guaranteed issue policies have no health questions or exams. Canadian LIC often recommends simplified issue for those needing more coverage, as guaranteed issue policies typically offer lower amounts.

Yes, but it may require another application and possibly a medical exam. Canadian LIC frequently guides clients who want to adjust their Term Life Insurance Plans as their needs change over time.

Eligibility varies, but younger, generally healthy individuals are often accepted without issue. Canadian LIC works with clients of various backgrounds to identify eligibility and explore coverage options without medical tests.

Once approved, your policy remains unaffected by changes in health. Canadian LIC frequently reassures clients that they can keep their Term Life Insurance without fear of changes in premiums due to future health issues.

Yes, most no-exam policies have age limits, typically capping eligibility at 50-60 years. Canadian LIC helps clients within these age ranges find options that align with their needs and life stages.

Yes, many plans allow renewal, but it might come with a premium increase. Canadian LIC assists clients in exploring renewal terms that suit their evolving needs and budget.

Factors include age, lifestyle, smoking status, and coverage amount. Canadian LIC provides personalized Term Life Insurance Quotes, helping clients understand how each factor influences their policy costs.

Some no-exam policies include waiting periods, typically lasting two years, for certain types of claims. Canadian LIC explains these terms to clients to ensure they fully understand their coverage timelines.

Yes, switching is possible, though it may require a new application and possibly a medical exam. Canadian LIC helps clients weigh their options when looking to upgrade or change Term Life Insurance Plans.

Canadian LIC has years of experience helping clients secure the best no-medical-exam policies with competitive quotes. They work closely with each client to match them with suitable Term Life Insurance Plans, offering support throughout the entire process.

Common term lengths are 10, 15, and 20 years, but options vary by insurance provider. Canadian LIC helps clients select term lengths that align with their needs, ensuring adequate coverage for the chosen period.

Getting a Term Life Insurance Quote without a medical exam is easy. Canadian LIC provides instant quotes and guidance online, allowing clients to compare and purchase the best options quickly.

This FAQ guide should help clarify any questions you might have about Term Life Insurance without a Medical Exam. Canadian LIC is ready to assist you with more information and help you choose the right coverage that fits your needs.

Sources and Further Reading

Canadian Life and Health Insurance Association (CLHIA)

CLHIA’s guide provides insights on different life insurance options in Canada, including Term Life Insurance without medical exams.

Insurance Bureau of Canada (IBC)

The IBC website offers valuable resources on life insurance policies, coverage options, and choosing the right plan based on your needs.

Government of Canada – Financial Consumer Agency of Canada

The Financial Consumer Agency offers guidance on choosing life insurance, including considerations for no-medical-exam policies.

Insureye

Insureye’s resources give insight into Term Life Insurance Plans, including the benefits and costs associated with no-medical-exam options in Canada.

Key Takeaways

- Quick Coverage: Term Life Insurance without a Medical Exam allows for fast approval, ideal for those needing immediate coverage.

- Coverage Limits: No-exam policies in Canada typically offer coverage from $50,000 up to $500,000, depending on the provider and applicant’s age.

- Higher Premiums: Skipping the medical exam can lead to higher premiums due to added risk for the insurer.

- Convenience for All: Perfect for those with health concerns, busy schedules, or anyone wanting to avoid medical exams.

Canadian LIC Support: Canadian LIC offers guidance, instant quotes, and tailored plans for Term Life Insurance online, making it easier to choose the right coverage.

Your Feedback Is Very Important To Us

IN THIS ARTICLE

- How Much Term Insurance Can You Get Without a Medical Test?

- Why Choose Term Life Insurance without a Medical Exam?

- How Much Coverage Can You Get Without a Medical Exam?

- Types of Term Life Insurance without a Medical Exam

- Important Considerations Before Choosing Term Life Insurance without a Medical Exam

- Real Stories: How Canadian LIC Clients Benefit from No-Medical-Exam Insurance

- How to Apply for Term Life Insurance without a Medical Exam

- Why Choose Canadian LIC for Your No-Medical-Exam Term Life Insurance?

- Understanding the No-Medical-Exam Insurance Landscape with Expert Guidance

- The Value of Term Life Insurance without a Medical Exam

- Tips for Applicants Considering No-Medical-Exam Term Life Insurance