What would happen if life threw a curveball at you and you were not in a position to pay for your loan? Any kind of setback, be it personal or business-related, becomes overwhelming with the stress of managing financial obligations during tough times. This is where a Loan Protection Insurance Plan steps in with the safety net that can considerably ease your burden. In this blog, we will walk you through the claim process, detailing how long it typically takes to help you understand the process and the vital role of timely insurance coverage.

What is Loan Protection Insurance?

Loan Protection Insurance assists a person in making payments in the unexpected time of illness, disability, or even job loss. For business people, Business Loan Protection Insurance acts as a safety net that allows their business to keep going even when the owner himself cannot.

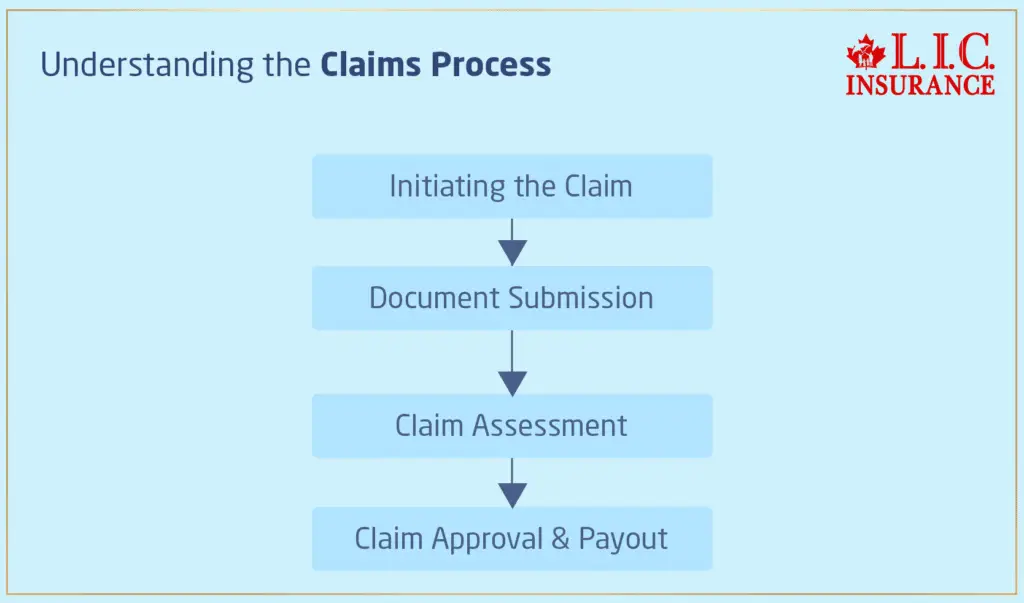

Understanding the Claims Process

Processing a Loan Protection Insurance claim—one that is going to help you through a difficult time of life—features various real key steps, each important to see that you get due support without undue delay. Let’s break down the steps involved and see some real-life examples from the experience of Canadian LIC.

Step 1: Initiating the Claim

Amanda’s Sudden Illness

Amanda, a small business owner in Halifax, was diagnosed with a severe illness. Her first step was to contact Canadian LIC to initiate a claim. This quick action is crucial and should ideally occur within days of the event that prevents you from working or managing your business.

What to Do: Immediately contact your insurance provider to initiate the claim. The sooner you start the process, the quicker you can receive support.

Step 2: Document Submission

Kevin’s Documentation Challenge

Kevin, who runs a construction business in Edmonton, found gathering the necessary documentation for his disability claim challenging. Canadian LIC assisted Kevin in understanding precisely what was needed, speeding up his claim process.

Submit all required documentation promptly. This may include medical reports, proof of income, or a letter from your employer. Accurate and complete documentation helps avoid delays.

Step 3: Claim Assessment

Emily’s Waiting Game

Emily, who had taken out a loan to expand her boutique in Montreal, faced a lengthy wait during the assessment phase of her claim due to incomplete documentation. Canadian LIC worked closely with her to rectify this, which facilitated a quicker resolution.

What to Do: Be prepared for this step to take some time as the insurer assesses the validity and extent of your claim. Stay in touch with your insurance provider and respond promptly to any additional information requests.

Step 4: Claim Approval and Payout

Raj’s Relief

Once Raj, a Toronto-based IT consultant, received approval for his claim after an unexpected layoff, the payout phase was straightforward. Canadian LIC ensured his loan payments were managed directly, allowing him to focus on his job search without the stress of looming debts.

What to Do: Once your claim is approved, the payout phase generally proceeds smoothly. Ensure that you understand how the payments will be made, either directly to you or to your loan account.

Factors Affecting the Claims Process Duration

While processing claims under a Loan Protection Insurance Plan, several factors can influence the time duration from initiation to payout. Clearly, how one should be prepared does matter, especially for Business Loan Protection Insurance holders, where timing has a big business operational impact. To explain all these further, let us consider real-life examples from our clients at Canadian LIC that will help guide you through your claims process.

The Complexity of the Claim

The Complex Case of Oliver’s Manufacturing Business

Oliver owns a large manufacturing business in Winnipeg, which was affected by a sudden market downturn, which led to his claim under his Business Loan Protection Insurance. The complexity arose due to multiple loans and creditors involved, each with different terms and conditions. This scenario required extensive documentation and verification to assess the claim comprehensively.

What to Do:

If you find yourself in a complex situation like Oliver’s, be proactive in gathering all relevant documentation as early as possible. It’s also wise to maintain a detailed record of all communications and transactions related to your loan. The more organized your documents, the easier it will be for the insurance company to process your claim.

Timeliness of Documentation Submission

Sarah’s Delay and Its Consequences

Sarah, a small café owner in Saskatoon, experienced a serious illness that led her to file a claim under her Loan Protection Insurance Plan. Unfortunately, Sarah delayed submitting her medical reports and other necessary documents, which extended the processing time of her claim significantly, affecting her business’s operation during her recovery.

What to Do:

Always strive to submit all required documentation as quickly as possible. Set reminders for deadlines, and perhaps appoint a trusted advisor or family member to help if your circumstances hinder your ability to manage the paperwork promptly.

Response Time from Third Parties

Delayed Responses in Jason’s Tech Startup

Jason’s claim under his Business Loan Protection Insurance involved verifying facts with third-party contractors who were slow to respond. This delay was partly due to the contractors’ busy schedules and the complexity of the information required by the insurers.

What to Do:

To mitigate such delays:

- Communicate clearly and regularly with third parties involved in your claim.

- Explain the importance of their timely response to your situation and persistent follow-up.

- If possible, offer to help them gather the necessary information to expedite the process.

Communication with Your Insurer

Enhancing Efficiency through Effective Communication

Linda, who owns a boutique in Toronto, exemplified how effective communication could enhance the efficiency of the claims process. After filing her claim, Linda maintained regular contact with Canadian LIC, providing updates and responding to inquiries promptly. This not only helped her process her claim more swiftly but also established a strong, supportive relationship with her insurer.

What to Do:

Maintain open lines of communication with your insurer. Regular updates and responsiveness to requests for additional information can significantly speed up the claims process. Don’t hesitate to ask questions if certain aspects of the process need clarification; understanding each step can lead to more effective interactions and quicker resolutions.

At Canadian LIC, we understand that the duration of the claims process can be a crucial factor for our clients, especially those with Business Loan Protection Insurance. This shall make the process as easy and smooth as possible, by expert guidance at every step.

Be proactive, organized, and communicative. The complications involved in filing can be managed effectively by applying the proper approach and careful support. Again, we are here to support you, help you, and ensure that your claim gets processed efficiently and timely.

Do you want to know how long it will take to process your Loan Protection Insurance claim? Are you hazy about what’s going to be required and all the steps involved? Don’t hesitate to contact Canadian LIC today. Our professional team is here to walk you through each stage of your claim to ensure that you are provided with the information and help you need to secure your financial stability. Allow us to help in protecting what matters most to you.

Why Choose Canadian LIC for Your Loan Protection Needs?

Canadian LIC stands out as a leader in providing comprehensive and empathetic support to its clients. Our team is dedicated to guiding you through each step of the claim process, ensuring that you understand all aspects and facilitating a smooth and timely claim resolution.

Coming to the end

You can handle going through a Loan Protection Insurance claim, and it is a very simple deal that can offer you peace of mind in times of distress if properly supported and understood. At Canadian LIC, we understand the need to support our clients in difficult times. Avoid waiting until the crisis throws the punch—get your Loan Protection Insurance now. Contact Canadian LIC today to discuss your options and make sure that you are protected against life’s uncertainties. Remember that getting a Loan Protection Insurance Plan with Canadian LIC does not mean it is purely a financial move, but it is your step towards securing your future and staying on stable ground no matter how things go in life.

Ready to lock in your financial future? Contact Canadian LIC, the best in insurance brokerages across Canada—let us help you find a Loan Protection Insurance Plan that will work for you. Give protection to yourself, your family, and your business today. Your peace of mind is just a conversation away.

Know More on Loan Protection Insurance

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions About Loan Protection Insurance Claims

Getting to know the complexities of filing a claim for your Loan Protection Insurance Plan can raise many questions. At Canadian LIC, we have some of the common questions our clients usually ask and hereby give insightful answers so you can relate to and understand them better.

Notify your insurer as soon as possible after an event that may lead to a claim. Notification is very important and must be done in a timely fashion. Mark, who ran his own landscaping business, suffered a terrible injury to himself and contacted Canadian LIC within a week. This prompt action allowed us to start the process of his claims immediately, ensuring your protection of business loan insurance and having the right financial support available when you could not work.

These documents may vary, but generally, they would call for medical records, proof of income, and those related to the loan, like the loan agreement papers.

Now, put yourself in the shoes of a graphic designer like Emily. She had to present her medical records and loan documents when she became temporarily disabled. Because she had prepared what she needed, she fast-tracked her claim on her Loan Protection Insurance Plan, putting less of a burden on her financial responsibilities.

Keep all documents regarding claims complete and submitted on time. Also, maintain open lines of communication with your insurer so that in case of any request for information, you can give a prompt response.

Sarah, the owner of a cafe, regularly kept in touch with the Canadian LIC and responded promptly to requests for more documents. This good communication really picks up the pace of her claim process quite considerably.

Delays are often caused by incomplete documentation and slow responses. Tom’s claim under his Business Loan Protection Insurance was delayed because his medical provider failed to respond quickly enough with the required reports. Once this hold-up was explained to Tom, he helped facilitate communications between his doctor and Canadian LIC, which expedited matters.

Yes, partial disability coverage is covered in many policies, with varying terms. Refer to your policy document or contact your insurer for specific information.

Linda partially hurt her back, limiting her ability to work full-time in her retail store. Her Loan Protection Insurance Plan covered partial disability, so she could claim benefits that helped pay her loan while she worked reduced hours.

Your insurer will notify you directly once your claim has been assessed and a decision has been made.

Canadian LIC sent an e-mail and followed it up with a call to Raj, owner of a small IT consultancy, regarding the confirmation of approval for his claim and the payout amounts with dates.

Read your insurer’s reasons for denial and collect more supporting documents in order to appeal, if need be.

Insufficient documentation led to the denial of Kevin’s initial claim, after which he organized more detailed medical evidence and successfully appealed with the guidance of Canadian LIC.

Payout timelines may differ, but most, in any case, occur a few weeks after claim approval.

After Nicole’s claim had been approved, Canadian LIC processed the payout on her loan within two weeks and helped to keep her beauty salon operational while she recovered.

Let your insurance company know if your financial situation changes significantly. This can impact your claim and, more importantly, the support you receive.

Carlos, who owns a small printing business, experienced an improvement in his medical condition sooner than expected. He updated Canadian LIC immediately, which adjusted his benefits accordingly, ensuring a fair process.

Although you can, generally, cancel your scheme at any time, an exit after filing a claim may affect the benefits of continuing or future claims.

Harold, who owns a small bookstore, considered cancelling his policy after making a claim during a temporary health issue. After discussing with Canadian LIC, he decided to maintain his coverage, which proved beneficial when he needed to claim again later.

Staff at Canadian LIC understand that every client represents an individual case. Therefore, we try to provide unique consultation and support at every step of the claim process. If you have other questions or need help with your Loan Protection Insurance policy, don’t hesitate to contact us. Our staff is here to ensure your experience turns smooth and hassle-free, from securing your financial health to your business stability.

Coverage can vary depending on the policy, but it will generally range from months to a few years, depending on how you are covered.

Sophia runs a digital marketing firm and used her Business Loan Protection Insurance for the full 12 months her policy allowed, which gave her the chance to recover from her illness and time to get back into business full-time.

Keep your documents in order, file on time, and communicate with your insurer consistently enough. Be sure you promptly get to any request for additional information.

Alex, an owner of a landscaping business, had his documents all pre-organized and communicated with Canadian LIC frequently. His proactive approach ensured that his claim got processed within just a few weeks.

If the amount of the payout appears inconsistent with your policy terms, request details from your insurer. If necessary, consider a formal appeal with the support of legal or financial counsel.

When freelance photographer Emma received less than the expected payout, she called Canadian LIC for clarification of the situation. There was a mistake about her level of income, which was resolved quickly after she provided the correct details.

Usually, seeking a quote for Visitor Insurance comes with certain questions about some of the basic pieces of information regarding one’s parents—ages, the period they intend to stay in Canada, and any specific health conditions. This is much the same way you book a flight, requiring you to proceed with the passengers’ details. For example, when James was inquiring about insurance for his mom, the site only wanted the age of his mom and the travel dates; he didn’t need to give full details about his mom and even got a quote for the trip.

Sources and Further Reading

To deepen your understanding of Loan Protection Insurance claims in Canada and enhance your knowledge on related topics, here are some recommended sources and further reading materials:

Financial Consumer Agency of Canada (FCAC)

Website: Canada.ca/en/financial-consumer-agency

Overview: Provides comprehensive information on various financial products including insurance, with specific guidelines and regulatory information about insurance products in Canada.

Insurance Bureau of Canada (IBC)

Website: IBC.ca

Overview: Offers detailed resources on all types of insurance available in Canada, including business and personal Loan Protection Insurance, with FAQs, policy details, and consumer rights information.

Canadian Life and Health Insurance Association (CLHIA)

Website: CLHIA.ca

Overview: A wealth of information on life and health insurance products, including guides on understanding different types of insurance plans and the claims process.

These resources provide valuable insights and expert guidance that can help you navigate the complexities of Loan Protection Insurance and ensure you are well-informed about your rights and options. Whether you are a business owner or an individual looking to safeguard your financial commitments, these sources will equip you with the necessary tools to manage your insurance needs effectively.

Key Takeaways

- Know the steps of the Loan Protection Insurance claim process to better navigate challenging times.

- Notify your insurer immediately after an incident and quickly submit all required documentation.

- The complexity of a claim can extend processing times due to additional verifications.

- The duration of claims processing can vary based on documentation completeness and the type of claim.

- Learn from real-life stories for practical insights on navigating the claims process efficiently.

- Utilize the expertise and support of your insurance provider to minimize stress and ensure financial stability.

Your Feedback Is Very Important To Us

We appreciate your time in helping us understand the experiences of Canadians with the processing time of Loan Protection Insurance claims. Your feedback is crucial for us to identify areas for improvement and to better support our clients. Please answer the following questions:

Thank you for sharing your experiences. Your feedback is invaluable to us and will be used to improve the services provided by Loan Protection Insurance providers in Canada.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]