- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- What Is The Rule Of Term Life Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Insurance Policy?

Reviews

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Does Term Life Insurance Expire At Age 65?

- Does Term Life Insurance Expire at Age 65 (Summary)

- What Happens After 65?

- How Age Affects Term Life Insurance Rates in Canada

- Age-Affecting Term Life Insurance Rates in Canada

- Why You Should Consider the Best Term Life Insurance Policy Brokers in Ontario, Canada

- What to Do if Your Term Life Insurance Expired at Age 65

- Conclusion

- More on Term Life Insurance

How Long Does It Take To Get Approved For Term Life Insurance?

Canadian LIC

CEO & Founder

- 11 min read

- February 26th, 2025

SUMMARY

This blog covers the approval process for Term Life Insurance in Canada, including the factors that affect approval time, such as health, age, and coverage amount. It explains the steps from application submission to policy issuance and provides tips to speed up the process. Real-life struggles and solutions are shared, along with frequently asked questions to clarify common concerns. The blog emphasizes the importance of securing coverage and offers guidance on navigating the approval process smoothly.

Introduction:

In Canada, there are a few steps to apply for Term Life Insurance. But a lot of folks are left wondering about the approval process. How long does it take to apply for Term Life Insurance? What determines the timeline? These questions might be at the top of your mind if you’re in Brampton or the rest of Canada looking for an affordable Term Life Insurance Plan.

You’ve likely heard stories of others waiting weeks to receive a response or, alternatively, receiving one in a timely manner. Whatever the case may be, you should have a general idea of how the process works so that you can be prepared ahead of time and reduce any unnecessary stress. That being said, let’s review the approval process and get you better familiar with what happens when you purchase a Term Life Insurance Policy in Canada!

Understanding the Approval Process

Getting approved for Term Life Insurance in Canada will vary based on a few factors, but generally follows these key steps: Whether it’s an affordable Term Life Insurance Plan in Brampton, Canada, you’re after or seeing Term Life Insurance Policy Quotes Online, knowing each step that you will encounter in the Life Insurance Application Process will enable you to go through it confidently.

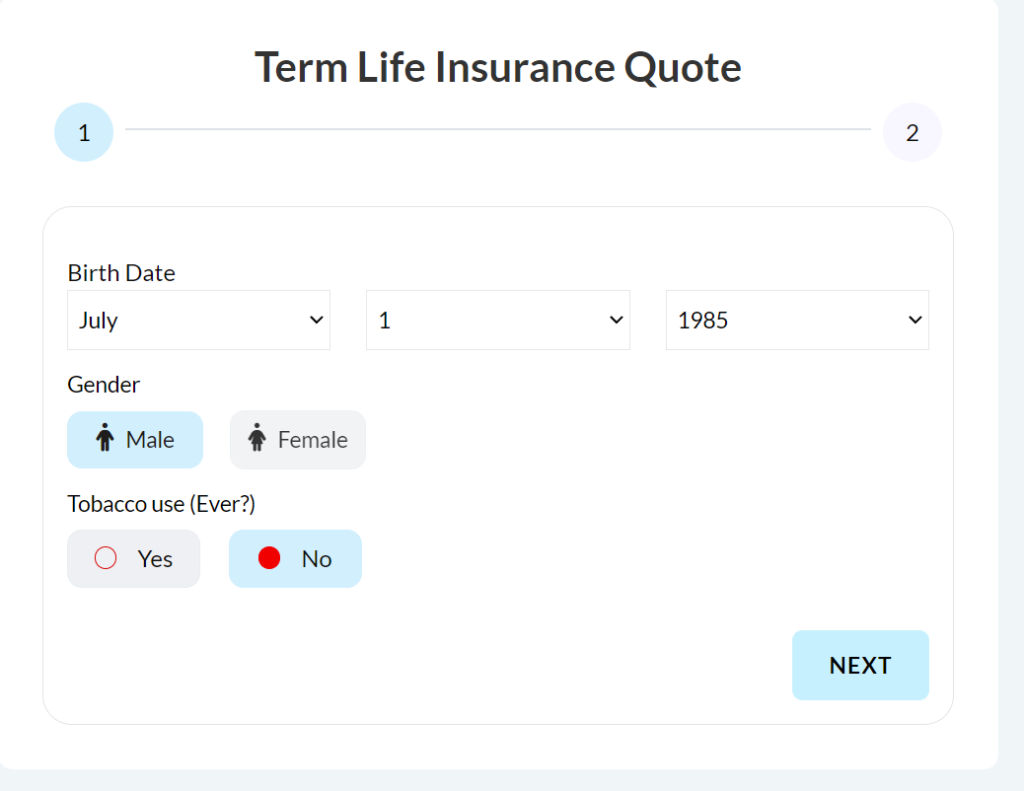

Step 1: Submit an Application

The Life Insurance Application itself is the first step. It’s here that you’ll fill in details about your health, lifestyle, occupation and, in some cases, family medical history. You’ll also specify how much coverage you’d like to have and the length of the term (typically 10 to 30 years). The average price of this kind of Term Life Insurance Policy in Canada depends on your desired coverage type; you may also get an estimate here.

Some applicants may hesitate to divulge too much personal information, but being honest is crucial. Life insurance companies will review the information you provide, so if you misrepresent your health status or lifestyle, it can cause problems down the road, including denied claims.

Step 2: Medical Underwriting

The insurer will often require medical underwriting in many cases. This could be a range of tests, including blood and urine tests, a medical examination, or occasionally simply a health questionnaire. The objective is to gauge your health risks and to charge you for insurance.

The affordable Term Life Insurance Plan in Brampton, Canada that you are interested in may not need a medical exam if you’re young and healthy or if you’re seeking lower coverage amounts. But if you’re older or have certain health conditions, you may need more extensive medical underwriting.

Depending on how complex your health history is, this stage may take time. For others, a simple health questionnaire may suffice, and approval may take a few days. For others, though, the process could be longer if additional tests are needed.

Step 3: Risk evaluation and Verdict on Approval

After reviewing your application and any medical exam (if needed), the life insurance company will conduct a risk assessment. This means assessing your health, lifestyle choices and family history in relation to your premium and eligibility.

For a quote on a Term Life Insurance Policy online, you might receive an initial quote, but the final price will depend on how the insurer views your overall risk. Younger, healthier people will usually pay lower premiums and smokers, those with chronic illnesses or high-risk jobs, might pay higher rates.

Depending on their findings, the insurer will either accept or reject your request at this stage. The authorization process may take from a few days to several weeks. If your insurer requires additional health or lifestyle information, though, the process may take longer.

Step 4: Policy Issuance and Confirmation

When your policy is approved, you will get a formal offer. You’ll have to examine the terms, making sure the coverage and premiums align with what you expect. Your Term Life Insurance Policy is officially issued after you sign the offer and pay the initial premium.

Some insurers may quote you a Term Life Insurance Policy online and approve you instantly if you qualify for standard rates. But if more details are needed, it could take weeks until everything is completed.

Factors That Affect the Approval Time

The process is otherwise relatively similar across the board, but there are some variables that can help determine how long it takes to be approved for your term life insurance in Canada. Here are some important considerations:

- Health History: As mentioned before, your health is one of the largest determinants of how long you will wait to get approved. If you’re in good health without any pre-existing medical conditions, your process will probably be faster. If you have a chronic illness, a history of surgery or other medical conditions, however, the insurer may require more testing or a review of your medical history in detail. This may slow down the approval process.

- Age: Your age is also an influential factor in the approval crowd. The younger and healthier you are, the faster the approval usually is.” Older patients or patients with health problems might be scrutinized more closely, which can slow down the approval process.

- Lifestyle Choices: Your lifestyle choices also determine the time required for approval. Suppose you’re a smoker or practice a high-risk activity like skydiving or scuba diving. In that case, you will likely have a much longer approval time because of the risk related to those activities.

- Amount of Coverage: The greater the coverage amount, the longer it might take the insurer to process your application. Larger amounts might be subject to further medical tests or more detailed risk assessments. This is especially true if you are applying for a large amount of coverage, such as a life insurance policy for a million dollars.

- The complexity of Your Case: If your case isn’t standard, for example, you have a complex medical history or a profession that carries certain risks, it will take the insurer longer to evaluate your application and decide.

How to Speed Up the Approval Process

If you’re looking to get your Term Life Insurance Policy in place as soon as possible, here are a few steps you can take to help the insurer approve you faster:

- Be Honest and Accurate on Your Application: Making mistakes — or failing to mention critical things — can delay or even prevent your application from being approved. Be honest about your health, lifestyle and medical history.

- Get your Medical exams done as quickly as possible: If the insurance company asks for doctors’ examinations or some tests, ensure you get them done quickly. Delayed completion of the medical requirements can extend the approval process as well.

- Pick a Standard Amount for Coverage: When you want to get an affordable Term Life Insurance plan in Brampton, Canada, then determine a standard amount for coverage. These policies can be processed more quickly than high-coverage plans, which are often more thoroughly reviewed.

- Seek the Help of a Knowledgeable Insurance Broker: A qualified insurance broker, like Canadian LIC, can take the sting out of the application process. Brokers know the industry inside and out and can help make sure that all your paperwork is in order, lowering the chances of delays.

Real-Life Struggles and Solutions

Let’s look at some real challenges that people face in their journey to obtain approval and how working with the right resources can change the outcome.

Struggle 1: Health Concerns

Medical underwriting is one of the most common concerns people have when applying for Term Life Insurance. John, a 42-year-old who had a family history of heart disease, found the process intimidating.” He was concerned that his health would make insurance expensive.

Solution: After reaching out to Canadian LIC, John was guided on how to present his medical history accurately, and he was able to find an affordable Term Life Insurance Plan in Brampton, Canada, that worked for him, even though his health history posed a challenge.

Struggle 2: The Waiting Game

A concern for many applicants is how long it takes to receive a decision from the insurer. Maria, a 35-year-old non-smoker, was growing frustrated with the waiting time, which lasted well over a month.

Maria partnered with Canadian LIC to expedite the process. They helped her pursue the insurer and made sure her paperwork was in order. As a result, Maria received her approval faster than expected.

How Long Does It Really Take?

How long does it take to get approved for term life insurance in Canada? It takes a few days to a few weeks, which is the average time to get approval. This highly depends on insurer requirements, your state of health, and how much coverage you need. Although the wait may feel interminable, understanding what to expect and how to navigate the process can alleviate your worries.

Take Action Today for Peace of Mind

While navigating the Term Life Insurance approval process may feel overwhelming, it’s an essential step to securing financial peace of mind for your loved ones. Knowing what to expect and how long it might take can help alleviate the stress and also keep you in the loop through the process. If you are looking for an economical Term Life Insurance Plan in Brampton, Canada or want to get instant Term Life Insurance Policy Quotes Online, then take the help of an expert to make informed decisions with confidence.

If you’re ready to move forward, here are a few things you can do today to get started:

Assess Your Insurance Requirements:

Consider your family’s needs and what that translates to, how much coverage. If you are a bit lost, consulting with a seasoned insurance broker will clarify. You can explore Term Life Insurance Policy Quotes Online as well. This will give you an idea of alternatives and the cost of coverage. Take the time to make sure you won’t overpay for unnecessary coverage or under-protect your family.

Organize Your Medical Records:

Being prepared by having your medical history readily available can fast-track the approval process. Gather the required documents before applying. The required documents, which may include your recent medical history, prescriptions, and test results, should be gathered before applying. If you can be proactive in this area, then you can significantly reduce any delays.

Have an Insurance Broker’s Expertise On Your Side:

An experienced insurance broker like Canadian LIC can simplify the process. We can help you navigate through the complicated application process by making sure all required documents are in order and also ensure that you are getting the cost of Term Life Insurance Plan in Canada that fits into your budget. Brokers may also advise you on which insurers are most likely to offer you the best terms, considering your individual situation.

Compare Different Policies:

Do not take the quote that suits you the best. Devote time to search for different term life insurance policy quotes online. Premiums can vary widely, and it’s worth doing a bit of shopping around to make sure you’re getting the best deal that meets your needs. Shopping for policies also affords you the opportunity to hear about specific details about what is and isn’t covered.

Ensure your Application Remains Current:

After submitting your application, follow up regularly. Insurance companies may ask for further details or explanations. If you are on this early and participate in the process, it will go much faster.

What Happens if Your Application is Denied?

The first situation that you will encounter is a rejection in the approval process. If this happens, don’t panic. Here are some examples of potential choices you have:

- Know Why You Were Denied: You’ll need to know how and why you were denied. Insurers need to explain what that is: a health condition, a lifestyle choice or something else entirely. So you can handle it next time.

- Seek Out Life Insurance Alternatives: If you’re unable to qualify for a standard term life policy, that’s not the end of the road. You could apply instead for guaranteed issue life insurance, which does not require a medical exam and is available to most applicants but at higher rates. Another option is a simplified issue life insurance policy, which might have fewer requirements than a fully underwritten plan.

- Discuss with a Broker: If there are options elsewhere, trading to alternative solutions with the backing of an experienced insurance broker can make sure you have explored all avenues in relation to seeking a solution. If you are appealing the denial or want to look for alternate policies, having the support of a professional means you don’t have to go through it all alone.

Final Thoughts on Getting Approved for Term Life Insurance

Once you familiarize yourself with the approval process of Term Life Insurance in Canada, you’ll know what to expect and have fewer surprises. Whether you complete an application for an affordable Term Life Insurance Policy In Brampton, Canada, or just simply search for the most beneficial term life insurance estimates on the net, being a measure ahead and on the front side might help you purchase a Term Life Insurance in a faster manner.

When clients take out Term Life Insurance funds, this should be highlighted and valued. The sooner you apply, the sooner you can lock in coverage and the less you have to worry about what tomorrow might bring.

Don’t wait any longer to start shopping now for Term Life Insurance options that suit your needs. Seek advice from a trusted insurance broker who can lead you through getting quotes, answering your questions, and comparing your best insurance options.

And ultimately, the best advice is for you to get some coverage in place to make sure you are protecting your family. So, whether you’re inquiring about a cheap Term Life Insurance Plan in Canada or are just starting to get free quotes, it’s decided that now’s the time to take the first step and ensure that your loved ones are covered.

More on Term Life Insurance

- What Is Level Term Life Insurance Policy And How To Buy It

- Can A Smoker Get Term Life Insurance?

- How Many Years Is A Term Life Insurance Policy?

- Which Company Has The Highest Claim Ratio In Term Insurance?

- What Is The Best Amount For Term Life Insurance Policy?

- How Expensive Is Term Life Insurance?

- What Is The Rule Of Term Life Insurance?

- What Is The Waiting Period For Term Insurance?

- Is Natural Death Covered In Term Insurance?

- Should I get a 20 or 30-year Term?

- How Do I Claim Term Insurance?

- Can I Use My Term Life Insurance To Pay Off Debt?

- Who Is The Largest Provider Of Term Life Insurance?

- What Happens After 15-Year Term Life Insurance?

- What is a 5-Year Term Life Insurance Policy?

- What Is The Expiry Date On Term Life Insurance?

- What Is The Short Term Policy Rate?

- Can I Change My Nominee In Term Insurance?

- The Evolution Of Term Life Insurance: Past, Present, And Future

- From Confusion To Clarity: How Harpreet Puri Guided A Client Through Complex Term Life Insurance Decisions

- Do Rich People Have Term Life Insurance?

- What Are The Common Term Life Insurance Clauses?

- What Are The Disadvantages Of Joint Term Insurance?

- What Is The Oldest Age At Which You Can Get Term Life Insurance?

- How Do You Choose The Right Claim Payout Option For Your Term Insurance?

- Is There a Medical Exam for Term Life Insurance?

- Limited Pay vs Regular Pay Term Insurance

- When To Cancel Term Life Insurance?

- Best Term Life Insurance Plans For Couples

- Joint Term Insurance VS. Two Separate Term Plans

- Which Is Better – Term Insurance Or Health Insurance?

- Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

- Why Are Term Life Insurance Claims Rejected

- What Type Of Risk Is Covered By Short Term Insurance?

- What Happens If You Can’t Pay Your Term Life Insurance?

- What Will Disqualify You From Term Life Insurance?

- Can Riders Be Added To Term Life Insurance?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Insurance Policy?

FAQs

It may take a few days to a couple of weeks to obtain approval. The answer depends on things like your health, how much coverage you need and the insurer’s requirements. If you’re healthy and applying for a lower coverage amount, the process could be faster.

Your health history, age, lifestyle choices (like smoking or risky hobbies) and the amount of coverage you’re applying for are the key factors that determine how long the approval process takes. More complicated cases may also require further medical underwriting, prolonging the approval process.

If you have a pre-existing condition, you can get approved for Term Life Insurance, but it can come with increased premiums or a longer medical review. Each case is different, and an insurance broker can assist you in finding the best options.

To expedite the process, make sure your application is accurate, complete, and honest. Answer all requests from the insurer as quickly as possible, and consider using an insurance broker to help you navigate the process.

By being informed about the terms of approval and by being proactive and working with the right professionals, securing Term Life Insurance can be a smoother and quicker process. Act now to protect a future for your family and your finances.

Yes, a lot of insurance providers do provide the choice of applying for Term Life Insurance on the web. This can be a handy way to request quotes for a Term Life Insurance Policy online. An online platform lets you complete your application, submit medical information and even receive preliminary quotes. However, some insurers may still request a medical exam depending on the coverage amount you’re seeking and your health.

Usually, you will have to enter some personal information like sex, age, profession, smoking status, etc. Other insurers also require medical history, family health history, and lifestyle information. You will also need to attend and pass required medical examinations in a timely manner. It’s always a good idea to have medical history at your fingertips.

Your coverage requirement varies based on your financial liability, such as mortgage, debt, and dependents. As a rule of thumb, you’ll want a policy that is worth around 10-12 times your yearly income. However, a licensed broker can help you find the appropriate amount of coverage for your individual needs.

Yes, most Term Life Insurance Policies give you the flexibility to change the amount of coverage you have after you have been approved. However, any changes can also affect your premium rates. It’s worth discussing this with your insurance broker to understand how this will affect your policy and premiums.

Most insurers provide a grace period — typically 30 days — after a missed payment, during which you can make up the missing payment without losing coverage. But if the premium lapses after this time, your policy could be cancelled, and you could lose coverage. Pay your premiums on time to avoid this.

Yes, you can have term life insurance without a medical exam, but it usually makes for higher premiums. This is called simplified issue life insurance, and it is intended for people who do not want to have a complete medical examination. However, you will still have to answer health questions, and approval depends on your answers.

You can cancel your Term Life Insurance Policy anytime you want. But if you cancel early in the policy term, you are unlikely to get back the premiums you have paid. Checking policy terms is essential to understanding any applicable cancellation clauses and fees.

Sources and Further Reading

Insurance Bureau of Canada (IBC)

- Learn more about life insurance policies and industry regulations in Canada.

Website: https://www.ibc.ca

Canadian Life and Health Insurance Association (CLHIA)

- Provides resources on life insurance products, industry updates, and consumer guides.

Website: https://www.clhia.ca

Investopedia – Life Insurance

- An in-depth resource for understanding different life insurance policies, including term life.

Website: https://www.investopedia.com/life-insurance-4427696

Financial Consumer Agency of Canada (FCAC)

- A government resource offering guidance on buying life insurance and understanding contracts.

Website: https://www.canada.ca/en/financial-consumer-agency.html

Sun Life – Life Insurance

- An insurance provider offering insights into various life insurance options, including term life.

Website: https://www.sunlife.ca/en/insurance/life-insurance/

Key Takeaways

- Approval Process Overview: The process of getting approved for Term Life Insurance in Canada typically involves submitting an application, undergoing medical underwriting (if required), and receiving an approval decision, which can take anywhere from a few days to several weeks.

- Factors Influencing Approval Time: Health history, age, lifestyle choices (e.g., smoking), and the coverage amount all impact how long it will take to get approved for a policy. Healthier individuals generally experience quicker approvals.

- Speeding Up Approval: To expedite the process, be honest on your application, promptly complete medical exams, and work with an experienced insurance broker to ensure all documentation is in order.

- Medical Underwriting: A key component of the approval process, which may include tests and health questionnaires. More comprehensive reviews can result in longer approval times, especially for older individuals or those with pre-existing health conditions.

- What Happens if Denied: If your application is denied, understand the reason for the denial and explore other options, such as guaranteed issue or simplified issue life insurance policies.

- Taking Action: Don’t wait to secure coverage. Start by evaluating your insurance needs, comparing quotes online, and consulting with a trusted insurance broker to ensure you get the best plan for your situation.

- Real-Life Struggles: Common concerns include health issues and long waiting periods. Solutions include working with a broker and responding quickly to any insurer requests.

Your Feedback Is Very Important To Us

Thank you for sharing your experience with us. Your feedback is valuable in helping us improve our content and services. Please take a few minutes to fill out this questionnaire regarding the approval process for Term Life Insurance.

Your feedback will help us tailor our content to better serve individuals navigating the Term Life Insurance approval process. Thank you for taking the time to share your insights!

IN THIS ARTICLE

- How Long Does It Take To Get Approved For Term Life Insurance?

- Understanding the Approval Process

- Factors That Affect the Approval Time

- How to Speed Up the Approval Process

- Real-Life Struggles and Solutions

- How Long Does It Really Take?

- Take Action Today for Peace of Mind

- What Happens if Your Application is Denied?

- Final Thoughts on Getting Approved for Term Life Insurance