- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- How Expensive Is Term Life Insurance?

- Understanding the Costs Behind Term Life Insurance

- Breaking Down the Influences on Premium Rates

- Comparing Term Life Insurance Quotes in Canada

- Tips for Keeping Your Term Life Insurance Premiums Affordable

- How to Work Effectively with Top Rated Term Life Insurance Agents

- Choosing the Best Term Life Insurance Plan for You

- Practical Advice on Buying Term Life Insurance Policy Online

- Stories from the Field: Real Experiences That Resonate

- Steps to Take for Securing Your Future

- Benefits of Making the Right Choice Now

- Bringing It All Together

How Expensive Is Term Life Insurance?

By Pushpinder Puri

CEO & Founder

- 11 min read

- February 6th, 2025

SUMMARY

This blog is all about the cost of Term Life Insurance in Canada. It is a breakdown of the factors that contribute to the cost, for instance, age, health, coverage amount, and the term length. Here is the post, which offers some practical tips on cutting costs, how to compare Term Life Insurance quotes in Canada, and how the best-rated Term Life Insurance agents assist clients in choosing the proper Term Life Insurance Plan for them. It also assists you in how to buy a Term Life Insurance Policy online.

Introduction:

When you type Term Life Insurance Quotes Canada on your search bar, you can expect to get a wide variety of numbers. Sometimes, it makes you wonder whether you can afford Term Life Insurance. Like many Canadians who have browsed Term Life Insurance quotes in Canada, some of you may have already been frustrated when you tried comparing seemingly confusing rates. You will probably have been confused while trying to figure out the difference between some Term Life Insurance Plans and how premium rates would change with age, health, and other factors. Even with our discussions with clients at Canadian LIC, the best insurance brokerage in Canada, we see many individuals struggling to make sense of options. In this blog, we shall detail what aspects drive the prices of Term Life Insurance and advise you on how to compare the plans with how to purchase life insurance online. The purpose behind doing so will be to arm you with detailed and actionable knowledge so that you make the best selection possible that also comes within your means.

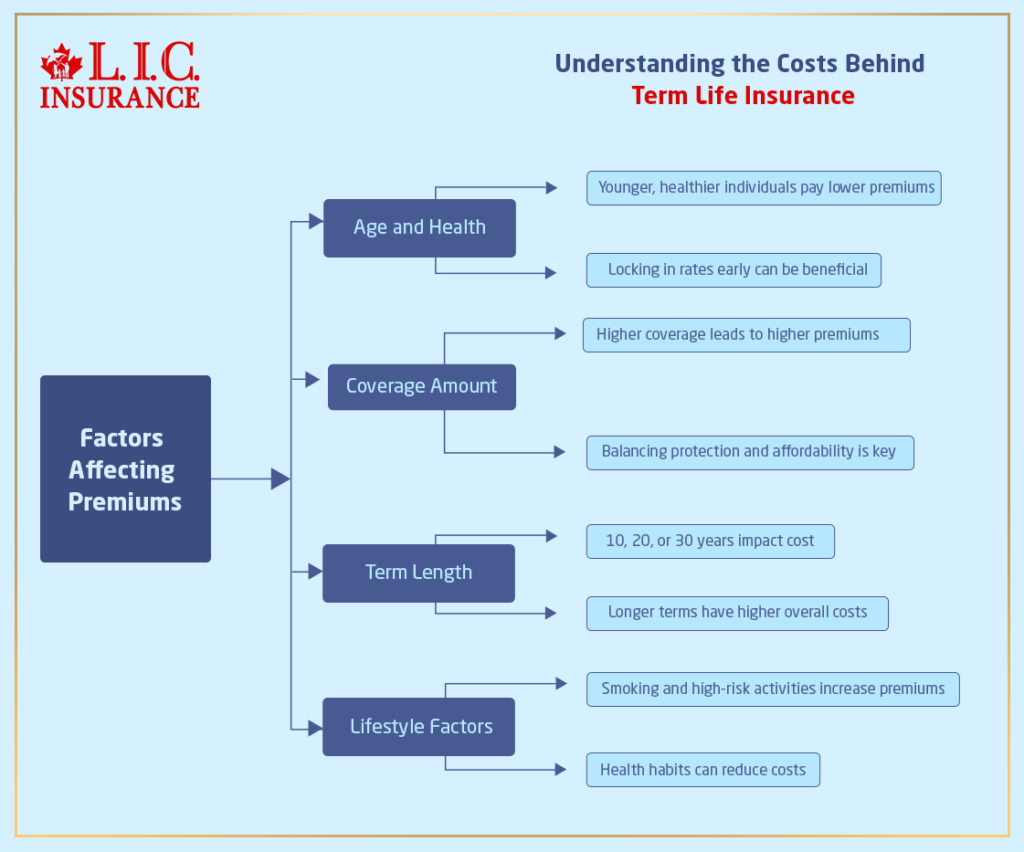

Understanding the Costs Behind Term Life Insurance

Popular for many Canadians is Term Life Insurance, which is a fairly straightforward mechanism through which coverage can be secured for a predetermined period of time. However, one of the most common questions remains: How expensive is Term Life Insurance? We consider several factors to determine what kind of premium you will pay.

Many of our clients have shared that they were shocked by the high premium rates at first when looking at Term Life Insurance quotes in Canada. A few thought it was a little too pricey compared to what they expected, and others found out that a little change in health habits or lifestyle could reduce the premium. You might also wonder how your personal situation, like your age or family history, affects the rate you pay.

The cost of Term Life Insurance depends on many key factors.

- Age and Health: Generally, younger, healthier people will have lower premium rates. Our group at Canadian LIC often finds that younger clients really benefit by locking in the lower-Term Life Insurance Prices before health issues come along.

- Coverage Amount: The greater the sum assured, the higher the cost. Customers have also learned how to strike the perfect balance between protecting their income and affordability while opting for coverage amounts.

- Term Length: The term of coverage for 10, 20, or 30 years will influence the premium cost. A longer-term usually has a higher overall cost, but in some cases, the annual premium is manageable.

- Lifestyle Factors: Smoking, high-risk activities, and other lifestyle habits will determine the Term Life Insurance price.

This is what enables you to understand why Term Life Insurance quotes in Canada may vary widely from one individual to another. During our meetings with clients, many of them breathe a sigh of relief once they see how small changes can add up to mean significant savings.

Breaking Down the Influences on Premium Rates

Do you ever wonder why a profile similar to yours would pay less for Term Life Insurance? For myself, our experience with Canadian LIC has been that many of our clients have such stories to share. Let’s look at some of the more critical influences:

Age and Health Conditions

The most basic element in any insurance calculation is age. If you are in your 20s or 30s, you can normally get cheaper rates compared to someone in their 50s. Most of our clients remember how early they acted in order to benefit from low rates. However, many Top Rated Term Life Insurance Agents say that improvement in health, sometimes through regular check-ups, a better diet, or exercising more, can re-evaluate a premium rate regardless of your slightly older age.

Coverage Amount and Term Duration

It is critical to select how much you want to have covered. Some of our clients have actually shared struggles deciding whether they want a higher payout with a slightly increased premium or a lower payout that fits their budget perfectly. When you are going for a Term Life Insurance Policy, consider what your family would need in case you do not make it. Many of you have already faced uncertainty with not being able to save. Therefore, investing in adequate coverage now will help to protect the future of your family.

Occupation and Lifestyle Choices

The other factor is that your occupation and lifestyle will contribute to the costs. For example, if you are in an occupation that falls into a risk category or indulge in some very extreme sports, then the companies consider you as a higher risk. Many of the clients said that after explaining their lifestyle to a top-rated Term Life Insurance agent, they found options where they could have reasonable premiums and not compromise lifestyle choices.

Policy Add-ons and Riders

Sometimes, you may wish to have additional features above and beyond straight-Term Life Insurance. These features are known as riders, and you may expect higher Life Insurance Premiums. There are times when riders may be very valuable additions, but not all of them should be taken. Sometimes, our advisers recommend reviewing each rider to verify its necessity for maintaining reasonable Term Life Insurance Prices.

Comparing Term Life Insurance Quotes in Canada

If you search online for Term Life Insurance quotes in Canada, then you will face the dilemma of several options presented. Many clients, when searching online, seem to be bewildered about the differences between providers’ offers. Let’s simplify this discussion by breaking it down.

Research and Compare Online

The internet offers many tools that allow you to compare quotes side by side. By using these tools, you can see how premium rates vary for similar coverage. When you compare quotes, pay attention to:

- The coverage amount

- The term length

- Any riders or additional benefits included

You might have surely faced disappointment when quotes appeared to jump from one extreme to the other. Many people find that even a slight difference in coverage terms can lead to significant price differences. Our team at Canadian LIC quite often advises our clients to seek multiple Term Life Insurance Quotes in Canada and get the most comprehensive idea of what could be available.

Use Trusted Resources

Working with sources that one trusts is fundamental while comparing quotes. Many customers can attest to situations where they experienced agents explaining confused policy features to them. Comparing the most rated Term Life Insurance agents sometimes makes things even clearer. You can also depend on a qualified agent for a proper explanation about the reasons a given quote will cost more than the other one and why he or she selects a Term Life Insurance that satisfies your need while not making a mistake with price.

Consider Your Needs

Every person has a different condition. Some individuals may require significant coverage amounts in case they are left with many dependents or large debts; others may elect to have minimal coverage. Your financial obligations will determine the suitable coverage for you. We ensure our clients realize that the correct coverage is based on individualistic decisions that merge cost with necessity.

Tips for Keeping Your Term Life Insurance Premiums Affordable

Many Canadians are concerned that Term Life Insurance might be a costly proposition. However, if you get it right, you can actually achieve protection without spending too much money. Here are some workable ideas that our advisors at Canadian LIC have been able to help many of our clients do so:

Improve Your Health

A healthier lifestyle can result in better premium rates. Quitting smoking, losing weight, or getting fit generally means that the insurers can offer you lower rates. Most of our clients reported that Term Life Insurance rates have lowered for them after making these positive improvements.

Choose the Right Coverage

Then, avoid the tempting idea of obtaining more coverage that you may not need. To be frank and honest, ensure that you adequately calculate your exposures. For certain clients, determining a midpoint coverage instead of the maximum payable has resulted in significantly lower amounts of premiums they pay.

Shop Around

Do not go for the very first quote that you get. Compare several quotes for Term Life Insurance in Canada to get the best deal for you. Invest a little of your time, and you could save money for a long period. Our customers are often thrilled after realizing how a little time spent researching might lead to major savings.

Regularly Review Your Policy

Once you’ve established a policy, it makes sense to go over it every so often. Life changes — whether it is a new job, the addition of a child, or altered financial responsibilities — may mean your current coverage requires adjustment. A few clients have said that it has kept their coverage optimal and affordable over the years by making regular check-ins on their policy with the best Term Life Insurance agents.

How to Work Effectively with Top Rated Term Life Insurance Agents

You might wonder if it is even necessary to use an agent to purchase Term Life Insurance. Many find the knowledge and guidance that an agent will bring invaluable while buying Term Life Insurance. The following are just some ways they can assist you:

Clear Communication

Top Rated Term Life Insurance Agents use simple words and phrases. They break down every detail about your Term Life Insurance Plan so you understand your entire policy. Our clients often describe feeling relief once their agent breaks down the complex terms and conditions that, on first impression, seemed very intimidating.

Tailored Advice

Every person’s situation is unique. Insurance agents can guide you to find the Term Life Insurance Policy that meets your needs and financial goals. With the aid of such agents, you get customized recommendations for a plan suitable for your specific situation. Many customers have described how it made them feel secure knowing their policy was built to meet the needs of their family in the future.

Assistance with the Application Process

The buying process of an online life insurance policy seems to be quite laborious via other means. Your agent accompanies you to go through the application according to your true needs so that all the specifications do not go wrong. This minimizes your chances of having your application delayed or put into trouble somewhere in the future. Most people look forward to such personal support offered and thus also facilitates hassle-free experiences.

Ongoing Support

It is not the end of an agent’s job when you sign up for a policy. They continue to provide you with support and advice on various changes in your coverage or any questions that arise. This continuous relationship can be very important, especially when big life events demand changes in your policy.

Choosing the Best Term Life Insurance Plan for You

With so many options available, determining which Term Life Insurance Plan is suited to your needs can be a daunting process. However, focusing on a couple of key points may make your decision much more manageable.

Evaluate Your Financial Needs

Start with a list of your debt, such as a mortgage, student loans, or daily living expenses. Many clients have realized that knowing exactly what they owe helps them choose an amount of coverage that will indeed provide actual protection without overpaying.

Consider the Duration

Decide for how long you will need insurance protection. The term length must cover the duration when your family relies on your income. You may be more likely to take a shorter-duration plan, which is less costly but should be aligned with your long-term financial goals. Our team here at Canadian LIC often helps determine the right term length for most clients based on their life stages and future plans.

Balance Cost and Coverage

There should be a balance between how much you can afford and how much coverage you require. You would not want to overinsure, as that increases your premiums unnecessarily. At the same time, too little might expose your family to unnecessary risks. Our advisors urge you to take into account your present and future needs before you settle on a Term Life Insurance Plan.

Read the Fine Print

Every policy has terms and conditions. There’s often a lot to read through; take the time or have your agent explain any parts that seem unclear. Many clients share that knowing the whole scope of their policy gives them more confidence in their decisions.

Practical Advice on Buying Term Life Insurance Policy Online

Online Term Life Insurance Policy purchasing is convenient and efficient for most people. However, research into this method is also called for. Below are some easy ways to guide you through the process.

Use Reputable Websites

Begin by looking on trusted, popular websites that give you Term Life Insurance quotes in Canada. Many of them have comparison tools that will enable you to view several policies side by side. The moment you see multiple rates and different features, remember that these quotes are based on your personal details.

Fill Out Accurate Information

The quotes you receive depend on your information. Be candid with the information on your health, age, and lifestyle. Many customers have discovered that slight errors may lead to differences in the quotation of Term Life Insurance. Accurate information means that the policy you buy reflects your actual risk level.

Review and Compare

Once you have a few quotes, take the time to review each one. Compare the coverage details, term length, and any additional benefits or riders. Our clients often comment to us that taking a little more time to compare the features of each policy has helped them avoid future costs that might not have occurred otherwise.

Secure Your Policy

Once you have a policy that matches your needs, you can complete the purchase process. Most of insurance firms have an online process for Term Life Insurance purchases. During the process, expect to receive some confirmation emails along with detailed copies of the policy. It would be beneficial if an agent could go through this information with you so that you know exactly what you are entering.

Follow Up on the Process

After the initial sale, you’ll want to confirm that you can obtain all supporting documentation and, if needed, know who to contact for clarifications. In fact, several of our customers have reported a simple phone call to their agent to clarify issues and put their minds at ease: everything was now in place.

Stories from the Field: Real Experiences That Resonate

Over the years, our discussions with clients at Canadian LIC have thus revealed our impressions of how the cost of Term Life Insurance impacts daily life. Let’s take a look at some of the commonly recurring themes and experiences that most Canadians reflect.

The First-Time Buyer’s Experience

One client still remembered the horror of comparing different quotes, trying to figure out why her rate was much higher than her friend’s. As it turned out, tiny differences in lifestyle and family medical history could still have a huge impact on the premium rate charged. After she had discussed all of this with one of the Top Rated Term Life Insurance Agents, she adjusted her lifestyle slightly, and her monthly premiums payment went quite down.

Balancing Budget and Future Security

Another typical scenario involves families with children who are very concerned about making sure they get enough coverage without overburdening their monthly budget. In fact, one parent confessed to having been discouraged at first due to the apparently high premiums, but after obtaining several Term Life Insurance quotes in Canada and having a frank discussion with a trusted advisor, they settled on a policy that fits into their budget yet provides adequate protection. This client felt a huge relief knowing that they would support the future of their children if something were to go wrong.

Overcoming the Online Purchase Hurdle

The complexity of buying a Term Life Insurance Policy online seems too impersonal and technical, causing some difficulty in the procurement of Term Life Insurance Policies online for some customers. A user commented that, although they knew how to get the best rates from Term Life Insurance quotes online, they didn’t know much about the rest of the application process until a top-rated Term Life Insurance agent walked them through the application and gave them reassurance.

These personal stories are reminders that however crucial the cost remains, the cost of clear and honest communication, reliable guidance, and planning is priceless. Each decision taken today will always affect your long-term financial picture. Having these things in hand is what ultimately matters.

Steps to Take for Securing Your Future

Your path to cheap Term Life Insurance begins with straightforward, actionable steps. Let’s break down a simple guide that will help you achieve the coverage you need:

Evaluate your financial situation.

Start by writing down your financial responsibilities. Understand the amount of coverage that would be needed to keep your family living as they are if you’re not around anymore. From this personal list, the right policy would be selected.

Collect Personal Data:

Information regarding your health, lifestyle, and medical background must always be adequately ascertained. This is essential for the procurement of Term Life Insurance quotes in Canada and the anticipation of no surprises in the process.

Compare Online:

There are many websites that offer comparisons in Term Life Insurance rates. Use those to narrow your options based on the amount of coverage, length of the term, and rider benefits.

Consult with Professionals:

Top Rated Term Life Insurance Agents can help clarify all doubts. Their expertise will help you customize a Term Life Insurance Plan according to your individual requirements and within a budget.

Policy Details Review:

Whether you buy Term Life Insurance Online or any other way, take some time out to understand each and every aspect of the policy. Clear all your doubts by asking questions.

Finalize and Secure Your Policy:

After you are certain of your decision, finalize and complete the process regarding the application. Ensure that you get confirmation and whatever other documentation will be required.

The process followed by many has empowered them and secured them further in their financial lives. It may seem to be tough at first, but with proper support and clear planning, you will end up making the right decision to stand for long-term benefits.

Benefits of Making the Right Choice Now

You may still wonder if Term Life Insurance is actually worth paying for. But then think of the long-term benefits which come along with this thoughtful decision. The well-thought-out policy not only provides you with financial security for your family but also the peace of mind of knowing that you have planned for the unexpected.

For many Canadians, finding that the right policy could be within their budget and flexibility was a relief. Have access to options that suit your budget and your future goals by comparing Term Life Insurance quotes in Canada and working with trusted advisors.

Protecting Your Family’s Future

Basically, Term Life Insurance provides protection. And proceeds paid on a death claim can help pay for daily living expenses, outstanding loans, or even future plans like education for your children. Our clients have informed us that even a modest amount of coverage relieves the worry of financial instability.

Financial Flexibility

There are many policies that offer updates. If your circumstances change, you can quite easily change your coverage or add more benefits. Such flexibility is important because that means you’re always being protected as your life changes. A good number of highly rated Term Life Insurance agents note that the idea is to create a policy that grows with your needs.

Cost-Effective Coverage

One of the very common myths related to Term Life Insurance is that it is pretty expensive. Quite often, even when you get the policy when you are much younger or even when you’ve made lifestyle adjustments that improve your health, your premiums do not become too high. Our client experiences often point out that, with the right Term Life Insurance Plan, value is great, but it never stretches your budget too far.

Easy Access to Information

Today’s technology makes it easy to research and obtain coverage; you can use a few mouse clicks to easily buy a life insurance policy. You can request multiple Term Life Insurance quotes from Canada and can compare options even from the convenience of your house. This comfort empowers the decision-making processes based on concrete, reliable information rather than an assumption.

Bringing It All Together

The quest for affordable Term Life Insurance in Canada begins when you become aware of your needs, research the available options, and seek guidance from truly caring professionals about your future. Focusing on key factors like age, health, coverage amount, and term length helps you better understand the range of prices within which you have Term Life Insurance options.

Many people faced similar issues-such as fearing unexpected expenses, dealing with convoluted quotes online, or being uncertain regarding the application. However, the proactive approach coupled with consulting a top-rated Term Life Insurance agent can overcome them. Every action you take in the direction of an informed choice strengthens your foundation and offers life-long security to you and your family.

Working closely with professionals having firsthand experience with clients’ needs, as we do here at Canadian LIC, can change your attitude toward insurance. Here at Canadian LIC, we listen to your concerns, explain the details in clear language, and ensure that the plan you choose serves all your requirements without being financially burdensome.

This sums it all up – perhaps if you’ve ever wondered how Term Life Insurance quotes are calculated, or you’ve gotten stuck on conflicting information, remind yourself that the right information and guidance can definitely make all the difference. We’ve seen firsthand how a bit of clarity and support make a real difference for many Canadians, creating a safe future that’s affordable.

Take some time to assess your current financial situation, collect some information, and then contact the experts who are here to help you. It might be choosing to compare Term Life Insurance quotes in Canada online or scheduling a consultation with a top-rated Term Life Insurance agent– most of it’s up to you.

A Final Word on Securing Your Coverage

The road to getting low-cost, Term Life Insurance might be tricky, but with every step of the way, you’re inching closer to a safer tomorrow for loved ones. Thus, with all that said, it is easy to find the perfect policy to suit the budget, most importantly offering necessary protection at the time it is needed the most.

Your decision today will ensure financial stability for your family at the worst possible time. It does not surprise us that many Canadians have acted after learning that, with careful research and the support of knowledgeable professionals, the cost of Term Life Insurance is often less daunting than the cost first appears.

Remember, the best insurance brokerage in Canada- Canadian LIC has a proven history of helping people like you find the right policy at a price that works. Remember that when you choose to hire experts who know the ins and outs of the market, you open doorways to options you may not have thought possible to reach otherwise. Modest plans or more comprehensive coverage, the steps you take now lay the groundwork for a secure tomorrow.

So, if, for whatever reason, you have never made a final decision because maybe you were apprehensive about either the cost of the policy or the complexity itself, take just a little moment to explore it. Look up the premium rate, think about how small lifestyle changes can lower one’s rate and consult with great professionals who’ll guide you along the way on each step involved. Your future security deserves better thought; after all, that tool is merely at your fingertips.

Securing a Term Life Insurance Plan tailored to your requirements means embracing the future free from worrying about some unforeseen financial burden. Make the call now, contact our professionals who have helped so many Canadians before you, and choose what will guarantee protection for a lifetime for those loved ones in your life.

Thanks for reading this somewhat comprehensive guide. We hope that with this information, you are now empowered to make the best decisions regarding your money when it comes to Term Life Insurance costs in Canada. A single step may seem too much for anyone in search of affordable and reliable coverage. Make that step today and secure your future not with worry but with peace of mind and confidence.

Don’t wait any longer to seek out our skilled professionals, who’ll guide you through the process of making these decisions. There is too much at stake with your future that you can’t gamble and let it happen. But when you do get that knowledge, then such a decision might become clearer. Take control, ensure you have the right protection in place, and reap the rewards of a plan to safeguard you and your family for generations.

More on Term Life Insurance

- What Is The Waiting Period For Term Insurance?

- Is Natural Death Covered In Term Insurance?

- Should I get a 20 or 30-year Term?

- How Do I Claim Term Insurance?

- Can I Use My Term Life Insurance To Pay Off Debt?

- Who Is The Largest Provider Of Term Life Insurance?

- What Happens After 15-Year Term Life Insurance?

- What is a 5-Year Term Life Insurance Policy?

- What Is The Expiry Date On Term Life Insurance?

- What Is The Short Term Policy Rate?

- Can I Change My Nominee In Term Insurance?

- The Evolution Of Term Life Insurance: Past, Present, And Future

- From Confusion To Clarity: How Harpreet Puri Guided A Client Through Complex Term Life Insurance Decisions

- Do Rich People Have Term Life Insurance?

- What Are The Common Term Life Insurance Clauses?

- What Are The Disadvantages Of Joint Term Insurance?

- What Is The Oldest Age At Which You Can Get Term Life Insurance?

- How Do You Choose The Right Claim Payout Option For Your Term Insurance?

- Is There a Medical Exam for Term Life Insurance?

- Limited Pay vs Regular Pay Term Insurance

- When To Cancel Term Life Insurance?

- Best Term Life Insurance Plans For Couples

- Joint Term Insurance VS. Two Separate Term Plans

- Which Is Better – Term Insurance Or Health Insurance?

- Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

- Why Are Term Life Insurance Claims Rejected

- What Type Of Risk Is Covered By Short Term Insurance?

- What Happens If You Can’t Pay Your Term Life Insurance?

- What Will Disqualify You From Term Life Insurance?

- Can Riders Be Added To Term Life Insurance?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Insurance Policy?

Frequently Asked Questions

Many customers ask this. Premiums depend on age, health, and lifestyle. We work with customers who are anxious about the price until they understand that slight modifications can bring the premium down. Maintaining a healthy lifestyle might even bring lower-Term Life Insurance quotes. Specialists always recommend that one compare all possible options so as to figure out what works within the budget.

You can get quotations online fast. There are some websites that allow you to compare Term Life Insurance quotes in Canada. A client once became stressed because of the vast differences in quotes. After getting all the details clear from a reliable agent, the client opted for a plan that was within the budget and needed. This process will enable you to know what the other providers have for you.

Top Rated Term Life Insurance Agents explain details in simple words. Instead, they discuss the advice one needs based on the experiences of very many clients. For example, a client has relieved his life since an insurance agent explained available options and fully answered his or her questions to date. Professionals demonstrate how the term life covers one’s life with financial freedom.

A Term Life Insurance Plan covers you for an agreed period. It will take care of your family if you pass away. We have customers who discover that the number of coverage and term years influence the premium price, most like knowing that a defined plan helps them avoid overpaying. Ensure it meets your responsibilities and objectives.

Yes, Term Life Insurance coverage can be purchased online. Many life insurance companies provide simple applications on their websites. A client felt uncertain at first. After using an online application form and later discussing the details with an agent, it all became clear. This method saves time and simplifies the comparison of options.

Sources and Further Reading

- Insurance Bureau of Canada – Offers data and insights on various insurance products. https://www.ibc.ca

- Financial Consumer Agency of Canada – Provides information on financial products and consumer rights. https://www.canada.ca/en/financial-consumer-agency.html

- Canadian Life and Health Insurance Association – Contains industry statistics and policy details. https://www.clhia.ca

- Canadian Underwriter – Features news and analysis on insurance trends. https://www.canadianunderwriter.ca

- MoneySense – Offers practical financial advice and insurance tips. https://www.moneysense.ca

Key Takeaways

- Understanding Costs:

Term Life Insurance Prices depend on age, health, coverage amount, term length, and lifestyle choices. - Quote Comparison:

Use multiple Term Life Insurance Quotes Canada to compare rates and coverage details. - Expert Guidance:

Top Rated Term Life Insurance Agents provide clear, personalized advice to help select the right Term Life Insurance Plan. - Online Options:

It is easy to buy Term Life Insurance Policy online with accurate information and proper research. - Financial Security:

A well-chosen policy secures your family’s future while keeping costs manageable.

Your Feedback Is Very Important To Us

Thank you for taking the time to share your thoughts. Your feedback helps us understand the challenges you face when dealing with Term Life Insurance costs.

Thank you for your responses. Your input is valuable and will help us improve the support we provide. We appreciate your time and honesty.

IN THIS ARTICLE

- How Expensive Is Term Life Insurance?

- Understanding the Costs Behind Term Life Insurance

- Breaking Down the Influences on Premium Rates

- Comparing Term Life Insurance Quotes in Canada

- Tips for Keeping Your Term Life Insurance Premiums Affordable

- How to Work Effectively with Top Rated Term Life Insurance Agents

- Choosing the Best Term Life Insurance Plan for You

- Practical Advice on Buying Term Life Insurance Policy Online

- Stories from the Field: Real Experiences That Resonate

- Steps to Take for Securing Your Future

- Benefits of Making the Right Choice Now

- Bringing It All Together