You’ve taken out a Critical Illness Insurance plan to protect yourself and your family from financial stress if you were to fall ill. You breathe a sigh of relief, knowing that if the unexpected happens, you’ll have a safety net to fall back on. But as time goes by, you start to notice that the cost of living is increasing. Groceries are more expensive, your utility bills are rising, and even a trip to the doctor costs more than it did a few years ago. This creeping increase in costs is inflation, and it can eat into your Critical Illness Insurance coverage.

You’re probably thinking, “How does inflation affect my Critical Illness Insurance?” It’s a good question and one that many Canadians are facing. We see this every day with our clients at Canadian LIC. Inflation can eat into the value of your insurance payout, so the lump sum you were counting on may not go as far as you thought. In this blog, we’ll get into how inflation affects your Critical Illness Insurance and what you can do to protect your coverage.

Understanding Critical Illness Insurance

Before we get into the details of inflation, let’s start with the basics. Critical Illness Insurance pays out a lump sum if you’re diagnosed with a serious illness like cancer, heart attack or stroke. You can use this money however you want – to pay medical bills, pay off debts or even take a break from work to focus on recovery.

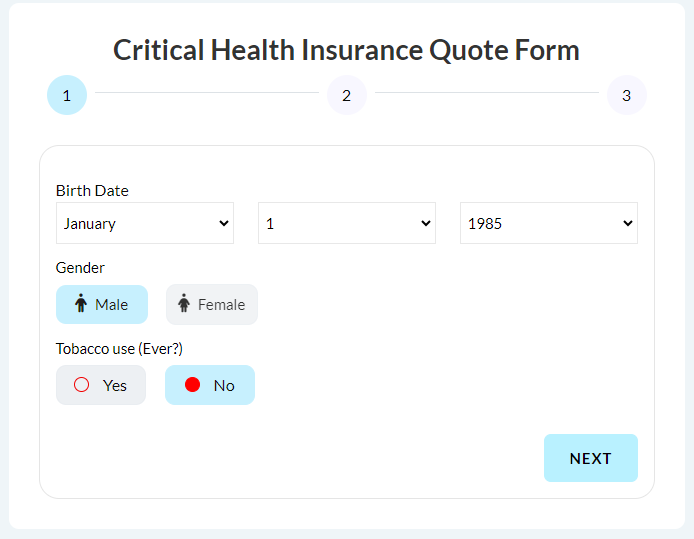

When you get Critical Illness Insurance quotes online, you’ll find different plans from different companies. Each plan has its own terms and coverage amounts. It would be best if you chose a plan that suits you and your budget. But even the best plan can be affected by inflation if you don’t take proactive steps to protect your cover.

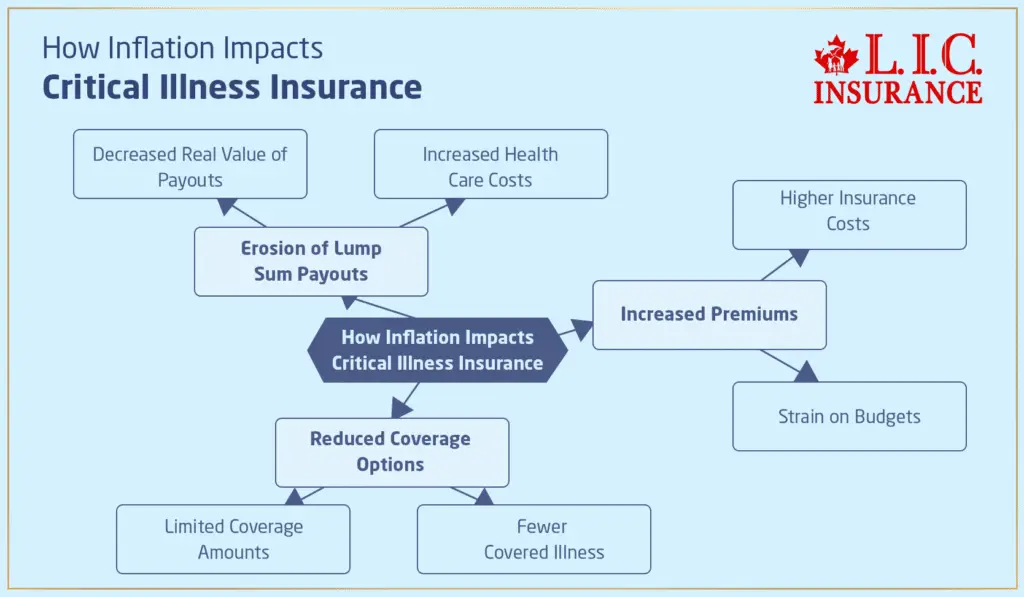

How Inflation Impacts Critical Illness Insurance

Inflation is the level at which the general price of goods and services is increasing. It erodes purchasing power. Therefore, all other things being equal, the cost of living is going to rise, so the same money will buy less now than it would have in the past. This is how that might affect your Critical Illness Insurance:

Erosion of Lump Sum Payouts

The main effect of inflation on Critical Illness Insurance is the erosion of the lump sum payout. For example, if you took out a policy ten years ago with a $100,000 benefit, that amount may not go as far today due to inflation. Health care costs, living expenses and other financial needs have likely increased, so the real value of your insurance benefit has decreased.

At Canadian LIC, we’ve seen this happen to our clients. One client, for example, had a policy ten years ago that included a $50,000 benefit. When he was diagnosed with a serious illness, he realized the payout didn’t go as far as he thought. Medical advancements had increased costs of treatment, and his day-to-day living expenses had gone up significantly.

Increased Premiums

Inflation doesn’t just affect the payout; it can also lead to increased premiums. Insurance companies adjust premiums over time to account for the rising cost of claims. This means you could end up paying more for the same coverage. For many people, this increase can strain their budgets, making it difficult to maintain their policies.

Reduced Coverage Options

As inflation drives up costs, some insurers might reduce the range of illnesses covered or limit the coverage amount for new policies. This can make it harder to find a plan that provides comprehensive protection. It’s essential to regularly review your policy and compare it against new Critical Health Insurance Plans available in the market.

Strategies to Combat Inflation

So, what can you do to protect your Critical Illness Insurance from the effects of inflation? Here are some strategies:

Opt for Inflation Protection Riders

After all, it would be one of the best ways to add a surety to your coverage with the addition of an inflation protection rider. This increases your amount of coverage to match inflation year after year so that even though it might cost a little more, it ensures that your lump sum benefit does not depreciate over any period of time.

Here is a client story from a Canadian LIC: Jane was a long-term client, along with a critical illness policy and an inflation-protection rider. Meaning of Benefit: When she developed breast cancer, the eventual minor on the policy was indexed and adequate to support her critical illness experience.

Regularly Review and Update Your Coverage

It will be important that you review your critical illness policy regularly. Changes in your life, for example, getting married, having children, or buying a home, could alter your financial requirements. Make sure the amount is enough to meet the expenses of today and those of the future.

Our client, Tom, was single when he purchased Critical Illness Insurance. Years down the line, after he had started a family, he felt that his coverage was no longer sufficient. By reviewing his insurance policy regularly, he was able to update the coverage to reflect his new financial responsibilities.

Compare Critical Illness Insurance Quotes Online

The insurance market is always evolving, with new products and features being introduced regularly. By comparing Critical Illness Insurance quotes online, you can find the latest plans that might offer better coverage or more competitive premiums. This helps ensure that you’re getting the best value for your money.

Choose Reputable Critical Illness Insurance Providers

Selecting a reputable insurance provider is vital. Established companies have the financial stability and customer service infrastructure to support their policyholders over the long term. At Canadian LIC, we work with some of the best Critical Illness Insurance Providers to ensure our clients receive reliable and comprehensive coverage.

Real-Life Struggles and Solutions

The Rising Cost of Medical Care

Take the case of Mark, one of our clients. He had a $75,000 benefit critical illness policy. But upon his heart condition diagnosis, he soon found that many of those medical costs were through the roof since his policy purchase: massive treatments and overwhelming medications, along with associated hospital stays, were very costly—and the $75,000 did not go very far.

To get additional coverage, Mark chose a top-up policy. That certainly meant higher premiums, but protection from the rising costs of medical care was quite sufficient for him.

Balancing Premiums and Coverage

Saira is another client but has a different problem. She had bought a critical illness policy a few years ago, and today, the premiums were very high, and she couldn’t afford it since she had very little money to spare.

Working with Saira, we found a solution through Canadian LIC. We worked on the quotes for Critical Illness Insurance online and managed to find a similar protection plan but at a lower rate—and this worked for her.

Planning for the Future

Inflation is disruptive not just to the present but also to the future. For instance, a client by the name of Michael had taken his policy long back when he was in his 30s; now that he is in his 50s, the harsh reality dawns on him, realizing that the coverage was so minimal and shallow that it would not support his future family or treatment if he fell really sick.

Michael, however, added an inflation protection rider to his policy by working in partnership with Canadian LIC. This embedding made sure that his coverage followed inflation, giving him security for both himself and his family.

Concluding Words

Inflation can eat away at your critical illness coverage, reducing your payout and increasing your premiums. But by taking proactive steps like adding inflation protection riders, reviewing your policy regularly and comparing Critical Illness Insurance quotes online, you can protect your coverage from inflation.

At Canadian LIC, we understand the challenges of inflation for our clients. We can help you navigate those challenges and find the best Critical Illness Insurance plans that cover you. Don’t let inflation undermine your financial security. Review and update your Critical Illness Insurance now. Contact Canadian LIC—the best insurance brokerage—today and make sure you and your family are protected from the unexpected.

More on Critical Illness Insurance

Can You Claim Twice For Critical Illness Coverage?

Can I Switch Critical Illness Insurance Providers?

Can I Purchase Critical Illness Insurance For My Children?

Does Critical Illness Insurance Cover Broken Bones?

Can I Cancel My Critical Illness Insurance?

Can You Add Critical Illness Cover To An Existing Policy?

What Is A Critical Illness Insurance Claim?

What Cancers Are Not Covered By Critical Illness Insurance?

Does Critical Illness Insurance Cover Heart Failure?

Does Critical Illness Insurance Cover Death?

Can I Have Two Critical Illness Policies?

Can You Take Out Critical Illness Cover Without Life Insurance?

What Age Should You Get Critical Illness Cover?

What Is The Difference Between Life Insurance And Critical Illness Insurance?

All About The Critical Illness Insurance Policy & The Benefits Of Critical Illness Insurance

Why Is Critical Illness Insurance Coverage Important? And Do We Need It?

How Critical Illness Insurance Can Be Your Lifesaver In Canada?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions About Inflation and Critical Illness Insurance Coverage

Inflation can then lead to an erosion, in some cases being very significant, of the purchasing power of your Critical Illness Insurance payout. Thus, what you would have contracted for would not cover nearly as much in both medical and living expenses when you purchased the policy. For Canadian LIC, it has been no less a surprise for most of the clients who have come through our offices. For instance, Emily was one of our clients: she had a policy with a cover that seemed really big ten years ago, but then, when it came to her having to need it, the amount barely paid for half of her huge treatment expenses, partly due to inflation.

Visit reputed comparison websites that provide quotes from different providers of Critical Illness Insurance. It would also be an excellent idea to seek the support of professional insurance brokers from the team at Canadian LIC, who may go into the details of policies to help you understand them. Also, they help the customers understand which plans have inflation protection riders, thus ensuring that your coverage stays current over time.

Yes, there are many good Critical Illness Insurance companies that allow options for inflation. The most characteristic of these is where a rider, increasing your coverage amount automatically each year, is available to maintain your level of protection. In Canadian LIC, we handle clients like John, who took an inflation protection rider and later found out that the amount of his benefit greatly increased to keep up with the surging costs. It gave him great peace of mind that, at the time he needed to claim, he would have ample coverage.

While renewing your Critical Health Insurance policy due to inflation, do recall how the present coverage compares to today’s healthcare cost and the magnitude of your existing financial liabilities. Reflect on whether it has inflation protection or if you may need to buy more coverage. At Canadian LIC, we suggest our customers review their policies on an annual basis. An example is that of helping a client, Lisa, to update her amount of coverage after she learned that inflation had consumed the value of her policy over the past five years.

We recommend comparing Critical Illness Insurance quotes online every few years or after major life changes like a new child, marriage, or home purchase. Doing this will help ensure your coverage keeps up with your current needs and economic changes such as inflation. One of our clients, Tom, did report a nice better rate overall later, as he went for the quote right after the birth of his second child when he learned that his old policy no longer matched the expanding needs of his family.

Sure! You can switch to another provider for your Critical Illness Insurance if you can get a better policy out there that, among other things, has inflation protection built in. One only wants to be careful that there are no penalties or waiting periods that would harm their coverage by switching. At Canadian LIC, we help our clients—like Sarah—transition with no gap in coverage to a new provider, necessary to secure a policy that fits their financial situation and offers inflation protection.

The most common oversight is failing to provide for inflation from the very inception of buying a policy. People mostly select a policy based on current needs without factoring in how inflation would affect their coverage amount in the coming years. For instance, our client Mark had no idea how much the medical costs would increase, and, hereby, he got payback at a glance, which was just enough for him, not in times of need. This mistake can easily be avoided by revising and updating your policy on a regular basis.

Most major health insurance plans include an inflation protection rider with your policy. This rider typically increases your coverage amount every year, either by the growth in the Consumer Price Index or by a fixed percentage. Of course, at Canadian LIC, we advise this product to clients such as Anita, who had some reluctance to take this rider. After much earnest argumentation and long reasoning over rising healthcare costs, Anita chose to include it, and years later, she was grateful because the raised payout was just perfect for her needs during her illness.

So, when you run your online quote for Critical Illness Insurance, look for details concerning inflation protection or cost-of-living adjustments. Where it is not clear, this should cause no fear in asking the provider so that the matter may be clarified. At Canadian LIC, we guide clients like Robert in traversing online platforms for quotes that mention the explicit inclusion of these protections—leaving nothing to chance.

The first step is getting in touch with your insurance company and letting them know you’d like to add inflation protection to your existing policy. Be very specific. You’re concerned that your coverage won’t keep pace with inflation. At Canadian LIC, we often have these discussions on behalf of our clients with the providers, such as we did with Maria, to ensure they are clearly stating these concerns and aware of all the terms and adjustments that adding such a rider entails.

Yes, it can, given the fact that the cost which the insurers incur in providing healthcare is rising, and they may raise the premium so as to match the changing dynamic. We have had clients like James whose surprise came from increasing premiums that made it very difficult for them to continue paying for the policy. Here, at Canadian LIC, we help clients of that sort review their financial plans and coverage to manage the high premiums while always taking advantage of the essential protection they need.

We look for providers with a track record of stability and good customer reviews toward the claims process and policy updates. Always remember that when providers offer more flexibility in their policies, with a host of optional riders on their product, it would be best to handle the change in economic conditions. At Canadian LIC, we offer products that are focused on providing sustenance to providers rather than on one provider who was very active in adjusting policies in response to different economic shifts, and we have managed to help Helen transfer.

Although we recommend a policy review every two years or upon a major life or financial change occurring in your life, this critical health policy is required to be updated and aligned with regard to inflation, and your requirements are bound to change. Our client, Derek, learnt it the hard way when he forgot his policy review for over five years and realized there was a major shortcoming in his coverage. We helped him reframe and rejuvenate his coverage to be relevant and fit better into the present economic scenario.

If inflation is not taken into consideration, this means that a time when it is needed most goes underinsured. This may literally mean that some bills necessitated for medical recovery or rehabilitation are left hanging because inflation was taken for granted. This is what no single kind of client would dream of, and yet poor funds are the frustrations many customers like Susan in Canadian LIC face due to the improper adjustments for inflation in her policies. We use such examples to emphasize the importance of regular policy reviews and updates.

Yes, some plans are designed to keep in mind the consideration for inflation, which provides an annual increase in coverage. Here at Canadian LIC, we mostly advise these plans to clients primarily concerned with long-term financial protection; for instance, our client Alex who wanted a sturdy plan to secure his family against such rising healthcare costs.

The only thing to bear in mind about any discussion on Critical Illness Insurance is inflation. Be updated and go for a plan that avails a new wave of protection against inflation; hence, you are well guided in your insurance with Canadian LIC amidst the complexities of critical illness plans towards a befitting decision for a secure tomorrow. Don’t hesitate to contact us to obtain a plan that is in tune with changes in the economy and one that ensures your financial safety.

Sources and Further Reading

Certainly! Here are some sources and suggestions for further reading on the topic of inflation and its impact on Critical Illness Insurance:

Canadian Life and Health Insurance Association (CLHIA) – The CLHIA provides comprehensive guides and detailed reports on various types of insurance, including critical illness coverage in Canada. Their resources can be particularly useful for understanding policy specifics and industry standards.

Website: Canadian Life and Health Insurance Association

Insurance Bureau of Canada (IBC) – The IBC offers information on different insurance products, including Critical Illness Insurance. They provide insights into how insurance policies work in the context of economic changes like inflation.

Website: Insurance Bureau of Canada

Financial Consumer Agency of Canada (FCAC) – The FCAC provides educational material on financial products, including insurance, and how inflation affects financial planning and insurance policies.

Website: Financial Consumer Agency of Canada

Investopedia – For a broader understanding of how inflation impacts financial products, Investopedia offers detailed articles explaining the basics of inflation and its economic implications.

Website: Investopedia

Bank of Canada – The Bank of Canada’s website offers resources on current economic conditions, including inflation rates and predictions, which can be crucial for understanding the broader context of your insurance planning.

Website: Bank of Canada

These sources can provide you with a deeper understanding of how inflation affects Critical Illness Insurance and help you make informed decisions about your insurance needs.

Key Takeaways

- Inflation decreases the purchasing power of Critical Illness Insurance payouts due to rising costs.

- Opting for inflation protection riders ensures your coverage amount keeps pace with inflation.

- Regularly review your policy to ensure coverage meets current needs and economic conditions.

- Regularly compare plans to stay updated with the best available Critical Illness Insurance options.

- Choose providers with a good track record and flexible policies to better meet long-term needs.

- Discuss concerns about inflation with your insurance provider to understand your coverage options.

- Be proactive in managing the impact of inflation on your insurance by staying informed and making timely adjustments.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]