- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- How Do You Calculate Term Insurance Value?

- Step 1: Understand the Purpose of Term Life Insurance

- Step 2: Identify Your Coverage Needs

- Step 3: Calculate Using a Term Life Insurance Premium Calculator

- Step 4: Factor in Lifestyle and Health Considerations

- Step 5: Exploring Term Length Options

- Step 6: Comparing Term Life Insurance Quotes

- Step 7: Deciding to buy Term Life Insurance Online

- Step 8: Reassessing Coverage Over Time

- Step 9: Understanding the Cost-Benefit Analysis of Your Term Life Insurance Premium

How Do You Calculate Term Insurance Value?

By Harpreet Puri

CEO & Founder

- 11 min read

- November 12th, 2024

SUMMARY

Calculating the right Term Insurance value is a decisive step to a prosperous financial future for your family. Many Canadians face challenges when determining how much Term Insurance they actually need. We commonly find clients at Canadian LIC who recount experiences of being confused over the terms, numbers, and formulas that make picking the right coverage seem daunting. For example, a parent with children may wonder whether the coverage they have chosen is going to be enough to cover possible mortgage costs, children’s tuition, or everyday expense needs in case the worst-case scenario becomes reality. This blog will help guide you through the process of determining the right value of the Term Life Insurance Policy that will help you sleep peacefully at night.

We will simplify all the parts in this guide so that you can understand precisely what factors determine the Term Life Insurance premium. You will then know how to apply a Term Life Insurance Premium Calculator and where to obtain free Term Life Insurance Quotes. We will also show you how purchasing life insurance online has eased and streamlined the process.

Step 1: Understand the Purpose of Term Life Insurance

So, before we start reading the mathematical books, let’s first learn what Term Life Insurance is and how it could be beneficial. Unlike Permanent Life Insurance, which will provide you with life-long protection, Term Life Insurance will provide coverage for a certain period of years, often 10, 20, 30 or 50 years. This could be a great option for those who need affordable protection during periods of significant responsibility and who might have high mortgage payments or young children.

Step 2: Identify Your Coverage Needs

The first step in calculating your Term Insurance value is identifying the total coverage amount you need. Here’s a simplified breakdown:

- Income Replacement: Calculate how much income your family would need if you were no longer around. A general rule is to have coverage that’s 5 to 10 times your annual income, but this can vary based on individual circumstances. For instance, one of our clients, a single mother, chose a policy with a value that would cover her income until her children reached adulthood.

- Debts and Financial Obligations: Consider any outstanding loans, mortgages, or credit card debts that your family would need to manage. You’ll want to ensure that the Term Life Insurance Policy value covers these expenses.

- Education and Childcare Costs: If you have young children, factoring in future education and childcare costs is crucial. These can add up significantly, and knowing that you have planned for them can provide a sense of security.

- Emergency Fund: Some clients prefer to add a buffer in their coverage amount to account for unexpected expenses.

The goal is to create a policy that truly reflects your family’s financial needs so they don’t struggle financially in your absence.

Step 3: Calculate Using a Term Life Insurance Premium Calculator

A Term Life Insurance Premium Calculator can be used to find your insurance. Several Canadians have utilized these tools and discovered them to be common, accessible, and requiring only input for instant quotations. Information that you might need to provide on a Term Life Insurance Premium Calculator may include:

- Your Age: Insurance premiums generally increase with age.

- Health Status: Pre-existing conditions or lifestyle factors such as smoking can influence your premium.

- Desired Coverage: How much do you wish to cover based on the calculations in Step 2?

- Term Length: The duration you want coverage for, such as 10, 20, or 30 years.

Most calculators are simple to apply. Input these approximations, and the tool will produce an estimate of premiums for varying coverage amounts. In most of the Term Life Insurance Quotes in Canadian LIC, most of the clients appreciate how quick and easy it is.

Step 4: Factor in Lifestyle and Health Considerations

Your health and lifestyle play a vital role in calculating the value of your Term Life Insurance. This factor often surprises clients who assume that age is the only criterion. For instance:

- Smokers vs. Non-Smokers: Smoking significantly increases premiums because of the associated health risks.

- Medical Conditions: Conditions like diabetes or heart disease can impact the cost and availability of coverage.

For example, a client in her late 40s was concerned about her ability to afford coverage due to a recent health diagnosis. The advisor changed the term period and the amount to be covered to an acceptable limit, balancing both of their needs with affordability.

These lifestyle factors make it clear why it would be advantageous to utilize an experienced advisor to assist you in getting customized quotes. Even if you are using a Term Life Insurance Premium Calculator, talking to a professional can help clarify your uncertainties.

Step 5: Exploring Term Length Options

The length or term of the policy directly impacts both the cost and the appropriateness of your Term Life Insurance Policy. It is quite obvious that selecting the appropriate term will mean matching the duration of the policy to the time over which your financial obligations are the greatest. Examples include:

- 10-Year Term: A shorter term is ideal if you’re looking for temporary coverage. For example, if you have a short-term debt that will be cleared within 10 years, this might be a cost-effective solution.

- 20-Year Term: This is often chosen by individuals in their 30s or 40s who are in the midst of their working years. It can cover the time span during which children are financially dependent.

- 30-Year Term: A longer term is generally suitable for younger individuals who have recently taken on long-term commitments, such as a mortgage.

Step 6: Comparing Term Life Insurance Quotes

Once you have a rough idea of your coverage requirements and terms, it is time to compare quotes. Term Life Insurance Quotes can be different from one provider to another, and it really pays to shop around for the best rates. Here are some helpful hints when comparing quotes:

- Use Multiple Calculators: Try different Term Life Insurance Premium Calculators available online to compare rates.

- Speak with Brokers: Brokers often have access to exclusive deals that may not be available directly from insurers.

- Evaluate Payment Options: Some providers offer monthly, quarterly, or annual payments, which can impact overall costs.

Our clients at Canadian LIC often benefit from our extensive network, which helps them secure competitive Term Life Insurance Quotes tailored to their needs.

Step 7: Deciding to buy Term Life Insurance Online

Buying Term Life Insurance online is becoming increasingly popular, especially among tech-savvy Canadians. This method allows for a streamlined application process with minimal paperwork. Here’s how it typically works:

- Apply for Quotes Online: After using a premium calculator and deciding on coverage, you can apply for a quote through the provider’s website.

- Complete Health Questionnaire: Most online applications include a brief health questionnaire.

- Submit for Review: Once submitted, you’ll receive feedback on eligibility and, in some cases, instant approval.

One client was pleasantly surprised at how fast and easy it was to buy Term Life Insurance Online. She was able to complete the application during her lunch break, receive a confirmation, and enjoy the peace of knowing her family was protected.

Step 8: Reassessing Coverage Over Time

Life is a rollercoaster ride, and so are Life Insurance needs. Getting married, having a child, or buying a house may call for an evaluation of your Term Life Insurance coverage. Revisiting your cover will ensure your policy is in line with your financial situation.

You also revisit the amount of coverage when reviewing the Term Life Insurance Policy to establish whether your original coverage amount is still sufficient to meet your family’s needs. For instance, you could have bought a more expensive home recently, meaning that the mortgage amount would be higher than it is at present. Similarly, adding children to your family means that future financial obligations such as education may increase. Some of the Canadian LIC clients decide to purchase extra coverage in the mid-term to ensure that, if life’s responsibilities continue growing, their families’ financial position does not get severely damaged.

Re-evaluation doesn’t necessarily mean that one has to cancel your existing policy. Many of the insurers that we represent offer the choice to add extra coverage on top of term coverage or even allow for conversion to Permanent Coverage in case your needs change. In this way, your term life will be there for you every step of the way.

Step 9: Understanding the Cost-Benefit Analysis of Your Term Life Insurance Premium

While the premium has to be affordable, it is also equally crucial to treat your Term Life Insurance premium as an investment in your family’s security. Calculating the actual value of a Term Life Insurance Policy should not limit one to finding the cheapest premium. Instead, compare the cost of the premium with the coverage received and the security it brings. At Canadian LIC, we encourage our clients to consider the benefits that their families would gain rather than the monthly payments they make themselves.

Consider this example: a young father with two children recently evaluated several policies. The most affordable policy provided a basic level of coverage, but a slightly higher premium offered a substantially greater benefit amount. By spending just a bit more each month, he was able to secure coverage that fully accounted for future expenses, ensuring a solid financial cushion for his family. This approach of balancing cost and value can help you make an informed decision.

Step 10: Working with Experienced Insurance Brokers

Calculating the Term Insurance value and choosing the right policy can be overwhelming, but it needs not to be. Experienced brokers make the process much easier and will provide valuable insights that fit your situation. Every day at Canadian LIC, we assist and collaborate with our clients to enable them to decide on Term Life Insurance Policies that fit their preferences and budgets.

We once worked with a business owner who did not know what coverage was right for her and her business. We helped her build the policy she needed through personalized advice and detailed term life quotes.

Brokers can offer benefits like:

- Exclusive Access: Brokers often have access to rates and offers not available directly to the public.

- Objective Advice: They work with multiple insurance providers, so their recommendations are unbiased.

- Expertise on Riders and Add-Ons: Many policies include optional riders like disability or critical illness coverage, which can enhance your policy’s benefits.

Calculating Term Insurance Value: Key Considerations

To wrap up our step-by-step guide, let’s highlight some key considerations that can guide you in calculating the ideal Term Insurance value for your needs:

- Financial Priorities: Start by defining your financial priorities. Are you focused primarily on income replacement, paying off debts, or covering children’s future expenses? Understanding what matters most will guide the amount of coverage you need.

- Term Length: Selecting the right duration can save you money. Opt for a term that matches your peak financial responsibilities. If your children are young, a 20-year term might work well. If you’ve just bought a home, a policy matching the mortgage length could be ideal.

- Premium Affordability: Use a Term Life Insurance Premium Calculator to find a premium within your budget. While it’s essential to secure adequate coverage, ensure the monthly cost doesn’t become a strain on your finances.

- Health and Lifestyle Factors: If you have health conditions or specific lifestyle factors, these may impact your premiums. Working with a broker can help you find insurers that offer favourable rates for your unique profile.

- Consider Future Changes: Life changes, and so might your needs. Consider policies with flexible options that allow for increased coverage or conversion to Permanent Insurance.

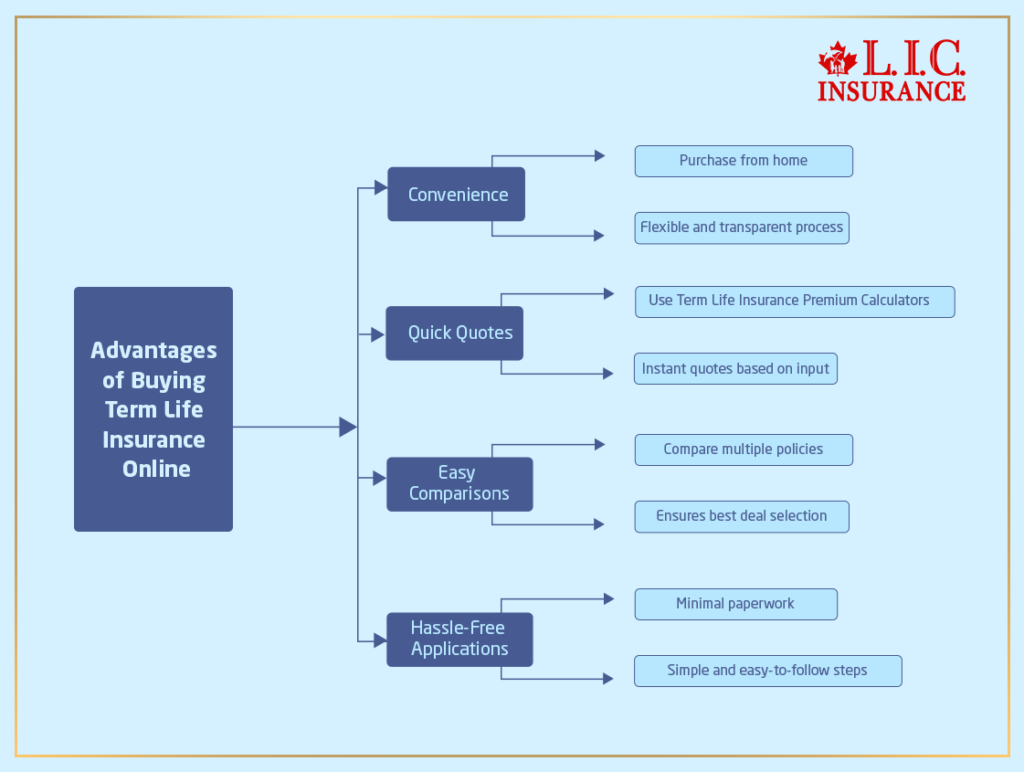

The Advantages of Buying Term Life Insurance Online

In today’s fast-paced world, buying Term Life Insurance online is convenient and straightforward. You can compare different Term Life Insurance Quotes, calculate premiums, and even finalize the application—all from the comfort of your home. At Canadian LIC, we often find that clients appreciate the flexibility and transparency of this digital approach.

Here’s why buying Term Life Insurance online has become popular:

- Quick Quotes: With just a few clicks, you can access Term Life Insurance Premium Calculators that provide instant quotes based on your input.

- Easy Comparisons: Shopping online allows you to compare multiple policies side by side, ensuring you get the best deal.

- Hassle-Free Applications: The online process is usually straightforward, with minimal paperwork and easy-to-follow steps.

Canadian LIC: The Best Insurance Brokerage for Term Life Insurance

Ultimately, choosing the Term Life Insurance Policy will be easy with the help of an experienced brokerage. Canadian LIC, known as one of the best insurance brokerages in Canada, prides itself on delivering tailored insurance solutions that genuinely meet its clients’ needs. Our team understands that calculating the right Term Insurance value is not a one-size-fits-all approach. We have covered so many clients. From a new parent to a business owner, we have given them the coverage they need to ensure and secure the future of their families.

From first premium calculations to quotes or purchasing Term Life Insurance online, Canadian LIC is here to help make it smooth, personalized, and supportive.

Ready to Secure Your Family's Future?

One of the most important steps to securing your family’s financial stability is calculating the correct value for Term Life Insurance. Through that process, by carefully assessing the areas of need, using Term Life Insurance Premium Calculators, and comparing quotes, you will find just the right policy to help guide you through your next step in life. Having Canadian LIC as your trusted partner will ensure that you have a company that will be there to back you every step of the way.

Begin today by assessing your insurance needs, calculating an estimate of your premium, and contacting Canadian LIC for professional guidance. Protect your loved ones with a Term Life Insurance Policy that meets their needs—because planning today means a more secure tomorrow.

More on Term Life Insurance

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs on Calculating Term Life Insurance Value

A Term Life Insurance Premium Calculator is an online tool that helps you estimate the monthly or annual cost of your policy. You input details like age, desired coverage, health status, and term length, and the calculator provides an estimate based on these factors. At Canadian LIC, clients find this tool useful because it quickly gives a clear picture of the premium they might pay, helping them decide on the right policy amount.

The amount of Term Life Insurance you need depends on your financial goals. Most people consider income replacement, mortgage payments, debts, and future expenses for children, like education. Canadian LIC often advises clients to think about these factors and use a Term Life Insurance Premium Calculator for an estimated coverage amount that fits their family’s needs.

Yes, getting Term Life Insurance Quotes online is simple. Many providers and brokers, like Canadian LIC, offer online quote tools that give you real-time quotes after entering basic information. This helps you quickly compare policies and select one that aligns with your budget and needs.

Yes, your health is a key factor in determining your premium. Conditions like high blood pressure, diabetes, or a smoking history can increase premiums, as they may present a higher risk. At Canadian LIC, we help clients find Term Life Insurance Policies with reasonable premiums, even if they have health concerns. A Term Life Insurance Premium Calculator will typically include health as a variable to give an accurate premium estimate.

The best term length depends on your life situation. For example, if you have young children, a 20-year policy might be ideal to cover them until adulthood. If you just bought a house, you might choose a term that matches your mortgage length. At Canadian LIC, we often recommend matching the term length with your biggest financial commitments to make sure your family is covered when they need it most.

Yes, you can buy Term Life Insurance Online. Most insurers and brokers allow you to complete the application process digitally. Buying online is convenient, especially for busy individuals, as it saves time and allows you to explore different policies on your schedule. Canadian LIC offers an online platform where you can buy Term Life Insurance, ensuring the process is smooth and supportive.

While you can get Term Life Insurance Quotes on your own, working with a broker can be beneficial. Brokers like Canadian LIC compare multiple options from different providers to find the best rates and terms for your needs. Our clients often tell us that having a broker simplifies the process and ensures they’re getting comprehensive coverage at the best price.

Yes, many Term Life Insurance Policies allow for adjustments. For example, some policies let you increase coverage or convert your Term Policy into a permanent one as your needs evolve. At Canadian LIC, we often guide clients through these changes, making sure their policies continue to reflect their financial goals and family needs.

Using a Term Life Insurance Premium Calculator is a good way to check if your premium aligns with industry standards for your age, health, and coverage needs. Additionally, comparing Term Life Insurance Quotes from various providers can help ensure you’re getting a fair deal. Canadian LIC helps clients understand their premiums and ensures they get value from their policies.

Yes, some Term Life Insurance Policies are available without a medical exam. However, the premium may be higher as the insurer has less information about your health risk. Canadian LIC has options for clients who prefer no-exam policies, and we help them weigh the costs and benefits to make an informed choice.

Several factors can help lower your Term Life Insurance premium. If you’re young and healthy, your premiums will likely be lower. Additionally, choosing a shorter-term or lower coverage amount can reduce costs. At Canadian LIC, we work with clients to explore these options, using a Term Life Insurance Premium Calculator to show how each decision affects the premium.

Term Life Insurance pays for a specified period, say 10, 20, 30 years or 50 years. Term Life Insurance is relatively cheaper than permanent insurance that covers a lifetime. Term Life Insurance is most suitable for people who have strong, short-term financial commitments, like paying off a mortgage. Often, Canadian LIC recommends Term Life Insurance to clients looking for low-cost coverage that matches a specific stage in life, like paying off a mortgage.

Yes, most Term Life Insurance Policies offer a renewal option, though premiums may increase due to age and any health changes. We find that clients at Canadian LIC sometimes prefer renewing rather than getting a new policy, especially if they want coverage for a few more years but don’t need another long-term policy.

Term Life Insurance Quotes provide an estimate based on your initial information, but the final premium may vary after a full application review. Factors like detailed medical exams or background checks might slightly adjust the premium. Canadian LIC provides a quote as accurately as possible upfront, so there are no surprises.

A Term Life Insurance Premium Calculator gives a good estimate based on the information you enter, like age, health, and coverage amount. However, the final premium may vary slightly after a detailed review. Canadian LIC helps clients understand the differences so they feel confident that their quote and final premium are in line with expectations.

Choosing the right length depends on your financial goals and obligations. If you have young children, a longer term, like 20 or 30 years, might make sense to cover them until they’re adults. If you’re only covering a loan, a shorter term might work. At Canadian LIC, we help clients match their term length to specific needs so they’re covered for the most important years.

Yes, there are ways to lower your quotes. Being younger, healthier, or choosing a shorter term length often results in lower premiums. Canadian LIC encourages clients to use a Term Life Insurance Premium Calculator to see how different factors, like term length and coverage amount, can affect quotes.

Look for a Term Life Insurance Policy that fits your budget and covers all your needs. Consider factors like term length, coverage amount, and any optional riders that might be valuable. At Canadian LIC, we guide clients to focus on policies that provide both affordability and comprehensive protection.

Yes, you can cancel a Term Life Insurance Policy if your needs change. Keep in mind that you won’t get back the premiums you’ve already paid, as Term Insurance doesn’t have a cash value. Canadian LIC often advises clients to review their needs before cancelling, as there might be affordable adjustments to the existing policy instead of a full cancellation.

Yes, Term Life Insurance Quotes typically increase with age, as insurers see older applicants as higher risk. This is why starting a policy early can lock in lower rates for the entire term. Canadian LIC often works with clients who are starting young, helping them benefit from more affordable long-term coverage.

Yes, you can still buy Term Life Insurance Online if you have a pre-existing condition, though premiums may be higher. Some online providers may ask for additional medical details, while others may offer a no-exam option at a higher rate. At Canadian LIC, we help clients with various health backgrounds find options that fit their circumstances.

If you outlive your policy, the coverage simply expires, and there’s no payout. At Canadian LIC, we often suggest options like policy renewal or conversion to Permanent Coverage if clients still need protection beyond their initial term.

Typically, there are no hidden fees in a straightforward Term Life Insurance Policy. The premium includes everything, but additional riders or features might have extra costs. Canadian LIC makes sure clients understand all potential costs before they commit to a policy.

Yes, using a Term Life Insurance Premium Calculator is a great way to compare policies from different providers. Many calculators allow you to see various options for coverage amounts, term lengths, and monthly premiums, helping you make an informed choice. At Canadian LIC, we encourage clients to use these calculators for initial estimates and then consult with us for a deeper understanding.

Yes, buying Term Life Insurance online is generally safe, especially if you’re working with a reputable provider or brokerage. Canadian LIC ensures a secure and reliable process for clients purchasing online so you can confidently protect your family without leaving your home.

To ensure you’re getting the best quotes, compare different policies and use multiple calculators. Speaking with a broker can also reveal exclusive rates or discounts. Canadian LIC’s team is skilled in finding clients competitive quotes, so they don’t overpay for quality coverage.

Yes, many people use Term Life Insurance specifically to cover a mortgage. You can choose a term length and coverage amount that matches your loan, so if something happens, your family won’t have to worry about mortgage payments. Canadian LIC often helps clients design policies with this in mind, giving them reassurance about their largest financial commitment.

Online quotes are quick estimates based on limited information, whereas quotes from a broker are often more detailed and tailored to your unique needs. Canadian LIC’s brokers provide customized Term Life Insurance Quotes, helping clients get a clearer picture of what they’ll actually pay after all factors are considered.

Yes, many online platforms allow you to add riders to your policy, such as disability or critical illness riders, for additional coverage protection Canadian LIC provides guidance on which riders might be beneficial, ensuring clients don’t miss valuable coverage that could enhance their policy.

These FAQs relate to the most common questions regarding the Term Life Insurance computation of the value, how you can use a Term Life Insurance Premium Calculator, and how you will get quotes on Term Life Insurance. For anything else you feel like knowing, Canadian LIC has come to make sense of your options and help you find a policy that suits you better.

Sources and Further Reading

- Sun Life Financial: Offers comprehensive information on Term Life Insurance options and provides tools to help determine appropriate coverage amounts.

Sun Life - TD Insurance: Provides insights into Term Life Insurance Policies, including premium calculations and online purchasing options.

TD Insurance - Canada Life: Features a Term Life Insurance quote tool to help estimate premiums based on individual needs.

Canada Life - Blue Cross Life: Details Term Life Insurance coverage options and offers an online quote system for prospective policyholders.

Blue Cross - ThinkInsure: Provides information on Term Life Insurance, including how to compare quotes and select suitable policies.

ThinkInsure - MoneySense: Features articles on life insurance in Canada, discussing different types of policies and considerations for choosing the right coverage.

MoneySense - Income.ca: Offers a life insurance calculator to help determine the necessary coverage amount based on personal financial situations.

Income - Edward Jones: Provides a life insurance calculator and resources to assist in understanding coverage needs.

Edward Jones - HelloSafe.ca: Features a life insurance calculator and guides on selecting appropriate Term Life Insurance Policies.

HelloSafe - TERM 4 SALE: Offers a life insurance calculator to estimate premiums and coverage needs.

Term4Sale

Key Takeaways

- Understand Coverage Needs: The right Term Life Insurance value depends on factors like income replacement, debts, and future family expenses. Identifying these needs helps in selecting appropriate coverage.

- Use a Premium Calculator: A Term Life Insurance Premium Calculator can provide an estimated premium based on age, health, and term length, making it easier to budget for coverage.

- Term Length Matters: Choose a term length that aligns with your financial responsibilities, such as the years left on a mortgage or the time until children reach financial independence.

- Compare Quotes Online: Accessing Term Life Insurance Quotes online is fast and allows you to compare different policies, ensuring you get the best option for your needs.

- Health and Lifestyle Impact Premiums: Factors like smoking and medical conditions can influence premiums, so consider your health profile when calculating costs.

- Buy Online for Convenience: Buying Term Life Insurance online streamlines the process, with options to complete applications, get quotes, and even purchase policies without leaving home.

- Reevaluate as Life Changes: Regularly reassess your policy as family and financial circumstances evolve, and consider renewal or conversion options if additional coverage is needed later on.

- Seek Broker Advice: Brokers can provide tailored guidance and access exclusive rates, helping you select a policy that best matches your unique needs and budget.

Your Feedback Is Very Important To Us

Thank you for taking the time to provide feedback. Your insights will help us understand the challenges Canadians face when determining Term Life Insurance coverage. Please answer the questions below.

Thank you for your feedback! Your responses will help us improve the tools and resources available for Canadians calculating Term Life Insurance value.

IN THIS ARTICLE

- How Do You Calculate Term Insurance Value?

- Step 1: Understand the Purpose of Term Life Insurance

- Step 2: Identify Your Coverage Needs

- Step 3: Calculate Using a Term Life Insurance Premium Calculator

- Step 4: Factor in Lifestyle and Health Considerations

- Step 5: Exploring Term Length Options

- Step 6: Comparing Term Life Insurance Quotes

- Step 7: Deciding to buy Term Life Insurance Online

- Step 8: Reassessing Coverage Over Time

- Step 9: Understanding the Cost-Benefit Analysis of Your Term Life Insurance Premium