Have you ever struggled to get a Super Visa Insurance claim to proceed? You may have been in the middle of making plans when you ran into a problem with the Super Visa Insurance. Your parents are finally ready to go on their trip to Canada, and spirits are high with whatever is already rolled up in their bags. But the plan falls through when you run into a problem with the insurance. There may be a delay in processing the claim, or the insurance company is arguing over a bill that they should clearly pay. These could not be insignificant hurdles but represent the difference between a happy family reunion and a logistical nightmare.

A lot of families in Canada have been through hard times like this. We hear these stories every day at Canadian LIC. Quite often, our clients tell us they are frustrated with how hard it is to understand the complicated world of Super Visa Insurance in Canada. Through our everyday experiences with our clients, we’ve learned a lot about the problems that families like yours will most likely face and, more importantly, how to solve them.

This blog will walk you step-by-step through effectively filing a complaint against your Super Visa Insurance provider using relatable scenarios and some very practical advice. What is our goal? You might learn what you need to know and be given the tools you need to easily solve insurance problems so that your family can enjoy their time in Canada without any extra stress. Now, let’s get started and explain the process so you can focus on the most important thing, which is your family members.

Understanding Your Super Visa Insurance Coverage

Scenario: Imagine a client, Mr. Kumar, whose mother fell ill during her stay in Canada. Despite having Super Visa Insurance, the claim he submitted was unjustly denied. The reason given was vague, mentioning something about pre existing medical conditions that were supposed to be covered under their policy.

Step-by-Step Guide to Addressing Your Concerns:

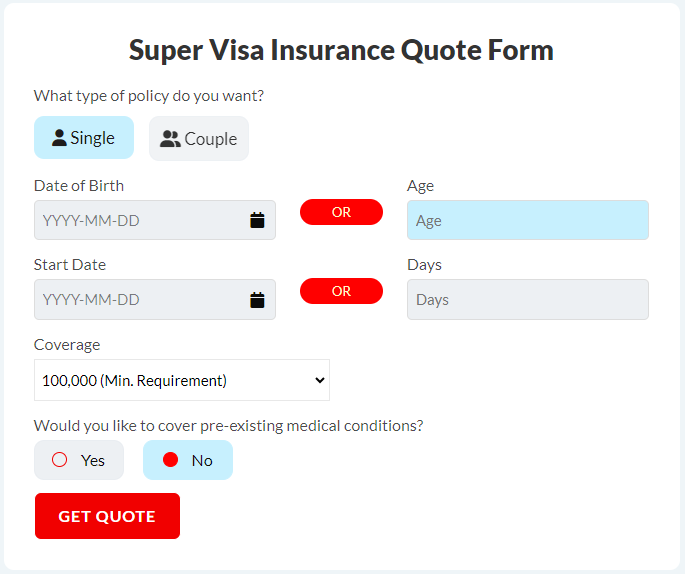

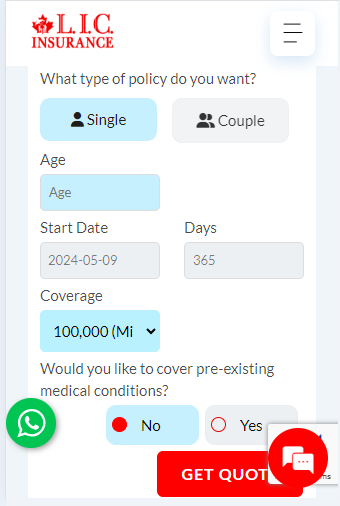

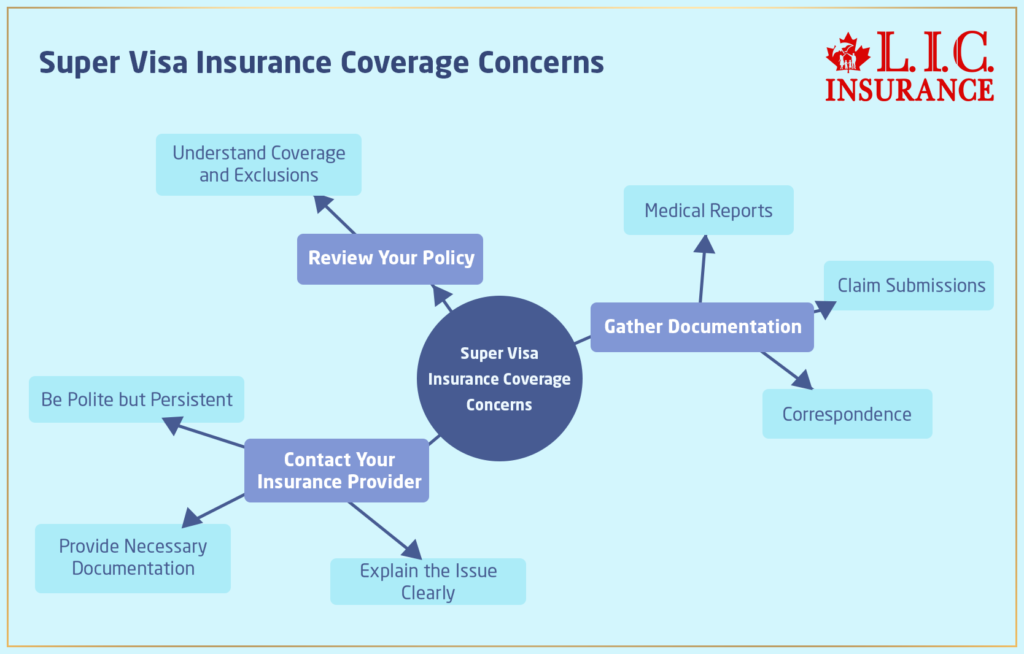

Review Your Policy: Always start by thoroughly reviewing your Super Visa Medical Coverage. Understand what is covered and what is not. This will equip you with the necessary knowledge to dispute any discrepancies with your provider.

Gather Documentation: Collect all relevant documents, such as medical reports, claim submissions, and any correspondence with your insurance provider. Mr. Kumar was able to provide detailed medical records and a copy of his insurance policy highlighting the coverage of pre-existing conditions.

Contact Your Insurance Provider: Reach out directly to your Super Visa Insurance company. Explain your issue clearly and provide all necessary documentation to support your case. Be polite but persistent.

When Things Don't Go as Planned

Scenario: Another client, Mrs. Chen, faced endless delays in her claim processing, causing significant financial and emotional strain for her family.

Understanding the Complaints Process:

When dealing with Super Visa Insurance in Canada, understanding how to go through the complaints process effectively can save you time and unnecessary stress. Below, we elaborate on each step to ensure you confidently and clearly handle any disputes with Super Visa Insurance Companies.

Internal Complaint Handling

Firstly, it’s essential to acknowledge that every Super Visa Insurance company in Canada is mandated by law to have an internal complaint-handling process. This is your initial pathway to address any grievances. We recommend asking for a written copy of this process as soon as you purchase your policy. This way, you’re prepared from the get-go.

Consider the case of Mr. and Mrs. Patel, who reached out to us at Canadian LIC when they encountered discrepancies in their Super Visa Insurance Coverage claims. The insurer initially seemed unresponsive. We advised the Patels to formally request the insurer’s complaint handling process document. Following it step-by-step, they engaged with the company’s designated complaint officer, which moved their case forward.

Keep Records

Documenting every interaction with your insurance provider is critical. Keep a log of dates, names of the people you spoke with, and a brief summary of each conversation. This record will be invaluable if you need to escalate your complaint.

Mrs. Singh, a client of Canadian LIC, faced persistent delays in her claim processing. Every phone call seemed to lead to another excuse. We coached her to start a detailed log. When she finally decided to escalate her complaint, her meticulous records clearly demonstrated the lack of responsiveness and action from the insurer’s side. This documentation helped significantly in moving her complaint to a resolution.

Formal Complaint

If your issue is not resolved to your satisfaction within the company, it’s time to escalate it by filing a formal complaint. This step involves more than just expressing dissatisfaction; it requires a structured approach to get results.

Writing a Formal Complaint: Write a detailed letter to your Super Visa Insurance provider. Clearly state your problem, reference your policy number, and explain how you would like it resolved. Include copies of all relevant communications, receipts, and a detailed timeline of events.

When Mr. Zhao contacted us about his unresolved claims with a Super Visa Insurance company, we helped him draft a formal complaint. His letter was precise: it included a clear description of the medical services that should have been covered, detailed the numerous interactions he had with the company, and attached all supporting documents. We guided him in expressing what resolution he expected and emphasized the impact of the issue on his family’s well-being.

Keep in mind that the key to arguing with a Super Visa Insurance company is to remain calm and professional—cool, calm, and courteous. Many companies process several complaints every day, so it’s very likely that only a well-documented and firmly polite approach will get the appropriate attention to your issue.

At Canadian LIC, we see such scenarios unfold every day. Dealing with insurance complaints can be a very intimidating issue, especially when it deals with the health and welfare of your loved ones who have come to visit you here in Canada. We are committed to walking with our clients through every step of the process, making sure that they understand their Super Visa Insurance Coverage and all the confusing factors that go into settling disputes.

Your proactive engagement and our expert guidance can make all the difference in turning a frustrating insurance issue into a successfully resolved claim. Let’s make sure your loved ones really can enjoy their visit without any additional stress related to insurance disputes.

Escalating Beyond the Insurance Company

Scenario: Mr. Lee’s complaints were initially dismissed by his insurance provider, leaving him feeling helpless and frustrated.

Engaging Third-Party Help:

When you face challenges with your Super Visa Insurance Coverage that seem impossible, turning to third-party organizations can offer you a new avenue for resolution. Let’s delve deeper into how these bodies can help you.

Contacting the OmbudService for Life & Health Insurance (OLHI)

Scenario: Consider the case of Mr. Ahmad, whose claim for his father’s emergency surgery was repeatedly rejected by his Super Visa Insurance company despite clear policy terms. The frustration and anxiety he faced were overwhelming.

Steps to Engage OLHI:

Prepare Your Case: Before reaching out to OLHI, organize all relevant documents, including your insurance policy, any correspondence with the insurer, and records of the medical incident. Mr. Ahmad prepared a concise file that outlined the timeline of events and the insurance company’s responses.

Submit Your Complaint: Visit the OLHI website and submit your complaint online or via mail. Clearly state your problem and what resolution you seek. For Mr. Ahmad, the clarity of his submission was crucial in moving his case forward efficiently.

Cooperation and Follow-up: Engage cooperatively with the OLHI as they review your complaint. They may require additional information or clarification, so staying responsive is key. Mr. Ahmad made sure to respond promptly to inquiries, which helped maintain the momentum of his case.

What OLHI Offers: OLHI provides a free, impartial review of complaints related to Super Visa Insurance in Canada. They can mediate between you and the Super Visa Insurance Companies to find a fair resolution. In Mr. Ahmad’s case, OLHI’s intervention led to a re-evaluation of his claim, and eventually, the claim was honoured.

Engaging with Your Provincial Insurance Regulator

Scenario: Ms. Nguyen was stuck because her Super Visa Insurance provider wouldn’t answer her repeated questions about benefits for her mother’s long-term illness. She had tried reconciliation but failed, and she was very upset.

Steps to Contact the Provincial Insurance Regulator:

Identify Your Regulator: Each Canadian province has its own insurance regulator. Identify which regulator oversees Super Visa Insurance Companies in your area. Ms. Nguyen found her provincial regulator through a quick search on the Canadian Council of Insurance Regulators (CCIR) website.

File Your Complaint: Provide a detailed account of your issue, supported by all relevant documentation. Be clear about what actions you’ve taken with the insurance company and any responses received. Ms. Nguyen compiled a full record of all her conversations with the insurance company.

Engage with the Process: The provincial regulator may investigate the practices of the Super Visa Insurance provider. This can lead to disciplinary actions if the insurer has violated regulatory standards. For Ms. Nguyen, the regulator’s involvement prompted a swift review and rectification of her mother’s claim application process.

What the Provincial Regulator Does: The regulator ensures that Super Visa Insurance Companies in Canada operate within legal and ethical guidelines. They protect consumer interests by enforcing adherence to these standards and can take corrective measures against insurers if necessary.

Why This Matters

Considering the involvement of organizations like OLHI and provincial insurance regulators is a powerful move to be undertaken to resolve disputes between Super Visa Insurance Companies. These bodies uphold consumer rights and ensure that insurance providers effectively meet their obligations to them. At Canadian LIC, we walk our clients through each step so they feel protected and well-informed. Our goal is not just simple redressal of grievances but also an open and transparent atmosphere in the market of Super Visa Insurance dealings.

Keep in mind that you are not alone in facing these challenges. With the right level of support and advice, you should be able to work through these complexities to ensure the protection of loved ones coming to Canada.

Conclusion: Why Choose Canadian LIC for Your Super Visa Insurance?

You definitely don’t walk alone through the intricacies involved in Super Visa Insurance in Canada. Here at Canadian LIC, we know how frustrating it can be to deal with Super Visa Insurance Companies and their complicated processes. That’s why we promise to assist clients at all times during their insurance journey, from buying the right policy to dispute settlement.

Go for Canadian LIC for complete peace of mind. With in-depth knowledge of the insurance landscape and a client-first approach, we ensure that your family’s visit to Canada is safeguarded against unexpected medical expenses. Don’t let insurance disputes dampen the experience for your family. Contact Canadian LIC today, and let us help you secure the best possible Super Visa Insurance Coverage for your loved ones. Make this smart choice today to ensure that your family is protected during their precious time in Canada.

Find Out: The consequences not having a valid Super Visa Insurance

Find Out: What Happens If The Super Visa Insurance Expires While The Visitor Is Still In Canada?

Find Out: The Waiting Period For Super Visa Insurance?

Find Out: Is Super Visa Insurance Refundable?

Find Out: How To Find The Most Affordable Super Visa Insurance Plan?

Find Out: Where Can You Buy Super Visa Insurance In Canada?

Find Out: Can We Cancel Super Visa Insurance?

Find Out: Can we Pay Monthly For Super Visa Insurance?

Find Out: When Should Super Visa Insurance Start In Canada

Find Out: When Should Super Visa Insurance Start In Canada

Find Out: What Happens If The Super Visa Insurance Expires While The Visitor Is Still In Canada?

Find Out: Mistakes To Avoid While Buying Super Visa Insurance

Find Out: What To Look For In Super Visa Insurance In Canada?

Find Out: Everything You Need To Know About The Canadian Super Visa Insurance

Find Out: How To Apply For A Super Visa Insurance?

Find Out: How To Get Super Visa Insurance In Canada

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions About Super Visa Insurance in Canada

Canada’s Super VisaMedical Insurance leaves a lot of people questioning what to do. At Canadian LIC, we understand that our clients deal with similar questions time and again. We, therefore, have compiled a list of the most frequently asked questions and their corresponding answers to best capture such common concerns and circumstances. All answers are written to provide specified clarity and guidance by way of our everyday interaction with those fighting for these very issues.

Mrs. Johal contacted us after her Super Visa Insurance company refused to cover her father’s emergency medical expenses despite her belief that the policy covered such incidents.

First, check your policy details to confirm that the expense should have been covered. Gather all related documents, such as your medical bills and any letters you or your doctor may have written to your insurance company. Contact them and explain what the problem is and get things sorted out. If your insurance company cannot or will not help, or if your situation is very complicated, contact the OmbudService for Life & Health Insurance, OLHI, or your provincial insurance regulator.

Mr. Singh was anxious about choosing the right Super Visa Insurance company and came to us for advice after reading mixed reviews online.

Research the reputation of many Super Visa Insurance Companies. Check customer reviews, ratings by financial institutions, and complaints records handled by the regulatory body. Canadian LIC advises you to choose providers that are well-established and have a clean record in terms of claim handling and customer service.

After her parents arrived in Canada, Ms. Chen realized that her current Super Visa Insurance plan was insufficient for their needs, especially concerning their pre-existing conditions.

You will usually be able to adjust most of the Super Visa Insurance Coverage. You have to contact your insurance provider to discuss your needs and if they can adjust the coverage accordingly. Sometimes, if they are not able to provide you with the coverage you desire, then you would be able to change the insurance company. Just be sure that any changes you make do not disrupt the continuity of your Super VisaCanada.

Mr. Aziz experienced delays and a lack of responses when trying to claim his mother’s medical treatment costs, causing significant stress and uncertainty.

Document all attempts to contact the insurer and any responses received.

If you do not receive a satisfactory response, escalate the matter by filing a formal complaint through the insurer’s internal complaint process.

If this does not resolve the issue, seek help from OLHI or your provincial insurance regulator.

Choosing the right plan can be a headache, though looking at a few Visitor Insurance Quotes and being guided by factors such as the parent’s health and duration of the visit helps. In the case of pre-existing conditions for the parents, you have to go in for plans that offer such coverage. Consider this—Sarah does everything it takes to ensure her mother’s diabetes is taken care of. You would be the best judge of the value of the plans; maybe you would also like the plans with more benefits but at a slightly higher price.

Mrs. Kaur was surprised by a policy change that affected her coverage, which she only discovered during a medical emergency involving her visiting mother.

Review your Super Visa Insurance policy at a minimum annually or whenever there is any significant change in your situation or the health of the visitor to be insured. By doing this, you would be updated on the new policy and would not experience any gaps in protection.

Mr. LeBlanc found himself in a difficult situation when his mother, visiting under a super visa, incurred medical expenses that far exceeded their basic insurance coverage.

The right Super Visa Insurance can, therefore, help you stay away from financial stress. Suppose the insurance coverage provided needs to be revised; you will then be responsible for the costs of medical expenses not covered. It may be financially draining and stressful. We would recommend being thorough regarding your policy details to ensure everything is included and satisfies all needs and requirements in your policy; adjust if necessary with the help of your insurance provider.

Mr. Thompson, who had a positive experience with a U.S.-based insurer, wondered if he could use them for his father’s Super Visa Insurance.

Super Visa Insurance Coverage must be purchased only from a Canadian insurance company. Super Visa applicants will be guided by support while choosing an acceptable Canadian company that suits them best to or her liking and in terms of adequate coverage to meet his or her requirements.

Mrs. Garcia disputed with her insurance provider over a claim denial for her father’s prescription medication, which she believed was covered under their policy.

The first step in case of a dispute is to go through your policy documents and confirm the details of the coverage. If, even after going through the policy papers, you feel there is an error, give your proof to the insurance company. If they refuse to budge and you are not satisfied, take it up further by contacting the OLHI or provincial regulator of insurance for insurance review.

Mr. Thakur was concerned about how his mother’s pre-existing heart condition would be covered under a new Super Visa Insurance policy they were considering.

Coverage of pre-existing conditions varies from one Super Visa Insurance company to another and from one policy to another. Generally, coverage includes the conditions that have been stable for some time before the policy comes into effect. Thus, it is very important to declare all pre-existing conditions when you purchase insurance and to choose a policy that clearly covers these conditions in order to avoid disputes that might arise in the future. At Canadian LIC, we assist our clients in choosing policies that will provide suitable coverage based on their health needs.

Canadian LIC brings you clear and actionable advice on the way forward in managing and using your Super Visa Insurance to its full potential for a peaceful and enjoyable stay with your loved ones in Canada. The educated customer is the protected customer. We’re here to help guide you every step of the way with your insurance.

Sources and Further Reading

To further understand the process of filing complaints against Super Visa Insurance providers in Canada and to get a deeper insight into your rights as a consumer, consider exploring the following resources:

Financial Consumer Agency of Canada (FCAC) – Provides comprehensive information on consumer rights and financial services regulations in Canada.

Website: FCAC – Insurance

OmbudService for Life & Health Insurance (OLHI) – Offers assistance and information on resolving disputes with life and health insurance providers in Canada, including those offering Super Visa Insurance.

Website: OLHI – How It Works

Canadian Life and Health Insurance Association (CLHIA) – A non-profit association that provides essential information on life and health insurance products, including Super Visa Insurance.

Website: CLHIA – Consumer Information

Insurance Bureau of Canada (IBC) – Provides insights and advice on various insurance topics, including the handling of complaints against insurance companies.

Website: IBC – Consumer Information

Canadian Council of Insurance Regulators (CCIR) – An association of insurance regulators that ensures fair and effective insurance regulatory practices in Canada.

Website: CCIR – Consumer Information

These resources can offer valuable guidance and are a great starting point for anyone looking to understand more about Super Visa Insurance Coverage, the responsibilities of Super Visa Insurance Companies in Canada, and the processes involved in addressing disputes.

Key Takeaways

- Know the details of your Super Visa Insurance Coverage to handle discrepancies effectively.

- Keep detailed records of all communications with your insurance provider.

- Utilize the internal complaint-handling process provided by your insurance company.

- Write clear and concise formal complaints, specifying the issue and desired resolution.

- Contact third-party organizations like OmbudService or provincial regulators if needed.

- Maintain a professional demeanor throughout the complaint process.

- Leverage resources from consumer protection agencies for guidance.

- Choose reputable Super Visa Insurance Companies to prevent issues and ensure quality service.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]