- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

How Do I Claim Term Insurance?

By Harpreet Puri

CEO & Founder

- 11 min read

- January 30th, 2025

SUMMARY

This blog details how to file a Term Life Insurance claim in Ontario, Canada, explaining the most crucial steps, such as document gathering and efforts to contact the insurer, filling in claim forms, and common issues to avoid delays in the claims process. It also discusses the role of Term Life Insurance Agents in simplifying that process, along with understanding Term Life Insurance Costs, options for payout, and how “Canadian LIC” can help the beneficiaries ensure the smoothest claim experience for their beneficiaries.

Introduction

Losing a loved one is painful. Besides coping with the pain, families are subjected to financial pressure. Many make Term Life Insurance Investments to ensure that their families stay financially stable. However, most of them get perplexed when it comes to insurance claims. How do you start? What documents are required? How do you ensure that there is no delay? These are questions that numerous families ask themselves, and finding answers to them could be overwhelming. Term Life Insurance Agents often have families struggling to do this. This experience has occurred to many clients when we helped them file their claims successfully and receive payouts. This blog will guide you all the way through the claim procedure so that everything becomes easy and non-tense for you.

Step 1: Understand the Claim Process

It’s a common myth that the insurance payment is automatically issued once the policyholder dies. A claim, however, must be filed and certain procedures followed. The process is about the same for all the insurance providers, though quotes for Term Insurance in Canada depend on coverage and provider.

Who Can File a Claim?

The beneficiary listed in the Term Life Insurance Policy is responsible for filing the claim. If multiple beneficiaries are named, they will each need to submit their claims separately.

How Long Does It Take to Process a Claim?

Normally, the insurance company would need a few weeks to settle a claim; however, the claims process is turned into longer dates. This happens due to missing documents, insufficiency in information, or even some investigation. In all these cases, term life agents always encourage one to lodge the claim early so as not to wait for a longer date than necessary.

Step 2: Gather the Required Documents

Filing a claim requires certain documents. If the paperwork is missing, then it will delay the process, so everything should be prepared beforehand.

Essential Documents for Claim Submission:

- Death Certificate: This is the most vital document. If this is missing, the insurance company will not be able to process the claim.

- Policy Document: This is the actual insurance policy carrying the details of the coverage.

- Claimant’s Identification – The beneficiary’s valid ID; these are a passport, driver’s license, or any other state-issued identification.

- Claim Forms: Each insurance company offers a claim form that is to be filled.

- Medical Records (if applicable): Medical records (in the case where the cause of death has some medical illness involved) are considered and sought in the additional file from insurance firms.

- Proof of Relationship: If applicable, proof may be required depending on the relationship between the beneficiary and the deceased, e.g., a birth or marriage certificate. Preparing all these documents in advance will help in avoiding delays in the claim process.

Step 3: Contact the Insurance Provider

After preparing all the documents, the following step is to notify the insurance company. Term Life Insurance Ontario Canada providers have a specific claim department which deals with claims and payouts.

Steps to Inform the Insurance Company:

- Call the customer support team: Most insurance companies will have a dedicated number for claims support.

- Visit the Insurance Office (if needed): Visit the local office of an insurer if that is what one is looking for (if assistance isn’t possible without a visit).

- Submit Documents Online (if applicable) – Many insurers now allow online claim submissions for convenience.

In receipt of the claim, the insurance company will hire a claims adjuster who is authorized to check through and authenticate the papers.

Step 4: Understand Potential Delays and How to Avoid Them

Even with proper documentation, delays may occur. Knowledge of the usual causes of claim delay can help in avoiding frustration.

Common Reasons for Claim Delays:

- Lack of Inadequate Documentation-Instead, verify all the forms and documents prior to submitting them.

- Policy Lapse–If Term Life Insurance Premiums have not been paid, the policy must have lapsed, and now the claim was rejected.

- Disputed Beneficiaries: If more than one person claims the benefit without proof, the distribution may be withheld.

- Cause of Death Investigation: Should the insured die in the contestability period? This period usually extends to the first two years of a policy, and the insurance firm can investigate the cause of death.

How to Prevent Claim Delays:

- Maintain Term Life Insurance Investments by paying all your premiums at the right time.

- Update beneficiaries regularly.

- Tell family members about the policy and where the documents are kept.

- One can seek assistance from Term Life Insurance Agents so that all formalities are fulfilled before a claim is made.

Step 5: Claim Approval and Payout Options

Once the insurer reviews and approves the claim, the payout process begins.

How Are Term Insurance Payouts Made?

- Lump Sum: The total amount of the death benefit is payable in a single lump sum. Many people favour this method.

- Installment Payments: Some insurance companies pay in installments over time rather than as a lump sum.

- Retained Asset Account: The money is kept by the insurer in an interest-bearing account and withdrawn by the beneficiary as she requires in a retained asset account.

What If a Claim Is Denied?

If a claim is rejected, the insurance company gives a reason for the rejection. The beneficiaries can

- Explain to the insurer in detail.

- Appeal the decision by submitting additional documentation.

- Term Life Insurance Agents may be solicited to help in filing a reconsideration request.

Step 6: Get Professional Help

Most people are intimidated by the procedure of filing a claim for term life. Term Life Insurance Agents help the beneficiaries to streamline the process.

Benefits of Consulting an Insurance Agent:

- Guidance on necessary documents.

- Assistance with avoiding mistakes which cause delays in the claiming process.

- Assistance in appealing if a Term Life Insurance Claim is rejected.

- Information regarding the payout options will be helpful in making the right decision.

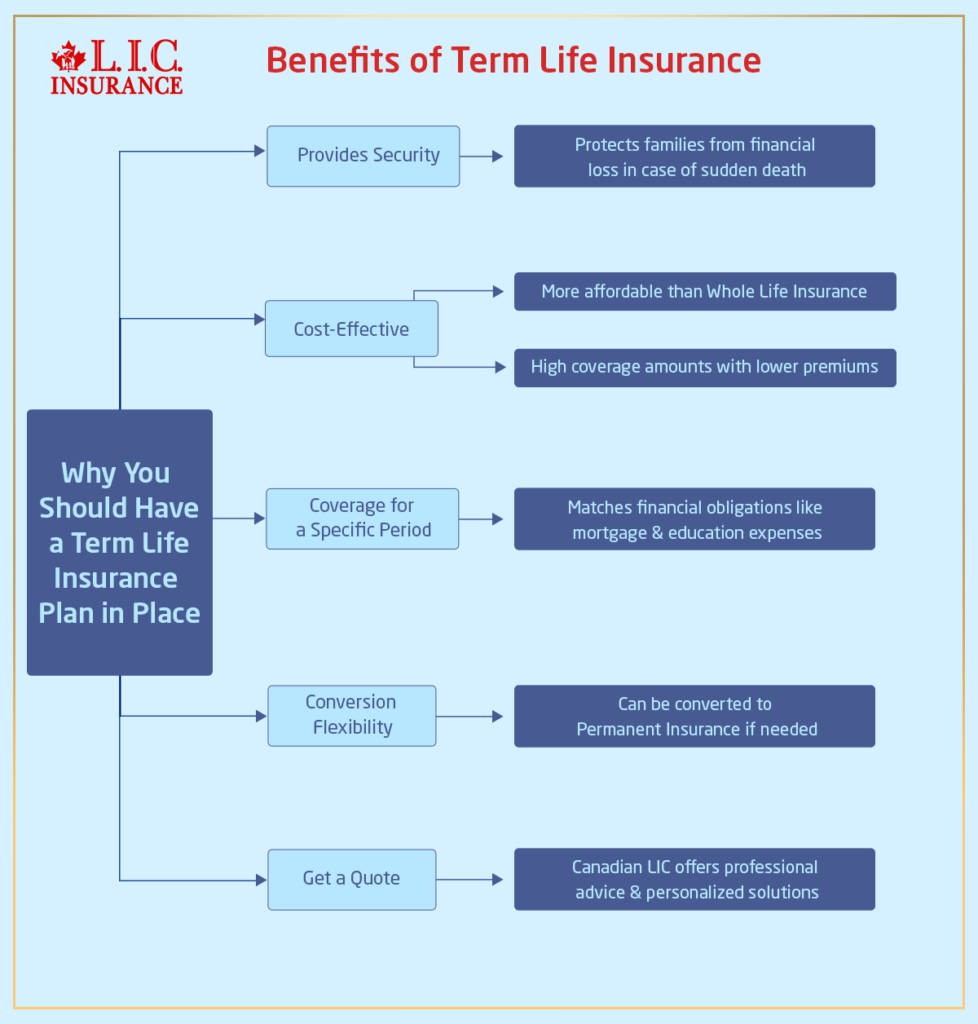

Why You Should Have a Term Life Insurance Plan in Place

Most families in Ontario, Canada, and the world at large have Term Life Insurance to offer security. Compared to Permanent Life Insurance Policies, Term Life Insurance is quite cheap; thus, most families need it to provide security. Term Life Insurance Investments help ensure that if a person is lost in a sudden occurrence, the burden does not come with financial loss to their loved ones.

Benefits of Term Life Insurance:

- It is more affordable compared to Whole Life Insurance.

- High coverage amounts pay lower premiums.

- Protection for a specified period, similar to financial obligations such as mortgage and education expenses.

- The ability to convert to permanent insurance, if required.

If you haven’t yet obtained Term Life Insurance Quotes in Canada, now is the right time. Canadian LIC provides professional advice and personalized solutions for insurance so you and your loved ones are safe and protected.

Take Action Now

There is no need for the process of claiming Term Life Insurance in Ontario, Canada, to be hectic. Preparation and knowing the procedure are important aspects that make this experience seamless, and it gets even better if one has access to Term Life Insurance Agents. If you have Term Insurance already, make sure your beneficiaries are well-informed. If you need one, consult an expert today at Canadian LIC. Protect your family’s future by making informed decisions about Term Life Insurance Investments.

More on Term Life Insurance

- Who Is The Largest Provider Of Term Life Insurance?

- What Happens After 15-Year Term Life Insurance?

- What is a 5-Year Term Life Insurance Policy?

- What Is The Expiry Date On Term Life Insurance?

- What Is The Short Term Policy Rate?

- Can I Change My Nominee In Term Insurance?

- The Evolution Of Term Life Insurance: Past, Present, And Future

- From Confusion To Clarity: How Harpreet Puri Guided A Client Through Complex Term Life Insurance Decisions

- Do Rich People Have Term Life Insurance?

- What Are The Common Term Life Insurance Clauses?

- What Are The Disadvantages Of Joint Term Insurance?

- What Is The Oldest Age At Which You Can Get Term Life Insurance?

- How Do You Choose The Right Claim Payout Option For Your Term Insurance?

- Is There a Medical Exam for Term Life Insurance?

- Limited Pay vs Regular Pay Term Insurance

- When To Cancel Term Life Insurance?

- Best Term Life Insurance Plans For Couples

- Joint Term Insurance VS. Two Separate Term Plans

- Which Is Better – Term Insurance Or Health Insurance?

- Importance Of Accidental Total And Permanent Disability Rider With Term Insurance

- Why Are Term Life Insurance Claims Rejected

- What Type Of Risk Is Covered By Short Term Insurance?

- What Happens If You Can’t Pay Your Term Life Insurance?

- What Will Disqualify You From Term Life Insurance?

- Can Riders Be Added To Term Life Insurance?

- Why Buy Term Life Insurance From An Insurance Broker?

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Insurance Policy?

Frequently Asked Questions About Claiming Term Insurance in Canada

Many families worry about how to make claims when it is due to Term Insurance. At Canadian LIC, we help our customers every day with their policies and claims. Here are the common questions on claims of Term Life Insurance Investments so that you won’t be bugged at a time when it matters.

Contact the insurance company to initiate a claim. You would need a policy number, details of the insured person, and a copy of the death certificate. Term Life Insurance Agents can make things easier if you are not sure what to do next.

Most of the essential documents include:

- A certified death certificate

- A claim form completed by the insurance company

- The policyholder’s details, including policy number

- Any other relevant documents, which may include a medical report if necessary

Paperwork is also something that can slow the process down. Canadian LIC in Canada helps many families compile documents for easy claims.

In general, most claims can be processed from 10 to 30 business days with complete documentation. However, longer processing might ensue when further verification checks are needed. Cases often stall as a result of missing documents and disputes by beneficiaries. Therefore, maintaining current policy documentation is bound to eliminate potential problems.

Yes, for multiple reasons, a claim may be denied.

- It had lapsed because of non-payment of premiums.

- The policyholder did not disclose a pre-existing condition.

- Beneficiary information was wrong or out of date.

Working with Term Life Insurance Agents before making a claim will ensure that all details are correct, thus lowering the chances of rejection.

Even if the insured dies outside Canada, the claim will still be honoured. However, insurance companies may ask for more requirements, such as a local death certificate and embassy verification. The payout is according to the terms of the policy.

With so many instances within which Canadian LIC has dealt with such claims, benefits to families will be received without delays.

The payout depends on the sum assured in the policy. In case there were investments in Term Life Insurance or extra riders, the total payout may also include these Term Life Insurance Benefits. Checking the details of the policy helps the beneficiaries know exactly how much they are to receive.

Yes, if there are several beneficiaries, the payment will be distributed in accordance with the wishes of the policyholder. If the policyholder makes no distribution plan, the insurance company has a legal rule to follow when separating the benefits. Updated details of the beneficiaries prevent making mistakes when their claims arise.

However, if the policyholder names minors as beneficiaries of the policy, then the payout awaits them until he or she has attained age. In addition, a custodian is appointed to administer this money. The majority of families require that term life agents help them construct a proper plan for their estate structures before they die.

Most accidental and natural deaths are included in Term Life Insurance in Ontario, Canada. If the covered person died from excluded conditions, such as suicide, within the first two years of the policy, the claim would be denied. Beneficiaries will know that checking policy terms can help them with what to expect.

If the policies cannot be found, then search the financial records, e-mails, and safety deposit boxes first. One could also contact the insurance company with the full name of the insured and the date of birth to obtain the policy details if needed. Term Life Insurance Agents can further help on that matter.

In Canada, for instance, any Term Life Insurance investment and payout can be tax-free to the beneficiary. The cash can be taken for any purpose- from paying off existing debts to covering living expenses and investing in one’s future.

If the insurance company is taking longer than expected, check if all of the required documents have been forwarded correctly and contact the insurer for updates. And, if needed, assistance from Term Life Insurance Agents can expedite the process.

Yes, you can appeal in case your claim is rejected. Read the reason for the denial carefully and resubmit all the missing documents. You can even seek professional help from Canadian LIC to increase your approval potential.

To keep your policy up to date:

- Ensure premiums are paid on time

- Update the beneficiary information if necessary.

- Review the policy terms of your insurance company regularly.

Many clients hire Term Life Insurance Agents to keep their policies up to date.

Benefits are actually received through professional insurance advisors, such as Canadian LIC, who walk their beneficiaries through the claims process, ensuring all paperwork is completed accurately, and families receive the benefits to which they are entitled.

A person claiming Term Life Insurance in Ontario, Canada, is required to pay attention to details. To avoid delays, always keep your policy information up-to-date and engage experts who are familiar with the process. Seeking help through contacting Term Life Insurance Agents makes the claiming experience hassle-free and free of stress.

Sources and Further Reading

- Government of Canada – Life Insurance Information

https://www.canada.ca/en/financial-consumer-agency.html

(Official government guidance on life insurance policies, coverage, and claims.) - Canadian Life and Health Insurance Association (CLHIA)

https://www.clhia.ca/

(Industry association offering insights on Term Life Insurance policies and claims in Canada.) - Insurance Bureau of Canada (IBC)

https://www.ibc.ca/

(Comprehensive insurance resources, including claim procedures for life insurance policies.) - Canadian Bar Association – Legal Aspects of Life Insurance Claims

https://www.cba.org/

(Legal guidelines related to insurance claims and beneficiary rights in Canada.) - Financial Consumer Agency of Canada (FCAC) – Understanding Term Life Insurance

https://www.canada.ca/en/financial-consumer-agency.html

(Consumer protection resources for insurance buyers and claimants.)

Key Takeaways

- Claiming Term Life Insurance in Ontario, Canada, is straightforward if all documents are prepared correctly.

- Essential documents include the death certificate, policy details, and claim forms.

- Most claims are processed within 10 to 30 business days, but missing paperwork can cause delays.

- Working with Term Life Insurance Agents ensures accuracy and speeds up the claim process.

- Keeping policy information updated helps beneficiaries avoid claim rejections.

- Payouts are usually tax-free in Canada and can be received as a lump sum or annuity.

- Beneficiaries can contest denied claims by providing additional documentation or appealing the decision.

- Canadian LIC assists families in making claims easier and stress-free.

Your Feedback Is Very Important To Us

Thank you for taking the time to complete this questionnaire. Your feedback helps us understand the challenges people face when claiming Term Life Insurance in Ontario, Canada and allows us to improve our support.