- How Can You Use Whole Life Insurance to Create Wealth?

- Talking About The Basics

- The Cash Value: Your Hidden Wealth Generator

- Using Whole Life Insurance as Collateral

- Dividends: An Extra Boost to Your Wealth

- Whole Life Insurance and Retirement Planning

- Estate Planning: Protecting and Passing on Wealth

- Whole Life Insurance vs. Other Investment Options

- Tools to Help You Get Started

- How Canadian LIC Helps Clients Build Wealth

- Conclusion: Take Action Today with Canadian LIC

Have you ever wondered how you can create your wealth safely and responsibly, particularly when conventional investment opportunities seem risky? If you’re like most Canadians, you’ve probably been thinking of everything from stocks to real estate, only to discover that it puts your head in a spin. This is where Whole Life Insurance comes into the picture as a financial tool often overlooked in the creation of real wealth and security in the long run.

At Canadian LIC, we meet interested parties who want to create wealth but are often confused about the way forward. Their hope and hesitation say, “Can Whole Life Insurance really help me build my wealth? And how does it fit into my financial plan?” These questions are more common than you might think, and the answers can unlock a whole new perspective on financial planning.

This blog will lead you on how life insurance can be much more than a safety net prepared for your dear ones. We will share with you how you can use it as a solid tool to create and sustain wealth, which our clients are doing. At the end of this blog, you’ll be in a position to determine why Whole Life Insurance might be the missing piece of your financial puzzle and how Canadian LIC can help you make it happen.

Talking About The Basics

But before proceeding to how Whole Life Insurance can build wealth, let’s look at what it is. Whole Life Insurance is a form of Permanent Life Insurance Policy, meaning that it will take care of your entire life so long as the premiums are paid. Unlike Term Life Insurance, which covers you for a stipulated period, Whole Life Insurance covers you for a lifetime up until death. The policy also allows for a savings element through an accumulated cash value, which grows with time.

Quite often at Canadian LIC, we meet clients for whom Whole Life Insurance is just another monthly bill. After they understand the potential of this cash value component, everything changes. This cash value grows tax-deferred, meaning you do not pay taxes on the growth until it’s withdrawn. “Overtime, this can grow into a lot of money that you can use in several ways.”

The Cash Value: Your Hidden Wealth Generator

Whole Life Insurance has an element of cash value, which is similar to a savings account directly connected with your policy. With every premium one pays, some part of the money entered into this account will grow at a guaranteed interest rate. Now, the real magic happens when you let it lie there for some years.

Let’s take the example of one of our clients, Jaydeep. Jaydeep started his Whole Life Insurance Policy at age 30. He had built up a very respectable cash value in his policy by age 50. But when an unexpected financial challenge came along—major home renovations that went over budget—he didn’t have to dip into his retirement savings or take out some high-interest loan. Instead, he was able to borrow against the cash value of his Whole Life Insurance Policy.

The best part was that this loan did not require any type of credit check or long approval process. Jaydeep could get to the funds easily and quickly because, actually, he was borrowing from himself via his policy. The interest rates were way lower than a traditional loan. What’s more, the death benefit of the policy remained fully intact, guaranteeing the protection of his family’s finances.

Using Whole Life Insurance as Collateral

Another way Whole Life Insurance can help you to create wealth is by using the policy as security for loans. This strategy is particularly useful for business owners or investors looking to leverage their assets. Many financial institutions have a ready ear for such transactions because Whole Life Insurance is low risk.

Take, for instance, another client of Canadian LIC: Shamma. Shamma owns a small business, and she needed capital to expand. Wanting to avoid the hassle of securing a business loan at exorbitant interest rates, she used her Whole Life Insurance Policy as collateral. This lets her get the funding she needs right away at a fraction of the cost. Her business flourished, and she was able to pay off the loan and still have her policy in force.

This is something we have seen work time and time again with our clients. It really can help unlock the potential of a Whole Life Insurance Policy without disrupting your overall financial plan.

Dividends: An Extra Boost to Your Wealth

By buying a Participating Whole Life Insurance Policy, you will also gain dividends from the insurance company. Dividends are a portion of the company’s profits, which are usually paid yearly. Although dividends are not guaranteed, most Canadian insurance companies have paid out their dividends consistently over the years.

Here are some of the ways dividends can help boost your wealth:

- Reinvest in the Policy: You can use the dividends to purchase additional coverage that will increase the death benefit and cash value of the policy.

- Lower Premiums: You can reduce your out-of-pocket premium payments with dividends, freeing up more of your income for other investments or expenses.

- Take as Cash: You can also take the dividends in cash for use for whatever purposes you may want, be it funding a vacation or paying down debt or investing elsewhere.

At Canadian LIC, we’ve worked with many clients who used the dividends to significantly add to their financial situation. For example, Emily actively used her dividends to pay her policy’s premiums in full by the age of 55—effectively giving her the coverage for free while her cash value continued to grow.

Whole Life Insurance and Retirement Planning

It can also play a critical role in your retirement planning. With the increase in life expectancy, most people in Canada are concerned about outliving their retirement savings. Whole-life insurance provides a solution by delivering a steady and foreseeable source of retirement income.

Here’s how it works: Once you have built up enough cash value in the policy, you can either withdraw cash from it or borrow against it to supplement retirement income. Since the cash value grows tax-deferred, you can plan withdrawals strategically to minimize your tax liability.

Let’s consider Richard and Susan, who spent a good many years at Canadian LIC. As retirement loomed closer, they suddenly realized how inadequate the RRSPs and CPP might be to sustain the level of living they wanted. They utilized the cash value from Whole Life Insurance to generate an income stream that was tax-efficient, thus bridging the deficit to have a comfortable retirement they so desired—without being haunted by running out of money.

Estate Planning: Protecting and Passing on Wealth

Whole life can also be a great estate planning tool. When you die, the death benefit from your policy is typically tax-free to your beneficiaries. It can be a nice financial boost to your loved ones at the worst possible time.

This means that estate planning is not only concerned with the welfare of the family but also ensures tax protection for your assets. Any capital gains at death could be subject to taxation in Canada. Whole Life Insurance can help defray these taxes, ensuring that more of your hard-earned wealth passes on to your heirs.

For example, one of the clients availing of this estate planning strategy was the Thompson family. They had large holdings of real estate that, at their death, would have incurred huge taxes. When you purchase life insurance with a death benefit equal to the expected tax liability, they ensure that their children can inherit the family properties without the burden of a large tax bill.

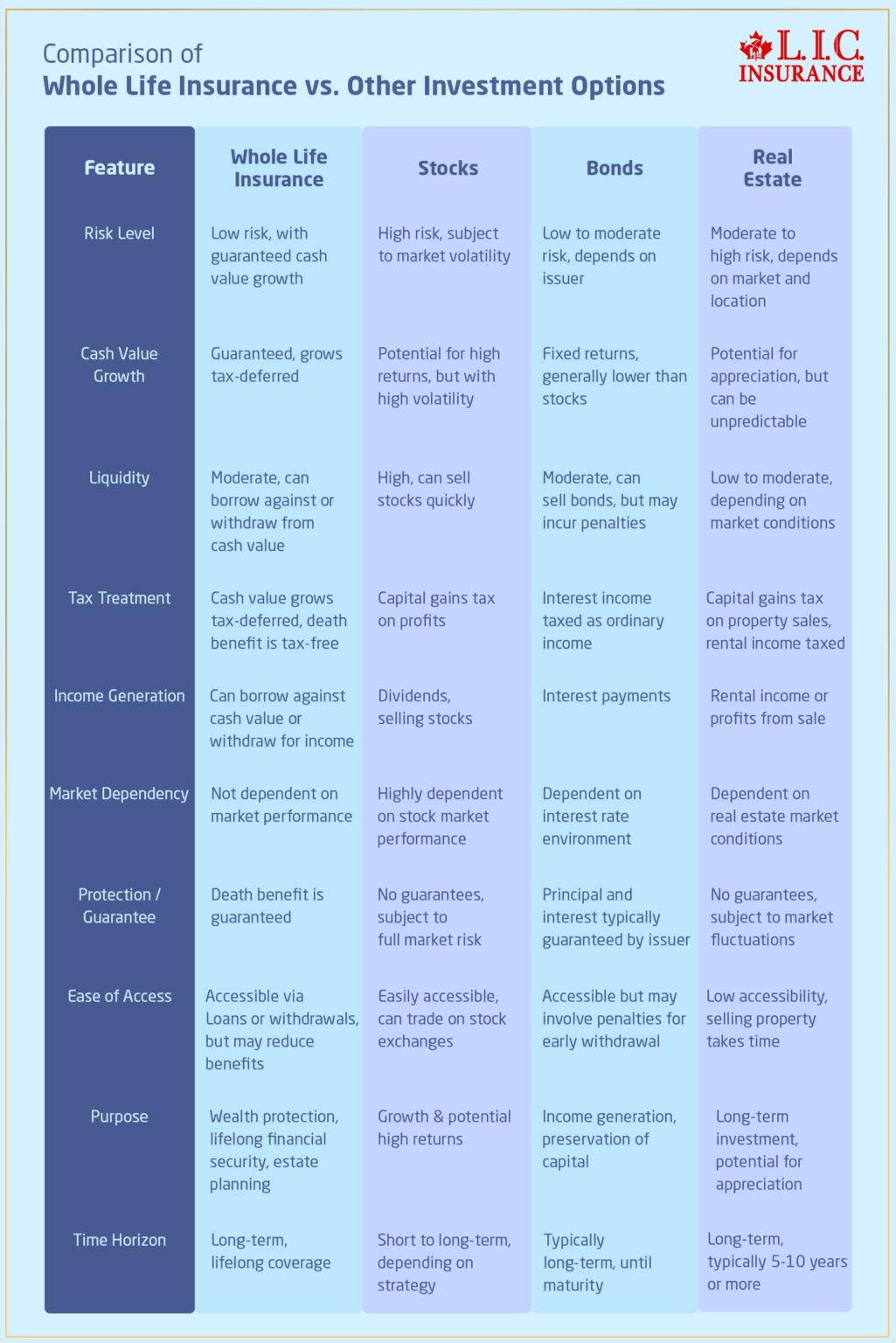

Whole Life Insurance vs. Other Investment Options

One can only wonder how Whole Life Insurance stands against other investment instruments: Stocks, Bonds, or Real Estate. The truth of the matter is that each investment has its upside and downside. It depends on your financial goal, risk appetite, and time horizon.

What really sets Whole Life Insurance apart, however, is that it bundles all these advantages into one product:

- Guaranteed Growth: The cash value of a Whole Life Insurance Policy grows at a guaranteed rate, providing stability and predictability.

- Tax Advantages: The cash value grows tax-deferred, and the guaranteed death benefit is paid out tax-free to your beneficiaries.

- Flexibility: You can access the cash value through withdrawals or loans, giving you flexibility to address financial needs as they arise.

- Risk Management: Unlike stocks or real estate, which can be volatile, Whole Life Insurance offers a low-risk option for wealth accumulation.

A diversified approach toward the building of wealth is often recommended at Canadian LIC. You will want some of your money in growth-oriented investments, but your whole life can be the foundation that provides stability and security in uncertain times.

Tools to Help You Get Started

Even though it’s quite a task at the very beginning to get started with the journey of wealth creation using Whole Life Insurance, with the right tools, you can make informed decisions that align with your financial goals. At Canadian LIC, we have seen how the use of these tools can put our clients in the driving seat concerning their financial future. Now, let’s get to the good bit: some essential resources to help you get started, along with real-life stories from our clients who have gone through this process successfully.

Customizing Your Policy: Tailoring Whole Life Insurance to Your Financial Goals

After attaining quotes and choosing a policy, the next step in the process is customization. Most Whole Life Insurance Policies sold in Canada have a range of options for customizing coverage according to the needs of the insured. This may include riders, premium payment schedules, and/or options related to dividend distribution.

You can tailor the policy according to your specific needs and objectives, whether it is maximum growth in cash value, maximum death benefit, or flexible premium payments.

Miya, another Canadian LIC client was looking into Whole Life Insurance, and she wanted a policy that would allow her to increase her coverage as her income grew. This flexibility to personalize her policy initiated with lower premiums at the onset, and with improvements being considered later on, this gradually increased her coverage without stretching her budget.

Miya opted to have a rider that would allow her to claim part of her death benefit early if a critical illness were to befall her. The added cushion of protection eased her heart, giving her the peace that no matter what life threw at her, she was prepared.

Reviewing and Adjusting Your Policy: Staying on Track with Your Wealth-Building Goals

In a whole-of-life insurance policy, the commitment is for the long term; therefore, your policy should be reviewed and updated according to changing life circumstances. From getting promoted at work to having a baby or changing your mind about how you want to use your money, reviewing a policy regularly will let you know it is still suitable for you.

We at Canadian LIC do urge our clients to review their policies yearly with us. During the review, we will look at the growth of the policy’s cash value, discuss any changes in financial goals, and make adjustments accordingly.

Peter is a long-time client of Canadian LIC. In the early years, he originally purchased his Whole Life Insurance to provide for his young family. Over the years, Peter’s children grew up and his financial goals shifted towards retirement planning. We adjusted his policy to focus more on cash value growth during the review, which he could utilize during retirement rather than just for a death benefit.

This gave Peter the flexibility to make his Whole Life Insurance Policy a key part of his retirement strategy, an example of how it is that through periodic reviews and adjustments in your policy, you can be kept on track in trying to meet your long-term goals.

A diversified approach toward the building of wealth is often recommended at Canadian LIC. You will want some of your money in growth-oriented investments, but your whole life can be the foundation that provides stability and security in uncertain times.

How Canadian LIC Helps Clients Build Wealth

Canadian LIC is proud of the hundreds of clients whom the company has had the privilege of assisting in using Whole Life Insurance to build wealth for themselves and secure a strong financial future. Here are a few stories that illuminate the power of this financial tool:

Story 1: Protecting Future Generations

The Johnson family came to us with one specific goal in mind: to provide the financial resources for their grandchildren’s attendance at university. By setting up Whole Life Insurance Policies for each grandchild allowed the Johnsons to leave a legacy of education. Over time, the cash value of these policies will grow, and when they’re ready for post-secondary education, each grandchild will have a nice sum.

Story 2: Supporting a Family Business

The Tran family operates a successful business in Toronto. They wanted to be certain that their business would go on indefinitely, beyond their generation. We helped them structure a Whole Life Insurance Policy that would serve as key person insurance for the business. Should the business owner die untimely, the death benefit would allow the company to stay in business by providing the funds necessary to do so.

Story 3: Securing Retirement with Peace of Mind

David and Margaret were concerned about outliving their retirement funds. They had laboured all their lives and wanted to enjoy their retirement years free of financial stress. We helped them structure a Whole Life Insurance Policy that focused on building cash value. Now, as they enter retirement, they have a sure source of income from their policy, giving them peace of mind about maintaining their lifestyle without worrying about it.

Conclusion: Take Action Today with Canadian LIC

It is way more than just protection—Whole Life Insurance is an extremely powerful way to build and preserve wealth. Guaranteeing a secure retirement, having peace of mind with regard to your family’s financial future, or creating a legacy—all of these and so much more are possible with Whole Life Insurance.

At Canadian LIC, we are dedicated to demystifying Whole Life Insurance. We have a professional, experienced team that knows the different nature of challenges facing Canadians in financial planning and is ready to walk with you through every step.

Don’t wait- Start building your wealth now. Contact Canadian LIC today to discuss how Whole Life Insurance can be the core of your financial strategy. With the right policy in place, you will be able to rest easy, knowing that your wealth is growing and that your future is secure. Allow us to create a wealthy future for you and your loved ones.

More on Whole Life Insurance

- Taking a Loan from My Whole Life Insurance Policy

- Can the Cash Value of My Canadian Whole Life Coverage Reduce?

- Know About Paid-Up Additions in Whole Life Insurance

- Under What Circumstances Under Which the Death Benefit of Whole Life Insurance Would Not Be Paid?

- Impact of Smoking on Whole Life Insurance Premiums

- Adjusting Your Whole Life Insurance Policy

- The Way the Cash Value of a Whole Life Policy is Taxed

- Find the Best Whole Life Insurance Without a Medical Exam

- The Age At Which Whole Life Insurance End

- The 2 Disadvantages of Whole Life Insurance

- Whole Life Or Term Life Insurance- Which One is Better

- Number Of Years You Pay on a Whole Life Policy

- The Best Age For Whole Life Insurance

- Buying Whole Life Insurance for My Child

- Opting for Whole Life Insurance

- Is Whole Life Insurance Costly in Canada?

- The Differences Between Money Back Policy and a Whole Life Policy

- Converting Universal Life to Whole Life

- How Does a Whole Life Insurance Policy Work

- The Biggest Risk for Whole Life Insurance

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs About Using Whole Life Insurance to Create Wealth

A Whole Life Insurance Calculator is very effective at showing how much coverage you’ll need, how much your premiums might be, and how your policy’s cash value could grow over time. This calculator will give you a much clearer vision of how Whole Life Insurance fits into your plan for building wealth.

For example, very often, a lot of clients come through the doors at Canadian LIC who do not know how to start off by determining how much coverage they really need to buy. Such a client was Jake, who made use of a Whole Life Insurance Calculator to come up with the proper amount of coverage for his family while making sure his policy could also work as a tool in building wealth. This calculator provided Jake with a way to make an informed decision about his policy and growth in the years to come, which proved just how it could help his long-term financial goals.

It provides a basis for comparing the different policies of various providers. This is very important because, in Canada, Whole Life Insurance Policies are not alike. Some provide better cash value growth, some give lower premiums, and others provide additional benefits like dividend payments.

One of our clients, Linda, wanted to make sure she had the best deal over her Whole Life Insurance Policy. Comparing quotes online helped her to have a number of options, thus to find a policy which would suit her wallet and have very good cash value growth. It was easy for Linda to select a policy that worked toward her financial goals and thus be at peace, confident with her choice.ss

In determining whether Whole Life Insurance is the right policy for you, consider your long-term financial goals, the need for lifetime coverage, and whether you want to build cash value over time. A Whole Life Insurance Calculator helps you understand where a policy fits in with your financial plan, while Whole Life Insurance quotes available online further outline cost versus benefit.

When Subha, a client of Canadian LIC, was exploring her options, she used a Whole Life Insurance Calculator to see how much coverage she needed. She then obtained quotes online to compare different policies. All this helped Subha be sure of the choice that would meet her needs and be within her budget. She felt more secure in the knowledge that the policy would not only safeguard her family’s future but also serve as an excellent financial tool for her in years to come.

In Canada, you can modify the entire life insurance policies in line with your specific needs. Whether you want to change the premium payment, add riders, or choose options for handling dividends, the ability to customize your policy will ensure that your plan is designed to meet specific financial goals.

Manish was one of our clients who needed a flexible policy because his financial situation was changing. Through work with Canadian LIC, Manish was able to really customize a Whole Life Insurance Policy: one that started lower but with premiums and coverage that would rise as his income did. That flexibility allowed Manish to stay with his policy without pressure on his budget and still continue the valuable strategy of building his wealth.

It’s important to review your Whole Life Insurance Policy regularly, especially when your life circumstances change, such as getting a promotion, having children, or adjusting your financial goals. This will ensure that your policy is up to date and continues to meet your needs in supporting your objectives of building wealth.

At Canadian LIC, for the benefit of our clients, we highly advocate booking an annual review of the policy. For example, our client Peter had initially taken the policy in order to protect his young family. As his children grew up and his financial goals changed to fit his retirement planning, we were able to tweak them. During a review, we adjusted Peter’s policy to focus more on cash value growth, helping him create a reliable income stream for retirement. Such a review will at all times help Peter’s policy fall in line with his changing financial needs.

A consultant will help one to get personal advice and consultation, which online tools just cannot achieve. An advisor is able to explain the individual nuances of the different policies, help to clarify financial goals, and ensure that you are well-placed to make the best decisions in the future ahead.

It was an advisor with Canadian LIC to whom Susan turned when she became a little overwhelmed with the options in Whole Life Insurance available online. It was with the advisor’s expert advice that Susan picked a policy which not only provided her with the required coverage but also supported the long-term goal of wealth accumulation. This advice holds the key to Susan’s confidence in making financial planning decisions.

Your Path to Wealth Building with Whole Life Insurance

Whole life can be a very powerful tool to create and preserve wealth, but using the right tools and resources is very important along your journey to decision-making. Looking to get an estimate for your coverage needs using a Whole Life Insurance Calculator, getting Whole Life Insurance Quotes Online to compare policies, or customizing a policy by consulting with an expert? These steps will set you on the right path.

At Canadian LIC, we are here to guide and help you every step of the way. From the simplest inquiry regarding a Whole Life Insurance Policy in Canada to buying a policy, our staff is dedicated to attending to you till you get to your goals in wealth building. Contact us today for more information regarding how Whole Life Insurance can play a very important role in your financial strategy.

Sources and Further Reading

- Canadian Life and Health Insurance Association (CLHIA)

The CLHIA provides comprehensive information on various life insurance products, including Whole Life Insurance. It’s a great resource to understand how these policies work in Canada.

Visit CLHIA Website - Assuris: Protecting Policyholders in Canada

Assuris offers details on how life insurance policies are protected in the event of an insurer’s insolvency. It’s crucial to know your policy is secure.

Learn More at Assuris - Government of Canada: Life Insurance Basics

The Government of Canada offers guidance on choosing the right life insurance policy, including Whole Life Insurance, helping you understand the benefits and limitations.

Read More on Canada.ca - The Globe and Mail: Whole Life Insurance Explained

This article provides an in-depth look at Whole Life Insurance, including its benefits, drawbacks, and how it compares to other types of life insurance in Canada.

Read the Article on The Globe and Mail

These sources will help you delve deeper into understanding how Whole Life Insurance can be used to create wealth and provide more context on the Canadian insurance landscape.

Key Takeaways

- Whole Life Insurance provides lifelong coverage and a cash value component for wealth creation.

- Cash value grows tax-deferred, offering a stable financial asset for various uses.

- Policies can be customized to fit your financial goals, including premium adjustments and riders.

- Use a calculator to estimate coverage and get online quotes to compare policies.

- Professional advice ensures your policy aligns with your wealth-building strategy.

Your Feedback Is Very Important To Us

Thank you for taking the time to share your experiences. Your feedback will help us understand the common challenges Canadians face when using Whole Life Insurance to create wealth.

Thank you for your feedback. Your insights are invaluable in helping us support Canadians like you in achieving their wealth-building goals with Whole Life Insurance.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]