- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Reviews

Common Inquiries

- How Can One Appeal a Denied Claim Under Super Visa Insurance?

- Can a Visitor Visa Be Converted to a Super Visa?

- Can I Include My Spouse in the Same Super Visa Insurance Policy?

- How Do I File a Complaint About My Super Visa Insurance Provider?

- How to Find the Most Affordable Super Visa Insurance Plan?

- Is a Medical Test Required for Super Visa Canada?

- Can I Pay Monthly for Super Visa Insurance?

How Can You Use Deductibles to Reduce the Premium of Super Visa Insurance?

SUMMARY

This blog talks about how a family can cut the Super Visa Insurance premiums cost by changing their deductibles. It brings out what the term “deductible” entails, how this affects your premiums, and when to increase your deductible to cut the costs. The main emphasis here is striking a balance between affordability and out-of-pocket expenses through consideration of financial situation, health conditions, and length of stay. With practical examples, it helps families make the right decisions to save money while ensuring proper coverage for visiting parents.

Finding a balance between getting the right coverage and keeping it affordable is one of the major challenges most families face when researching Super Visa Insurance for their parents. The notion of a deductible can help reduce the premiums for many, but taking advantage of deductibles is not quite straightforward. At Canadian LIC, we see clients every day who are confused about how to use deductibles to get the best deal on their Super Visa Insurance Policies. These conversations often start with families looking for help on ways to reduce their Super Visa Insurance Quote, and we guide them through the process of choosing an appropriate deductible.

Let’s dive into how deductibles work, the impact they have on your premiums, and how you can make the most of them.

- 11 min read

- September 13th, 2024

By Harpreet Puri

CEO & Founder

- 11 min read

- September 20th, 2024

Introduction

This blog talks about how a family can cut the Super Visa Insurance premiums cost by changing their deductibles. It brings out what the term “deductible” entails, how this affects your premiums, and when to increase your deductible to cut the costs. The main emphasis here is striking a balance between affordability and out-of-pocket expenses through consideration of financial situation, health conditions, and length of stay. With practical examples, it helps families make the right decisions to save money while ensuring proper coverage for visiting parents.

The Struggle with Super Visa Insurance Premiums

For most families, purchasing parent Super Visa Insurance is a must-have plan to protect their loved ones during their stay in Canada, but from time to time, each family does face at least some issue related to managing the cost of premiums. There is always a desire to provide the best possible coverage, though affordability does often come into question. One of the most powerful ways to lower the cost of Super Visa Insurance is to adjust the deductible. But how does that work, and what are the things you should be considering when choosing a deductible?

We have worked with many individuals who, prior to discussing deductibles, did not think that a higher deductible would be helpful for them. Then, they would discuss their financial situation and comfort with risk, and altering the deductible was one of those remarkably easy yet effective ways of slicing your premiums down. This can also be one way you take advantage of deductibles.

What is a Deductible?

By the term deductible, it is meant that under a policy, the sum of money that has to be directly paid by you as a policyholder becomes active when the insurance kicks in. If your policy has a $1,000 deductible, you pay the first $1,000 of the medical bills, and the insurance company only covers over and above that amount. Many of our clients here at Canadian LIC view deductibles as an added expense without realizing this may be a key to unlocking a lower premium.

You can choose to have a higher deductible, whereby you take more responsibility for the emergency, but the good side about this is that your monthly or yearly insurance payments will be lower.

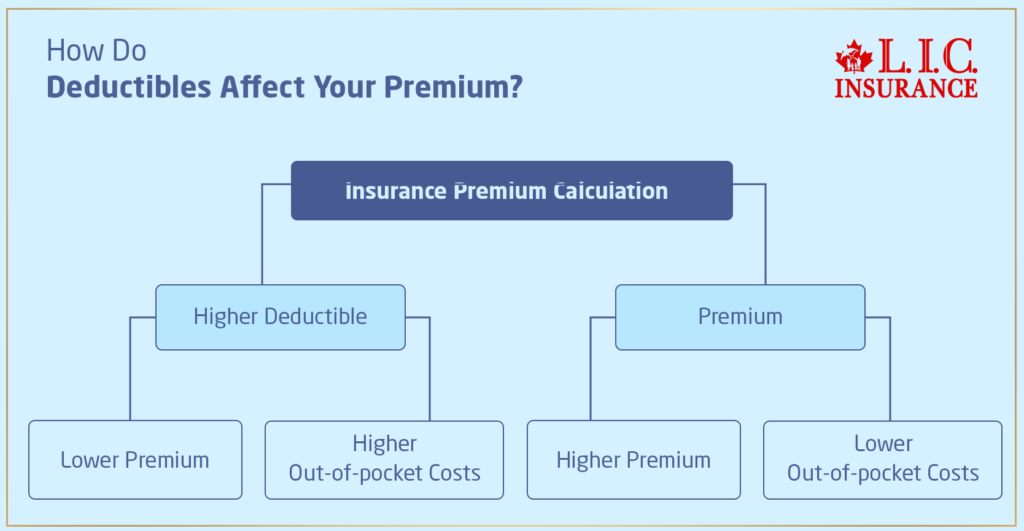

How Do Deductibles Affect Your Premium?

The main reason that deductibles impact your premium is risk. An insurance company bases premiums on how much risk they are taking. The more risk you take choosing a higher deductible, the less risk there is for the insurance company. This reduced risk for the insurance provider translates into lower premiums for you.

This is something we have to explain to clients often by giving them examples. Recently, a client, a mother trying to get insurance for her elderly parents, found herself in a state of shock upon seeing the premium rates. After discussing options regarding deductibles, she chose one with a higher deductible and found that her monthly payments came down considerably. While that meant she would have to pay more out-of-pocket in case of a medical emergency with her parents, the reduced premium allowed her to afford coverage comfortably.

Why Consider a Higher Deductible?

Although a higher deductible may not be to everyone’s taste, it is quite smart under certain circumstances to choose one. Here are some reasons why some of our clients at Canadian LIC opted for higher deductibles:

- Lower Premiums: A higher deductible will automatically lower your Super Visa Insurance Quote. This is a great option for families who want to save money on their monthly payments.

- Emergency-Only Coverage: If you are confident that your parents are healthy and unlikely to need routine medical care, a higher deductible makes sense. You’ll still be covered in the event of a major emergency, but you won’t be paying high premiums for day-to-day healthcare.

- Shorter Visits: If your parents are only visiting Canada for a short period, the likelihood of needing extensive medical care is lower. Many families with parents coming for a few weeks or months opt for a higher deductible to save on premium costs during shorter stays.

One of the families we worked with came in for a stay of only two months, so both parents visiting wanted to go with a high deductible since, within that period, the likelihood of medical issues was very low. This helped them save money, yet they were covered in case something happened.

Balancing Risk with Savings

However, while a higher deductible equates to lower premiums, you want to consider whether you can be comfortable with the potential out-of-pocket expenses. We always encourage clients to first look at their financial situation before making this type of decision.

For instance, one of our clients had to make a choice between going for a low premium with a high deductible or a higher premium with a low deductible. However, upon careful review of her savings and financial goals, she felt that in the unlikely event of some major health issue arising, she could meet the higher deductible amount without much strain. This gave her the confidence to go in for the higher deductible and enjoy lower monthly payments.

In our experience at Canadian LIC, the families that weigh their financial situation alongside the health and age of their parents tend to make the best decision.

Steps to Use Deductibles Effectively

- Assess Your Budget: Start by understanding how much you can comfortably pay out-of-pocket in case of an emergency. This will help you determine a deductible that won’t cause financial strain.

- Consider the Length of Stay: Shorter visits may justify a higher deductible since the likelihood of using the insurance is lower. Families with parents visiting for a short period often choose a higher deductible and save significantly on premiums.

- Factor in Health Conditions: If your parents are generally healthy, a higher deductible might make sense. However, if they have existing health issues or are older, you might want to reconsider taking on too much risk.

- Request Multiple Quotes: At Canadian LIC, we always advise clients to request quotes with different deductible options. Comparing quotes can give you a clearer idea of how much you can save by choosing a higher deductible.

- Talk to an Expert: Sometimes, the best way to figure out the right deductible is by talking it through with an insurance expert. We’ve helped many families figure out the right balance between deductible and premium by discussing their unique needs and concerns.

Struggles: Balancing Deductibles and Premiums

Over the years, we have spoken to numerous families about this balancing act of premiums versus deductibles. One case that surely comes to mind is the father, who was very apprehensive about taking a high deductible in relation to his parent’s Super Visa Insurance. Of course, his parents were healthy, yet he did not want to take the financial risk in case something went wrong. After a thorough discussion, he chose a middle-tier deductible that reduced his premium while still keeping his potential out-of-pocket costs manageable.

These kinds of decisions are never easy, but when families work with us, they gain confidence in their choices. Here at Canadian LIC, the idea is to guide the family through a process that will help them save money without losing peace of mind.

Conclusion: Making the Right Decision with Canadian LIC

The most effective way to choose the right deductible for the parent Super Visa Insurance is not to consider merely saving money. A person needs to understand his or her financial situation, estimate the health conditions of the parents, and strike a balance.

At Canadian LIC, we work day in and day out with a lot of families who have just the same struggles as you do. By adjusting their deductibles, a lot of our clients were able to bring premiums down but still keep appropriate protection for their parents. Our team is here to help guide you in making the best decision based on your unique circumstances.

By selecting an appropriate deductible that works for you and your budget, you can lower the quote for Super Visa Insurance and, at the same time, have the assurance that your parents are well taken care of during their stay in Canada. Let us help you find the right balance so that you can focus on spending quality time with your loved ones.

More on Super Visa and Super Visa Insurance

- What is a Deductible in Super Visa Insurance?

- Can I Choose My Own Doctor or Hospital with Super Visa Insurance?

- Are Psychological or Psychiatric Services Covered Under Super Visa Insurance?

- How Can One Appeal a Denied Claim Under Super Visa Insurance?

- Can a Visitor Visa Be Converted to a Super Visa?

- Can I Change the Effective Dates of My Super Visa Insurance After Purchase?

- Can I Include My Spouse in the Same Super Visa Insurance Policy?

- Can I Get Super Visa Insurance If I Am Over 85 Years Old?

- How Do I File a Complaint About My Super Visa Insurance Provider?

- What Are the Consequences of Not Having Valid Super Visa Insurance?

- What Happens If the Super Visa Insurance Expires While the Visitor Is Still in Canada?

- Is There A Waiting Period For Super Visa Insurance?

- Is Super Visa Insurance Refundable?

- How to Find the Most Affordable Super Visa Insurance Plan?

- Where Can You Buy Super Visa Insurance in Canada?

- Is a Medical Test Required for Super Visa Canada?

- What Is the Processing Time for a Super Visa in Canada?

- Can Parents Work on Super Visa in Canada?

- Can We Cancel Super Visa Insurance?

- Can I Pay Monthly for Super Visa Insurance?

- When Should Super Visa Insurance Start in Canada

- 2023 Super Visa Program and Insurance Requirements Guide: Essential Updates and Insights

- Visitor Visa vs. Super Visa: Understanding the Differences

Frequently Asked Questions: Using Deductibles to Reduce Super Visa Insurance Premiums

A deductible is the amount you must pay out-of-pocket before your insurance starts covering expenses. The higher the deductible, the lower your premium.

By choosing a higher deductible, you take on more risk. This lowers the insurance company’s risk, and they reward you with a lower premium.

People choose a higher deductible to reduce their monthly or yearly premiums. Families often do this when their parents are in good health or staying for a shorter time.

No, the coverage remains the same. The deductible only affects how much you pay before the insurance kicks in. The rest of the coverage stays unchanged.

You should think about your financial situation and how much you can afford to pay in an emergency. We always remind our clients to choose a deductible they can comfortably manage.

Usually, you cannot change the deductible during the policy term. However, you can adjust it when you renew your policy.

Many families prefer higher deductibles to save on premiums, especially if their parents are visiting for short stays or are in good health.

If an emergency happens and you can’t pay the deductible, your insurance may not cover the costs. That’s why it’s important to choose a deductible amount you’re confident you can handle.

We help families every day at Canadian LIC by showing them different deductible options. We recommend choosing a balance that keeps your premiums low but doesn’t leave you financially strained if a claim arises.

Yes, the deductible applies to each new claim. If you file multiple claims, the deductible will apply to each one. We always explain this to our clients so they aren’t surprised by the additional costs.

These FAQs are based on the questions we often hear from clients at Canadian LIC, helping them make smarter decisions about their Super Visa Insurance Policies.

Sources and Further Reading

- Government of Canada – Super Visa for Parents and Grandparents The official website provides information about the Super Visa requirements, including the need for medical insurance. This is a crucial resource to understand the baseline requirements. Link to official resource

- Canadian Life and Health Insurance Association (CLHIA) The CLHIA website offers extensive information on different types of insurance, including health and life insurance, which can help in understanding how deductibles work in insurance policies. Link to CLHIA

- Insurance Bureau of Canada (IBC) – Understanding Deductibles IBC provides general resources on how deductibles work and how they affect premiums, applicable across different types of insurance. This can help families assess risk versus cost. Link to IBC

- “How to Save on Super Visa Insurance Premiums” – Insure in Canada This article discusses practical tips on saving money on Super Visa Insurance, with a strong focus on how adjusting deductibles can be a useful strategy. Link to Insure in Canada

- “Super Visa Insurance: Guide to Deductibles” – InsuranceHotline.com A well-rounded guide that breaks down how deductibles work specifically for Super Visa Insurance and their impact on reducing premiums. Link to Insurance Hotline

- “Super Visa Insurance: Choosing the Right Deductible” – Canadian Underwriter This article offers insights into the considerations for choosing a deductible when purchasing Super Visa Insurance, based on risk tolerance and financial standing. Link to Canadian Underwriter

- “How to Balance Risk and Premium with Deductibles” – MoneySense MoneySense provides financial advice on various topics, including insurance. Their articles can help you understand the pros and cons of opting for higher deductibles to save on premiums. Link to MoneySense

These sources provide valuable information for international students looking to better understand Travel Insurance and the benefits of having proper medical coverage while studying in Canada.

Key Takeaways

Understanding Deductibles: A deductible is the amount a policyholder pays out-of-pocket before insurance coverage begins. Opting for a higher deductible can significantly lower your Super Visa Insurance premiums.

Impact on Premiums: Choosing a higher deductible reduces the risk for the insurance company, resulting in lower premium costs for the policyholder. This is a useful strategy for families seeking affordable coverage.

When to Consider Higher Deductibles:

- Healthy Parents: If your parents are in good health and don’t require frequent medical care, a higher deductible might be a good option to save on premiums.

- Shorter Stays: For short-term visits, where medical needs are less likely, a higher deductible can help reduce insurance costs.

- Emergency-Only Coverage: Families who only need coverage for emergencies may prefer a higher deductible, as routine care isn’t a concern.

Balancing Risk with Savings: While a higher deductible saves on premiums, families must assess their financial ability to handle out-of-pocket costs in case of a medical emergency.

Making the Right Decision: It’s important to evaluate factors like your financial situation, your parents’ health, and the length of their stay before selecting a deductible. Consulting with insurance experts like Canadian LIC can help in finding the right balance between deductible and premium.

Steps to Use Deductibles Effectively:

- Assess your budget.

- Consider your parents’ health and the length of their stay.

- Request quotes with different deductible options to compare savings.

- Talk to an insurance expert to find the best fit for your situation.

No Change During Policy Term: Deductibles typically cannot be changed during the policy term but can be adjusted when renewing the policy.

Common Choices: Many families choose higher deductibles to reduce premiums, especially if their parents are healthy or visiting for a short period.

By Pushpinder Puri

CEO & Founder

Your Feedback Is Very Important To Us

We value your feedback and would like to understand the challenges you face regarding using deductibles to reduce the premium of Super Visa Insurance in Canada. Please take a few moments to answer the following questions. Your input will help us improve our services and provide better support for families like yours.

Thank you for your time! Your feedback will help us improve our services and better meet the needs of Canadians and international students alike.

IN THIS ARTICLE

- How Can You Use Deductibles to Reduce the Premium of Super Visa Insurance?

- The Struggle with Super Visa Insurance Premiums

- What is a Deductible?

- How Do Deductibles Affect Your Premium?

- Why Consider a Higher Deductible?

- Balancing Risk with Savings

- Steps to Use Deductibles Effectively

- Struggles: Balancing Deductibles and Premiums

- Conclusion: Making the Right Decision with Canadian LIC