Think about this: On a Saturday afternoon, you’re sitting on the couch in your living room and thinking of one great way to protect the future of your family with a Whole Life Insurance policy. But you’re afraid of needles and the in-depth questions that come with medical exams. It’s not just you. Many Canadians go through similar experiences as this and many others, yet they search for a simple and stress-free method of obtaining Life Insurance. Now you have to find Whole Life Insurance that doesn’t come with a medical exam. Let’s talk about Whole Life Insurance in Canada today, with a bit more focus on those that do not require a medical exam. Let’s talk about how to get around the world of insurance easily. We’ll also give you some great tips on how to find the best insurance brokers and maybe even share some stories that make you think about your own problems with insurance. By the end of this blog, though, you’ll know enough to make an educated choice and get a policy that meets your needs and gives you and your family peace of mind.

Understanding Whole Life Insurance Without a Medical Exam

The Basics of Whole Life Insurance

Whole Life Insurance is a type of permanent Life Insurance where, after the entire lifetime, all premiums are completely paid for, and a payout is created. It consists of a death benefit and cash value, which can be a source of funds payable on the upcoming date. What is often asked is, “Can I get Whole Life Insurance without a medical exam?”

Why Choose No Medical Exam Insurance?

Let’s consider a story that might sound familiar. Shreya, a 45-year-old mother of two, recently decided to look into Life Insurance. However, her busy schedule and a slight fear of doctors made the thought of undergoing a medical exam daunting. This scenario is where no medical exam insurance policies come into play, offering convenience and comfort.

These policies are particularly beneficial for those who have health concerns that might make traditional insurance either too costly or difficult to obtain. They also cater to individuals who prefer a quick and straightforward insurance buying process.

Finding the Right Provider

Identify Your Needs

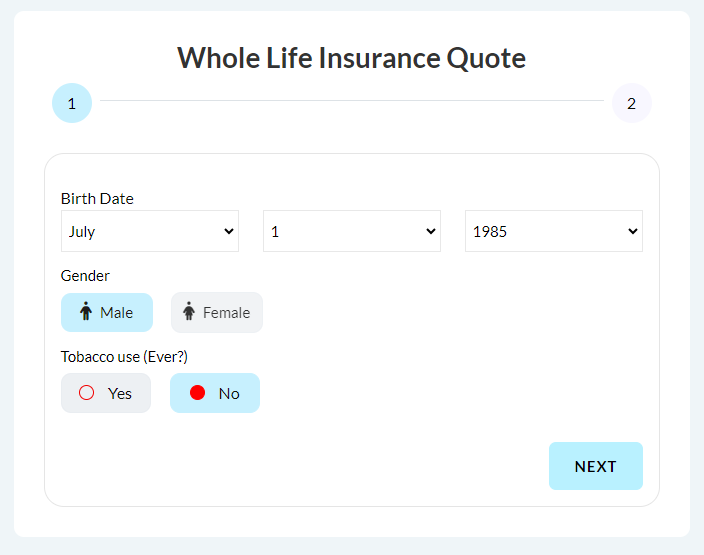

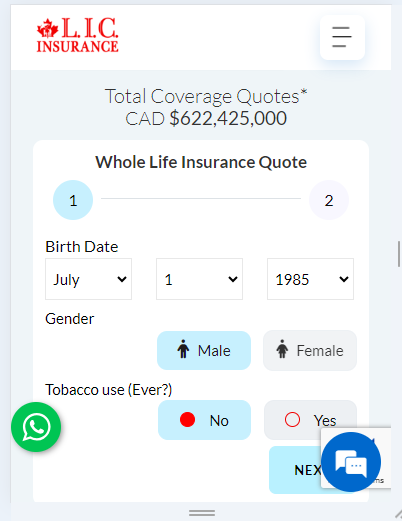

Before you start looking for quotes, it’s crucial to assess what you need from your insurance policy. Are you looking for coverage that supports your family in the long term? Do you have debts that will need to be covered? Understanding your requirements will help you and your broker find the perfect policy. Meet Emily, a freelance graphic designer and a single parent. She wants to ensure her daughter has financial support through college. Emily’s main need is a policy that includes educational fund provisions without a medical exam requirement.Research Potential Brokers

Not all brokers are created equal, especially when it comes to Whole Life Insurance without a medical exam. Look for Whole Life Insurance Brokers who specialize in or are highly knowledgeable about no-medical exam policies. Tom, after being overwhelmed by too many options online, decided to seek a broker. He chose one with excellent reviews for handling no-medical exam insurance cases, which made navigating his choices much simpler and more efficient.Schedule a Consultation

Once you have a list of potential brokers, schedule a consultation. This step is about building a relationship where you can openly discuss your situation and needs. A good broker will ask questions to understand your financial goals and health background better. Linda had several medical conditions and was worried about her insurance prospects. During her consultation, she was honest about her health and what she hoped to achieve with her insurance. Her broker used this information to pinpoint the right insurers who offer competitive Whole Life Insurance Quotes for such cases.Compare Quotes

With the help of your broker, you’ll receive various quotes from insurers. Compare these not just on price but also on what benefits they offer. Do they include an accelerated death benefit? Is there a cash value growth guarantee? Raj compared three different quotes he received from his broker. One was slightly more expensive but offered a better cash value accumulation and a waiver of premium in case of disability, which was important to him as a construction worker.Ask About the Fine Print

Insurance policies can be full of complicated terms and conditions. Have your broker explain the fine print, including any exclusions, limitations, and the process for filing a claim. When Naomi was reviewing her policy options, her broker explained the implications of each term, including what ‘limited pay’ meant, which greatly influenced her decision as she planned to retire early.Make an Informed Decision

Now that you have all the information and expert advice, it’s time to make a decision. Remember, the cheapest option is not always the best. Choose the policy that offers the most value, addressing your specific needs comprehensively. After thorough discussions and considering his family history, Mark opted for a policy that was a bit pricier but offered extensive coverage without a medical exam, ensuring peace of mind for his family’s future.Regularly Review Your Policy

Once you have your policy, set up annual reviews with your broker. Your needs and circumstances might change, and so might the policy terms from the insurer. Every year, Julia meets with her broker to review her policy. Last year, they adjusted her coverage to include her new spouse and child, ensuring her growing family was fully protected. Remember that your Whole Life Insurance broker is not a point of transaction but a partner you work with to ensure a safe financial future. Working with a Whole Life Insurance broker specializing in no-medical-exam products means you are being guided by somebody who knows their product in this niche. Imagine holding insurance protection that fits you like a glove in this kind of partnership. With the shared steps, you are in the best place to find the no-medical-exam Whole Life Insurance as they will help you in shopping for your best insurance will make a difference. So, be the first to act, and secure a future that is safe and peaceful for you and your loved ones.John’s Challenge of Finding the Right Fit

The Benefits of Whole Life Insurance Without a Medical Exam

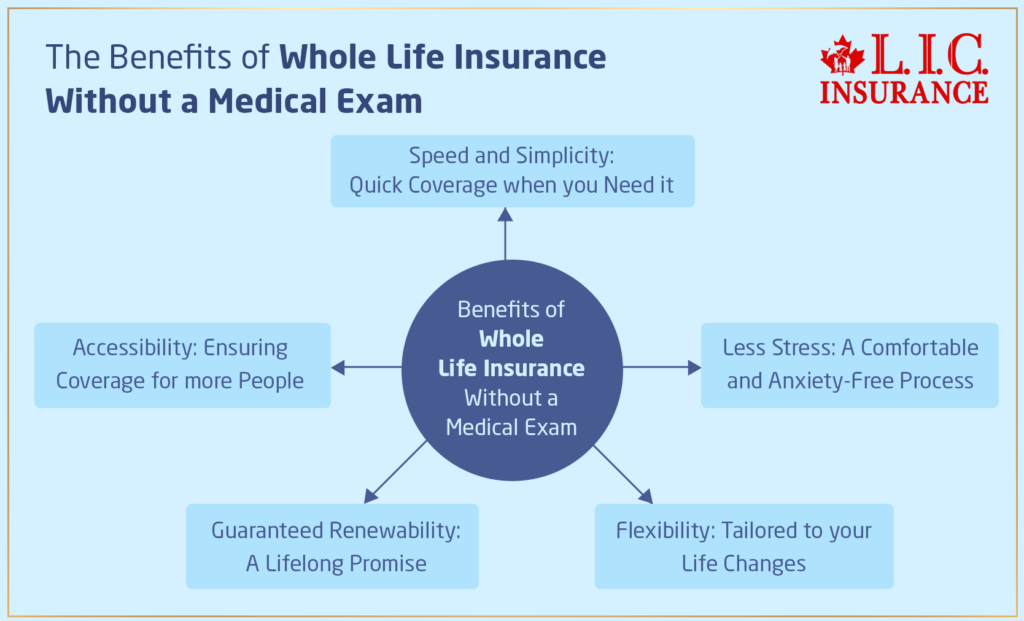

When considering Whole Life Insurance, the option of securing a policy without a medical exam can seem like a breath of fresh air. Below, we delve deeper into the benefits of this convenient choice, presenting them as a listicle. Let’s explore why so many are turning to this simplified insurance path.

Speed and Simplicity: Quick Coverage When You Need It

The most immediate advantage of no medical exam, Whole Life Insurance is the speed at which you can secure coverage. Traditional policies often require weeks to process, as they involve scheduling and waiting for the results of medical exams. However, with no medical exam policies, this timeline is significantly shortened.

Take the case of Maria, a freelance graphic designer who needed insurance quickly to secure a business loan. She chose a no-medical exam policy because it provided immediate coverage. Within days, Maria had her policy activated, facilitating the loan process and helping her expand her business. This example underscores the importance of quick action, particularly for busy professionals like Maria. When looking for Whole Life Insurance Quotes, consider the efficiency of no medical exam options offered by seasoned Whole Life Insurance Brokers.

Less Stress: A Comfortable and Anxiety-Free Process

Many people dread the medical exam required by traditional Life Insurance policies. The fear of needles, the inconvenience of scheduling an appointment, or the worry about one’s medical conditions affecting the insurance rates can be daunting.

Think about Liam, who had always avoided doctors due to anxiety. For him, the thought of undergoing a physical examination was a significant barrier to applying for Life Insurance. When he learned about the no medical exam policy, he was relieved and applied without hesitation. This stress-free option removed a major hurdle, allowing Liam to protect his family’s future without added anxiety. Remember, a simple conversation with knowledgeable Whole Life Insurance Brokers can guide you toward the most stress-free options available.

Accessibility: Ensuring Coverage for More People

One of the most compelling advantages of no medical exam, Whole Life Insurance is its accessibility. This type of insurance is often available to those who might be denied coverage under traditional policies due to pre-existing conditions or other health issues.

Sarita, a 50-year-old who was diagnosed with a chronic condition, had previously been denied Life Insurance. She felt hopeless, knowing her health could leave her family unprotected. When she discovered that no medical exam policies were available, it was a game changer. Sarita was able to obtain Whole Life Insurance despite her health issues, ensuring her family’s financial security.

Flexibility: Tailored to Your Life Changes

No medical exam Whole Life Insurance policies are often more adaptable to changes in your life and health. They can provide options to increase coverage or adjust terms without additional medical scrutiny, giving policyholders peace of mind as their circumstances evolve.

Consider Bob, who initially bought a no-medical exam policy when he was in good health. Years later, after experiencing health issues, he worried about his insurance. Fortunately, his policy allowed him to adjust the coverage to better suit his new circumstances without undergoing a new medical assessment.

Guaranteed Renewability: A Lifelong Promise

Most no medical exam Whole Life Insurance policies come with guaranteed renewability, ensuring that your coverage continues without interruption, regardless of any changes in your health status.

Emily purchased her policy when she was in her thirties. Over the years, her health fluctuated, but her insurance coverage remained constant, providing her and her family with stability and reassurance.

Engage with Your Broker

Discuss your health, lifestyle, and expectations related to the insurance with your broker. That way, he can find you the best match for the situation you are in. Remember, a great broker is not a salesperson; he’s your advisor and your advocate in the maze of insurance.

The Bottom Line

Dealing with the world of a whole life without a medical exam does not have to be a scary task. With skillful brokers on Whole Life Insurance and credible information, such as what has been shared with you today, you can find a policy that assures security and peace of mind. As you think about your choices, remember the shared stories. These stories show that each person needs to find a solution that fits their unique situation without having to go through the trouble of a medical test.

Now is the time to do that. Secure your future, and of the ones that you love, by reaching out to the best insurance brokerage in the country, Canadian LIC. They understand your needs and can guide you through choosing the perfect Whole Life Insurance policy without a medical exam. There’s still time, so don’t wait. Protect the money of your family today.

Find Out: What age does Whole Life Insurance end?

Find Out: The two disadvantages of Whole Life Insurance

Find Out: Which is better, Whole Life Insurance or Term Life Insurance?

Find Out: How many years do you pay for Whole Life Insurance?

Find Out: At what age is Whole Life Insurance good?

Find Out: Can you buy Whole Life Insurance for your child?

Find Out: Who should go for Whole Life Insurance?

Find Out: What is the biggest risk for Whole Life Insurance?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs: Understanding Whole Life Insurance Without a Medical Exam

Managing the ins and outs of Whole Life Insurance can be quite a task. The following are some FAQs on how to secure Whole Life Insurance without a medical exam, along with some relatable examples and the role of Whole Life Insurance Brokers.

Whole Life Insurance without a medical exam is basically a permanent insurance cover without the need to check on one’s health. This way, you get insurance quicker and have no hassle with a medical exam.

Carlos is a busy restaurateur who wanted the cover to just seal that one business deal but hated the medical exams that seemed to take forever. Carlos was happy with the no-medical exam policy, as it was quick, and he was back doing business with no waiting.

Whole Life Insurance Quotes without a medical exam can be obtained by contacting Whole Life Insurance Brokers that deal exclusively with these policies. Once they have had a conversation with you to understand your needs and resources, they can assist you in getting the quotes.

Samridhi had to get a cheap insurance option quickly. She approached one of the brokers who handled the no-medical-exam policy, and that same day, she got several quotations. This made her decision-making process much easier and more informed.

Generally, these are a little costly for those at risk compared to those that require a medical exam, as a big threat to the insurance firm is not checking one’s health status.

Mark felt it was a little high in cost, but he felt that the difference in premiums was a fair tradeoff for the convenience and peace of mind in taking care of the issue, and he didn’t like medical procedures anyway.

These policies might have a lower coverage limit than traditional policies and could include something known as a graded death benefit, where the full death benefit isn’t available until the policy has been in effect for a number of years.

Emily went with a no-medical exam policy but had to accept a lower limit on her death benefit. She thought it was a reasonable compromise, given that she needed the coverage as soon as possible without the need for a medical exam.

While no exam policies are easier to obtain, they are not open to anyone. Insurers may still require some basic information about your health and lifestyle to determine eligibility.

When John applied, he needed to answer questions about whether or not he smoked or had good health in general. No medical exam was given, but this basic information helped the insurer to determine his application, which was indeed approved.

Whole Life Insurance Brokers are knowledgeable about the market. They will assess your needs and then offer highly-rated policies. They also assist you during the application process and help you comprehend all the terms and conditions, which you may not understand.

Linda was pretty much dazzled by the many options and terms when Linda was overwhelmed by the variety of options and terms. She consulted a broker who explained the nuances of each policy and helped her choose one that was just right for her lifestyle and budget, simplifying what had initially seemed a daunting task.

Yes, of course you can. Many insurers will allow you to enjoy increased coverage just by considering that request, but most of them will require some level of underwriting, while a few demand a medical exam.

Tom had initially taken a very modest coverage figure but wanted to increase it after a few years. With his broker’s help, he was able to negotiate a higher coverage figure with very little fuss.

If you already have a pre-existing condition, you can still qualify for a no-medical-exam Whole Life Insurance policy, but the premiums will be higher, and coverage may differ depending on the health status at that time.

Anita had been suffering from diabetes for decades, which made her abandon the idea of buying Life Insurance. But good for her, her broker found a no-exam policy with a little higher premium that would fit her condition. Anita was pleased to leave her children with a financially sorted future, even with her state of health.

Yes, most Life Insurance companies make it possible to include riders in your policy. This includes accelerated death benefits and children-term riders to make your no-medical exam Whole Life Insurance plan even better tailored to your needs.

Robert said he wanted a Critical Illness Rider attached to his Whole Life Insurance Quotes. His broker explained to him how the rider works and helped him include it in his policy, making him feel more secure against potential health uncertainties.

Find a broker with experience, good reviews, and a specialty in no medical exam insurance. A great broker will ask you questions about your needs, make sure all your options are well explained, and guide you to the best decision fitting your case.

Emily was shopping for a broker and found one who came highly recommended by her friends. This person was known for clear communication. He helped her understand the varying Life Insurance quotes and policies, making her decision process very easy and informed.

A no medical exam Whole Life Policy is typically a Permanent Policy, which means that the policy can last for your entire life as long as the premiums are paid. It’s not going to expire after a certain number of years, as you might find with a Term Life Insurance Product.

Jake was looking for an insurance policy that would see him through all his days without the need for renewal. He, therefore, settled for the no medical exam Whole Life Policy. This permanent solution meant that he had no fear of compromising his insurability.

No exam policies can often be placed and in force much more quickly than policies where you must complete an exam. With many providers, your coverage could be in place just days from the date of your application.

Lucia urgently needed a policy as part of a loan requirement. She applied for a no medical exam Whole Life Insurance and was surprised to have her coverage begin within just 48 hours. Her broker expedited the process, ensuring everything was in order swiftly.

If your financial situation changes, you’ll let your broker know. That way, they can talk about adjusting the premiums or coverage at the same time. Many policies offer flexibility and allow you to adjust to your life changes.

After experiencing a significant change in income, Raj contacted his broker to discuss options. Together, they adjusted his policy to better align with his new financial reality, ensuring his premiums remained manageable.

Hopefully, these FAQs have given a clearer sense of what to expect when thinking about Whole Life Insurance with no medical exam. Remember: every scenario is different, and what worked for Carlos, Sarah, or Mark may be different than what may work for you. Without a doubt, you should get in touch with Whole Life Insurance Brokers right away to get your personalized options and find out what you need to do. Start building a solid financial future today; just make sure your first step is well-informed.

Sources and Further Reading

When considering Whole Life Insurance without a medical exam in Canada, it’s important to have access to reliable information and expert opinions. Below are some valuable resources that can provide deeper insights and broader perspectives:

Insurance Bureau of Canada (IBC) – Offers comprehensive details about different types of Life Insurance available in Canada, including whole life policies. Visit IBC

Canadian Life and Health Insurance Association (CLHIA) – Provides information on Life Insurance products and advice on choosing the right policy. Explore CLHIA

Financial Consumer Agency of Canada (FCAC) – Offers guidance on choosing insurance products that fit your needs and financial situation. Check out FCAC

By utilizing these resources, you can gain a comprehensive understanding of Whole Life Insurance policies without a medical exam, empowering you to make well-informed decisions about your insurance needs.

Key Takeaways

- Whole Life Insurance without a medical exam offers a quick and easy application process.

- These policies are accessible for individuals with health issues that might limit their insurance options.

- Insurance brokers are crucial for navigating insurance options and obtaining the best coverage.

- No medical exam policies may have higher premiums but provide convenience and peace of mind.

- These policies often allow for adjustments in coverage to suit changing life circumstances.

- As permanent Life Insurance, these policies provide lifelong coverage and a cash value component.

- Effective communication with your broker is key to finding the right insurance product.

Your Feedback Is Very Important To Us

We appreciate your input on your journey to find the best Whole Life Insurance without a medical exam. Your responses will help us better understand the common challenges and preferences. Please answer the following questions, selecting the most appropriate option for each:

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]