Imagine yourself in the centre of a busy Canadian city or one of its calm lakeside towns. You or someone you are travelling with requires some medical attention. The very first thing that comes to your mind is, “Will the local hospital accept my Visitor Visa Insurance?” This is quite a common situation many people find themselves in while travelling, and knowing how to check on insurance acceptance can be quite important for having a hassle-free stay in Canada.

Welcome to our educational blog on how you can ensure that hospitals and clinics in Canada will accept your Visitor Visa Insurance. We will share with you some key insights and real-life examples from Canadian LIC, the best insurance brokerage, which assists clients daily with similar queries. This is not only an educational blog but also one that will captivate you with practical advice and life experiences that will empower you during your visit across the border.

Understanding Visitor Insurance Acceptance

Firstly, let us explain what Visitor Visa Insurance is. It is a health insurance plan that covers the medical expenses of a person when he or she comes to visit Canada, providing peace of mind during this stay. You will be aware that the insurance is admitted at medical facilities, which is equally important as having the coverage itself.

Step-by-Step Guide to Verifying Insurance Acceptance

Consult Your Visitor Insurance Agents: Before you travel, speak with your Visitor Insurance representatives. These agents know a lot about the best and most current information regarding which hospitals and clinics will or will not accept your Visitor Insurance plan. In fact, quite often, Canadian LIC agents like to help travellers by providing a listed version of which facilities are “in-network” with a particular Visitor Insurance plan. John was a client of Canadian LIC who was planning a trip to Toronto. He had a few questions regarding where his medical insurance would be accepted. He also received from his agent a long list of all networked hospitals and clinics in and around Toronto where his Visitor Insurance was easily accepted.

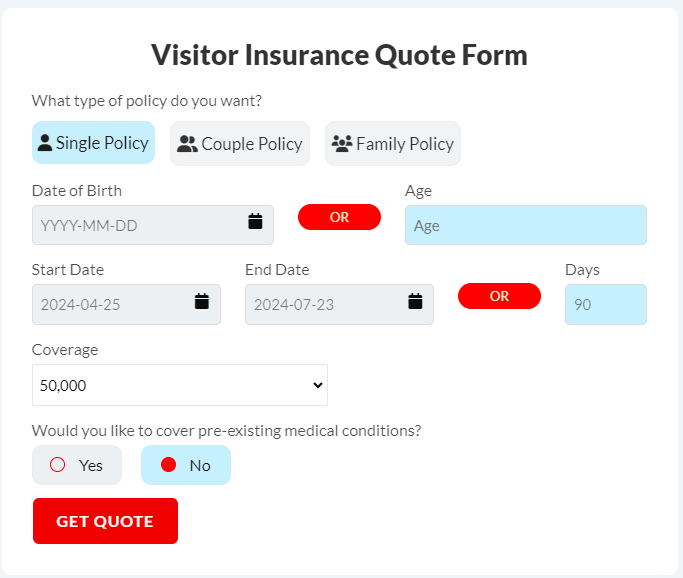

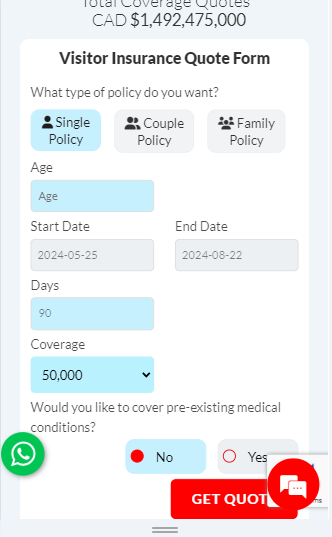

Use the Insurance Provider’s Online Tools: Most insurance providers have online tools you can use to check which hospitals and clinics accept their plans. Most of these tools are relatively simple: You enter the area you will be visiting, and the tool lists compatible facilities. Maria used her insurance provider’s website, as recommended by Canadian LIC, to find a clinic near her stay in Vancouver, BC. Relieved, she could now have a few options that would ensure medical care when needed.

Call the Hospital or Clinic Before Your Visit: If you’re unsure of acceptance, you can call the hospital or clinic. Is there someone who accepts Visitor Visa Insurance? Is there anything else that you should do at that time to cover it? Alex, another client of LIC from Canada, required some specialized medical care. He called ahead to several clinics, confirmed that they accepted his insurance and chose the one that provided him with the best options for his condition.

Check for Any Required Pre-Authorizations: Some plans include the condition of pre-authorization for some medical services. Knowing the details of each plan will help a visitor to this country avoid nasty surprises in the event of a medical emergency. In Linda’s case, surgery was required. Because Canadian LIC Visitor Insurance Agents explained to her about pre-authorization and what needed to be done, she did everything duly and on time. Thus, surgery was performed smoothly without financial stress.

What to Do if Your Insurance is Not Accepted?

In some cases, a hospital or clinic does not accept your Visitor Visa Insurance. Here’s what you can do:

Emergency Medical Services: In Canada, emergency medical services will not deny care based on insurance issues. Ensure you receive the necessary care and sort out the insurance matters afterward.

Direct Reimbursement: If you have to pay out of pocket, keep all receipts and medical reports. You can claim a reimbursement from your insurance provider according to the terms of your Visitor Insurance plan.

Real-Life Scenario: When Siksha visited a remote clinic in Northern Canada, her Visitor Insurance was not directly accepted. She paid upfront, kept all documentation, and was reimbursed swiftly after submitting her claim through Canadian LIC’s guidance.

Building a Relationship with Your Insurance Company

Establishing a clear communication channel with your Visitor Health Insurance provider is vital. Canadian LIC emphasizes regular check-ins with their clients to update any changes in the policy or to address any concerns.

The End

It is very important to check whether a particular hospital or clinic accepts your Visitor Visa Insurance in Canada in order to ensure a safe and hassle-free visit. This process can easily be dealt with by taking help from experienced Visitor Insurance Agents from the Canadian LIC. They are ready to provide you with full Visitor Insurance Plans according to your needs and help you out with any difficulty at any moment in Canada.

Don’t let uncertainties about medical care make a mess of your exciting Canadian adventure. Contact Canadian LIC today and get a Visitor Insurance Quote to travel with confidence—you are fully covered. This is to say that the best strategy anyone can contemplate, therefore, is to ensure a safe and delightful visit to Canada or simply be a visitor by being informed and prepared for it.

More on Visitor Insurance

Does Visitor Insurance Cover Mental Health Services?

Can Family Members Visiting Together Get A Group Discount On Visitor Insurance?

Are There Any Age Restrictions For Purchasing Visitor Insurance?

What Documents Do I Need To Buy Visitor Insurance?

How Do You File A Claim For Visitor Insurance?

Can I Extend My Visitor Insurance If I Decide To Stay Longer?

Which Visitor Insurance Is Best?

Is Visitor Insurance Mandatory?

Is Visitor Insurance The Same As Travel Insurance?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs: Understanding Visitor Insurance in Canada

To obtain a Visitor Insurance Quote, you simply need to contact the Visitor Insurance Agents at Canadian LIC. They are always ready to assist you by providing customized quotes for Visitor Insurance. Last month, for example, a family who contacted them for their upcoming vacation was able to receive a detailed quote a few hours later that covered all members well enough to prepare better and feel more secure about the trip.

If you happen to visit a hospital that does not accept your Visitor Insurance plan, then do not panic. First, ensure that you are getting the needed medical attention. Pay all the bills upfront and retain all the receipts and different medical documents for your claim. You can file a claim for reimbursement as per your insurance plan. The same was the case with one of our clients from Canadian LIC. She got fully reimbursed without hassle with our proper guidance.

Absolutely! Our Visitor Health Insurance agents at Canadian LIC take pride in helping clients find hospitals and clinics across Canada that take their insurance plans. When Paul, a recent visitor, needed to find specialized clinics for his condition, our agents were able to create a list of healthcare facilities that would accept his insurance, making his visit to the doctor or any other medical facility hassle-free.

Yes, there are a few steps you can take:

Before your visit, contact the hospital or clinic to confirm if they accept your Visitor Insurance plan.

Check if your plan requires pre-authorization for certain treatments and obtain it if necessary.

Always carry your insurance information with you during the visit. One of our clients, Emily, followed these steps when she needed an unexpected medical procedure. This preparation allowed her to focus on her recovery without worrying about insurance coverage.

When you request a quote from the agents of the Canadian LIC Visitor Insurance, be sure to indicate your personal health condition and concerns to ensure that the Visitor Insurance policy provides the required coverage. They will help you devise a plan that will meet all your needs and include those regarding pre-existing conditions. Just like with our client Tom, who had diabetes, we helped him select a plan that provided comprehensive coverage for any diabetes-related emergencies.

If you have an emergency, do not waste time; attend to your medical needs first. All hospitals in Canada will treat you in an emergency, irrespective of your insurance details. Once you are stable and well enough, you can reach out to Canadian LIC or your Visitor Insurance provider for your coverage and the initiation of any claims you may need to make. Keep in mind that having a copy of your insurance details with you at all times can speed things up in this regard.

Keeping in touch with the Visitor Insurance Agents throughout your stay if your health changes or you choose to extend your visit for a further time is always the best advice. It makes one properly covered at all times. She kept us updated regularly during her extended stay, which helped us adjust Lisa’s coverage as needs changed.

Yes, you can extend Visitor Insurance. All you need to do is contact Canadian LIC before your current plan expiry, and we will discuss extension options with you. We have helped many clients, one of whom, much like John, wanted to extend his stay. We quickly updated his insurance plan so that he maintained continuous coverage without any lapse.

The most common inadequacy is an overall lack of knowledge about which hospitals will take your Visitor Insurance plan. Canadian LIC at least addresses this with a comprehensive list of compatible hospitals and clinics, as well as technical support in real-time if issues arise during hospital visits. For instance, when one of our clients encountered a rather unwilling clinic to accept her insurance, our agents jumped into action right away. The need to clarify the details of coverage with the clinic’s administration ensured the ability to proceed with treatment.

Choosing Canadian LIC means experience, dependability, and dedicated service. We understand what each visitor particularly needs and are able to offer individual insurance solutions with continuing support and easy claim processes. Our ability to assure you peace of mind while you stay safe in Canada makes us one of the most preferred partners of travellers.

It is highly advisable to contact Visitor Insurance Agents at least a few weeks before your trip to Canada. You would have adequate time to discuss your needs, compare various Visitor Insurance Plans, and come up with a well-informed decision. Consider our client Elena, who contacted us a month before her travel date to explore a variety of available options and get a plan that really suited her travelling and health needs.

Provide information about your age, the length of time you have been in Canada, any pre-existing conditions, and details regarding the kind of coverage one would wish; Canadian LIC will use this to come up with a plan tailored towards an individual’s specific needs to ensure one is comprehensively covered. Another recent customer, Mark, was initially cagey about revealing his pre-existing condition; after he did, we locked in a plan specifically covering his medical needs.

Yes, you can switch to another Visitor Health Insurance Plan or upgrade it even after coming to Canada if only then you realize that your purchased visitor’s insurance does not fully meet your needs. But you should get in touch with the agents of Visitor Insurance the very moment you realize any gap in the coverage. Just like Lisa, she realized soon after arrival in Canada that she needed extra dental coverage, so we helped her change the course quickly to include it.

Visitor Insurance Agents can greatly facilitate the process of making a claim. If you have already paid for medical services, all you need to do is get in touch with your agent. Your agent will walk you through the steps involved in filing your claim, including what documents you will have to collect and how to file your claim.

Visitor Insurance Plans generally provide coverage for medical emergencies, hospitalization, doctor visits, and, in some cases, prescription drugs. It is always good to bring out your specific plan details or even ask your Visitor Insurance Agents for clarity on the same. When Shahana required emergency surgery during her stay, she was very relieved that her plan had the full procedure co

While some Visitor Insurance Plans might cover maternity or childbirth, it is restricted by certain conditions. Recently, one of our agents helped a couple expecting a child while away in Canada to find the right plan that would let them have maternity services for proper preparation for birth.

In the case of foreign language problems, Canadian LIC will correspond directly with your healthcare provider. We have multilingual agents who will be able to assist in closing a communications gap. For example, when our client Hiroshi needed assistance, we had a Japanese-speaking agent who helped facilitate the conversation with the hospital staff.

Be sure your Visitor Insurance covers your complete stay by verifying that the effective date of your insurance policy is the same as your travel dates. Should you intend to extend a stay, call Canadian LIC and speak with someone about the possibility of an extension of coverage? We recently helped a client, Michael, who was going to extend his stay for an extra month by adjusting his insurance coverage really quickly for his new date of departure.

Yes, you have the option of taking multi-trip Visitor Insurance Plans whereby a number of trips within a year are covered. These are good if you visit Canada frequently. Our client, Diane, belongs to the business consultancy field, so she visits quite often within a year. With respect to knowing that she is covered for all of her trips with one insurance purchase, a multiple-trip plan really works well for her.

Canadian LIC is the act of choosing a different kind of provider, one uniquely positioned to provide personalized service, experience, and comprehensive coverage options. We realize the unique challenges that you may face as an International Visitor and are committed to ensuring you have the best possible experience during your stay here in Canada. Just ask any of our clients—like James, for example—who at one time praised how seamless the service and support he got when he had a medical emergency in Montreal.

These FAQs arm you with the required knowledge and confidence in regard to your coverage and support during your stay in Canada so that worrying about your health remains the last thing on your agenda.

Sources and Further Reading

Here are some recommended sources and further reading materials to expand your understanding of Visitor Visa Insurance in Canada:

Government of Canada – Travel Insurance Page

Provides official information on travel and Visitor Insurance requirements in Canada.

Canadian Life and Health Insurance Association (CLHIA)

Offers detailed guides and tips on choosing the right health insurance for visitors to Canada.

Insurance Brokers Association of Canada

Provides resources and advice on various types of insurance, including Visitor Visa Insurance.

Immigration, Refugees and Citizenship Canada

Offers insights into health insurance coverage for different types of visas and entrants into Canada.

Canadian Healthcare Network

A useful resource for understanding healthcare services in Canada that can be linked with Visitor Insurance Plans.

Travel Insurance Review

An independent site that provides reviews and comparisons of different travel insurance plans, including those for visitors to Canada.

These sources will help you get a deeper understanding of Visitor Visa Insurance in Canada and assist you in making informed decisions about your insurance needs while traveling.

Key Takeaways

- Verify hospital and clinic acceptance of your Visitor Visa Insurance before visiting.

- Use online tools from insurance providers to locate medical facilities that accept your insurance.

- Reach out to Visitor Insurance Agents for guidance and a list of networked facilities.

- Know the details of your Visitor Visa Insurance policy, including pre-authorization requirements.

- Prepare for possible out-of-pocket expenses by understanding the claim process.

- Maintain regular communication with your Visitor Insurance provider throughout your stay.

- Opt for a reputable insurance brokerage like Canadian LIC for personalized service and expert advice.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]