Are you feeling nervous about making a career change or starting your first job in the insurance industry? So many of us go through countless job portals, refining search terms and yet struggle to pin down that perfect opportunity. To many Canadians who want to get into or advance their jobs as Insurance Advisors, this sounds a lot like their lives. Anybody in Canada, whether they are fresh out of college or looking to change careers, who is looking for a job as an Insurance Advisor has a huge and exciting chance of getting one.

This blog will help you with the practical steps on how to find Insurance Advisor jobs and further explore what forms the basis of most of the Insurance Advisor job descriptions and what one can expect from an Insurance Advisor’s salary. So, let’s begin this journey of transforming your career aspirations into reality!

Finding Job Opportunities as an Insurance Advisor

Understanding the Role: What Does an Insurance Advisor Do?

An Insurance Advisor plays a crucial role in helping individuals and businesses choose the best insurance policies for their needs. This responsibility involves analyzing clients’ needs, suggesting suitable policies, and helping clients understand the terms and coverage options. For instance, at Canadian LIC, advisors often encounter clients who are overwhelmed by the complexity of choosing the right insurance plan. Through one-on-one consultations, advisors simplify these complexities, showcasing the immediate value of personalized advisory.

Qualifications and Getting Licensed

To become a licensed insurance agent in Canada means first becoming licensed in the province in which one will work. Much of this licensing most commonly includes completion of some sort of insurance coursework, which is then followed by passing a provincial exam. Canadian LIC gives examples of applicants who went easily from businesses like retail or hospitality to insurance after getting a lot of help with their exams.

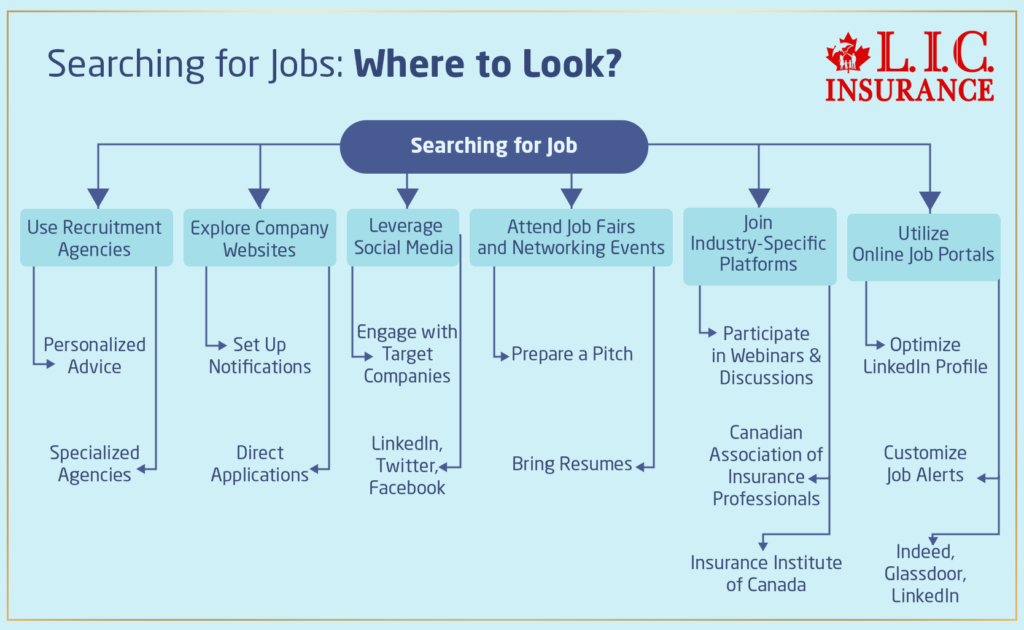

Searching for Jobs: Where to Look?

Conducting a job search could be the most nerve-wracking proposition, and it requires much focus and support to get a good outcome. Let us discuss how to pursue this career effectively, which holds the top leadership position in the insurance brokerage field across Canada.

Utilize Online Job Portals

Platforms to Consider: Start with well-known job search websites such as Indeed, Glassdoor, and LinkedIn. These platforms offer a vast array of job listings and allow you to filter searches based on location, salary expectations, and job type.

Tip from Canadian LIC: Customize your job alerts to include specific keywords like “Insurance Advisor jobs” and “Insurance Advisor salary” so you’re always informed when new postings match your criteria.

John, a recent applicant at Canadian LIC, shared that tweaking his LinkedIn profile with relevant insurance keywords and joining insurance-related groups helped recruiters find him more easily.

Join Industry-Specific Platforms

Key Resources: Register on platforms like the Insurance Institute of Canada or the Canadian Association of Insurance Professionals. These sites not only list jobs but also provide valuable networking opportunities.

Tip from Canadian LIC: Participate in discussions and webinars hosted by these platforms to increase your visibility and establish yourself as a knowledgeable candidate.

Sheena, who secured a position through such a platform, noted that the specific insights into the Insurance Advisor job description she gained through webinars made her interviews much more impressive.

Attend Job Fairs and Networking Events

What to Do: Look for local and national insurance-specific job fairs and networking events where you can meet potential employers in person.

Tip from Canadian LIC: Bring multiple copies of your resume and prepare a short, impactful pitch about your background and what makes you an excellent candidate for an Insurance Advisor role.

Mike, a new hire at Canadian LIC, met his manager at a job fair and was able to discuss the Insurance Advisor’s salary and job expectations on the spot, which accelerated the hiring process.

Leverage Social Media

Platforms to Use: Beyond LinkedIn, use platforms like Twitter and Facebook to follow insurance companies and join insurance-related groups.

Tip from Canadian LIC: Engage with content posted by your target companies; comment and ask insightful questions to draw attention to your profile.

Anna found her role by actively participating in a Facebook group for insurance professionals in Canada. Her thoughtful questions and comments caught the attention of a Canadian LIC recruiter.

Explore Company Websites

Direct Applications: Visit the careers section of insurance companies websites, like Canadian LIC, where they often post vacancies that might not be listed elsewhere.

Tip from Canadian LIC: Set up notifications for your favourite companies so you’re alerted as soon as new job openings are posted.

James highlighted that applying directly through the Canadian LIC website led to a quicker interview process because it demonstrated his specific interest in the company.

Use Recruitment Agencies

How They Help: Specialized recruitment agencies can help tailor your job search in the insurance sector, matching your skills and career aspirations with potential employers.

Tip from Canadian LIC: Choose agencies that specialize in finance and insurance to get more targeted job opportunities.

Linda used a recruitment agency and appreciated the personalized advice she received on refining her resume to better reflect the skills highlighted in Insurance Advisor job descriptions.

Remember, all of these methods are not steps in your job search process; instead, they are opportunities for connecting, engaging, and making an impression. As time flows through these channels, keep on sharing your experiences and learning from others. This career search for fulfilling the role of an insurance adviser is not about how an individual gets employed but about building careers where everything is focused on your professional goals and personal values. Keep exploring, stay connected, and let the passion take you further in your profession in the insurance industry.

Crafting a Winning Resume and Cover Letter

Your resume and cover letter are your first points of contact with potential employers. They should highlight your understanding of insurance products, your ability to manage client relationships, and any sales experience you have. Canadian LIC has seen a significant increase in interview calls for candidates who tailor their resumes to highlight problem-solving and client-facing experiences, directly correlating these skills with insurance advice.

Prepare for the Interview

Interviews can be stressful, but that stress can be lessened with some preparation at the front end. Review some of the common insurance situations, and be prepared to walk the interviewer through how you would approach a number of client scenarios. Canadian LIC often shares stories of candidates who practiced with mock interviews and succeeded in real ones, where applicants showcased knowledge and passion for helping others through insurance solutions.

Salary Expectations

It all depends on experience, location, and the company in question when talking about the salary for an Insurance Advisor in Canada. Normally, junior advisors would have a base salary in addition to commissions on policies they could sell. At Canadian LIC, many new advisors are pleasantly surprised by the competitive starting salary and commission structures that provide stable yet growth-oriented income potential.

Ongoing Learning and Advancement

This learning certainly doesn’t stop once you land a job. Indeed, insurance is an industry where continuous education has to be modelled in keeping with changing policies, legislation, and market conditions. Canadian LIC provides ongoing training programs and development prospects for its advisors, again putting emphasis on career development inside the corporation.

The Bottom Line

Starting an Insurance Advisor career in Canada is far from just getting a job; it is making a career that will fulfill you personally and professionally. When you fully understand what the role entails, get qualified, and apply some strategy to your job hunt, you’re really setting yourself up for success. If you have a passion for guiding others regarding insurance needs and feel empowered by the content of this blog, do not hesitate to fill in the application to become an Insurance Advisor with Canadian LIC—the best insurance brokerage firm across Canada. With their support and your dedication, you can thrive in this dynamic field and make a significant impact on the lives of many. Apply today and take the first step toward a promising future in insurance advising!

Find Out: How to Choose the Right Insurance Broker?

Find Out: Why Using an Insurance Broker is Beneficial for Purchasing Insurance?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions (FAQs) for Aspiring Insurance Advisors

An Insurance Advisor advises clients about their insurance needs, finds them suitable kinds of insurance products, and manages policy-related issues. To put it in perspective, imagine a Canadian LIC client who was confused about choosing between comprehensive and third-party car insurance. An advisor explained the benefits and limitations of each, helping the client make an informed decision that suited their budget and coverage needs.

To seek Insurance Advisor jobs in Canada, first surf through the job postings section on some of the most popular career websites like Indeed, LinkedIn, and Glassdoor. In addition, industry networking events and a good network with other professionals on platforms like the Insurance Institute of Canada can make a huge difference in securing Insurance Advisor jobs. Canadian LIC quite often posts new job opportunities on its website and other social media channels; they could be a good source as well.

The salary scale for an Insurance Advisor varies greatly in Canada and depends on several factors, such as experience, location, and the employer. Entry-level positions may offer a base salary plus commissions, while experienced advisors could have higher base salaries with potential bonuses. For instance, a new advisor at Canadian LIC might start with a competitive base salary and have the opportunity to increase their earnings significantly through commissions and bonuses as they gain experience and build their client base.

The typical requirement would be a high school diploma, but most employers would prefer an applicant with some college courses in business, finance, or economics. Licensing is also required, and one has to pass a province-specific exam. For example, Canadian LIC offers to guide their new hires through the licensing process, providing study materials and even reimbursement for exam fees.

Be prepared for the interview, and based on the Insurance Advisor job description, give examples from real-life experiences. Review common insurance terms and be prepared to role-play a client interaction. Canadian LIC advises candidates to come equipped with questions about the company’s products and services, showing a genuine interest and proactive attitude.

Certainly, one of the best examples I can recall is of an advisor who started with little experience in insurance but had a great customer service background. This particular individual quickly utilized the training programs offered by Canadian LIC, quickly mastered the product knowledge, and became one of the top performers within the company in less than a year. His success story was pioneered by his relentless dedication to understanding what his clients wanted and providing them with advice that surely suited their requirements, leaving them highly satisfied and at ease, hence numerous referrals.

This may include promotion to senior advisory positions, management, or other specialty areas like underwriting and claims management. Continuous education is key, allowing advisors to stay current with industry changes and advancements. At Canadian LIC, many advisors have progressed by taking additional courses and obtaining advanced certifications, which the company supports through educational incentives and training opportunities.

Customize the resume and your cover letter for each application you make. Outline particular skills and experiences in the light of the Insurance Advisor role description to which you are applying. Canadian LIC has noted that candidates who personalize their applications to reflect the specific needs and values of the compan

Commissions for Insurance Advisors are typically based on the policies they sell or renew. This will increase your overall earnings to a great extent based on the quality of sales performance. For instance, the pay at Canadian LIC included a double bonus salary for one advisor. Reports have been received where a new advisor began working with a base salary but quickly doubled it through diligent service to clientele and effective sales of policies, thus showing that such commission-based pay can be an income-enhancer.

One common challenge is the handling of client objections/misunderstandings regarding insurance policies. Efficient communication and in-depth knowledge about the product are important to get out of such hurdles. An advisor once shared an experience about how, due to a misconception over the terms of the policy, he was unavoidably engaged in a difficult conversation with the client. By explaining patiently, clear information and data-backed arguments, the advisor could resolve the concerns of the client and retain his strong relationship.

Emphasize concretely the achievements associated with client management, sales targets, or specialized insurance knowledge. For example, a candidate applying for Canadian LIC said he had experience with life insurance. This fits perfectly with a vacancy that was actually looking to increase its life insurance clientele, which resulted in an interview.

Insurance consultants can be seen to specialize in Life Insurance, Health Insurance, Auto Insurance, Property Insurance, Commercial Insurance, etc. This kind of specialization makes an employee more attractive to an employer who is seeking special experience and skills in a certain area. Example: A Canadian LIC employee specialized in Commercial Insurance and became the go-to expert in the company, leading to career advancement and increased job satisfaction.

It is important that employees are continuously educated since insurance products and legislation can change, as, over time, so can the needs of the clientele. Engaging in ongoing education and professional development can help you stay competitive and knowledgeable. One Canadian LIC advisor continued courses in Advanced Risk Management, which not only improved their job performance but also positioned them as a candidate for future leadership roles within the company.

It involves studying materials related to the provincial licensing exam and attending some preparation courses if required. Many candidates would also require their study group sessions. Canadian LIC supports its candidates through study groups and resources that have proven helpful, with hundreds of candidates able to pass in the first attempt.

The job outlook for Insurance Advisors in Canada is generally positive. Steady demand is noted in most provinces. This stems from constant demands to help people and businesses regarding personal and business insurance solutions. Canadian LIC has consistently expanded its team of advisors in response to growing client demand, indicating a solid job market.

Social media may be helpful for networking in the industry and finding a job opening, especially through LinkedIn. Create a professional profile, engage with industry groups, and connect with insurance companies directly. A new employee in the Canadian LIC company was recruited after his active involvement in the discussions about insurance on LinkedIn since it showed his vast knowledge in this sphere and interest therein.

These FAQs equip you with the foundation as you start off on becoming an insurance adviser. Whether fresh from school or looking for a career change or promotion, understanding these key fa

Sources and Further Reading

Insurance Institute of Canada: Provides detailed information on courses, licensing, and certifications required for insurance advisors in Canada.

Website: Insurance Institute of Canada

Job Bank – Government of Canada: Lists job openings, job descriptions, and salary information for insurance advisors across Canada.

Website: Job Bank

LinkedIn: A valuable tool for networking with other professionals, joining industry groups, and finding job postings in the insurance field.

Website: LinkedIn

Glassdoor: Offers insights into company cultures, salaries, and interview processes, which can be helpful when applying for positions as an insurance advisor.

Website: Glassdoor

Indeed: A comprehensive job search engine where you can find listings for insurance advisor positions across Canada and tips for enhancing your resume and cover letter.

Website: Indeed

Canadian Underwriter: Features articles, news, and updates on the insurance industry in Canada, which can provide context and background knowledge helpful for advisors.

Website: Canadian Underwriter

By exploring these sources, you can gain a broader understanding of the career opportunities and industry standards for insurance advisors in Canada, aiding in your professional development and job search efforts.

Key Takeaways

- Familiarize yourself with the job responsibilities and skills required for an insurance advisor.

- Meet the educational and licensing requirements necessary to work as an insurance advisor in Canada.

- Use job search websites, professional networks, and industry-specific platforms to find opportunities.

- Tailor your resume and cover letter to highlight insurance knowledge, client management, and sales experience.

- Prepare to discuss your insurance knowledge and client service experiences in interviews.

- Understand the compensation structure for insurance advisors, including base salary and sales commissions.

- Emphasize ongoing education and professional development for career advancement.

- Learn from real-life examples to navigate career challenges and leverage industry opportunities.

Your Feedback Is Very Important To Us

We appreciate your participation in this questionnaire. Your responses will help us better understand the challenges faced by Canadians seeking job opportunities as Insurance Advisors. Please take a few moments to share your experiences and insights.

Thank you for taking the time to complete this questionnaire. Your feedback is invaluable and will help us address the needs and challenges faced by aspiring Insurance Advisors in Canada.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]