- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- Understanding Group Term Life Insurance

- Pros and Cons of Group Term Life Insurance

- Group Term Life Insurance Pros and Cons

- Understanding Individual Term Life Insurance

- Pros and Cons of Individual Term Life Insurance

- Individual Term Life Insurance Pros and Cons

- Comparing Group Term and Individual Term Life Insurance

- Group Term V/S Individual Term Life Insurance

Group Term Life Insurance & Individual Term Insurance: Know The Details

By Pushpinder Puri

CEO & Founder

- 11 min read

- November 7th, 2024

SUMMARY

Planning for future life insurance is a fundamental building block in any solid financial strategy. Many of the clients at Canadian LIC, the best insurance brokerage, are now asking whether they should rely on Group Term Life Insurance provided by their employer or seek an individual term insurance plan. This may make it difficult to differentiate between the two alternatives, as no one will know which better secures the future of their family. This is entirely understandable, especially considering one has to weigh the various financial goals against the requirements of the moment.

In Canada, there are two types of Term Life Insurance: Group Term Life Insurance, provided by an employer, and Individual Life Insurance Plans, bought directly. While both provide essential coverage, they each come with unique advantages, potential downsides, and varying degrees of control. Canadian LIC has helped countless clients determine which of these Term Life Insurance Plans is the right fit, offering tailored advice to align with their life stages, financial objectives, and family responsibilities.

Let’s dive in and explore how these two different types of Term Life Insurance vary, why some people prefer one over another, and how each serves as a meaningful step in your Term Life Insurance Investments.

Understanding Group Term Life Insurance

What is Group Term Life Insurance?

Group Term Life Insurance is a type of Group Coverage. One policy covers a group of people under one contract. This benefit is usually offered by a company to its employees in a package deal. An advantage of Group Term Life Insurance is that it often comes at no cost to employees, so many Canadians buy it, who may not otherwise buy Life Insurance for themselves.

Many of our clients at Canadian LIC feel relief knowing they have this coverage through their employer. But it’s when they begin wondering if it is actually enough that the main problem starts. Group Term Life Insurance typically provides a simple amount of coverage, perhaps one to two times an employee’s annual salary. Although this seems like a great deal of money, it will still be insufficient to meet all the needs that may arise in a family at the time of a sudden loss.

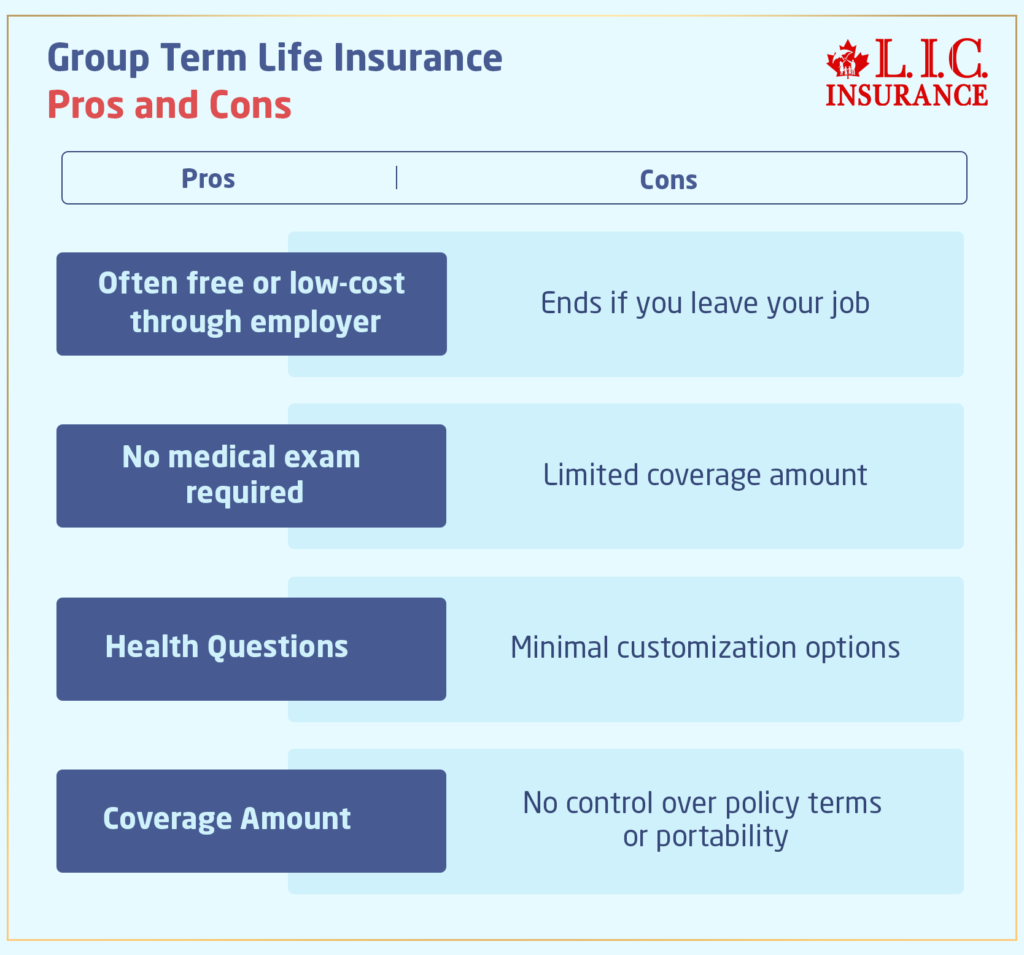

Pros and Cons of Group Term Life Insurance

Here’s a breakdown of some key advantages and disadvantages of Group Term Life Insurance based on what we often discuss with clients:

Pros:

- Affordable or Free: Most employers cover the cost entirely or offer the plan at a minimal rate, making it highly accessible.

- No Medical Exam: This type of insurance typically doesn’t require a medical exam, making it easier for individuals with pre-existing conditions to get coverage.

- Convenience: Group Term Life Insurance is convenient, as it’s automatically set up by the employer, with no effort required on the employee’s part.

Cons:

- Limited Coverage: One of the most significant limitations is that the coverage amount may not be sufficient to meet all financial obligations.

- Lack of Portability: Group Term Life Insurance is generally only valid while you’re employed with that specific employer. If you change jobs, you may lose your coverage or have to buy a new policy, often at a higher rate.

- No Personalization: Group policies don’t allow customization based on individual family needs or goals.

Group Term Life Insurance Pros and Cons

For example, one of our clients, Mr. Smith realized that his Group Term Life Insurance was only covering a portion of his financial needs. Although he appreciated the cost-free coverage from his job, he began looking into Individual Term Life Insurance Plans to fill the gaps, ensuring his family wouldn’t face financial hardship.

Understanding Individual Term Life Insurance

What is Individual Term Life Insurance?

It provides coverage that you will acquire, and you have total authority to determine how much money you want the benefit amount to be. What this means is you do get more flexibility as far as personalization than you could with Group Term Life Insurance. Suppose serious money-making commitments are desired by investing in term life. In that case, personal choices can be set and fit individual financial responsibilities that an investment must meet, for instance, for mortgages, children’s educational years, or perhaps that comfort cushion for the future care of your spouse while alive or after death.

We have helped hundreds of customers at Canadian LIC to make their choices from all the options that exist under Individual Term Life Insurance Canada offers. They often find that having the freedom to choose their coverage amount and duration—typically ranging from 10 to 30 years—brings them peace of mind. This ensures they’re not only meeting their current needs but also preparing for future possibilities.

Once you’ve gathered all the necessary documents, the next step is to submit them to the insurance company. At Canadian LIC, we advise beneficiaries to submit claims as soon as possible to prevent delays. Many clients who follow this advice find the process much easier, as the insurer can then work on validating and processing the claim without obstacles.

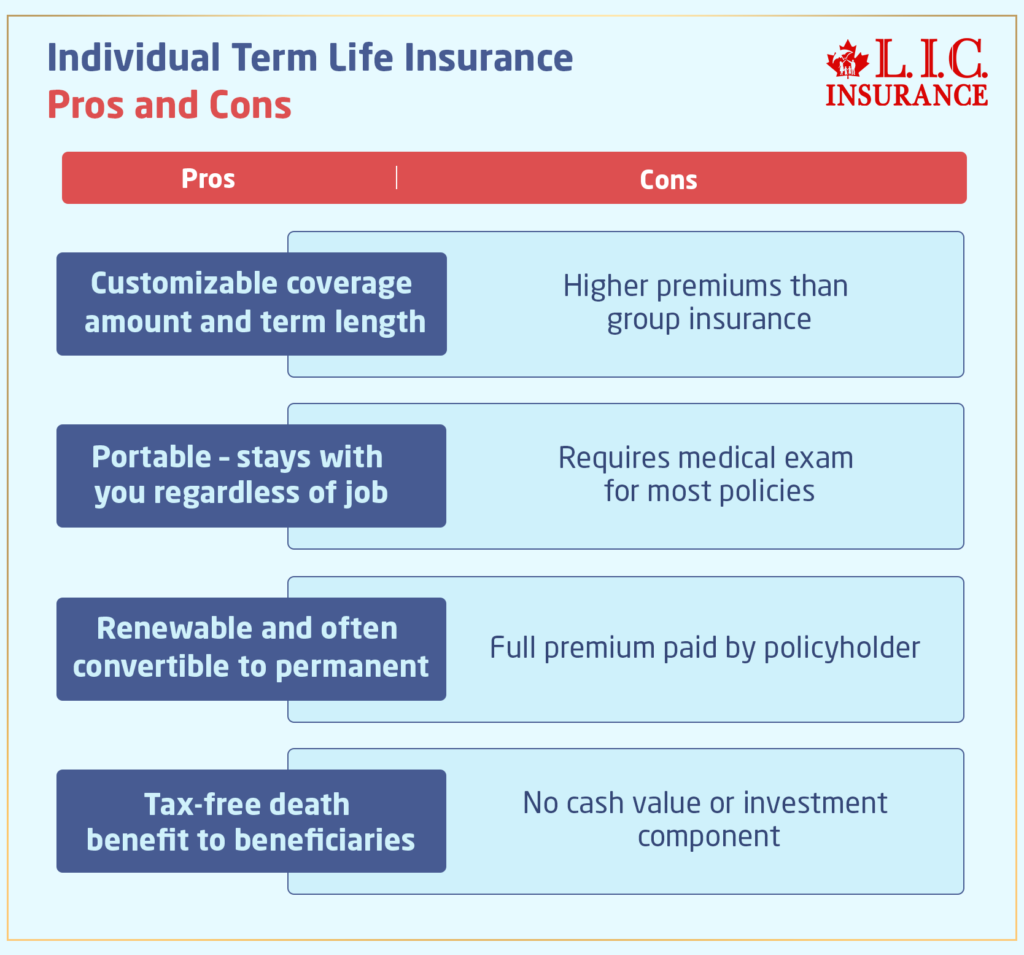

Pros and Cons of Individual Term Life Insurance

Here’s a closer look at the benefits and drawbacks of Individual Term Life Insurance, highlighting what we discuss with clients:

Pros:

- Customizable Coverage: You have control over the coverage amount and term length, which can be tailored to suit your specific needs and financial goals.

- Portability: This policy stays with you even if you change jobs or retire, giving you uninterrupted coverage.

- Opportunity for Term Life Insurance Investments: Unlike group policies, individual term policies can be an investment toward long-term financial stability, as they are designed to protect your personal obligations and assets.

Cons:

- Cost: Individual policies are generally more expensive than group term insurance. However, the cost is often justified by the higher coverage and flexibility.

- Medical Underwriting: Individual term insurance usually requires a medical exam, which can be a barrier for some. However, Canadian LIC can help clients navigate this, offering options for coverage based on their health situation.

Individual Term Life Insurance Pros and Cons

Our client, Ms. Lee chose an Individual Term Life Insurance policy because she had the requirement of having a big sum to pay off the mortgage and leave some amount for the children. For the choice of the 20-year term, she could lock into a rate suited to her budget and ensure her family will be protected long after she is no longer around.

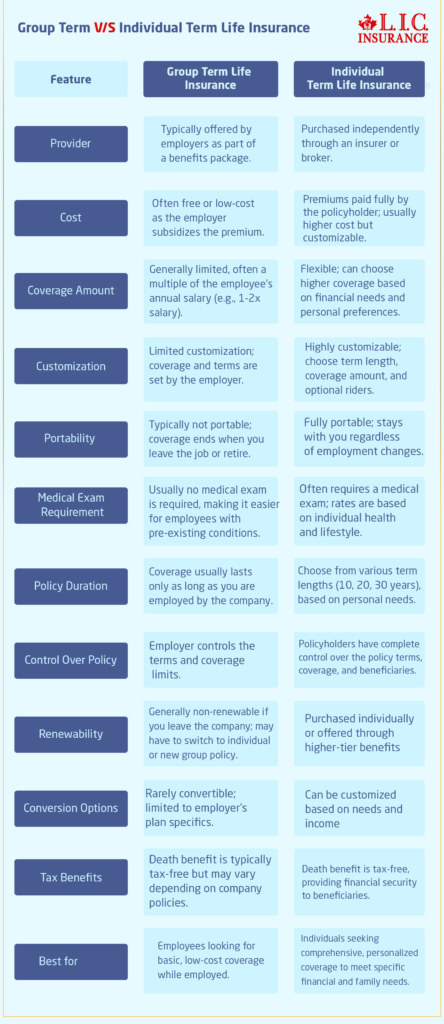

Comparing Group Term and Individual Term Life Insurance

Consider the life goals you have for making an informed decision between Group Term and Individual Term Life Insurance Plans. The following are some common factors that clients weigh at Canadian LIC:

- Affordability vs. Coverage Needs: Group policies are often cheaper, but individual plans provide the option to cover larger needs.

- Control and Personalization: Individual policies allow you to choose the term length and coverage amount, while group policies have predetermined limits.

- Longevity of Coverage: Group insurance is tied to your employment, meaning it may end when your job does. Individual policies stay with you as long as you pay the premiums, regardless of job changes.

Group Term V/S Individual Term Life Insurance

Why Individual Term Insurance Might Be Worth the Investment

Group Term Life Insurance certainly is a convenient option, but the benefits of Individual Term Life Insurance often make it the better choice for clients looking for total protection. You may well want to plan for sizable financial commitments, for instance, with dependents, outstanding debts, or long-term goals.

The Canadian LIC often makes the clients realize how a reliable Term Life Insurance plan invested in now provides them with lots of financial security later. Many realize that Individual Term Life Insurance isn’t an expense but an investment in the future stability and comfort of their family.

Why Both Types of Insurance Could Complement Each Other

One common question that arises is whether it’s necessary to choose between group and Individual Term Life Insurance Plans. In many cases, a combination of both may be beneficial. Group Term Life Insurance serves as a foundation, offering basic coverage that doesn’t require out-of-pocket expenses. Meanwhile, an individual term policy can supplement this by providing additional protection tailored to personal needs.

Take the case of Mr. Thompson, who preferred to hold on to the group insurance offered by his employer while supplementing it with a personal term policy for extra security. That way, he would make sure the financial protection for his family would be more than the one that his group insurance could provide. This method is how one can use Term Life Insurance Canada and have coverage for all scenarios in life without overstraining the budget.

Key Takeaways for Choosing the Right Term Life Insurance Plan

When deciding on group versus Individual Term Life Insurance, Canadian LIC encourages clients to think beyond just immediate costs. By considering long-term needs, potential changes in employment, and personal financial obligations, you can make a choice that truly aligns with your goals.

- Assess Your Coverage Needs: Estimate your family’s financial requirements in the event of an unexpected loss.

- Consider Your Employment Situation: If you’re likely to change jobs, an individual policy offers more stability.

- Look at Term Life Insurance Quotes Online: Get a range of Term Life Insurance Quotes Online to compare options and understand the market rate for the coverage you’re seeking.

The journey toward choosing the right life insurance isn’t just about finding affordable rates; it’s about finding a plan that serves your family’s unique needs.

Why Canadian LIC is Your Partner in Life Insurance

Life insurance decision-making is a pretty daunting task, but with Canadian LIC’s years of experience, our team guides the client through the entire process. We do not merely sell policies; we know what real-life situations make life insurance crucial. Our informed agents offer insights from first-hand interaction with families across Canada who trust us to protect their futures.

If you’re willing to find Term Life Insurance Plans that fit your lifestyle, Canadian LIC can certainly help. Our team will be happy to guide and answer your questions regarding determining the coverage you’ll require and to provide Term Life Insurance Quotes Online for which you can budget with proper goals. With Canadian LIC, you are choosing a trusted partner dedicated to securing what matters most.

A Term Life Insurance from Canadian LIC is not just an investment in a policy; it’s a promise to your family toward financial security. So, let us begin securing our future today

More on Term Life Insurance

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs: Understanding Group Term Life Insurance & Individual Term Insurance in Canada

Generally, an employer usually gives a Group Term Life Insurance whereby all employees under a certain company fall into one insurance. Group term life gives the minimum form of protection, which depends on the income you make. The Group term life is, most of the time, rather cheap and sometimes absolutely free. On the other hand, Individual Term Life Insurance is a policy you buy on your own. This makes individual term insurance more flexible for investment purposes, especially for people with special needs who need insurance tailored to their specific requirements.

Yes, you can have both. Most of our clients find it useful to have both as, for example, the Group Term Life Insurance provided by your employer is often the minimum, and an individual term policy is found to complement this better for your family’s financial needs. It is a common practice that many use to guarantee themselves protection in all walks of life.

Group Term Life Insurance may be adequate here if the need is not heavy and your present employer has a good reason to be stable for at least a long period of time. However, if the financial burdens are increasing, for example, to finance a mortgage or pay for education if you have children, keeping all other debt in check, an individual term insurance may be able to cover that extra demand. When clients come to Canadian LIC with this question, we assess their overall financial picture to help them decide if additional coverage through Individual Term Life Insurance is wise.

Individual Term Life Insurance is actually an investment. You could have a policy term of ten to fifty years, which depends on what you require. You also get to decide how much coverage you will need to ensure that your family will be provided for. In this sense, you are not confined to the limitations of a group plan. For many clients, buying an individual plan is more of taking control over one’s financial future and having peace of mind in knowing there is always something for security. Canadian LIC generally interacts with clients who crave comfort and security that something has been placed there, particularly for them.

Getting Term Life Insurance Quotes Online allows you to compare policies, coverage amounts, and premiums quickly. Many people use these quotes to understand the market and get a sense of how much coverage they can afford within their budget. Canadian LIC provides an easy way to compare quotes so clients can see which plans offer the best value and align with their long-term financial goals.

No, Group Term Life Insurance is typically associated with your employment. When you leave that job, coverage typically ends or is very costly to continue individually. This is a serious issue for many Canadian LIC customers; it’s also a common situation for clients who have recently changed careers or are about to retire. For this reason, most people obtain an individual term life policy for continuity of coverage; the coverage ends when your employment does.

Some employers allow you to increase your coverage under their group plan, but it’s often limited. The increase may also come at a higher cost to you. If you need substantial coverage beyond what your employer provides, an Individual Term Life Insurance plan may be a better solution. Clients who need larger policies often consider individual plans that offer customizable coverage without the restrictions of group policies.

Group Term Life Insurance is generally more affordable or even free, as the employer usually subsidizes the cost. Individual Term Life Insurance typically costs more because you’re paying for it independently. However, the cost difference reflects the additional benefits of individual plans, such as greater flexibility, portability, and personalization. When comparing costs, Canadian LIC helps clients balance affordability with the level of protection they need.

Yes, it can be a sound investment if you have dependents, and this kind of insurance will definitely give you peace of mind because you know your family will not go broke in case of an event that occurs against you. Many clients consider investments in Term Life Insurance as securing the future of their families. Term Life Insurance can cover the mortgages, education of their children, and other debts. Canadian LIC has helped many Canadians understand the benefits of investing in Individual Term Life Insurance for long-term peace of mind.

Generally, benefits from Term Life Insurance are tax-free in Canada and, thus, an excellent way of providing for loved ones without any more tax burdens after death. In fact, despite the fact that the paid premiums cannot be used to claim tax deductions, the payout from the insurance company is actually tax-free. Many of our clients at Canadian LIC value the fact and feel confident about their families receiving the amount of benefit they have selected, tax-free.

The length of your term should match your goals and your family’s needs. Many clients choose a term to mirror their main financial responsibilities, such as paying a mortgage or having children in college. A 20-year or 30-year term may be suitable for a young family, and someone who is almost ready to retire might need a shorter term. Canadian LIC advises its clients to pick the term that best represents their life stage and obligation.

Yes, you may still be eligible for a Term Life Insurance policy despite health problems, but premiums will likely be higher. In fact, in some cases, group-Term Life Insurance policies do not require a medical exam. This is often a very good option for people who have health problems. However, individual policies do include health assessments. Canadian LIC works on the client’s behalf, identifying the best options available based on their health status while searching for group or individual plans that could possibly be suitable for them.

Obtain free Term Life Insurance Quotes Online and start comparing quotes from various plans. Canadian LIC gives our customers specific, well-crafted quotes with respect to all details of a plan and leading through an application process. We encourage you to have a list of questions ready and think about your family’s financial needs so you can choose the right plan with confidence. Applying for Term Life Insurance in Canada is straightforward, especially with expert guidance along the way.

Yes, Individual Term Life Insurance policies enable you to change your coverage as your needs change. Most people find that as other responsibilities arise, such as buying a home or starting a family, they are likely to require additional coverage. We help our clients update their policies so that their Term Life Insurance investment at all times aligns with their changing needs.

If you outlive your term, your coverage simply ends. In most cases, you opt to renew or convert into a Permanent Life Insurance Policy. Most of the clients walking into Canadian LIC decide on a renewal, especially when the client prefers to maintain uninterrupted coverage, but on account of aging, one has to pay a little extra premium. In many cases, conversion into Permanent Insurance Coverage is also available, which provides lifelong protection; subject to future needs, we help clients deliberate the same.

Yes, most Term Life Insurance policies include accidental death coverage. However, if you want extra protection for accidents, you can also purchase an accidental death benefit rider. The rider pays out additional money if the death of the insured person is caused by an accident. Canadian LIC helps clients evaluate riders who can improve their Term Life Insurance Investments without over-extending their budgets.

Age significantly impacts the cost of Term Life Insurance Quotes Online. Younger applicants generally pay lower premiums, as they pose a lower risk to insurers. The premium increases with age, and therefore, the earlier one obtains the plan, the more affordable it will be in the long run. At Canadian LIC, we advise our clients to obtain Term Life Insurance early enough to secure lower rates.

Typically, Term Life Insurance Plans in Canada don’t have a waiting period. Once your policy is approved and active, your coverage begins immediately. Some clients are surprised by this, as other types of insurance may include a waiting period. Canadian LIC ensures clients understand when their coverage starts and how it applies to their individual needs.

Yes, most Term Life Insurance policies have specific exclusions, such as suicide within the first two years of the policy or death resulting from criminal activities. These exclusions can vary, so it’s important to read your policy carefully. At Canadian LIC, we review these details with our clients so they fully understand what their Term Life Insurance plan covers and what it doesn’t.

Term Life Insurance covers you for a specific period, usually 10 to 50 years, and is often more affordable. On the other hand, Whole Life Insurance provides lifelong coverage and includes a cash value component, making it more expensive. Many clients initially prefer Term Life Insurance Plans for their lower premiums and simplicity, especially when their focus is on Term Life Insurance Investments for specific financial goals.

Yes, most Term Life Insurance Canada providers allow both monthly and annual payment options. Many people find that paying annually can even save money on premiums. At Canadian LIC, we help clients compare payment options and find the one that best fits their budget so they feel confident in managing their policy costs.

If you miss a payment, most insurers offer a grace period (typically 30 days) to catch up before coverage lapses. If payments remain unpaid after this period, the policy may be cancelled. We always advise clients to stay on top of payments to avoid losing their coverage. Canadian LIC also assists clients in setting up automatic payments to make premium management easier.

Yes, you can cancel your Term Life Insurance policy at any time without penalties, though you won’t receive a refund for the premiums paid. Some clients reconsider their coverage as their financial situation changes, and Canadian LIC supports them in making decisions that are financially sound. However, we encourage clients to weigh the long-term impact before cancelling, as starting a new policy later may cost more.

Most Term Life Insurance sold in Canada is renewable. You can renew the coverage after your term is done, but the renewal price tends to be higher due to the fact that this renewal rate is quoted when you renew. Canadian LIC presents these options to its clients and works with those clients to determine whether this type of renewal makes financial sense based on the family’s needs and the client’s available income.

Yes, your health is a key factor in determining your premium. Insurers typically review your medical history, lifestyle, and habits like smoking. Clients with excellent health often receive lower rates, while those with health risks may face higher premiums. At Canadian LIC, we guide clients through this process, helping them understand how health factors impact costs and exploring options that fit within their budget.

If you die within the term, Term Life Insurance Plans will pay out tax-free to your beneficiaries. This benefit can help keep up with the ongoing family expenses, including paying off your home, everyday lifestyle, education fees, and many other things. Often, it’s a big consolation for the client when they know that Term Life Insurance can be used as a good safety net, securing daily life without much worry over financial burdens.

The above FAQs represent some of the common questions people often raise when thinking about Group and Individual Term Life Insurance. Whether you are thinking about investing in term life or just want some peace of mind, Canadian LIC will help you make an informed decision that will suit your family’s needs.

Sources and Further Reading

For a deeper understanding of Group Term Life Insurance and Individual Term Life Insurance in Canada, consider exploring the following resources:

- TD Insurance: Offers insights into the differences between employer’s Group Term Life Insurance and Individual Term Life Insurance, helping you make informed decisions.

TD Insurancel - Savvy New Canadians: Explains how group life insurance works in Canada, its benefits, and how it compares to personal life insurance.

Savvy New Canadians - Manulife & CAA: Discusses the differences between group and individual life insurance, offering perspectives to help you choose the right coverage.

Manulife Insurance - Canada Revenue Agency: Provides information on Group Term Life Insurance policies and employer-paid premiums, including tax implications.

Canada.ca

These resources offer valuable information to help you understand the nuances of life insurance options in Canada.

Key Takeaways

- Coverage and Cost: Group Term Life Insurance is often affordable or free through employers, providing basic coverage. Individual Term Life Insurance, although typically more expensive, offers flexibility and allows for higher coverage amounts tailored to your needs.

- Portability: Group Term Life Insurance is tied to your employment, meaning it usually ends if you leave the job. Individual Term Life Insurance, on the other hand, is fully portable, ensuring you stay covered regardless of employment changes.

- Customization and Control: Individual Term Life Insurance provides full control over policy details, such as term length, coverage amount, and additional riders. Group policies are limited in customization and are controlled by the employer’s terms.

- Medical Exam Requirements: Group term insurance generally does not require a medical exam, making it accessible to those with health concerns. Individual policies typically involve medical underwriting, impacting rates based on health and lifestyle.

- Renewability and Conversion: Individual Term Life Insurance policies often offer renewability and can be converted to Permanent Coverage options, giving you long-term security. Group Term Life Insurance usually lacks these options, limiting flexibility in the future.

- Complementary Approach: For comprehensive protection, combining group and Individual Term Life Insurance can be beneficial. Group insurance offers foundational coverage, while individual insurance provides additional, customizable security.

- Financial Security for Loved Ones: Both types of insurance can play an essential role in securing your family’s financial future, but Individual Term Life Insurance Investments provide a more personalized and lasting safety net.

Your Feedback Is Very Important To Us

Thank you for sharing your experience with Group Term Life Insurance and individual term insurance. Your insights will help us understand the challenges you face and how we can provide better guidance. Please take a few moments to answer the questions below.

Thank you for your feedback! Your responses will help us tailor our services and offer guidance that aligns with your needs.

IN THIS ARTICLE

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- Understanding Group Term Life Insurance

- Pros and Cons of Group Term Life Insurance

- Group Term Life Insurance Pros and Cons

- Understanding Individual Term Life Insurance

- Pros and Cons of Individual Term Life Insurance

- Individual Term Life Insurance Pros and Cons

- Comparing Group Term and Individual Term Life Insurance

- Group Term V/S Individual Term Life Insurance