Imagine you have arrived in Canada to see its beauty and enjoy the modernity of its cities. During your stay here, things get overwhelming, and you feel anxious, which spirals down into a mental health crisis. The last thing you want to worry about in such a vulnerable moment is whether your Visitor Insurance covers mental health services. This concern is more common than you might think, and we frequently hear it from our clients at Canadian LIC.

“Does Visitor Insurance cover mental health services?” is probably among the top questions we come across. Yes, dealing with visitor health insurance can be tricky, more so when mental health issues are at play. In this blog, we will draw from some common concerns and real-life stories our clients have shared and guide you through the pitfalls of Visitor Insurance Policies.

The Basics of Visitor Insurance

Visitor Insurance protects one from devastatingly high costs when sudden medical emergencies strike while visiting Canada. While most people are aware of the coverage that it provides for physical illnesses and accidents, there’s often uncertainty when it comes to mental health services.

Coverage for Mental Health Services

Varying Policies and Their Limits

There are differences among Visitor Insurance Policies. Some policies do offer coverage for mental health services, but this is often subject to specific terms and conditions. For example, emergency psychiatric care might be covered, but routine therapy sessions might not be.

Here at the Canadian LIC, we have seen how people could assume they have all-rounded coverage, and they come to find out mental health care isn’t covered. For example, one of our clients, Sana—on a visitor’s policy—had an illness in which the therapy sessions were not covered in her policy. Endless pockets of expenses surrounded her after falling extremely ill in Toronto. This highlights the importance of thoroughly understanding your policy’s coverage limits.

The Importance of Reading the Fine Print

Visitor Insurance can be complex, and the details around mental health coverage are usually quite discreetly placed within the fine print. It’s super important for you to either read and get your head around policy documents or talk with an insurance advisor who can point it out to you.

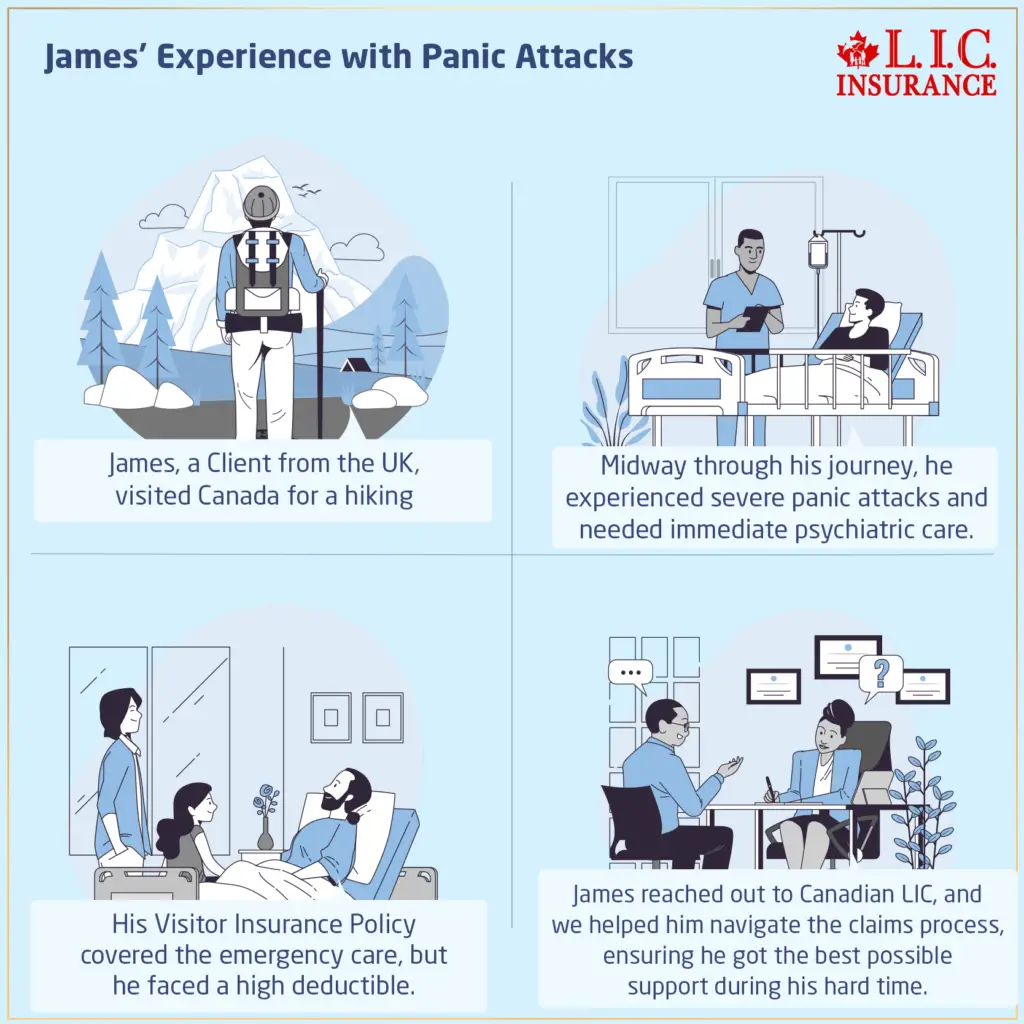

One of the stories was about one really close client of ours, Jai. He visited Canada on a business trip and had a panic attack. He assumed his health insurance for visitors to Canada also catered for emergencies in mental health. However, upon contacting us in distress, we reviewed his policy and found that while his Visitor Insurance Policy did cover emergency psychiatric care, it had a high deductible that he wasn’t prepared for.

Emergency vs. Non-Emergency Situations

Visitor Insurance normally makes a very big difference between medical emergency and non-emergency circumstances. Emergency situations, such as a sudden psychiatric episode requiring hospitalization, are more likely to be covered. In contrast, non-emergency mental health services, such as regular counselling sessions, are often excluded or available for a very low coverage amount.

For Maria’s month-long stay in Canada to attend her daughter’s wedding, she really needed regular counselling, as she was already managing anxiety. The only insurance she had for being a visitor was coverage for emergencies with a psychiatrist, not her regular therapy. Unfortunately, this means she now has no support to manage the crisis from within while on a visit.

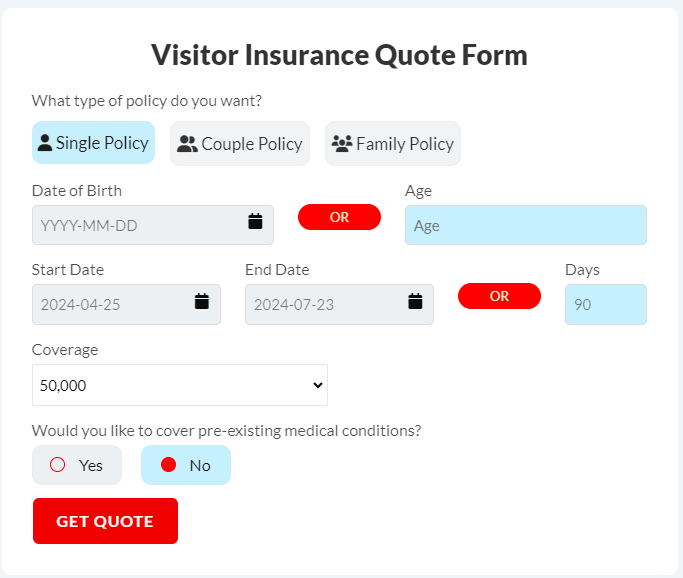

Exploring Visitor Insurance Quotes

Obtaining Accurate Quotes

When shopping for Visitor Insurance Quotes, it’s essential to ask specific questions about mental health coverage. Be upfront about your needs and any pre-existing medical conditions to get accurate quotes that reflect potential costs.

Canadian LIC often helps clients navigate this process. For instance, when Rajvendra, an international student, came to us, he needed a Visitor Insurance Policy that included mental health services. By discussing his requirements in detail, we provided him with several Visitor Insurance Quotes that included mental health coverage, ensuring he had the protection he needed.

Comparing Different Plans

Comparing Visitor Health Insurance Plans is crucial to finding one that best suits your needs. Look beyond the price and consider the coverage limits, exclusions, and network of healthcare providers.

We often advise clients to not only compare the premiums but also the coverage details. One of our clients, Elena, was visiting Canada and needed Visitor Insurance. Initially, she chose the cheapest plan, but upon our recommendation, she compared it with a slightly more expensive plan that offered comprehensive mental health coverage. This decision ultimately saved her significant stress and expense when she needed to seek psychiatric care during her visit.

Stories from Canadian LIC

James’ Experience with Panic Attacks

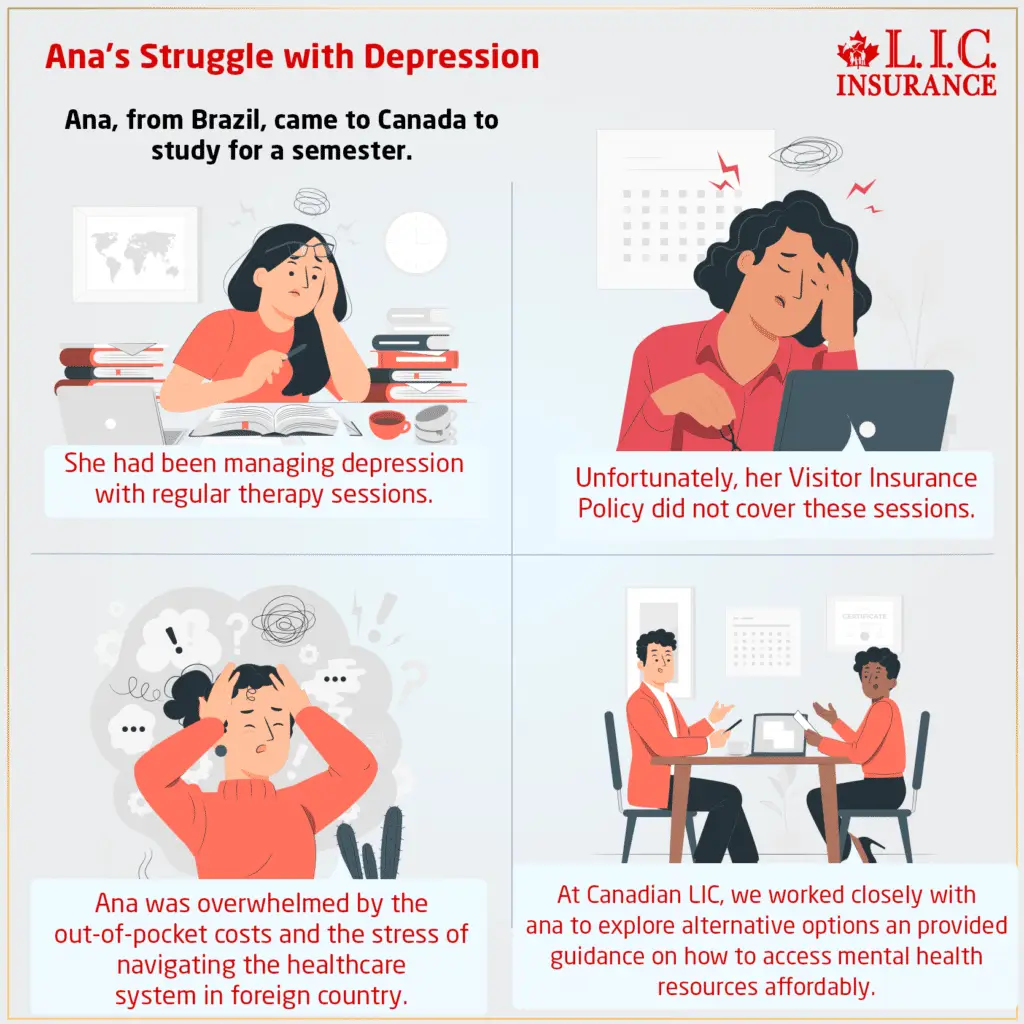

Ana’s Struggle with Depression

Understanding the Coverage Details

Policy Exclusions and Limitations

All Visitor Insurance plans come with exclusions and restrictions. The list of such exclusions may lead to a big impact on your visit with regard to mental health details and services. Some of the common ones are pre-existing conditions, such as therapy sessions that do not constitute an emergency or alternative treatments.

For instance, one of the clients, Li, had a problem with her insurance policy not covering her pre-existing anxiety. She was unaware of this exclusion until she needed care. At Canadian LIC, we always assure our clients that these are some of the details one ought to know so as not to get surprised at the last minute.

Seeking Professional Advice

There are so many options under Visitor Insurance Policies that one may get overwhelmed. The professional advice of an insurance broker, such as Canadian LIC, will help you understand the nitty-gritty details of various plans and make a wise choice.

We’ve had numerous clients who, like Sara from Germany, were initially confused about their policy details. Sara needed to understand whether her Visitor Insurance Policy covered her ongoing therapy sessions. By consulting with us, she gained clarity and chose a plan that provided the necessary coverage, giving her peace of mind during her stay in Canada.

The Importance of Mental Health Coverage

The Growing Need for Mental Health Services

Mental illness is now incorporated into the broader definition of health. The pressure of travel, adjustment to new environments, and being away from home can all exacerbate mental illness.

For example, an Indian IT professional, Rajiv, received an opportunity for a long-term project in Canada. Heavy anxiety due to work pressure and being away from family has led to severe consequences in his life. Luckily enough, since the Visitor Insurance Policy covered emergency psychiatric care, he was able to get support without much concern regarding paying an enormous sum for the same reason.

Ensuring Comprehensive Coverage

Visitors should ensure that their Visitor Health Insurance package includes mental health services. This would help protect the visitors from inflated prices charged against such emergency mental health situations by providing proper coverage and access to their needed care.

This very outcome came to be for one of our clients, Linda, when she opted for a comprehensive Visitor Insurance Policy. During her visit, she had both medical and psychiatric care needs. Her Visitor Insurance Policy covered both, saving her from heavy financial strain and allowing her to focus on recovery.

The Final Verdict

Visitor Insurance can sometimes be quite tricky to navigate and very hard to understand. Canadian LIC sees firsthand the frustration clients go through in finding the very best health insurance available that will satisfy their many needs. From having pre-existing conditions regarding your mental health to needing peace of mind while staying, finding the right visitor unplanned plan with good coverage is paramount.

Do not take chances with your mental health. Consult the best insurance brokerage for personalized advice on insurance policies and acquire Visitor Insurance Quotes to be fully covered and protected. Your peace of mind is invaluable. So take action today and secure peace of mind while visiting Canada.

More on Visitor Insurance

Can Family Members Visiting Together Get A Group Discount On Visitor Insurance?

Are There Any Age Restrictions For Purchasing Visitor Insurance?

What Documents Do I Need To Buy Visitor Insurance?

How Do You File A Claim For Visitor Insurance?

Can I Extend My Visitor Insurance If I Decide To Stay Longer?

Which Visitor Insurance Is Best?

Is Visitor Insurance Mandatory?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs on Visitor Insurance Covering Mental Health Services in Canada

Not all Visitor Insurance plans are similar in covering mental health. While some visitor health insurance products can include emergency psychiatric care, others may exclude regular therapy sessions. At Canadian LIC, we’ve had cases like our client Seema, who discovered that her Visitor Insurance excluded mental health services only when she needed them. You must read the fine print or seek advice from a professional to ensure you’re properly covered.

The details concerning coverage can be known either by carefully reading the policy document or contacting one’s insurance provider. In Canadian LIC, we would suggest that clients get a specific quote concerning mental health while buying Visitor Insurance. For instance, while searching for coverage, we made sure to provide Rajvendu quotes where his mental health services are well explicit.

There are a few Visitor Health Insurance Plans that will offer coverage for pre-existing conditions, while other Visitor Insurance plans of a specific type may exclude pre-existing conditions related to mental illness. We helped Lokesh through when she came to know that her anxiety had not been covered by Visitor Insurance. Therefore, it is important to disclose all your pre-existing conditions so you can decide which is the right policy for providing proper protection.

In a mental health emergency, contact your insurance provider immediately for guidance on seeking care. At Canadian LIC, we’ve assisted clients like James, who had a panic attack during his visit. His Visitor Insurance Policy covered emergency psychiatric care, and we helped him through the claims process to ensure he received the necessary support.

Yes, it is possible to purchase a Visitor Insurance Policy after arrival in Canada, but it is highly recommended to do so pre-departure in order to enable immediate coverage. Upon learning that her visitor health policy did not cover her therapy sessions, Ana contacted us, and we could arrange an alternative for her even though she was already in Canada at that time.

After all, comparing Visitor Health Insurance Plans should go far more in-depth than just the premiums; look into the coverage limits and exclusions, including the network of providers for health care services available in the plan. We helped Elena, who initially chose the cheapest plan without realizing it excluded mental health services. She found a plan that provided comprehensive mental health coverage by comparing multiple Visitor Insurance Quotes.

Most Visitor Insurance Policies include coverage for emergency psychiatric care, but they won’t necessarily include coverage for routine therapy visits—never mind a typical situation involving a shopper like Maria, who was visiting for the graduation of her daughter and would have wanted to receive regular counselling. Her Visitor Insurance would cover only emergency cases. This knowledge will help you to choose a plan that suits your needs for mental health care.

Contact your Canada travel insurance company immediately if your parents become ill during the visit. Most companies have hotlines open 24 hours a day, seven days a week. Take the insurance information with your parents so that he or she will be able to present it at the health facilities if needed. This will streamline the treatment from their own initiative, just the way it would have helped in Alex’s case when his mother needed urgent care after falling.

When seeking an accurate Visitor Insurance Quote, do also disclose your mental health needs and, generically, the pre-existing conditions. In our case, we at Canadian LIC assist clients like Raju by discussing his specific needs and providing quotes, which will include the potential costs associated with his mental health, to ensure the purchase of a policy that provides the necessary protection.

In case of denial, go through the policy terms and conditions again, then approach your insurance provider to understand what went wrong. At Canadian LIC, we have stood by our clients, including John, who had a very high deductible for the emergency psychiatric care he received. We guided him through the appeal process and helped him collate documents in support of his claim.

Mental health issues can arise unexpectedly, especially when travelling. Such a policy will ensure protection from exorbitant medical bills and various other medical expenses related to visitor health and access to primary medical treatment. Linda’s experience underscores this importance; her Visitor Insurance Policy covered both medical and psychiatric care, saving her from significant financial strain during her visit to Canada.

Make sure that your Visitor Insurance Policy covers your particular mental health needs by discussing your needs in great detail with your insurance broker. We have many instances like Siya’s, who came to us for insurance on a continuous basis for therapy sessions. We knew her needs and could cater to her by presenting the Visitor Insurance Quotes that cover all her needs, including the mental health services she required.

Deductibles and co-pays can significantly impact your out-of-pocket costs for mental health services. Understanding these terms is crucial. For example, Johny faced a high deductible for his emergency psychiatric care, which affected his finances. At Canadian LIC, we explain these details to our clients, helping them choose Visitor Insurance plans that minimize unexpected expenses.

Many Visitor Insurance Policies do have some common exclusions to coverage for pre-existing mental conditions and non-emergency therapy sessions. One of our clients, Luv, was going through anxiety but was shocked that this condition was not covered under the Visitor Insurance Policy. The client needs to be made aware of these exclusions so that he/she is not surprised in times of need.

In case of denial of your mental health claim, check the policy terms and collect all related documents for appeal. Initially, when the claim was denied, we assisted Joy in understanding the reason behind the denial and how to appeal. We are guiding him to get through to the help he is receiving.

Yes, visitors to Canada can access a wide range of mental health services, including those of a community or helpline nature. At Canadian LIC, we often direct clients like Meesha to these resources when their Visitor Health Insurance Plans don’t cover all of their needs so that they can access the necessary support, even if they are not fully covered.

One has to be mindful of the coverage for mental health services under Visitor Insurance, however complex it might be, to make their stay in Canada worry-free. At Canadian LIC, we see the struggles our clients face and understand the essence of helping them get a suitable Visitor Health Insurance Plan. Whether you have been dealing with lingering mental health problems or just want to have overall peace of mind, it becomes extremely imperative to look for a Visitor Insurance Policy that incorporates mental health services. For tailor-made advice and the right Visitor Insurance Quotes, get in touch with Canadian LIC—the top insurance brokerage. Your mental health matters; the right coverage can make a world of difference. Take action now to secure peace of mind during your visit to Canada

Sources and Further Reading

Canadian Life and Health Insurance Association (CLHIA)

Explore the guidelines and coverage options provided by the Canadian Life and Health Insurance Association. CLHIA – Insurance Information

Mental Health Commission of Canada

Access resources and information about mental health services available in Canada. Mental Health Commission of Canada

Canadian Mental Health Association (CMHA)

Discover support and resources for mental health, including services available to visitors. Canadian Mental Health Association

International Travel Insurance Group (ITIG)

Compare different Visitor Insurance Policies, including those that cover mental health services. ITIG – Travel Insurance Comparison

Insurance Bureau of Canada (IBC)

Get information on various insurance options, including health insurance for visitors. Insurance Bureau of Canada

Visitor Insurance Canada

Detailed guides and comparisons of Visitor Insurance plans tailored for those visiting Canada. Visitor Insurance Canada

Canadian Psychiatric Association (CPA)

Insights into psychiatric care standards and access in Canada. Canadian Psychiatric Association

Key Takeaways

- Visitor Insurance Policies vary in mental health coverage.

- Review policy details carefully or consult an advisor.

- Emergency psychiatric care is often covered, but regular therapy may not be.

- Clearly state mental health needs when seeking insurance quotes.Clearly state mental health needs when seeking insurance quotes.

- Be aware of exclusions like pre-existing conditions and non-emergency services.

- Some policies allow customization to include mental health services.

- Consult an insurance broker for help navigating complex policies.

- Real-life stories show the importance of understanding your coverage.

- Canada offers mental health resources for visitors beyond insurance.

- Choose a policy with mental health coverage and seek professional advice.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]