- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Does the Term Life Cover Accidental Death?

- What Does Term Life Insurance Cover?

- How Does Accidental Death Impact Term Life Insurance Investments?

- Understanding the Role of Term Life Insurance Rates

- Common Exclusions to Keep in Mind

- Standard Term Life Insurance Plan vs. Term Life Insurance Plan with Accidental Death Rider

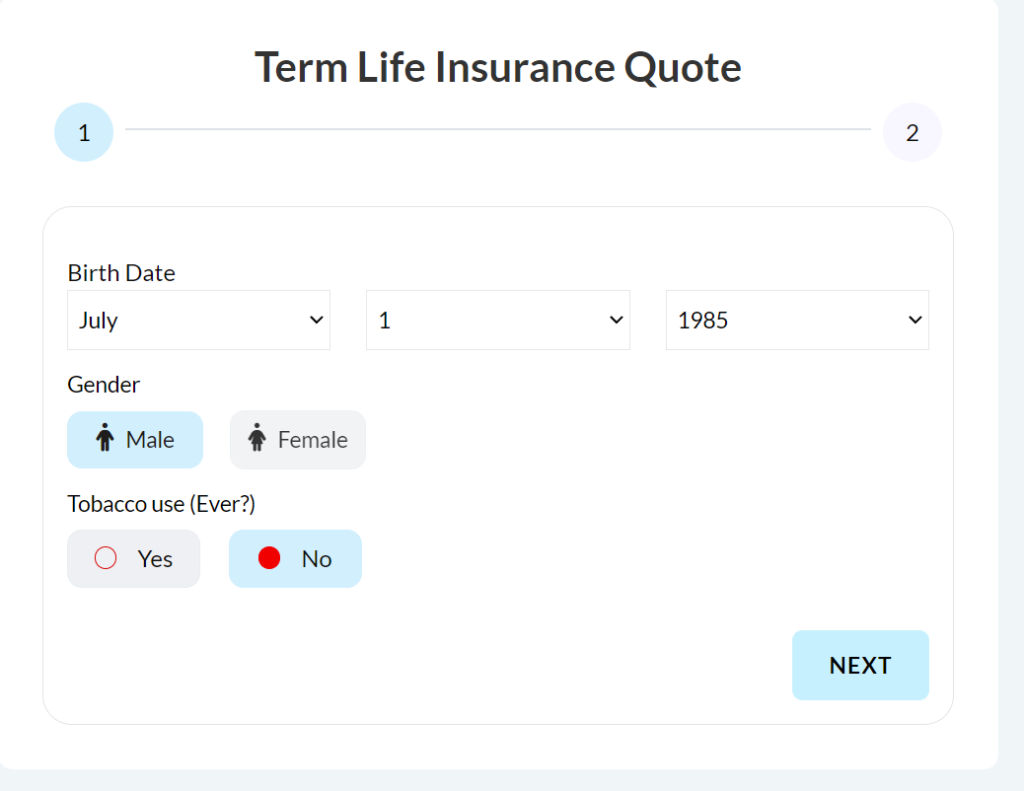

- Why Consider Term Life Insurance Quotes Online?

- How to Maximize Your Term Life Insurance Coverage

- What Makes Canadian LIC the Best Choice?

Does The Term Life Cover Accidental Death?

By Pushpinder Puri

CEO & Founder

- 11 min read

- December 9th, 2024

SUMMARY

When we talk about protecting our families financially, Term Life Insurance often becomes part of the conversation. Yet, one common question people ask is, “Does Term Life Insurance cover accidental death?” This question usually arises from confusion around the different types of insurance and their scope of coverage.

Many people have struggled to understand the nitty-gritty details of Term Life Insurance. One example is a client we recently had at Canadian LIC who expressed her concern as to whether her Term Life Insurance would support her if her husband died in a car accident. Such concerns are not only about money but also about ensuring peace of mind for loved ones.

In this blog, we’ll explore the answer to this important question while also delving into how Term Life Insurance Investments, Term Life Insurance Rates, and choosing the right Term Life Insurance Plan can make all the difference. Let’s uncover the facts to help you make informed decisions.

What Does Term Life Insurance Cover?

A Term Life Insurance Plan pays out for your loved ones in case of your death during the term of the policy. What is “passing away”? And what does it include? Generally, Term Life Insurance covers any kind of death, including natural causes, illness, and accidental death.

But this will be paid only if the policy is in existence at the time of death. Now, let’s consider a case study based on our experience with Canadian LIC. A young father opted for Term Life Insurance when his first child was born. Unfortunately, he died in an accident in his workplace. His family will now be assured of carrying out their lifestyle and expenses since he left his money for them in the policy.

Key Takeaway: Term Life Insurance covers accidental death if the terms and conditions are met. This insurance is, therefore, important for anyone wishing to safeguard their family against unexpected events.

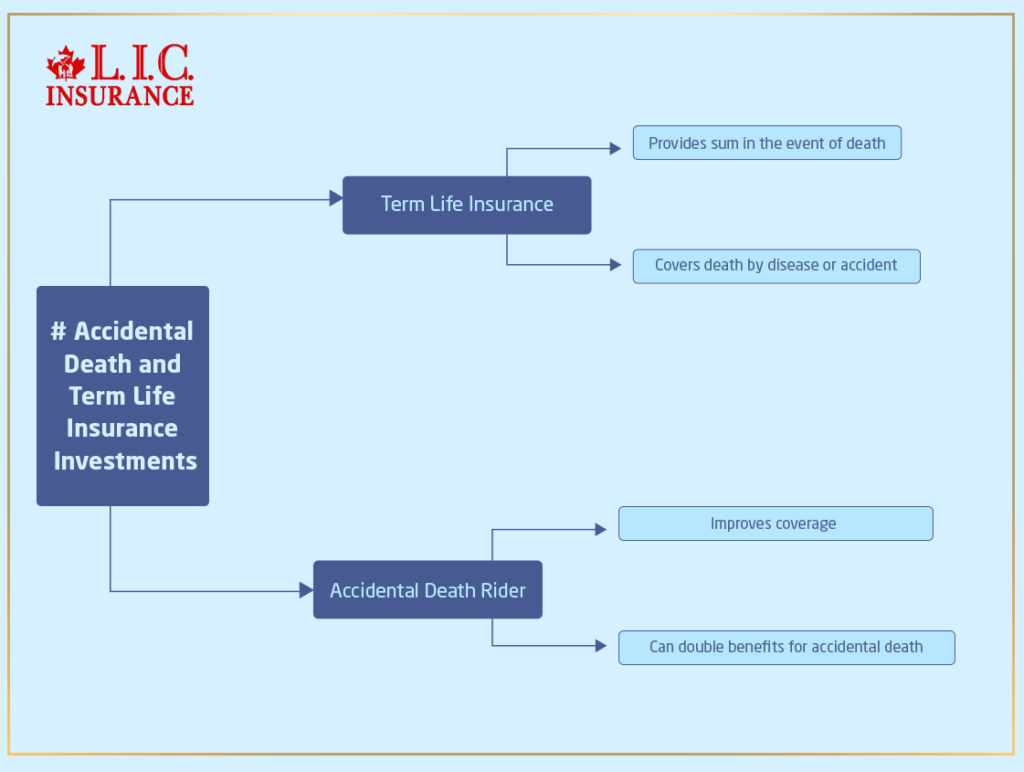

How Does Accidental Death Impact Term Life Insurance Investments?

The most attractive feature of Term Life Insurance Investments is how easy it is to understand. The amount of money you pay is there to provide a sum in the event of your death within the term. Whether your death is caused by disease or accident, the amount received is usually the same.

But sometimes, riders such as accidental death can improve policyholders’ coverage. These accidental death riders may even double the benefit in case of an accidental death. A client of ours added an accidental death rider to his policy because his job was a travel job. His base Term Life Insurance Policy was pretty adequate, but the rider would give his family additional security.

Key Takeaway: Accidental death does not diminish the value of your Term Life Insurance Investments. Instead, it underscores the importance of customizing your policy to suit your needs.

Understanding the Role of Term Life Insurance Rates

An additional point to be understood is how the Term Life Insurance Rates are calculated. The rate of Term Life Insurance is further impacted by factors such as age, health condition, lifestyle, and the duration of the term policy. Adding riders to your policy, like accidental death coverage, adds a little cost but does more in terms of protecting one’s interests.

One of our clients, a young mother, was initially hesitant to have an accidental death rider as she felt it added some cost. After discussing these concerns with her, we demonstrated how a slight increase in her premium could offer her family much better protection than the rider. Seeing the bigger picture made her decide to have more coverage.

Key Takeaway: Term Life Insurance Rates may vary, but including accidental death coverage doesn’t drastically increase costs. It’s a worthwhile consideration for anyone looking for added security

The Importance of Choosing the Right Term Life Insurance Plan

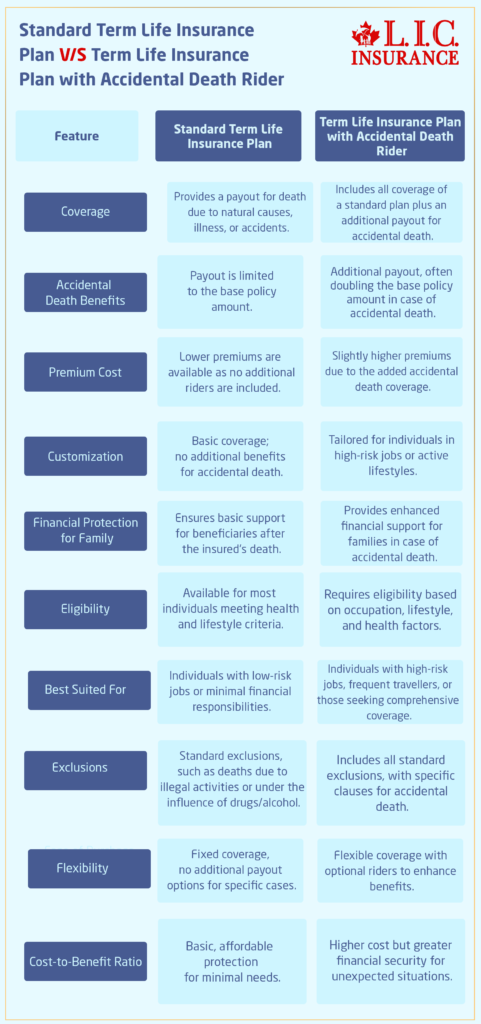

It is more than just comparing Life Insurance premiums when selecting the right Term Life Insurance Plan. You have to understand the coverage details, whether accidental death is covered, and if any additional riders might be beneficial.

We at Canadian LIC have helped many clients who were in the process. One client was a small business owner who wished for his family to be able to survive in case there was an unexpected tragedy by reviewing his options. Therefore, he opted for the Term Life Insurance Policy coupled with an accidental death rider in order to ensure his family would be protected in whatever circumstances.

Key Takeaway: The difference between making and breaking when securing your family’s future may well be made with the right Term Life Insurance. Feel free to shop around for policies that provide accidental death riders to get additional peace of mind.

Common Exclusions to Keep in Mind

While Term Life Insurance usually covers accidental death, there are some significant exclusions that one needs to know. These include:

- Death by illegal activities or rash behaviour.

- Death from war or terrorism

- Accidents while drunk or under the influence of drugs

It helps prevent some nasty surprises for your beneficiaries. We helped a couple at Canadian LIC, who initially were not aware of such exclusions. We made them review their policy, and then they made necessary corrections so that their coverage was aligned with their expectations.

Key Takeaway: Familiarize yourself with the exclusions of your Term Life Insurance Policy to ensure there are no gaps in coverage.

Standard Term Life Insurance Plan vs. Term Life Insurance Plan with Accidental Death Rider

Why Consider Term Life Insurance Quotes Online?

Finding the correct Term Life Insurance doesn’t necessarily overwhelm you. Term Life Quotes may now be easily compared from various policies online, taking in a whole set of coverage and options offered for a minimal time cost. If you happen to have in mind adding some sort of accidental death rider into the package, compare more.

Many clients of Canadian LIC have greatly benefited from this process. For instance, one busy professional used online comparison tools to acquire a Term Life Insurance rate and plans that he settled on. Online quotes were mainly convenient and clear, giving him the security of making the right choice.

Key Takeaway: Comparing Term Life Insurance Quotes Online simplifies the process and helps you find a policy that fits your needs and budget.

How to Maximize Your Term Life Insurance Coverage

If accidental death coverage is of much importance to you, then follow these tips to get the most from your Term Life Insurance Plan.

- Check your needs: Check your financial responsibilities, like debts, mortgaged houses, and future family needs.

- Consider Riders: Accidental death riders can significantly enhance your policy’s benefits.

- Compare Rates: Use free online tools to compare Term Life rates and find the best price.

- Consult Experts: Work with trusted brokers like Canadian LIC to customize your coverage according to your needs.

Key Takeaway: Maximizing your Term Life Insurance coverage ensures your loved ones are fully protected, even in unforeseen circumstances.

What Makes Canadian LIC the Best Choice?

We at Canadian LIC have helped hundreds of families ensure their futures with personalized Term Life Insurance Plans. With our expertise, you understand what your options are, even the subtle differences between accidental death coverage. We believe that our clients should be able to make informed decisions for their financial security.

Recently, one family whose Term Life Insurance we serviced shared with us how this policy provided them with so much relief during a very tough moment. This is why we’re committed to delivering policies that offer both value and comprehensive coverage.

Partnering with a knowledgeable and compassionate broker can make the process of choosing Term Life Insurance seamless and stress-free.

The Bottom Line

Accidental death is one thing that is hard to predict, and yet, by getting the right Term Life Insurance, you can provide your loved ones with security financially. You can also create an appropriate policy for yourself by knowing the options of accidental death riders and Term Life Insurance Quotes Online.

Whether you are a newcomer or looking to develop a new policy, Canadian LIC is here to assist. Contact us today, and let’s get to securing your loved ones.

More on Term Life Insurance

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

Frequently Asked Questions About Term Life Insurance and Accidental Death

Yes, Term Life Insurance does cover accidental death. So, if the policy is active when the insured person dies by accident, then the Life Insurance payout goes to the beneficiaries. This has relieved many of our clients at Canadian LIC to find out that their Term Life Insurance covers accidental death.

No, most Term Life Insurance Policies treat deaths by accidents just like deaths caused by other natural causes or illnesses. Adding an accidental death rider to your plan, though, can provide extra coverage. Adding such a rider may cause your payout for accidental deaths to be higher, allowing your beneficiary more money.

Indeed, you can add accidental death coverage to your Term Life Insurance Policy by using a rider. One of our customers, who had a more physically demanding job, added this rider as this may help his family be assured of additional protection in the case of accidents. Riders are generally inexpensive and may help strengthen your coverage.

Adding an accidental death rider does add a slight increase in your Term Life Insurance costs, but many families can easily justify this extra protection. Recently, we were able to help one young couple balance their budget in such a way that included adding this rider for the important financial safety net needed.

Your age, health, lifestyle, and the length of the policy determine the rates for Term Life Insurance. In addition, adding riders such as accidental death coverage will also affect the premium. We help our clients compare Term Life Insurance Quotes Online at Canadian LIC so they can get the best balance between coverage and cost.

Death caused by illegal activities, reckless behaviour, or by drug or alcohol use is excluded from some policies. One client we dealt with was surprised by the exclusions; however, knowing them helped her make the right choice in selecting a Term Life Insurance Plan for her family.

You can compare Term Life Quotes Online through reputable insurance firms or brokers. This facilitates the comparison of different policies, time durations, and riders for accidental death coverage. One of our customers found this very helpful in selecting a plan tailored to his family’s needs.

Indeed, riders to cover accidental death can be made specifically fitting one’s job or lifestyle. Such as, a person whose line of work is risky might prefer greater coverage against accidental death. We at Canadian LIC have many customers who are in the process of choosing just the right Term Life Insurance for their individualized condition.

Generally speaking, though it may increase your premium rate minimally, Term Life with accidental death coverage is worth the money. Many times, clients have expressed that it’s worth the little expense for peace of mind so that when they are gone, all their loved ones will indeed take care of themselves.

At Canadian LIC, we are helping clients navigate through the Term Life Insurance options, and we ensure that clients are well aware of accidental death coverage benefits. We guarantee that you find a plan that meets your family’s financial goals and provides comprehensive protection.

Most Term Life policies cover accidental death as an added feature of the standard policy. However, some policies may require an accidental death rider for additional benefits. In the case of some of our clients at Canadian LIC, this was one of the changes that was made to accommodate their unique needs.

A basic Term Life Insurance covers death by natural causes, sickness, or accident. A rider for accidental death boosts the payout in the event of death due to an accident. One of our clients appreciated the added security when they learned this rider doubled the payout for their family.

Yes, most insurance companies allow you to modify your policy over time. For example, one of our clients cancelled the accidental death rider once their financial responsibilities had lessened. This way, you pay for only what you need.

Accidental death riders are particularly quite useful for those with risky professions or lifestyles. A construction worker chose this rider because of the additional protection it would give to his family.

Online quotes for Term Life Insurance take minutes. In fact, most of our clients can get the quotations done in minutes for rate and coverage comparisons. The one family we helped first went to an online site to narrow down the options, and then they settled the matter with us.

Your health significantly influences Term Life Insurance Rates. A healthy client who does not smoke achieves lower premiums, showing how staying healthy is very important at the time of applying for coverage.

Yes, in case needs change, a term insurance plan can easily be exchanged for another. One of our customers had opted for the most simple plan but upgraded to a policy with an accidental death rider after he started working at a new job. Going through review options regularly is the first step to making your plan relevant.

Yes, Term Life Insurance Investments pay when one seeks to secure one’s family’s future. We worked with a young couple who stated that the policy gave them the confidence that their children would be taken care of no matter what might happen.

Yes, accidental death coverage can be combined with other riders, such as Critical Illness or Disability Coverage. One client wanted complete protection for his family. He found that combining those riders provided excellent coverage without much increase in the premium.

If you survive your Term Life Insurance Plan, the policy simply lapses. However, some clients choose to convert their Term Plan into Permanent Life Insurance or to renew it for another term. In fact, we have assisted many people in evaluating their options before the end of their term.

Online Term Life Insurance Quotes enable you to compare policies and find the most suitable one that fits your budget. In fact, one of my recent clients shared how this process allowed them to secure a policy with an accidental death rider that fit their specific needs.

If you are not eligible for accidental death coverage because of certain exclusions, you can still take advantage of a basic Term Life Insurance Policy. One client who was unable to add the rider because of health issues was glad that the basic policy gave his family the protection they needed.

Sources and Further Reading

- Sun Life Canada – Accidental Death Insurance: This page provides insights into accidental death insurance, including eligibility criteria and coverage details.

Sun Life - TD Insurance – Accidental Death Insurance: TD Insurance offers information on accidental death coverage, highlighting its importance and the financial support it provides in unforeseen circumstances.

TD Insurance - Canada Life–Term Life Insurance: This resource explains how Term Life Insurance works in Canada, detailing coverage periods, costs, and exclusions.

Sun Life - MoneySense – Guide to Life Insurance in Canada: MoneySense offers a comprehensive guide on life insurance, discussing different types of policies, their costs, and considerations for choosing the right coverage.

MoneySense - Investopedia – Term Life Insurance: This article provides an overview of Term Life Insurance, including its benefits, types, and how it compares to other life insurance options.

Investopedia

Key Takeaways

- Term Life Insurance Covers Accidental Death

Most Term Life Insurance Plans include accidental death coverage, ensuring beneficiaries receive a payout if the insured passes away due to an accident. - Accidental Death Riders Enhance Coverage

Adding an accidental death rider to your Term Life Insurance Plan can provide additional financial benefits, often doubling the payout in case of an accidental death. - Affordable Protection for Families

Term Life Insurance Rates remain cost-effective even when including riders. It’s an affordable way to secure your family’s financial future. - Exclusions to Be Aware Of

Accidental death coverage does not apply in cases involving illegal activities, reckless behavior, or deaths caused under the influence of drugs or alcohol. - Customizable Policies for Your Needs

Term Life Insurance Plans can be tailored with riders like accidental death coverage, critical illness coverage, and more, to align with your unique lifestyle and financial responsibilities. - Comparing Term Life Insurance Quotes Online Helps

Reviewing Term Life Insurance Quotes Online simplifies the process of finding the right policy for your budget and needs. - Accidental Death Coverage Is Especially Useful for High-Risk Jobs

Individuals in high-risk professions benefit significantly from policies with accidental death coverage, providing extra security for their families. - A Trusted Broker Makes the Process Easier

Working with an experienced broker like Canadian LIC ensures you get the right coverage without confusion or hidden surprises.

Your Feedback Is Very Important To Us

We value your input! Please take a few minutes to share your thoughts and experiences regarding Term Life Insurance and accidental death coverage. This will help us address your concerns more effectively.

Thank you for your valuable input! Your responses will help us provide clearer and more tailored support for your Term Life Insurance needs.

IN THIS ARTICLE

- Does the Term Life Cover Accidental Death?

- What Does Term Life Insurance Cover?

- How Does Accidental Death Impact Term Life Insurance Investments?

- Understanding the Role of Term Life Insurance Rates

- The Importance of Choosing the Right Term Life Insurance Plan

- Common Exclusions to Keep in Mind

- Standard Term Life Insurance Plan vs. Term Life Insurance Plan with Accidental Death Rider

- Why Consider Term Life Insurance Quotes Online?

- How to Maximize Your Term Life Insurance Coverage

- What Makes Canadian LIC the Best Choice?