- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Does Term Insurance Automatically Renew?

- Let’s Understand Term Life Insurance Plans First

- Does Term Life Insurance Automatically Renew?

- Why Do Term Life Insurance Rates Increase Upon Renewal?

- What Are the Options When a Term Life Insurance Policy is Up for Renewal?

- Why Renewal Isn't Always the Best Option

- How to Make the Most Term Life Insurance Policies Before Renewal

- Common Misconceptions About Term Life Insurance Renewal

- How to Lower Your Term Life Insurance Rates at Renewal

- Why Choose Canadian LIC for Your Term Life Insurance Needs?

- Taking the Next Step

Does Term Insurance Automatically Renew?

By Pushpinder Puri

CEO & Founder

- 11 min read

- October 11th, 2024

SUMMARY

This blog explores whether Term Life Insurance automatically renews, what renewal means, and how it impacts policyholders. It explains that some policies include a renewal guarantee, allowing coverage to continue without a medical exam, but at higher premiums due to age and health risks. The blog also discusses why renewal rates increase, available options at renewal, and why automatic renewal isn’t always the best choice. It offers tips to manage costs and highlights Canadian LIC’s expertise in helping clients secure the best Term Life Insurance coverage.

Introduction

Term Insurance is actually one of the simplest and least expensive kinds of life insurance. However, one question that often arises is: “Does Term Insurance automatically renew?” If you’ve ever worried about your Term Life Insurance Plan expiring and leaving your loved ones unprotected, you’re not alone. Many of them are uncertain about the situation when their Term Life Insurance expires. We will discuss whether Term Life Coverage automatically renews, what the renewal means, and factors that influence Term Life Insurance Rates once renewal is activated. We’ll also discuss what Canadian LIC, the best insurance brokerage, has experienced with clients who’ve gone through this process.

Let’s Understand Term Life Insurance Plans First

Term Life Insurance covers the insured for a set period and is more popular for 10, 20, 30 or 50 years, over which the insured pays premiums to purchase coverage that will pay a death benefit to their beneficiaries upon the death of the policyholder. Since term life only pays a tax-free death benefit and does not have an investment component, it is much less expensive than other types of life insurance, such as Whole Life Insurance.

At the beginning of the term, individuals may find attractive Term Life Insurance Rates that align with their budget. However, as the policy term nears its end, the question of automatic renewal comes into play. Many clients at Canadian LIC have shared their concerns about whether they need to take any actions to keep their policy active or if it will automatically renew.

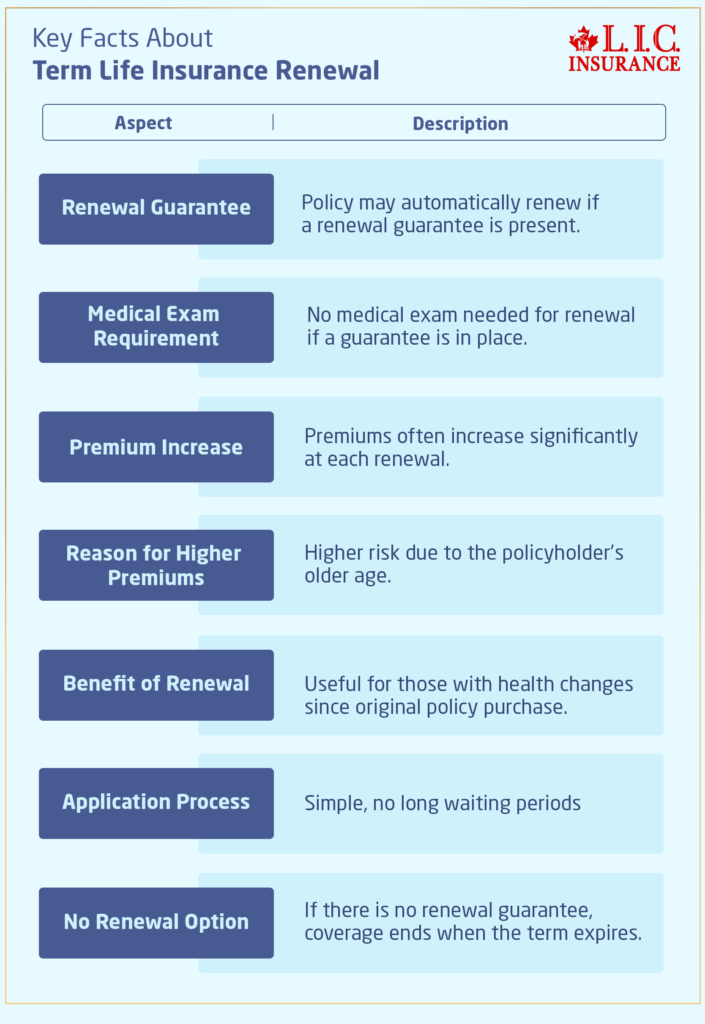

Does Term Life Insurance Automatically Renew?

The simple answer is: Yes, very many automatically renew. But, of course, nothing’s that easy. Anyway, when a Term Life Insurance Policy expires at the end of the initial term, some policies contain a “renewal guarantee,” whereby the insured can continue his coverage for another term without having to get another medical exam. This renewal can be very useful for individuals who have experienced health changes since they bought their policy because it assures them of coverage after a change in health.

But that does not come without an explanation. While the policy automatically renews, Term Life Insurance Rates are often drastically increased at each renewal date. This is because the life insurance company increases the premiums because insuring an older person poses more of a risk. Through time, we have had clients whose Term Life Insurance Quotes Online skyrocketed when the renewal date occurred. Such a shock of an increase can land many unprepared.

Why Do Term Life Insurance Rates Increase Upon Renewal?

Term Life Insurance premiums are quoted initially based on considerations such as the age of the insured, his or her health status, whether he or she smokes, and the length of the term. When the Term Life Insurance Policy renews, these factors are reviewed again, and since the insured is now older, the renewal premiums generally are higher. In some states, serious health conditions which occur during the initial term may also drive up the renewal premiums, although the renewal guarantee often ensures that there will still be coverage.

For example, Mark (the request of confidentiality has changed name) from Canadian LIC found himself in such a state of affairs when his 20-year Term Life Insurance Plan came to its end. During renewal, his monthly premium really hiked up to a great extent, although he was still fit. Though he was prepared for some hike, he did not expect them to be at such an elevated level. This is very common in itself, and knowing beforehand that the rates will rise may be very helpful information for policyholders when it is their time to decide on coverage.

What Are the Options When a Term Life Insurance Policy is Up for Renewal?

When the Term Life Insurance Plan reaches its expiration, policyholders typically have three options:

- Renew the policy Automatically: With many policies, automatic renewal is an option, but it comes at higher premiums due to increased age and potential changes in health status. Some policyholders accept the higher premiums because they want the convenience of continued coverage.

- Convert to a Permanent Policy: Some Term Life Insurance Policies offer a conversion option, allowing the insured to convert part or all of the term coverage into a permanent policy, such as whole life or universal life insurance, without undergoing a medical exam. While permanent life insurance typically has higher premiums, it provides lifelong coverage and may include a cash value component. Many clients at Canadian LIC find this option appealing, especially if they are nearing the end of their term and do not wish to go through the process of securing a new Term Life Insurance quote online.

- Shop for a New Life Insurance Policy: Another option is to apply for a new Term Life Insurance Plan. While this may involve a new medical examination, it could potentially secure lower premiums compared to renewing the existing policy at the higher renewal rates. However, if the policyholder’s health has deteriorated, finding favourable Term Life Insurance Rates could be challenging.

Why Renewal Isn't Always the Best Option

However, although it will ensure continuous coverage, auto-renewal is not usually the best financial option. Some people may end up accepting higher rates when renewing an existing Term Life Insurance Plan, and this will draw out their budget a bit too far. It is for this reason that many clients at Canadian LIC opt for other alternatives to circumvent the cost burden of automatic renewal.

For instance, let’s look at a client we worked with recently. When Lisa’s 10-year Term Life Insurance Policy ran out, she was shocked by just how much her renewal rate would be. She approached one of our insurance advisors, and after that, she thought it a good idea to try getting a fresh Term Life Insurance quote online rather than simply renewing her current policy automatically. As a result, she finally discovered a new policy that offered lower premiums, even with a medical exam, compared to the renewal rates of her existing policy.

How to Make the Most Term Life Insurance Policies Before Renewal

Proper preparation is required to approach the end of the life insurance policy term. Check out these tips that can be helpful to come to a well-informed decision before the terms lapse:

- Review Your Coverage Needs: As your life changes, your coverage needs may change too. Take the time to assess whether you still need the same amount of coverage. If your mortgage is paid off or your children are grown, you may not need as much life insurance as before. Clients at Canadian LIC are encouraged to revisit their coverage needs with one of our advisors to make sure their Term Life Insurance Plan still aligns with their current life stage.

- Get Term Life Insurance Quotes Online: Before automatically renewing your policy, compare policies rates from various providers. Getting new quotes can help you determine whether it is more cost-effective to renew your current policy, convert it, or get a new term policy altogether.

- Explore Conversion Options: Some term policies allow you to convert to permanent coverage. This might be worth considering if you are nearing retirement or want coverage that lasts a lifetime. Even though permanent life insurance tends to be more expensive, the lifelong coverage and cash value growth may benefit you in the long run.

- Consider Your Health Status: If you are still in good health, you may be able to secure better-Term Life Insurance Rates by applying for a new policy. However, if your health has declined, automatic renewal could be the best way to maintain coverage.

Common Misconceptions About Term Life Insurance Renewal

Several misconceptions surround the topic of Term Life Insurance renewal, leading to confusion among policyholders. Here are some common misunderstandings:

- Renewal Means the Same Premium: Some individuals assume that their premium will stay the same upon renewal. Unfortunately, renewal almost always results in higher premiums because the policyholder is older and potentially at greater risk.

- All Policies Automatically Renew: While many policies offer automatic renewal, not all do. It is essential to read the terms of your policy to understand whether your Term Life Insurance Plan includes a renewal guarantee.

- Renewal Without a Medical Exam Is Always Best: While a renewal guarantee without a medical exam is convenient, it doesn’t always mean better Term Life Insurance Rates. If you are still healthy, taking a new medical exam might help you qualify for a lower rate with a new policy.

How to Lower Your Term Life Insurance Rates at Renewal

As the term comes to an end, there are several strategies that policyholders can use to help lower the renewal premiums:

- Choose a Longer Term: When purchasing a new term policy, consider opting for a longer term, such as 20 or 30 years. This can lock in your Term Life Insurance Rates for a longer period, potentially saving you money over time.

- Reassess Your Coverage Amount: If your life circumstances have changed, you may not need as much coverage as before. Reducing the coverage amount can lower your premiums upon renewal.

- Explore Discounts: Some insurance companies offer discounts for bundling policies, such as life and home insurance. Look into these options, as they can help reduce your overall insurance costs.

- Work with an Insurance Brokerage: An experienced brokerage like Canadian LIC can help you shop around for the best rates and advise you on the most cost-effective way to renew or replace your Term Life Insurance Plan.

Why Choose Canadian LIC for Your Term Life Insurance Needs?

Indeed, the Term Life Insurance renewal process can be intimidating, especially due to the hiked premiums at renewal. With the help of Canadian LIC, you are sure to get an expert insurance advisor who is knowledgeable about how Term Life Insurance works and can guide you accordingly. Whether you’re shopping on the web for Term Life Insurance quotes, you’re looking to convert your coverage over to a permanent policy, or you’re getting new coverage, Canadian LIC’s advisors are with you each step of the way.

Taking the Next Step

Term Life Insurance renewal is one of the critical phases that have a serious direct impact on your future financial situation as well as the protection of your family. Being proactive and considering options well before your Term Life Insurance Plan expires is helpful in securing appropriate coverage that meets your needs without overburdening your budget.

Don’t wait for your Term Insurance to lapse. Contact the people at Canadian LIC today and discuss your options with them so that you can secure Term Life Insurance that would be relevant to your future. Let Canadian LIC guide you through the renewal process so you don’t have any nasty surprises in terms of Term Life Insurance Rates.

More on Term Life Insurance

- Can you extend a 20-Year Term Life Policy?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Frequently Asked Questions About Term Life Insurance Renewal in Canada

Many face the renewal of a Term Life Insurance Plan. How does the process go, and what can I expect? Below are some of the most frequently asked questions, with answers that are explained in detail. Additionally, the FAQs include insights from Canadian LIC’s experiences with clients to ensure things get clarified for you.

Yes, many Term Life Insurance Plans offer automatic renewal. When the term ends, the policy is usually renewed for another period, such as a year. However, the Term Life Insurance Rates will likely be higher upon renewal because premiums increase as you age. At Canadian LIC, we often see clients surprised by these higher rates, so it’s essential to know what to expect and prepare ahead.

When a Term Life Insurance Plan renews, the insurance company adjusts the rates to reflect the increased risk of insuring an older person. This usually results in higher premiums. For example, some clients at Canadian LIC have experienced a significant increase in Term Life Insurance Quotes Online after renewing their policy. The higher rates reflect the policyholder’s age and potential health changes since the original policy started.

Yes, getting Term Life Insurance Quotes Online is a smart move before automatically renewing your plan. Comparing quotes from different insurance providers can help you find more affordable options. At Canadian LIC, we often recommend clients explore new quotes before committing to renewal, as they might find better rates with a new policy.

Typically, a medical exam is not required for renewal. If your policy includes a renewal guarantee, you can renew without undergoing a new medical exam, which is helpful if your health has changed since you first purchased the policy. However, because Term Life Insurance Rates can be high upon renewal, some people choose to apply for a new policy that may require a medical exam but offers better rates.

- Apply for a new Term Life Insurance Policy: This may involve a new medical exam, but it can potentially lower your premiums.

- Convert to a permanent policy: Some term policies allow conversion to whole life or universal life insurance without a medical exam. Clients at Canadian LIC often explore this option when nearing retirement.

Yes, reducing your coverage amount can help lower the premiums when your policy renews. For instance, some clients at Canadian LIC find that they no longer need as much coverage because their mortgage is paid off or their children are financially independent. In such cases, adjusting the coverage can make the renewal more affordable.

Start by reviewing your current coverage and considering whether you still need the same amount of protection. Next, get Term Life Insurance Quotes Online to compare rates. At Canadian LIC, we advise clients to prepare at least a few months before the term ends so they have enough time to explore their options and find the most cost-effective solution.

Yes, you can switch to another insurance company when your term ends. Many people choose to do this if they find better-Term Life Insurance Rates elsewhere. It’s always a good idea to shop around and compare Term Life Insurance Quotes Online before making a decision. Clients at Canadian LIC often find this approach beneficial, especially if their health has remained stable or improved.

If you miss the renewal deadline, some insurance companies offer a grace period, during which you can still renew the policy without losing coverage. However, the terms may vary, so it’s best to contact the insurance company immediately. At Canadian LIC, we always encourage clients to stay proactive to avoid lapses in coverage.

Yes, extending a Term Life Insurance Policy is possible even if you’re over 60, but it may come with much higher premiums. At this age, insurers see a higher risk, which affects the cost. However, some clients find it worthwhile to keep coverage, especially if they still have dependents or outstanding debts. Working with Canadian LIC can help you assess whether extending or converting to a different type of insurance is the better option for your specific needs.

When a Term Life Insurance Plan renews, the new term is often shorter, such as one year. You can renew annually, but the Term Life Insurance Rates will usually increase each year. If you want a longer term, you may need to apply for a new policy with a fixed term, such as 10 or 20 years.

Yes, you can cancel your Term Life Insurance Plan before it renews. If you find a better Term Life Insurance quote online or decide you no longer need coverage, you can cancel the policy. It’s wise to ensure you have a new policy in place before cancelling to avoid gaps in coverage.

With a renewal guarantee, your health status won’t affect your ability to renew, but your age will still impact your Term Life Insurance Rates. At Canadian LIC, we advise clients to apply for a new policy if they are in good health, as this might help them qualify for lower rates.

Many Term Life Insurance Policies allow for conversion to a permanent plan up until a certain age, usually before 65. Clients at Canadian LIC often take advantage of this option when they want lifelong coverage and prefer not to renew a term policy that has increasing premiums.

This depends on your circumstances. Renewing ensures you keep coverage without a medical exam, but it often comes with higher premiums. Getting a new policy could mean lower-Term Life Insurance Rates if you qualify. At Canadian LIC, we help clients weigh the pros and cons to make the right choice.

You can often renew your Term Life Insurance Plan annually once the original term ends, but the Term Life Insurance Rates will likely increase each year. Some clients at Canadian LIC continue renewing annually if they only need coverage for a few more years.

These FAQs aim to provide clarity around the renewal of Term Life Insurance. If you’re approaching the end of your policy or considering your options, remember that Canadian LIC can help you find the best path forward.

Sources and Further Reading

If you would like to learn more about Term Life Insurance and the renewal process, the following resources can provide additional information and insights. These sources offer detailed explanations on topics such as Term Life Insurance Rates, renewal options, and comparison of policies.

- Canadian Life and Health Insurance Association (CLHIA)

- Visit the CLHIA website to learn more about life insurance products in Canada, including Term Life Insurance. The site provides valuable information about different types of coverage, policy features, and industry regulations.

CLHIA Website

- Visit the CLHIA website to learn more about life insurance products in Canada, including Term Life Insurance. The site provides valuable information about different types of coverage, policy features, and industry regulations.

- Insurance Bureau of Canada (IBC)

- The IBC offers information on various insurance products, including life insurance. Their resources can help you understand your insurance options, rights, and responsibilities.

Insurance Bureau of Canada

- The IBC offers information on various insurance products, including life insurance. Their resources can help you understand your insurance options, rights, and responsibilities.

- Canadian LIC – The Best Insurance Brokerage

- Canadian LIC offers guidance on Term Life Insurance Plans, rates, and the renewal process. They can help you get Term Life Insurance Quotes Online and advice on converting policies or finding new coverage.

Canadian LIC

- Canadian LIC offers guidance on Term Life Insurance Plans, rates, and the renewal process. They can help you get Term Life Insurance Quotes Online and advice on converting policies or finding new coverage.

- Government of Canada – Life Insurance Guide

- The official Canadian government website provides an overview of life insurance, explaining different types of policies, including term and permanent life insurance. The guide also covers essential aspects like choosing a policy and renewing coverage.

Government of Canada – Life Insurance

- The official Canadian government website provides an overview of life insurance, explaining different types of policies, including term and permanent life insurance. The guide also covers essential aspects like choosing a policy and renewing coverage.

- Insurance Comparison Websites (e.g., Ratehub, PolicyMe, and InsuranceHotline)

- These websites allow you to compare Term Life Insurance Rates and get Term Life Insurance Quotes Online from multiple providers. They provide insights into the cost and features of different Term Life Insurance Plans.

- Ratehub

- PolicyMe

- InsuranceHotline

- Financial Consumer Agency of Canada (FCAC)

- The FCAC provides resources on understanding and choosing insurance products. They offer tools to help you compare life insurance policies and make informed decisions about renewing or switching your coverage.

Financial Consumer Agency of Canada

- The FCAC provides resources on understanding and choosing insurance products. They offer tools to help you compare life insurance policies and make informed decisions about renewing or switching your coverage.

These resources can help you deepen your understanding of Term Life Insurance and support your decision-making process. Exploring these sites will provide additional information about policies, renewal options, and ways to secure better Term Life Insurance Rates.

Key Takeaways

- Term Life Insurance Often Renews Automatically

Many Term Life Insurance Plans offer automatic renewal at the end of the term. However, while the coverage continues, the premiums will usually be higher due to age and potential changes in health status. - Term Life Insurance Rates Increase Upon Renewal

When a policy renews, Term Life Insurance Rates typically go up because the policyholder is older, which increases the risk for the insurance company. It’s important to be prepared for this increase in premiums. - Exploring New Quotes Can Help You Save

Before accepting an automatic renewal, getting Term Life Insurance Quotes Online from different providers can help you find more affordable options. Comparing rates may lead to a new policy with better terms. - Conversion to a Permanent Policy May Be an Option

Some Term Life Insurance Plans allow you to convert your coverage to a permanent policy without a medical exam. This option may be beneficial if you want lifelong protection. - Review Your Coverage Needs Before Renewal

As your life circumstances change, your insurance needs may change too. Before renewing your Term Life Insurance Plan, reassess your coverage to see if the same amount is still necessary. - Automatic Renewal Doesn’t Always Require a Medical Exam

Many policies with a renewal guarantee allow you to renew without undergoing a medical exam, ensuring coverage despite changes in your health. However, renewal rates will still be higher based on your age. - Preparing Ahead Can Help You Avoid Surprises

Start exploring your options a few months before your Term Life Insurance Plan expires. This preparation can help you find the best rates and choose a policy that fits your needs. - You Can Switch to Another Insurance Provider

If you find better Term Life Insurance Rates with another company, you can switch when your current policy ends. Shopping around may lead to more competitive premiums.

Your Feedback Is Very Important To Us

We value your insights and would love to hear about your experiences with Term Life Insurance. Your feedback will help us better understand the challenges Canadians face when it comes to Term Insurance automatically renewing. Please take a few minutes to answer the following questions.

Thank you for sharing your feedback! Your responses will help us improve our services and provide better support for Canadians facing Term Insurance renewal challenges.

IN THIS ARTICLE

- Does Term Insurance Automatically Renew?

- Let’s Understand Term Life Insurance Plans First

- Does Term Life Insurance Automatically Renew?

- Why Do Term Life Insurance Rates Increase Upon Renewal?

- What Are the Options When a Term Life Insurance Policy is Up for Renewal?

- Why Renewal Isn't Always the Best Option

- How to Make the Most Term Life Insurance Policies Before Renewal

- Common Misconceptions About Term Life Insurance Renewal

- How to Lower Your Term Life Insurance Rates at Renewal

- Why Choose Canadian LIC for Your Term Life Insurance Needs?

- Taking the Next Step