- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Reviews

Common Inquiries

- What is a Deductible in Super Visa Insurance?

- Can a Visitor Visa Be Converted to a Super Visa?

- Can I Get Super Visa Insurance If I Am Over 85 Years Old?

- How Do I File a Complaint About My Super Visa Insurance Provider?

- What Are the Consequences of Not Having Valid Super Visa Insurance?

- Is There A Waiting Period For Super Visa Insurance?

- What Is the Processing Time for a Super Visa in Canada?

Does Super Visa Insurance cover prescription medications?

SUMMARY

This blog explains whether Super Visa Insurance covers prescription medications. It details how emergency and routine medication coverage differ, highlights common challenges families face in finding adequate prescription benefits, and offers guidance on comparing policies, obtaining quotes online, and consulting experts to ensure proper coverage for seniors’ medical needs.

One of the most important considerations in planning to bring your parents or grandparents to Canada to stay for an extended period is Super Visa Insurance. Indeed, once you apply for the Super Visa, getting proper medical insurance for your family members is of great importance. Yet, some people might wonder if Super Visa Insurance does include prescription drugs. Many do not know what the insurance policies will cover concerning medical, and many of older adults’ health care includes prescription drugs.

- 11 min read

- October 2nd, 2024

By Pushpinder Puri

CEO & Founder

- 11 min read

- October 2nd, 2024

Prescription medication coverage under SuperVisa Insurance Policy -We will elaborate on the details of prescription medication coverage under Super Visa Insurance, guide you through how factors determine what’s covered, and explore the Medical Insurance for a Super Visa related to medications and why it is important to select the right policy.

Struggles of Finding Prescription Medication Coverage

One of the challenges that many families in Canada face is trying to ensure that their parents or grandparents are adequately covered for their time with them. One of the biggest questions when deciding on Medical Insurance for a Super Visa is whether prescription drugs are included in that coverage. With aging family members often living on a regimen of regular medication, it becomes a daunting task to find a Super Visa Insurance Policy that adequately covers this area.

One of the clients, Ravi, was trying to bring over his parents from India. His father has high blood pressure, and his mother is on daily tablets for diabetes. Ravi was worried about how much it would cost back in Canada for the drugs. Many are confused due to their Super Visa Insurance Policies being different, and they do not know which ones cover prescription medicines.

The situation becomes a repetition too familiar to count. People constantly end up in the web of insurance jargon, policy options, and quotes without knowing which plan to choose. Let’s try to break this down to clarify whether Super Visa Insurance in Canada normally includes prescription drugs and what you should watch out for.

Understanding Medical Insurance for Super Visa

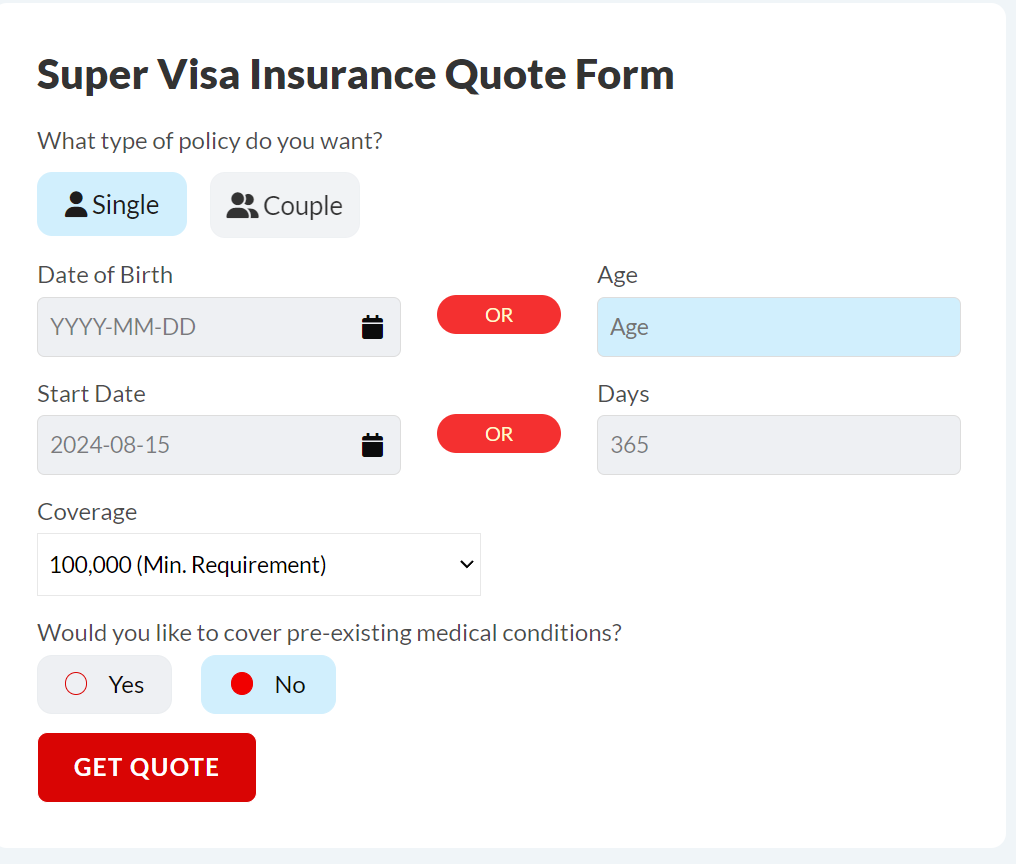

There are certain requirements with super visa medical insurance, including the stipulations applied by the Canadian government to all policies. It is that the policy has to cover emergency medical services that cost at least CAD 100,000 in general hospitalization and repatriation; however, other types of coverage vary from Super Visa Insurance Plans.

For example, many families worry that their loved ones will not be prescribed enough medication under the scheme without making high out-of-pocket expenditures. Some Super Visa Insurance Policies provide partial coverage for prescription medications, and each has to be reviewed carefully based on its terms.

Prescription Medications: Are They Covered?

The simple answer, however, is that not all Super Visa Canada Insurance policies automatically include prescription medications. It really depends on the prescription drugs they may be offering under a specific policy. Super Visa Insurance, according to general rules, was designed to take care of emergency medical costs and hospitalization. Though some will offer prescription drug coverage, most will not include prescription drugs as a normal part of their package or just pay for any prescription drugs regarding emergency treatments.

When Ravi came to the Canadian LIC, he walked in with how he could find a plan that would give him some form of prescription coverage. That eased some of that worrying: his parents wouldn’t be charged extortionate prices for their medications. Ravi’s experience points to the most important takeaway: comparison of policies and sensible counsel from an insurance broker.

- Adjusting the Death Benefit: Depending on the size of your estate and your financial obligations, you can choose a death benefit that aligns with your goals. Whether you want to cover capital gains taxes, leave a significant inheritance, or donate to charity, the death benefit can be tailored to meet those needs.

- Adding Riders for Enhanced Coverage: Many Whole Life Insurance Policies allow for additional riders that can enhance the coverage. For example, you might want to add a rider that covers long-term care, ensuring you have funds to cover potential healthcare costs in your later years without dipping into your estate.

Different Types of Coverage for Prescription Medications

There are generally two types of coverage related to prescription medications under Super Visa Insurance Policies:

- Coverage for Medications Related to Emergency Medical Treatment: Most Super Visa Insurance Policies cover this kind of treatment. If your parents or grandparents are taken to the hospital or receive urgent medical care, then the prescription medication prescribed in the course of emergency treatment is covered. For example, if a parent has an infection and receives antibiotics during an emergency room visit, it counts for the cost of the medication.

- Coverage for Routine Prescription Medications: Routine, non-emergency prescription medications are typically not covered through standard Super Visa Insurance. Optional coverage or riders may be available with some policies that include routine prescription medications. This is an important consideration when purchasing a plan, especially if the family member has prescribed medication for diabetes, hypertension, or cholesterol control, for example.

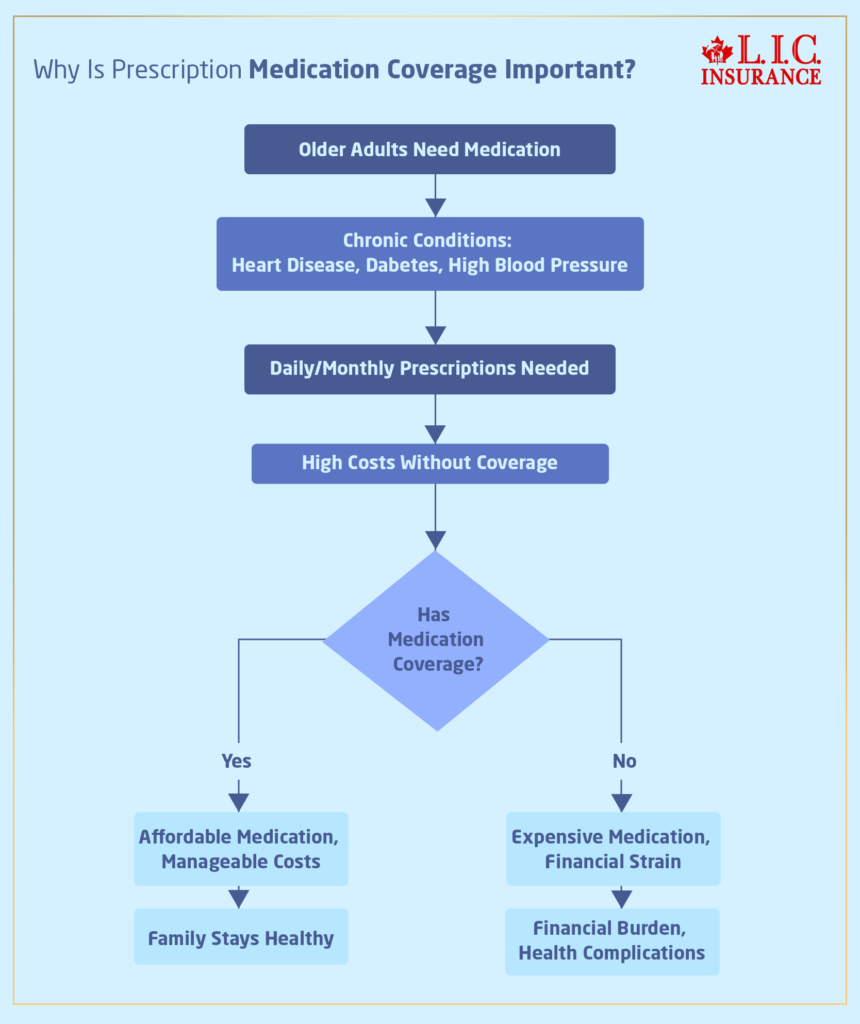

Why Is Prescription Medication Coverage Important?

For many older adults, prescription medications are the lifeblood of health care. Chronic conditions such as heart disease, diabetes, or high blood pressure require constant control with daily or monthly prescriptions. The costs increase very fast if not covered appropriately. For Ravi’s family, his father required blood pressure medication and his mother insulin; finding the medication coverage was imperative to keep them well during their visit to Canada.

A good insurance plan with medication coverage can save families from the surprise thrust of unforeseen expenses. Prescription drugs in Canada can really be expensive without coverage. For those reasons, securing medical insurance for the Super Visa that includes medication coverage will ensure your loved ones have access to needed treatments without breaking the bank.

What to Look for in Super Visa Insurance Policies

If seeking Super Visa Insurance that covers prescription medications, consider the following to avoid confusion and to ensure that your loved ones are protected:

- heck Policy Terms: Always read the fine print of your insurance policy to determine whether prescription medications are included. Some policies will only cover medications that are related to emergency treatments, while others may provide broader coverage.

- Ask About Optional Riders: If prescription medications are not covered in the base policy, ask about adding a rider or purchasing additional coverage specifically for medications. This can be an invaluable option if your family member is on long-term medication.

- Get Super Visa Insurance Quotes Online: Use online resources to compare Super Visa Insurance quotes and understand what different providers are offering. This will allow you to identify which policies include prescription medication coverage and compare prices for the best value.

- Consult an Expert: When in doubt, reach out to experts like Canadian LIC—the best insurance brokerage. They have extensive experience helping clients navigate the complexities of Super Visa Insurance and can help you find a policy that covers prescription medications.

Challenges and Solutions

Every family has its unique story while securing the right Super Visa Insurance. Many of Canadian LIC’s clients share their frustration when they find out, often too late, that the policy they have chosen doesn’t cover their parents’ regular medications. That is what happened with client Meena, who found out only recently that her policy does not cover medication prescribed during an emergency visit. This meant that her mom’s arthritis medicine, which she is to take daily, had to be paid for, meaning extra and unexpected costs.

Fortunately, through an experienced broker, she was able to switch to a plan that did include coverage for her mother’s routine prescriptions. Such nitty-gritty frustrations are but one of the reasons why it is so very important to really take the time to research and work with an insurance expert.

How to Find Super Visa Insurance That Covers Prescription Medications

- Research Providers Offering Prescription Coverage: Start by identifying which Canadian insurance providers offer Super Visa Insurance Policies that include prescription medication coverage. Not all providers offer the same level of coverage, so make sure to choose one that meets your specific needs.

- Request Super Visa Insurance Quotes Online: You can easily obtain Super Visa Insurance Quotes Online from various providers. This will give you a clear idea of the cost and coverage options available. Make sure the quote includes coverage for prescription medications if that’s a priority for your family.

- Compare Policy Benefits: Don’t just focus on price when comparing quotes. Pay close attention to what is covered under each policy, including the extent of prescription medication coverage. A slightly more expensive policy may provide better overall coverage and save you money in the long run.

- Speak to a Broker: Working with a professional insurance broker like Canadian LIC can help streamline the process. They can provide expert advice and guide you toward policies that fit your family’s specific needs, ensuring prescription medication coverage is included.

Conclusion: Choosing the Right Policy

To those like Ravi, who want to feel secure with the knowledge that prescription drugs will be covered under Super Visa Insurance, this is often at the top of the list. Of course, not all super visa policies include coverage for prescription drugs, but there are certainly ample options available if you know what you are looking for. Carefully review your policy details, consult with an expert broker, and compare Super Visa Insurance Quotes Online, as all this will help ensure that your parents or grandparents’ medical needs are taken care of during their visit to Canada.

Don’t let prescription drug coverage be left to chance. Contact Canadian LIC today —to discuss possible options and get the most suitable Super Visa Insurance Policy available, covering prescription medication in case of illness. Whether daily medication or some urgent treatment, it’s a huge relief for your dear ones to know that they can always rely on the right kind of coverage when needed.

More on Super Visa Insurance And Super Visa

- How Can You Use Deductibles to Reduce the Premium of Super Visa Insurance?

- What is a Deductible in Super Visa Insurance?

- Can I Choose My Own Doctor or Hospital with Super Visa Insurance?

- Are Psychological or Psychiatric Services Covered Under Super Visa Insurance?

- How Can One Appeal a Denied Claim Under Super Visa Insurance?

- Can a Visitor Visa Be Converted to a Super Visa?

- Can I Change the Effective Dates of My Super Visa Insurance After Purchase?

- Can I Include My Spouse in the Same Super Visa Insurance Policy?

- Can I Get Super Visa Insurance If I Am Over 85 Years Old?

- How Do I File a Complaint About My Super Visa Insurance Provider?

- What Are the Consequences of Not Having Valid Super Visa Insurance?

- What Happens If the Super Visa Insurance Expires While the Visitor Is Still in Canada?

- Is There A Waiting Period For Super Visa Insurance?

- Is Super Visa Insurance Refundable?

- How to Find the Most Affordable Super Visa Insurance Plan?

- Where Can You Buy Super Visa Insurance in Canada?

- Is a Medical Test Required for Super Visa Canada?

- What Is the Processing Time for a Super Visa in Canada?

- Can Parents Work on Super Visa in Canada?

- Can We Cancel Super Visa Insurance?

- Can I Pay Monthly for Super Visa Insurance?

- When Should Super Visa Insurance Start in Canada

- 2023 Super Visa Program and Insurance Requirements Guide: Essential Updates and Insights

- Visitor Visa vs. Super Visa: Understanding the Differences

Frequently Asked Questions About Super Visa Insurance and Prescription Medications

Here you go with the most frequently asked questions regarding the coverage of prescription medication under Super Visa Insurance Coverage in Canada. The following FAQs show you step-by-step how to understand the crucial key points of Medical Insurance for a Super Visa, including real-life concerns and issues people face daily.

It depends on the policy. Some Super Visa Insurance Policies cover prescription medications only during emergency treatments, while others may offer more comprehensive coverage. Many of our clients at Canadian LIC, like Ravi, faced confusion when trying to find a plan that included regular prescription medications. It’s important to check the details of the policy or speak to an expert broker to ensure the right coverage.

Yes, some Medical Insurance for Super Visa policies allows you to add extra coverage for prescription medications. This option can be especially useful if your parents or grandparents require regular medication. We often advise families who want peace of mind for their loved ones to explore this option.

Routine prescription medications are not automatically covered in all Super Visa Insurance Policies. Typically, policies focus on covering medications prescribed during emergencies. However, you can find policies or riders that provide coverage for routine prescriptions. Canadian LIC helped a client, Meena, switch to a plan that included her mother’s daily medication after she found her initial policy did not cover it.

Start by getting Super Visa Insurance Quotes Online from different providers. Make sure to check if they include prescription medication coverage. It’s always helpful to consult an experienced broker who can guide you to the right policy. At Canadian LIC, we help clients compare policies to find the best fit for their needs.

Yes, adding prescription medication coverage to Super Visa Insurance Policies can increase the premium. However, many clients find that paying a little extra for added coverage saves them from high medication costs later. Canadian LIC helps families balance cost and coverage so they get the best value.

Coverage for pre-existing conditions varies. Some medical insurance policies for Super Visa include prescription medications for stable pre-existing conditions, while others may not. It’s essential to disclose any pre-existing conditions when applying for insurance to ensure the right coverage. Many of our clients find it easier to navigate these choices with guidance from Canadian LIC.

Yes, you can switch policies. We’ve seen many clients realize too late that their current policy doesn’t meet their needs. It’s possible to transfer to new Medical Insurance for a Super Visa Plan that includes the coverage you need, such as prescription medications, but you should ensure continuous coverage during the switch.

If the condition is stable and covered under the policy, some plans will include medications for chronic conditions. Many of our clients, like Ravi, needed specific coverage for conditions like diabetes or hypertension. It’s important to review Super Visa Insurance Policies carefully and work with a trusted broker to find one that covers medications for chronic conditions.

You can find this information in the policy’s details. Make sure to ask your insurance provider or broker for clarification. At Canadian LIC, we help our clients break down the terms of Medical Insurance for Super Visa so they understand what is covered, especially when it comes to medications.

Yes, most Super Visa Insurance Policies cover prescription medications that are part of an emergency treatment. For example, if your parents require antibiotics after a sudden illness, those medications are likely covered. However, always confirm this with your provider when choosing a policy.

Some providers offer partial refunds if no claims are made and your family leaves Canada early. However, this depends on the specific terms of the policy. Canadian LIC often helps clients who face this situation by contacting providers on their behalf to understand their refund options.

Not all Super Visa Insurance Policies include prescription medication coverage. You may need to purchase an additional rider or select a policy that offers this coverage as an add-on. Our clients often come to us for help in finding policies that match their specific needs, including medication coverage.

Yes, you can easily compare Super Visa Insurance Quotes Online from various providers. Make sure to pay close attention to what each policy covers, especially when it comes to prescription medications. At Canadian LIC, we help clients understand the differences between policies to make an informed choice.

No, over-the-counter medications are generally not covered under Medical Insurance for Super Visa. These policies typically only cover prescribed medications, particularly those required as part of cover medical emergency care.

The best approach is to contact your provider or speak with an experienced broker like those at Canadian LIC. They can clarify any questions about your Super Visa Insurance Policies and help you determine whether prescription medications are covered.

These FAQs clarify important points about prescription medication coverage, which are going to address key concerns families have when making decisions for medical insurance under Super Visa. Working with specialists at Canadian LIC is going to help find you just the right policy so your loved ones have access to any and all required care and medications.

Sources and Further Reading

- Government of Canada – Super Visa Program Requirements

Visit the official page to understand the requirements for the Super Visa, including mandatory medical insurance.

Government of Canada – Super Visa - Canadian Life and Health Insurance Association (CLHIA)

A helpful resource for understanding insurance policies and the role of coverage in Canada.

CLHIA - Canadian LIC – The Best Insurance Brokerage for Super Visa Insurance

Canadian LIC offers expert guidance and quotes for Super Visa Insurance, helping families find policies that cover prescription medications.

Canadian LIC - Insurance Bureau of Canada (IBC)

Provides insights into health and travel insurance, including emergency medical coverage and prescription medications for visitors to Canada.

IBC

These sources offer reliable information on Super Visa Insurance and related coverage options, helping you make informed decisions.

Key Takeaways

- Prescription Medications May Not Be Automatically Covered: Not all Super Visa Insurance Policies include coverage for prescription medications. It’s crucial to review your policy.

- Emergency Medication Coverage Is Common: Most Super Visa Insurance Policies cover prescription drugs related to emergency medical treatments.

- Routine Medication Coverage Requires Extra Consideration: If your parents or grandparents need daily medications for chronic conditions, look for policies that offer additional coverage or riders.

- Costs Can Increase With Added Coverage: Adding prescription medication coverage may raise premiums, but it can save on out-of-pocket costs for essential medications.

- Compare Policies and Get Expert Help: It’s essential to compare Super Visa Insurance Quotes Online and consult experts like Canadian LIC to find the best policy for your family’s needs

By Pushpinder Puri

CEO & Founder

Your Feedback Is Very Important To Us

Thank you for taking the time to provide your feedback. Your input will help us better understand the struggles and needs related to Super Visa Insurance Coverage for prescription medications in Canada.

Your feedback is valuable in helping us understand and address the struggles faced by families in Canada regarding Super Visa Insurance and prescription medication coverage. Thank you!

IN THIS ARTICLE

- Does Super Visa Insurance cover prescription medications?

- Struggles of Finding Prescription Medication Coverage

- Understanding Medical Insurance for Super Visa

- Prescription Medications: Are They Covered?

- Different Types of Coverage for Prescription Medications

- Why Is Prescription Medication Coverage Important?

- What to Look for in Super Visa Insurance Policies

- Challenges and Solutions

- How to Find Super Visa Insurance That Covers Prescription Medications

- Conclusion: Choosing the Right Policy