Have you ever faced times when you were under such pressure that it was overwhelming, and not just for one day, but week in and week out or month after month? Perhaps you’ve seen a friend or colleague struggle to come to work because they’re battling an invisible illness that doesn’t just go away with a good night’s sleep. Mental health issues are legitimate and common. Yet, we so often are tepid about discussing them openly, let alone in terms of insurance coverage for these types of treatments.

Of all the issues that must be discussed in the Canadian Disability Insurance Policy, today’s really stands: whether or not it actually covers mental health. For many, especially those self-employed, understanding the nuances of Disability Insurance for mental health can be the difference between security and uncertainty. We will illustrate, through real-life stories from Canadian LIC—a leading insurance brokerage—how Disability Insurance can fit into the picture for those affected by mental health challenges and how these policies really can be a lifeline in times of need.

Mental Health and Disability Insurance: A Real Need

Imagine Seema, a self-employed graphic designer who was crippled by anxiety to the extent that she couldn’t deliver work on time to clients. Take, for example, John, while working as a project manager, who used to suffer from uncontrolled depression and was forced to take a leave of absence from work. These are not just scenarios; they are real stories delineating a lot about how mental health impinges on professional souls.

Does Disability Insurance Cover Mental Health Issues?

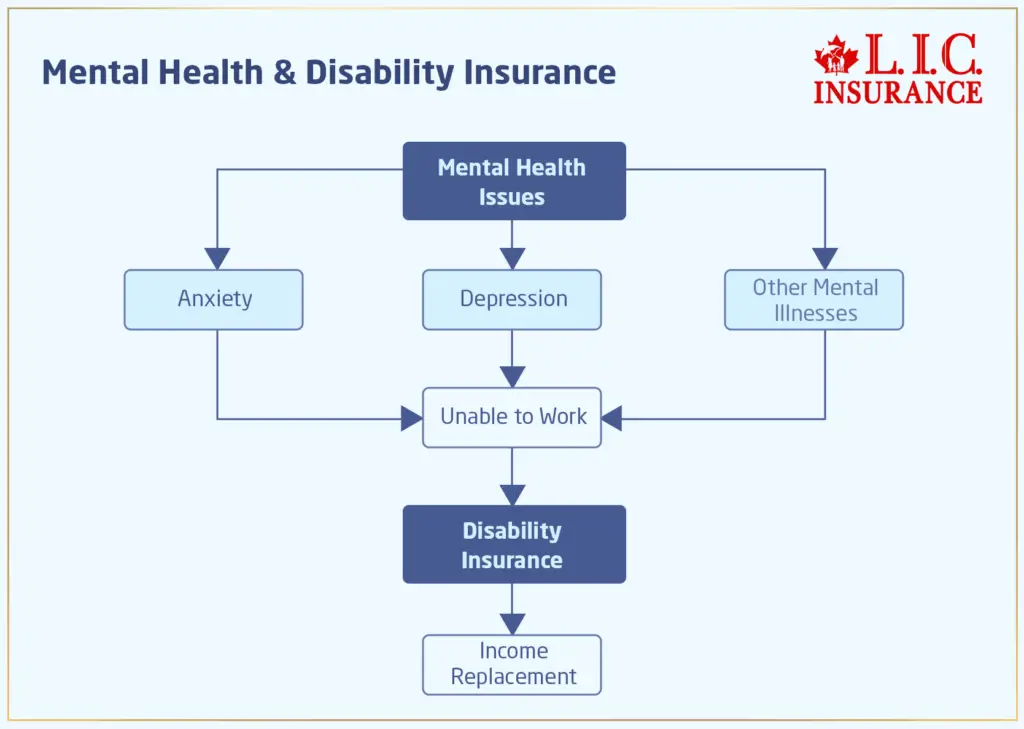

Most Disability Insurance Policies would include the impact of mental health problems as a major reason someone might not be able to work. However, coverage details can vary widely between policies and insurers. Generally speaking, these are income replacement policies in case you cannot work due to some type of medical reason, such as psychological stress medically recognized as depression, anxiety, and other mental illnesses.

Knowing Disability Insurance Policies

Understanding the specifics of Disability Insurance Policies can often feel daunting. Here’s what you typically need to look out for:

Definition of Disability: Each policy has its definition of what constitutes a disability. For mental health, this usually includes psychiatric conditions that are diagnosed by a healthcare professional, which prevent you from performing your work duties.

Coverage Details: It’s crucial to understand what your policy covers. Does it cover partial disability or only total disability? Is there a specific period during which benefits are paid for mental health-related disabilities?

Exclusions and Limitations: Some policies might have a waiting period before coverage starts or may limit the duration of coverage for mental health issues compared to physical disability issues.

A Case Study from Canadian LIC

Mark, a client at Canadian LIC, assumed his policy would immediately kick in when he started experiencing severe panic attacks. However, he was unaware of the 90-day waiting period his policy stipulated. This gap in understanding underscores the importance of knowing your policy inside and out.

Disability Insurance for Self-Employed: A Safety Net

Disability Insurance for self employed is even more critical. Without any safety net coming from employer benefits, the self-employed individual is on his or her own in securing monetary stability.

Choosing the Right Policy: While buying Disability Insurance for self employed, one has to be very careful about the definition of disability coverage, stating whether it includes mental health conditions. Rather, it’s best to buy a policy that really adheres to your requirements for work-life balance and mental health.

Real-Life Challenges and Solutions

In our day-to-day dealings at Canadian LIC, very often, we come across clients who have a problem understanding and utilizing their Disability Insurance with regard to mental health. Let’s run through some common issues and how best to correct them:

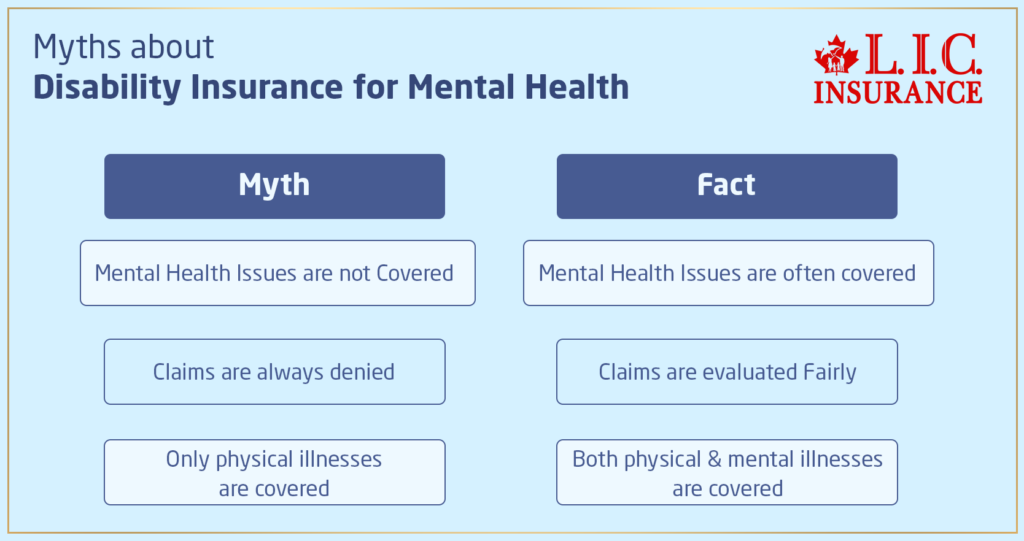

Lack of Awareness: Many are unaware that their policies might cover mental health. Education and clear communication are key here.

Proof of Disability: Documenting mental health for insurance claims can be challenging. Regular consultations with healthcare providers and keeping detailed records are essential steps.

Fear of Stigma: Some clients hesitate to claim mental health issues. Encouraging a supportive dialogue around mental health can alleviate this fear.

Given the complexity of Disability Insurance Policies with regard to mental health, knowledge and high activity concerning the same would be very important. Take the time to speak with Canadian LIC insurance experts about your special needs and concerns. Be knowledgeable and seek proper coverage so that you are best secured against any eventuality that may come your way with regard to your mental health.

Conclusion: Act Right Away with Canadian LIC

Understanding and securing Disability Insurance that covers mental health issues is not about the money; it is about the peace of mind. As you can tell from the stories of Seema and John, proper coverage can make all the difference in one’s life and in the tackling of mental health challenges.

Do not wait until the crisis pushes you to buy comprehensive Disability Insurance. Speak to Canadian LIC today, one of the best insurance brokerages in Canada, and take the first step toward a policy that will protect you comprehensively. Your mental health is as important as your physical health, and your insurance should reflect that. Have a policy secured now, and be certain that you are covered for tomorrow’s uncertainties.

Know More on Disability Insurance

Is Disability Insurance Taxable?

How To Calculate Disability Insurance?

Why Can’t I Buy Disability Insurance?

Must Know Pros And Cons Of Disability Insurance In Canada: A Comprehensive Guide

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions (FAQs) About Disability Insurance and Mental Health Coverage

Understanding a Disability Insurance Policy can be tricky. We will address some common questions from a day-in-the-life experience of Canadian LICs. This should help clarify your doubts and ensure you make informed decisions about your Disability Insurance, particularly if you are self-employed.

Most Disability Insurance Policies cover a range of mental health conditions that severely interfere with the performance of your job. Generally, this will include major depression, anxiety disorders, bipolar, and even PTSD. For example, a client of Canadian LIC was claimed for major depression under her policy, thereby allowing her the necessary financial reinforcement during her treatment period.

Most states prove mental health conditions with well-documented evidence from licensed mental health professionals. In order to receive coverage from the plan, a need for it has to be clearly diagnosed, with treatment records indicating how the condition obstructs the performance of your work. For example, a Canadian LIC client had to submit regular updates from his psychiatrist to continue receiving his benefits for an anxiety disorder.

Yes, there are Disability Insurance Policies for the self-employed that cater specifically to the different challenges freelancers and entrepreneurs face—specifically, variable income. Be sure to consider a policy that has flexible terms and comprehensive coverage. A self-employed photographer with Canadian LIC opted for a flexible benefit structure policy, which became very important as she stepped back due to anxiety.

Standard exclusions usually include pre-existing conditions diagnosed before buying the policy and issues with mental health as a result of substance abuse. One Canadian LIC client truly found out about the exclusion of pre-existing conditions in the worst possible way whenever he tried to claim for an anxiety disorder diagnosed years prior to his availing of his policy.

The elimination and waiting periods vary with every policy but are commonly 30-90 days. This period must pass after the onset of disability before benefit payments begin. A client at Canadian LIC had to wait 60 days under her policy’s terms before she started receiving benefits for her PTSD.

Indeed, some Disability Insurance Policies allow for partial disability benefits, which come in handy in case you are able to work part-time as a result of your mental health condition. For example, a graphic designer client of mine has coverage with the Canadian LIC that allows him to work reduced hours while living with depression.

Look for coverage that is flexible in its coverage options, recognizes irregular income patterns of self-employed professionals, and covers a broad spectrum of mental health conditions. You also have to consider policies that have short waiting periods, comprehensive benefits, etc. For example, a consultant with the Canadian LIC chose her policy based on these criteria, so she had robust coverage in place while dealing with intermittent anxiety issues.

Canadian LIC understands all the personal requirements and needs very well, gives personalized advice, and recommends the best available Disability Insurance Policies. Starting from ascertaining the kind of coverage needs you have; our experts can bring you through to explaining complicated policy details to ensure you get the right type of protection for professional and personal situations.

While all Disability Insurance Policies can cover mental health conditions, some have varying tenures. Some will provide coverage for a few years, and some might extend it until retirement age. The main factor of consideration, however, would be the severity of the condition itself and how well or how badly it has been faring over time. A Canadian LIC client, who is a freelance web developer, benefited from a policy that provided long-term benefits due to his chronic depression, helping him maintain financial stability over the years.

This is generally more stringent in terms of proof of income and may command higher premiums due to the additional risk involved with uncertain or variable income. Meanwhile, such policies are highly customizable. For instance, a self-employed consultant-client of Canadian LIC could certainly get far more comprehensive mental health coverage under her Disability Insurance Policy, which is suitable for fluctuating work hours and income.

Yes, most insurers do allow policy upgrades to provide more comprehensive mental health coverage. It is always advisable to review one’s policy at periodic intervals and change it according to the changing needs. A Canadian LIC graphic designer upgraded her Disability Insurance Policy after she realized her existing coverage was very little for her anxiety and stress disorders.

If you’re well enough to return to work after making a mental health claim, one of the most crucial things you can do is to communicate this change to your insurance provider. They’ll take you through the necessary steps on how to transition off benefits, potentially transitioning to a partial return to work. One Canadian LIC client did just that—and he returned to work part-time successfully with the benefits adjusted proportionally, which allowed an easier adjustment.

Other things that may help trim premiums are selecting a longer waiting period, choosing a benefit period consistent with financial planning and proof of stable income history. For example, one of our Canadian LIC advisors was able to adjust the waiting period for an independent photographer who is able to reduce her monthly premiums, where she still has good coverage for her bipolar disorder.

You will need to contact your insurer immediately; you will be required to provide the necessary medical records from your treating psychologist or psychiatrist and proof of lost income as a result of your mental illness. A Canadian LIC client, an event planner, followed these steps meticulously, which ensured a smooth claim process when she was diagnosed with severe anxiety.

Should you have differences or disputes, the first step is to go through the details of your policy. If it still remains unresolved, consider consulting an insurance broker or a lawyer. Canadian LIC has assisted several clients in negotiating with insurers to recognize and cover claims for mental health issues accurately.

A broker like Canadian LIC can be of immense help, for he provides you with knowledge regarding policy details, can help in tailoring insurance solutions to suit your needs, and can assist with mental health disability claims. They look more closely at minute details of the Disability Insurance Policies and even represent you in the finest way so that you get the benefits due to you.

Disability Insurance Policies should be reviewed every year or at any time a person’s health or professional situation undergoes a change in suffering. Such regular reviews are important because the coverage will match your current needs. A Canadian LIC client, a freelance editor, found it beneficial to adjust her coverage after her therapy sessions increased, ensuring her policy continued to meet her evolving mental health needs.

Most mental illness disability claims, however, require a heavy burden of documentation from your treating psychiatrist or psychologist, including the nature of the diagnosis, a treatment plan, and an assessment with regard to the impact of your condition on your ability to work. For example, one of our clients was required to provide a comprehensive record of treatment in his claim for depression, which was very useful in proving to the insurance provider that he was suffering from a serious medical condition.

Yes, some Disability Insurance Policies cover intermittent mental health issues under the clause of recurrent disabilities. In such cases, one can claim benefits during those periods when the condition keeps you away from work, provided that these episodes meet the policy’s criteria for disability. There was a case for Canadian LIC where a graphic designer could claim benefits in periods of episodic anxiety that interrupted her ability to complete projects.

A common misunderstanding is that all Disability Insurance Policies provide the same level of mental health coverage. In reality, coverage can vary significantly between policies. Some might have lengthy waiting periods or require extensive documentation. For instance, a Canadian LIC client was surprised to learn that his policy did not cover short-term mental health issues, only long-term or permanent disabilities.

Canadian LIC is committed to understanding the pressure one faces when self-employed. Canadian LIC will help customers pick policies that provide sufficient coverage for mental health, flexible terms, and low premiums, further investigating their special needs. Recent success story: With Canadian LIC’s guidance, a self-employed photographer has picked a policy that suits her fluctuating income and includes full mental health coverage.

Yes, you can change your Disability Insurance provider if you find a better plan offering full coverage for mental health care for your needs. However, be very careful when comparing the new policy benefits and terms of interest that attract you to the current one, specifically new waiting periods that may apply to you or exclusions to pre-existing conditions. Canadian LIC recently assisted a client in transitioning to a new provider that offered more favourable conditions for managing his bipolar disorder.

If you currently have a policy in place that does not truly satisfy your needs for your mental health condition, in the first instance, you should meet with your insurance broker. They would be better placed to look at your policy in detail and explain alternatives if needed. A Canadian LIC advisor helped a client enhance her coverage for anxiety through additional riders that provided broader protection.

Pre-existing conditions can impact mental health coverage to a great degree, particularly if your mental health condition had been diagnosed prior to availing of the policy. This would disallow one to claim benefits for such conditions. One such client of ours had to negotiate this dilemma through detailed case histories to allow newly diagnosed conditions—unrelated to his pre-existing mental health issues—to be covered in the scheme.

These FAQs will walk you through all that’s necessary to know about Disability Insurance for mental health issues. If you have more questions or need personalized advice, don’t hesitate to reach out to Canadian LIC immediately—as we have the experts who can match you with the right insurance solutions.

Sources and Further Reading

Here are some sources and suggested further reading materials to deepen your understanding of Disability Insurance Policies, particularly those covering mental health issues in Canada:

Canadian Life and Health Insurance Association (CLHIA) – Guide to Disability Insurance: This guide offers a comprehensive overview of Disability Insurance in Canada, including specifics on coverage for mental health issues.

Website: CLHIA Guide to Disability Insurance

Mental Health Commission of Canada – Workplace Strategies for Mental Health: Explore strategies and support systems for managing mental health in the workplace, which can complement your understanding of insurance needs.

Website: Workplace Strategies for Mental Health

Government of Canada – Canada Pension Plan Disability Benefits: Learn about public disability benefits available in Canada, which can provide context to how private Disability Insurance integrates with public systems.

Website: CPP Disability Benefits

Insurance Bureau of Canada – Understanding Insurance Basics: This resource provides foundational knowledge about various types of insurance, including Disability Insurance.

Website: Insurance Bureau of Canada

Psychology Today – Articles on Disability and Mental Health: A collection of articles discussing the challenges and considerations of living with mental health issues and how Disability Insurance can play a role.

Website: Psychology Today – Disability and Mental Health

These resources will provide valuable insights and additional context to help you make informed decisions about Disability Insurance, especially if you are self-employed and concerned about mental health coverage.

Key Takeaways

- Many Disability Insurance Policies in Canada cover mental health conditions like depression and anxiety.

- Coverage specifics, including conditions covered and duration, vary significantly between policies.

- Disability Insurance is crucial for self-employed individuals due to the lack of employer benefits.

- Claiming benefits for mental health issues requires comprehensive documentation from mental health professionals.

- Regularly reviewing and updating your Disability Insurance Policy ensures it meets your changing needs.

- Understanding the claims process and handling disputes is crucial for receiving benefits.

- Consulting with knowledgeable insurance brokers can help in choosing the right policy and navigating claims.

Your Feedback Is Very Important To Us

This questionnaire aims to better understand the experiences and challenges faced by Canadians regarding Disability Insurance for mental health issues, allowing for more tailored solutions and advocacy in this area.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]