What if you were diagnosed with diabetes—a condition that affects your health and your wallet? Many Canadians get diagnosed each year, and while managing diabetes is tough enough, figuring out how to protect yourself financially from the consequences is another stress on top of that. This is where Critical Illness Insurance comes in, or does it? Today, we’re going to explore if diabetes is covered by Critical Illness Insurance in Canada and get the answers through real-life stories from Canadian LIC, a top insurance brokerage that sees these challenges firsthand.

We see many clients at Canadian LIC who are surprised to learn about the specifics of Critical Illness Insurance Coverage. They come looking for peace of mind, hoping their policy will cover them if they get a serious condition like diabetes. Let’s dig in get the answers, and discover how Critical Illness Insurance can be a game-changer for those at risk or living with diabetes.

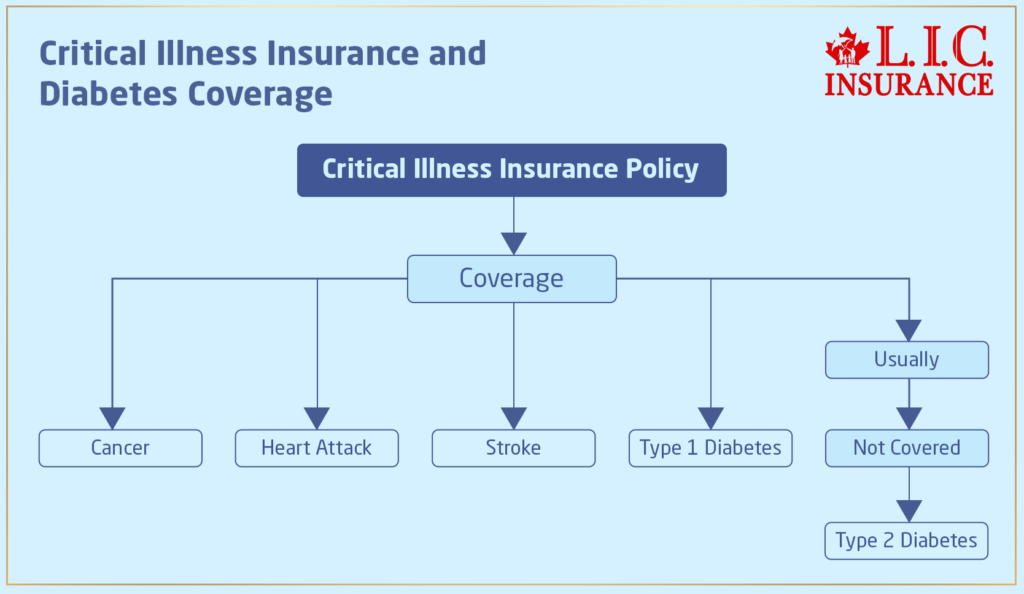

Understanding Critical Illness Insurance and Diabetes Coverage

These Critical Illness Insurance Policies are designed to alleviate the financial burdens by providing for a lump-sum payment in case the diagnosis of a specified serious illness is made. Not all conditions, however, are viewed equally, and this is where many of our clients at Canadian LIC find themselves confused.

Does Critical Illness Insurance Cover Diabetes?

Up to now, most Critical Illness Insurance Policies that have been approved for sale in Canada cover life-threatening diseases like cancer, heart attack, and stroke. Some policies provide coverage for diabetes, especially if Type 1 or juvenile diabetes has been diagnosed, but generally, this is not the case. Type 2 diabetes, the kind more commonly related to lifestyle, is usually not covered as a standard condition. This is relevant information to anyone seeking Critical Illness Insurance Quotes, as it is only by understanding what is and isn’t covered that a person can get to know how to choose the right policy.

At Canadian LIC, we have often shared stories like that of Maya, a client assuming her Critical Illness Insurance Policy would cover her upon being diagnosed with diabetes. She assumed that was the case; however, she hadn’t checked the policy beforehand and was in distress to find out her type of diabetes was not covered. Her story is one example of misunderstandings that can happen with Critical Illness Insurance.

Key Features of Critical Illness Insurance Policies

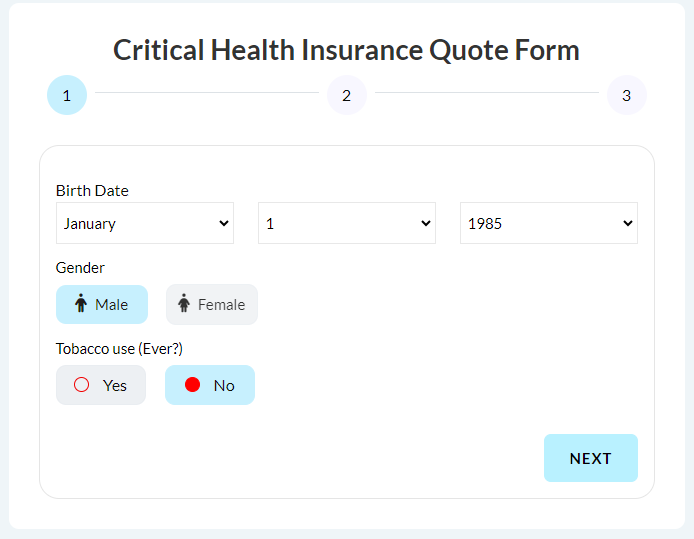

When exploring Critical Illness Insurance Quotes, it’s vital to scrutinize the details of what each policy covers. Here’s what you typically need to look for:

List of Covered Illnesses

Not all policies are created equal. Some might offer broader coverage than others, which is something to compare carefully.

Exclusions and Limitations

Knowing what’s not covered is just as important as knowing what is. This can prevent unpleasant surprises like Maya’s.

Payout Conditions and Waiting Periods

Most policies have specific criteria about when and how the payout occurs. For diabetes, this could include whether the payout is contingent on a particular diagnosis severity or complications arising from the condition.

How Coverage Affects Lives: The Transformative Power of Critical Illness Insurance

At Canadian LIC, we have witnessed firsthand the depth of impact that a well-chosen Critical Illness Insurance cover can have on the lives of our clients. Each case, unique in its story, underpins the importance of getting comprehensive Critical Illness Insurance Coverage. Let’s consider a number of real-life examples to show just how critical this kind of coverage can be:

John’s Journey: Proactive Planning Pays Off

John learned the importance of insurance the hard way through his father’s struggles with diabetes. Determined to avoid similar financial pitfalls, he sought Critical Illness Insurance Quotes that specifically included coverage for diabetes-related complications. His foresight paid dividends when he needed surgery and could recover without worrying about the financial implications. His story highlights the value of anticipating one’s health needs and securing a policy that addresses them directly.

Emily’s Experience: A Lifeline When Least Expected

Emily was a young professional with a Critical Illness Insurance Policy that she considered a precautionary measure more than a necessity. However, when she was unexpectedly diagnosed with a severe complication from diabetes, the policy she had was a financial and emotional lifeline. The lump-sum payment helped cover her out-of-pocket medical expenses and allowed her to take time off work to focus on her recovery. Emily’s experience serves as a powerful reminder that life can be unpredictable, but having the right insurance policy means you don’t have to face it unprepared.

David’s Decision: Tailored Coverage That Transformed His Treatment Options

David, a dedicated husband and father, was diagnosed with diabetes at an early age. Knowing his risks, he worked with Canadian LIC to find a Critical Illness Insurance Policy that offered broad coverage for treatments not typically covered by standard health insurance. When he needed an advanced, expensive treatment, his policy covered it, significantly enhancing his quality of life and management of diabetes. David’s case exemplifies how tailored Critical Illness Insurance Coverage can open up access to better healthcare options.

Linda’s Lifesaver: Coverage That Cared Beyond the Illness

When Linda’s spouse was diagnosed with a critical illness related to diabetes, their family was devastated. However, their Critical Illness Insurance Policy included provisions for caregiving and rehabilitation costs, which were crucial during his recovery. This comprehensive coverage allowed Linda to hire help at home, reducing her burden and enabling her to maintain her career while caring for her spouse. Linda’s story underscores the importance of considering how an illness affects the entire family and choosing a policy that supports broader needs.

Mark’s Miracle: Financial Freedom to Choose the Best Care

Mark’s story is particularly touching. Diagnosed with a rare complication of diabetes, he faced a long road to recovery with several treatment options, some of which were experimental and not covered by public health insurance. Thanks to his Critical Illness Insurance Policy, he was able to access cutting-edge treatments without the usual financial constraints. This freedom not only helped him recover but also allowed him to participate in trials that benefited others with his condition. Mark’s experience illustrates how Critical Illness Insurance can provide not just security but also hope and new possibilities.

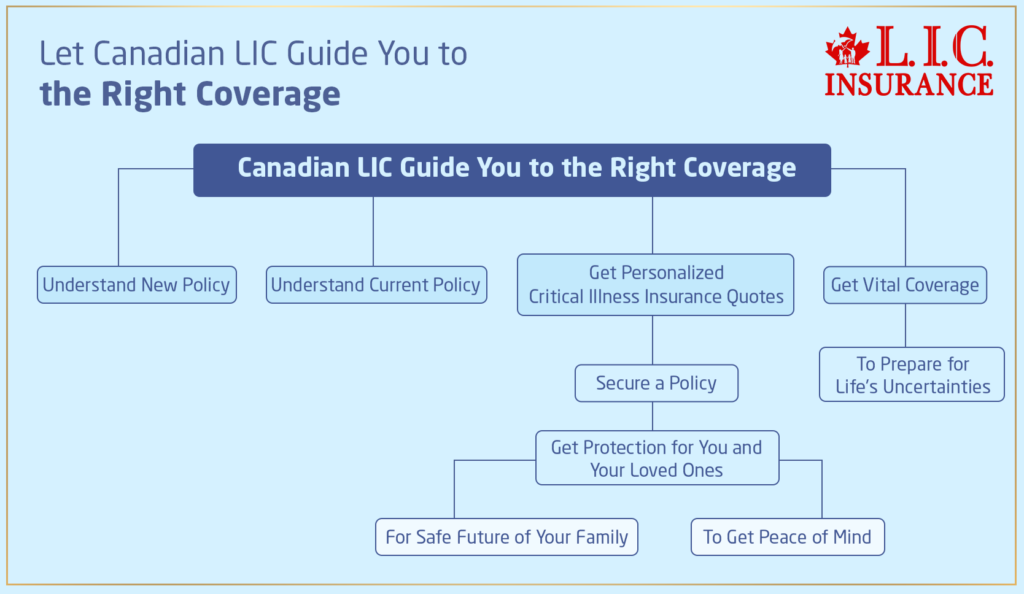

Let Canadian LIC Guide You to the Right Coverage

Every story we share at Canadian LIC shows in some fundamental ways the transformative power of Critical Illness Insurance. Whether it be a new policy or you want to understand your current one better, we are here for that. Don’t wait until it is too late. Reach out to us for personalized Critical Illness Insurance Quotes, and let us help secure a policy for you that truly has you and your loved ones protected. With Canadian LIC, you buy not only insurance but also the future of your family and peace of mind for them. Allow us to walk you through this very vital coverage and ensure that you are prepared for whatever life brings your way.

Preventing Common Misunderstandings

Most of the time, a huge part of the daily discussions at Canadian LIC is educating our clients about what Critical Illness Insurance really covers. One can’t emphasize enough the importance of proper discussion and comparison before deciding. It’s not all about affordable Critical Illness Insurance Quotes; it’s about matching your coverage with your individual health risks and needs.

Summing Up

To find out if diabetes is covered by Critical Illness Insurance in Canada, you need to look at the fine print of each policy. If you are at risk or have diabetes, it’s a must-do for financial security. At Canadian LIC, we will guide you through this process to find a policy that suits your situation.

Don’t let confusion get in your way. Contact Canadian LIC, the best insurance brokerage and get your Critical Illness Insurance Policy today. Protect yourself and your family from the unexpected turns of life with a policy that truly covers your needs. Remember, in the world of insurance, knowledge is power.

More on Critical Illness Insurance

How Does Inflation Affect My Critical Illness Insurance Coverage?

Can You Claim Twice For Critical Illness Coverage?

Can I Switch Critical Illness Insurance Providers?

Can I Purchase Critical Illness Insurance For My Children?

Does Critical Illness Insurance Cover Broken Bones?

Can I Cancel My Critical Illness Insurance?

Can You Add Critical Illness Cover To An Existing Policy?

What Is A Critical Illness Insurance Claim?

What Cancers Are Not Covered By Critical Illness Insurance?

Does Critical Illness Insurance Cover Heart Failure?

Does Critical Illness Insurance Cover Death?

Can I Have Two Critical Illness Policies?

Can You Take Out Critical Illness Cover Without Life Insurance?

What Age Should You Get Critical Illness Cover?

What Is The Difference Between Life Insurance And Critical Illness Insurance?

All About The Critical Illness Insurance Policy & The Benefits Of Critical Illness Insurance

Why Is Critical Illness Insurance Coverage Important? And Do We Need It?

How Critical Illness Insurance Can Be Your Lifesaver In Canada?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs: Understanding Critical Illness Insurance Coverage

Critical Illness Insurance can be complex. At Canadian LIC, we encounter some common questions from our clients in their quest to understand their Critical Illness Insurance Policy better and to determine the best option for their needs. We have compiled a list of frequently asked questions below, together with their detailed and scenario-based real, relatable answers, to act as guides in daily living.

Critical Illness Insurance usually pays out as one lump sum in the event of diagnosis with a covered illness, subject to the policyholder surviving the waiting period. In this regard, such a payout is expected to be used at one’s discretion, whether for medical treatments, living expenses, or any other financial needs during recovery. All necessary medical documentation with the filled-in claim form will help the process start quickly.

The amount of Critical Illness Insurance that one should get is often determined by several factors. Aspects that one will take into consideration are liabilities, health risks, and available funds or insurance coverage. It is important to know how much income you need to replace if you can’t resume work for a long period. Also, there might be some medical costs and ongoing living expenses. A general rule of thumb is to obtain a policy that covers between 1 and 2 years of your gross income; however, a discussion with a financial adviser can help personalize this to your situation.

Choosing the right Critical Illness Insurance Policy involves considering several factors:

Coverage

Look for a policy that covers diseases you are most concerned about, whether due to family history or personal health.

Exclusions:

Be aware of any conditions or circumstances that the policy does not cover.

Payout:

Ensure the payout amount will sufficiently cover your needs.

Premiums

Consider whether you prefer fixed premiums (which do not change over time) or adjustable rates (which may start lower but can increase).

Insurer’s Reputation:

Choose a provider known for reliable claims service and financial stability.

It’s beneficial to compare multiple Critical Illness Insurance Quotes and policies to find the best fit for your needs.

Critical Illness Insurance pays a tax-free, one-time lump sum to the policyholder upon diagnosis of a covered critical illness. This payout is flexible and can be used for various purposes, such as:

Medical treatments are not covered by public health insurance or other insurance.

Daily living expenses while you are unable to work.

Paying down debts or mortgages, which can be crucial if income is reduced.

Modifications to your home or vehicle if your illness requires it.

Travel and accommodation expenses if treatment is far from home.

Critical Illness Insurance generally pays out only after the policyholder has survived a minimum period from the date of diagnosis of a defined covered illness, usually in 30 days. Any policy will outline this and must be adhered to before a lump sum will be paid out. A claim should be submitted as soon as possible after diagnosis to avoid payout delays.

It’s best to buy Critical Illness Insurance when you are relatively youthful and healthy. Premiums may tend to be lower for younger people and increase over the years. Also, getting insurance early and before any major health problems occur will avoid limits on pre-existing conditions. It would help to consider insurance when you have enormous financial obligations, like a mortgage or dependents who rely entirely on you for their care.

Critical Illness Insurance cover is the promise of a lump sum in the event that you are diagnosed with any of the specified illnesses noted in your policy. Typically, these would include major, serious, or fatal illnesses such as cancer, heart attack, and stroke. However, based on what we saw in our client John’s case, one should check the policy regarding coverage for diabetes or any complications that result from it because there are some wherein it might be included, depending on the policy details.

Getting quotes for Critical Illness Insurance is easy at Canadian LIC. We just need to be contacted, and then we will ask you for some basic information about your health and coverage. We then shop a number of policies through different insurers to establish the best rates and options for you. Remember, as Emily found out, the cheapest quote isn’t always the best if it doesn’t cover your specific needs.

Yes, the majority of policies will allow you to make changes or add additional coverage that will suit your needs. In addition, David accumulated more advanced treatment possibilities in regard to his diabetes. You should review your policy regularly and contact us at Canadian LIC to discuss any pertinent changes in your health or family history that require your coverage to be adjusted accordingly.

While selecting a Critical Illness Insurance Policy, look out for the illnesses covered, the actual amount that will be paid out in a lump sum, and any exclusions or limitations. A policy with caregiving expenses really helped Linda while her spouse was ill. Be sure to get a policy that will not only help you with your health risks but also meet other peripheral expenses.

Your premium costs and eligibility would have a lot to do with your current health. Mark had a pre-existing condition yet was able to get coverage that allowed for experimental treatments. His premiums were higher, of course. Please take note of this: it has to be ensured that all health information is revealed at the time one applies for Critical Illness Insurance; otherwise, this insurance may not prove legally binding or effective.

The best time to buy Critical Illness Insurance is right now—immediately after you can afford it. The younger you are when applying, the lower your premium will be; moreover, you’re less likely to have any existing medical conditions that could be excluded from your policy or reflected in its price. As with what we learned from how John approached securing it early, the proactive approach gives peace of mind and protection where it is really needed.

It differs in all policies but is generally 30 days from diagnosis of a covered illness. One should furnish medical proof of diagnosis and fill in the claim form. We assist our clients like Emily in navigating this process to ensure they receive their payouts as quickly and smoothly as possible.

Health insurance and Critical Illness Insurance are two different products: health insurance pays for medical bills and ongoing health care costs; instead, Critical Illness Insurance pays out a lump sum regarding the diagnosis of a covered critical illness. This difference spelled everything in Mark’s case, for it enabled him to pay for things that would not be covered alone by health insurance—such as experimental treatments or the lost income due to his illness.

Yes, most Critical Illness Insurance Policies have age limits for new applicants, usually to the age of about 65. Coverage can usually continue beyond this once you have a policy. This was a key consideration for Dev, who ensured he secured his policy before reaching the maximum age to ensure continuous coverage for his ongoing health needs.

Yes, some Critical Illness Insurance Policies do allow for family coverage, including your spouse and dependent children. This, to Lily, was a very special feature since it kept her mind at peace, knowing that her whole family was under one Critical Illness Insurance Policy.

Although specifics may vary, generally speaking, most Critical Illness Insurance Policies cover the person worldwide. Remember that you will have to contact your insurer before moving and ensure that your policy remains effective. Alia encountered this situation when she contemplated a temporary move for her career, and Canadian LIC helped her confirm her coverage would continue during her time abroad.

Making claims requires one to fill in a claim form with some medical proof about the diagnosis one has, normally given out by a qualified healthcare provider. In Canadian LIC, we help clients like John navigate the process by making sure that all paperwork is done right and gets submitted on time to avoid delays in receiving this payout.

It’s important to go through your policy documents and discuss with your insurance consultant exactly what diseases are covered. If you are dealing with Canadian LIC, then we can explain everything in detail to help you get a clear understanding of your Critical Illness Insurance Policy, just like we did with Maria when she had questions regarding diabetes coverage.

We would encourage you to review your Critical Illness Insurance Policy at least every two years or following major events in your life, such as when you get married, have a baby, or are diagnosed with something new regarding your health. This will help to ensure that your coverage remains relevant to your current situation and needs. It is this kind of proactive approach that helped Dinesh adapt his coverage over the course of time as his family and health needs changed.

Your journey to getting the right Critical Illness Insurance doesn’t have to be complicated. We at the Canadian LIC are here to help you through every step—from getting the quotes to making a claim. Do you still have questions? Let us know. We’re here to make sure you get the right Critical Illness Insurance Policy that will protect you and your loved ones from the financial impacts of serious health issues.

Sources and Further Reading

Here are some sources and further reading suggestions that can provide additional information and deeper insights into Critical Illness Insurance, specifically concerning coverage for diabetes in Canada:

Canadian Life and Health Insurance Association (CLHIA) – Offers comprehensive guides and publications on Critical Illness Insurance Policies in Canada

Diabetes Canada – Provides resources on managing diabetes, including financial aspects and insurance advice for those living with diabetes.

Insurance & Investment Journal – Features articles on insurance products, including Critical Illness Insurance, with industry insights and updates

. Insurance & Investment Journal

Financial Consumer Agency of Canada – Offers information on various types of insurance, including Critical Illness Insurance, and how to choose the right policy.

These resources can help readers gain a better understanding of Critical Illness Insurance and make informed decisions about their insurance needs, especially if they are managing or at risk for diabetes.

Key Takeaways

- Critical Illness Insurance typically covers specified serious illnesses, and diabetes coverage varies between policies.

- It's crucial to understand what your Critical Illness Insurance Policy covers, especially for conditions like diabetes.

- Being proactive in managing Critical Illness Insurance can provide financial relief and peace of mind.

- Comparing different policies is important to ensure they meet specific health needs, including diabetes risk.

- Critical Illness Insurance aids financial planning by providing a lump sum for various needs after a diagnosis.

- Obtaining insurance early can be cost-effective and provide coverage before serious health issues develop.

- Consulting with professionals can help navigate the complexities of Critical Illness Insurance and ensure adequate protection.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]