- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Reviews

Common Inquiries

- Can I purchase Critical Illness Insurance if I am already retired?

- What Happens If I Never Claim My Critical Illness Insurance?

- Does Critical Illness Insurance Cover Diabetes?

- Can You Claim Twice for Critical Illness Coverage?

- Can I Switch Critical Illness Insurance Providers?

- Does Critical Illness Insurance Cover Broken Bones?

- Can You Add Critical Illness Cover to an Existing Policy?

- What Cancers Are Not Covered by Critical Illness Insurance?

- Does Critical Illness Insurance Cover Heart Failure?

- Does Critical Illness Insurance Cover Death?

- Can I Have Two Critical Illness Policies?

- Can You Take Out Critical Illness Cover Without Life Insurance?

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- How Expensive Is Term Life Insurance?

- The Growing Concern Over Liver Health

- Insurance Policies: How They Work and What They Cover

- Clarifying Policy Definitions and Exclusions

- Exploring the Different Critical Heath Insurance Plans

- Steps to Ensure Your Policy Matches Your Needs

- Real-Life Experiences and Shared Stories

- Financial Relief Through Accurate Coverage

- Understanding the Underwriting Process

- Evaluating the Long-Term Benefits of a Policy

- Tailoring Your Policy to Fit Personal Health Needs

Does Critical Illness Cover Liver Disease?

By Harpreet Puri

CEO & Founder

- 11 min read

- February 7th, 2025

SUMMARY

This blog discusses the coverage of a Critical Illness Insurance Policy for liver disease in Canada. It provides information on how policies work, what conditions are included or excluded, and it compares different types of Critical Heath Insurance Plans. The article shares tips on checking policy details, getting clear quotes on Critical Illness Insurance, and stories from day-to-day client experiences to bring clarity to some common insurance problems and help in choosing the correct coverage.

Introduction

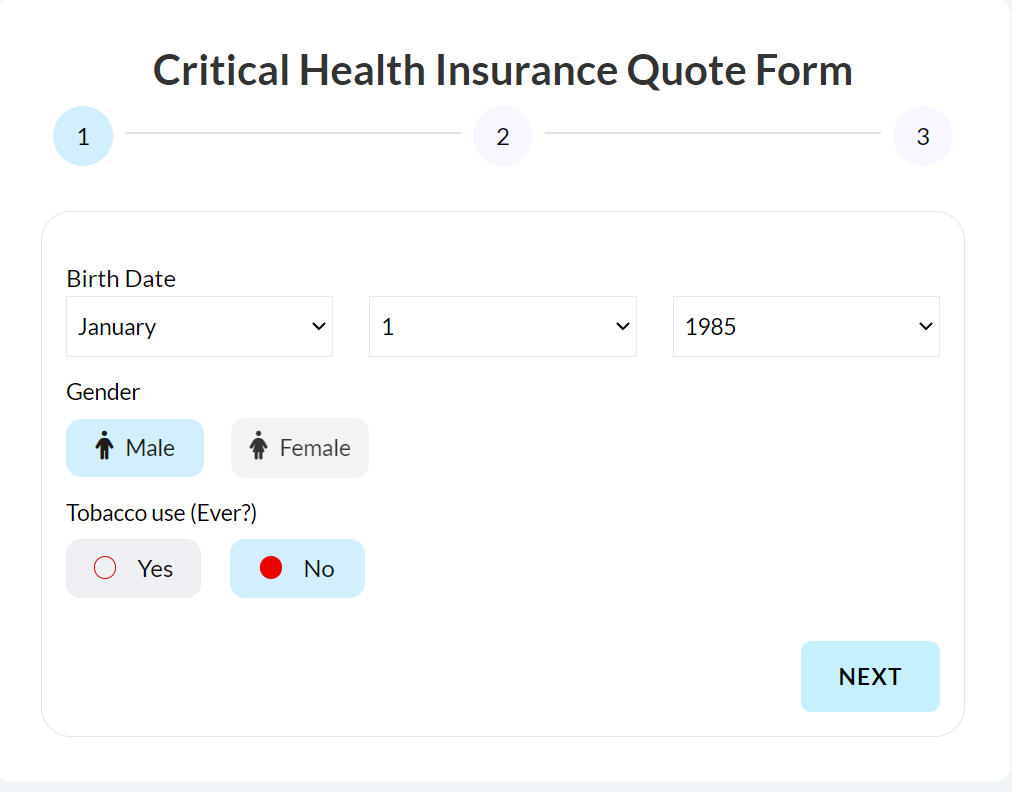

Many Canadians are concerned about the associated costs of major health issues. When talking about critical illness quotes, a typical question that most people ask is: does my critical illness policy cover liver disease? Here, we discuss the different benefits of numerous Critical Heath Insurance Plans and talk about common daily experiences that an insurance brokerage from Canada witnesses among its clients. Perhaps you felt that the liver disease had interrupted your life and are not quite sure whether your insurance would support you if needed. The details come into play here, along with how we work together with your experiences.

The Growing Concern Over Liver Health

Liver disease may pose some uninvited change in life to the affected individuals. In addition, many face confusion regarding whether certain conditions fall under the covers of their insurance. Most of the clients voice their concerns that they find their liver disease silent and sneaky. They have always been questioning whether their Critical Illness Insurance Quotes will cover them. In some policies, conditions like heart attack, stroke, and certain forms of cancer may be covered, but not for cases of liver diseases.

This brings us into frequent contact with clients who lament unclear policy details. We seek to make them realize the advantages and disadvantages of their coverage. In personal conversations, people usually talk about how hard it is to understand complex medical bills, unanticipated health crises, and the perpetual quest for reliable information. These talks bring back the big question of whether a Critical Illness Insurance Policy that covers liver disease can be relied upon in case of a serious diagnosis made. When discussing such protection against financial burdens resulting from a serious diagnosis, these topics become even more pertinent.

Insurance Policies: How They Work and What They Cover

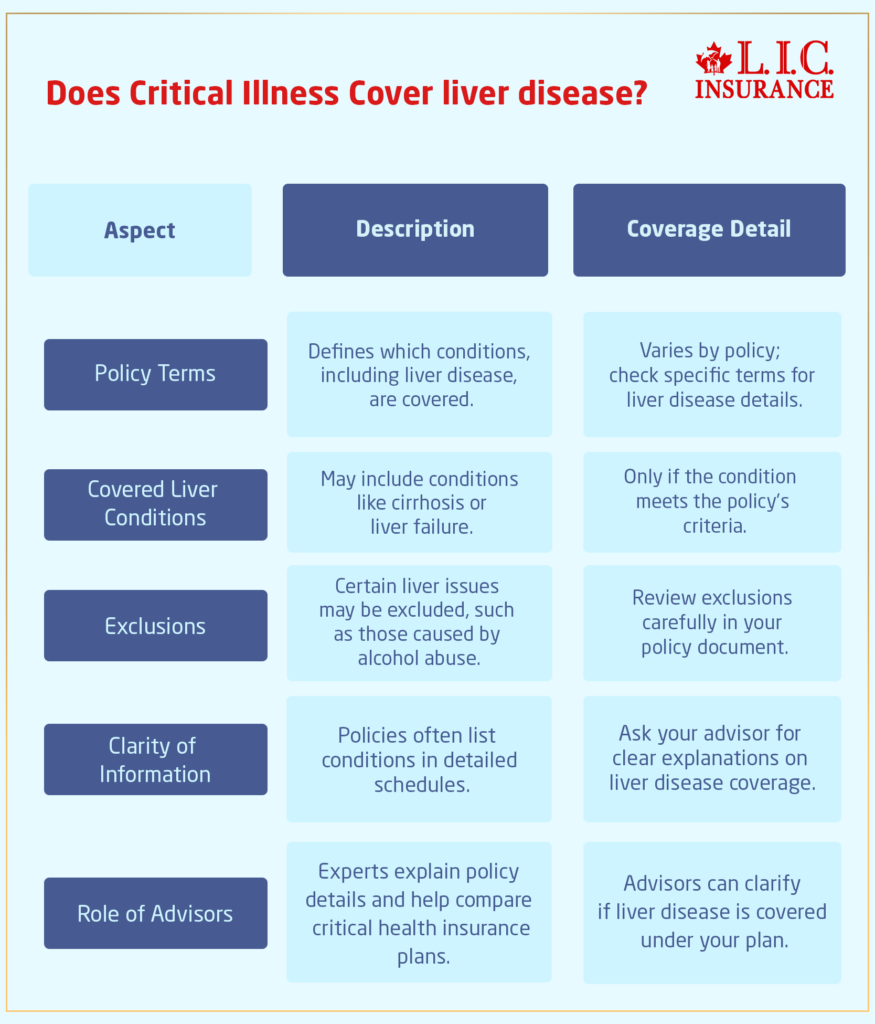

The main purpose of Critical Illness Coverage is to provide the financial means when a serious medical condition is diagnosed. They provide a lump-sum payment upon the diagnosis of any covered illness. However, it may vary based on the type of Critical Illness Insurance Plan and the definitions that are used within the policy. Sometimes, it covers liver disease if the definitions of the insurance company meet the criteria for the specific condition. Many clients seek these details when reviewing Critical Illness Insurance Quotes. In our everyday interactions, we emphasize the need to read through the policy’s terms carefully and discuss any doubts with an experienced advisor.

One thing to be remembered is that the coverage information differs from company to company. Some of the essential health covers include liver conditions if they have a relation to chronic conditions, such as cirrhosis or liver failure; others may leave out some kinds of liver disease. Clients experiencing continuous liver disorder often express how they are frustrated with the decision on whether or not their situation falls under claim. Our job as consultants is to break all of this down into clear, actionable information. More than once, we explained how “liver disease” and “liver failure” are defined within the policy. We then get them to ask questions until they are comfortable with what they’ve bought.

Clarifying Policy Definitions and Exclusions

Insurance policies tend to specifically outline what is covered and explained, as well as what is not. Many critical illness policies point out the defined conditions with a schedule or list. For liver conditions, these may include but are not limited to the following:

- Chronic Liver Disease: This will include cases of the liver being gradually lost.

- Liver Failure: In some of the policies, the claim might be valid if the liver ceases to function altogether.

- Hepatitis: This might include fulminant cases of hepatitis that eventually lead to liver failure.

Some policies state that liver disease caused by lifestyle factors such as alcohol abuse will not be included, while other policies do not state such exclusion. We discuss these cases regularly with our clients during their meetings. There is always an argument that lifestyles affect one’s eligibility for certain Critical Illness Insurance Claims. Therefore, we recommend asking the correct questions when asking for quotes and reviewing every little detail with the right advisor.

Our brokerage approach is to share all the available details. We urge our clients to read the fine print so that they can question and ask for clarifications on what is considered a liver disease. Then, they would be well-equipped to make decisions when selecting a plan.

Exploring the Different Critical Heath Insurance Plans

There are a lot of Critical Heath Insurance Plans to choose from within Canada. Some policies allow more coverage, while the rest are strictly based on those that normally occur, such as heart diseases and cancers. When opting for a given policy, liver disease should also be covered, whether it is major or minor, and we consult on the advantages and disadvantages comparison of various options with our clients.

Some of the customers shared their tribulations in choosing which policy may or may not include liver disease. One customer expressed how her friend’s liver failure made her think twice about changing her coverage. Another client expressed how she failed to understand some of the definitions in the policy, making it confusing when she needed clarity during a tough time. These experiences bring great importance to detailed questions related to quotes of Critical Illness Insurance and a very thorough review of the policy. Experts advise clients that they check their policy to see if it has taken into consideration liver disease and for what reasons the claim might become eligible.

Steps to Ensure Your Policy Matches Your Needs

Many individuals desire assurances that their Critical Illness Insurance covers all risk categories. In order to have assurance that the cover is ideal for your needs, you may wish to follow the following guidelines;

Carefully study the policy document: Start from each page, especially the part concerning liver disease, and ensure you identify specific definitions, as well as exceptions which can apply.

- Discuss with an Advisor: Discuss the policy with a knowledgeable representative who can explain it in simple terms. We ensure to explain what liver disease coverage means in simple terms so you feel secure.

- Ask Specific Questions: Ask if the policy covers liver disease that is caused by chronic conditions or lifestyle factors. Many clients appreciate when we break down the differences in coverage.

- Compare Various Plans: Compare several Critical Health Insurance Plans. Our customers often find that comparing plans highlights subtle differences in liver disease coverage that are important to their final decision.

- Consider Future Needs: Consider your future health and how liver-related issues may impact you. Many find that discussing long-term health risks helps them decide on a plan that remains worthwhile over time.

Many of our clients come in looking worried about all the details that might overwhelm them; however, these steps enable them to grow more confident with the decision they have made, which leads them to long-term satisfaction with the plan they select.

Real-Life Experiences and Shared Stories

Every day, our experts hear Canadians relate their mixed feelings about Critical Illness Insurance policies. The first client noted an instance in which they said when they started feeling a condition related to a rare liver disease, the cover was not in place. When diagnosed with cirrhosis in the liver, the second felt relieved knowing it would help their finances through this critical health cover. Shared most of the rest with such anxiety over whether it’s enough cover.

A patient was diagnosed with a critical liver disease, and a heavy medical bill was waiting for him. He felt himself in such confusion regarding the terms of the coverage that he would go for consultation over this issue. After due verification, it was found that his condition fell within the purview of the policy only if the concerned criterion of the policy was satisfied. Inspirational stories like these fill the minds of those who tread carefully amidst the difficulties of insurance coverage with confidence.

Many clients have commented that they felt much more secure after knowing all the details about their policy. They like to have all these details discussed and cleared by our team. Most of the time, this leads to a much better decision when selecting a suitable policy.

Financial Relief Through Accurate Coverage

There is a common thread running through most discussions of financial relief of having a well-matched insurance policy. Liver disease can come on unexpectedly, and families may not be prepared for the increasing expenses. If a policy covers liver disease, then the lump sum can pay for hospital stays, medications, and even home care. Relief for those who are not able to save for these unexpected costs is critical.

In many meetings, clients reveal how the financial support provided by the Critical Illness Insurance Policy made a difference in recovery. They are able to state how the payment allowed them not to worry over the overwhelming bills and focus solely on their health. This is one of the strongest reasons why people invest so much time and effort into receiving Critical Illness Insurance Quotes and comparisons of different plans.

Clients who face severe conditions thank their insurance company for the safety it offers. They say knowing that they can rely on this financial support at difficult times keeps them in a state of comfort and control. Our conversations bring out the point that the proper plan selection demands knowledge of all the possible benefits and that such conditions as liver disease are included if necessary.

Understanding the Underwriting Process

Critical illness underwriting plays an important role in applying for an insurance policy. An underwriter checks your medical history and could question any problems that have ever affected your liver. Underwriting makes sure the policy corresponds well to your risk health profile. Most clients find themselves tensed about the process, especially in a situation like when they have liver-related pre-existing conditions.

In these discussions, our experts tell clients that the underwriting process is fair and thorough. They will learn that any history of liver disease must be disclosed and discussed openly. This openness will ensure that the chosen critical health insurance plan meets its requirements and does not bring about any surprises later on. Our advice usually includes tips on how to prepare for underwriting discussions, which makes the process less daunting.

Evaluating the Long-Term Benefits of a Policy

Critical Illness Insurance investment is a long-term investment. It provides both financial security during a health crisis and stability in your future plans. In most cases, clients are often concerned about whether the coverage will adjust to the needs of the individual over time. For example, if a client has a history of liver disease in the family, then there is a requirement for a policy that can evolve with the needs of the times.

During our counsel, most customers have told us that they appreciate long-term plans. They wanted to know, for example, how their Critical Illness Insurance would stand for them later in life whenever a liver disorder arises. For this, they advise our planners that the company sometimes attaches or includes additional policy riders with higher benefits to boost coverage. Riders provide security whereby even when circumstances change with one’s health issues, their benefits will continue in support.

We make our clients feel more secure in their decisions by discussing long-term benefits. They learn that a robust insurance policy can serve as a financial safety net during multiple life stages. Such discussions often lead to a more thoughtful review of various Critical Heath Insurance Plans available in the market.

Tailoring Your Policy to Fit Personal Health Needs

Every person’s health history is unique, and your insurance policy should reflect that. Many clients ask if their current state of health and family history, including liver-related issues, will impact their coverage when purchasing a policy. Our team listens to every client’s story and works hard to find a plan that fits their specific needs.

For clients with concerns over liver disease, we recommend looking for policies that explicitly mention liver conditions as part of the cover. We explain all the pros and cons associated with various Critical Illness Insurance Quotes, compare treatment options for liver disease for different policies, and empower our clients to ask questions through interactive discussions with clear answers provided.

We see clients relieve themselves when they know that unique health needs are taken into account. They also appreciate having questions answered in simple language. That is the personal approach that makes sure you will choose a policy that supports your health and financial goals.

Examining Policy Reviews and Consumer Feedback

Researching various Critical Heath Insurance Plans requires reading reviews and consumer feedback. Most potential policyholders today read reviews online. Based on our experience, most of our clients have said that other people’s feedback is what usually lets them know a policy’s strengths and weaknesses. They state that a policy highlighting its coverage of liver diseases usually receives more positive reviews.

We discuss how our experiences through reviews and hands-on interaction with various policies make us understand them better. We let the client know that reputation does play a role in a policy, which means you need to compare your Critical Illness Insurance Quotes from reputed companies to make better decisions. Clients like to hear what you have to say when you come across such different cases through your years of experience.

It is through these discussions that you can ask others about their experiences, and knowing how a policy handled the claim for liver disease can try to reassure you that the policy will work in your favour if it is needed.

Addressing Common Misunderstandings

Many insurance policies and their coverage have misconceptions. One common misconception is that all Critical Illness Insurance policies automatically cover liver disease. Our experience dictates that, indeed, certain conditions are included under certain policies with regard to liver disease coverage, while others have no such coverage. This causes a lot of confusion and stress for policyholders.

We endeavour to make it clear that the fine print of your policy is very important. We usually explain to you how these details could be pertinent when dealing with terms like “liver failure” or “chronic liver disease” and any exclusion related to these. Such clarity will give you a better understanding of what is and what isn’t covered. Our explanations are beneficial to our clients, and they leave feeling more confident about their choices.

By clearing up such misconceptions, we open ourselves to a discussion. You will be able to ask your questions and concerns and make sure that you have everything you need to decide.

Steps for Reviewing and Updating Your Policy

Change is a dynamic attribute of your health, and the insurance coverage must be equally adaptable. People always ask themselves if their Critical Illness Insurance coverage remains adequate over time with respect to new risks arising in the medical field. We recommend our clients revisit their policies regularly if there are risks of family predisposition toward liver disease or any other risk.

Steps when you review your policy:

Regular review: Meet the advisor at least once a year to discuss new health conditions and policy updates

Update medical Information: Inform them of new medical diagnoses, especially those concerning liver diseases, and have them reflected in your current policy.

Compare with New Offers: Insurance companies update their products quite often. Compare your prevailing critical health plans with new ones to ensure coverage.

Discuss Future Needs: Raise potential future risk factors with the advisor. Quite often, your advisor will guide you to enhance riders or tweak to better safeguard against liver conditions.

Clients who follow these steps report feeling more secure about their long-term coverage. They often share that regular reviews help them avoid surprises when it comes time to make a claim.

Understanding the Claims Process for Liver Disease

Once the reality of having liver disease, the claims process is a bit daunting. We have had clients feel anxiety when they reach this stage as they fear the potential delay or denied claim. In any case, understanding the process has always soothed such concerns. The Critical Illness Insurance Policy, by and large, always provides for the claims process within the documents. It also advises clients on what medical records and documentation to provide.

Our advisors feel that being proactive in the claim process saves more time and lowers stress. This is achieved if you keep your clients well-advised of all medical visits and treatment notes concerning liver diseases. By keeping detailed documentation, you improve the chances that your claim will be processed smoothly.

Most patients want to understand the process of empowering themselves. They pose direct questions related to what would be required of them in the documentation and how many days the final approval usually takes. This question further makes one approach certain paperwork about being affected by the liver disorder.

Learning from Peer Experiences

In fact, relating with others who may have gone through similar experiences will give one some comfort and clarification. Many Canadians share stories of how their Critical Illness Insurance Policy helped them overcome the financial strain of severe liver conditions. This shared experience will give policyholders a feeling of community. You must have heard anecdotal evidence from friends or colleagues about the hard times of managing unexpected health bills.

Our team always shares stories about peers and, of course, experiences of individuals where coverage from a policy made a big difference during challenging times when someone suffered from liver disease. These questions remind you that you are not the only one experiencing those uncertainties, and they also encourage you to ask questions regarding how a particular policy dealt with the liver disease claim while comparing your Critical Illness Insurance Quotes.

Weighing the Pros and Cons of Various Plans

Choosing the best Critical Heath Insurance Plans means considering the advantages and disadvantages of each. Many customers are concerned about getting the right value out of the policy, starting with liver disease. To guide them, we enumerate the pros and cons in simple, easy-to-understand terms.

Pros:

- Financial Security: A good policy provides a single lump-sum payment that can help care for expenses related to medical costs, income loss, and further costs for care.

- Customized Choices: Most policies allow you to customize coverage to include conditions like liver disease.

- Peace of Mind for the Future: Knowing you have a safety net in place reduces stress when things are uncertain.

Cons:

- Complex Terms: Some policies contain language that can be confusing and lead to misunderstanding of what is covered.

- Exclusions: Some types of liver conditions, especially lifestyle-related ones, are not covered.

- Coverage Cost Differences: Deeper coverage may sometimes be costly, and individuals cannot afford to pay for such insurance.

Talking to an advisor about such points will help you balance out the decision. Clients will appreciate having a defined list of benefits and challenges, making it easy for you to decide on a policy that covers both your health needs and finances.

Strategies for Getting the Best Insurance Options

The number of people worrying about the price and reliability of their insurance has been on the rise. Determining the best Critical Illness Insurance Quotes requires comparisons, reading the details, and asking informed questions. Our experience is that when you take the time to collect more detailed information, you end up making better choices.

Recommendations

You can take charge by:

- Making thorough research of credible insurance companies.

- Requesting detailed explanations of the terms of the policies.

- Comparing the ways different policies treat liver disease coverage.

- Discussing choices with trusted advisors who understand your health history and financial objectives.

This strategy has given many clients the opportunity to have plans that provide strong support during tough times. They are better served because they can count on investing in a policy that will cater to current needs and predictively anticipate future challenges.

Planning Ahead with a Focus on Well-Being

Your health journey is often characterized by uncertainty. It is thus very important to prepare for such moments. Full-scale Critical Illness Insurance provides a financial safety net when life throws unknown challenges your way. These plans are, in many cases, invested in for protection against unforeseen expenses- some being liver disease-related.

Our daily interactions remind us that taking time for proper planning today will eradicate major tension tomorrow. “Our clients tell us that knowing their policy details and having a clear plan keeps them feeling much more secure,” they say. “The process of choosing a plan, asking questions about Critical Illness Insurance Quotes, and comparing Critical Heath Insurance Plans has been a liberating process to be in control of one’s future.”

Ensuring Clarity in Communication

Throughout all of our talks, we keep emphasizing the need for communication with insurers. When a policy has simple language, it is not hard to determine what is covered by the policy. Many clients have indeed been thankful to know that the coverage for liver disease is explained in simple words. You benefit from talks that break down jargon into simple everyday language.

This will not only establish trust but also make it possible for you to make wise decisions. Through regular discussions regarding the policy details, you understand what is being provided and what you have to contribute. This type of openness gives the client much-needed reassurance when in dire health circumstances.

Reflecting on Your Options

It is necessary to take some time to think about your insurance options. Indeed, many Canadians have reported feeling overwhelmed when deciding on a policy, especially considering conditions such as liver disease. However, you can clear the confusion by educating yourself and having experts answer your questions.

It helps to ask yourself:

- Do I fully understand what conditions my policy covers?

- Have I inquired about specific questions regarding coverage for liver disease?

- Am I okay with the monetary terms and claims process?

This would tell you if your insurance policy meets your expectations or not. Our financial advisors encourage such reflective questions to help you make decisions that align with your long-term goals.

Building a Supportive Network

The most reassuring aspect of having a Critical Illness Insurance Policy is the community around shared experiences. You might get new insights while discussing your worries with family or friends, and sometimes with experts you trust. At our brokerage, we like to open our conversations on how challenging it could be and rewardingly so for investing in the right insurance plan.

Shared experiences bring sources of support in the most unlikely places. You learn that you’re not alone when it comes to the uncertainty caused by a serious health condition like liver disease. The strengthening of this support system makes the desire to do one’s best at making decisions about one’s health more solidified.

Taking Action for a Secure Future

A source of comfort that can be quite soothing in deciding to purchase Critical Illness Insurance is community building through shared experiences. You find that talking with family, friends, or professional individuals whom you trust gives you a new point of view concerning your fears and worries. Open conversations at our brokerage encourage frank discussions about challenges and rewards as people invest in the right kind of insurance plans.

You frequently find potential sources of support and understanding in ordinary people when you share your journey. Interactions like these help you realize that you aren’t alone in the uncertainties of severe health conditions like liver disease. Strengthening your resolve to make the best possible decision for your well-being is part of this process.

Does Critical Illness Cover liver disease?

Final Thoughts and Next Steps

Your journey toward complete coverage begins by understanding what options are available to you and which questions you must ask. From our conversation so far, you have probably witnessed how well-aligned coverage reduces some of the monetary burdens involved during health-related issues. Your conversation about liver disease and Critical Illness Insurance can give you the point that a clearer understanding leads to better preparedness.

You will have a great safety net when you decide on a policy that clearly shows what is covered under liver disease. The whole process of finding personalized Critical Illness Insurance Quotes, reviewing your policy, and comparing the best Critical Heath Insurance Plans can only be decided by such research. This kind of care ensures your future financial security and supports you in such trying times.

We encourage you to reflect on your personal health needs and consider all aspects of your insurance coverage. The decisions you make today can shape a more secure tomorrow. By taking active steps—reviewing your policy details, asking specific questions about liver disease, and comparing plans—you position yourself to receive the assistance you may need when a serious condition arises.

Gather all information, seek informed advisors, and study your available options. All these proactive approaches ensure that all aspects of coverage support your health and financial security. The following experiences demonstrate how, with proper preparation and good communication, one can make the right decisions that will actually improve their future.

Always stay informed and engaged while maintaining your well-being. With clear understanding and careful planning, you are the master of your own insurance coverage. Secure a future by picking a policy that shows how you need it, and every question asked brings you closer to support.

More on Term Life Insurance

- Can I Use Critical Illness Insurance to Cover Mortgage Payments?

- What’s the Maximum Payout for Critical Illness Insurance in Canada?

- Can I purchase Critical Illness Insurance if I am already retired?

- What Happens If I Never Claim My Critical Illness Insurance?

- Does Critical Illness Insurance Cover Diabetes?

- How Does Inflation Affect My Critical Illness Insurance Coverage?

- Can You Claim Twice for Critical Illness Coverage?

- Can I Switch Critical Illness Insurance Providers?

- Can I Purchase Critical Illness Insurance for My Children?

- Does Critical Illness Insurance Cover Broken Bones?

- Can I Cancel My Critical Illness Insurance?

- Can You Add Critical Illness Cover to an Existing Policy?

- What is a Critical Illness Insurance Claim?

- What Cancers Are Not Covered by Critical Illness Insurance?

- Does Critical Illness Insurance Cover Heart Failure?

- Does Critical Illness Insurance Cover Death?

- Can I Have Two Critical Illness Policies?

- Can You Take Out Critical Illness Cover Without Life Insurance?

- What Age Should You Get Critical Illness Cover?

- Critical Illness vs. Disability Insurance in Canada: Understanding the Differences and Making Informed Choices

Frequently Asked Questions

It’s a common question many clients have. Critical Illness Insurance can actually cover liver disease. Some of the plans that include liver disease are only provided if they fulfill the criteria. We hear cases of clients asking if their policy will cover them. Our advisors explain every little detail to the clients so as to clarify anything.

Several critical health insurance policies cover liver diseases. Some consider it as one of the chronic liver conditions under their policies. We see several clients compare and contrast different policies to find their best match. They ask some very detailed questions about the coverage of liver diseases. This allows them to find a plan that suits their requirements.

You can request quotes on Critical Illness Insurance from different companies. With clear quotes on some, you will know if liver disease is included. Clients also testify that getting clear quotes helps them decide. Ask your team to ensure you specifically ask for liver disease in your quote.

With added coverage, the cost of a policy can change. Some will charge extra for the support of liver disease. So we see clients who compare prices and benefits before making up their minds. Our advisors help explain the difference in simple terms.

Yes, a previous liver issue may impact your coverage. The underwriters do ask about your health history in the application. Many clients get anxious when they disclose this information. We guide them on how it may impact their Critical Illness Insurance Policy.

Our team hears your concerns and examines your needs. We help explain how each plan covers liver disease. We hear from our clients that it really makes all the difference in clear, easy answers. Let us help you compare Critical Heath Insurance Plans and quotes in plain language.

There are, however, those policies that do not cover most of the conditions. According to the clients, they were so stranded when their claim for liver disease was declined. We advise them to ask for a policy review or find another plan. Our experts guide you to plans that match your health needs.

You have to review your policy regularly. Most clients schedule an appointment with an advisor each year to verify their coverage. They ask for a change, if any, in their Critical Illness Insurance Policy. This will help you remain updated on your protection.

Sources and Further Reading

- Insurance Bureau of Canada

https://www.ibc.ca - Canadian Life and Health Insurance Association

https://www.clhia.ca - Government of Canada – Health Benefits

https://www.canada.ca/en/services/benefits.html - Financial Consumer Agency of Canada

https://www.canada.ca/en/financial-consumer-agency.html

Key Takeaways

- Critical Illness Insurance policies in Canada may cover liver disease, but coverage details vary by plan.

- Policy documents clearly define which liver conditions are included and any exclusions.

- Clients should ask detailed questions when requesting Critical Illness Insurance Quotes.

- Reviewing policy details regularly helps ensure the chosen critical health insurance plan meets evolving needs.

- Advisors share client experiences to clarify coverage specifics and guide better decision-making in choosing a policy.

Your Feedback Is Very Important To Us

Thank you for taking the time to share your thoughts. Your feedback helps us improve our content and support your needs. Please fill out the form below.

Thank you for your responses. Your input is valuable and will help us improve the support we provide. We appreciate your time and honesty.

IN THIS ARTICLE

- Does Critical Illness Cover Liver Disease?

- The Growing Concern Over Liver Health

- Insurance Policies: How They Work and What They Cover

- Clarifying Policy Definitions and Exclusions

- Exploring the Different Critical Heath Insurance Plans

- Steps to Ensure Your Policy Matches Your Needs

- Real-Life Experiences and Shared Stories

- Financial Relief Through Accurate Coverage

- Understanding the Underwriting Process

- Evaluating the Long-Term Benefits of a Policy

- Tailoring Your Policy to Fit Personal Health Needs