- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Do Term Life Insurance Plans Offer Cash Value?

- What Is Cash Value, and Why Do People Look for It in Term Life Insurance?

- The Core Features of Term Life Insurance Plans: Why Choose Term Insurance?

- Understanding Why Term Life Insurance Plans Don’t Offer Cash Value

- Who Benefits Most from Term Life Insurance Plans in Canada?

- Alternatives to Term Life Insurance for Cash Value

- How Term Life Insurance Can Fit into a Balanced Financial Strategy

- Understanding Term Life Insurance Quotes Online: Getting Started

- How does Canadian LIC Help Clients Decide on Term Life Insurance Plans?

- Why You Should Consider Term Life Insurance Plans

- Taking the Next Step with Canadian LIC

Do Term Life Insurance Plans Offer Cash Value?

By Harpreet Puri

CEO & Founder

- 11 min read

- October 29th, 2024

SUMMARY

Many Canadians, during the decision-making process when choosing which life insurance plan to follow, are concerned about understanding if Term Life Insurance has a cash value. It’s understandable—insurance is an investment, and people often want to know if they’re building any cash value that could be used in the future. Unlike other types of life insurance plans, the term life plan has traditionally been considered a no-frills, direct purchase that will keep you covered over a given number of years. So, how about cash value? Here’s a step-by-step breakdown of Term Life Insurance, how it works, and what you can look forward to having outside the term of coverage.

What Is Cash Value, and Why Do People Look for It in Term Life Insurance?

In the insurance world, “cash value” refers to that portion of the premium that over time builds up and may be borrowed against or withdrawn later. Many Canadians feel that this added financial benefit makes Life Insurance Policies more of an investment than just an expense. Term Life Insurance Policies, by design, do not offer this cash value feature.

Instead, Term Life Insurance only covers the period for which it is purchased. It can be 10, 20, 30 or 50 years. It works similarly to how a renter’s insurance policy works—you pay for protection but do not own or build up any cash value.

Although this feature is not available, Term Life Insurance is still very popular. The reason is affordability, simplicity, and a capacity to provide strong, cost-effective protection during the years one needs it most.

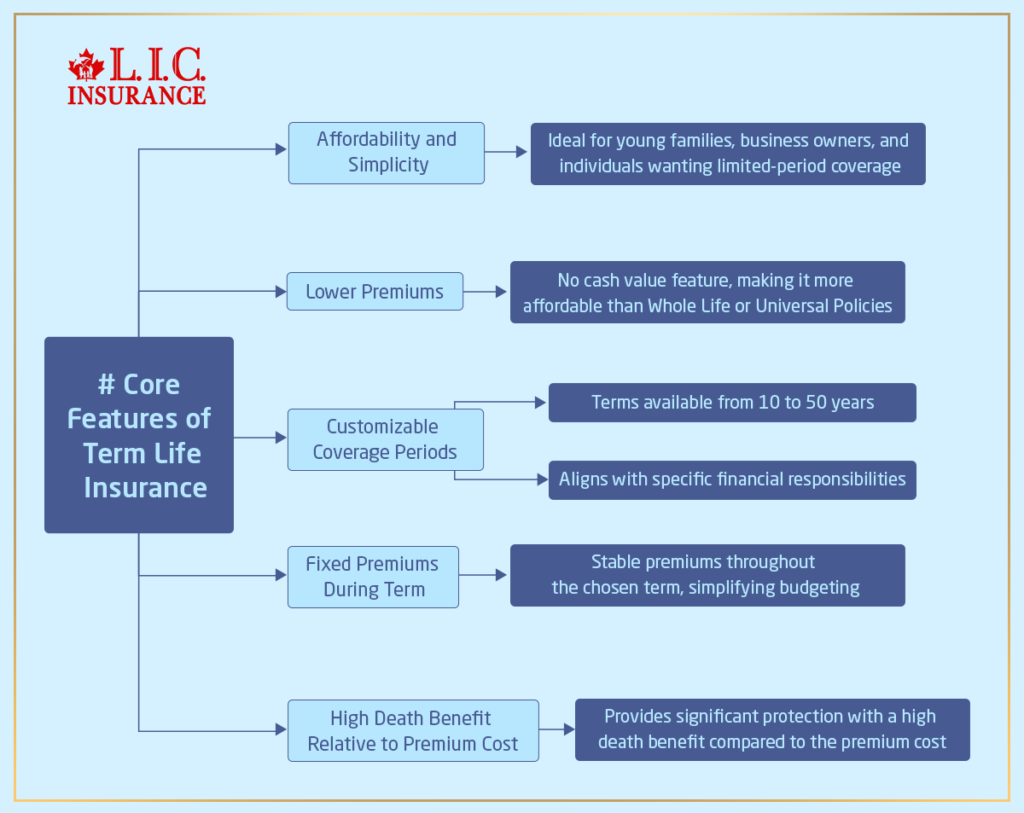

The Core Features of Term Life Insurance Plans: Why Choose Term Insurance?

When Canadian LIC meets with clients every day, we find that affordability and simplicity make Term Life Insurance the favourite choice for young families, business owners, or any individual wanting focused coverage for a limited period. Here’s why people are attracted to it:

- Lower Premiums: Since Term Life Insurance doesn’t include a cash value feature, the premiums are more affordable than those of a Whole Life Policy or Universal Policy.

- Customizable Coverage Periods: You can select the term that suits your needs, from 10 years to 30 years. This flexibility allows you to align coverage with specific financial responsibilities.

- Fixed Premiums During Term: The premium payments remain stable throughout the selected term, making it easy to budget for.

- High Death Benefit Relative to Premium Cost: Term Life Insurance provides a high death benefit for a lower monthly or annual premium, giving significant protection in exchange for a minimal investment.

Understanding Why Term Life Insurance Plans Don’t Offer Cash Value

Let’s take a closer look at why Term Life Insurance Plans do not have cash value and why this is a good thing in the opinion of many Canadians. Term Life Insurance is a purely protection-oriented product and hence is different from policies such as Whole Life or Universal Life Insurance, which have protection combined with an investment element.

This story illustrates the importance of updating your Term Life Insurance Policy regularly, particularly after significant life events like the death of a nominee.

A Day-to-Day Example with Canadian LIC: Many clients approach Canadian LIC wanting Term Life Insurance Cash Value options within Term Life Insurance. When we explain the cost benefits and simplicity of term policies, clients often find peace of mind knowing they can allocate those saved funds toward their own investments.

What Happens If the Nominee Dies After the Policyholder?

Things get complicated again in cases where the nominee dies after the policyholder but before receiving the death benefit. As there is no payout yet, the funds usually become part of the nominee’s estate. So, the money will go to the nominee’s heirs, which may not align with the policyholder’s original intentions.

Term Coverage aims to provide the largest death benefit at the lowest price possible without overloading the policy with too many add-ons. This ensures that premiums are not very expensive, so families and individuals will get the required protection while raising children, paying mortgages, or establishing a career.

A Day-to-Day Example with Canadian LIC: Many clients approach Canadian LIC wanting Term Life Insurance Cash Value options within Term Life Insurance. When we explain the cost benefits and simplicity of term policies, clients often find peace of mind knowing they can allocate those saved funds toward their own investments.

Who Benefits Most from Term Life Insurance Plans in Canada?

The question of Term Life Insurance’s value is best understood by looking at who benefits most from it:

- Young Families: If you’re starting a family, Term Life Insurance provides the coverage needed to secure your family’s financial future.

- Mortgage Holders: People who have recently purchased a home often align their Term Life Insurance with their mortgage term, offering peace of mind during those critical years.

- Business Owners: Entrepreneurs and business owners can utilize term insurance to protect their families, cover business expenses, or use it as part of a buy-sell agreement.

- Individuals on a Tight Budget: Term Life Insurance is particularly suitable for people looking to maximize protection without a significant cost, allowing for additional funds to be invested in other financial vehicles.

Alternatives to Term Life Insurance for Cash Value

There’s no cash value in a Term Life Insurance Policy; however, if building some cash is important, the following can be found through other life insurance options:

- Whole Life Insurance: This type of insurance comes with a guaranteed cash value that grows over time. It also has fixed premiums but comes with higher costs due to the cash value feature.

- Universal Life Insurance: Known for flexibility, universal life policies allow you to invest the cash value, often appealing to those seeking both insurance and investment in one package.

These options tend to come at a higher premium, but for those looking for long-term security and investment growth within their policy, they may be the right choice.

How Term Life Insurance Can Fit into a Balanced Financial Strategy

We often consider the entire financial situation for clients at Canadian LIC to determine whether they are choosing the right option with Term Life Insurance. Sometimes, Term Life Insurance can work in conjunction with a bigger financial plan that includes investing outside of insurance, for example, RRSPs or TFSAs.

Term Life Insurance, therefore, can free up funds for other financial goals by focusing on affordability. Here is how:

- More Flexibility in Investments: Without the cash value component, term insurance costs less, allowing Canadians to allocate more to high-return investments.

- Tailored Coverage Periods: Term policies can be matched to specific obligations, like paying off a student loan, which frees up funds once the term ends.

- Builds Habitual Financial Planning: As Term Life Insurance premiums are predictable and easy to budget for, it encourages disciplined financial planning without unexpected premium hikes.

Understanding Term Life Insurance Quotes Online: Getting Started

When you’re ready to compare Term Life Insurance Plans, starting with online quotes can save time and provide a clearer picture of your options. With trusted online platforms like Canadian LIC, you can view and compare Term Life Insurance Quotes Online, which narrows down the right policy and term length based on your budget and coverage needs.

How does Canadian LIC Help Clients Decide on Term Life Insurance Plans?

At Canadian LIC, we know that the process can be overwhelming and confusing for clients while trying to choose an appropriate insurance plan-they may not even know whether term insurance will meet their needs. And that’s where our expertise comes in discussing the client’s goals, future plans, and family needs.

From using coverage amounts that have to match income levels to the selection of terms to match big financial responsibilities, we are certain that you will feel confident with your choice. And because we understand how important affordability is, we are here to help you make a cost-effective choice without compromising on coverage.

Why You Should Consider Term Life Insurance Plans

Whether or not a cash value is important to you, Term Life Insurance offers practical benefits which often outweigh its lack of a cash accumulation feature. Here’s a recap of why Term Life Insurance can be an excellent choice:

- Focused, High Coverage at a Low Cost: Term Life Insurance delivers high coverage at a relatively low cost, which is ideal for people looking to cover specific expenses.

- Easily Accessible Quotes Online: You can obtain Term Life Insurance Quotes Online easily, helping you get a sense of the market rates before making a commitment.

- Simple, No-Fuss Protection: Term insurance is straightforward, giving you and your family peace of mind without any added complexities.

Taking the Next Step with Canadian LIC

When Canadians choose Term Life Insurance, they’re investing in security without stretching their budget. Canadian LIC understands the realities of daily life, balancing expenses, and planning for the future. By working closely with clients, we see the relief on their faces when they realize they’ve found affordable, reliable protection. Term Life Insurance Plans do not accumulate any cash value, but this gives peace of mind since one’s loved ones will be cared for.

With Canadian LIC, you don’t get only a policy; you’ll get a partner with whom you will stand strong for financial security. If you are looking for the best one in line with your family’s requirements, get online Term Life Insurance quotes from Canadian LIC, make the right, well-informed decision, and invest today.

More on Term Life Insurance

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

Frequently Asked Questions About Term Life Insurance and Cash Value

Term Life Insurance Plans are designed to provide affordable coverage for a set period, like 10, 20, or 30 years. Unlike whole life or universal life insurance, Term Life Insurance doesn’t build cash value. Many clients ask this question, and Canadian LIC explains that term insurance is focused purely on protection at a lower cost, which allows you to get the coverage you need without the added investment feature.

Many people choose Term Life Insurance Plans because of their affordability and flexibility. At Canadian LIC, we see clients daily who are interested in protecting their families without high premiums. Term Life Insurance allows you to secure a significant death benefit while keeping costs manageable, making it ideal if you’re looking for focused coverage for specific years, like when you have a mortgage or young children.

Yes, many providers, including Canadian LIC, offer Term Life Insurance Quotes Online. This is an easy way to compare different Term Life Insurance Plans and see how much coverage fits your budget. Clients often find it helpful to see options side by side to understand how coverage and term length affect the price.

Once the term of a Term Life Insurance plan ends, the coverage typically expires. Some clients at Canadian LIC choose to renew their term policy, though it often comes with higher premiums due to age. Others decide they no longer need coverage or switch to a different type of policy if their needs change.

Some Term Life Insurance Plans offer a conversion option. At Canadian LIC, we help clients check whether this feature is available. Converting your Term Life Insurance into a whole or universal policy could be a good option if your financial goals shift and you want to build cash value later on. However, it’s essential to understand that converting often increases the premiums.

Term Life Insurance is best for people who need high coverage at an affordable rate. We find it especially popular among young families, homeowners with a mortgage, and those looking for coverage to protect loved ones during a specific period. Without the cash value component, Term Life Insurance Plans remain affordable and accessible for these focused needs.

Many Canadians choose to buy Term Life Insurance online for convenience and easy access to various Term Life Insurance quotes. Canadian LIC offers a streamlined online quote and application process, helping you explore the coverage and rates that suit you best. You can compare Term Life Insurance Plans and find a policy tailored to your budget and needs without visiting a branch.

If you outlive your Term Life Insurance plan, there’s generally no payout or refund since there’s no cash value. Some clients at Canadian LIC look into other policy types, such as return-of-premium term insurance, if they’re interested in recovering some premiums. However, these policies tend to have higher costs than standard Term Life Insurance.

If you need coverage after your Term Life Insurance plan ends, you have options. Canadian LIC helps clients explore new term policies or consider converting to a different type, like whole life if it fits their financial situation. Remember that premiums might be higher due to your age, but keeping some coverage may still provide peace of mind.

Term Life Insurance is recommended because it’s an affordable way to provide significant financial protection for your family. The team at Canadian LIC sees clients daily who appreciate that term insurance offers flexibility, high death benefits, and affordability. It’s perfect for anyone who wants reliable protection without a high monthly cost.

Sources and Further Reading

Canadian Life and Health Insurance Association (CLHIA)

The CLHIA provides comprehensive resources on life insurance types, including Term Life Insurance. Their materials cover policy features, cash value information, and industry standards.

Visit CLHIA’s Website

Insurance Bureau of Canada (IBC)

The IBC offers insights into insurance products available to Canadians, including a breakdown of Term Life Insurance benefits, costs, and suitability for different needs.

Visit IBC’s Website

Canadian Financial Consumer Agency (FCAC)

The FCAC provides tools and information on understanding insurance options, budgeting for insurance, and accessing online Term Life Insurance quotes.

Visit FCAC’s Website

Insurance Information Institute (III)

The III’s resources on term and permanent life insurance cover the specifics of cash value, how it works in various policies, and the pros and cons of Term Life Insurance.

Visit III’s Website

Key Takeaways

- Term Life Insurance Plans do not offer cash value, focusing instead on affordable, high-coverage protection for a set period.

- Affordability and flexibility are key benefits of Term Life Insurance, making it popular for families, homeowners, and those needing coverage for specific years.

- Alternative options like whole or universal life insurance are better for those seeking cash value and lifelong coverage but come at a higher cost.

- Online quotes are a helpful starting point for comparing Term Life Insurance Plans, allowing you to match coverage to your budget and needs.

- Canadian LIC provides a straightforward, supportive experience, guiding clients in choosing the right term insurance policy based on their individual goals and life stages.

Your Feedback Is Very Important To Us

We’d love your insights to better understand the challenges Canadians face when considering Term Life Insurance. Your feedback will help us improve our services and provide the guidance you need. Thank you for your time!

Thank you for sharing your thoughts! Your feedback helps us serve Canadians better and ensures you find the best insurance options for your needs.

IN THIS ARTICLE

- Do Term Life Insurance Plans Offer Cash Value?

- What Is Cash Value, and Why Do People Look for It in Term Life Insurance?

- The Core Features of Term Life Insurance Plans: Why Choose Term Insurance?

- Understanding Why Term Life Insurance Plans Don’t Offer Cash Value

- Who Benefits Most from Term Life Insurance Plans in Canada?

- Alternatives to Term Life Insurance for Cash Value

- How Term Life Insurance Can Fit into a Balanced Financial Strategy

- Understanding Term Life Insurance Quotes Online: Getting Started

- How does Canadian LIC Help Clients Decide on Term Life Insurance Plans?

- Why You Should Consider Term Life Insurance Plans

- Taking the Next Step with Canadian LIC