When planning a visit to Canada, understanding the various entry options and visa types is crucial. Two common visa categories you may encounter are the Visitor Visa and the Super Visa. In this comprehensive guide, we’ll explore what these visas are, how they differ, and the significance of each when planning your visit to Canada.

Visitor Visa vs. Super Visa: Understanding the Differences

By Canadian LIC, November 06, 2023, 10 Minutes

When planning a visit to Canada, understanding the various entry options and visa types is crucial. Two common visa categories you may encounter are the Visitor Visa and the Super Visa. In this comprehensive guide, we’ll explore what these visas are, how they differ, and the significance of each when planning your visit to Canada.

Visitor Visa

A Visitor Visa, also known as a Temporary Resident Visa (TRV), is an official document issued by the Canadian government that allows foreign nationals to enter Canada temporarily for a variety of purposes. These purposes include tourism, visiting family and friends, attending business meetings or conferences, or studying for a short duration. Visitor Visas are typically valid for up to six months but may be issued for a shorter period based on the intended purpose of the visit.

Key Features of a Visitor Visa

- Temporary Stay: A Visitor Visa permits a temporary stay in Canada. The duration of your stay is determined by the immigration officer at the port of entry or as indicated on your visa.

- aried Purposes: Visitor Visas are versatile and can be used for different purposes, including tourism, visiting family, conducting business, or attending short courses.

- Healthcare Considerations: While in Canada, visitors under a Visitor Visa do not have access to the country’s publicly funded healthcare system. It is essential to have private health insurance to cover medical expenses during your stay.

- Application Process: Obtaining a Visitor Visa involves applying to the Canadian government, providing necessary documents, and meeting specific eligibility criteria. The application process varies depending on your home country and the nature of your visit.

Super Visa

The Super Visa, introduced in 2011, is a unique visa category designed for parents and grandparents of Canadian citizens or permanent residents. It allows eligible parents and grandparents to visit their family members in Canada for an extended period, often up to five years on a single entry. The Super Visa is an excellent option for family reunification and enables family members to spend quality time together.

Key Features of a Super Visa

While specific costs can vary widely, it’s helpful to look at average figures to get a sense of what Canadians are paying for funerals in 2023. Keep in mind that these figures are approximate and can fluctuate based on location and choices made by the family:

- Extended Stay: Super Visa holders can stay in Canada for an extended period, typically up to five years on a single entry. This extended duration alleviates the need for frequent visa renewals.

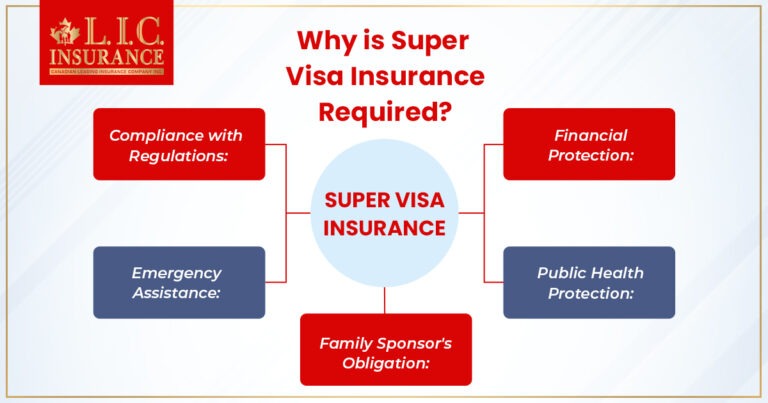

- Healthcare Coverage: One of the distinctive features of the Super Visa is that it requires applicants to obtain private health insurance from a Canadian insurance provider. This ensures comprehensive health coverage for the duration of their stay.

- Financial Eligibility: To be eligible for a Super Visa, applicants must demonstrate that they meet specific financial criteria, indicating their ability to financially support themselves during their visit to Canada.

- Family Reunification: The Super Visa is a valuable tool for family reunification, allowing parents and grandparents to spend quality time with their loved ones in Canada without the restrictions of a standard Visitor Visa.

Read More – Canadian Super Visa here

Key Differences Between Visitor Visa and Super Visa

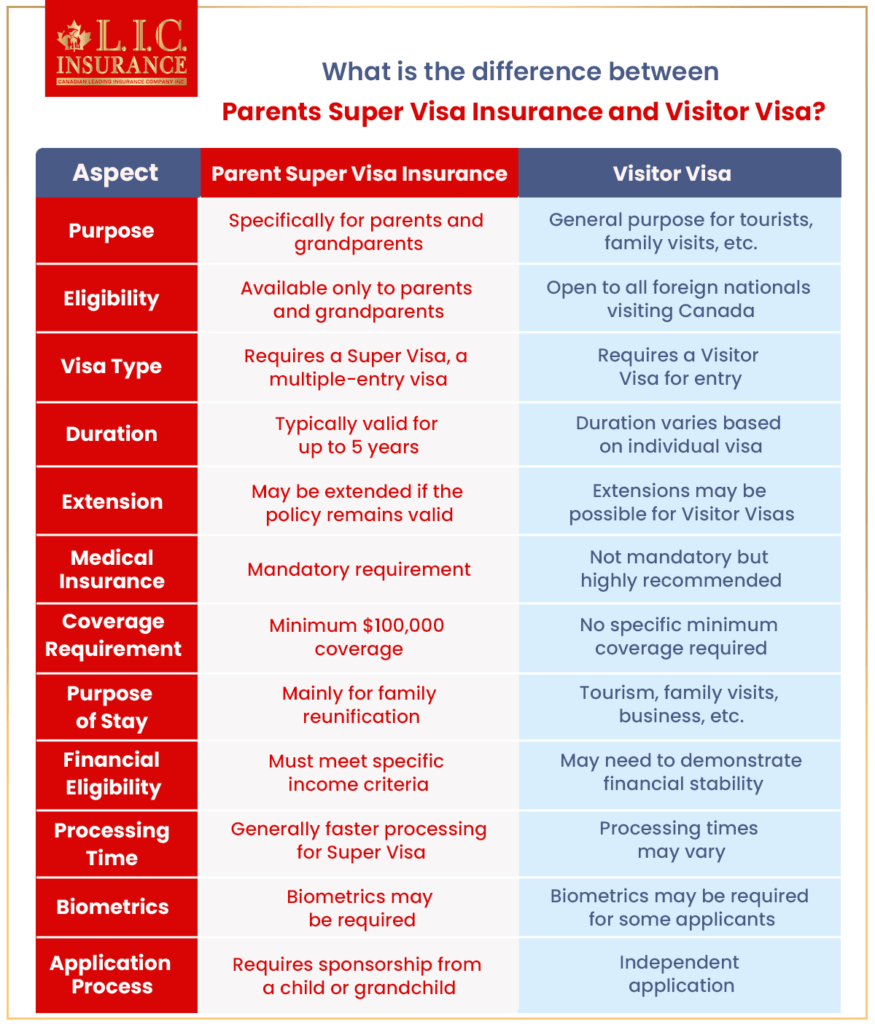

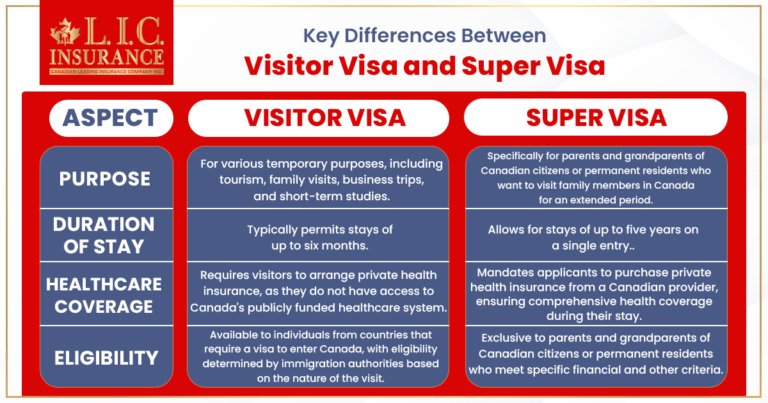

Purpose:

Visitor Visa: Designed for various temporary purposes, including tourism, family visits, business trips, and short-term studies.

Super Visa: Specifically created for parents and grandparents of Canadian citizens or permanent residents who wish to visit family members in Canada for an extended period.

Duration of Stay:

Visitor Visa: Typically permits stays of up to six months.

Super Visa: Allows for stays of up to two years on a single entry, providing an extended visitation period.

Healthcare Coverage:

Visitor Visa: Requires visitors to arrange private health insurance, as they do not have access to Canada’s publicly funded healthcare system.

Super Visa: Mandates applicants to purchase private health insurance from a Canadian provider, ensuring comprehensive health coverage during their stay.

Eligibility:

Visitor Visa: Available to individuals from countries that require a visa to enter Canada, with eligibility determined by immigration authorities based on the nature of the visit.

Super Visa: Exclusive to parents and grandparents of Canadian citizens or permanent residents who meet specific financial and other criteria.

Read More – Super Visa Income Requirement

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

To Sum Up

Visitor Visa and Super Visa are distinct visa categories, each serving a unique purpose. While a Visitor Visa is suitable for various temporary visits to Canada, the Super Visa caters specifically to extended family reunification visits. Understanding the differences between these visas is essential for planning your visit to Canada. Depending on your circumstances and the nature of your trip, you can choose the visa type that best suits your needs, ensuring a smooth and enjoyable stay with your loved ones in Canada.

Faq's

A Visitor Visa is designed for various temporary purposes, including tourism, visiting family and friends, business trips, and short-term studies.

A Super Visa is specifically intended for parents and grandparents of Canadian citizens or permanent residents who want to visit family members in Canada for an extended period.

A Visitor Visa typically permits stays of up to six months.

A Super Visa allows for stays of up to five years on a single entry, providing an extended visitation period without the need for frequent renewals.

Yes, for both a Visitor Visa and a Super Visa, it is essential to have private health insurance. Visitors under these visas do not have access to Canada’s publicly funded healthcare system.

Yes, to be eligible for a Super Visa, applicants must demonstrate that they meet specific financial criteria, indicating their ability to financially support themselves during their visit to Canada. This requirement is not applicable to a standard Visitor Visa.

Yes, you can apply for a Visitor Visa even if you are eligible for a Super Visa. The choice between the two visas depends on the nature of your visit and your preferences for the duration of your stay.

While a Visitor Visa can be used for visiting family members, it typically permits shorter stays (up to six months) and may require more frequent renewals compared to a Super Visa.

Yes, the application process varies between the two visas, with specific requirements and documentation needed for each. The eligibility criteria for a Super Visa are more stringent due to its extended visitation period.

While it is possible to switch from one visa to another in some cases, it is subject to immigration regulations, and you should consult with Canadian immigration authorities for guidance on this matter.

Both Visitor Visas and Super Visas are generally available to individuals from various countries. Eligibility and visa requirements may vary based on your nationality, so it’s advisable to check with the Canadian government’s official website or consult with the nearest Canadian embassy or consulate.

A Visitor Visa is intended for various temporary purposes, including tourism, visiting family and friends, attending business meetings or conferences, and pursuing short-term studies in Canada.

The Super Visa is specifically designed for extended family reunification visits, allowing parents and grandparents to spend an extended period with their family members in Canada, typically up to five years on a single entry.

A Visitor Visa typically permits stays of up to six months. The specific duration is determined by the immigration officer at the port of entry or as indicated on the visa.

Yes, for both visa types, visitors must have private health insurance to cover medical expenses during their stay in Canada. Visitors under these visas do not have access to Canada’s publicly funded healthcare system.

No, the Super Visa is exclusively available to parents and grandparents of Canadian citizens or permanent residents who meet specific financial and other eligibility criteria.

The choice between a Visitor Visa and a Super Visa depends on your specific circumstances and the purpose of your visit. If you are a parent or grandparent of a Canadian citizen or permanent resident and wish to visit family for an extended period, a Super Visa may be more appropriate. Otherwise, a Visitor Visa is suitable for various temporary purposes.

You can find detailed information and guidance on applying for both Visitor Visas and Super Visas on the official website of Immigration, Refugees, and Citizenship Canada (IRCC) or by consulting with a Canadian immigration professional or consultant.

The best option is to get in touch with Canadian LIC today for the best advice.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]