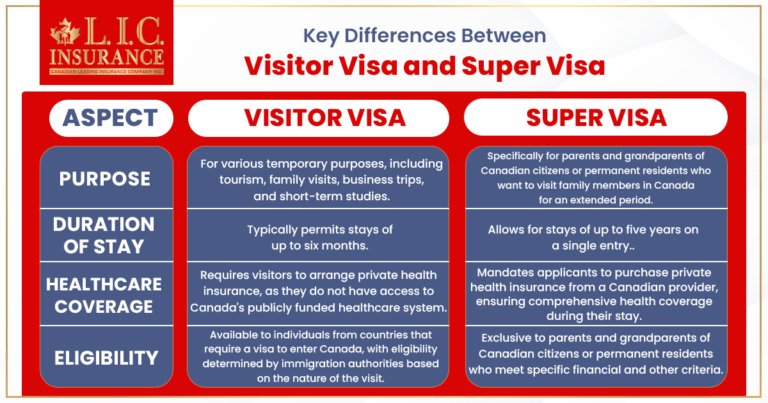

In recent years, Canada has emerged as a popular destination for families to reunite and for individuals to explore new opportunities. One pathway that enables families to stay connected is through the Super Visa program. This program lets parents, grandparents, Canadian citizens, and permanent residents visit and stay in Canada for long periods of time. However, along with the Super Visa comes the requirement to obtain Super Visa Insurance. So here we will get to know about Super Visa Insurance in Canada, including whether it can be cancelled or not.

Can We Cancel Super Visa Insurance?

By Canadian LIC, February 12, 2024, 6 Minutes

In recent years, Canada has emerged as a popular destination for families to reunite and for individuals to explore new opportunities. One pathway that enables families to stay connected is through the Super Visa program. This program lets parents, grandparents, Canadian citizens, and permanent residents visit and stay in Canada for long periods of time. However, along with the Super Visa comes the requirement to obtain Super Visa Insurance. So here we will get to know about Super Visa Insurance in Canada, including whether it can be cancelled or not.

Let’s get to know first- ‘What is Super Visa Insurance?’

Super Visa Insurance is a must for individuals applying for the Super Visa. It provides coverage for emergency medical expenses during the stay in Canada. For a Super Visa, the insurance must cover at least $100,000 and be good for at least one year from the date of entry into Canada.

Super Visa Insurance Quote

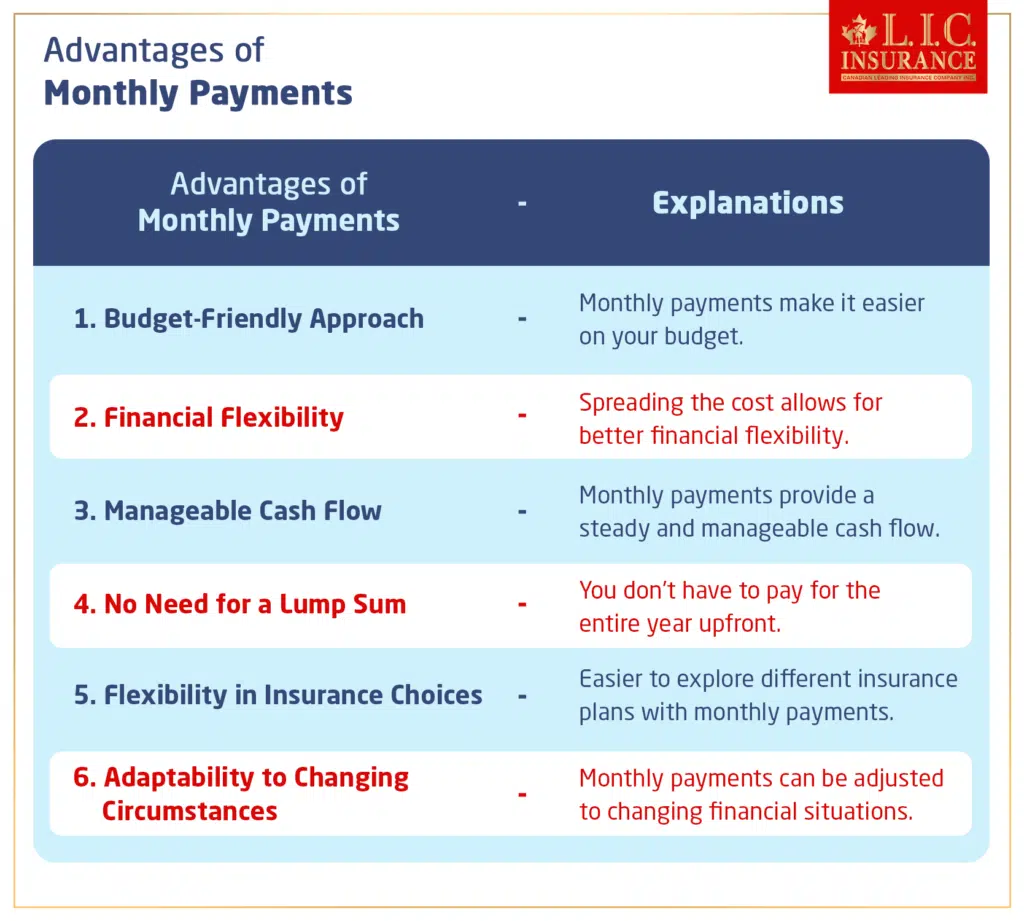

It’s important to get quotes from several insurance companies before you buy Super Visa Insurance so that you can compare benefits and costs. A Super Visa Insurance quote typically includes details such as the coverage amount, premium cost, deductible, and any additional benefits the insurance provider offers. By obtaining multiple quotes, applicants can decide which insurance plan is most suitable as per their needs and budget.

Super Visa Insurance Coverage typically includes emergency medical expenses such as hospitalization, ambulance services, emergency dental care, and repatriation of remains. That being said, the exact coverage may be different based on the Canadian insurance company and the plan chosen. It is very important to read the policy information very carefully to know what is covered and what may not be covered.

Click here – To get to know the right time to start Super Visa Insurance

Can Super Visa Insurance be Cancelled?

One common question among Super Visa applicants is whether the insurance can be cancelled once purchased. Understanding Super Visa Insurance is crucial when planning a trip to Canada under the Super Visa program. One of the most common queries among Super Visa applicants is whether the insurance can be cancelled. So, let’s explore this question in detail, along with the cancellation process, timelines, penalties, and important considerations.

Timeframe for Cancellation:

Most insurance providers allow for cancellation within a specific timeframe, usually within the first 10 to 30 days of purchasing the policy.

This timeframe provides applicants with a grace period to review the policy terms, assess their needs, and make any necessary adjustments.

Cancelling within this period typically incurs no penalties or fees, and applicants may be eligible for a full refund of the premium paid.

Conditions for Cancellation:

Cancellation conditions vary among insurance providers and may be outlined in the policy documents.

Generally, cancellation is allowed if no claims have been made under the policy during the specified timeframe.

It’s important to read the policy terms carefully to find out if there are any conditions or restrictions on cancelling.

Penalties and Fees:

Cancelling the policy after the initial grace period may result in penalties or fees imposed by the insurance provider.

These penalties could be in the form of a percentage of the premium paid or a flat fee, depending on the provider’s policies.

Additionally, refunds for cancellations made after the grace period may be prorated based on the remaining coverage period.

Refund Process:

Refund processes vary among insurance providers and may be subject to certain conditions.

Upon cancellation, applicants should contact their insurance provider to initiate the refund process.

Refunds are usually processed within a certain amount of time, which can be anywhere from a few days to a few weeks, based on how the provider does things.

Flexible Cancellation Options:

Some insurance providers offer flexible cancellation options to accommodate changing travel plans.

These options may include the ability to suspend coverage temporarily if the visitor returns to their home country earlier than expected.

Flexible cancellation options provide added convenience and peace of mind for Super Visa applicants.

Understanding Policy Documents:

Before purchasing Super Visa Insurance, it’s essential to read and understand the policy documents carefully.

Pay close attention to the cancellation policy, including any conditions, penalties, and refund processes outlined therein.

To get more information about any terms or clauses that aren’t clear, don’t be afraid to ask the insurance expert.

Concluding Words

In conclusion, while Super Visa Insurance can typically be cancelled within a specific timeframe, it’s essential to understand the conditions, penalties, and refund processes associated with cancellation. By familiarizing yourself with the policy terms and considering any flexible cancellation options offered by the insurance provider, you can make the proper decisions and ensure you have the coverage you need for your trip to Canada. Remember to review multiple Super Visa Insurance quotes to find the best coverage for your needs.

Find out – How to apply for Super Visa Insurance?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Faq's

In order to get medical insurance for a Super Visa in Canada, research insurance providers, obtain quotes, compare coverage and premiums, purchase the chosen policy, and keep a copy handy during your visit. Make sure to provide necessary information like age, coverage amount, duration, and any pre-existing conditions for accurate quotes.

People who are seeking a Super Visa to visit Canada must have Super Visa Medical Insurance. It provides coverage for emergency medical expenses during the stay in Canada. It is necessary to ensure that visitors can access medical care without financial hardship in case of unexpected health issues.

To obtain a Super Visa Insurance quote, you can contact various insurance providers that offer coverage for Super Visa applicants. You can either visit their websites and request a quote online or contact them directly by phone or email. Provide the necessary information, such as the duration of the visit and the coverage amount required to receive an accurate quote.

Super Visa Insurance Coverage typically includes emergency medical expenses such as hospitalization, ambulance services, emergency dental care, and repatriation of remains. But based on the Canadian insurance company and the particular plan chosen, coverage may change. This is why it’s important to carefully read the policy information to know what is covered and what may not be covered.

The cost of insurance for a Super Visa in Canada can vary depending on several factors, like the age of the applicant, the coverage amount desired, the duration of coverage, and any pre-existing medical conditions. On average, Super Visa Canada Insurance premiums can range from $1,000 to $3,000 CAD per year. It’s essential to obtain quotes from different insurance providers to compare premiums and coverage options before purchasing Super Visa Insurance.

Yes, most insurance providers allow for cancellation of Super Visa Insurance policies within a certain timeframe, usually within the first 10 to 30 days of purchasing the policy, provided that no claims have been made. However, cancelling the policy after this timeframe may incur penalties or fees, and refunds may be prorated based on the remaining coverage period.

Cancelling a Super Visa Insurance policy after the initial grace period may result in penalties or fees imposed by the insurance provider. These penalties could be in the form of a percentage of the premium paid or a flat fee, depending on the provider’s policies. Refunds for cancellations made after the grace period may also be prorated based on the remaining coverage period.

Some insurance providers offer flexible cancellation options to accommodate changing travel plans. These options may include the ability to suspend coverage temporarily if the visitor returns to their home country earlier than expected. It’s important to inquire about flexible cancellation options when you buy Super Visa Insurance.

To understand the cancellation policy of your Super Visa Medical Insurance, carefully review the policy documents provided by the insurance provider. Pay close attention to any conditions, penalties, and refund processes outlined therein. If there are any terms or clauses that are unclear, feel free to reach out to the insurance provider for complete clarification.

Yes, you can switch Super Visa Insurance providers if you’re not satisfied with your current coverage. However, it’s important to ensure that there is no gap in coverage during the transition period. Before switching providers, obtain quotes from other insurance companies and compare coverage and premiums to find the best option for your needs.

When choosing a Super Visa Insurance provider, consider factors such as the coverage amount offered, premium cost, deductible, reputation of the insurance company, customer service, and any additional benefits or features included in the policy. It’s also important to ensure that the insurance provider meets the requirements set by the Canadian government for Super Visa Insurance.

It’s recommended that you purchase Super Visa Insurance as soon as you have confirmed your travel dates to Canada. This ensures that you have adequate coverage in place before your trip and helps you avoid any last-minute complications or delays. However, you can purchase Super Visa Insurance at any time before your departure date as long as the policy is valid for the duration of your stay in Canada.

Pre-existing medical conditions may or may not be covered under Super Visa Insurance, depending on the insurance provider and the specific policy chosen. Some Super Visa Insurance covers diseases that were there before the policy was issued, while others may not. Before buying a policy, it’s important to read the fine print and talk to the insurance company about any health problems you already have.

No, a medical exam is not typically required to qualify for Super Visa Insurance. However, applicants may be required to complete a medical questionnaire as part of the application process. The information provided in the medical questionnaire helps the insurance provider assess the applicant’s health status and determine the appropriate coverage and premium.

If you stay in Canada longer than planned, some insurance companies will let you add more time to your Super Visa coverage. However, extensions are subject to approval by the insurance provider and may require additional documentation and payment of premiums. It’s important to contact an insurance professional as soon as possible if you need to extend your coverage.

Anytime you file a claim under your Super Visa Insurance, the company will look at it and decide if it meets the requirements for coverage. Insurance companies will pay for eligible costs once the claim is accepted. It’s important to keep records of any medical expenses and documentation related to the claim to facilitate the claims process.

Yes, some insurance providers offer multi-trip Super Visa Insurance policies that provide coverage for multiple trips to Canada within a specified period. These policies are convenient for individuals who plan to visit Canada multiple times under the Super Visa program. However, it’s important to carefully review the policy terms and conditions, including any limitations on the number of trips and duration of coverage.

Must know mistakes to avoid while Buying Super Visa Insurance

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]