The time has finally arrived when, after months of planning, your parents have finally come to visit you in Canada. You show them around, ensure that the guest room is in order, and have even prepared a list of places that they should definitely visit. Visitor Insurance and the aspect of whether to consider it a must-purchase is a very confusing puzzle. Knowing and exploring these requirements is essential to understanding whether Visitor Insurance is mandatory in Canada or not. In this blog, we are going to discuss Visitor Insurance inside out. It is going to be helpful for the family hosting, especially parents and those who are visiting Canada to explore its vast beauty. Let’s bring alive the world of ‘Visitor Insurance for Parents‘ with real struggles that many go through—so that you find it easier to understand and relate.

Is Super Visa Insurance refundable?

By Harpreet Puri, May 08, 2024, 7 Minutes

When most of you were preparing to get united with your family, who were waiting in Canada, many of you might have stumbled upon the term “Super Visa Insurance..” Well, it’s not just a piece of paper but one of the prime conditions for your safe and stress-free stay. But what happens when a change of plans comes rather unexpectedly? Maybe the visa gets rejected, or maybe there is a personal emergency that forces your hand into postponing the trip. In such an event, the main question that comes into your mind is: “Is the Super Visa Insurance refundable?

It is precisely this important aspect that we will look at here through the reality of common day-to-day experiences that many people face. Just picture yourself preparing to organize your visit to Canada to come see your kids and grandkids, purchasing Super Visa Insurance, and ticking all the boxes of a successful visa application. But then, imagine the confusion and frustration when you’re faced with a visa rejection or suddenly have to cancel the trip. What do you do with the insurance costs that have already been incurred? This type of story is quite common, and being aware of how to handle a situation like that and getting refunded is a must. This blog is intended to elaborate on the return policies in detail for Super Visa Insurance in Canada, keeping in mind the respective Super Visa Insurance cost in 2024. This will lead to choosing a more appropriate Super Visa Insurance Policy that has flexibility and assures you peace of mind when your loved ones visit Canada.

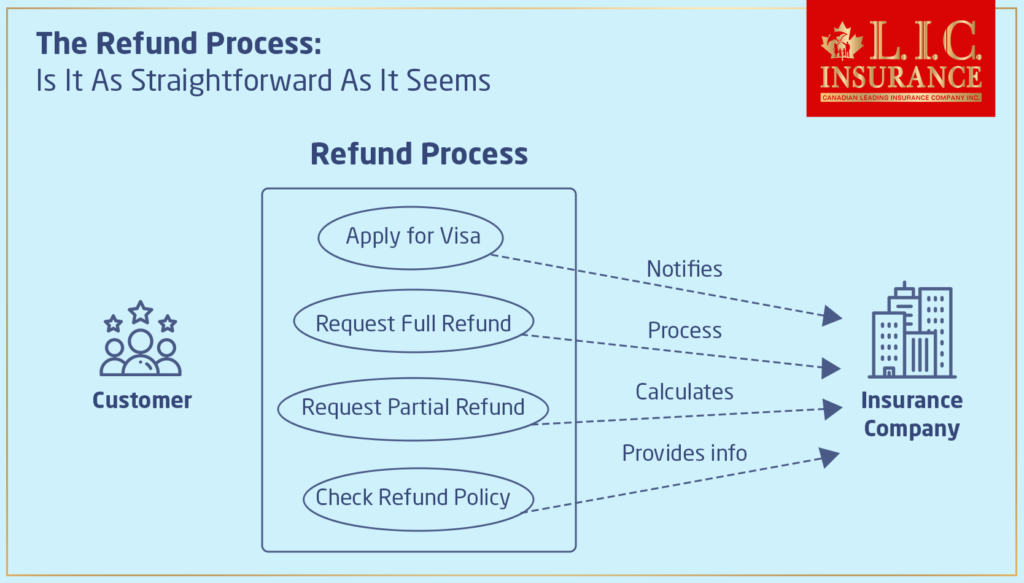

The Refund Process: Is It As Straightforward As It Seems?

Scenario 1: Visa Rejection

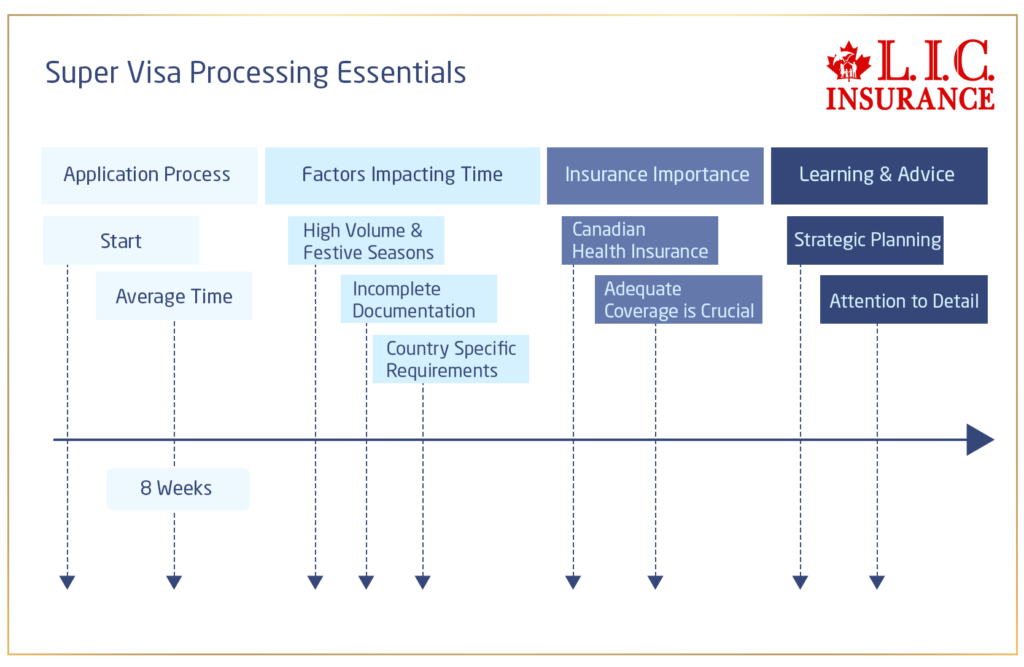

Rejection for a visa can be disappointing, more so if a lot of time, effort, and money are put into the preparations. Super Visa Insurance is quite different from other Travel Insurance, whereby you only present proof of insurance during your application for the visa. But then, supposing your application turns out to be in vain?

For example, Maria had applied for a super visa to visit her son, who is located in Toronto. After it had been refused, she could not figure out what she would do with the large amount of insurance premiums she had been paying. Most insurance companies are very understanding, and if the visa doesn’t come through, they usually refund the entire premium money. The catch is to produce a copy of the rejection letter of the visa from Citizenship and Immigration Canada (CIC). And yes, while comparing the best Super Visa Insurance Policies in 2024, be sure to check for this feature.

Scenario 2: Change in Travel Plans

Life is unpredictable, and even the best-laid plans can go wrong from time to time. Changes in the travel schedule rank among the most common causes for Super Visa Insurance refunding, although the conditions under which such refunds may be allowed differ significantly from policy to policy. Take, for example, the case of Anil. He had bought Super Visa Insurance well in advance for the parent’s visit from India. However, due to health issues, his parents decided to postpone their trip for an indefinite period. Anil found, however, that while his Canadian insurance company does offer a full refund, there was, in fact, a fee included for the cancellation since he had had the policy now for a month.

You should shop around and look for the best Super Visa Insurance Policy, which has flexible terms. For instance, there should be low or no cancellation fees, mainly in situations where the visa has not been issued, or there has been no claim against the policy.

Scenario 3: Partial Refunds for Shortened Stays

Most Super Visa applicants, however, do not even intend to stay that long in Canada under the Super Visa Program and are required to buy Super Visa Insurance for a full year. What if one decides to return earlier? This was the case of Elena, who was planning to stay for six months but needed to come back home in an emergency after staying there only for three months.

Most insurance policies return part of the premium calculated pro rata; in other words, you can get back some part of the premium money for the period the policy was not utilized. Always be on the lookout for processing fees and minimum usage requirements that may bite into the refund amount. When assessing Super Visa Insurance costs for 2024, consider how the partial policy refund will affect your overall financial planning.

Find Out: Where can you buy Super Visa Insurance?

Find Out: Can you cancel Super Visa Insurance?

Find Out: Can you pay monthly for Super Visa Insurance?

Find Out: When should Super Visa Insurance start?

Find Out: Super Visa Insurance Benefits

Conclusion: Why Acting Now Is Necessary

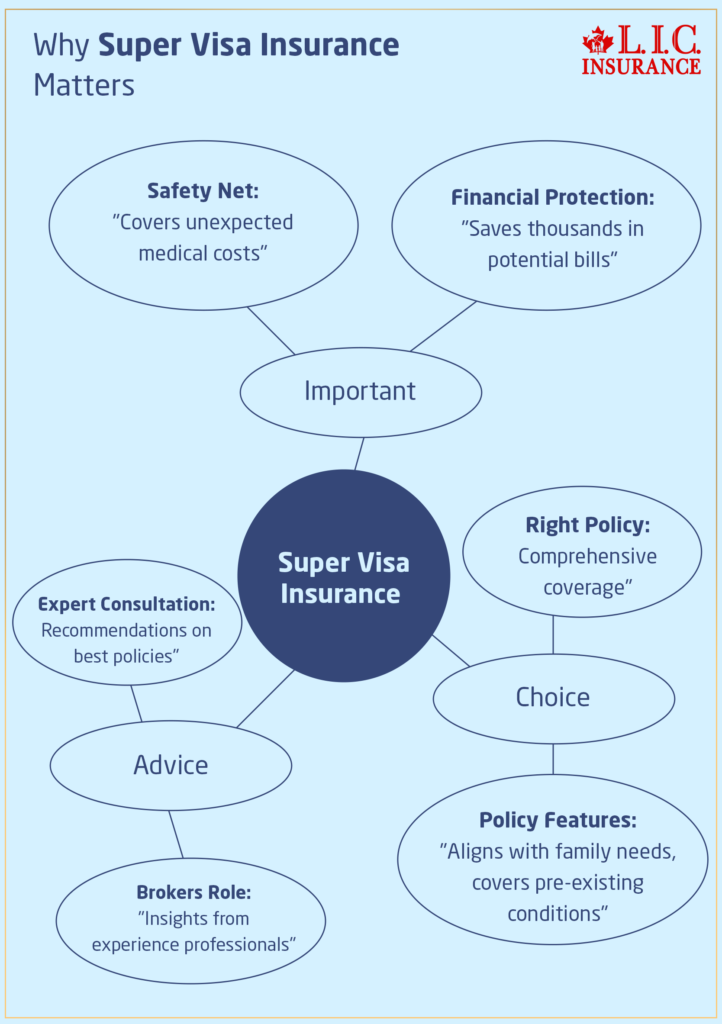

Now, armed with the right kind of knowledge and understanding of the manner in which the policies work in this regard, one need not be able to face fear while going through the complexities of Super Visa Insurance refunds. A flexible and comprehensive Super Visa Insurance Policy should be the right choice for any unexpected visa rejections or sudden changes in your travel plans.

Canadian LIC would be the best insurance brokerage for you in simplifying these. By opting for insurance through Canadian LIC, you not only secure the best Super Visa Insurance Policy tailored to your needs but also ensure peace of mind, knowing that you can recover your costs in unpredictable circumstances. Do not let the fear of losing money stop you in the middle of the road. With Canadian LIC, purchase Super Visa Insurance today and thus take your first step toward a worry-free visit of your dear ones in Canada. That being said, the big time has come. The Canadian LIC is here to make sure that nothing keeps you from being with your family.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs on Super Visa Insurance Refunds

While planning for a Family Reunion in Canada, it is advised to have a budget that will provide for all those required expenses, among them being Super Visa Insurance. The cost of Super Visa Insurance in 2024 can be guided by one’s age, health, and the duration of the proposed coverage. Generally, expect to pay anything from $1,000 up to $2,000 per year. It’s good that you shop around or talk with the pros, like Canadian LIC, to get the best rates you are considering for your budget and your needs.

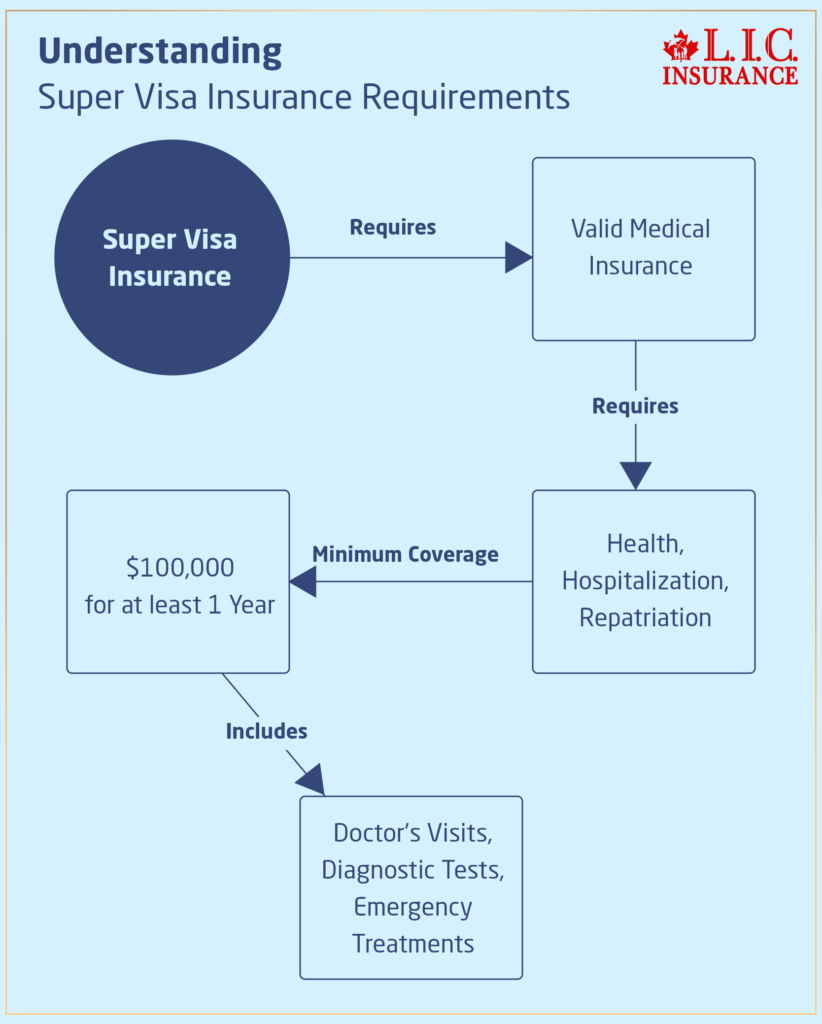

In order to choose the best Super Visa Insurance Policy, you have to weigh some factors first. This should be the policy that does not only satisfy the minimum requirements put in place by the Canadian government but also a policy that covers most, if not all, areas of concern – for instance, hospitalization, repatriation, and emergency services. Jane, for instance, had to settle for the policy as it offered full coverage against the flexible refund plans, something that was essential to her in case she accidentally cancelled the trip at the last minute for a family emergency back home.

If you find yourself needing to cancel your Super Visa Insurance after your visa has been approved but before you travel—perhaps due to a change in your personal circumstances—it’s important to contact your insurance company immediately. Most of them, however, offer full refunds if there is no claim, while a few may charge cancellation fees. Snigdha’s experience highlights this. She cancelled her policy two weeks after getting her visa because she fell sick, and she was given a full refund minus a small administrative fee.

Partial refunds will usually work out on a pro-rata basis; this means that you receive a refund equivalent to the unused portion of your insurance coverage. Consider Robert’s story: He took out a one-year policy, but he came back after five months since they didn’t require his help any longer. He looked for a refund and was refunded to the tune of only some premium but with a processing fee deducted from it. Always check the policy details for minimum usage fees or requirements that can hamper the amount refunded to you.

Yes, there are certain conditions under which you cannot get a refund. Most insurance providers will not refund your premium if you make any claims on the policy. Additionally, if you use any part of the insurance, such as calling the medical helpline, some insurers might consider it as utilizing the policy and may deny a refund. An example is when Emily called the emergency medical number provided by her insurance for advice during a minor medical situation. Later, when she tried to claim a partial refund for her early return, she discovered that her call had been registered as a claim, making her ineligible for a refund.

Consulting with Canadian LIC for your Super Visa Insurance ensures you receive expert advice tailored to your specific needs. Canadian LIC offers a range of policies from top insurers, ensuring that you not only comply with super visa requirements but also get the best coverage at competitive rates. Their experienced insurance broker can help to make you understand the complexities of insurance refunds and adjustments, much like they did for Tom, who needed to adjust his policy at the last minute due to unexpected changes in his travel plans. With Canadian LIC, you get personalized service that makes the insurance process straightforward and stress-free.

The cost of Super Visa Medical Insurance in 2024 is influenced by several key factors, including the age of the applicant, their medical history, the duration of coverage, and the amount of deductible chosen. For instance, Ram, a 65-year-old with a chronic condition, found that his Super Visa Insurance cost was higher than his 60-year-old friend’s due to his pre-existing condition. To find the most affordable option, Ram consulted Canadian LIC, which helped him compare coverage and choose the best Super Visa Insurance Policy that offered good coverage at a reasonable price.

To ensure you are choosing the best Super Visa Insurance Policy for your parents, consider their specific health needs, review the extent of coverage provided, and compare different insurers’ refund policies and customer service reputations. For example, Lila selected a policy with comprehensive medical and hospitalization coverage and straightforward refund policies after her parents had to cut their last visit short due to health issues. She valued having clear information and reliable customer support, which she found through recommendations and thorough research at Canadian LIC.

To process a Super Visa Medical Insurance refund, you generally need to provide documentation such as the visa rejection letter from Citizenship and Immigration Canada, proof of the policy purchase, and sometimes communication regarding the cancellation of the trip. Omar encountered this when his visa application was rejected; he quickly gathered all the necessary documents and submitted them to his insurance provider, ensuring he received his refund without any hassle.

To process a Super Visa Medical Insurance refund, you generally need to provide documentation such as the visa rejection letter from Citizenship and Immigration Canada, proof of the policy purchase, and sometimes communication regarding the cancellation of the trip. Omar encountered this when his visa application was rejected; he quickly gathered all the necessary documents and submitted them to his insurance provider, ensuring he received his refund without any hassle.

The Super Visa Insurance is often non-transferable to another person. Each policy is issued to only one individual in accordance with certain risk factors and insurance needs. When Meera asked if the policy could be transferred to her brother, she learned it wasn’t possible. She had to process a cancellation and advised her brother to secure his own policy, highlighting the importance of understanding policy restrictions and terms.

Common mistakes to avoid when purchasing Super Visa Insurance include:

- Not reading the policy details thoroughly.

- Overlooking the need for comprehensive coverage.

- Choosing a policy based solely on price without considering the quality of coverage.

Take the case of Rahim, who initially bought the cheapest policy he found online but later realized it didn’t cover specific medical services that were critical for his condition. After this costly misunderstanding, he consulted with Canadian LIC to find a more suitable and comprehensive policy.

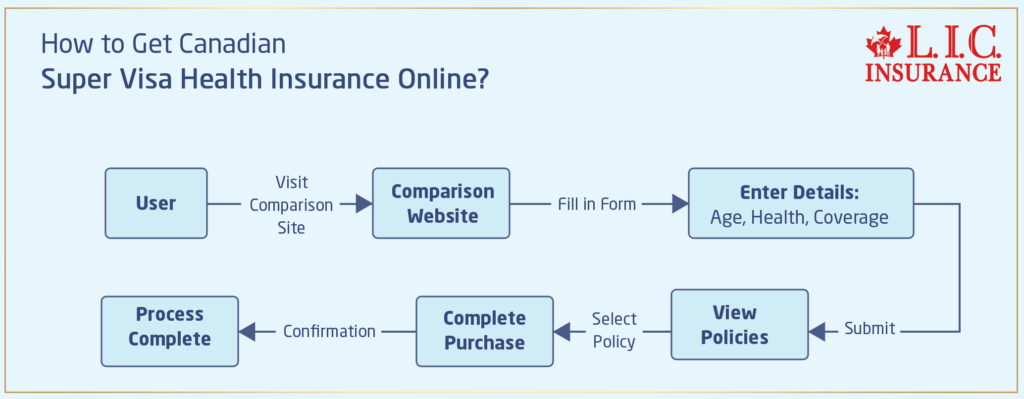

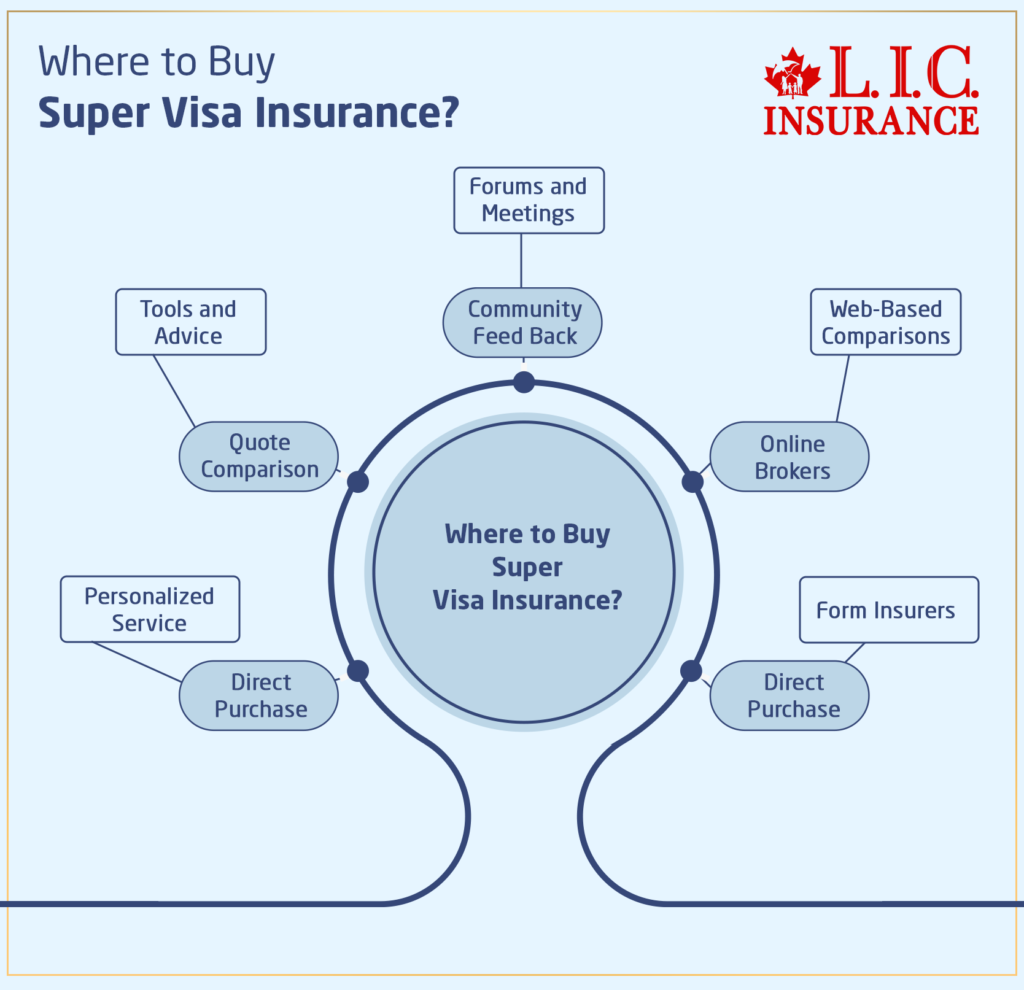

To find competitive Super Visa Insurance costs for 2024, start by comparing quotes from several insurance providers. Consider using online comparison tools or consulting with insurance brokers like Canadian LIC, who specialize in super visa policies. For instance, when Kevin was searching for the best deal, he used an online comparison tool that helped him see different options side by side, allowing him to choose a plan that was both affordable and comprehensive.

The best Super Visa Insurance Policy for frequent travellers should offer flexible terms for multiple entries into Canada and provide coverage that resets with each entry. It should also cover emergency medical expenses without too many restrictions. Joanna, a frequent traveller, chose a policy through Canadian LIC that allowed her to leave and re-enter Canada multiple times within the year without any hassle, which perfectly suited her dynamic travel schedule.

The Super Visa Insurance is often non-transferable to another person. Each policy is issued to only one individual in accordance with certain risk factors and insurance needs. When Meera asked if the policy could be transferred to her brother, she learned it wasn’t possible. She had to process a cancellation and advised her brother to secure his own policy, highlighting the importance of understanding policy restrictions and terms.

When choosing a Super Visa Insurance Policy for a pre-existing condition, look for a policy that clearly covers such conditions, possibly with a stable period requirement. The best Super Visa Insurance Policy will provide clarity on how pre-existing conditions are handled. Mia settled for a policy where her dad would be a

Make sure that the Super Visa Insurance you are buying is refundable in case you cancel a trip. Check out the policies and go through clear cancellation terms; understand the grounds for a person getting a refund. Therefore, it is of great importance to buy such insurance from reputable companies that have straightforward processes for getting a refund. Mark learned this the hard way when he had to cancel his trip at the last minute but struggled with the refund because the terms were not clear from the start. It is, therefore, upon consulting with the Canadian LIC that he later chose a more transparent policy.

Whether you get a refund if your insurance starts before your visa is approved will vary according to the policy’s terms. Most would advise that a person hold off on this insurance start date until the visa has most definitely been confirmed. Juan hadn’t done that, so his policy started while his visa was still in process. Fortunately, his insurance company allowed him to adjust the start date without a penalty after explaining his situation, which is not always guaranteed.

The longer the period you are going to stay, of course, greatly influences the Super Visa Insurance rates in 2024. In most cases, the longer your stay, the higher the premium is going to go. Lucy found this out when she initially planned for a three-month visit but extended it to a full year, leading to an increase in her insurance cost. However, her insurer offered a pro-rated increase, which meant she only paid extra for the additional months she stayed.

How to handle an insurance claim if you need to go back to your home country earlier with a super visa would involve alerting your insurance provider right away and forwarding the required documentation covering your early departure. George had to return home to Canada after two months due to a family emergency. He contacted his insurer immediately, which helped facilitate a smooth claim process and a partial refund for the unused portion of his insurance.

Failure to go for the best Super Visa Insurance Policy may bring up the risk of being covered inadequately at the time when medical emergencies arise unexpectedly or when travel plans are changed. That was the case for Sophia, who had purchased a cheaper policy that didn’t cover certain expensive emergency medical procedures she had to undergo in the country. After facing high out-of-pocket costs, she stressed the importance of carefully reviewing policy details before purchasing.

In order to lower your Super Visa Insurance costs for 2024, you may consider the option of a higher deductible, which will, in turn, lower the premium. At the same time, compare several policies for the best rate with what best suits your needs. Elena did this with a consultant from Canadian LIC, who advised her to increase her deductible, thus saving on monthly premiums without failing to have essential coverage. Nevertheless, remember that saving money is important, but ensure the coverage meets all potential needs.

When searching for the best Super Visa Insurance Policy, especially if you or your family member has a chronic illness, look for policies that clearly state the coverage for pre-existing conditions and any limitations. But Mohan’s policy was such that it included all expenses, including medication expenses for hypertension, which most other policies do not include. It is with the help of this prudently chosen policy that he could relax during his stay without concern for the expenses that could be incurred in case of medical requirements.

Yes, definitely look into the exclusions that can have an impact on your refund, such as travel advisories or failure to notify the insurer right away of changes in your status. Tanya learned this the hard way when she delayed notifying her insurer about her visa denial, which complicated her refund process. Always read the fine print and keep your insurer updated to ensure you can claim your refund smoothly.

One of the latest trends in Super Visa Insurance costs for 2024 is the gradual increase in premiums due to rising healthcare costs. They shall keep checking for updates to be ahead in the race and keep seeking advice from experts like Canadian LIC, who keep updating themselves on market trends and would guide you to be able to choose a cost-effective, comprehensive policy. Raju had done just that and could lock in the rate early in the year before prices rose.

These will mostly influence the length of coverage and the choice of the best Super Visa Insurance Policy. If your stay is planned for a short while and you are not sure of the possibility of an extension, then choose a policy that allows such an extension without big penalties. Clara opted for a flexible policy that allowed her to extend her stay twice without hefty fees, which gave her peace of mind during her extended visit with her grandchildren.

Usually, the Super Visa Insurance has to be bought outside Canada before entry into Canada as a component of the visa application. A few insurers do, however, make the option of purchasing or renewing policies in Canada available for those who forgot or need to extend a policy. Max went through such a situation and was so relieved to see that the insurance provider had provided an option to renew his policy for him, being already in Canada.

These frequently asked questions were created to provide as much information and help as possible due to the complexities of the Super Visa Insurance refunds. This will further ensure that your experience is as easy and stress-free as possible.

Sources and Further Reading

Citizenship and Immigration Canada – Official guidelines and requirements for super visas. Visit CIC website

Canadian Life and Health Insurance Association (CLHIA) – Offers detailed information on insurance products including Super Visa Insurance. Visit CLHIA website

Insurance Brokers Association of Canada (IBAC) – Provides resources and advice on choosing the right insurance policy. Visit IBAC website

Financial Consumer Agency of Canada (FCAC) – Tips on understanding insurance policies and consumer rights in Canada. Visit FCAC website

Kanetix Ltd. – Useful for comparing Super Visa Insurance quotes to find competitive rates and coverage options. Visit Kanetix website

These sources can provide additional detailed information and help guide decisions regarding Super Visa Insurance, ensuring you choose the best policy for your needs and understand all associated costs and refund processes.

Key Takeaways

- Know when you are eligible for Super Visa Insurance refunds, including visa rejections and plan cancellations.

- Stay informed about Super Visa Insurance costs for 2024 for better financial planning.

- Choose the best Super Visa Insurance Policy considering coverage, refund flexibility, and pre-existing conditions.

- Keep necessary documents ready for processing refunds, such as visa rejection letters

- Understand your policy's terms to avoid surprises related to refunds.

- Consult insurance experts like Canadian LIC to simplify selecting and managing Super Visa Insurance.

- Familiarize yourself with the claims process to efficiently handle any medical issues that arise.

- Familiarize yourself with the claims process to efficiently handle any medical issues that arise.

Your Feedback Is Very Important To Us

We appreciate your time in helping us understand your experiences with Super Visa Insurance refunds. Your feedback is crucial in improving our services and resources. Please answer the following questions:

Thank you for sharing your experiences. Your input is invaluable in helping us enhance our services and ensure a better experience for all our clients.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]