BASICS

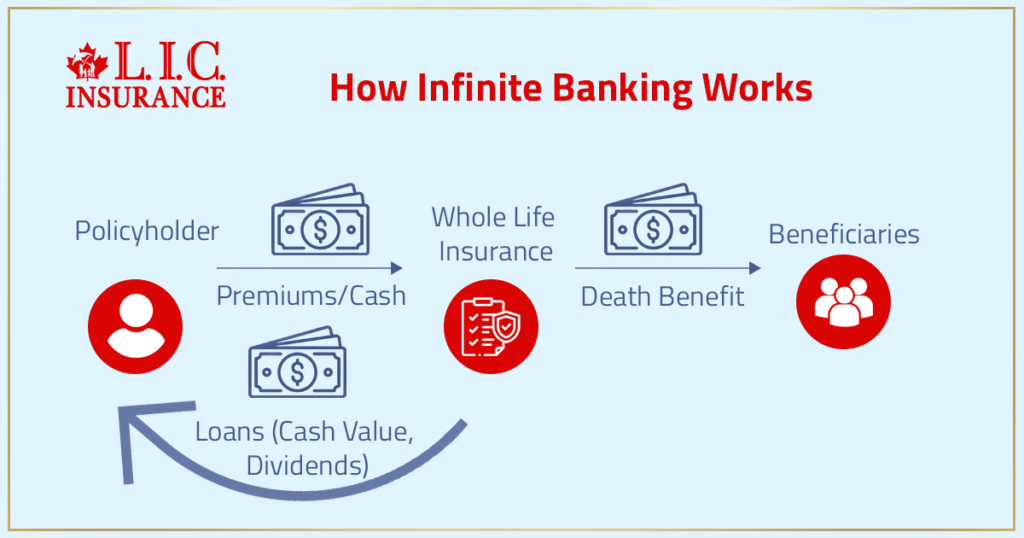

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

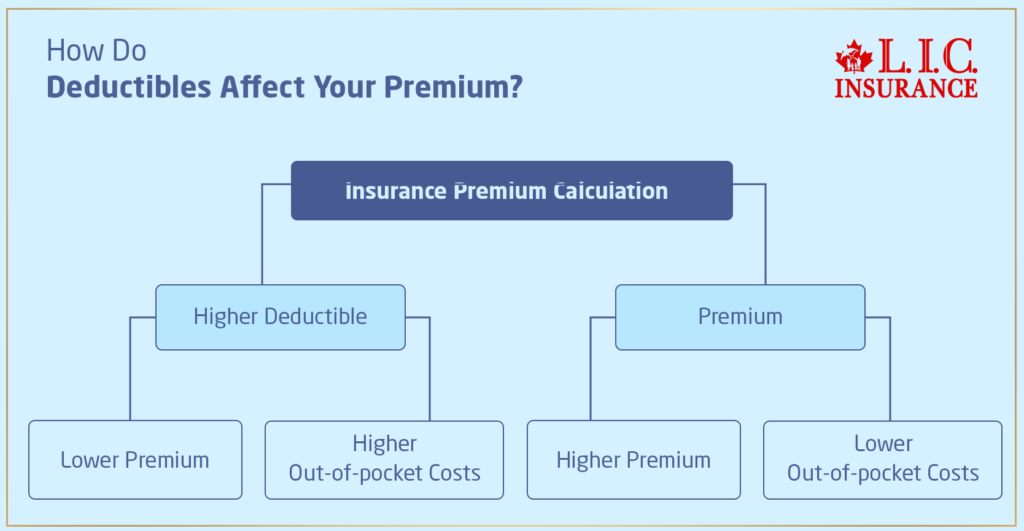

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

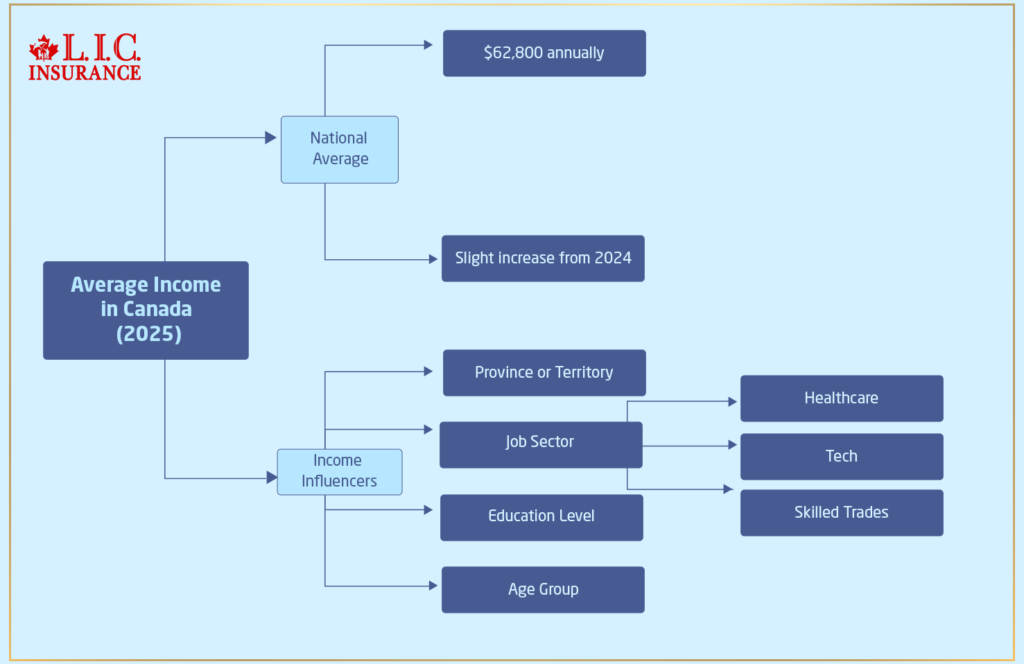

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Quick And Easy Ways To Transfer Money Between Banks

By Harpreet Puri

CEO & Founder

- 15 min read

- June 18th, 2025

SUMMARY

Canadian LIC shares trusted insights on quick and easy ways to transfer money between banks in Canada. From Interac e-Transfers to wire transfers and EFTs, it outlines smart, secure, and fast methods tailored for everyday needs, backed by 14+ years of client experience. It also explains how to reduce fees, avoid delays, and simplify domestic and international transfers using expert strategies trusted by Canadian families and businesses.

Introduction

Transferring money between banks doesn’t have to feel like a frustrating chore, yet we see clients walk into our Canadian LIC office every week, stressed about delays, hidden charges, and confusing steps. After helping thousands of families and individuals streamline their finances over the past 14+ years, I can say this with certainty: even something as seemingly simple as a bank transfer can snowball into unnecessary stress when you don’t know the right way to do it.

Let’s fix that.

From working professionals trying to manage multiple bank accounts to seniors transferring savings to their grandkids’ RESP, our clients at Canadian LIC face these everyday struggles. And every time, we offer simple, tailored, and secure solutions that work quickly and reliably.

Below, you’ll find the methods we recommend to our clients, along with the same guidance we give during our consultations. Every strategy mentioned here is backed by real experiences, with names changed for privacy.

Interac e-Transfer: The Everyday Hero

When Poonam came to us needing to send emergency tuition fees to her niece studying in Vancouver, we walked her through Interac e-Transfer. Within minutes, the money was transferred directly from her TD Bank account to her niece’s RBC account.

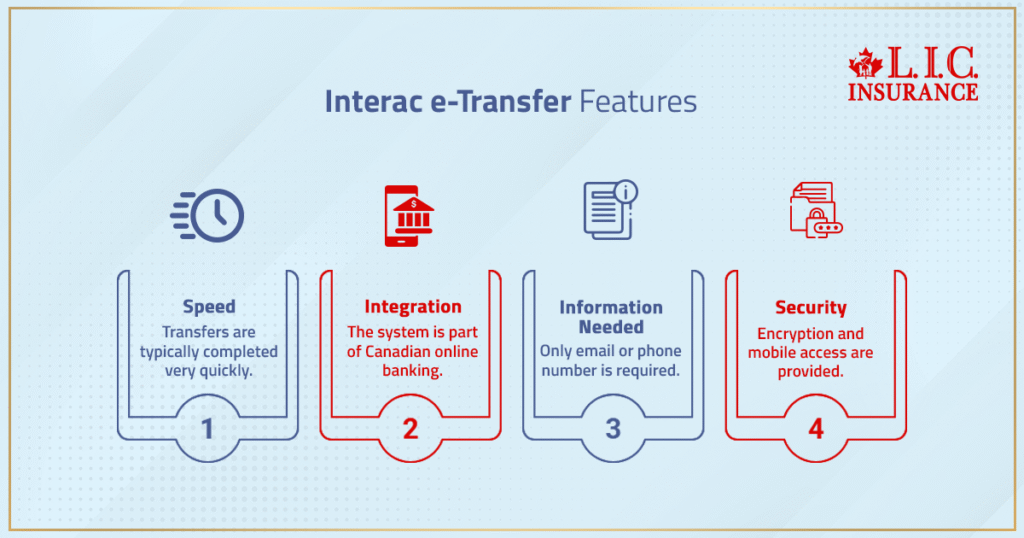

Why We Recommend It at Canadian LIC:

- Most transfers happen in seconds.

- It’s embedded into most Canadian online banking systems.

- There’s no need for a person’s account numbers—just an email or phone number.

- Secure encryption and easy mobile access.

It’s ideal for clients looking to move money fast with zero learning curve.

Electronic Funds Transfer (EFT): Reliable for Scheduled Transfers

Harjeet, a small business owner we’ve worked with for over a decade, was manually paying herself and her vendors each month from different accounts. After reviewing her setup, we suggested EFTs through her business bank portal.

Why Canadian LIC clients prefer EFTs:

- Perfect for predictable, recurring transactions.

- Works well for both personal and business banking.

- No physical paperwork or manual follow-ups.

- Completely digital, with low or no fees from Canadian banks.

Online Bank-to-Bank Account Transfers: Simplicity Meets Security

Many of our clients, like Nav, a 45-year-old investor with four bank accounts, didn’t realize how easy it was to link external accounts through online banking. We walked him through linking his BMO and Scotiabank accounts.

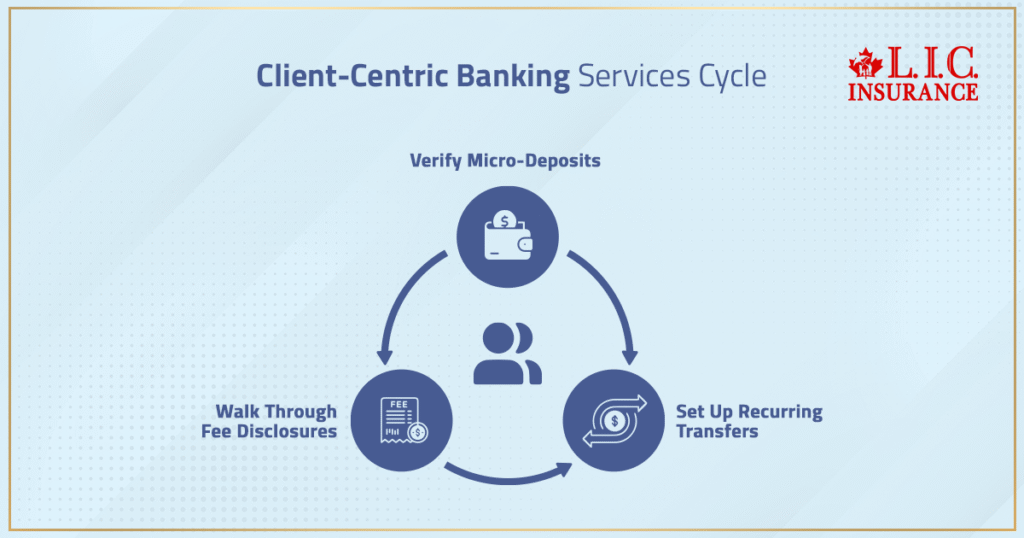

How We Simplify the Process at Canadian LIC:

- Help clients verify micro-deposits to connect accounts.

- Set up recurring transfers to automate savings.

- Walk clients through fee disclosures.

This method eliminates the need for third-party tools and keeps everything under the same financial umbrella.

Third-Party Apps (Wise, PayPal, Remitly): When You're Going Global

Our international clients—like Manoj, who frequently sends money to his family in India—ask about low-cost global transfer options. Our advice? Use Wise (formerly TransferWise) for transparent fees and mid-market exchange rates.

How Canadian LIC Supports International Transfers:

- Compare fee structures across services.

- Highlight processing times and exchange rate accuracy.

- Offer client-friendly onboarding to the platforms.

Apps like Wise, Remitly, and PayPal are invaluable for cross-border transfers.

Wire Transfers: Big Transfers, Done Safely

When our client, Sukhbir, needed to send a large down payment for a home, we arranged a bank-certified wire transfer. It reached the lawyer’s trust account within hours.

When We Recommend Wire Transfers:

- For real estate closings

- For international business payments

- For any transaction above $10,000

They cost more than other methods, but they’re fast, secure, and traceable.

Pre-Authorized Debits (PADs): Set It and Forget It

One of our retired clients, Baljit, was struggling to keep track of all her monthly deductions—utility bills, charity donations, and credit card payments. We helped her automate everything with PADs.

Our PAD Setup Process at Canadian LIC:

- We guide clients through vendor forms.

- Ensure deduction dates align with pension deposit dates.

- Help them monitor and adjust recurring PADs as needed.

PADs free up your mind and reduce financial stress.

Canadian LIC's Smart Transfer Tips for 2025

We often advise our clients to take the following steps before and after every transfer:

- Double-Check Details: A wrong digit in an account number can cause long delays.

- Enable Alerts: Get instant text or email confirmations.

- Schedule Your Transfers: Avoid weekend or holiday delays by setting up transactions on business days.

- Understand the Fees: Always ask us or your bank about hidden charges.

- Save Receipts: For large or international transfers, always keep screenshots or confirmation numbers.

More Ways Canadian LIC Clients Are Simplifying Transfers

Linking Accounts for Seamless Movement

Many families now manage both personal and corporate finances. We often solve the issue of helping them link personal checking accounts with corporate accounts, which gives our clients faster control over cash flow. We also advise on how to maintain CRA compliance when shifting funds between business and personal use.

Helping Seniors Navigate Transfers

Older clients often feel overwhelmed by online banking. At Canadian LIC, we set aside time to show them how to access their accounts safely, avoid scams, and transfer funds without needing to visit a branch. We recently helped a senior couple switch to mobile banking for the first time, and now they manage their entire monthly budget using their iPad.

International Students Sending and Receiving Funds

Whether it’s tuition, rent, or living expenses, we’ve helped hundreds of international students set up a secure money pipeline between Canada and their home countries. We make sure their accounts are CRA-compliant and that they’re using the most cost-effective platforms for cross-border transactions.

Fee Breakdown: Know What You're Paying For

Too many people come to us unaware of the fees they’ve been charged. That’s why part of our consultation includes walking you through:

- Interac e-Transfer daily/monthly limits

- Bank-to-bank transfer fees and delays

- Currency conversion markups with third-party apps

- Flat charges on wire transfers (usually $15–$40)

- PAD penalties if a debit fails

We also help our clients dispute charges when necessary. Our financial advocates speak directly to banks or providers to resolve unjustified fees.

Why We Emphasize Personalized Guidance

Each person’s banking situation is different. That’s why Canadian LIC never provides one-size-fits-all suggestions. Every strategy is customized based on your:

- Bank’s technology access (some rural branches still have limitations)

- Transfer Frequency

- Preferred access (mobile vs. desktop)

- Security requirements

- Tax implications (especially for business owners or joint accounts)

We often go as far as drafting a monthly transfer calendar for our clients, down to the exact days, amounts, and platforms.

Final Word

At Canadian LIC, we believe no one should feel anxious about moving their own money. Our mission has always been to educate and empower—because when you’re financially informed, you’re financially free.

If you’re still relying on outdated methods, paying unnecessary fees, or worrying about delays, now is the time to change that. Let us help you move your money safely, swiftly, and without stress.

Give us a call, book a consultation, or walk into our office—we’re ready to show you how easy transfers can be in 2025.

FAQs – Canadian LIC's Expert Answers on Bank Transfers

We’ve had clients panic when transfers don’t show up right away, especially if rent or tuition is due. Delays can happen due to bank holidays, transfer limits, or mismatched details. At Canadian LIC, we advise clients to immediately contact both sending and receiving banks, keep all transfer confirmations, and escalate through proper channels. For recurring issues, we help switch to faster, more reliable platforms.

Yes, but be careful. Many clients unknowingly lose money due to poor exchange rates or hidden fees. That’s why we help set up USD-denominated accounts within Canadian banks or guide clients through currency exchange tools with lower markups. We also teach our clients how to lock in favourable exchange rates when planning large transfers.

It can be if it is set up correctly. Our team helps clients activate multi-factor authentication, disable biometric login on shared devices, and use virtual private networks (VPNs) when accessing banking apps on public Wi-Fi. We also show seniors and newcomers how to check if an app is legitimate before using it for sensitive transfers.

We’ve seen spouses and business partners struggle with this. Joint account transfers aren’t always “tax-neutral.” If the accounts belong to different entities or involve income-producing assets, you could trigger a reportable event. We offer personal guidance on how to structure transfers between spouses, parents and children or business accounts to stay compliant.

This comes up frequently when clients want access to savings. Unlike regular transfers, withdrawals from TFSAs or RRSPs can have tax consequences. At Canadian LIC, we guide our clients on the timing, paperwork, and withholding tax implications before initiating the transfer. We often recommend strategic withdrawals to reduce tax exposure or avoid contribution limit issues.

Banks have internal fraud detection systems that can flag unusual activity. If you suddenly move $50,000 when you usually send $500, your transaction could be paused. To prevent this, we help clients notify their banks in advance and document the purpose of the transfer, especially for purchases, investments, or down payments. This small step can save a lot of headaches.

We’ve helped clients stuck with low daily limits, especially when paying contractors, tuition, or hospital bills. Options include splitting the amount over multiple days, using certified cheques, or initiating a wire transfer instead. We also help clients request a temporary limit increase by submitting the right documents to their bank.

Absolutely. We often create tiered strategies for self-employed clients using variable-income models. This might include setting up flexible transfers triggered by income thresholds or transferring a percentage instead of a fixed amount. With the right planning, your savings can grow consistently, even with unpredictable income.

That depends on the type of transfer. Some methods, like Interac e-Transfers (if not yet accepted), can be cancelled. Others, like wire transfers, are nearly impossible to reverse. That’s why we educate our clients to always use the transfer confirmation checklist we provide. In cases where a mistake occurs, we intervene with the bank directly to explore recovery options.

We prepare a custom emergency transfer checklist for each client. This includes linking backup accounts, setting preferred contact methods with banks, and knowing exactly which platforms work best when time is limited. Whether it’s sending money to a child abroad or paying for a medical emergency, being prepared can make all the difference.

Key Takeaways

- Transferring money between Canadian banks can be fast, simple, and secure—when the right method is chosen based on your needs.

- Interac e-Transfer is ideal for instant, everyday transactions, offering speed, accessibility, and strong encryption.

- Electronic Funds Transfers (EFTs) are perfect for recurring payments and scheduled transactions, especially for personal and small business use.

- Online bank-to-bank transfers work well for managing multiple accounts securely, especially when linked through verified setups.

- Third-party apps like Wise and PayPal offer cost-effective options for international money transfers, especially for clients with family or business abroad.

- Wire transfers are the safest option for large or time-sensitive payments, such as real estate transactions or major business dealings.

- Pre-Authorized Debits (PADs) help clients automate regular payments, reducing missed bills and budgeting stress.

- Canadian LIC provides customized, real-world support, including transfer checklists, fraud protection tips, and fee analysis.

- Clients with joint accounts, business structures, or variable incomes benefit from tailored strategies to stay compliant and financially efficient.

- Transfer limits, timing, and platform choice can make or break a successful transaction, which is why professional guidance is crucial.

- Transferring money between Canadian banks can be fast, simple, and secure—when the right method is chosen based on your needs.

Sources and Further Reading

Below are authoritative sources and further reading on transferring money between banks in Canada. These resources cover the main methods, security, fees, and tips for seamless transfers.

- Government of Canada: Transferring Your Products or Services to Another Financial Institution

Comprehensive guidance on how to transfer chequing and savings accounts, including steps for identifying automated transactions, opening new accounts, and moving your funds.

Read on, Canada.ca1 - Wise (formerly TransferWise): International Money Transfers

Transparent fee structure and real-time exchange rates for sending money internationally, often at lower costs than traditional banks.

Read on Wise - Remitly: Send Money Internationally

Fast and secure options for sending money abroad, with a focus on speed, transparency, and customer support.

Read on Remitly - PayPal: How to Send Money

Overview of sending money domestically and internationally using PayPal, including fees, security, and recipient options.

Read on PayPal Canada

These resources will help you understand your options, avoid unnecessary fees, and ensure your money transfers are safe and efficient.

Feedback Questionnaire:

We’d love your input! Please take a moment to answer a few quick questions so we can better assist Canadians looking for faster, safer, and simpler ways to move money between banks.

Thank you for sharing your experience. Your feedback helps us continue to offer the most relevant and personalized financial guidance across Canada.

– The Canadian LIC Team

IN THIS ARTICLE

- Quick And Easy Ways To Transfer Money Between Banks

- Electronic Funds Transfer (EFT): Reliable for Scheduled Transfers

- Online Bank-to-Bank Account Transfers: Simplicity Meets Security

- Third-Party Apps (Wise, PayPal, Remitly): When You're Going Global

- Canadian LIC's Smart Transfer Tips for 2025

- More Ways Canadian LIC Clients Are Simplifying Transfers

- Fee Breakdown: Know What You're Paying For

- Why We Emphasize Personalized Guidance

- Final Word