- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Understanding Term Life Insurance Mortgage Protection

- How Term Life Insurance Offers Flexibility

- Why Choose Term Life Insurance for Mortgage Protection?

- How Term Life Insurance Supports Families Facing Mortgage Challenges

- Key Steps to Buying Term Life Insurance for Mortgage Protection

- Benefits of Term Life Insurance Over Mortgage Insurance

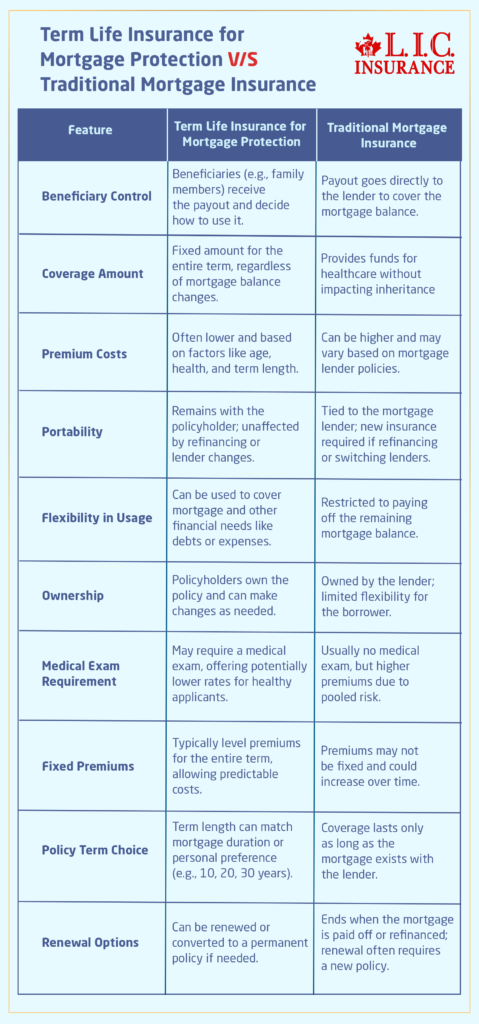

- Term Life Insurance for Mortgage Protection V/S Traditional Mortgage Insurance

- Common Concerns About Using Term Life Insurance for Mortgage Protection

- How Canadian LIC Supports Your Mortgage Protection Needs

- Act Now to Secure Your Mortgage with Term Life Insurance

Can You Use Term Life Insurance to Pay Off a Mortgage?

By Harpreet Puri

CEO & Founder

- 11 min read

- October 31th, 2024

SUMMARY

Owning a home is sometimes a dream for many for their whole lives, but for most Canadians, this reality becomes a nightmare: making monthly mortgage payments over many decades creates financial stress. It is not only about the upfront cost but also about making sure that those monthly payments are manageable and ensuring your family is protected in case something happens. We actually get asked the question one of the most: How can Term Life Insurance possibly help secure my mortgage?

“For many families, Term Life Insurance Mortgage Protection is a smart, affordable way to ensure that the family home is secure, no matter what life throws your way. In this blog, we’ll explore how Term Life Insurance Policies can serve as a reliable safety net to cover mortgage payments, safeguard your family’s home, and offer peace of mind.” We will share relatable client stories from Canadian LIC’s experiences that demonstrate how Term Life Insurance can play a crucial role in mortgage protection, especially when unexpected challenges arise. Let’s dive into how Term Life Insurance could be the right tool to help you protect one of the biggest investments of your life.

Understanding Term Life Insurance Mortgage Protection

For many people, a mortgage is the largest single financial investment they will ever make. Failure to pay off a mortgage can put this investment at risk, and a serious event will result in loved ones paying the financial consequences much later. Mortgage protection by Term Life Insurance is designed to address exactly this type of problem. Unlike the Traditional Mortgage Loan Insurance policies offered by lenders, Term Life Insurance lets you have control over the proceeds so that your family remains financially prepared to pay the mortgage even after you are gone.

When buying Term Life Insurance, the policyholder selects a level of coverage that is designed to last the same length as the mortgage, typically between 10 and 30 years. If he or she dies during that term, the payout could be used to pay remaining mortgage payments and ease those left behind.

How Term Life Insurance Offers Flexibility

One of the good things about Term Life Insurance compared to Traditional Mortgage Insurance is flexibility. When the policyholder dies, Term Life Insurance pays out a direct death benefit to a chosen beneficiary, where they get to decide how best to utilize the funds. One of the ways we see flexibility appreciated at Canadian LIC is that the family of clients can allocate funds not only towards a mortgage but also to other financial requirements that may soon become emergent, such as household expenses, education, or medical conditions.

The Term Life Insurance online also has made purchasing easier. Most of our clients purchase term life online since it offers more convenience, better rate comparison, and easier application processes.

Why Choose Term Life Insurance for Mortgage Protection?

1. Cost-Effectiveness

Mortgage insurance happens to be expensive compared to the term life. They go with a higher amount of cover at relatively lower rates, and most frugal homeowners go after them very aggressively. One of our clients, for instance, was able to secure a 20-year Term Life Insurance Policy that covered his entire mortgage balance at a premium far lower than what he was quoted for mortgage insurance through his lender. This allowed him to have peace of mind without breaking his budget.

2. Flexibility in Beneficiaries

With Term Life Insurance Mortgage Protection, the payoff is paid out directly to the beneficiaries, and they may use the insurance money however they wish; it doesn’t have to be applied directly to the mortgage. In fact, just recently, a client shared with me a story about a young mom who had purchased Term Life Insurance, so she was glad that when she died, her kids could get the benefit so they not only could stay in the family home but also pay for education.

3. Coverage Continuity

Unlike mortgage insurance, which only covers the remaining mortgage balance, Term Life Insurance guarantees a fixed payout. Whether the mortgage is partially paid off or not, the full amount of the Term Life Insurance Policy remains intact. This feature provides a more reliable financial safety net. At Canadian LIC, we encourage clients to look at Term Life Insurance as a more robust way to cover their mortgage obligations while offering extra protection.

How Term Life Insurance Supports Families Facing Mortgage Challenges

Scenario 1: Protecting Family Security

A father of two, who is a Canadian LIC client, shared this story: “I needed to buy Term Life Insurance for mortgage protection. With a young family to support, he worried that his sudden absence could mean his children might lose their home. A 25-year Term Life Insurance Policy aligned with his mortgage term, ensuring that if anything happened to him, his family would have a lump sum payout to cover the remaining mortgage. This affordable solution became a key part of his financial planning, offering him peace of mind knowing his children would be safe in their home.

Scenario 2: Term Life Insurance for Single Homeowners

Single persons can also take Term Life Insurance Mortgage Protection. One of our customers was a single female who bought an apartment and had a huge mortgage. She had no near blood ties but wanted to ensure that she left something for her chosen heirs. So, with Term Life Insurance online, she secured a 20-year affordable policy aligning with the mortgage term. That ensured that in the event that she died unanticipatedly, her estate would pass smoothly, and she wouldn’t leave an inheritance in paying the mortgage.

Key Steps to Buying Term Life Insurance for Mortgage Protection

Step 1: Determine the Coverage Amount

When considering Term Life Insurance for mortgage protection, calculate the outstanding mortgage balance as well as any other debts or financial obligations. You want to ensure the death benefit is large enough to cover these amounts. Canadian LIC often advises clients to round up slightly to allow for additional expenses, such as legal fees or possible home repairs.

Step 2: Match the Term Length to Your Mortgage

Select a term that matches or slightly exceeds the duration of your mortgage. For example, a 25-year mortgage would ideally be covered by a 25- or 30-year Term Life Insurance Policy. This ensures that your coverage lasts as long as you’re making mortgage payments, providing financial security throughout the life of your mortgage.

Step 3: Buy Term Life Insurance Online for Convenience

Today, you can buy Term Life Insurance online quickly and efficiently. This option allows you to compare policies from various insurers and secure the best rate. Many Canadian LIC clients appreciate the flexibility of purchasing online, as it’s both time-saving and allows for transparent comparisons.

Benefits of Term Life Insurance Over Mortgage Insurance

While both Term Life Insurance and mortgage insurance offer protection, Term Life Insurance provides unique advantages.

- Higher Coverage Flexibility: Mortgage insurance generally decreases in value as you pay down your mortgage, whereas Term Life Insurance maintains a fixed payout throughout the policy term.

- Beneficiary Control: With Term Life Insurance, your family has control over the payout, using it to cover various expenses—not just the mortgage.

- Portability: Mortgage insurance is often tied to a specific mortgage lender, so if you refinance or switch lenders, you may need a new policy. Term Life Insurance is portable and remains with you, regardless of your mortgage insurance company.

Term Life Insurance for Mortgage Protection V/S Traditional Mortgage Insurance

Common Concerns About Using Term Life Insurance for Mortgage Protection

1. Will My Premiums Increase Over Time?

Typically, Term Life Insurance Policies come with level premiums, meaning your payments won’t increase during the policy term. This predictability is essential for long-term budgeting. Some clients initially worry about rate increases but are relieved to learn that level premiums keep their costs stable.

2. What Happens if I Outlive My Policy?

If you outlive your Term Life Insurance Policy, coverage simply ends unless you opt to renew. By the end of a 20- or 30-year term, many clients have paid off their mortgage or are in a stable financial position, making coverage extension less necessary. However, Canadian LIC often discusses renewal options for clients who feel they still need coverage.

3. Can I Have Both Term Life and Mortgage Insurance?

Yes, but most clients find that Term Life Insurance alone suffices. Mortgage insurance duplicates coverage in some respects, making it an unnecessary expense when Term Life Insurance offers more flexibility. Canadian LIC advises focusing on term life policies due to their comprehensive and beneficiary-friendly design.

How Canadian LIC Supports Your Mortgage Protection Needs

Canadian LIC is striving hard to guide families in making the right decision regarding mortgage protection for their homes. Using Term Life Insurance Mortgage Protection, we provide customized plans according to a customer’s particular financial requirements. Our team has seen firsthand how securing a Term Life Insurance Policy can lift the weight off the families’ minds and offer a predictable plan for the family.

Each client situation is unique, and we are here to help you all the way, from finding the right policy term for you to determining how much coverage you need. So, buying Term Life Insurance online can be quite advantageous because you can now enjoy the freedom of checking some options that would fit your family’s needs while at the same time making a crucial investment in your financial security.

Act Now to Secure Your Mortgage with Term Life Insurance

Taking steps now to protect your mortgage with Term Life Insurance can make all the difference for your family in the future. Here at Canadian LIC, we have helped thousands of families find the right coverage to give them the assurance their homes are secure. Whether you’re just beginning your homeownership journey or are a few years into your mortgage, a Term Life Insurance Policy offers an affordable, reliable way to protect your loved ones.

More on Term Life Insurance

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

Frequently Asked Questions: Term Life Insurance for Mortgage Protection

Term Life Insurance Mortgage Protection is a type of Term Life Insurance that can cover your mortgage if you pass away during the policy term. When you buy Term Life Insurance, the coverage lasts for a set period, often aligned with the mortgage length. If anything happens to you during that time, the insurance payout goes to your family, who can then use it to pay off the mortgage or other expenses. Canadian LIC has seen many clients relieved knowing their family has this security in place, ensuring the home stays in the family’s hands.

Term Life Insurance Policies give your family control over the payout, while regular mortgage insurance goes directly to the lender. This means your loved ones can use the insurance benefit for the mortgage or other financial needs. Many clients at Canadian LIC choose Term Life Insurance because it provides flexibility and a level payout that doesn’t decrease as you pay down the mortgage. This way, your family has the full benefit amount to cover both the mortgage and other costs if needed.

Yes, you can buy Term Life Insurance online, and it’s a reliable, straightforward way to secure coverage. Many clients prefer this option because it allows them to easily compare Term Life Insurance Policies, find affordable rates, and complete the process from home. Canadian LIC offers guidance for those buying Term Life Insurance online, helping clients choose policies that meet their mortgage protection needs effectively.

The coverage should ideally match or slightly exceed your mortgage balance. This ensures that your family can pay off the mortgage if something happens to you. Canadian LIC recommends adding a small buffer to cover additional expenses like legal fees or home maintenance. Our team works closely with clients to calculate the right amount so that their family feels secure and prepared for any unexpected expenses.

If you outlive the policy term, the coverage simply ends, and no payout is made. However, by the time many clients reach the end of their term, they have either paid off most of their mortgage or are in a strong financial position. Canadian LIC also discusses renewal options for those who want extended coverage, helping clients stay protected as their needs change.

Yes, Term Life Insurance is generally one of the most affordable ways to secure mortgage protection. Compared to regular mortgage insurance, Term Life Insurance Policies offer a higher payout amount at lower premiums. Our clients at Canadian LIC appreciate that they can obtain reliable coverage that fits their budget, giving them security without straining finances.

Yes, you can have both, but many find that Term Life Insurance Mortgage Protection alone is sufficient. Mortgage Insurance directly pays the lender, while Term Life Insurance allows your family to decide how to use the payout. Canadian LIC often advises clients to consider Term Life Insurance alone for mortgage protection because of its flexibility and comprehensive coverage.

No, with Term Life Insurance, the payout amount remains fixed for the entire policy term. This is different from mortgage insurance, which only covers the remaining balance. Many clients at Canadian LIC find reassurance in knowing that the full benefit amount is always available, no matter how much is left on their mortgage.

The benefit from Term Life Insurance goes to the beneficiaries you choose, usually family members. Unlike mortgage insurance, which pays directly to the lender, Term Life Insurance allows your loved ones to control the funds. This option provides more flexibility, as Canadian LIC clients often prefer having their families make financial decisions according to their specific needs.

Yes, Term Life Insurance stays with you, even if you refinance or switch lenders. This is another reason why clients prefer Term Life Insurance over mortgage insurance. Canadian LIC helps clients keep their mortgage protection active through refinancing, providing stable security without needing to change or repurchase coverage.

The ideal term lengths of Term Insurance Coverage aligns with the length of your mortgage. For example, if you have a 25-year mortgage, a 25-year Term Life Insurance Policy would offer coverage throughout the loan. At Canadian LIC, we help clients select term lengths that suit their mortgage and future needs, ensuring their family has protection during critical years.

Absolutely. Single homeowners can also benefit from Term Life Insurance Policies for mortgage protection. It’s a way to ensure that your mortgage is covered if something happens to you, preventing any financial burden on your loved ones or estate. Canadian LIC assists single clients in selecting coverage that protects their investment, giving them assurance that their property is secure.

Term Life Insurance Mortgage Protection is an essential part of many financial plans. It not only ensures that your mortgage is covered but also provides a financial safety net for other expenses. At Canadian LIC, we work with clients to integrate Term Life Insurance into their broader financial goals, helping them build stability and protect their most valuable assets.

Yes, Term Life Insurance Policies provide a flexible payout. This means your family can use the benefit not only for the mortgage but also for other debts like car loans or credit cards. At Canadian LIC, we often see clients who appreciate this flexibility, knowing that their loved ones can cover a range of financial needs.

Term Life Insurance is temporary, lasting only for the set period you choose (like 20 or 30 years). Whole life insurance, on the other hand, provides lifelong coverage but is more expensive. Many clients at Canadian LIC find that Term Life Insurance Mortgage Protection aligns better with their mortgage terms and budget, offering affordable premiums while they pay off the mortgage.

Most Term Life Insurance Policies are fixed once they’re set. However, if you need changes, Canadian LIC can help you explore additional coverage or renewal options. We often assist clients who want more coverage or a longer term as their needs change, making sure they always have the right level of mortgage protection.

Some Term Life Insurance Policies require a medical exam, but others do not. The choice often depends on your coverage amount and age. Many clients at Canadian LIC prefer policies that don’t require a medical exam for convenience. Our team helps clients find options that suit their health and coverage needs while ensuring mortgage protection.

Usually, coverage for Term Life Insurance Mortgage Protection begins as soon as the policy is active. However, some policies may have specific conditions or short waiting periods. Canadian LIC advisors make sure clients understand all the terms so they feel secure from day one.

Yes, Term Life Insurance Mortgage Protection stays with you, no matter where you live or which lender holds your mortgage. Canadian LIC often assists clients who move or switch lenders, making sure their mortgage protection remains seamless and fully in place.

To buy Term Life Insurance online, you can simply fill out an application on a trusted insurer’s website. Many of our clients at Canadian LIC enjoy the convenience of comparing Term Life Insurance Policies online and applying from home. We guide clients through the process to ensure they find the right fit for their mortgage needs.

If you pay off your mortgage early, your Term Life Insurance Policy still provides full coverage until the end of the term. At Canadian LIC, we often see clients continue their coverage for added financial protection or transfer the coverage to meet other needs, like income replacement for their family.

Yes, you can cancel your Term Life Insurance Policy if you no longer need it. However, Canadian LIC often discusses options with clients to determine if they still want coverage for other financial goals. Many choose to keep it for added security for their family, even after the mortgage is paid.

Yes, the death benefit from Term Life Insurance is generally tax-free for your beneficiaries in Canada. This means your family receives the full amount, which can be used for the mortgage or any other financial needs. Canadian LIC always ensures clients understand this benefit, as it maximizes the value of their mortgage protection.

Some Term Life Insurance Policies offer a conversion option to switch to a permanent policy without a medical exam. If clients at Canadian LIC foresee a longer-term need, we discuss these options with them to help secure extended mortgage protection or lifelong coverage.

A good rule of thumb is to match your Term Life Insurance to your mortgage duration. However, some clients choose a longer term for additional security. Canadian LIC advisors help clients evaluate their mortgage and financial situation to find a term that ensures mortgage protection for as long as it’s needed.

Yes, most Term Life Insurance Policies come with level premiums, meaning your payment won’t change throughout the term. Many clients appreciate this predictability for budgeting. Canadian LIC prioritizes these level-premium policies for mortgage protection, ensuring clients know exactly what to expect.

Yes, it’s often possible to qualify for Term Life Insurance with certain health conditions, though premiums may vary. Canadian LIC works with clients to find policies that accommodate their health and mortgage protection needs. Some options don’t require medical exams, which can be helpful for those with existing health concerns.

Term Life Insurance covers most causes of death, not just accidental. This includes natural causes, illness, and some other unexpected events. Canadian LIC ensures clients understand what is and isn’t covered, providing a clear picture of their mortgage protection.

Yes, you can name multiple beneficiaries for Term Life Insurance. Many clients at Canadian LIC choose to split the benefit among family members, ensuring that each person receives a portion that can cover mortgage and other expenses.

These FAQs address some of the most common concerns we see at Canadian LIC, helping you make informed choices about Term Life Insurance Mortgage Protection.

Sources and Further Reading

- Canadian Life and Health Insurance Association (CLHIA) – Term Life Insurance

Provides information on Term Life Insurance options, costs, and coverage benefits in Canada.

CLHIA - Financial Consumer Agency of Canada (FCAC) – Mortgage Insurance vs. Term Life Insurance

Compares mortgage insurance from lenders to Term Life Insurance for mortgage protection and highlights their pros and cons.

FCAC - Canadian Mortgage and Housing Corporation (CMHC) – Mortgage Protection Options

Explores different types of mortgage protection, including Term Life Insurance for homeowners.

CMHC - Insurance Bureau of Canada (IBC) – Understanding Term Life Insurance

Offers insights on how Term Life Insurance Policies can benefit families and support mortgage protection.

IBC

Key Takeaways

- Term Life Insurance for Mortgage Protection

Term Life Insurance provides a reliable way to cover your mortgage, ensuring your family can retain the home if something happens to you. - Flexibility Over Mortgage Insurance

Unlike traditional mortgage insurance, Term Life Insurance allows beneficiaries to control the payout, using it for various financial needs beyond the mortgage. - Affordable and Convenient

Term Life Insurance Policies generally have lower premiums, offering an affordable solution to protect your mortgage. You can also buy Term Life Insurance online for added convenience. - Coverage Remains Constant

The benefit amount in Term Life Insurance Policies stays fixed, giving your family consistent coverage even as mortgage balances reduce. - Long-Term Financial Security

Term Life Insurance can be customized to match the length of your mortgage, providing security for as long as you’re paying down your home loan.

Your Feedback Is Very Important To Us

We appreciate your feedback! This survey aims to understand your experiences and challenges in using Term Life Insurance for mortgage protection. Your responses will help us better address the needs of Canadians.

Thank you for sharing your experiences and challenges with us. Your feedback will help us better serve Canadians in finding the right Term Life Insurance options for mortgage protection.

IN THIS ARTICLE

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Understanding Term Life Insurance Mortgage Protection

- How Term Life Insurance Offers Flexibility

- Why Choose Term Life Insurance for Mortgage Protection?

- How Term Life Insurance Supports Families Facing Mortgage Challenges

- Key Steps to Buying Term Life Insurance for Mortgage Protection

- Benefits of Term Life Insurance Over Mortgage Insurance

- Term Life Insurance for Mortgage Protection V/S Traditional Mortgage Insurance

- Common Concerns About Using Term Life Insurance for Mortgage Protection

- How Canadian LIC Supports Your Mortgage Protection Needs

- Act Now to Secure Your Mortgage with Term Life Insurance