- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Can you extend a 20-Year Term Life Policy?

- Can You Extend Your 20-Year Term Life Insurance Policy?

- Why Would You Want to Extend Your Term Life Insurance Policy?

- How Does Renewal Work for a 20-Year Term Life Insurance Policy?

- Can You Convert Your Term Life Insurance Policy to a Permanent Life Insurance Policy?

- Should You Buy a New Term Life Insurance Policy?

- Strategies for Managing the Cost of Extending Your Term Life Insurance Policy

- What Are the Benefits of Working with Canadian LIC When Extending a Term Life Insurance Policy?

- Why Extending Term Life Insurance with Canadian LIC is the Smart Choice

- Taking the Next Step

Can You Extend a 20-Year Term Life Policy?

By Harpreet Puri

CEO & Founder

- 11 min read

- October 10th, 2024

SUMMARY

A 20-year Term Life Insurance Policy provides security for families, but when it ends, many wonder about extending it. Options include renewing the policy, often with higher premiums, or converting it to Permanent Life Insurance for lifelong coverage. Buying a new policy may be cost-effective for healthy individuals. Factors like mortgage payments, children’s needs, and health changes influence the decision. Canadian LIC helps clients find the best strategy for continued protection.

Introduction

Most buy a 20-Year term life in order to guarantee the security of loved ones as they raise children, pay off a mortgage, or accumulate a nest egg for retirement. But when the 20 years run out, the need for coverage doesn’t go away. Many Canadians are in that very same position, wondering if one can extend the term on life insurance or if one has to purchase a new one.

The truth is, you may find, at the end of a 20-Year term, that you still want to protect your family financially. Life is unpredictable, and your needs may not always align perfectly with the original term length of your policy. So, if this is you, then don’t worry; you are among many others. We have seen many clients at Canadian LIC struggle for this very reason, and we can tell you that there are indeed choices whereby your protection will not come to an end.

Can You Extend Your 20-Year Term Life Insurance Policy?

Yes, extending a 20-Year Term Life Insurance Policy is often possible, but the process is not always very simple. Most Term Life Insurance Policies in Canada have a renewal option that allows you to extend the policy for an additional term, usually in increments of five or ten years. It is, thus, more convenient, as one does not have to undergo a medical examination or re-qualify for the coverage to continue.

However, there is a catch: renewing your Term Life Insurance will most likely carry a significant increase in premium. When you first bought your term life, its quotes were likely drawn from what your age, health, and lifestyle used to be. Now that 20 years have passed, and you are probably older and possibly less healthy, it will cost you to renew your policy.

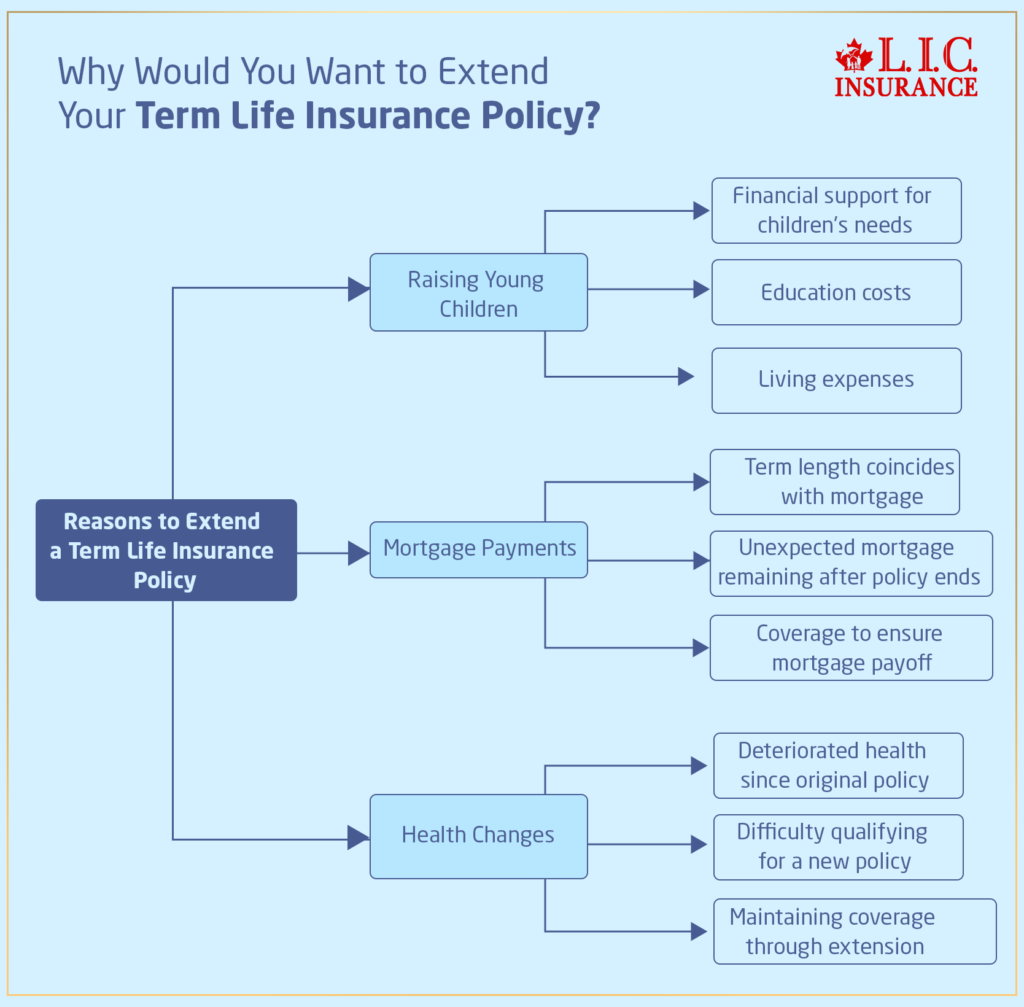

Why Would You Want to Extend Your Term Life Insurance Policy?

There are many reasons why someone may want to extend a 20-Year Term Life Insurance Policy. Let’s consider a few common scenarios we’ve encountered at Canadian LIC:

- Raising Young Children: If you purchased a 20-Year policy when your children were very young, you might find that they still need financial support after the term ends. Extending your policy can help ensure that their needs are met, from education costs to living expenses.

- Mortgage Payments: Many people choose a term length that coincides with their mortgage. However, life doesn’t always go as planned, and you might find yourself with several years left on your mortgage when your policy ends. An extension can help ensure that the mortgage will be paid off if something happens to you.

- Health Changes: If your health has deteriorated since you first bought your policy, you may not qualify for a new Term Life Insurance Policy at reasonable rates. Extending your existing policy can be a more accessible way to maintain coverage.

How Does Renewal Work for a 20-Year Term Life Insurance Policy?

Generally, you can renew your Term Life Insurance, keeping the coverage going for another term without having to undergo a medical exam. However, when you purchase life insurance online or through an insurance agent, it usually contains details on renewal options in your policy documents.

Upon renewal, the life insurance company works out new premiums based on your age. Very probably, new premiums will be many times more than you had earlier when you signed up, and it might shoot high also because the insurer takes into account all your growing years and possible health risks.

Although it is an easy option because you do not need to do a new medical, you should be prepared to pay the cost implications of it. The renewed premiums can jump to an amount quite drastically different from what our clients at Canadian LIC expected, and you would be surprised to see if you are not prepared for it.

Can You Convert Your Term Life Insurance Policy to a Permanent Life Insurance Policy?

While you are near the end of your 20-Year term, if you want to have something for much more than your remaining years, conversion of your Term Life Insurance Policy to a Permanent Life Insurance Policies may be your best alternative. Most Term Life Policies have a conversion feature whereby they can be converted to a Whole or Universal Life Policy just before the term. It guarantees coverage up to a lifetime with no requirement for a new medical examination.

The fixed premiums for Permanent Insurance are generally higher than for Term Life Insurance, but they remain fixed for the rest of your life. In addition, Permanent Policies accumulate a cash value component as time passes. Sometimes, these values might be drawn upon and are very flexible if you want to maintain coverage for life or to leave a legacy for your loved ones.

Should You Buy a New Term Life Insurance Policy?

For instance, if you are healthy, a new Term Life Insurance would be the best option to renew when the term is up. Despite the premium still being higher than what you paid in your Term Life Insurance Quotes 20 years ago, it could be cheaper to buy a new policy than renew the old one. If your health has remained stable, you are in a good position to enjoy the preferential rates, thereby making this option cost-effective.

When you buy a new policy, you’ll have the flexibility to choose an option that meets your current needs. Rather than choosing another 20-Year term, you might choose a 10- or 15-year policy, depending on how long you think you’ll need coverage for.

Struggles with Extending Term Life Insurance Policies

We’ve helped numerous clients at Canadian LIC navigate the challenges of extending Term Life Insurance Policies, and their experiences highlight some of the common struggles faced during this process

- Sticker Shock with Renewal Premiums: Many clients find themselves shocked by the significant increase in premiums when they renew their policies. For instance, a client who initially paid $30 per month for a 20-Year term found that his premiums jumped to over $150 per month upon renewal. This unexpected increase can make the decision to renew difficult, especially if there are budget constraints.

- Health Concerns Impacting New Policy Options: We once assisted a client who had developed a chronic health condition during the 20-Year term. She was concerned about being denied coverage if she applied for a new Term Policy. Her only realistic option was to renew her existing policy, despite the higher premiums, to ensure her family’s financial security.

- Confusion Over Conversion Options: Several clients have expressed confusion over whether they should convert their policies to Permanent Coverage. While conversion can be a valuable option, it’s important to understand the differences between term and Permanent Life Insurance and to weigh the benefits of lifelong coverage against the higher premiums.

Strategies for Managing the Cost of Extending Your Term Life Insurance Policy

If you’re concerned about the increased cost of renewing a Term Life Insurance Policy, there are some strategies you can consider to manage the expense:

- Opt for a Shorter Renewal Term: If your policy allows, you could renew for a shorter term, such as five or ten years, rather than another 20 years. This can help keep premiums lower while still providing the coverage you need.

- Reduce the Coverage Amount: If you no longer need the full coverage amount, reducing the death benefit can help lower your premiums. For example, if your original policy covered $500,000, you might reduce it to $250,000 if your financial obligations have decreased.

- Shop Around for New Policies: Don’t assume that renewing is your only option. Comparing Term Life Insurance Quotes from different providers could help you find a better deal, especially if you’re still in good health.

What Are the Benefits of Working with Canadian LIC When Extending a Term Life Insurance Policy?

The decision on what to do when your 20-Year Term Life Insurance Policy comes due is overwhelming, but you don’t need to navigate this road alone. We have extensive experience at Canadian LIC in working through this process with clients and understand the uniquely difficult challenge of extending, converting, or buying a new policy.

Our expert brokers could review your existing policy, explain the implications of extending or converting, or even assist you in comparing Term Life Insurance Quotes. We take pride in knowing each client’s situation on a very personal level, ensuring that the best and most affordable options are recommended

Indeed, the end of a 20-Year term does not have to mean the end of your financial protection, especially if you opt for Canadian LIC. This means that you can rely on these people to take care of your needs and stay within your budget.

Why Extending Term Life Insurance with Canadian LIC is the Smart Choice

It would be very confusing to have so many options if an insurance choice needs to be made to decide to extend a 20-Year Term Life Insurance Policy. Let the experts at Canadian LIC help you and make it easy. Our team will take time to know your personal needs, discuss all available options, and guide you through the most effective solution for continued coverage.

Many clients feel comfort in speaking with someone who has seen similar situations and, therefore, knows what works. We use our experience at Canadian LIC; therefore, we’ll offer you practical advice and recommendations so that you’re not buying just coverage but rather your family’s future.

Taking the Next Step

When it comes to extending a 20-Year Term Life Insurance Policy, the choices you make can have a long-lasting impact on your family’s financial future. But whichever route you choose – to renew, convert, or buy a new Term Life Insurance Policy – selecting the best choice is paramount. And at Canadian LIC, we’re here to help navigate each step of the way.

Contact now for free Term Life Insurance Quotes to talk over options to renew coverage or convert that temporary coverage into a permanent policy. We are here to help ensure your coverage remains as strong in the future as it is today.

With the knowledge of your options, cost control, and the help of professionals who know what they are talking about, you will be able to extend Term Life Insurance coverage with much confidence and continue to protect the people who matter most to you.

More on Term Life Insurance

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

FAQs about Extending a 20-Year Term Life Insurance Policy

Yes, you can usually extend your 20-Year Term Life Insurance Policy. Most policies in Canada come with a renewal option that lets you continue coverage without taking a new medical exam. However, keep in mind that the renewal premiums will be higher than the original Term Life Insurance Quotes you received when you first bought the policy. The increase is due to your age and any potential changes in health since you first took out the coverage.

If you renew your Term Life Insurance Policy, your premiums will increase significantly. We often see this with clients at Canadian LIC. For example, someone who paid $50 per month during the first 20 years may face monthly payments of $200 or more upon renewal. This jump can be surprising, but it reflects the added risk to the insurer as you get older.

Buying a new Term Life Insurance Policy can be a good alternative if you’re still in good health. At Canadian LIC, we’ve seen clients save on premiums by qualifying for new-Term Life Insurance Quotes. However, a new policy will require a medical exam and may not be an option if your health has changed significantly. It’s essential to compare both options to see which works better for your situation.

Yes, many Term Life Insurance Policies include a conversion option. This allows you to switch your Term Life Insurance Policy to a permanent policy, like Whole Life or Universal Life Insurance before the term ends. The benefit is that you won’t need to take a medical exam, and you can secure lifelong coverage. The premiums will be higher, but some clients at Canadian LIC find this option appealing because it provides lasting financial protection.

Deciding whether to renew or buy a new Term Life Insurance Policy can be challenging. If you’re still in good health, getting new Term Life Insurance Quotes might be the more affordable option. However, if health changes make it hard to qualify, renewing your current policy could be the better choice. Our brokers at Canadian LIC often suggest reviewing your needs and budget to see which option fits your situation best.

Yes, reducing the coverage amount is usually an option if you decide to renew. For example, if your original Term Life Insurance Policy covered $500,000, you might choose to lower it to $300,000 to make the premiums more manageable. We’ve seen clients at Canadian LIC choose this path when their financial obligations, like mortgage payments, have decreased over time.

Working with Canadian LIC can make the process easier and more personalized. Our brokers understand the struggles clients face when they need to extend a Term Life Insurance Policy. We help you compare renewal options, new-Term Life Insurance Quotes, and conversion choices to find the best fit. Our goal is to provide the support you need to make an informed decision that ensures your family’s continued financial security

It’s best to start considering your options a year before your Term Life Insurance expires. This gives you enough time to explore different choices, compare Term Life Insurance Quotes, and prepare for any necessary medical exams. At Canadian LIC, we encourage clients to be proactive, as rushing the process can lead to missed opportunities for better coverage or rates.

No, renewal premiums typically increase with each renewal period. For instance, if you renew for another ten years, the premiums might be high initially, but they could increase further if you decide to renew again after that. We’ve noticed that some clients at Canadian LIC choose to renew for shorter terms to manage the cost, especially if they only need coverage for a few more years.

Yes, extending a Term Life Insurance Policy is possible even if you’re over 60, but it may come with much higher premiums. At this age, insurers see a higher risk, which affects the cost. However, some clients find it worthwhile to keep coverage, especially if they still have dependents or outstanding debts. Working with Canadian LIC can help you assess whether extending or converting to a different type of insurance is the better option for your specific needs.

Yes, you can often extend your Term Life Insurance Policy more than once, depending on the terms of the original policy. However, each time you extend, the premiums will increase because of your age. We’ve had clients at Canadian LIC who renewed their term policies for additional five- or ten-year terms to maintain coverage for as long as they needed. While the premiums go up, extending is still possible as long as the policy allows.

Yes, most Term Life Insurance Policies have age limits for renewal. For example, some policies only allow renewals up to age 70 or 75. It’s important to check the details of your Term Life Insurance Policy so you know your options before the renewal deadline approaches. At Canadian LIC, we help clients understand these limits and find alternative solutions if they’re nearing the maximum age for extending their policies.

You can take steps to lower the cost when you renew your Term Life Insurance Policy. One option is to reduce the coverage amount to match your current financial needs. For example, if your original policy was for $1,000,000, you could lower it to $500,000 to keep premiums affordable. We’ve seen clients at Canadian LIC make this adjustment to fit their budget while still protecting their families.

If you don’t extend your Term Life Insurance Policy, the coverage will expire, and your beneficiaries won’t receive any payout if you pass away. At Canadian LIC, we’ve worked with clients who realized too late that their policy had ended, leaving them without protection. To avoid this, it’s crucial to explore your options well in advance, whether it’s renewing, converting, or buying a new Term Life Insurance Policy.

Yes, you can usually extend your Term Life Insurance Policy even if you have developed a health condition. One benefit of renewing is that you don’t need to take a new medical exam. We’ve had clients at Canadian LIC with health issues who were able to keep their coverage by renewing, although the premiums were higher. It’s often the best choice when a new policy might be difficult or expensive to qualify for due to health concerns.

Both options have their benefits.When you buy Term Life Insurance online it is convenient and allows you to compare Term Life Insurance Quotes from different companies quickly. However, working with an agent, like one at Canadian LIC, can provide personalized advice and help you understand which policy is the best fit for your situation. Many clients appreciate the one-on-one guidance that brokers offer, especially when extending a policy or exploring new coverage options.

When extending a Term Life Insurance Policy, most insurers don’t allow you to increase the coverage amount. If you want more coverage, you’ll usually need to apply for a new Term Life Insurance Policy. We’ve seen clients at Canadian LIC who chose to keep their existing policy and then add a new one to meet their increased coverage needs. This approach can be an effective way to combine old and new policies to protect your family adequatel

When comparing Term Life Insurance Quotes, focus on factors like the coverage amount, term length, premiums, and any additional features such as a conversion option. At Canadian LIC, we encourage clients to look beyond the monthly cost and consider how each policy fits their financial situation and future needs. Getting advice from a broker can help you make sense of the options and choose the right plan for your circumstances.

Yes, in many cases, you can still convert your Term Life Insurance Policy to a Permanent Policy after extending it, as long as you do so within the time frame allowed by the insurer. Conversion gives you the option for lifelong coverage without needing a medical exam. Some clients at Canadian LIC found that extending first and then converting later allowed them to keep their options open and make the transition when they were ready.

The cost of renewing your Term Life Insurance Policy is based on your age at the time of renewal, not how close you are to the expiration date. Whether you renew one year or one month before the term ends, the premiums will be calculated based on your age and the insurer’s rates. At Canadian LIC, we recommend reviewing your renewal options well before your term ends to avoid any last-minute surprises.

This is so true, especially if you want to renew a 20-Year Term Life Insurance Policy. Here are some questions you may want to know answers to whether you are renewing, purchasing a new Term Life Insurance, or converting, you will want to know your options in order to guarantee your family’s financial future.

We are here to walk you through the Canadian LIC process and help you find the right coverage for you. We are aware of the challenges and are committed to making this process smooth and straightforward.

Sources and Further Reading

- Canada Life – Term Life Insurance Overview Canada Life provides details on Term Life Insurance Policies, including renewal options and the benefits of extending coverage.

- Manulife – Term Life Insurance Guide Manulife offers a comprehensive guide to Term Life Insurance Policies in Canada, explaining how term lengths, premiums, and renewal terms work.

- Sun Life Financial – Extending Term Life Insurance Policies Sun Life Financial discusses different Term Life Insurance Policy options, including the pros and cons of extending versus converting to permanent insurance.

- Insurance Bureau of Canada (IBC) – Life Insurance Basics IBC provides information on life insurance types, term vs. permanent life insurance, and considerations for renewing or purchasing a new policy.

- RBC Insurance – Options for Term Life Insurance RBC Insurance covers the key considerations when extending a Term Life Insurance Policy, including premium changes and health requirements.

- Canadian Life and Health Insurance Association (CLHIA) CLHIA offers resources on the life insurance industry in Canada, including details about Term Life Insurance Policies and regulatory guidelines.

- PolicyAdvisor – Term Life Insurance Quotes Comparison PolicyAdvisor allows users to compare Term Life Insurance Quotes online in Canada, making it easier to evaluate different options.

- Canadian LIC – Your Trusted Insurance Brokerage Canadian LIC provides insights and personalized advice on Term Life Insurance Policies, helping clients make informed decisions about extending or purchasing coverage.

Key Takeaways

- Extending a 20-Year Term Life Insurance Policy is Possible: Many policies offer renewal options, allowing you to extend coverage without a new medical exam.

- Expect Higher Premiums Upon Renewal: Renewed Term Life Insurance Policies usually come with higher premiums due to age and potential health changes.

- Conversion to Permanent Insurance is an Option: You can convert a Term Life Insurance Policy to a permanent policy, like Whole or Universal Life Insurance, for lifelong coverage.

- Buying a New Term Life Insurance Policy May Be Cheaper: If you’re in good health, new Term Life Insurance Quotes could offer lower rates compared to renewing an old policy.

- Multiple Extensions are Allowed, But With Limits: Policies may permit multiple renewals, but there are usually age limits for extending coverage.

- Reducing Coverage Can Lower Premiums: If you don’t need the same amount of coverage, lowering the death benefit can make renewal more affordable.

- Start Planning Before the Policy Ends: Reviewing your options a year before the term expires helps ensure continued coverage without interruptions.

- Working With a Broker Provides Personalized Guidance: Brokers like Canadian LIC can help you compare options and decide whether to renew, convert, or buy a new policy.

Your Feedback Is Very Important To Us

We would love to hear about your experiences with extending a 20-Year Term Life Insurance Policy. Your feedback will help us understand the challenges Canadians face and how we can better support you. Please take a few minutes to answer the questions below.

Thank you for taking the time to share your experiences. Your input will help us better understand the struggles Canadians face when it comes to extending Term Life Insurance coverage.

IN THIS ARTICLE

- Can you extend a 20-Year Term Life Policy?

- Can You Extend Your 20-Year Term Life Insurance Policy?

- Why Would You Want to Extend Your Term Life Insurance Policy?

- How Does Renewal Work for a 20-Year Term Life Insurance Policy?

- Can You Convert Your Term Life Insurance Policy to a Permanent Life Insurance Policy?

- Should You Buy a New Term Life Insurance Policy?

- Strategies for Managing the Cost of Extending Your Term Life Insurance Policy

- What Are the Benefits of Working with Canadian LIC When Extending a Term Life Insurance Policy?

- Why Extending Term Life Insurance with Canadian LIC is the Smart Choice

- Taking the Next Step