- Can You Claim Twice For Critical Illness Coverage?

- Critical Illness Insurance Coverage- A Short Explanation

- Claiming Multiple Times On Critical Illness Insurance

- How To Ensure Your Critical Illness Insurance Covers Multiple Claims

- Factors Affecting Multiple Claims On Critical Illness Insurance

- Steps To Take If You Need To Claim Again

- The Role Of Canadian LIC In Understanding Critical Illness Insurance

- Learning From Experience

- Conclusion: Safeguard Your Future With Canadian LIC

Imagine this: You have just recovered from a bad illness like cancer because of your Critical Illness Insurance Coverage. A year later, you are diagnosed with another critical illness. The first question that will come into your mind probably might be, “Can I make another claim under my Critical Illness Insurance?”

This is precisely the challenge many Canadians face. Critical Illness Insurance is designed to be there for clients in the most difficult times in their lives, but the logistics of filing multiple Critical Illness Insurance claims make this very tough to do. At Canadian LIC, we see these concerns every day. Clients come to us and share stories of health battles and the financial strain taken on families. They wonder how their Critical Health Insurance Plans can continue to protect them in these cases. This blog is going to delve into details on the possibility of making a double claim under Critical Illness Insurance Coverage in Canada.

Critical Illness Insurance Coverage- A Short Explanation

Critical Illness Policy is a product that provides the assurance of a tax-free lump sum payment in the event that one is diagnosed with a covered serious illness. This lump sum can help replace lost income and pay for expensive medical care and other qualified medical expenses that arise. At Canadian LIC, in most of our consultations, we strongly impress our clients with the need for Critical Health Insurance Plans and explain to them in detail the coverage and limitations under their respective policies.

This was precisely the case for one of our clients, Sonakshi. Diagnosed with breast cancer, the payout from her Critical Illness Insurance had been important in helping her meet treatment and living costs. She still wonders, however, what will happen in case she suffers another, different illness someday. Can the policy support her once more?

Claiming Multiple Times on Critical Illness Insurance

One can claim for Critical Illness Policy twice, depending on certain factors. These would include the actual terms of your policy and the specifics of the illnesses. Here are some general scenarios:

Multiple Claims for the Same Illness: Most of the standard Critical Illness Policies with regard to Critical Illness Insurance do not allow multiple claims resulting from an illness. For instance, just because you have already filed a claim because of a heart attack, you cannot file again because of another heart attack.

Claims for Different Illnesses: Some do permit claims for different illnesses. Some policies do permit claims for different illnesses. If you claimed first for cancer and at a later date you had a stroke, then you may be able to claim again, subject to the terms of your policy. This is precisely what happened to one of our clients, Mark, who claimed a heart attack initially, after which he developed kidney failure. His policy permitted a second claim, which provided the much-needed financial support at that point.

Enhanced or Multi-Claim Policies: There are also specialized Critical Health Insurance Plans that offer enhanced, multi-claim benefits. These plans are designed to provide coverage for more than one claim—perhaps for the same illness, or perhaps for different illnesses—and usually come laden with very specific conditions both on the kind of ailment, as well as the waiting period subjected to them. We mostly recommend such plans to our clients with higher risk factors and those where family history has been critical.

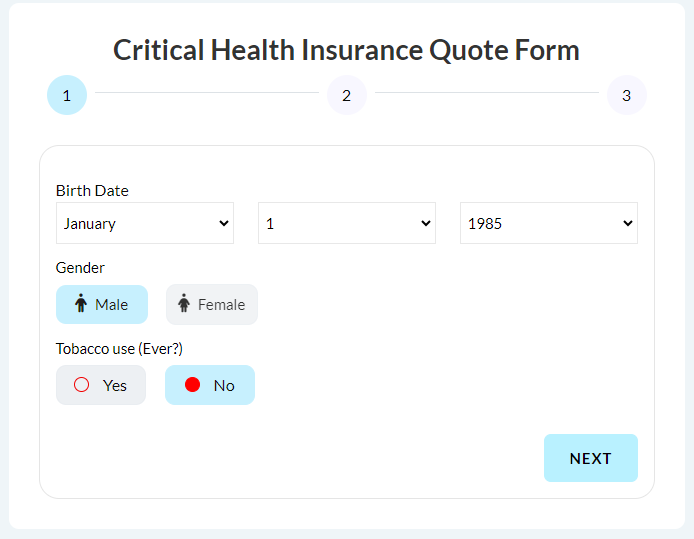

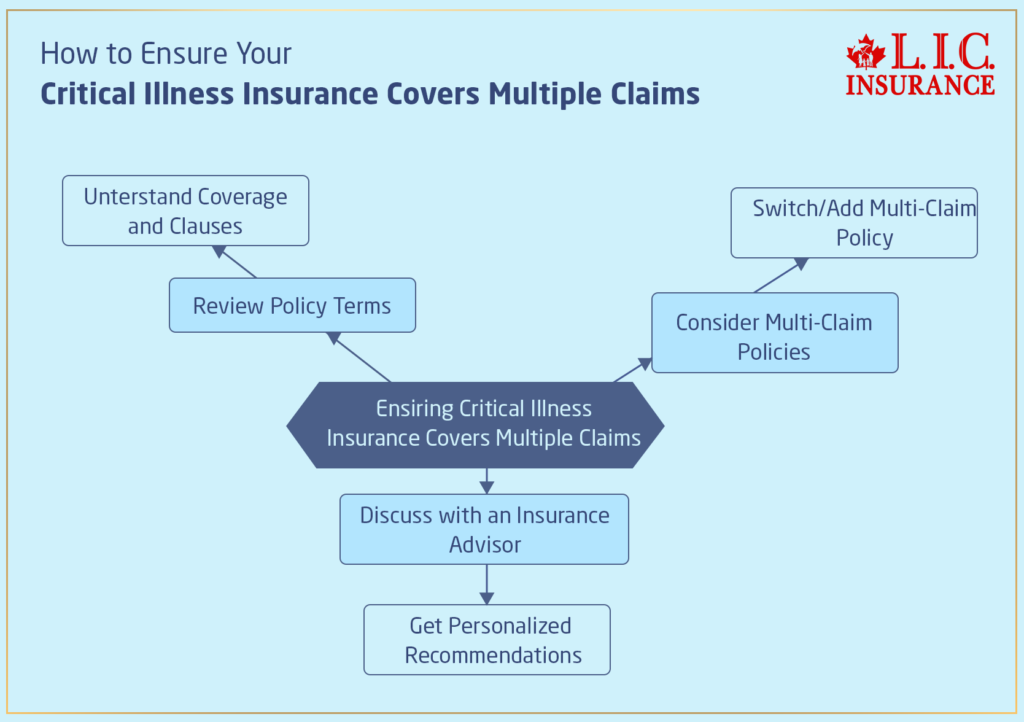

How to Ensure Your Critical Illness Insurance Covers Multiple Claims

To ensure your Critical Illness Insurance can support multiple claims, consider the following steps:

Review Your Policy Terms: Carefully review your policy’s terms and conditions to understand what is covered. Look for any clauses related to multiple claims, waiting periods, and exclusions. If you need clarification, our team at Canadian LIC is always here to help interpret the fine print.

Consider Multi-Claim Policies: If your current policy doesn’t cover multiple claims, consider switching to or adding a multi-claim policy. These policies may come with higher premiums, but they provide peace of mind knowing you have extended coverage.

Discuss with an Insurance Advisor: Speak with an insurance advisor who can provide personalized recommendations based on your health history and financial needs. At Canadian LIC, our advisors have helped countless clients like you navigate their options and secure the best Critical Illness Insurance Quotes for their circumstances.

Real Stories of Understanding Critical Illness Insurance

At Canadian LIC, we’ve encountered numerous clients who have faced multiple critical illnesses and needed to understand their insurance options. Here are a few stories that illustrate the importance of having the right coverage:

Sona’s Story: From Cancer to Stroke

Sona was a vibrant 45-year-old when she was diagnosed with breast cancer. Thankfully, she had a comprehensive Critical Illness Insurance Plan that provided a lump-sum payout. This payout covered her medical expenses and allowed her to take time off work for recovery without financial stress.

A year after her recovery, Sarah suffered a stroke. Her initial policy did not cover multiple claims, leaving her without the financial support she desperately needed. After consulting with Canadian LIC, she switched to a multi-claim policy, ensuring she had coverage for future illnesses. Sona’s experience highlights the need to reassess your insurance needs regularly and consider policies that offer extended protection.

Mark’s Story: Heart Attack and Kidney Failure

Mark, a 60-year-old engineer, experienced a heart attack and claimed his Critical Illness Insurance. He assumed that was the end of his coverage. However, two years later, he was diagnosed with kidney failure. Fortunately, Mark had an enhanced policy that allowed for multiple claims. This second payout helped cover his dialysis and transplant expenses.

Mark’s story underscores the importance of understanding your policy’s terms and considering enhanced Critical Health Insurance Plans. These plans, though sometimes more costly, can be lifesaving in the event of multiple health crises.

Factors Affecting Multiple Claims on Critical Illness Insurance

Several factors can influence your ability to claim multiple times on a Critical Illness Insurance Policy. Understanding these factors can help you make informed decisions about your coverage.

Policy Terms and Conditions

Every insurance policy has specific terms and conditions that dictate the coverage limits, including multiple claims. It’s essential to read these terms carefully. Policies with multi-claim benefits often have stipulations such as:

Waiting Periods: There may be a mandatory waiting period between claims. For example, after claiming for a heart attack, you might have to wait a certain number of months before you can claim for another illness.

Survival Periods: Some policies require the insured to survive for a specific period after diagnosis to qualify for the payout.

Different Illness Requirements: Some policies only allow a second claim if it’s for a different illness than the first claim.

Premium Costs

Enhanced and multi-claim policies usually come with higher premiums. It’s crucial to weigh the cost against the potential benefits. At Canadian LIC, we help clients compare Critical Illness Insurance Quotes to find the most cost-effective options that still provide solid coverage.

Health and Age Factors

Your health status and age at the time of policy purchase can affect your ability to get multi-claim coverage. Younger and healthier individuals typically have more options and lower premiums. However, it’s never too late to explore your options. Consulting with an experienced advisor can help you navigate the complexities.

Steps to Take if You Need to Claim Again

If you find yourself needing to claim again on your Critical Illness Insurance, follow these steps to ensure a smooth process:

Review Your Policy: Confirm that your policy allows for multiple claims and understand any specific requirements.

Gather Documentation: Collect all necessary medical documentation and proof of diagnosis. This will streamline the claims process.

Contact Your Insurer: Notify your insurance provider as soon as possible to initiate the claim process.

Consult with an Advisor: If you encounter any issues or have questions, consulting with an insurance advisor can provide clarity and assistance.

The Role of Canadian LIC in Understanding Critical Illness Insurance

At Canadian LIC, we understand the complexities and emotional toll of dealing with critical illnesses. Our mission is to provide support and guidance to ensure our clients have the best possible coverage. Here’s how we help:

Personalized Insurance Advice

We offer personalized advice tailored to your health history, financial situation, and coverage needs. Our advisors take the time to understand your unique circumstances and recommend policies that provide comprehensive protection.

Comparing Critical Illness Insurance Quotes

We help you compare Critical Illness Insurance Quotes from various providers, ensuring you get the best value for your money. Our goal is to find policies that offer extensive coverage at competitive rates.

Ongoing Support

Our commitment to you doesn’t end after you purchase a policy. We provide ongoing support, helping you understand your coverage, navigate the claims process, and make adjustments as your needs change.

Learning from Experience

Let’s look at another story from our experience at Canadian LIC:

Lisa’s Story: The Importance of Policy Review

Lisa, a 50-year-old teacher, had a Critical Illness Insurance Policy that she hadn’t reviewed in years. When she was diagnosed with multiple sclerosis, she was relieved to have coverage. However, she didn’t realize her policy had a clause that excluded neurological diseases diagnosed after age 45. This oversight left her without the financial support she needed.

After this experience, Lisa consulted with Canadian LIC and updated her coverage to include a multi-claim policy with broader protection. Her story emphasizes the importance of regularly reviewing and updating your insurance policies to ensure they meet your current needs.

Conclusion: Safeguard Your Future with Canadian LIC

Every Critical Illness Insurance is hard to explore, but appreciating the multi-claim options is really very essential. Whether you are insured for a single specified illness or looking at risks with possibly more than one health problem, adequate coverage brings both financial security and peace of mind.

Canadian LIC is dedicated to assisting you in obtaining the best possible Critical Illness Insurance Plans that will satisfy your demands. Do not procrastinate on this long-term investment in the well-being of yourself and your loved ones; rather, take out comprehensive protection through Critical Illness Insurance today. Let Canadian LIC guide you through expert advice and competitive quotations for Critical Illness Insurance. Your health and financial well-being are our top priorities. The sooner you get protection, the better. Act now and ensure you have the protection you deserve.

More on Critical Illness Insurance

Is It Possible to Switch Critical Illness Insurance Providers?

Can I Buy Critical Illness Insurance For My Children?

Can Critical Illness Insurance Cover Broken Bones?

Is it Possible to Cancel My Critical Illness Insurance?

Understand A Critical Illness Insurance Claim

The Cancers That Are Not Covered By Critical Illness Insurance

Does Critical Illness Insurance Cover Heart Failure?

Does Critical Illness Insurance Cover Death?

What Is The Difference Between Life Insurance And Critical Illness Insurance?

How Critical Illness Insurance Can Be Your Lifesaver In Canada?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs: Understanding Multiple Claims on Critical Illness Insurance in Canada

Yes, you can make a claim twice on your Critical Illness Insurance Coverage; it depends on the policy. Some policies allow claims with respect to different illnesses on more than one occasion, while others are limited to only one claim. At Canadian LIC, in very many cases, it is found that clients need to claim a second illness. Example: Mark claimed a heart attack and later claimed using the enhanced policy for kidney failure. We would always advise that you check your policy terms or discuss with an advisor to see what’s covered.

There are special Critical Health Insurance Plans designed for multiple claims. These plans usually have specific conditions and put a waiting period between the claims. As Canadian LIC, with the help of such multi-claim policies, we helped clients like Sona, who had cancer and had a stroke later, to get extended protection. These plans will be suitable if you are at risk of developing more than one critical illness.

You will have to check your terms of condition to determine whether you can make more than one claim from the policy you bought from the Critical Illness Insurance provider. Note the clauses on multiple claims, waiting periods, and special requirements stipulated. If you have any questions, please get in touch with Canadian LIC. We are always at your service to help our clients understand exactly what their policies entail by making sure that they have appropriate coverage in case something goes wrong.

Waiting periods are agreed-upon time frames wherein you are required to wait between making a claim and when a further claim cannot be made on your Critical Illness Insurance cover. In other words, if you have a heart attack, you most probably will have to wait a few months before claiming for another illness. Here at Canadian LIC, we see our clients through these periods and help plan accordingly to ensure continuous coverage.

Indeed, premiums run higher for multi-claim critical health insurance schemes. Such products give greater coverage and peace of mind at an enhanced price. Our agents at Canadian LIC help ensure that clients compare Critical Illness Insurance Quotes that best suit their needs at a reasonable cost. For instance, Lisa had to switch over to the multi-claim policy after her battle against multiple sclerosis to make sure she was well covered despite the higher premium price tag associated with such policies.

Yes, you can switch to a multi-claim policy if your current policy does not allow multiple claims. At Canadian LIC, we often assist clients in transitioning to policies that better meet their needs. For example, Saba switched to a multi-claim policy after her initial diagnosis to ensure she had ongoing coverage. We can help you find the best options and handle the transition smoothly.

If you need to claim again on your Critical Illness Insurance, follow these steps:

Review your policy to confirm it allows multiple claims.

Gather all necessary medical documentation and proof of diagnosis.

Notify your insurer as soon as possible to initiate the claims process.

Consult with an advisor if you encounter any issues or have questions.

At Canadian LIC, we guide clients through this process daily, ensuring they receive the support and benefits they deserve. For example, we helped Manish navigate his second claim for kidney failure, providing clarity and assistance throughout the process.

You should check on relevance in relation to the current state of affairs from time to time and update your Critical Illness Insurance Policy. Your insurance should be adjusted according to the changes in your life. Canadian LIC often helps people like Lisa, who, upon diagnosis with multiple sclerosis, realized her coverage needed updating. Reviewing will help clear up any gaps and provide you with peace of mind.

Canadian LIC offers tailored advice based on your own health history, financial situation, and need for coverage. We take the time required to compare a number of various Critical Illness Insurance Quotes to ensure that you have the best value for your money. Our ongoing support includes helping you understand your coverage, navigate the claims process, and make adjustments as needed. For instance, we helped Sarah and Mark secure multi-claim policies and supported them through their claims.

The standard conditions that are usually covered under Critical Illness Insurance are cancer, heart attack, stroke, kidney failure, and major organ transplant. At Canadian LIC, we always review our clients’ specific policies to ensure they cover a broad range of conditions. For example, one client, John, had coverage that included both cancer and heart attack, allowing him to make a claim for each diagnosis separately.

Yes, you can be insured for critical illness despite having pre-existing conditions, but it may come with certain exclusions or higher premiums. For example, we have a client with diabetes. Although her policy excluded direct claims that were the result of her diabetes, she is still protected from other critical illnesses. That’s what our advisors at Canadian LIC do: help clients like Linda find the best possible plan given their health conditions.

Compare quotes to have the best Critical Illness Insurance Quotes available. At Canadian LIC, we work with our clients—comparing quotes—to ensure they get the best value for their money. For instance, we helped Tim get an affordable policy that would cover his extensive family history with regard to heart disease. Comparing quotes will let you decide on a plan that best fits your wallet and your needs.

Survival periods are part of Critical Illness Insurance Plans, stating the span one has to survive after diagnosis to be eligible for the payout. Normally, this is 30 days. We at Canadian LIC work to help explain all this to our clientele, like Emily, who had to know the survival period for claiming based on her cancer treatment. Knowing the terms helps plan and manage expectations.

Yes, some Critical Illness Insurance Plans do have a return on premium option. What this means is that part or full premium paid can be returned in case there is no claim during the policy period. For example, we had a client named Peter who opted for this option. It provided him, in effect, peace of mind—a knowledge that should a critical illness strike, he would have financial backing; otherwise, he would get a return on his investment. At Canadian LIC, we help clients evaluate whether this makes sense for their situation.

Age is a major determinant of the type of Critical Illness Insurance Coverage one will receive in terms of premiums and types of policies. In most cases, younger policyholders receive better premiums and have higher chances of obtaining policies. For example, Canadian LIC helped a young couple, Tom and Jane, to obtain inexpensive multi-claim policies. The premiums will increase when you are older, but we shall still pursue appropriate plans that give you maximum protection.

You may want to bear in mind several factors when switching to another Critical Illness Insurance Policy: multi-claim coverage, premium costs, exclusions, waiting periods, etc. Canadian LIC helps clients go through the process of switching. For instance, we assisted Mike in moving to a policy with better coverage for his medical history. Evaluating these factors ensures you make an informed decision that enhances your protection.

Most Critical Illness Insurance focuses on severe physical illness and might not extend their coverage to mental coverage. However, the more comprehensive policies do offer limited coverage for some mental health conditions. At Canadian LIC, our job, in this case, would be to help clients understand what’s all in their policy and, if they need it, find additional coverage.

To file a critical illness claim, follow these steps:

Notify your insurer as soon as you are diagnosed.

Complete the claim form provided by your insurer.

Submit all required medical documentation and proof of diagnosis.

At Canadian LIC, we help clients through each step of the claims process, ensuring they receive their benefits smoothly. For instance, when Anna was diagnosed with a stroke, we assisted her in gathering the necessary paperwork and liaising with the insurer.

Common exclusions in Critical Health Insurance Plans include pre-existing conditions, self-inflicted injuries, and illnesses resulting from illegal activities. At Canadian LIC, we make sure our clients understand these exclusions. For instance, we made it clear to Robert that his pre-existing condition, hypertension, was indeed excluded. If one clearly understands the exclusions, then it avoids surprises later on when the claim is processed.

We hope that these FAQs will help make the associated loopholes clearer to you while making repeated claims on a Critical Illness Insurance Policy. If you have further questions or need any kind of personalized advice, then don’t feel embarrassed to contact Canadian LIC. Our group of experts will always help you sort your options and make sure you invest in only the best for your health and financial security.

Sources and Further Reading

Canadian Life and Health Insurance Association (CLHIA)

Provides comprehensive information on life and health insurance products in Canada, including Critical Illness Insurance.

Canadian Cancer Society

Canadian Cancer Society – Financial Help

Offers resources and support for individuals diagnosed with cancer, including information on financial assistance through insurance.

Government of Canada – Health Insurance and Critical Illness Coverage

Provides details on public health insurance and the role of private Critical Illness Insurance Coverage.

Insurance Bureau of Canada (IBC)

A resource for understanding various types of insurance available in Canada, including Critical Health Insurance Plans.

Assuris – Protecting Policyholders

Explains the protection available to policyholders if their life insurance company fails, relevant to Critical Illness Insurance Policies.

Sun Life Financial – Critical Illness Insurance

Provides information on Critical Illness Insurance products, coverage details, and benefits.

Manulife – Critical Illness Insurance Coverage

Offers insights into different Critical Illness Insurance Plans, including multi-claim options.

Canada Life – Critical Health Insurance Plans

Detailed descriptions of Critical Health Insurance Plans, their coverage options, and policy benefits.

Globe and Mail – Financial Planning with Critical Illness Insurance

Articles and insights on integrating Critical Illness Insurance into your financial planning strategy.

Key Takeaways

- You can claim twice on Critical Illness Insurance, but it depends on your policy.

- Some policies allow multiple claims for different illnesses, but not for the same illness.

- Enhanced or multi-claim plans offer coverage for multiple claims, usually with higher premiums.

- Regularly review and update your insurance coverage to ensure it meets your needs.

- Understand your policy's waiting periods, survival periods, and exclusions.

- Multi-claim policies are more expensive but offer extended protection.

- Consulting an insurance advisor helps you find the best quotes and comprehensive coverage.

- Real-life stories from clients illustrate the importance of the right insurance coverage.

- If you need to claim again, review your policy, gather documentation, and contact your insurer.

- Canadian LIC offers personalized advice, helps compare quotes, and provides ongoing support.

Your Feedback Is Very Important To Us

Thank you for taking the time to provide your feedback. Your responses will help us understand the challenges Canadians face when claiming twice for Critical Illness Coverage and improve our services.

Thank you for your valuable feedback. Your responses will help us enhance our services and better support Canadians facing critical illnesses. If you would like to discuss your feedback further, please contact us at Canadian LIC.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]