- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is The Waiting Period For Term Insurance?

- What Is The Rule Of Term Life Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Insurance Policy?

Reviews

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Can You Be Denied Term Life Insurance?

- Pre-Existing Health Conditions and Medical History

- Age-Related Concerns and Policy Limitations

- Lifestyle Risks: Smoking, Extreme Sports, and Hazardous Occupations

- Financial Factors: Income, Debt and Coverage Amount

- The Consequences of Non-Disclosure and Misrepresentation

- How Often Are Term Life Applications Denied? (Stats and Reality Check)

- Expert Tips: Avoiding Common Mistakes and Strengthening Your Application

- Key Factors Influencing Term Life Insurance Eligibility and Approval

- Conclusion

Can You Be Denied Term Life Insurance?

By Pushpinder Puri

CEO & Founder

- 11 min read

- March 4th, 2025

SUMMARY

This blog explains why you may be denied Term Life Insurance in Canada, covering factors such as health conditions, age, lifestyle choices, and financial status. It explores how Term Life Insurance Rates by Age, pre-existing conditions, risky activities, and non-disclosure can lead to denials. The blog also highlights how to improve your chances of approval and get the best Term Life Insurance Policy Quotes Online by understanding and addressing key risk factors.

Introduction

Most Canadians get approved when applying for Life Insurance – in fact, the overwhelming majority of applications are approved. However, some applicants do get turned down for coverage, particularly if they pose a higher risk to the insurer. In Canada, around 10 percent of Life Insurance applications are denied every year, and that number is even higher — roughly 25 percent — for Disability or Critical Illness Insurance, according to one financial adviser.

This can especially be disconcerting when you’re seeking financial protection for your family. By knowing some of the most common reasons for Life Insurance denial, you can do your part to avoid these mistakes and decrease your potential for being denied Life Insurance. This article looks at the many reasons why insurers may decline coverage — from health issues to lifestyle hazards to financial and disclosure concerns — and offers expert advice from advisors and underwriters on how to improve your chances of a life insurance approval. All insights are supported by trusted sources, including the Financial Consumer Agency of Canada (FCAC), the Canadian Life and Health Insurance Association (CLHIA), top insurers and seasoned financial advisors.

Pre-Existing Health Conditions and Medical History

The applicant’s health history is among the main reasons that Life Insurance applications are denied. Life Insurance underwriters evaluate your medical risk profile to issue your insurance. Suppose you have certain pre-existing medical problems or a record of serious illness. In that case, an insurer might deny coverage. For instance, an active cancer diagnosis or a recent heart attack will just about always result in a denial. Progressive diseases such as advanced ALS (Lou Gehrig’s disease) are often uninsurable because of their severity. Some less acutely life-threatening conditions, poorly controlled, could also render a candidate for rejection — uncontrolled high blood pressure is one example; unless it has been medically managed, it’s grounds for rejection. Another red flag is uncontrolled diabetes; well-managed diabetics can usually still get coverage, but blood sugar that isn’t well-controlled may get you denied.

Insurers broadly weigh the big picture of health. They consider factors such as your BMI — severe obesity can lead to denial, though if you lose weight and get healthier over time, that could reduce risk and increase insurability. A previous stroke or heart disease won’t automatically disqualify you but will reduce your options, and some Life Insurance Companies may decline such cases based on the severity. Even common conditions such as asthma or well-controlled diabetes can cause higher premiums or be excluded from a policy — and, in rare cases, a denial on the grounds that it’s associated with complications. Generally speaking, the more serious and recent your health problems, the greater the risk of rejection.

Case in point: One Canadian financial advisor who has Crohn’s disease wrote about how he was quickly turned down for a variety of coverage because of his condition — he was denied disability and critical illness insurance and could only get a term life policy at a high rate because he was considered at high risk

“Traditional insurance companies like to insure people that have a good health background,” he adds. That doesn’t mean that people with health issues are totally uninsurable. Some insurers have specialized products for people with medical issues — for example, simplified issue or guaranteed issue Life Insurance policies that require few or even no health-related questions. They charge higher premiums and offer lower coverage amounts, but they can cover you when a standard policy will deny you. As for the advisor, he eventually was able to secure some Life Insurance after being declined by traditional providers — but only through companies who have products for individuals living with chronic conditions who take care of their health (i.e., in his case, because he is compliant with his Crohn’s).

Bottom line: Get used to insurers combing through your medical records if you have any chronic health conditions. Each insurer has its own underwriting guidelines — one company might turn down a condition that another would cover with a premium rating or exclusion. In most cases, you can still obtain some coverage even with health problems, but you may need to apply with an insurer that’s more flexible about your condition or choose a no-medical policy. It is critical to be upfront about your health (with documentation from your doctor if necessary) — something we’ll discuss in the context of disclosure below.

Age-Related Concerns and Policy Limitations

Age is one of the primary determinants of Life Insurance eligibility. In other words, there are age restrictions on buying Term Life Insurance, and if you happen to be above a particular age, insurers may turn down your application for a specific term length. Maximum issue ages vary by the policy term per insurance company. For example, an insurer may offer a 20-year term policy until, say, age 60 or 65, but not beyond that. If a 75-year-old attempted to apply with a company whose cutoffs for that term are age 70, the application would be denied solely on the basis of age.

Insurers also often have an overall maximum age for any term coverage (usually around age 75 or 80 at application for some companies). Older than those ages, you may get only Permanent Life Insurance or Guaranteed Issue Policies. Even within allowable age ranges, premiums rise steeply as you age, which can also affect approval indirectly if the cost becomes prohibitive (a financial issue). Older applicants may be rejected with this policy if the policy doesn’t make sense from a purely actuarial point of view (e.g. a colleague who’s 80 applying for a large term policy likely won’t offer this coverage, but their app for a smaller final expense policy might be approved).

Keep in mind seniors can qualify for Life Insurance but usually need to manage expectations. Instead of long-term policies, shorter-term policies, forced a smaller coverage amount, or permanent life with lower death benefits are commonly used for older applicants. If you’re a senior searching for coverage, it can be worth working with an advisor to identify the insurers that target older age brackets. Every insurer has its own age limit, so being denied because of your age by one doesn’t mean you’ll have no options elsewhere.

In short, age can also be a basis for denial if you are outside a policy’s allowable range. Always verify the insurer’s age limits for the term length you want. If you’re getting close to the cutoff, opt for a shorter-term or a Permanent Policy conversion option. Beginning your Life Insurance planning sooner rather than later can bypass the age limit crunch altogether.

Lifestyle Risks: Smoking, Extreme Sports, and Hazardous Occupations

Beyond health and age, insurers look at your lifestyle and hobbies to gauge risk. Certain habits and activities can tag you as a higher-risk applicant. Here are some major lifestyle-related factors that can lead to a denial or stricter terms:

- Smoking and Substance Use: Tobacco use won’t usually result in outright denial (most smokers are insurable but at higher premiums). However, heavy smoking combined with other health issues (like emphysema or heart disease) could cause a decline. More critical is drug use – a history of illicit drug abuse is a major red flag for insurers. If you admit to current drug use on an application, expect a denial. Even past drug addiction can lead to a postponement or decline unless you’ve demonstrated a period of sobriety (often insurers want to see at least a few years clean) lsminsurance.ca. Excessive alcohol use is similar; a history of alcohol abuse can either jack up your premiums or lead to denial if the abuse was recent. Insurers may reconsider if you show you’ve quit and remained sober for a significant time (e.g. one year or more). In short, lifestyle habits that negatively impact health (smoking, drugs, heavy drinking) make you a riskier bet. While moderate drinking or having quit smoking for over a year won’t prevent approval, active substance abuse will likely lead to a rejection of coverage.

- Extreme Sports and High-Risk Hobbies: Do you race motorcycles, skydive, or climb mountains for fun? Life Insurance companies will ask about any hazardous hobbies or sports. Frequent participation in high-risk activities can result in either an exclusion rider (coverage granted, but any death from that activity won’t be covered), higher premiums, or a flat denial for certain risk sports.protectyourwealth.ca. For example, someone who regularly skydives or scuba dives may find insurers either charge extra or refuse coverage, especially if done at a professional or competitive level

- Rock climbing, BASE jumping, hang-gliding, backcountry skiing, and auto racing are the kinds of activities that raise concerns. Insurers each have their own tolerance; some may insure a hobby with an added premium, while others won’t. If your adventurous hobby is deemed too risky and you’re unwilling to stop or limit it, the insurer might decline the application. It’s crucial to disclose these activities honestly. Lying about them (e.g., not mentioning your weekend skydiving) could lead to a policy being voided later if discovered. Remember, “if your cause of death is on the exclusion list, your beneficiaries may be denied the claim.”

- canadalife.com

- – meaning if you didn’t disclose a hobby and died doing it, the insurer won’t pay. So it’s better to be upfront and find an insurer who’ll work with you, perhaps at a higher cost, than to hide it.

- Hazardous Occupations: Your job can also influence insurability. Statistically dangerous professions – such as mining, oil rig work, logging, commercial fishing, bomb disposal, or piloting small aircraft – carry higher mortality risk. Insurers know this from claims data and may charge more or decline applicants in certain occupations.

For example, a roofer or a bush pilot has a greater chance of accidental death on the job than an office worker, which might lead some insurers to refuse to offer life coverage. Even some frontline professions like police officers or firefighters might face exclusions or premium surcharges (though many insurers do cover them, sometimes with specific conditions). Military service, particularly if you’re deployed to combat zones, is another situation where standard Life Insurance might be unavailable or limited. If you work in a dangerous field, it’s wise to seek out insurers known to cover that occupation or consider Group Life Insurance benefits if available through your employer. Keep in mind that insurers can also exclude certain causes of death; for instance, they may offer a policy but explicitly exclude any death while performing that occupation (similar to a hobby exclusion). Depending on the company and the job, hazardous occupations can lead to higher premiums or outright denial of coverage

- Criminal Record and Driving History: Your personal histories of behaviour – such as criminal convictions or a pattern of reckless driving – factor into the “lifestyle” risk category. A recent or serious criminal record can cause an insurer to deny coverage. For example, suppose you have a felony conviction or are currently facing charges. In that case, many insurers will at least postpone consideration until a certain number of years have passed with no further incidents. Driving history is also surprisingly important: multiple DUIs (Driving Under the Influence) or a record of reckless driving and accidents signal an elevated risk of death from accidents. Underwriters see a poor driving record similar to how they see hazardous hobbies – as an indicator of risk-taking behaviour. If you have a recent DUI conviction, some insurers will decline your application or require a waiting period (e.g. no insurance offers until you’ve been clear of protectyourwealth.ca

Even too many speeding tickets or a license suspension can jeopardize an application. As one insurance expert explains, “if you have a terrible driving record where your license has been taken away [or] multiple speeding fines, the insurance company may see you as high risk.”

Similarly, involvement in illegal activities or a history of violent crime will make insurers wary of covering you. lsminsurance.ca

While having any criminal or driving infraction in your past doesn’t bar you from Life Insurance forever, recent and significant incidents can lead to denial until you’ve demonstrated a change. In practice, an applicant with a DUI or criminal offence might need to seek out specialized insurers or wait a few years and maintain a clean record before reapplying.

In all these lifestyle scenarios, insurers are trying to gauge the probability of an early death. Risky hobbies, jobs, and behaviours statistically increase that probability, which is why they can result in higher premiums or denials. Each insurer has different underwriting “appetites” – some are more accommodating of certain risks than others. So, if you love extreme sports or work a risky job, you may get a no from one company but a yes from another willing to insure you (often at a cost). Working with an insurance broker can help, as they can point you to companies known to be more lenient about, say, scuba diving or motorcycling.

Financial Factors: Income, Debt and Coverage Amount

It may surprise some applicants, however, that financial reasons can also cause a denial of Life Insurance Coverage. Life Insurance is not just about health and lifestyle; it is also about the economic reasoning behind the coverage. Insurers want to ensure that the amount of insurance makes sense for their financial condition — a principle related to the idea of “insurable interest” and then prevent abuse. As one Canadian brokerage describes it: “You cannot obtain more coverage than what your life is worth. Otherwise, you’d be worth more dead than alive, which would be a risk to both you as well as the insurer protectyourwealth.ca. In practice, that means insurers will consider your income, net worth and debts to ensure the coverage amount is reasonable.

The other reason for being denied or receiving a lower offer is applying for a much larger policy that far exceeds your financial profile. So, for example, if you’re a student without any income and you ask for a $5 million policy, no insurer will issue that – no basis for it financially.” In general, insurers have formulas (a maximum multiple of your annual income for a life cover — for example, 10 at age 30/40 and 18/20 in the late 40s/early 50s) for the insurance amount one can take. If you exceed those limits, the underwriter might cut coverage or reject the application entirely. They want to avoid a situation where someone ends up being “worth more dead than alive,” which could perversely incentivize fraud or might simply suggest the person is unlikely to keep paying the premiums.

On the note of premiums, your payment capacity is also a factor. If your income is very low in relation to the policy’s cost, the insurer may elicit your doubts about keeping the policy in force. The policy would lapse if premiums were regularly unpaid, so insurers are reluctant to issue a policy they know is likely to lapse. Sometimes, they may just offer something less but cheaper to cover rather than outright refuse, but if your finances really are in a miserable state, then refusal is an option for them.

Unpaid debts and general financial health are also factors. And while debt (like a mortgage) is commonly a reason to get Life Insurance (so your debts are covered when you die), if you’re drowning in debt or bankrupt, insurers may raise an eyebrow. A recent bankruptcy may cause Life Insurance to be postponed or denied until you’re discharged and your finances improve. Bad credit history isn’t generally directly checked by life insurers (they don’t pull a credit report as a lender would), but most applications will ask about bankruptcy. An expert underwriter explains that past bankruptcy or current unemployment can affect your application, as it questions your financial justification and ability to pay premiums to ensure you are not easily qualified lsminsurance.ca. Life Insurance shouldn’t be used as a way for someone on the edge of bankruptcy to gamble on a payout. Insurers also work together if more than one policy is in effect — if you already have a substantial amount of Life Insurance, a new insurer will evaluate whether there is a need for more coverage.

Don’t Apply for More Coverage Than You’re Able to Afford: The last thing you want is a financial denial. Come ready with documentation for sources of income or assets if you are looking for very large policies. Explain why the insurance is justified using other means (like the value of your contribution or existing assets) if you have no income (e.g. homemaker or retired person). And if you’ve had a bankruptcy, you may have to wait until it’s completed or find insurers who are forgiving of it. Insurers might inquire: What’s the insurance for – i.e., to cover a mortgage, to replace income for dependents, to plan an estate, etc? If you have a clear, legitimate motive backed by financial numbers, the road will be easier. On the flip side of the equation, if underwriters aren’t convinced there needs to be a financial need for the policy, they may reject the application for economic reasons. In a nutshell, stable finances with a reasonable amount of coverage increase your chances of being approved, while unstable income or asking for the death benefit amount to be inflated can lead to denial.

The Consequences of Non-Disclosure and Misrepresentation

When applying for Life Insurance, honesty is critical. Failing to disclose relevant information or misrepresenting facts on your application is one of the fastest ways to get yourself denied – either at the underwriting stage or, worse, later when a claim is made. The Life Insurance application is a legal document, and you are required to answer questions truthfully to the best of your knowledge. The information you provide helps the insurer decide if you qualify for coverage and under what terms

clhia.ca. If you omit or lie about something important (like a medical condition, smoking habit, or dangerous hobby), the insurance company can take action when they discover the truth.

During the initial underwriting, discrepancies or red flags may lead the insurer to dig deeper or request additional information (such as doctor’s records). If they catch a lie or a significant omission at this stage – for example, medical records show a surgery that you didn’t mention – they could deny the application outright for misrepresentation. Even if the policy is approved, the danger isn’t gone: virtually all Life Insurance policies in Canada have a contestability period, typically the first two years of the policy. During this period, if you die, the insurer has the right to investigate the application for accuracy before paying the Life Insurance claim

canadalife.com. If they find that you gave incorrect or incomplete information and that the truth would have changed their decision, they can void the coverage and deny the claim

clhia.ca. In other words, your beneficiaries might receive nothing because of a misrepresentation. After two years, your policy generally becomes incontestable – the insurer can no longer void it for misrepresentation except in cases of outright fraud

clhia.ca. Fraud means a deliberate lie with intent to deceive, such as a smoker marking “non-smoker” on the application to get lower premiums

clhia.ca. Fraudulent misstatements can invalidate a policy even beyond the contestability window.

Insurance experts warn that withholding or falsifying information will backfire. It might be tempting to hide something (perhaps you worry a health issue or DUI will cause a denial), but doing so could result in a worse outcome. “While it may be tempting to withhold or falsify information on your application, this approach backfires in the long run,” an insurance industry article cautions

lsminsurance.ca. Even if you manage to get a policy issued with that false information, any discrepancy is likely to be uncovered at claim time, resulting in a denied payout to your family

lsminsurance.ca. Non-disclosure is effectively pointless – insurance companies share information through databases and required disclosures. In Canada and the U.S., insurers use the Medical Information Bureau (MIB), a shared database of application information. If you get denied by one insurer, that fact (and the general reason) goes into the MIB record. Other insurers checking MIB will see it. A Life Insurance rejection stays on your record for up to 7 years and will trigger scrutiny from other insurers’

policyadvisor.com. The MIB exists to prevent someone from lying to one company after being declined by another

policyadvisor.com. So, if you think you can hide a condition from one insurer after another has caught it, think again – the MIB will alert them that you were previously declined, prompting them to double-check your information.

The consequences of misrepresentation are severe: loss of coverage denied claims, and tarnished record for future applications. Non-disclosure is considered a form of insurance fraud. In addition to voided benefits, it can leave your loved ones with nothing after paying premiums, which defeats the whole purpose of insurance. To avoid this, always answer all application questions truthfully and completely. Disclose your medical history, medications, any diagnoses, and honestly report your lifestyle risks. It’s better to face a higher premium or even a temporary denial than to sneak through with a lie that nullifies your policy when it’s needed most. Insurers do understand that mistakes happen – if you genuinely forgot something or an error was made, you can often clarify it. However, intentional misstatements are not worth the risk. As Canada Life puts it, giving false information will void your policy and lead to a claim being denied canadalife.com. They give a simple example: if you fail to disclose a history of drug abuse and then die of an overdose, the insurer will rightfully deny the claim for misrepresentation

canadalife.com. The takeaway is clear: honesty is the best (and only) policy when applying for insurance.

Finally, keep in mind that if you are denied coverage for any reason (health, lifestyle, etc.), do not attempt to “game” the system by immediately applying elsewhere without addressing the underlying issue. Because of the information sharing and contestability rules, it’s far better to understand why you were denied and work on a solution (like waiting a period, improving your health, or applying for a different policy type) than to hide the denial. We’ll discuss next steps and tips for such cases in the next section.

How Often Are Term Life Applications Denied? (Stats and Reality Check)

So, after hearing all of these reasons, hopefully, you don’t think that getting approved for a loan is a long shot. But as with all things, perspective is key, and what better way to understand than with some statistics and context? As noted in the previous section, Life Insurance is issued to most Canadians who apply. One financial institution states that although there are some declines — “the vast majority of applications are approved”

. Applications are either turned down or are accepted at standard rates or rated (higher premium). Life insurers write policies — a denial is itself pretty rare and generally a last resort when risk is outside the insurer’s own acceptable range.

We even saw a Canadian advisor mention a statistic of nearly 10% of Life Insurance applications being denied each year in Canada. That means about 90% are accepted (with some alterations sometimes). That 10 percent figure is an industry-wide estimate, and it can vary by insurer and demographic. Young, healthy applicants are rarely turned down; denials tend to be concentrated among older or higher-risk demographics. To put this in context, up to 25% of disability insurance applications are denied from that same source – so Life Insurance is typically easier to obtain than disability insurance

. One told us it is the medical history that, in general, results in the most declines of coverage, but even though there are some alternatives, especially no-medical policies, we can still find coverage for many who may be declined by traditional underwriting.

It’s also important to consider what if you are denied: the denial itself is a data point (as mentioned, through MIB). You will usually be told the broad reason. Getting denied doesn’t mean you’ll never be able to be insured. It can also mean “not now” — for instance, coverage might be deferred until you finish treatment or until another risky window (like the first year following a DUI) passes. In others, you may have to apply for a different policy type at different cost (such as a guaranteed issue plan, which has higher costs but easier approval). While the majority of applicants who received letters of decline were declined when applying with some other insurer or product, there are many applicants who do get Life Insurance Coverage when reapplying with the right adjustments.

So, to summarize the landscape, around 90% of applicants for Life Insurance in Canada get approved, and those who don’t typically have one or more of the high-risk factors we’ve discussed. Look, insurers aren’t exactly eager to say “no” for arbitrary reasons – as long as your health, lifestyle, and financial situation fall comfortably within reasonable parameters, you’re highly likely to be made a legitimate offer (admittedly at non-standard rates if anything is less than ideal, but either way, an offer). It can be reassuring to understand the statistics: a decline is the exception, not the rule. And even if you do fall into that exception category, there’s usually an alternative route to coverage.

Expert Tips: Avoiding Common Mistakes and Strengthening Your Application

To wrap up, let’s look at some expert advice from financial advisors and underwriters on how to avoid pitfalls that lead to denials – in other words, how to put your best foot forward when applying for Term Life Insurance:

- Fill out the application accurately and completely. One of the most common mistakes is providing incomplete information or errors on the application forms. This includes personal data, medical history, and lifestyle questionnaires. Double-check all your answers. If unsure how to answer a question, ask your insurance advisor. Ensure you submit all required documentation as well – for example, if the insurer asks for an attending physician’s statement (APS) or identification documents, provide them promptly. Missing or illegible documents can stall underwriting and even lead to a rejection if not corrected. protectyourwealth.ca. Clear up any inconsistencies (e.g., your doctor’s report should match what you put on the form). Essentially, dot your i’s and cross your t’s – a neat, truthful application package makes the underwriter’s job easier and paints you as a reliable applicant.

- Disclose everything relevant (and do it upfront). As stressed, non-disclosure is a big no-no. If you have a health issue or risky hobby, don’t hide it. It’s better to address potential concerns directly in the application. Sometimes, providing a cover letter or additional notes can help explain a situation to the underwriter (your insurance broker can help with this). For example, if you had a health scare that is now resolved, a letter from your doctor explaining your full recovery can mitigate concern. Honesty and transparency will keep your application out of “contestability” trouble and actually increase your credibility. Advisors often say the mistake people make is assuming something isn’t important enough to mention – let the insurer decide what’s important by disclosing it; otherwise, you risk a denial later for hiding it.

- Choose the right insurer and policy for your situation. Not all insurance companies evaluate risk factors the same way. An activity or condition that one insurer declines might be acceptable to another. Shopping around is key, especially if you know you have a risk factor. This is where working with a knowledgeable insurance broker or advisor pays off. “It’s worth exploring insurers that are more open to covering the risks associated with your situation,” advises one Life Insurance expert, lsminsurance.ca For instance, some insurers specialize in higher-risk applicants or offer no-medical-exam Life Insurance that skips the stringent underwriting. If you have been declined by one company, don’t assume all hope is lost – another insurer’s guidelines may give a different result. An independent broker can direct you to a company that is more likely to say yes. They can also suggest the appropriate type of policy – perhaps a simplified issue or guaranteed issue policy if traditional coverage isn’t working. lsminsurance.ca One underwriter’s tip: “Consult a broker with multiple insurer connections…Brokers with experience in high-risk applications can significantly improve your chances of finding the right policy.”

- Right-size your coverage and demonstrate financial stability. Avoid the mistake of applying for an excessively large policy that you can’t justify. Calculate a realistic coverage need (there are online calculators and advisors to help with this). If you’re asked to provide financial evidence (income, assets), do so. If you recently changed jobs or have irregular income, consider waiting to establish steady earnings before applying for a huge policy or opt for a smaller policy for now. Also, keep up with your premium payments once the policy is in force; letting it lapse could make it harder to get insured next time. If cost is an issue, adjust the coverage amount or term rather than risking nonpayment. Showing that you can comfortably afford the policy you’re applying for makes the insurer more confident in approving it protectyourwealth.ca

- Improve what you can before applying (or reapplying). Some risk factors are modifiable. If you were denied due to a health issue or lifestyle factor that you can change, take steps to address it and then reapply. For example, if obesity and high blood pressure led to a decline, work on weight loss and blood pressure control for a period of time – even a 6 to 12-month improvement can make a difference in underwriting. Quitting smoking or alcohol abuse is another powerful step; insurers usually consider you a non-smoker after 12 months of abstinence, which can not only avoid a denial but dramatically lower your premiums. Similarly, improving your driving record (no violations for a couple of years) or staying crime-free will help. An insurance article recommends, “quitting smoking, managing alcohol use, adopting safer driving habits, or improving your physical fitness can help remove barriers to obtaining coverage.” lsminsurance.ca

- Don’t expect immediate results – insurers will want to see sustained changes (e.g. weight kept off for a year, maintained sobriety, etc.), but these efforts can move you from a decline to an approval over time. Essentially, control the controllable risks in your life. If declined, find out why and explore the next steps. Despite best efforts, you might still get a declination. Don’t panic, and don’t take it personally. Instead, proactively request an explanation from the insurer or your agent. You have a right to know the main reason. As one expert advises, “If you were declined, the first step would be to request a detailed explanation from the underwriter as to why.”lsminsurance.ca Sometimes, it could be based on an error (for instance, if your medical report had incorrect information, you can appeal with corrected data). If you believe the decision was based on inaccurate or unfair information, you can request a reconsideration or appeal. lsminsurance.ca

- After understanding the reason, use a broker to inquire with other insurers – what one rejects, another might accept lsminsurance.ca Also consider alternative products: “Finally, you might consider applying for a no-medical simplified issue policy, which has fewer health questions and is geared toward people who are more difficult to insure,” says the expert lsminsurance.ca

- Many who are declined for a fully underwritten term policy can get some coverage through simplified or guaranteed issue policies. It might not be the full amount you wanted, but partial coverage is better than none. The key is not giving up – there are always options, and a good advisor can guide you to them.

If you follow these tips, then it will help you avoid the most common mistakes that often result in denials. In short, tell the truth, prepare and pivot. Have your application correct and complete. We are working with professionals who are informed about the market. Adjust your coverage to your circumstances. Mitigate your risk profile to the extent you can. And if you don’t succeed on your first attempt, come back with a better game plan — a denial is often just a bump in the road and not necessarily a dead end.

Key Factors Influencing Term Life Insurance Eligibility and Approval

Conclusion

Being denied term life insurance can be disheartening, but knowing the reasons for the denial can go a long way. Canadian insurers can reject applicants based on health, age limits, risky lifestyles, financial concerns or a history of misrepresentation, but each of these areas is something you can plan for or work on. The good news, on the whole, is that the majority of you can, in fact, find coverage to match your circumstances — it might take tweaking the type of policy, amount of benefit or when you apply, but the alternatives are out there even if you’re dealing with less-than-perfect circumstances. Underwriters are more comfortable working with you and your information when you know what they want, and you show it to them honestly and fully. Leaving aside that, as consumers, it’s up to us to put our best profile forward and shop carefully — and the insurer’s role is to assess risk fairly and provide coverage where feasible. And when both parties compromise, you get the Life Insurance Coverage your family needs. By following the insights from experts and staying away from the traps detailed above, you’ll increase your chances that you hear “approved” — and get the peace of mind that Term Life Insurance offers.

More on Term Life Insurance

- How Expensive Is Term Life Insurance?

- What Is The Rule Of Term Life Insurance?

- What Is The Waiting Period For Term Insurance?

- Is Natural Death Covered In Term Insurance?

- Should I get a 20 or 30-year Term?

- How Do I Claim Term Insurance?

- Can I Use My Term Life Insurance To Pay Off Debt?

- Who Is The Largest Provider Of Term Life Insurance?

- What Happens After 15-Year Term Life Insurance?

- What is a 5-Year Term Life Insurance Policy?

- What Is The Expiry Date On Term Life Insurance?

- What Is The Short Term Policy Rate?

- Can I Change My Nominee In Term Insurance?

- The Evolution Of Term Life Insurance: Past, Present, And Future

- From Confusion To Clarity: How Harpreet Puri Guided A Client Through Complex Term Life Insurance Decisions

- Do Rich People Have Term Life Insurance?

- What Are The Common Term Life Insurance Clauses?

- What Are The Disadvantages Of Joint Term Insurance?

Frequently Asked Questions about Term Life Insurance

Yes, you can purchase term Life Insurance for children. Some parents opt to purchase Life Insurance policies for their children to secure low rates for their eventual future. These policies usually provide coverage for a limited time and can be converted to a permanent Life Insurance policy later. And while Term Life Insurance costs by age can rise as your little one grows, opening your policy earlier is one way to lock in an affordable cost. You should always shop for Term Life Insurance Policy Quotes Online to get the best deal.

Yes, you could be turned down for Term Life Insurance. You might be denied coverage based on your health, age, risky habits or financial issues. For instance, you might be declined if, for example, you have a pre-existing health issue like diabetes or you are older than the policy maximum age limit. You must answer every health-related question correctly and know the meaning of Term Life Insurance rates by age, as older applicants may receive a higher premium or could be denied coverage outright. If your request is denied, then you need to know why and improve on the weak links.

Term Life Insurance rates by age means your premiums will be different depending on how old you are when you apply for coverage. Younger applicants often pay lower premiums because they are considered to be at lower risk. Term Life Insurance generally gets more expensive as you get older since insurers consider older people more likely to die during the term than younger people. You should get Life Insurance when you’re young and healthy to lock in cheaper rates.

Term policy quotes can be obtained online via comparison sites or directly from providers. A lot of companies provide online calculators that let you enter your age, health conditions and coverage needs to get a quote. These sites enable you to quickly compare the costs and terms of various insurance policies to help you locate the cheapest policy. It’s important to read the details of each policy, exclusions included, to make sure it suits your needs. Since Term Life Insurance Rates by Age can vary, be sure to check multiple insurers for quotes.

Yes, your lifestyle can influence whether you’re eligible for Term Life Insurance. Health-related habits — including smoking, drinking and engaging in high-risk activities (like skydiving and extreme sports) — are considered by insurers as well. For example, if you smoke, your premiums are probably higher than someone who doesn’t smoke. If you’re an active smoker or have a history of drug or alcohol use, you could be quoted a higher rate or be denied altogether. When you apply for Term Life Insurance, you must be honest about your habits, or your policy can be cancelled.

Yes, older children can still purchase Term Life Insurance, but not at rates that are as low as they would have been when they were young. An 18-year-old child would have to apply for life insurance under their name, potentially paying a higher amount than if they purchased when they were younger. However, Term Life Insurance for Kids is still a smart purchase for most families, as it ensures they have coverage if they need it later in life. Rates are better for young adults, so decisions to take out a policy are better made early on.

Term life insurance does have an upper age limit, and this upper limit may differ based on the insurer and the amount of time of the policy you wish to purchase. Most insurers have an age limit on applying for a standard term life policy; it’s usually about 70 to 75 years old. For people who are older than that age, permanent Life Insurance may be a more appropriate option. Term Life Insurance Rates by Age can also spike significantly for older applicants, as the risk to the insurer increases with age.

How long your term Life Insurance lasts depends on the coverage you choose. Most Term Life Insurance Plans last 10 to 30 years, and coverage ceases once the term name expires. For instance, if you purchase a 30-year term policy and you are 30 years old, the coverage will cease when you reach age 60. When your Term Life Insurance is up, you might be able to convert it to a permanent policy, but expect steep premiums.

Yes, Term Life Insurance is cancellable, although it usually is up to the policyholder. You can cancel your term life insurance policy if you no longer need the coverage or want it. But cancelling the policy does not entitle you to a refund of any premiums you’ve already paid. If you have missed payments, the insurer might cancel the policy automatically. Please do remember that your premiums must be paid in a timely manner in order to avoid the serious consequence of your coverage being cancelled due to nonpayment.

Yes, the majority of Term Life Insurance Policies cover dying from natural causes, like a heart attack or old age. The caveat here is that you’ll want to check the terms of your specific policy to make sure there are no exclusions for certain natural causes or conditions. For instance, in some instances, coverage for certain pre-existing conditions may be excluded if they were not duly disclosed by the insured person at the application stage.

Many insurers include a conversion option in term life plans for kids, so the policy can be converted to permanent Life Insurance without a medical exam. This is an excellent feature to include since it means long-term coverage for your child as they age. Not being subject to medical underwriting means they will not be turned down or charged more because of a health problem in the future. Check with the insurance provider to verify the terms of the conversion and if the option exists for your child’s particular plan.

How much you’ll pay in premiums is influenced by a number of factors, but the biggest would have to be Term Life Insurance Rates by Age. And because insurers view younger applicants as less of a risk, your premiums tend to be much lower when you’re younger. However, as people grow older, the odds of a claim increase, and so can the premium. For example, a 30-year-old would pay far less for a Term Life Insurance Plan than a 50-year-old who applied for the same amount of coverage. Age is one of the key factors insurance companies use to calculate premiums.

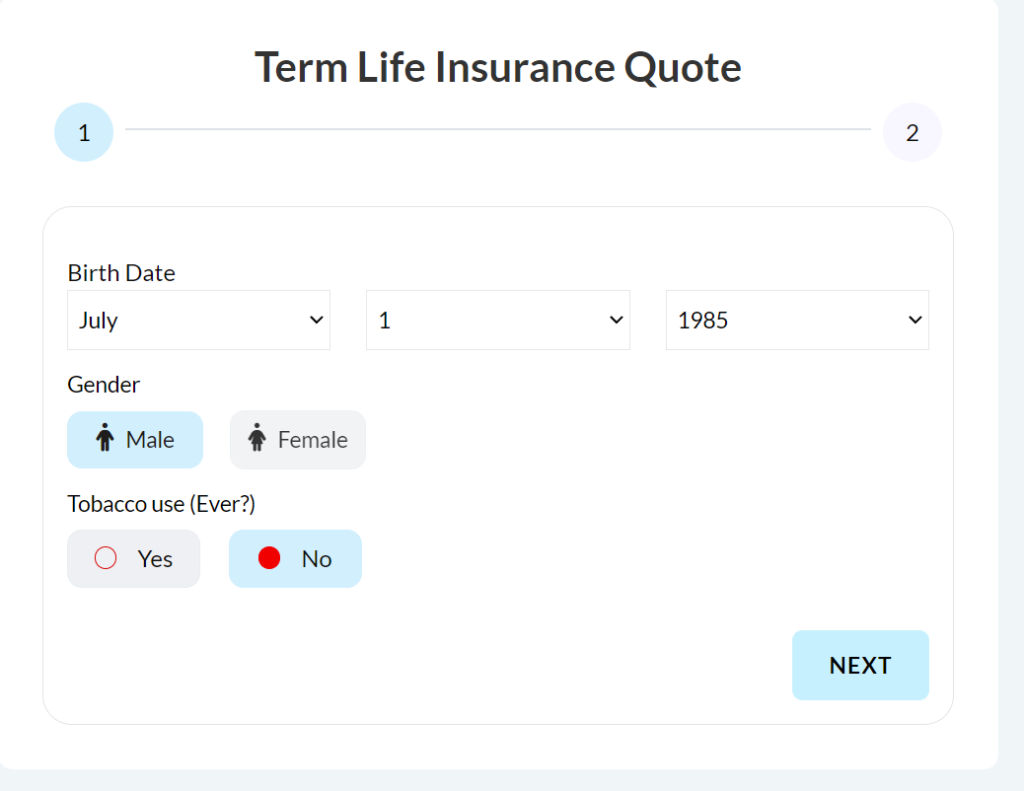

Will you easily apply for Term Life Insurance online? Most insurance companies now offer the ability to fill out your application online, so you can get Term Life Insurance Policy Quotes Online and submit your application through a simple process. The web-based application generally requires basic demographic information about your age, health, lifestyle and coverage preferences. A quote comparison between insurers can help you find even the best Term Life Insurance Rates by Age and best term Life Insurance rates for your specific needs quickly and easily.

Most Term Life Insurance policies have a suicide exclusion for the first two years the policy is in force. If the policyholder commits suicide in this period, the insurer won’t pay out the death benefit. But after two years, the contestability period ends, and most policies will pay the death benefit, regardless of whether the death was by natural causes, accident or suicide. Do check the conditions of your policy to see how suicide is treated.

The best Term Life Insurance Rates by Age are available to those who are young and healthy when they apply. The earlier you apply, the less expensive your premiums will be. Plus, live healthfully: Don’t smoke, exercise and watch your weight. Rates are lower for low-risk individuals, and insurers reward them. Be sure to compare term life insurance quotes online with several providers to find the best value for your needs. An insurance broker can assist you in finding the best deal for your age and health profile by walking you through options.

Sources and Further Reading

- Financial Consumer Agency of Canada (FCAC) – The official website of the FCAC provides detailed information on Life Insurance, consumer rights, and how to protect yourself from insurance-related risks.

Website: https://www.canada.ca/en/financial-consumer-agency.html

- Insurance Bureau of Canada (IBC) – IBC is a national industry association representing Canada’s private home, car, and business insurers. They offer resources on Life Insurance and general insurance policies.

Website: https://www.ibc.ca/

- Sun Life Financial – One of Canada’s top Life Insurance providers, Sun Life provides a wealth of information on Term Life Insurance Policies, including advice on coverage, rates, and various insurance options.

Website: https://www.sunlife.ca/

- Manulife Financial – Manulife is another leading insurance company in Canada. Their site includes resources for understanding Term Life Insurance, eligibility requirements, and detailed guides for purchasing coverage.

Website: https://www.manulife.ca/

- Canadian Life and Health Insurance Association (CLHIA) – CLHIA offers resources and information related to life and health insurance in Canada. It includes industry insights on Term Life Insurance Coverage, industry standards, and much more.

Website: https://www.clhia.ca/

- RBC Insurance – RBC Insurance offers various articles and resources on Life Insurance, including Term Life Insurance. They explain different policy types, benefits, and how to choose the right one.

Website: https://www.rbcinsurance.com/

- Canada Life – Canada Life provides comprehensive insurance options and resources, including guides on Term Life Insurance, rates, and coverage limits.

Website: https://www.canadalife.com/

- Desjardins Insurance – Desjardins offers resources to help Canadians navigate through the world of Life Insurance, including term life policies and the factors that influence premiums.

Website: https://www.desjardins.com/

- Financial Planning Standards Council (FPSC) – The FPSC offers financial planning resources and certification for advisors. It helps individuals understand the importance of financial protection and Life Insurance in planning for the future.

- Canadian Insurance Quotes – A comparison website for various insurance providers in Canada, offering articles on Term Life Insurance Policies, premium comparisons, and industry news.

- Great-West Life – Known for its extensive resources on Life Insurance, Great-West Life offers detailed guides on Term Life Insurance and the various factors influencing coverage and premium rates.

Website: https://www.greatwestlife.com/

Key Takeaways

- Term Life Insurance Denial: You can be denied Term Life Insurance in Canada based on several factors, including health conditions, risky lifestyle choices, and even your age. Insurers assess risk and may reject your application if they deem you to be high-risk.

- Health Factors Impact Denial: Pre-existing health conditions, such as diabetes or heart disease, are significant factors in whether you can secure Term Life Insurance. Accurate disclosure of your health history is crucial to avoid coverage denials.

- Age and Premium Rates: Term Life Insurance Rates by Age play a vital role in determining your eligibility and the cost of premiums. The older you are, the higher your premiums may be, and in some cases, coverage may not be available at all due to age restrictions.

- Lifestyle Choices Matter: Risky lifestyle factors, such as smoking, excessive alcohol consumption, or engaging in high-risk activities, can lead to higher premiums or even denials. Insurance companies often increase premiums for those with habits that present more significant risks.

- The Importance of Accurate Information: When applying for Term Life Insurance, it’s essential to be truthful and provide complete information, especially about your health and lifestyle. Failure to disclose relevant information could lead to policy cancellation or denial of claims in the future.

- Getting the Best Rates: To get the best Term Life Insurance Policy Quotes Online, it’s recommended to shop around and compare quotes from multiple providers. Understanding how Term Life Insurance Rates by Age work can help you plan and secure affordable coverage.

- Plan Early: The earlier you apply for Life Insurance, the better the rates you’ll get, especially if you’re young and in good health. It’s easier to lock in lower premiums when you’re younger and less likely to be denied coverage.

- Conversion Options: Some Term Life Insurance Policies offer a conversion option, which allows you to switch your term policy to a permanent policy without a medical exam. This can be beneficial if your Term Life Insurance is set to expire but you still need coverage.

- Seek Professional Guidance: Consult with financial advisors or underwriters to understand your insurance options better. Their expertise can help you navigate the complexities of Term Life Insurance, particularly if you have concerns about your eligibility.

- Research and Understand Your Policy: Always take the time to review and fully understand the terms and conditions of your Term Life Insurance Policy. This ensures that you are aware of the coverage details, exclusions, and conditions under which the insurance company can deny claims or coverage.

Your Feedback Is Very Important To Us

We would love to hear about your experiences and struggles regarding being denied Term Life Insurance. Your feedback will help us understand common challenges and improve the information provided to Canadians. Please take a moment to answer the following questions.

Thank you for sharing your feedback! Your responses will help us create more valuable resources and guidance on securing Term Life Insurance and addressing common struggles faced during the application process.

IN THIS ARTICLE

- Can You Be Denied Term Life Insurance?

- Pre-Existing Health Conditions and Medical History

- Age-Related Concerns and Policy Limitations

- Lifestyle Risks: Smoking, Extreme Sports, and Hazardous Occupations

- Financial Factors: Income, Debt and Coverage Amount

- The Consequences of Non-Disclosure and Misrepresentation

- How Often Are Term Life Applications Denied? (Stats and Reality Check)

- Expert Tips: Avoiding Common Mistakes and Strengthening Your Application

- Key Factors Influencing Term Life Insurance Eligibility and Approval

- Conclusion

Sign-in to CanadianLIC

Verify OTP