Have you ever wondered about your financial future and your insurance policies? Many Canadians are uncertain and confused about the cash value of their Canadian Whole Life Policies. You’re nearing retirement, and you start to notice that the cash value you were counting on is disappearing. This isn’t just a worry for nothing but a reality for many Canadians, especially when life throws them a curve ball and they have to reevaluate their safety nets.

At Canadian LIC, we see clients who are surprised by the changes in their policy’s cash value. These are good people who have been paying premiums on time and expecting their investments to grow. This blog will tackle this important topic, answer your questions, and make sure you’re armed with the information you need to make decisions about your Whole Life Insurance.

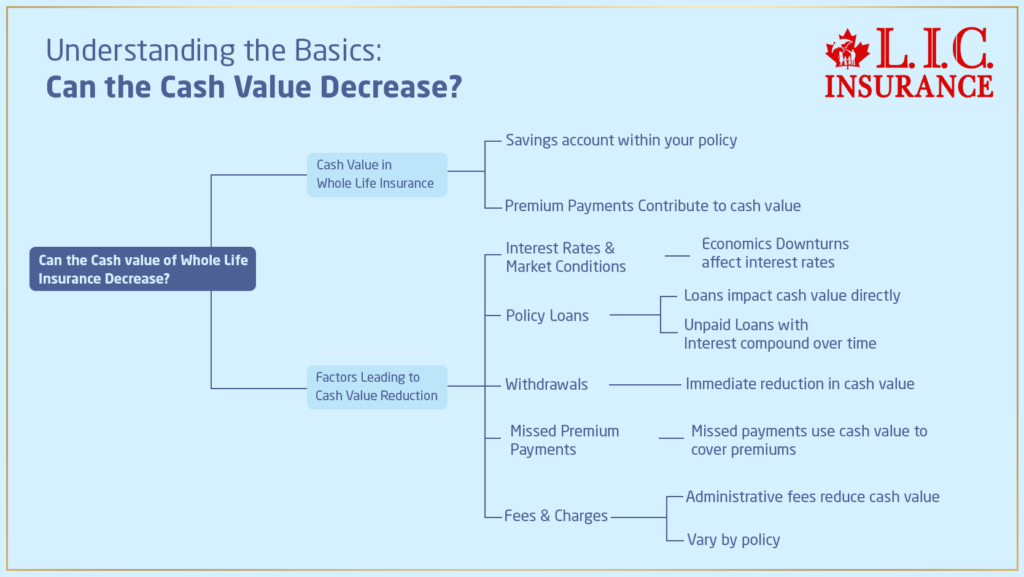

Understanding the Basics: Can the Cash Value Decrease?

The cash value in Whole Life Insurance is important; it is a savings account within your policy. When you make a premium payment, a certain portion is taken to pay premiums for the insurance; another portion goes to the creation of this cash value. Yet, a number of factors can lead to its reduction, which every policyholder may not know immediately.

Interest Rates and Market Conditions

One of the primary factors that affect the cash value is the interest rate set by the life insurance company. Broader economic conditions often influence these rates. In times of economic downturn, interest rates may fall, slowing the growth of your cash value. For instance, a client at Canadian LIC, a seasoned teacher nearing retirement, found her policy’s cash value growth stalling as the interest rates dipped unexpectedly. This was a wake-up call to reevaluate her financial strategies.

Policy Loans

Taking out a loan against your policy’s cash value is a common feature of Whole Life Insurance in Canada. Something to consider, though, is that while this does provide liquidity, it directly impacts the cash value. Unpaid loans increase with interest and may compound, diminishing both the cash value and the eventual policy’s death benefit. A Canadian LIC client once took a huge loan to partly fund his son’s education abroad, only to realize later by how much it cut down on his policy’s value.

Withdrawals

Similar to loans, making a withdrawal from your cash value can result in an immediate reduction. You may be tempted to take some of these funds from your policy during difficult times, but these are decisions you want to consider carefully. We often have people who had to withdraw funds to cover emergency medical expenses, only to face a reduced cash value that affected their long-term financial plans.

Premium Payments

Consistent premium payments should anchor a healthy cash value for the Canadian Whole Life Coverage. Miss payments and some policies allow the use of the collected cash value to pay for it—needless to say, your cash value will obviously decrease in this case. One client told us at Canadian LIC that a short-term setback prompted him to choose this route, and then he didn’t realize the implications that would affect his policy in the long term.

Fees and Charges

Canadian Whole Life Policies have a number of fees and administrative charges that chip into the cash value. These fees are usually taken out of the cash value and differ from policy to policy. It is thus very important to understand the charges that can highly reduce the growth of your cash value over some time.

How Canadian LIC Can Help

At Canadian LIC, we don’t just sell insurance policies. We’re there for you, providing the type of information and resources that will help you be empowered so you can make knowledgeable decisions regarding your financial future. Here’s how our dedicated team of Whole Life Insurance Agents can help you in Canada:

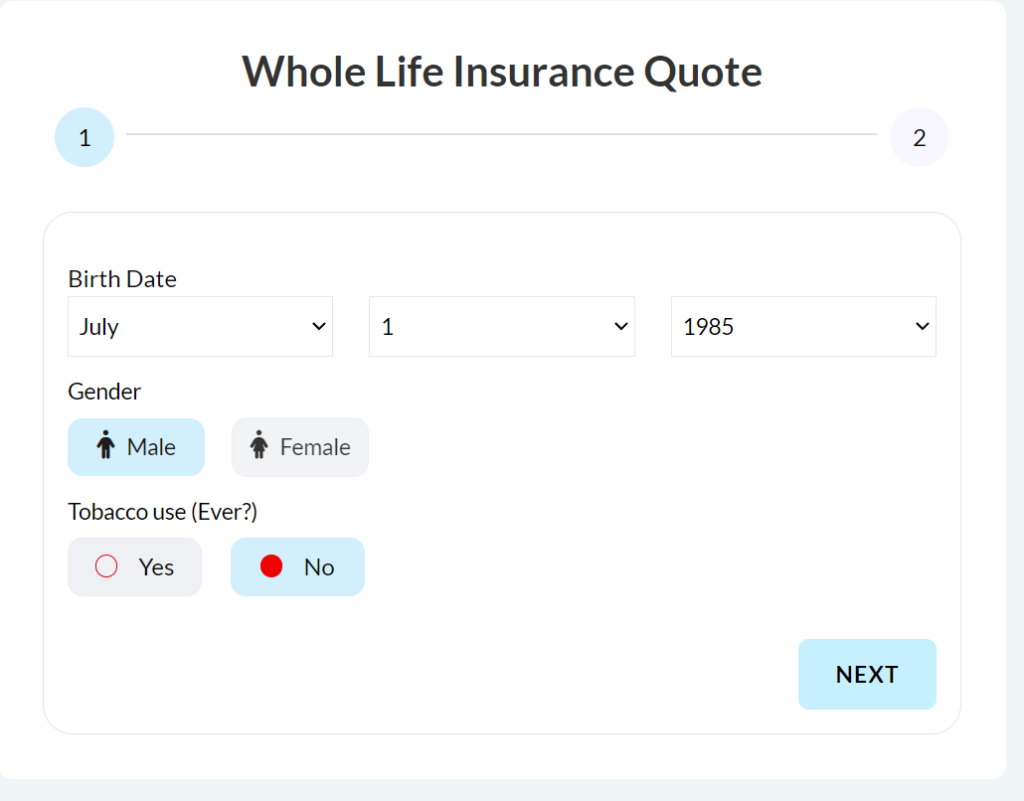

Personalized Whole Life Insurance Quotes

Consider the story of Marina, a young entrepreneur in Toronto. When she first approached us, she was overwhelmed by the complex terms and varying Whole Life Insurance costs. Our agents worked closely with her, explaining the nuances and providing customized quotes that fit her unique business and personal needs. Now, Marina confidently understands her policy and its long-term benefits.

Our Promise: We provide personalized Whole Life Insurance Quotes that reflect your life stage, financial goals, and the specific needs you might still need to consider.

Understanding Canadian Whole Life Insurance

Tej, a retiree in Vancouver, was puzzled by the fluctuations in the cash value of his policy. He wasn’t sure how the economic climate affected his investments. Our agents sat down with him, using clear, simple language to explain how market changes impact cash values and what that means for his retirement planning.

Our Approach: We ensure you grasp every aspect of Canadian Whole Life Insurance, from the basic structure to the complex interplay of market forces, so you can feel secure and informed.

Guidance on Policy Features and Benefits

Amina, a new mother in Calgary, was concerned about the future education of her daughter. She was considering Whole Life Insurance but was unsure about the benefits. Our team explained how she could use the policy’s cash value for future educational expenses, demonstrating the policy’s flexibility beyond just a death benefit.

Our Expertise: We dissect each policy feature, showing you how to maximize the benefits—whether it’s leveraging the cash value for educational purposes or planning for estate taxes.

Strategic Financial Planning

Rajvendar, a small business owner in Montreal, needed a strategy that aligned his business goals with personal financial security. He was confused about how his Whole Life Insurance could play a role in this. Our agents provided a comprehensive plan that integrated his policy into his business succession plan, offering stability and security for his future.

Our Strategy: We don’t just look at your policy in isolation but as a part of your overall financial landscape, helping you integrate your insurance into broader financial strategies.

Continuous Education and Updates

Samantha, an artist and a client for over a decade, has seen many changes in the insurance industry. To keep her updated, we regularly provide her with the latest information on policy changes, new benefits, and potential impacts due to legislative updates in Canada.

Our Commitment: Stay informed with our ongoing education efforts that keep you ahead of changes and ensure your policy continues to meet your needs over time.

Responsive Customer Support

Last winter, Kevin from Halifax had urgent questions about his policy after a family emergency. He was able to quickly connect with our support team, who provided immediate clarity and peace of mind during a stressful time.

Our Service: Our Whole Life Insurance Agents in Canada are just a call or an email away, ready to assist you with any queries or concerns, ensuring you always have the support you need.

At the Canadian LIC, we do much more than just provide insurance. We help you navigate through the complexity of Whole Life Insurance. With us, it is not just the purchase of a policy; it is the development of a team for your financial well-being. Let us help you secure a stable and prosperous future. Reach out today and take the first stride towards a stress-free tomorrow with the best insurance solutions in Canada. We work on keeping you at peace of mind—always in good hands with Canadian LIC.

Concluding Words

It’s not just about protecting your financial future – it’s about making informed decisions that match your life goals. At Canadian LIC, we see the struggles and worries of Canadians every day and are here to help you through them. Don’t let confusion hold you back from being financially free. Contact us for a consultation and get a custom quote for yourself. With Canadian LIC, you’re not just buying a policy – you’re investing in a lifetime of security and peace of mind. Act now and be financially free with the best. Let’s make sure your Canadian Whole Life Policy delivers on its promise and supports you every step of the way.

More on Whole Life Insurance

- What Are Paid-Up Additions in Whole Life Insurance?

- Are There Any Scenarios Under Which the Death Benefit of Whole Life Insurance Would Not Be Paid?

- The Impact of Smoking on Whole Life Insurance Premiums

- Is It Possible to Adjust My Canadian Whole Life Policy?

- How to Get The Best Whole Life Insurance Without a Medical Exam?

- When Does Whole Life Insurance End?

- Whole Life Or Term Life Insurance- Which is better?

- The 2 Disadvantages of Whole Life Insurance?

- How Long Do You Pay on a Whole Life Policy?

- What Is The Right Age For Whole Life Insurance?

- Is It Possible to Buy Whole Life Insurance for My Child?

- Who Should Go for Whole Life Insurance?

- Is Whole Life Insurance Costly?

- The Difference Between Money Back Policy and a Whole Life Policy

- Is It Possible to Convert Universal Life to Whole Life?

- Understanding How a Canadian Whole Life Policy Work

- The Biggest Risk for Whole Life Insurance

- Taxing of Whole-Life Policy

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions: Understanding Whole Life Insurance with Canadian LIC

If you need an accurate Whole Life Insurance quote, then you’ll want to be detailed and accurate when answering questions about your health, lifestyle, and other financial information. Last month, a lady named Lisa from Ottawa reached out to us. She was a little apprehensive about revealing her full medical history. We explained to her how important honesty is in really receiving an accurate quote. Once Lisa provided her complete health background, we could then give an accurate quote reflective of her needs and budget.

Canadian Whole Life Insurance differs mainly because it offers a combination of lifelong coverage and a life insurance cash value component, which grows over time. Mark is from Edmonton and wasn’t aware of how these benefits worked. It was very interesting that our agents had to explain to him that Whole Life Insurance, unlike Term Life Insurance Policy, is not an insurance product which covers a person for some period of his life; rather, with Whole Life Insurance, you will definitely be covered throughout your life while building cash value which you may need or want later in life.

Yes, you can change your policy, including adding or reducing the death benefit amount and riders. In fact, we recently had a customer, Sophia from Toronto, who needed to make some changes to her policy after having made a shift in her career that affected her financial situation. Our Whole Life Insurance Agents in Canada worked with her so that we could adjust her policy to correspond with her new income level while still protecting her family’s financial future.

They will be knowledgeable, open, and flexible in accommodating your very unique needs. When searching for an insurance agent, for example, Daniel of Vancouver wanted somebody who would sell him an insurance policy and, importantly, explain all the options to him. He chose Canadian LIC because our agents take the time to discuss various policies with you and are open and forthright about all terms and fees involved in doing so.

If this is happening to you, or if you’re having trouble making premium payments, please don’t hesitate to discuss your options with your insurance agent. We had a call from a young couple in Montreal who found themselves in a similar situation. They contacted us because they were concerned that they would have to surrender the policy. Our team helped them investigate options such as reducing the coverage amount temporarily or using the policy’s cash value to cover premiums until their financial situation improves.

You can fairly quickly gain access to your policy’s cash value. However, it would help if you spoke to your agent about the implications of this action. We remember that once, one of our clients, Sammy, from Halifax, had an unexpected home repair that required cash. She could borrow, in no time, against her policy’s cash value, and our agents made sure she was aware of how it would impact her policy’s future value and death benefit.

Yes, there are indeed risks associated with withdrawing from the cash value of your policy: it lowers the death benefit and has other tax implications. Take, for instance, Tomar, who lives in Quebec City, who came to us for advice because he was thinking of drawing from his cash value to pay for a big ticket item. Our agents pointed out the possible risks involved and helped balance his options so he could make an informed decision that didn’t put his family in financial jeopardy.

Comparing Whole Life Insurance Quotes goes beyond the premium quoted. Added to this would be the premium, coverage amount, cash value growth rate, and policy flexibility. Our Canadian Whole Life Insurance Agents walked her through the fine print of each policy last week for a Mississauga client named Jenna, who was comparing quotes and getting frustrated.

This generally leads to your policy review in terms of updated health information and change of financial status. In Calgary, we assisted Alex, a customer who wanted to increase his coverage when he became a father. His agents guided him through the necessary assessments and updated his policy, considering these new responsibilities that would maintain protection for his family.

We always encourage our clients to check their policies once every two to three years or whenever a major change occurs in their life—marriage, having a child, or a serious change in income. Robert of Toronto had not checked his policy for more than five years. Meeting with one of our agents, he realized that he needed to update his beneficiary and adjust the coverage to his current life situation.

Yes, most clients take advantage of and use their policy cash value as a source of funding for their retirement. Carol from Winnipeg came through with her worries about retirement planning, but our agents took her through how she can use her policy cash value to tone her retirement supplementing-source income. This is to make sure that one retires at their comfort without any hitches.

It’s always best to talk to your agent before cancelling your policy. There may be other options available that suit your needs better, like adjusting your policy or taking a loan against the cash value. For example, Neil of Surrey was thinking about cancelling his policy because he had been under some financial stress. We sat down with him for a proper discussion, and we helped him adjust his policy so that his premiums were lowered for some time, yet still maintaining his coverage.

An experienced agent will walk you through scenarios and projects to help illustrate how various policies can fit with your potential future goals. For example, Emily from Ottawa was looking for clarity on how her career change might affect her financial future. Our agents ran a number of scenarios showing how her Whole Life Insurance could adapt to her potential new income levels and career paths.

There are many tax advantages associated with Whole Life Insurance. You can grow the cash value tax-free and then pass that on to your beneficiaries tax-free upon death. Just last year, Patrick from Montreal had doubts regarding his policy’s tax consequences. Our agents explained these tax benefits clearly to him, and he understood how his policy not only provided security but also gave him efficient tax planning.

Choosing the Right Beneficiary: This is very important. Think about who it is that is going to be most affected by your death from a financial standpoint. We had a case of a client, Harpreet from Brampton, who was really confused regarding choosing her spouse or children as beneficiaries. Our Whole Life Insurance Agents in Canada helped her walk through what the implications would be from both scenarios, thus ensuring that she made a choice that guaranteed her family’s future financial security.

Inflation can erode the purchasing power of the cash value over time. Recently, we helped George from Halifax realize that even though his policy’s cash value grows, it doesn’t grow with inflation. Our agents worked with him to strategize some other investments that would work in conjunction with his Whole Life Insurance to balance out a financial portfolio.

Yes, you can have multiple policies. One of our clients, Sophia from Vancouver, decided to get the second policy after the first one worked well to cover her business needs. She came to see us, and we helped her understand how getting an additional policy can provide further financial security in her personal life.

One can expect quotes to be more reasonable for a young and healthy individual. Recently, we helped a young couple, Tom and Rita from Montreal, receive competitive Whole Life Insurance Quotes. Our agents put into light the big role their youth and good health played in securing preferential rates, emphasizing the benefit of early application.

Find transparent and knowledgeable agents who will listen to what you really need. It’s something like when Anita from Saskatoon was looking for an agent. She wanted one who could explain complex insurance terms in simple words. Our Canadian LIC agent met her expectations with easy-to-comprehend information and was on his way to building a trustful relationship.

Such incorporation of your Whole Life Insurance into your estate planning is an important aspect if maximum benefits are to be derived. We have assisted Edward of Toronto in tailoring his policy towards his estate plans so that the benefits accrue maximally and in a tax-effective manner to his heirs.

In most cases, the best time to buy is when you are young and healthy. The premiums at that time will be quite affordable. However, it is never too late to start. We have advised a 50-year-old lady from Edmonton called Linda, who felt it was a bit late to be getting the insurance. Our agents still gave her options with huge benefits at her age.

Reviewing and possibly updating your policy after major life events is important. For instance, Derek from Ottawa came to our attention with a request to amend his policy as he was now married and had a newborn child. Our agents modified the beneficiaries for him and increased the coverage amount.

Canadian LIC works hard to empower you with all knowledge in regard to your Whole Life Insurance so that you are confident and secure about your decisions. Whether it is getting a quote for the adjusting of your policy to better suit you or simply understanding the options at hand, be it for any sort of help that you may require at any step, our team is always ready. Do not hesitate to just get in touch and begin a conversation about securing your financial future today.

Sources and Further Reading

- Financial Consumer Agency of Canada (FCAC) – Provides comprehensive guides on different types of insurance available in Canada, including Whole Life Insurance.

- Canadian Life and Health Insurance Association (CLHIA) – Offers detailed information about life insurance products in Canada, their features, benefits, and how to choose the right one.

- Investopedia – Useful for understanding the basics of Whole Life Insurance, including how cash values work, policy loans, and comparisons with other types of life insurance.

- Insurance Bureau of Canada – Provides resources and articles about the insurance industry in Canada, including regulatory changes and advice on choosing insurance providers.

- Life Insurance Canada – Features various articles and blogs written by industry professionals discussing different aspects of life insurance, including Whole Life Insurance and its benefits.

These resources can help readers gain a deeper understanding of Whole Life Insurance in Canada, assisting in making informed decisions regarding their insurance needs.

Key Takeaways

- Cash value in Whole Life Insurance can decrease due to factors like market conditions and policy loans.

- Economic downturns can slow cash value growth by lowering interest rates.

- Loans and withdrawals directly reduce cash value and can lower the death benefit.

- Consistent premium payments are crucial to maintain policy benefits and cash value.

- Awareness of fees and charges is important as they can erode cash value over time.

- Whole Life Insurance should be part of broader financial strategies, including retirement and estate planning.

- Consulting knowledgeable agents helps in understanding policy details and making informed decisions.

Your Feedback Is Very Important To Us

We value your insights and experiences regarding balancing part-time work with receiving Disability Benefits in Canada. Your feedback will help us understand the challenges and needs you face. Please take a few minutes to answer the following questions:

This questionnaire is designed to gather insights into the experiences and challenges faced by Canadians with their Canadian Whole Life Policies, specifically focusing on the decreasing cash value. Your responses will help us better understand your needs and improve our services

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]