- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Can Term Life Insurance Be a Business Expense?

- Understanding Term Life Insurance for Business

- Why Consider Term Life Insurance as a Business Owner?

- Can Term Life Insurance Premiums Be Deducted as a Business Expense?

- When Term Life Insurance Premiums Are Deductible

- When Term Life Insurance Premiums Are Not Deductible

- Real-Life Applications of Term Life Insurance in Business

- Benefits of Using Term Life Insurance for Business

- How to Choose the Right Term Life Insurance Policy for Your Business

Can Term Life Insurance Be A Business Expense?

By Harpreet Puri

CEO & Founder

- 11 min read

- November 20th, 2024

SUMMARY

As a business owner in Canada, one of the first thoughts and questions asked is whether Term Life Insurance can be considered a business expense when making financial plans. You would ask yourself, “Can I pay Term Life Insurance premiums through my taxes? Will this protect my business, employees, and family in one single act?” This is definitely a valid concern as you juggle budgets, overhead costs, and personal financial security. At Canadian LIC, we frequently see entrepreneurs and business leaders wrestling with these challenges. Let’s look at how Term Life Insurance Policies intersect with business expenses and find practical solutions to work for you.

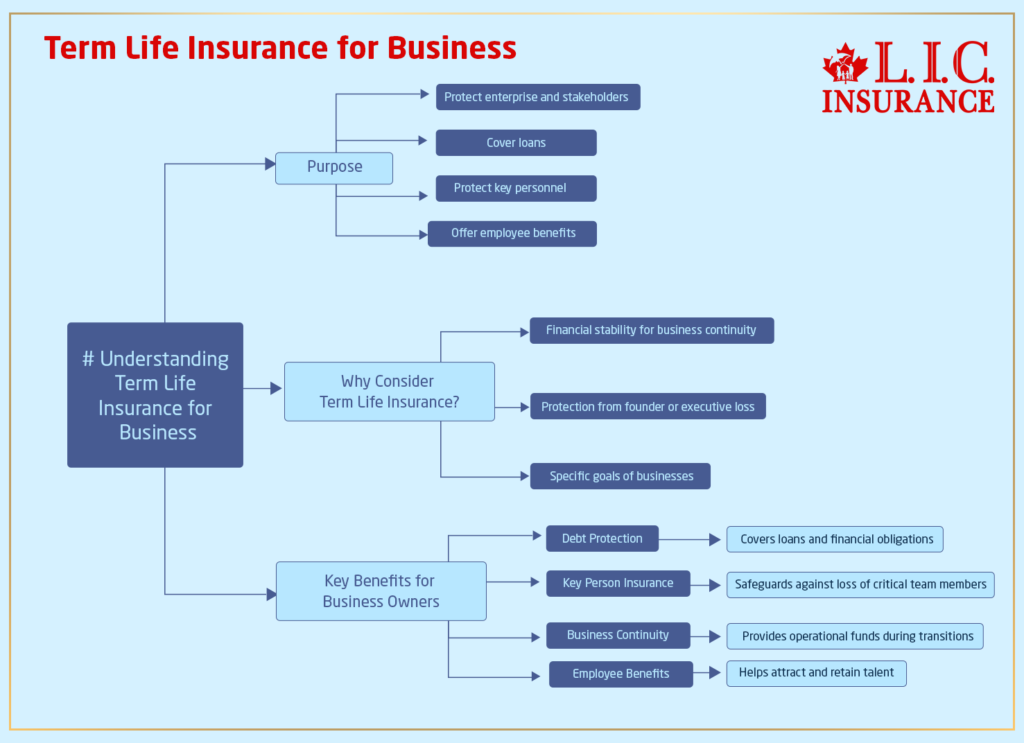

Understanding Term Life Insurance for Business

Term Life Insurance for Business is an incredibly powerful tool for protecting the enterprise and its stakeholders. The policy covers a given term and ensures that, upon the death of the insured person, the benefits are paid out to the beneficiaries. This kind of insurance is used mainly by businesses to secure loans, protect key personnel, or offer employee benefits.

Why Consider Term Life Insurance as a Business Owner?

Business owners wear multiple hats and are essentially the financial lifeline of their companies. When you and, especially, a key employee die, Term Life Insurance Policies provide financial stability that will enable the business to remain in operation. This is particularly important for small businesses, as the death of a founder or an executive can simply devastate a company. Canadian LIC has protected many business owners with Term Life Insurance plans that match the specific goals of their businesses.

For business owners, key reasons to invest in Term Life Insurance include:

- Debt protection: To ensure loans and financial obligations are covered.

- Key person insurance: To safeguard against the loss of critical team members.

- Business continuity: To provide funds for operations during transitions.

- Employee benefits: To attract and retain talent.

Can Term Life Insurance Premiums Be Deducted as a Business Expense?

The simple answer is it depends. In Canada, the Canada Revenue Agency (CRA) sets strict guidelines for determining whether Term Life Insurance premiums qualify as a deductible business expense.

When Term Life Insurance Premiums Are Deductible

Premiums for Term Life Insurance Policies are tax-deductible if the policy is used for explicit business purposes. For instance:

- Loan Collateral: If a lender calls for Term Life Insurance as a loan collateral, their premiums can be considered a deductible expense.

- Key Person Insurance: If the business owns the policy and is the beneficiary, the CRA allows a deduction for premiums paid to safeguard against the loss of a key employee.

When Term Life Insurance Premiums Are Not Deductible

If the policy’s principal objective is personal, such as securing your family’s financial well-being, the Life Insurance Premium is generally not tax-deductible. The CRA separates policies used for business purposes versus those used for personal benefit.

Agents in Canadian LIC know how to deal with the CRA regulations. Even for Term Life Insurance, they can guide you on structuring to make the most of the benefits while considering tax laws.

Real-Life Applications of Term Life Insurance in Business

A small business owner approached Canadian LIC for a suggestion on how to obtain a loan to expand their operations. The lending company required them to have Term Life Insurance to back the loan. We assisted the client in obtaining a Term Life Insurance policy, setting the premium amount to the loan term and amount, making the premiums a legitimate business expense. They could then use this expansion money with complete confidence in their venture.

We received a mid-sized tech company that consulted with Canadian LIC to seek how best to protect their Chief Technology Officer as the head figure in an organization. We assisted them in setting up a key person Term Life Insurance policy where the company was both the owner and beneficiary, offering not only financial protection but also partial premium deductions under CRA rules.

Benefits of Using Term Life Insurance for Business

Term Life Insurance covers the event of unexpected loss due to an owner or key employee. It facilitates the business’ continuation and smooth operation; instead, it could be used to pay off debts or find replacements for lost people.

Offering Term Life Insurance Policies as part of employee benefit packages enhances your company’s appeal. Employees value employers who prioritize their well-being and financial security.

Lenders view businesses with Term Life Insurance coverage as lower-risk borrowers, making it easier to secure financing for expansion or operations.

Whether it’s partners, investors, or employees, Term Life Insurance coverage reassures stakeholders that the business is protected against unforeseen events.

How to Choose the Right Term Life Insurance Policy for Your Business

Selecting the right policy involves evaluating your business needs, financial goals, and CRA compliance requirements. Here’s how Canadian LIC simplifies the process:

- Assessing Your Business Needs: Are you protecting a loan, a key employee, or your family? Defining the purpose of the policy helps narrow down the options.

- Comparing Term Life Insurance Quotes Online: With tools to compare Term Life Insurance Quotes Online, Canadian LIC helps you find policies that offer maximum coverage at competitive rates.

- Working with Expert Term Life Insurance Agents: Our experienced agents understand the unique challenges faced by Canadian businesses. We customize solutions that align with your objectives while ensuring compliance with tax regulations.

- Structuring Policies for Tax Efficiency: You can maximize business benefits and minimize tax liabilities by strategically structuring your Term Life Insurance Policies.

Why Choose Canadian LIC for Your Term Life Insurance Needs?

At Canadian LIC, we’ve spent years helping business owners across Canada navigate the complexities of Term Life Insurance Policies. Our personalized approach, extensive experience, and commitment to excellence make us the go-to brokerage for Term Life Insurance for Businesses.

Whether you’re looking to protect your business, secure a loan, or offer benefits to employees, our Term Life Insurance Agents are here to help. We’ll walk you through every step of the process – from policy selection to CRA compliance. Don’t leave your business’s future to chance; team up with Canadian LIC today and gain peace of mind for the future.

More on Term Life Insurance

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs Related to Term Life Insurance for Business

Yes, businesses can own Term Life Insurance Policies, especially for key person coverage or loan collateral. This allows the business to receive the payout directly.

No, only premiums for policies used specifically for business purposes may qualify. Personal policies are not deductible.

Look for agents with experience in business insurance solutions, like those at Canadian LIC. They can guide you through the process and help you make informed decisions.

The best policies are those that align with your business needs, whether it’s debt protection, employee benefits, or key person coverage.

The cost depends on factors like coverage amount, term length, and the insured’s age and health. Comparing Term Life Insurance Quotes Online can help you find affordable options.

In most cases, Life Insurance proceeds paid to the beneficiaries in Canada are tax-free. The same applies to Term Life Insurance, but only if the beneficiary is a named person or a business entity. As one would expect, if the policy has been used as a form of collateral for a business loan, then tax factors may come into play depending upon the application of proceeds. One should consult with an expert, like Canadian LIC, who can provide clarification about specific cases.

Other business insurances covered under the tax-deductible umbrella are general liability insurance, property insurance, and key person insurance, while Life Insurance premiums may be deductible where the policy is required for business purposes, in order to secure a loan or to cover key personnel.

Life Insurance offers several tax benefits, including:

- Tax-free death benefits: The payout to beneficiaries is usually not subject to income tax.

- Tax-sheltered growth: If the policy has a cash value component, the growth is generally tax-deferred.

- Deductible premiums: In specific business-related scenarios, such as policies used as loan collateral, premiums may be deductible.

In principle, death benefits paid out by Life Insurance are not taxable. However, in the case of a Life Insurance policy with a cash value, any profit gained from the surrender of such policy for cash beyond the premiums paid may be taxable. In addition, if the proceeds are related to business operations, the receipts could be taxed or exempted depending on the use of the proceeds.

Although there is no particular tax limit for Life Insurance in Canada, the CRA controls policies which have cash value contents very closely to ensure they meet specific requirements. A policy that exceeds these guidelines may not qualify under its tax-advantaged status anymore. Term Life Insurance Policies usually do not hit such limits because they are clear-cut.

Term Life Insurance is arguably the simplest tax-free death benefit. However, suppose you are looking to build on tax-sheltered investments. In that case, you will find a better fit for Permanent Life Insurance Policies, such as Whole Life Insurance or Universal Life Insurance. This choice should be aligned with your monetary goals, and seeking advice from experienced agents, such as those at Canadian LIC, helps.

You usually do not have to report the Term Life Insurance on your income tax return since you cannot claim the premiums paid for personal policies as deductions, and death benefits are tax-free. However, suppose it has a direct association with your business, for example, with your business-interest-based key person insurance or loan collateral coverage. In that case, you may have to report any corresponding deductions or taxable receipts. It would be wise to have a tax professional handle this to keep on the good side of CRA.

For advice on what form to take to structure Life Insurance for maximum tax benefits, contact one of the expert agents at Canadian LIC.

Sources and Further Reading

For a comprehensive understanding of term Life Insurance as a business expense in Canada, consider the following resources:

- Canada Revenue Agency (CRA) – Business Expenses: This official guide details deductible business expenses, including insurance-related costs.

- Sun Life – Are Your Insurance Premiums Tax-Deductible?: This article explores the tax implications of insurance premiums for individuals and businesses.

- Dundas Life – Is Life Insurance a Business Expense in Canada?: This resource discusses the conditions under which Life Insurance premiums can be considered business expenses.

- TurboTax Canada – When Are Life Insurance Premiums Tax-Deductible?: This article provides insights into the tax deductibility of Life Insurance premiums for businesses.

- Protect Your Wealth – Life Insurance and Taxes [Complete Canadian Guide]: This guide offers an in-depth look at the taxation of Life Insurance policies in Canada.

Key Takeaways

- Term Life Insurance provides financial protection for businesses by covering loans, safeguarding key employees, and ensuring continuity during unexpected events.

Tax-Deductibility Depends on Usage

- Premiums for term Life Insurance policies are tax-deductible only if the policy is explicitly used for business purposes, such as loan collateral or key person coverage.

Personal Use Policies Are Not Deductible

- Policies aimed at personal financial protection, like those benefiting family members, do not qualify for tax deductions.

Lenders Often Require Term Life Insurance

- Financial institutions may require term Life Insurance to secure loans, making it a critical tool for expanding or stabilizing a business.

Tax-Free Death Benefits

- In most cases, term Life Insurance death benefits are not taxable, providing significant relief for beneficiaries and businesses alike.

Choose the Right Policy for Your Business

- Assess business needs, compare term Life Insurance quotes online, and work with knowledgeable term Life Insurance agents to find the best solution.

Consult CRA Guidelines for Compliance

- Adhering to Canada Revenue Agency (CRA) rules ensures you maximize tax benefits while avoiding potential penalties.

Partner with Experts Like Canadian LIC

- Canadian LIC agents specialize in customizing term Life Insurance policies that align with your business needs and tax strategies.

Your Feedback Is Very Important To Us

Thank you for taking the time to provide your feedback. Your insights will help us better understand the challenges faced by individuals like you. Please answer the following questions:

Thank you for your feedback! Your input will help us provide better solutions and resources to support individuals and businesses navigating term Life Insurance.

IN THIS ARTICLE

- Can Term Life Insurance Be a Business Expense?

- Understanding Term Life Insurance for Business

- Why Consider Term Life Insurance as a Business Owner?

- Can Term Life Insurance Premiums Be Deducted as a Business Expense?

- When Term Life Insurance Premiums Are Deductible

- When Term Life Insurance Premiums Are Not Deductible

- Real-Life Applications of Term Life Insurance in Business

- Benefits of Using Term Life Insurance for Business

- How to Choose the Right Term Life Insurance Policy for Your Business