- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What Is the Longest Term Life Insurance?

- The Longest Term Life Insurance Policy: Understanding the Basics

- Who Should Consider a Long Term Life Insurance Policy?

- Pros and Cons of a Long Term Life Insurance Policy

- How to Choose the Right Term Length?

- Term Life Insurance Quotes Online: Get the Best Deals

- The Benefits of Working with Term Life Insurance Brokers

- Conclusion: Why Choose Canadian LIC for Your Long Term Life Insurance Policy?

Can Term Insurance Be Rejected After Five Years?

By Pushpinder Puri

CEO & Founder

- 11 min read

- October 16th, 2024

SUMMARY

The blog explores whether Term Insurance can be rejected after five years, addressing common concerns policyholders face despite paying premiums on time. It highlights key reasons for claim denials, including non-disclosure of medical history, missed premium payments, contestability periods, and policy exclusions. The blog also shares real-life client experiences from Canadian LIC and provides actionable tips on ensuring claims are approved, such as transparency in applications and keeping policies updated.

Introduction

Many think that after Term Life Insurance is approved, the problems are resolved, and one is all set for the term period. In most people’s minds, however, the fear of Term Insurance claim rejection remains even after five years. A common question that has been raised is this: Can Term Insurance be rejected even after five years? This has real concern factors, particularly when people have dutifully paid their premiums but then begin to worry about the possibility of being rejected once the claim arises.

There are quite a number of clients who often visit Canadian LIC with the same fears. They’ve heard stories or experienced struggles related to claim rejections. Let us look at some of those concerns by peeking into the reason why a Term Life Insurance Plan may end up being rejected even after several years and what you do to prevent such.

Understanding Term Life Insurance and Its Role

Before we talk about why a claim would be denied after five years, let’s first understand what Term Life Insurance is and why people pick it. Term Life Insurance is simply one of the favourite options people choose when they want to have some affordable insurance coverage for a particular period, whether ten years, twenty years, or thirty years. If an insured person dies during the period of the policy, the Life Insurance providers provide a death benefit to the respective beneficiaries. It provides peace of mind, particularly for those with dependents or significant financial obligations like mortgages.

Now, while Term Life Insurance is pretty much straightforward, many clients continue to misunderstand the finer details. For example, Term Life Insurance Rates tend to be lower than permanent Life Insurance policies, making them more attractive to those on a budget.

Additionally, comparing Term Life Insurance Quotes Online is a common step when shopping for a policy. However, even after five years, the concern of a claim rejection persists.

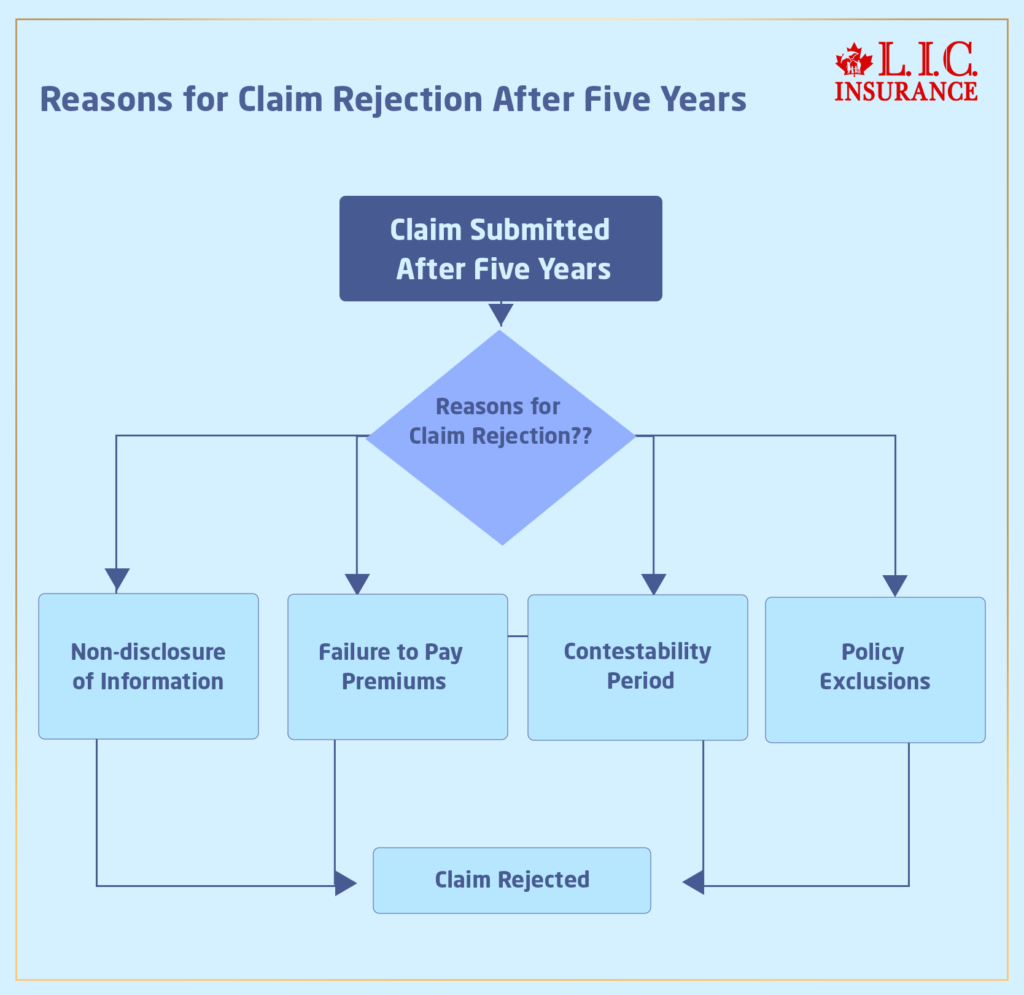

Why Would a Claim Be Rejected After Five Years?

Many factors might lead to the Term Insurance having a claim denied at the fifth anniversary, although the premium payer may be well up-to-date in payment terms and appear to be in clean standing. Following are some of the common causes:

Non-disclosure of Information

Many such Term Insurance claims are rejected solely and simply because material information had not been disclosed or misrepresented at the time of their proposal. Most of the time, despite completing five years of insurance, the insurance company rejects the claim simply because the policyholder failed to declare proper details about his health, lifestyle, or previous medical history. Many clients facing this fear at Canadian LIC go through this when they’ve unintentionally left out declaring something which they did not think was relevant.

Take, for instance, a client who applied for a Term Life Insurance Plan but failed to mention a minor surgery they underwent a few years ago, thinking it wouldn’t matter. If that detail later comes to light after their death, the insurance company might see it as grounds for rejecting the claim.

Failure to Pay Premiums

Although this is almost common knowledge, failure to pay premiums may result in a lapse in insurance coverage. Lapse of insurance policy refers to when the policy stops or remains inactive for a certain period during which all Life Insurance claims submitted afterwards may be disapproved. One of the common issues that our clients experience in their budgets is insurance payment lapses. Canadian LIC always reminds their clients to stay on top of their Term Life Insurance Rates and payments to avoid unintentional lapses.

Contestability Period

Most insurance policies, such as a Term Insurance Plan, contain a contestability period of about two years. In such circumstances, the insurer can cancel the policy based on new information discovered, especially during the application process relating to the policyholder or the claims made. Although the contestability period typically lasts for two years, some specific conditions or findings may compel an insurance company to conduct more extensive investigations even five years after such a suspicion of fraudulent action or misrepresentation of facts occurs. This is a practical concern that we constantly face as clients of Canadian LIC, and we assist them in making sure that their information is thoroughly and correctly filled out.

Policy Exclusions

Another reason for claim rejection is exclusions by the policy itself. Every Term Life Insurance Plan has explicit clauses specifying instances where a claim may be invalidated. For example, if the death of the policyholder is a result of high-risk activities not included in the policy, the claim shall be rejected. We often see clients who didn’t fully understand these exclusions when they initially purchased their policies.

For instance, one of our clients had a Term Life Insurance Policy but took up extreme sports activity that was not covered by the policy. When the man died, the family received the bitter shock that the claim would not be honoured because it was an exclusion. You should understand your policy well and consult with an experienced broker—such as those at Canadian LIC—before you decide.

How to Avoid Claim Rejections

True, the Term Insurance claim cases will be rejected sometimes, even after five years. However, in this case, proper methodologies can also reduce its occurrence. Here, at Canadian LIC, we guide our client’s step by step, avoiding stressful situations.

Be Transparent During the Application Process

Always tell the truth when applying for insurance, especially Term Life Insurance. Every kind of health condition, lifestyle choice, and important medical history should be accurately documented. No matter how slight it might seem, it’s still better to declare it so that the insurer will then decide what importance they should give it. In some cases, it may prevent rejection due to non-disclosure or misrepresentation down the line.

One of our clients initially feared sharing their smoking history, fearing it would be a sure way of increasing Term Life Insurance Rates. After consulting with one of our Canadian LIC agents, they disclosed everything upfront and were able to get into a policy that worked for them. The peace of mind that came with knowing their claim wouldn’t be denied later was worth the effort.

Keep Up with Premium Payments

As pointed out earlier, payment of premiums on time is what keeps your insurance policy active. We always encourage our customers to remind themselves of payment due dates or set up automatic payments so they do not miss making a payment. Regular payments assure continued Term Insurance Coverage; you can thus rely on having cover when it matters most to you.

Review Policy Exclusions

Also, be sure to always allow enough time to peruse the exclusions detailed in your Term Life Insurance Policy document. This is easily overlooked, as some clauses may be related directly to coverage in the future. We request our clients sit with one of our expert brokers at Canadian LIC to go through their policies in detail. Understanding what your policy does and does not cover will help avoid heartache later on.

One client was particularly concerned about how their policy would handle a sudden job change that involved some physical risk. By reviewing their Term Life Insurance Quotes Online and working with Canadian LIC, they adjusted their policy to better align with their new lifestyle, thus avoiding any potential claim denial.

.

Stories from Canadian LIC Clients

It is quite disheartening to see the many clients at Canadian LIC who have such depressing stories wherein their Term Life Insurance gets rejected after some years. Of course, some of them are merely lessons learned; others serve to emphasize the importance of having someone who can work with you.

For instance, one client was denied coverage solely based on an incomplete medical history. They come to us at Canadian LIC frustrated and worried for the future. We work closely with them by reviewing their health history and making sure all documents complete everything needed. We were able to secure a new policy for them, one that gave them and their family the coverage they needed. Such stories remind us why working with seasoned brokers- whose guidance to the clients during the process and their ability to spot potential pitfalls, as would be the case here- is so important.

Another example is a long-term client who had a Term Life Insurance Plan and had some issues with premium payments because of an unexpected financial hurdle. Luckily enough, we were able to adjust their payment cycle and keep their policy active. We offer such hands-on support at Canadian LIC so clients do not lose their coverage because of things out of their control.

Taking Action: Securing Your Term Life Insurance Today

That’s a valid question, which should be understood as to why a Term Insurance claim would face rejection after five years from the date of purchase of the policy. However, the right precautions- such as honest declarations during the application process, on-time payment of premiums, and a clear understanding of your policy’s exclusions, may significantly reduce the chances of your claim getting rejected.

We see these challenges each day at Canadian LIC while working hard to ensure that the clients are knowledgeable and confident about their coverage. From comparing Term Life Insurance Quotes Online to helping you find the most suitable Term Life Insurance Plan and walking you through each step of the process, we are here to help you.

If you are considering Term Life Insurance or you already have Term Life Insurance Coverage, it is time to do the right thing. Let Canadian LIC take you by the hand and guide you into covering yourself with a policy that can fit your budget and make you sleep peacefully, knowing how your family will be taken care of when you leave the world behind.

More on Term Life Insurance

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

FAQs: Can Term Insurance Be Rejected After Five Years?

Yes, a Term Life Insurance Plan can be rejected after five years in certain cases. Common reasons include non-disclosure of health issues, unpaid premiums, or specific exclusions in the policy. At Canadian LIC, we often see clients worried about their policy being rejected, and we help them understand how to avoid such situations by keeping their information accurate and their payments up-to-date.

If you didn’t disclose a medical condition when you applied, the insurance company may reject your claim, even after five years. It’s important to be transparent during the application process. We’ve worked with clients who unintentionally left out details and later faced issues. To avoid this, we always advise being upfront with your information.

Missing a payment could cause your Term Life Insurance to lapse, meaning you lose coverage. At Canadian LIC, we regularly remind clients to set up automatic payments or reminders to stay on top of their premiums. We’ve helped clients adjust their payment schedules when they’ve run into financial challenges, ensuring their policy stays active.

You can avoid rejection by being honest when applying, paying your premiums on time, and understanding the exclusions in your policy. We always recommend our clients at Canadian LIC carefully review their policies and ask questions if anything is unclear. This way, there are no surprises later.

Yes, most Term Life Insurance Plans have exclusions, such as death caused by high-risk activities not covered under the policy. Many clients come to Canadian LIC worried about exclusions, especially if their lifestyle has changed after they purchased the policy. We help them review their coverage and update it when necessary.

Yes, Term Life Insurance Plans usually have a contestability period, often two years. During this time, the insurance company can review your claim for accuracy. While the contestability period is typically short, Canadian LIC ensures that our clients understand what could trigger further investigations even after this period.

Yes, you can adjust your Term Life Insurance Plan if your health or lifestyle changes. Many clients we work with at Canadian LIC find that their needs change over time, whether due to job changes or new health conditions. We help them explore new options or add riders to their existing plans to ensure they stay fully protected.

Term Life Insurance Rates are usually fixed for the term of your policy. However, they may increase if you renew the policy after the initial term ends. At Canadian LIC, we help clients compare Term Life Insurance Quotes Online to find the best rates and guide them through what to expect when renewing their policies.

Yes, most Life Insurance Companies require a medical exam, but no-medical exam options are also available, often at higher rates. We always recommend that clients explore both options with Term Life Insurance Brokers to see what suits them best.

Yes, you can switch your Term Life Insurance Plan if you find a better option. We frequently work with clients who discover that their needs have changed or find a plan with better rates. Canadian LIC helps them make the switch smoothly, ensuring they maintain continuous coverage.

If you find an error in your application, it’s important to correct it as soon as possible. Contact your Life Insurance provider to update the information. At Canadian LIC, we have seen clients face problems later because of small mistakes. We always advise you to review your application carefully before submission and let us help with any corrections early on.

No, if you develop a health condition after your policy is in place, it will not affect your coverage. Term Life Insurance Rates are locked in when you buy the policy, and future health changes don’t impact claims. However, if there was a pre-existing condition you didn’t disclose, that could lead to a claim rejection. At Canadian LIC, we encourage clients to disclose all known health issues to avoid problems down the road.

You can cancel your Term Life Insurance Plan at any time. However, if you cancel, you will no longer have coverage, and any premiums you’ve paid won’t be refunded. Many clients ask us about this when their financial situation changes. We always help them explore other options before deciding to cancel, ensuring they understand the impact on their family’s financial security.

You should review your policy regularly, especially after major life events like getting married, having children, or buying a house. Canadian LIC often helps clients reassess their policies and provides updated Term Life Insurance Quotes Online to ensure they’re still getting the best rates and coverage for their needs.

Term Life Insurance Rates stay the same during the agreed term of the policy. However, if you renew after the term ends, the rates may increase based on your age and health at that time. We frequently help clients at Canadian LIC compare Term Life Insurance Quotes Online to find the most affordable options when it’s time to renew their policies.

If your policy lapses because of missed payments, contact your provider as soon as possible to see if you can reinstate it. At Canadian LIC, we’ve seen clients who let their policies lapse by accident. We often help them set up new Term Life Insurance Plans or explore options to reinstate their old ones, depending on the circumstances.

Yes, many Term Life Insurance Plans offer riders, such as Critical Illness Coverage or accidental death benefits. Clients often ask about these options when their life circumstances change. At Canadian LIC, we help you understand which riders might be right for you, ensuring your policy provides the protection you need without unnecessarily increasing your Term Life Insurance Rates.

You can start by comparing Term Life Insurance Quotes Online and speaking to an experienced broker. At Canadian LIC, we help clients assess their needs and find a policy that fits their budget. Whether you’re covering a mortgage, supporting dependents, or planning for the future, we make sure the plan matches your situation.

Most Term Life Insurance Plans cover accidental death, but checking your policy details is important. If you’re unsure, Canadian LIC can help you review your plan and suggest additional riders if needed. We’ve helped many clients clarify this part of their coverage to ensure their loved ones are protected.

Yes, some Term Life Insurance Plans offer the option to convert to a permanent Life Insurance plan. Many of our clients at Canadian LIC consider this as their financial goals evolve. We help them weigh the pros and cons and look at the long-term benefits of switching, along with Term Life Insurance Rates and quotes.

These FAQs address many of the most common questions regarding Term Life Insurance rejection after five years. Suppose you have questions about the coverage you currently carry. In that case, Canadian LIC can also help you compare Term Life Insurance Quotes Online and determine which Term Life Insurance product is best for your needs.

Sources and Further Reading

- Canadian Life and Health Insurance Association (CLHIA)

Visit the CLHIA website for official guidelines on Life Insurance policies in Canada, including details on Term Life Insurance, policy exclusions, and claim procedures.

https://www.clhia.ca - Government of Canada – Insurance Resources

The Government of Canada provides a detailed overview of insurance types, including Term Life Insurance, and tips on how to choose the right policy. - Financial Consumer Agency of Canada (FCAC)

The FCAC provides guidance on purchasing Life Insurance, understanding Term Life Insurance Rates, and avoiding claim rejection.

https://www.canada.ca/en/financial-consumer-agency.html - Insurance Bureau of Canada (IBC)

IBC is a national resource offering education on different types of insurance, including Term Life Insurance, and tips for ensuring valid coverage.

https://www.ibc.ca

These resources provide further reading to deepen your understanding of Term Life Insurance and help you make informed decisions when purchasing or managing your policy.

Key Takeaways

- Term Insurance claims can be rejected even after five years if there was non-disclosure of information, missed premium payments, or if the claim falls under policy exclusions.

- Honesty during the application process is crucial to avoid claim rejections later. Disclosing all health and lifestyle details is essential.

- Premium payments must be timely to prevent policy lapses. Setting up reminders or automatic payments can help ensure your Term Life Insurance Plan stays active.

- Understanding policy exclusions helps prevent surprises. Review your Term Life Insurance Plan regularly to ensure it meets your needs and covers your circumstances.

- You can compare Term Life Insurance Rates and quotes online to find the best plan that suits your budget and future financial goals.

- Canadian LIC provides expert guidance to help you navigate the process of buying, maintaining, and adjusting your Term Life Insurance to avoid issues with claim rejection.

Your Feedback Is Very Important To Us

We value your feedback and want to understand your concerns about Term Life Insurance in Canada. Please take a few moments to answer the following questions.

Thank you for sharing your thoughts with us! Your feedback helps us better understand the struggles Canadians face regarding Term Insurance and claim rejections.