- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

- What Is the Maturity Period of Term Insurance?

- Understanding the Uses of a Term Insurance Calculator

- What Is Underwriting in Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- How Do You Choose Term Insurance?

- Can You Cash Out a Term Life Insurance Policy?

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- Can Riders Be Added To Term Life Insurance?

- What Are Riders in Term Life Insurance?

- Types of Riders Available for Term Life Insurance in Canada

- Why Should You Consider Adding Riders to Your Term Life Insurance Policy?

- How to Add Riders to Your Term Life Insurance Policy

- Real Struggles and Solutions

- Comparison Table: Standard Term Life Insurance vs. Term Life Insurance with Riders

- How Canadian LIC Can Help You Customize Your Policy

- More on Term Life Insurance

Can Riders Be Added To Term Life Insurance?

By Harpreet Puri

CEO & Founder

- 11 min read

- December 19th, 2024

SUMMARY

The blog explains the significance of attaching riders to Term Life Insurance in Canada, making them more comprehensive and flexible as per the individual’s requirements. It describes different types of riders, such as critical illness, accidental death benefit, waiver of premium, child term, spousal, and return of premium riders, with their features and benefits. Real-life examples of Canadian LIC’s clients exemplify how riders offer security in trying times. Also under discussion in the blog are considerations such as what it costs and whether it is suitable to add riders, with the rider making Term Life Insurance an investment that proves versatile and cost-effective at once. Frequently asked questions involve processing how to add or take riders off, comparing Term Life Insurance Quotes Online, choosing the right riders, etc. Readers are encouraged to work with experienced Term Life Insurance Brokers such as Canadian LIC to create customized policies for comprehensive protection and peace of mind.

Introduction

People think Term Life Insurance is pretty simple. You choose a policy, pick a term, and buy coverage. Life isn’t always that predictable. Many Canadians wonder if their Term Life Insurance policy can grow with their needs. They may ask questions like, “Can I add more protection for my family?” or “What if I need to cover specific situations?

” are common concerns. This is when riders come into the playing ground, giving you flexibility so you can customize your investment on Term Life Insurance. Let’s delve into how riders can be applied to Term Life Insurance in Canada, how it really works, and why they’ll be necessary for you as well as your family.

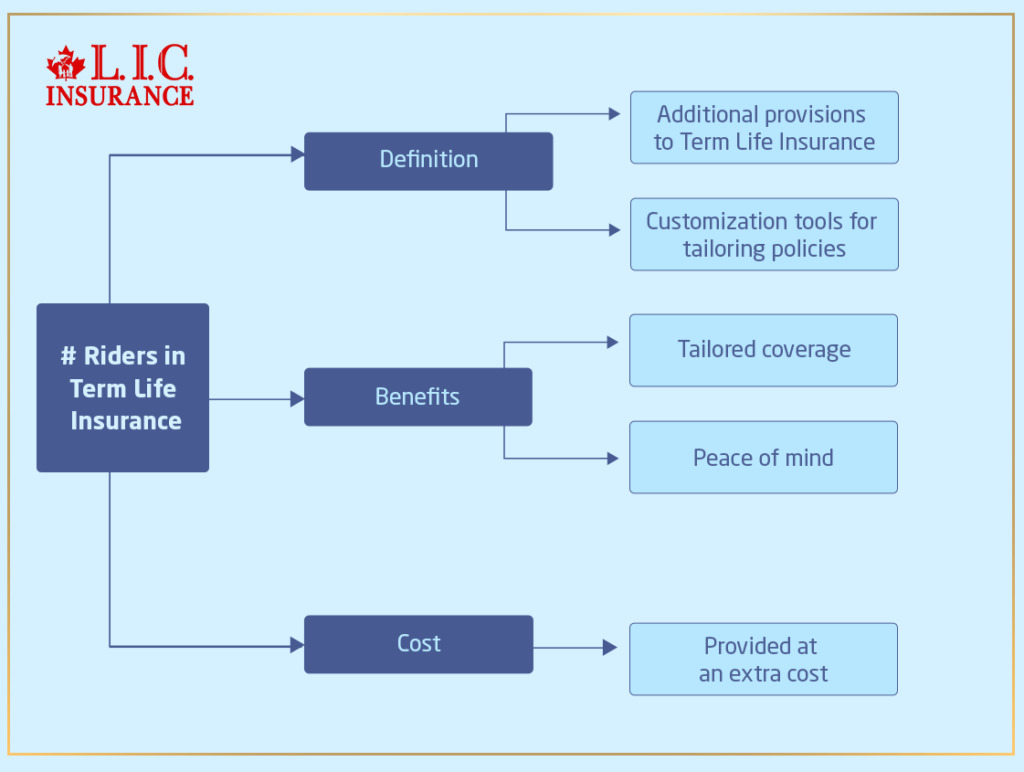

What Are Riders in Term Life Insurance?

Riders are additional provisions or riders that you can add to your Term Life Insurance. They are in the form of customization tools for tailoring a policy according to your particular needs. These are provided at extra cost but give peace of mind due to the closing of potential gaps in coverage.

For instance, we recently had a young couple in Toronto. They initially bought a basic Term Life Insurance policy but realized that they needed more than that. Canadian LIC’s expert advisors guided them in adding a child term rider to their policy so that their kids would be protected in case of unexpected events.

Types of Riders Available for Term Life Insurance in Canada

It is important to understand the available types of riders so that informed decisions are made over your Term Life Insurance in Canada. Every rider will add one more layer of customization for your policy to be a better fit for your personal needs and goals. Moving forward, let’s examine the most common Life Insurance riders that Canadians select to enhance Term Life Insurance.

Accidental Death Benefit Rider

The accidental death benefit rider gives out an additional payout in case the policyholder dies from an accident. It is very important to those in high-risk professions like construction, aviation, or emergency services as it provides financial security for their families. It also proves to be useful for frequent travellers who may face higher risks during their travels.

One of the clients from Alberta who was working in the oil industry once told us how this rider helped ease their minds. They were involved in work that was inherently dangerous, and they wanted to ensure their family would get extra financial support in case an accident occurred. This added rider made their Term Life Insurance Investment not only practical but much more comprehensive as well.

Child Term Rider

Many parents will probably worry about how they can manage their finances if something fatal happens to their children. The child term rider expands insurance coverage to your children so they can have money set aside to pay for funeral expenses or other unexpected expenses.

One of the biggest advantages of this rider is its affordability. Instead of purchasing a separate policy for your child, the child term rider can be added to your Term Life Insurance in Canada for a fraction of the cost. At Canadian LIC, we’ve helped numerous families secure this rider as a way to ensure their entire household is protected.

Critical Illness Rider

Critical Illness Riders are amongst the most in-demand add-ons for Term Life Insurance Policies in Canada. A lump sum payment is made by the rider when an insured develops a covered critical illness like cancer, heart attack, or stroke. These payouts may be used towards medical costs, alternative therapies, or daily expenses to get back on your feet.

A Toronto couple who purchased this rider explained how useful it became when one spouse was diagnosed with breast cancer. The payout helped the family cover many out-of-pocket medical expenses while keeping them on stable financial ground as they were being treated. For many, adding this rider converts their policy into a long-term Term Life Insurance Investment that will help cushion health-related financial crises.

Waiver of Premium Rider

The waiver premium rider waives the premium on your policy if you become disabled and cannot work. So, your insurance will always be active but without contributing to your financial problems during hard times.

A school teacher diagnosed with a long-term disability, living in Vancouver, said how this rider had been a lifesaver when he was not working at all. The Term Life Insurance policy stayed intact to give his family security despite his inability to work. This rider is, therefore, a must-have for anyone who prioritizes financial stability with Term Life Insurance in Canada.

Spousal Rider

The spousal rider lets you bring your spouse under the same Term Life Insurance policy. It is a cheap and convenient alternative for couples who would have otherwise had different insurance coverage combined into one.

Many Term Life Insurance agents advise this rider to couples who want to make things more simple in their financial planning. A couple from Ottawa had realized that adding a spousal rider was more economical than buying two different policies and also easier for coordinating coverage.

Return of Premium Rider

The return of premium rider is for people who see Term Life Insurance as an investment. This rider returns the premiums that you paid over the years if you outlive the term of your policy. This comes at a higher cost, but it is an attractive option for people who do not want their money to “go to waste” in case no claim is made.

A client from Montreal, who was the owner of a small business, took this rider simply because it aligned with the client’s financial goals. In his mind, the premiums were actually savings. They would be left to either leave as a legacy to their families or receive premiums back since they outlived the term.

Disability Income Rider

The disability income rider will provide you with a monthly income if you get disabled and cannot work. It’s a lifeline for those families that rely on just one source of income, and they want to have financial stability in case something unforeseen happens.

One young professional in Calgary told me that this rider was their “financial safety net.” After being temporarily disabled from a skiing accident, the monthly income helped them pay for their mortgage and other necessary expenses. It is very attractive to individuals looking for an all-inclusive Term Life Insurance Investment to secure their income and future.

Long-Term Care Rider

Another relatively new add-on, the long-term care rider, covers expenses incurred on long-term care services when you become incapable of conducting independent daily activities, such as bathing, dressing, or even eating.

This rider can then make Term Life Insurance in Canada a very useful tool for an older individual or someone with a family history of degenerative conditions by ensuring financial support in old age. Although not that commonly discussed, its benefits are definitely undeniable for those planning their future health-related challenges.

Adding riders to your term policy will make it a much more flexible and customized plan to meet your needs. Be it extra financial protection, easy coverage for the family, or simply the ability to transform Term Life Insurance Quotes Online into a completely personalized plan, the flexibility that these riders provide is unparalleled. The expert brokers at Canadian LIC guide the clients in finding the right options, thus making sure that Term Life Insurance becomes as effective as well as comprehensive as possible.

Why Should You Consider Adding Riders to Your Term Life Insurance Policy?

Adding riders to your policy is not just about extending the coverage but preparing for unknown situations in life. Life Insurance riders work to respond to specific concerns without buying different policies.

A recent example would be a client that was recently approached. A single mother living in Calgary wished to provide for her children’s financial security, even in the event of her being hospitalized. She added the child term rider and the critical illness rider, thereby having a safety net for her family. This would not have been possible if she had only the basic Term Life Insurance.

Cost-Effectiveness

Instead of having a different policy for every need, riders let you combine several benefits into one Term Life Insurance policy. Often, this method saves money and is fully comprehensive.

Flexibility

As life is constantly evolving, so should your insurance. Riders present you with the flexibility of changing your policy to overcome new challenges: having a child, changing jobs, or addressing health concerns, for instance.

Peace of Mind

Knowing that your insurance policy would cover a lot of contingencies is quite relieving. Be it a waiver rider against a premium rider when disability occurs or a spousal rider to ascertain that your spouse is kept secure, riders give you enough confidence while planning for the long term.

How to Add Riders to Your Term Life Insurance Policy

The procedure to add riders on Term Life Insurance is not complicated but definitely requires the advice of an insurance broker who is aware of everything about the insurance. The renowned Canadian LIC has helped numerous Canadians get individual solutions for their life goals.

Evaluate your current life stage, responsibilities, and potential risks. A young parent may have a child term rider; for example, someone in a hazardous profession may consider an accidental death benefit rider.

Term Life Insurance Brokers work with you to ensure you understand the options. Brokers will clarify costs, benefits, and limitations so that you can make an informed decision.

Most riders or terms are not alike; there is a need to understand the fine print of your policy. It helps in compatibility and eliminates any surprises later on.

As your life is changing, review your coverage to ensure it still works for you. Most of the riders can be included at the time of purchase and also when renewing policies.

Real Struggles and Solutions

Many Canadians face challenges when deciding on riders for their Term Life Insurance Policies. Here are some relatable scenarios and how Canadian LIC has addressed them:

Case 1: Securing a Family’s Future

A family in Mississauga was really intimidated by the cost of having different policies for each member of their family. With advice from Canadian LIC, they selected a spousal rider and a child term rider; they then consolidated all of these needs into one policy, which saved them money and was also very comprehensive.

Case 2: Preparing for Health Risks

The Edmonton small business owner was apprehensive about adding additional riders for reasons of budget concerns, but once he discussed how a critical illness would impact his business, he added the rider. His decision proved prudent since it put him in an ideal state financially during recovery.

Case 3: Overcoming Disability

A professional from Halifax added the waiver of premium riders to his policy, following the advice of his colleague, who suffers from a disability in Halifax. While he found himself in similar situations, it allowed him not to increase the cost of maintenance for that particular coverage but to retain his coverage.

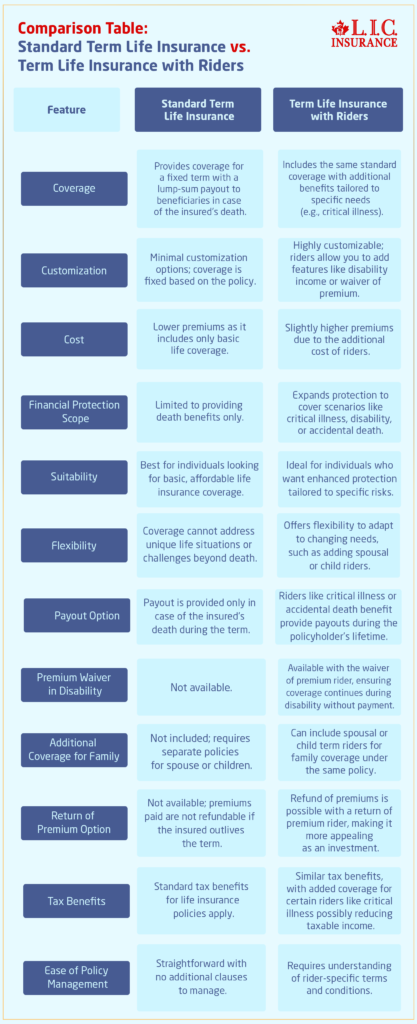

Comparison Table: Standard Term Life Insurance vs. Term Life Insurance with Riders

How Canadian LIC Can Help You Customize Your Policy

The personalized approach that the Canadian LIC uses stands out. They realize that everyone’s needs are unique, and they are doing all they can to offer them unique solutions. From online quotes on Term Life Insurance to riders and other nuances, Canadian LIC makes sure you know enough to make confident decisions.

Their brokers will take time to understand your situation and explain the best options that could suit your family or business. They ensure that if you’re looking at a Term Life Insurance Investment for the first time or want to improve your existing policy, you’ll have all the necessary expertise in place.

More on Term Life Insurance

- Why Not Buy Term Life Insurance From Banks?

- What Is The Difference Between Term Insurance And Group Term Insurance?

- Is There 10-Year Term Life Insurance?

- Does the Term Life Cover Accidental Death?

- Is Buying a Term Plan Online Safe?

- When Does Term Life Insurance Payout?

- Who Should Not Get Term Life Insurance?

- What Is the Maximum Limit in Term Insurance?

- What Are the 4 Types of Term Life Insurance?

- Can a Child Be the Owner of a Term Life Insurance Policy?

- Which Is Better, Term Insurance or SIP?

- What types of death are not covered in Term Insurance?

- Can I Pay Term Insurance Monthly?

- Pros and Cons of Buying Term Life Insurance Plans

- Can Term Life Insurance Be a Business Expense?

- What Happens When Term Life Insurance Expires?

- What Happens After 20 Years of Term Life Insurance?

- Can Term Life Insurance Be an Investment?

- Term Life Insurance Plan for All Age Groups

- What Does It Mean to Buy Term & Invest the Difference?

- How Do You Calculate Term Insurance Value?

- Why Is Term Life Insurance with a Return of Premium Option Not the Best Risk Coverage for You?

- Group Term Life Insurance & Individual Term Insurance: Know the Details

- What Is the Claim Period for Term Life Insurance?

- Can I Convert My Term Policy to Whole Life?

- Can You Use Term Life Insurance to Pay Off a Mortgage?

- Do Term Life Insurance Plans Offer Cash Value?

- What Happens to Term Insurance If the Nominee Dies?

- What Is the Shortest-Term Life Insurance Policy?

- What Is the Cheapest Term Life Insurance for Seniors Over 70?

- Who Benefits from Term Life Insurance?

- Can Term Insurance Be Rejected After Five Years?

- What Is the Longest Term Life Insurance?

- Does Term Insurance Automatically Renew?

- Can you extend a 20-Year Term Life Policy?

- Do I Get Money Back from Term Life Insurance?

- Can You Cash Out a Term Life Insurance Policy?

- Should Both Husband and Wife Get Term Life Insurance?

- What Is Underwriting in Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- What Is the Maturity Period of Term Insurance?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2024)

- At What Age Should You Stop Buying Term Life Insurance?

- What are the advantages of Short Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Do You Buy Term Life Insurance?

- What Is the Main Disadvantage of Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- How Do You Choose Term Insurance?

- What’s the Longest Term Life Insurance You Can Get?

FAQs About Adding Riders to Term Life Insurance in Canada

Absolutely; most Term Life Insurance plans have riders. These are the optional add-on benefits meant to make your coverage stronger, protecting you in case the unfortunate happens and giving you even greater protection customized according to your needs. It is the same thing we often do when recommending riders here at Canadian LIC: helping make the investment more worthwhile.

A rider is another benefit which can be added or used to customize your basic Term Life Insurance. For example, you can add the critical illness rider so that when you are diagnosed with an illness that is covered by the rider, you receive financial support. Our clients often select the rider for Term Life Insurance in Canada so that the package becomes more comprehensive.

An additional option on another rider, which can either add to or be used on a customized basic Term Life cover, is a rider. Consider, for instance, how the critical illness rider enables someone to get financial support whenever they are diagnosed with any such illnesses. Therefore, many of our customers in Canada order a rider for term insurance so that more would have such a package.

This lump sum amount from a critical illness rider will help you with some medical bills and other expenditures when you suffer from an illness such as cancer, heart attack, or stroke. This type of security will ensure the ability to pay for some of those medical bills and other costs necessary during recovery. Increasingly, more of these clients do have some family history of diseases, but now they feel that it is all part of the Term Life Insurance Investment process.

Yes, you may add a spousal rider to your Term Life Insurance plan that includes your spouse on the same policy. In fact, this is a more cost-effective and convenient approach for couples. We often encounter couples who benefit from spousal riders because the rider minimizes the requirements for two separate policies with manageable premiums.

The return of premium rider refunds the premiums you’ve paid if you outlive your Term Life Insurance policy. Although more costly, it is attractive to consumers who consider term insurance to be an investment. Lots of clients at Canadian LIC appreciate this rider since protection provides a savings element as well.

It caters to the financial requirements if anything happens to the child. It is pretty reasonable to obtain coverage without spending money on a separate child policy. Most families come to us with this child term rider in place since they need that extra safety net against any unexpected outlays.

This will prevent you from the premium payments if you become disabled and cannot work. Of the more practical riders, we highly recommend those of you with genuine concerns regarding keeping a policy active when things seem otherwise impossible; this certainly helps maintain the coverage. A client from Vancouver shared how this rider helped them keep their policy active after facing a disabling condition.

Yes, most Term Life Insurance Brokers allow you to add or remove riders once you have purchased your policy. However, some of the riders might require more underwriting. We advise you to review the policy with Canadian LIC to ensure it meets your goals.

The good thing is that riders’ availability differs across providers. Some will be extremely wide-ranging, while others could be more limited. Make sure you get advice from highly professional Term Life Insurance Brokers in order to settle for the right one.

Your specific needs and monetary goals determine which riders best suit your Term Life Insurance. An example of a dependent might find a child term rider valuable for their dependents. Anyone who is concerned about an illness they might experience benefit greatly from a critical illness rider. Canadian LIC regularly helps clients identify which riders add the most value to their Term Life Insurance in Canada.

Adding riders does raise your premiums, but it softens significantly less than buying a separate policy for the same benefits. Many clients feel this is an inexpensive means of building a comprehensive Term Life Insurance Investment.

If you do not attach a rider, then the benefit from the rider expires when the term ends. But attaching a return of premium rider makes you eligible to receive a refund for your premiums. This feature is really very attractive for those wanting some added value from the Term Life Insurance Investment.

Yes, Term Life Insurance Quotes Online usually include options for customization of policies with riders. When comparing quotes, you should know the costs and benefits of adding specific riders, which is something we help clients with at Canadian LIC to make sure they get the most value.

Canadian LIC is acknowledged for their expertise in helping customers tailor Term Life Insurance Policies to their specific needs. We make you aware of your options and thus allow you to choose your riders wisely. With us, you can turn your Term Life Insurance Investment into a thorough safety net for your future.

These FAQs address common questions that point out how the riders add to making your Term Life Insurance in Canada much more effective. When looking forward to enhancing the policy, working with well-known Term Life Insurance Brokers such as Canadian LIC can help one get started.

Understanding the functionality of riders and using consultations from Canadian LIC expert brokers, it will be possible to have standard Term Life Insurance turn out into a full-fledged security blanket for you and your family. Do not depend on chance and what fate may bring for you: take control of Term Life Insurance Coverage for yourself today.

Sources and Further Reading

- Canada Life – Learn about Term Life Insurance and available riders in Canada.

https://www.canadalife.com/insurance/life-insurance/what-are-life-insurance-riders.html - Manulife – Explore Term Life Insurance products and optional riders for Canadians.

https://www.manulife.ca/personal/insurance/our-products/life-insurance/term-life-insurance.html - TD Insurance – Insights into Term Life Insurance Policies and add-ons like riders.

https://www.td.com/us/en/investing/insights/term-life-insurance - Equitable Life of Canada – Understanding the benefits of riders with Term Life Insurance.

https://cdn.equitable.ca/forms/unsecured/insurance/Term-rider-admin-guide.pdf - Canada Revenue Agency (CRA) – Tax implications of Term Life Insurance in Canada.

https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/it87r2/archived-policyholders-income-life-insurance-policies.html

Key Takeaways

- Riders Enhance Term Life Insurance: Riders are optional add-ons that customize your Term Life Insurance in Canada, offering additional coverage tailored to your needs.

- Popular Riders Include: Critical illness, accidental death benefit, waiver of premium, child term, spousal, and return of premium riders, each serving specific purposes.

- Cost-Effective Protection: Adding riders is often more affordable than purchasing separate policies, making your Term Life Insurance Investment more valuable.

- Customizable Coverage: Riders like the critical illness and disability income options provide financial security for unexpected health or income-related challenges.

- Suitability is Key: Not all riders are necessary for everyone. Assess your needs and consult Term Life Insurance Brokers to make informed decisions.

- Work with Experts: Canadian LIC offers personalized guidance, helping you explore Term Life Insurance Quotes Online and choose riders that align with your goals.

Your Feedback Is Very Important To Us

We’d love to hear about your experience and struggles regarding Term Life Insurance as a potential business expense. Your feedback will help us better understand your concerns and provide tailored solutions.

Thank you for your time and valuable feedback! We’ll review your responses and, if requested, get back to you with tailored solutions.

IN THIS ARTICLE

- Can Riders Be Added To Term Life Insurance?

- What Are Riders in Term Life Insurance?

- Types of Riders Available for Term Life Insurance in Canada

- Why Should You Consider Adding Riders to Your Term Life Insurance Policy?

- How to Add Riders to Your Term Life Insurance Policy

- Real Struggles and Solutions

- Comparison Table: Standard Term Life Insurance vs. Term Life Insurance with Riders

- How Canadian LIC Can Help You Customize Your Policy

- More on Term Life Insurance