As a parent, you might be worried that your child’s is even growing faster than the rate of inflation that you hear about every night on the news. To give your child the best possible schooling that will help them get a good job, you’ve been putting money into a RESP. However, life often throws unexpected obstacles. Suddenly, losing your job, getting sick, or the cost of living going up could be the reason you are fighting to pay your rent every month as if every dollar were running out like water. This situation leaves many parents wondering: “Can my RESP funds be used for rent?” It makes sense to ask, especially when you are having a hard time with money and every dollar counts. In this blog, we examine the adaptable nature of a RESP, determining whether these funds can be used to cover rent and other living expenses during difficult circumstances. We will talk about some of these common money problems by sharing real stories from families. We will also talk about the rules for spending money in a RESP and how RESP providers can help you make some tough choices. Come along with us as we show you how an educational tool also has the potential to act as a lifeline when you least expect it!

Can RESP Be Used for Rent?

Understanding The Basics First

Even before we consider how you could pay for rent with RESP money, let us get a good understanding of what an RESP is. In Canada, a Registered Education Savings Plan (RESP) is a government program designed to help parents — and others — save for their children’s post-secondary education payments. With an RESP, the real advantage is tax-deferment and government grants that boost your savings. However, the main aim of these plans, which are run by Registered Education Savings Plan Providers, is to achieve financial accounting for an educational venture.

The RESP Usage Guidelines

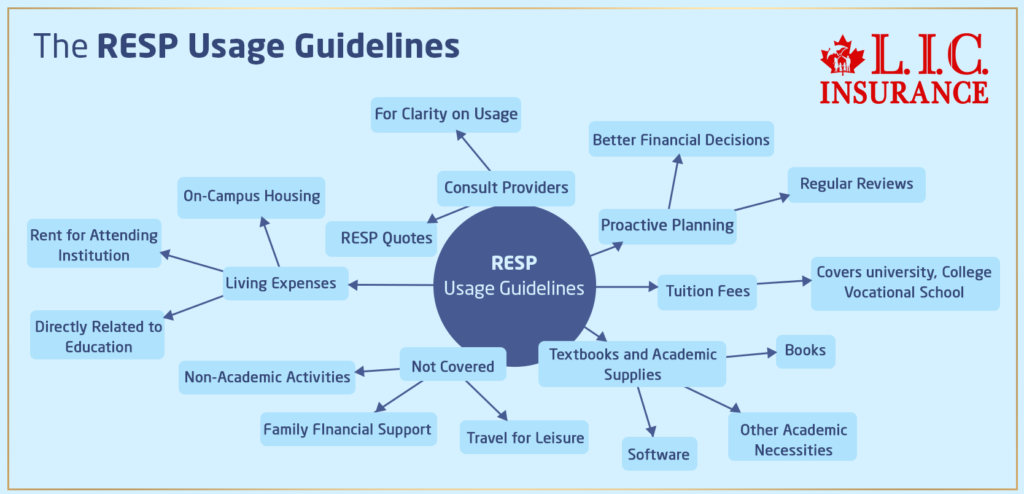

Sometimes, it seems like an impossible task to figure out what funds from a Registered Education Savings Plan (RESP) can be used for. Here’s an interesting listicle that breaks down the RESP rules so you can understand how to use this money-saving tool to help pay for your child’s schooling in the best way possible.

Tuition Fees: The Foundation of RESP Use

First and foremost, RESPs are designed to cover tuition fees. This is the most straightforward use of the funds. Whether your child attends a university, college, or vocational school, these funds are there to ensure tuition isn’t a barrier. For instance, consider the story of the Nguyen family, who used their RESP to cover all four years of their son’s engineering degree at the University of Toronto. Their proactive discussions with Registered Education Savings Plan Providers ensured they maximized every dollar saved, making the journey smooth and stress-free.

Textbooks and Academic Supplies: Essential Tools for Success

Next up are textbooks and other academic necessities, which can surprisingly accumulate to a hefty sum over the course of an education. RESPs can effectively ease this burden. Imagine Sarina, a graphic design student whose specialized textbooks and software could have derailed her budget if not for her RESP. By using her RESP funds, she could afford all her essential tools without compromise.

Living Expenses Directly Related to Education

Here’s where it gets a bit trickier. RESPs can cover living expenses, but only those directly related to education. This means if your child is renting an apartment to attend college or university, RESP funds can be used to pay that rent. For example, when Jamal moved to Vancouver for his Masters at UBC, his parents used his RESP to help pay for his on-campus housing, ensuring his focus remained on his studies rather than financial worries.

Rent – When Is It Eligible?

As mentioned, rent can be covered if it’s directly related to education. This doesn’t extend to paying the mortgage on your family home or covering a sibling’s rent. Let’s talk about Maya, who studied culinary arts in Montreal, living away from her hometown. Her RESP helped cover her rent, which was crucial in a city with high living costs. This strategic use of the RESP not only supported her education but also taught her valuable lessons in financial independence.

Limits and Boundaries: What RESP Doesn’t Cover

Understanding what RESPs don’t cover is as crucial as knowing what they do. For instance, casual expenses like travel for leisure, non-academic activities, or supporting family financial struggles are not covered. Chen family mistakenly thought they could use RESP funds to cover emergency repairs on their home. A quick consultation with their RESP provider clarified these boundaries, saving them from potential legal and financial repercussions.

Consulting with Providers for Clarity

When in doubt, it’s always wise to consult directly with Registered Education Savings Plan Providers. These experts can offer a RESP Quote and guide you through the specifics, ensuring you utilize the RESP within legal and practical boundaries. Thompsons initially struggled to understand how they could use their RESP. A detailed meeting with their provider laid out a clear, strategic use of the funds, aligning perfectly with their daughter’s educational path and needs.

Proactive Planning: Making the Most of Your RESP

Lastly, proactive planning with your RESP can make a significant difference. Understanding the scope and limitations early on allows for better financial decisions and ensures that the funds serve their intended purpose effectively. Consider setting up regular reviews of your RESP investment with your provider to keep on top of how best to use these funds as your child’s educational journey evolves.

By understanding these guidelines and preparing accordingly, you can ensure that your child’s education is well-funded and their future is secure. Engage with your RESP provider regularly and make informed decisions that will help pave a smooth educational path for your child. Remember, every step you take now is a step toward your child’s successful future.

The Anderson Family’s Story

Getting a Clear Picture: Contacting RESP Providers

When in doubt, speak directly with your RESP provider. If the description fits you, get a RESP Quote, or ask these experts for more information on using your money. This is why so many families turn to this frank counselling. One example: the Andersons received advice about allocating Emily’s RESP payouts while she was in school, which helped them make those dollars go as far as they could.

Making the Most of Your RESP

Planning for the Unexpected

Life’s twists and turns make it essential to have a financial safety net, especially when it involves your children’s future education. If you’re contributing to a Registered Education Savings Plan (RESP), understanding how to allocate these funds strategically can be crucial. Here’s actionable advice on planning for the unexpected while ensuring your RESP remains a solid foundation for your child’s educational institutions expenses.

Understand the Flexibility of Your RESP

First things first, grasp the flexibility that your RESP offers. While primarily for educational expenses, knowing exactly what counts can save you a lot of headaches. For instance, did you know that RESP funds can cover more than just tuition? They also cover textbooks, specific supplies, and yes, even rent—if it’s directly related to schooling. Always check with your Registered Education Savings Plan Providers for a comprehensive breakdown of allowable expenses. Their insights can help you avoid missteps and make informed decisions.

When the Martins faced unexpected medical expenses, they initially thought about dipping into their RESP. A quick consultation with their provider clarified that while they couldn’t use the funds for medical bills, they could adjust their daughter’s college budgeting to maximize her living expense allowance, thus freeing up other funds for their immediate needs.

Budget Proactively for Education-Related Living Expenses

Plan ahead by setting aside a part of your RESP specifically for education-related living expenses like rent. This is particularly important if your child plans to study in a city with high living costs. Budgeting this way ensures that you won’t scramble to cover rent when your child needs a stable living situation the most.

The Thompson family saved aggressively in their RESP but didn’t plan for high rental costs in Toronto. They had to adjust their budgets drastically when their son started university. Learning from this, they now advise new RESP contributors to estimate living costs early and consider them in their RESP contributions.

Keep Regular Tabs on Your RESP Contributions and Performance

Monitoring the performance and contributions of your RESP can help you stay on top of your financial goals. Set regular check-ins—perhaps annually or biannually—to review how your investments are performing and decide if you need to adjust your strategy.

Seema, a single mother, sets reminders to check her RESP status every six months. This routine helped her catch a calculation error that, if unnoticed, could have cost her a significant amount in missed government grants.

Explore RESP Contribution Matching and Grants

Make the most of government matching programs like the Canada Education Savings Grant (CESG), which matches up to 20% of your contributions, to maximize your RESP’s value. Understanding these opportunities lets you plan your contributions to ensure you get the maximum possible benefit.

The Lee family wasn’t aware of the additional grants available for lower-income families until they discussed it during an RESP Quote session. After learning about it, they adjusted their contributions to qualify for the maximum grants, which significantly boosted their RESP funds.

Establish an Emergency Fund Separate from Your RESP

While it’s tempting to pour all available resources into an RESP, it’s wise to maintain a separate emergency fund. This ensures that you don’t need to compromise your child’s education fund during unexpected financial difficulties.

The Patel family learned this the hard way when they had to withdraw money from their RESP prematurely, incurring penalties and taxes to cover an urgent home repair. Now, they keep a separate emergency fund, which has already saved them from making similar withdrawals twice.

Engage and Revisit Your Financial Strategy with RESP Experts

Lastly, maintain communication with your RESP provider or financial adviser. This advice is like gold dust—invaluable when you consider the financial sector’s minefield of ever-changing regulations. A professional advisor can provide you with guidance on your specific financial conditions and objectives.

Every year, Emily reaches out to her RESP provider to talk about where they are financially as a family. By continuing the conversation, her RESP strategy is continuously adjusted so that it best suits her family while still making use of every last penny possible to maximize whatever educational contributions she can for her son. Being proactive in these steps can help to cover your child’s education costs while still providing options through the RESP during financial hardship. Learn more, prepare better, and communicate with your RESP providers to discover their strong suit for funding your kid’s education easily.

Tips from Experts and Parents

It can be hard to keep your finances in order, especially if you are also trying to save for your child’s college education. With advice from parents who have been able to juggle both their Registered Education Savings Plan (RESP) and an emergency fund, the following points give you real tips that work. They have given their honest advice, which you can use. Each tip includes strategies from RESP providers as well as tried-and-true advice to make sure you can still break even with your money and not go broke trying to pay for your child’s college education tomorrow.

Establish a Clear Budget

Begin by separating your RESP contributions from your general savings. A clear budget helps you visualize where your money is going and ensures that funds designated for education are used exclusively for that purpose.

Meenakshi, a mother of two, uses a simple spreadsheet to track her monthly expenses and savings. She allocates a specific portion of her income to her RESP and another part to an emergency fund. This method helped her stay organized when she unexpectedly needed to repair her home’s roof without dipping into her children’s education funds.

Understand the Flexibility of Your RESP

Contact your Registered Education Savings Plan Providers to get detailed information on what expenses your RESP can cover. This knowledge can be crucial, especially when you need to plan for your child’s housing or other educational-related expenses.

When John’s daughter moved to another city for university, he was initially unsure if her RESP could cover her off-campus rent. After consulting with his RESP provider, he received a detailed RESP Quote that clarified the costs covered, allowing him to budget accordingly without any surprises.

Prioritize Contributions Based on Changing Circumstances

Life changes, and so should your savings strategy. Experts recommend reviewing and adjusting your savings plan annually or whenever there’s a significant change in your financial situation.

After the birth of their second child, Sarah and Tom reassessed their financial commitments. They adjusted their RESP contributions to reflect their new budget, ensuring that both children’s educational futures were secure while still contributing to their emergency savings.

Encourage Family Contributions to RESPs

To boost your RESP savings, encourage contributions from family members, such as grandparents, during special occasions instead of traditional gifts. This not only enhances the fund but also involves the family in the child’s future education.

Every year, for her son’s birthday and holidays, Lina asks relatives to consider contributing to his RESP instead of buying toys. This has substantially increased the savings, providing more security for her son’s educational prospects.

Educate Yourself on RESP Withdrawal Rules

Understanding the rules for withdrawing from your RESP can save you from potential taxes and penalties. Knowing when and how much you can withdraw will help you use the funds efficiently when the time comes.

Kevin, who thought he could use the RESP for non-educational emergencies, faced penalties for an unauthorized withdrawal. After this, he educated himself on the RESP rules to avoid future financial setbacks.

Prepare for Emergencies without Compromising Education Funds

Always have a plan for emergencies that does not involve your child’s RESP. This might mean setting up a separate high-interest savings account or a line of credit that you can access when needed without impacting your long-term savings goals.

Naomi experienced a major car breakdown, and thanks to her separate emergency fund, she could cover the repairs without tapping into her daughter’s education savings. This ensured her daughter’s RESP remained intact and continued to grow.

To Sum Up

It’s true that a RESP is mostly used for higher education expenses, but knowing that it can also be used for rent can help you plan better. If you are in the middle of a savings journey or even just starting your path to accumulate this valuable reserve, always remember that knowledge and preparation can make all the difference. If you are lost on the RESP system and need to know how to go about it or simply need some insight into what is ideal for your situation, feel free to contact the best insurance brokerage in Canada: Canadian LIC. They will offer you advice tailored to your specific circumstance, and RESP Quotes that match how much money you want in the end. Do not allow temporary challenges to throw off your long-term planning. Take action now, consult with a professional, and make sure your RESP is on track to fulfill its mission of funding your child’s education despite whatever life may bring.

Find Out: The disadvantages of RESP

Find Out: What is the RESP Limit?

Find Out: How to withdraw money from RESP?

Find Out: Does an RESP beneficiary need to live in Canada?

Find Out: How to check RESP in Canada?

Find Out: Can you transfer an RESP to an RRSP?

Find Out: RESP Importance

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions About RESP Usage

The following are some common FAQs about Registered Education Savings Plans (RESPs) which can give you a clear picture of how to manage and make the best out of RESP funds:

RESP stands for Registered Education Savings Plan, a type of tax-advantaged investment account Canadian parents can open to build savings for their child’s post-secondary education. Donor pays into the plan, and all contributions only increase until the beneficiary is ready for further education. In that case, the money is paid back and used by the student to help pay for education costs. You can think of it as a sum that changes the course of your life to pay for your child’s education.

RESP funds can be used to pay for rent, but the rent must directly tie into the beneficiary’s education. An RESP will pay for your child’s apartment rent if he has to move out of town because he goes to a university or someplace else, But it cannot be spent on rental for the family home (if that is where they are staying when the student is attending). The Johnsons used their daughter’s RESP to pay for her apartment in Montreal, where she attended university. This gave her the opportunity to concentrate on her university studies instead of worrying about living costs.

You need to contact your providers of Registered Education Savings Plan for RESP Quote. They provide you with a quote based on the amount you have saved already, how old your child is and what they believe post-secondary will cost. This quote also may assist you with knowing how many more contributions and withdrawals you have in your future.

When the Patel family was planning their budget for their son’s engineering degree, they contacted their RESP provider for a quote. This helped them understand how much they could expect to withdraw each year to cover his tuition and living expenses.

It depends on your individual needs, such as investment options, fees, and customer service for where you will get the best RESP provider. Make sure you do some research and compare several providers to find the best fit for your family cost-wise and educationally. Having explored a number of RESP providers, the Thompsons found one with better fees and greater investment choice that allowed them to make their contributions go further.

If your child does not pursue any post-secondary school, you have a few potential options. You can roll over the RESP money to another child or withdraw your contributions without any penalty (although you will have to give back any government grants, and earnings in the RESP account become taxable). Speak with your RESP provider about these choices.

The Green family had an RESP for their eldest son, who decided not to go to college. They transferred the funds to their younger daughter, ensuring the money was still used for educational purposes.

Yes, RESP funds can be used for online courses if they are part of a program at a designated educational institution. This includes universities, colleges, and certain trade schools. Make sure the online course qualifies under the rules of the RESP.

The Walters family discovered that their son could use his RESP to fund his online computer science program at a recognized university. They contacted their Registered Education Savings Plan Providers, who confirmed their eligibility and helped them plan the withdrawals.

The lifetime maximum amount that can be contributed to an RESP for a beneficiary is $50,000 similar to an TFSA. There are no limits each year on how much you can throw in, but check the total frequently to avoid taking a 1-percent additional tax hit.

The Lee family was planning to deposit a large inheritance into their daughter’s RESP. Before doing so, they sought advice from their RESP provider, who helped them understand that they should not exceed the $50,000 limit, thus avoiding unnecessary taxes and penalties.

Several grants from the Canadian government are available to bolster RESP contributions, but the most common one is the Canada Education Savings Grant (CESG). This grant gives 20% on the first $2,500 contributed per beneficiary annually to a maximum of $500 per year and has a lifetime limit of $7,200.

Singh’s family consumed all RESPs to gain maximum CESG each year. Due to the regular updates from their provider on available grants and how much they had contributed, th

RESP funds may be used to pay for housing costs when the student is enrolled in a full-time program of study at an educational institution and qualifies for the education amount on line 320 in his or her own tax return. This is considered an acceptable educational cost.

Maria decided to study architecture in Italy. Her parents were concerned about the costs but were relieved to learn from their RESP provider that her RESP funds could cover her accommodation expenses.

RESP EAPs (Early Access Payments) are meant for school-related uses. If you need to withdraw early for another reason, it’s worth having a chat with your RESP provider so that they can explain the effect of this type of withdrawal, such as penalties and tax implications.

The Howard family were struggling financially and they considered accessing their saved cash prior to retirement. The RESP provider told them the special circumstances under which they could withdraw their contributions without penalty, and what would happen on a non-educational withdrawal.

When RESP funds are withdrawn for education, the contributions are tax-free (you have already paid taxes on that money when you earned it). When the student withdraws funds in his or her name, EAP (earnings and govt grants) are taxable to him. It should be a small amount since students have limited incomes anyway.

When the daughter of the Nguyen family went to college, she was really afraid of the tax consequences of their RESP withdrawals. Their RESP provider also explained that taxation only applies to the EAPs and urged them to plan their withdrawals so that Ellie would pay fewer taxes, which would restrain her from fear during the transaction.

If the RESP is not used for school, you have to return both the grants and bonds back to the government (if any) and earnings made from investments in an RESP are taxed plus an additional penalty. But the good news is that contributions are always available for withdrawal without penalty.

When their son decided not to go to college, the Mitchell family was worried about the penalties on their RESP savings. They contacted their RESP provider, who explained how they could withdraw their contributions without penalties and helped them understand the tax implications for the remaining funds.

Don’t forget that the RESP is hard to understand and that everyone has a unique case. Talking to a RESP provider is a good idea because it will help you learn as much as you can. If you have more questions or need personalized advice, don’t hesitate to reach out to Canadian LIC. They are there to help you ensure that your child’s educational future is as bright as possible.

Sources and Further Reading

To deepen your understanding of the Registered Education Savings Plan (RESP) and its use for various expenses, including rent, consider exploring the following resources:

Canada Revenue Agency (CRA) – RESP Official Guide

Visit the CRA website for comprehensive details on RESP rules, contributions, withdrawals, and taxation.

Employment and Social Development Canada (ESDC) – RESP and Grants Information

ESDC provides extensive information about the different grants available through RESPs, such as the Canada Education Savings Grant (CESG) and how they can be utilized.

Financial Consumer Agency of Canada – Choosing an RESP Provider

This resource offers guidance on selecting RESP providers, comparing plan features, and understanding fees and investment options.

FCAC – Choosing an RESP Provider

The Globe and Mail – Article on RESP Strategies

Check out various articles discussing strategies for maximizing your RESP investments and using the funds effectively for education-related expenses.

The Globe and Mail – RESP Strategies

Investopedia – RESP Explained

A comprehensive guide to how RESPs work, including detailed explanations of withdrawal rules, contribution limits, and tax implications.

These resources will provide you with a deeper insight into how RESPs work, helping you make informed decisions about financing your child’s education while managing your family’s financial health.

Key Takeaways

- RESPs primarily fund post-secondary education expenses, including education-related rent.

- RESP funds can cover rent if the student is living away for studies, but not for general family housing costs.

- Engage with RESP providers to receive personalized information and RESP Quotes on fund usage.

- Knowing RESP withdrawal rules is crucial to avoid penalties and ensure proper fund use.

- Discuss plan management with providers during financial hardships for effective educational planning.

- Government grants like CESG enhance RESP savings, increasing funds available for educational expenses.

Your Feedback Is Very Important To Us

We’re interested in understanding your experiences and struggles with using Registered Education Savings Plans (RESPs) for rent in Canada. Your feedback will help us provide more relevant and helpful information. Please take a moment to answer the following questions:

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]