- Can I work part-time while receiving Disability Benefits?

- Understanding Disability Insurance Policies

- Stories from Canadian LIC

- Can You Work Part-Time While on Disability?

- Key Considerations for Returning to Work Part-Time

- The Role of Canadian LIC

- Common Concerns and Misconceptions

- Real Success Stories

- Tips for a Successful Transition

- The Ending Note

Disability Insurance is a lifeline for many Canadians, providing financial support when illness or injury prevents you from working. But what if you’re feeling well enough to go back to work, even part-time? This is a common question and a dilemma for many. You’re in your mid-30s, have a family to support and bills to pay, and you get diagnosed and are out of work. After months on short term disability, you start to feel a bit better. The urge to get back to some form of work, to get back to normal and contribute financially is strong. But how will working part-time affect your Disability Benefits? Are you going to lose the lifeline you’ve been relying on?

This question isn’t just hypothetical. It’s a daily reality for many Canadians. At Canadian LIC, we’ve seen it firsthand. We’ve heard the stories of courage and perseverance and witnessed the worry and confusion that come with these decisions. Let’s get into this, break it down, and make it real so you get well-informed.

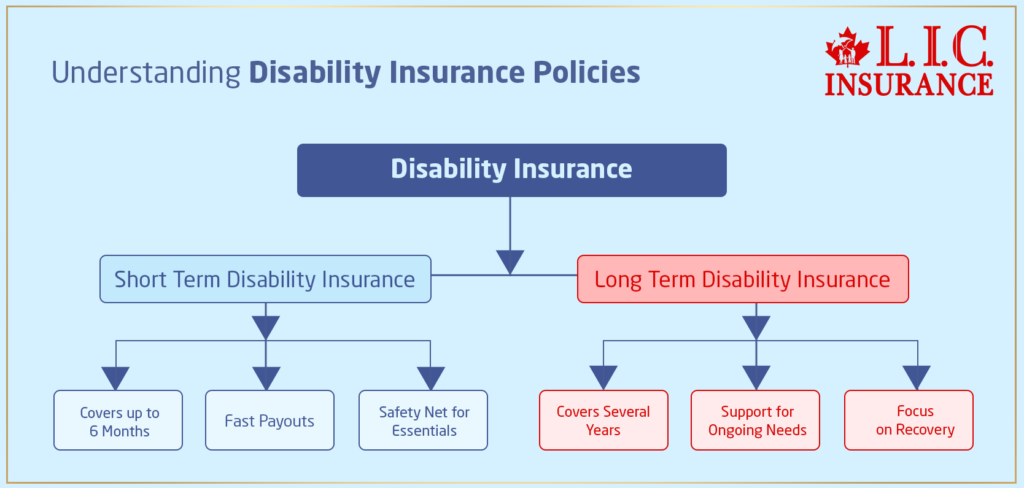

Understanding Disability Insurance Policies

Before we get into the part-time work stuff, let’s cover the basics of Disability Insurance. Disability Insurance in Canada replaces part of your income if you can’t work due to a disability. There are two main types: Short and Long Term Disability Insurance.

Short Term Disability Insurance is for a short period, usually up to 6 months. It’s the bridge that helps you cover your immediate needs as you get back on your feet. Think of it as your safety net while you find your footing again. This type of insurance kicks in fast, so you have funds to cover essentials without touching your savings.

Long Term Disability Insurance covers more. If your disability goes beyond the short-term period, Long Term Disability Insurance kicks in to provide ongoing support. This type of insurance can last for several years or even up to retirement age, so you can focus on getting better.

Stories from Canadian LIC

One of many of our clients at Canadian LIC has been unable to cope with the balance between work and Disability Benefits. Take Shanaya, for example; Shanaya was receiving long-term disability due to her chronic illness. After several months, she began to feel well enough to start looking for part-time work. She wanted to contribute to her household income and feel productive again; however, she was scared that this may affect her benefits.

Shanaya’s story is not unique. We have had many clients come to us with the same kinds of concerns, wondering how their Disability Insurance Policies would treat part-time work. It is always that precarious balance between wanting to feel a little normal again and the caution not to do anything that would undermine the continued need for financial support.

Can You Work Part-Time While on Disability?

The short answer is yes but with conditions. Disability Insurance Policies in Canada do allow for part-time work, but there are specific rules and considerations to keep in mind. Let’s break them down:

Understand Your Policy’s Definition of Disability: Every policy is designed to define what disability actually means. You need this information because definitions can limit your ability to work part-time and continue to receive benefits. Some policies define disability as the “own occupation” definition, which means that you are unable to perform your specific job duties. Others use an “any occupation” definition, meaning you’re disabled if you can’t perform the duties of any job for which you’re reasonably qualified. For example, Shabana’s policy used an “own occupation” definition. That provided her with the flexibility to pursue part-time work in a different role or industry, if she chose, without losing the benefits as long as she couldn’t perform her original job duties.

Report Any Changes in Your Work Status: The rule governing part-time work and disability claims is basic transparency. If you are planning to resume work, even on a part-time basis, you must notify your insurance provider about it. However, failing to report any such change in work status may only lead to complications in your claim, which could place your benefits at stake. Samaira took this advice to heart and contacted Canadian LIC before starting her part-time role. This proactive approach ensured she understood her policy’s guidelines and kept her benefits intact.

Understand the Impact on Your Monthly Disability Benefit: Part-time return to work can impact your benefits based on the income you will have and the terms within your policy. Some policies include a “rehabilitation” or “return-to-work” provision that allows you to earn some income while receiving partial benefits. This approach encourages gradual transitioning back into work, avoiding a leap into the unknown without financial support. Under Saba’s policy, there was a return-to-work provision that permitted her to earn up to a certain percentage of her pre-disability income while continuing to receive partial benefits. This meant she could supplement her income without fear of losing her benefits altogether.

Key Considerations for Returning to Work Part-Time

Understanding the transition from full-time disability to part-time work requires careful consideration and planning. Here are some key factors to keep in mind:

Assess Your Health and Readiness: Before you decide to return to work, you must first make sure you’re healthy enough and that it’s something you can do. Are you physically and emotionally up to handling a part-time job? You can gain insight and wisdom by speaking with your doctor as you consider your options.

Explore Alternative Roles: If the demands of your current job are too high, then other roles or industries can be assessed to see if they fall within your current capacity. Sometimes, this offers a real opportunity for great work in another capacity, well-suited to your health needs. For example, Seema found a part-time role in a less demanding field that allowed her to strike a good balance between work and health. Her new situation provided her with renewed purpose and satisfaction without undermining her well-being.

Communicate with Your Employer: Open communication is key if you are considering returning to your previous employer part-time. Discuss your limitations and your availability, with or without work accommodations in place, in order to effectively perform your job. This will help smooth the transition, which can be very effective and manageable if your employer is cooperative.

The Role of Canadian LIC

At Canadian LIC, we understand the complex nature of the Disability Insurance Policies issued and the options our consumers have to choose from when considering part-time employment. We are committed to giving you personalized guidance and help you so that you make meaningful decisions armed with the necessary information.

We are experienced in working with clients like Sarah to weave through the policy terms, wade through to insurers, and negotiate a seamless reentry into the workforce. Our goals are to assist you in reaching the best possible resolution—one that will balance the wants-to-work instinct with the necessity of financial security for the future.

Common Concerns and Misconceptions

Returning to work while receiving Disability Benefits can be daunting, and misconceptions abound. Let’s address some common concerns:

Fear of Losing Benefits: Many individuals fear that returning to work, even part-time, will result in losing their Disability Benefits entirely. While it’s true that your benefits may be adjusted based on your earnings, most policies are designed to support a gradual return to work without abruptly cutting off benefits.

Confusion About Policy Terms: Disability Insurance Policies can be complex, with varying terms and conditions. It’s easy to feel overwhelmed or confused about what is allowed and what isn’t. At Canadian LIC, we’re here to help you understand your policy, answer your questions, and provide clarity on your options.

Concerns About Health and Well-being: Returning to work too soon can be detrimental to your health and well-being. It’s crucial to prioritize your recovery and only consider part-time work when you feel ready. Your health should always come first, and our team can help you evaluate your readiness and explore suitable work options.

Real Success Stories

Throughout our work at Canadian LIC, we’ve witnessed numerous success stories of clients who successfully navigated the transition to part-time work while maintaining their Disability Benefits. Here are a few examples:

Jignesh’s Journey to a New Career: Jignesh, a client with a background in construction, suffered a severe injury that left him unable to continue in his field. After months of rehabilitation and recovery, he explored a new career path in office administration. With our guidance, Jignesh found a part-time role that accommodated his physical limitations and allowed him to contribute to his household income. His story is a testament to resilience and adaptability, showing that new opportunities can arise from challenging circumstances.

Meena’s Path to Balance: Meena, a single mother, faced a debilitating health condition that made full-time work impossible. With our support, she secured a part-time position in customer service, allowing her to work flexible hours while managing her health. Meena’s story highlights the importance of finding balance and making informed decisions that prioritize both financial stability and well-being.

Tips for a Successful Transition

If you’re considering returning to work part-time while receiving Disability Benefits, here are some tips to ensure a smooth and successful transition:

Educate Yourself: Take the time to understand your Disability Insurance Policy and its specific terms. Knowledge is power, and being informed will help you make confident decisions about your future.

Seek Professional Guidance: Working with an experienced insurance brokerage like Canadian LIC can provide valuable insights and guidance. Our team is here to support you every step of the way, from understanding your policy to exploring new career opportunities.

Prioritize Your Health: Your health should always be your top priority. Before returning to work, ensure that you’re physically and mentally prepared for the demands of a new role. Listen to your body and seek medical advice as needed.

Communicate Openly: Maintain open communication with your insurer, healthcare provider, and employer. Transparency will help you navigate the complexities of part-time work and ensure that your benefits remain in place.

Celebrate Your Achievements: Returning to work, even part-time, is a significant achievement. Celebrate your progress and take pride in your determination to regain your independence and contribute to your household.

The Ending Note

Going from full-time disability to part-time work is a journey with many challenges and opportunities. At Canadian LIC, we understand the intricacies of Disability Insurance Policies and the individual needs of our clients. Our team is here to provide personalized support and guidance so you can make informed decisions that fit your goals and priorities.

Suppose you’re thinking of going back to work while on Disability Benefits don’t go for it alone. Contact Canadian LIC today to explore your options, understand your policy and get the support you need to make the right decisions for your future. We’ll be your partner in financial stability and well-being so you can take the next step with confidence. The road to recovery and independence starts here. Act now and secure your future with the best insurance brokerage in Canada.

More on Disability Insurance

Does Disability Insurance Cover Mental Health Issues?

Is Disability Insurance Taxable?

How to Calculate Disability Insurance?

Why Can’t I Buy Disability Insurance?

Must Know Pros and Cons of Disability Insurance in Canada: A Comprehensive Guide

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQ's About Working Part-Time While Receiving Disability Benefits in Canada

Absolutely! At Canadian LIC, we often see clients wanting to return to work part-time while collecting Short Term Disability Insurance. One of our clients, Emma, wanted to return to work for a few hours a week just so she would feel productive and could maintain some social contacts. It’s essential to check with your own policy to see what limitations or requirements exist within your unique Disability Insurance Policy. Almost any policy will allow some forms of work, so long as you report that income and it doesn’t conflict with the terms under which you’re considered disabled.

This is very common with many of our clients here at Canadian LIC. For instance, Mark was receiving Long Term Disability Insurance due to a back injury. He eventually felt strong enough to return to work part-time as a consultant. The real key here is communication. Partial ability to work or rehabilitation programs are commonly an option in most Long Term Disability Insurance Policies. Provided that you are earning within the allowed limits and still remain disabled as defined by your policy, your benefits may be adjusted based on your earnings, but you won’t lose them outright.

First, you will want to have a discussion with your insurance advisor at Canadian LIC. As we did in the case of our client Lata, who was recuperating from surgery and who was very anxious to return to part-time work, review your Disability Insurance Policy to determine exactly what it states in terms of working part-time. Then, notify your insurance company of your plan to return to work part-time. By doing this, you are fulfilling your obligations under your policy and avoiding any potential problems with your benefits.

Yes, there could be. Your Disability Insurance Policy is going to have a variety of definitions. We had a guy, Tarun, an electrician who couldn’t return to full duty after a knee injury. He was able to find a part-time position working in a hardware store, which didn’t require him to be doing the heavy work of an electrician anymore. Your policy’s going to state whether you have to be unable to perform your own job or any job. It’s important to note these facts. You can discuss them with us at Canadian LIC, as we will seek to find part-time work that fits your ability and the policy restrictions fairly.

The impact of part-time income on your Disability Benefits varies by policy. We helped a client, Rachel, navigate this when she started a part-time online business. Most commonly, a Disability Insurance provider will directly deduct the amount you earn from part-time work, dollar for dollar, from your benefits to supplement your income up to a certain percentage of your pre-disability earnings, ensuring you do not suffer financially while encouraging your return to the workforce.

The more transparency, the better. We always tell our clients at Canadian LIC to keep the insurer in the loop. For example, after our client Derek started working part-time, we drafted a detailed letter to his insurer that noted the hourly work and the nature of his job. Always provide timely updates regarding any changes in your work status to avoid complications with your benefits.

Of course! At Canadian LIC, we not only provide advice on Disability Insurance Policies but also help our clients with part-time job placement that suits their current capabilities. For instance, we helped Nora, who could no longer work as a nurse, find a very fulfilling part-time role as a patient education coordinator. We can help you in the pursuit of opportunities within the realms of your health needs and areas of career interest.

If you start working part-time and your health begins to decline, you need to reassess your situation. We had a client, Alex, whose condition got worse, and we quickly took action in order for his work commitment to be adjusted and his benefits reappraised. Contact your insurance provider and treat the doctor immediately. Your Disability Insurance is there to help you, and adjustments can be made to benefit payments and the work plan if your health deteriorates negatively.

Everything has to be documented. So, in Canadian LIC, we do this quite often with our clients, as we did with Susan. Now, when Susan decided she wanted to start a part-time job while on Long Term Disability Insurance with Canadian LIC, we helped her get proper documentation, such as a letter from the employer detailing how many hours one works and the job description, along with recent medical reports. Always provide any required documentation on time to ensure your benefits are uninterrupted and not concealed from your insurance provider.

This is a big step, and it’s important to do it right. David was a client at Canadian LIC who increased his work hours from part-time to full-time on a gradual basis. If you’re thinking you’re ready for full-time, make sure you first talk to your doctor to confirm it’s safe for your health. Once you’ve determined your plan with your doctor, let’s discuss it here at Canadian LIC. We’ll help you understand what this change in employment means for your Disability Insurance Policy. Be aware that your benefits may change or terminate based on the conditions of the policy, so planning for this transition is very important.

This will vary widely depending on the policy. Recently, we had a case with a gentleman named Jeremy who was able to work part-time for as long as he earned little money. You should review your policy to learn what specific restrictions may apply to how much you are able to earn and how long you are allowed to work part-time. At Canadian LIC, these areas are worked through with our clients to ensure that they are making an educated choice about not harming their disability status.

You must, of course, decide to work part-time based on your abilities and medical limitations. For instance, one of our clients, Helen, worked part-time as a virtual assistant while she was collecting Short Term Disability Insurance benefits. In this way, she could easily work from home and manage her recovery more effectively. We at Canadian LIC will advise you on how to look for flexible and low-stress jobs that can be modified according to your health conditions. We will be able to help you find an appropriate position and even negotiate with future employers regarding your accommodation needs.

Generally speaking, getting added health benefits from a part-time job is considered good, but one would have to declare that to one’s Disability Insurance provider. Our client Greg started getting health benefits from a new part-time employer; those did not cut or directly affect his Disability Benefits; they increased his total health coverage. Obviously, every case is different. Let us review your Disability Insurance Policy at Canadian LIC to determine how additional health benefits might interact with your current Disability Benefits.

The process of reporting your earnings is very simple but important. Our client keeps proper records of the part-time earnings they collect and then submit them on a monthly basis to their provider for their Disability Insurance. Canadian LIC would also encourage regular basis reporting with your provider so that you can fulfill the requirements under the terms of your policy. This will definitely keep your provider updated about your recent income so that there will not be any misunderstandings when your benefits are calculated.

Yes, it can, depending on how much you bring in. For instance, Michael, a client at Canadian LIC, had balanced his earnings to stay within the permissive limits of his government Disability Benefits. You just have to know how much you’re allowed to bring in before you are impacted. We can help you understand both your private Disability Insurance Policies and government regulations to ensure you are receiving maximum benefits without jeopardizing your eligibility.

Canadian LIC knows how complex and daunting it may be for an individual to navigate between part-time work and Disability Benefits. Irrespective, we will help you in every way possible so that you make the right decisions for yourself regarding your health and financial well-being. Our team is here to help you understand your Disability Insurance Policy and support you in going back to work, no matter how small the step may seem. Let’s work together to find a balance that suits your unique situation.

Sources and Further Reading

Here are some sources and suggested further reading materials that can provide additional information and insights into managing Disability Benefits while working part-time in Canada:

Service Canada – Canada Pension Plan Disability Benefits: This official government site offers comprehensive details on CPP Disability Benefits, eligibility criteria, and application processes.

Canadian Life and Health Insurance Association (CLHIA) – A Guide to Disability Insurance: This guide provides an overview of what Disability Insurance covers, the different types available, and how to file a claim.

Office of the Superintendent of Financial Institutions – Disability Insurance: This resource offers insights into the regulatory framework governing Disability Insurance in Canada.

Canada Revenue Agency – Disability Tax Credit: Learn about tax credits available for persons with disabilities and how part-time income might affect these benefits.

The Council for Disability Awareness – Disability Insurance Learning Center: Although U.S.-based, this site offers valuable information on Disability Insurance that can be useful for understanding key concepts and considerations.

These resources provide a solid foundation for understanding Disability Insurance, navigating benefits while working part-time, and ensuring compliance with Canadian regulations. They are crucial for anyone looking to deepen their understanding of Disability Insurance Policies and their application in real-life scenarios.

Key Takeaways

- Understand your Disability Insurance Policy's terms and definitions to know your rights and the impact of part-time work.

- Always inform your Disability Insurance provider about your intent to work part-time to maintain benefit eligibility.

- Part-time income may adjust your Disability Benefits, but policies often allow some earnings without total benefit loss.

- Assess your health with healthcare providers before working part-time to ensure it won't compromise your recovery.

- Consider flexible and less demanding part-time jobs that accommodate your health needs and capabilities.

- Seek advice from experts like Canadian LIC to navigate the complexities of Disability Insurance effectively.

- Carefully plan any transition from part-time to full-time work with your healthcare provider and insurance advisor.

Your Feedback Is Very Important To Us

We value your insights and experiences regarding balancing part-time work with receiving Disability Benefits in Canada. Your feedback will help us understand the challenges and needs you face. Please take a few minutes to answer the following questions:

Thank you for sharing your valuable feedback. Your insights are crucial in helping to shape better support systems for individuals balancing work and health challenges.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]