- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Reviews

Common Inquiries

- Can I Name Multiple Beneficiaries for My Whole Life Insurance Policy?

- Can the Cash Value of My Canadian Whole Life Policy Decrease?

- What Is the Impact of Smoking on Whole Life Insurance Premiums?

- How Is the Cash Value of a Whole-Life Policy Taxed?

- How Can You Find the Best Whole Life Insurance Without a Medical Exam?

- What Age Does Whole Life Insurance End?

- Which Is Better, Whole Life Or Term Life Insurance?

- Can I Buy Whole Life Insurance for My Child?

Can I Use Whole Life Insurance for Estate Planning?

SUMMARY

This blog explores using whole life insurance for estate planning in Canada. It explains how whole life insurance offers lifelong coverage, builds cash value, and provides liquidity for estate taxes. The article discusses equalizing inheritances, supporting family businesses, and facilitating charitable giving, all while helping to minimize complications and costs in transferring assets.

It is one of those sensitive topics, but then it’s quite an important consideration for any individual who wants to ensure his estate gets passed on as smoothly as possible with the least amount of difficulty. We constantly see clients at Canadian LIC facing a similar challenge: “How do I ensure my loved ones are taken care of without leaving behind unnecessary complications?” Most of them have a clear goal, be it to leave behind a financial gift, minimize estate taxes, or ensure the distribution of assets according to their wishes. However, they often do not know how to achieve this balance. Whole Life Insurance Policies have lately become very popular, providing not only financial security for your loved ones but also offering a well-designed tool for Estate Planning.

- 11 min read

- October 1st, 2024

By Harpreet Puri

CEO & Founder

- 11 min read

- October 1st, 2024

Many of our clients at Canadian LIC come to us for consultation when dealing with Estate Planning intricacies. To our practice, Whole Life Insurance is one holistic approach to Estate Planning that will secure the assets of any family and smoothly transition their financial future to those they care about. Let’s break this down to how Whole Life Insurance works in Estate Planning and why it seems to be increasing in popularity among many Canadians.

Understanding Whole Life Insurance: The Basics

Understanding Whole Life Insurance is a great starting point before embarking on general Estate Planning. Whole life is a permanent form of insurance cover under which you will be covered for your whole life, provided you pay life insurance premiums. Differing from Term Insurance Coverage, which lasts a certain number of years, Whole Life Insurance accumulates cash value over time. The cash value grows tax-deferred, and you pay no tax on the growth unless you withdraw the money.

Whole Life Insurance Policies also offer a death benefit that is paid to your beneficiaries at the time of your death. That guarantee makes it more appealing to those who are planning ahead for an estate plan. Because it combines both elements of insurance with a savings component, many clients find it useful in trying to balance immediate financial protection with long-term estate goals.

How Whole Life Insurance Fits Into Estate Planning

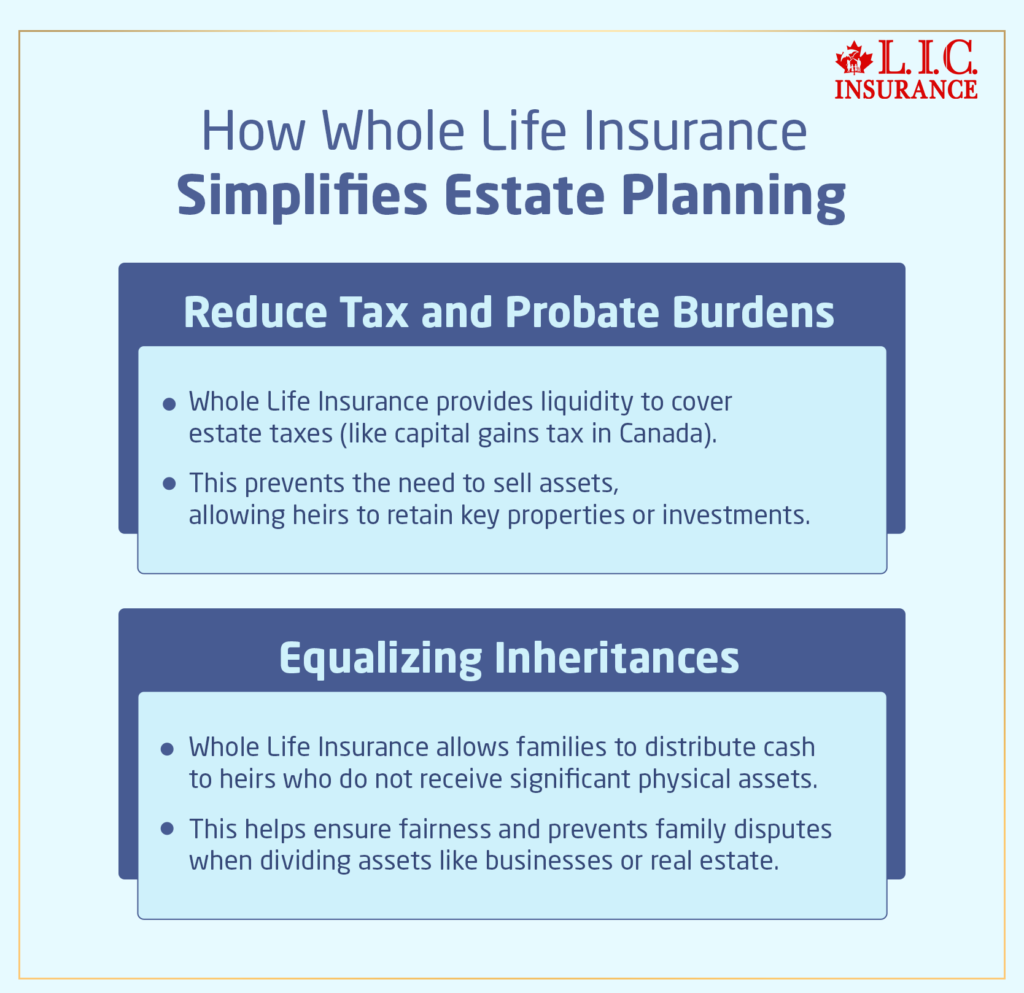

Estate Planning involves much more than it does when passing down the appropriate portions of your assets to the proper parties. It can also help reduce various financial burdens as a result of taxation and probate costs, among others, that will undoubtedly lessen the value of what is left behind to your beneficiaries. This is where Whole Life Insurance can truly stand out.

- Ensuring Liquidity for Estate Taxes: In Canada, while there isn’t a direct “estate tax,” capital gains taxes can come into play, particularly when passing down significant assets like real estate or investments. This often leaves beneficiaries in a position where they need to find liquidity to cover these taxes. Unfortunately, not all estates have enough liquid assets to handle these taxes, leading to the sale of properties or investments at inopportune times.

By having a Whole Life Insurance Policy, the death benefit can provide the liquidity needed to cover these taxes. This allows your heirs to retain key assets without needing to liquidate them quickly. We’ve worked with many clients at Canadian LIC who chose Whole Life Insurance for this exact reason. We have represented numerous clients at Canadian LIC in precisely that situation. The greatest concern was that the family members should not be forced to liquidate some of the precious assets or businesses to settle taxes. - Equalizing Inheritances: Families come in all shapes and sizes, and often, there is no way to divide assets fairly or at all. You might have one son run the family business, but you want to provide for your other children based on an equivalent amount of wealth. It can be tough.

The use of Whole Life Insurance allows for the equalizing of inheritances by providing a cash benefit to the heirs who will not receive significant physical assets. We recently serviced a client who had the exact concern. They were giving their family cottage to one child but didn’t want to disinherit other children. They used the purchase of Whole Life Insurance for an equal passing of money on to the other children to maintain harmony in the family and preserve their wishes without the risk of disputes.

Minimizing Probate Fees

When someone dies, it means their estate will undergo probate. Probate is the process wherein a will is proven, and it lets the assets go to heirs according to the desires of the maker of the will. However, each province and territory in Canada charges different probate fees, so the estate can definitely lose some of its value in administering probate. For that reason, life insurance proceeds are usually paid directly to beneficiaries, which helps them avoid paying all fees associated with probating a will. This means that your death benefits will be fully paid out without any discount resulting from probate costs.

This bypass of probate is the main reason why we are seeing so many clients look into incorporating Whole Life Insurance into Estate Planning. They love just how easy and fast a payout of the death benefit is, so their families don’t have to go through long legal processes.

Building Cash Value for Future Needs

One of the features of whole life that distinguishes it from all other types of insurance is cash value. Now, when you pay premiums for your whole life, you continue to pay for the rest of your life. Therefore, over time, what you paid in premiums will have built up to a cash value that you can borrow against, among other things, or take advantage of for retirement. In a multi-purpose estate-planning strategy, that’s really great.

- Emergency Funds: Some clients choose to use the cash value as a financial cushion, ensuring they have access to funds for unexpected expenses in their later years.

- Gifts During Your Lifetime: Others prefer to use the cash value to make gifts to their heirs while they are still alive. This is particularly appealing to those who wish to see their loved ones benefit from their wealth while they’re around to enjoy it with them.

We have also seen families using the cash value of their Whole Life Insurance Policy to help children buy homes, start a business, or pay for the education of their grandchildren. A bit of this flexibility in building wealth is something that a Whole Life Policy does, and generally, traditional Estate Planning tools don’t offer.

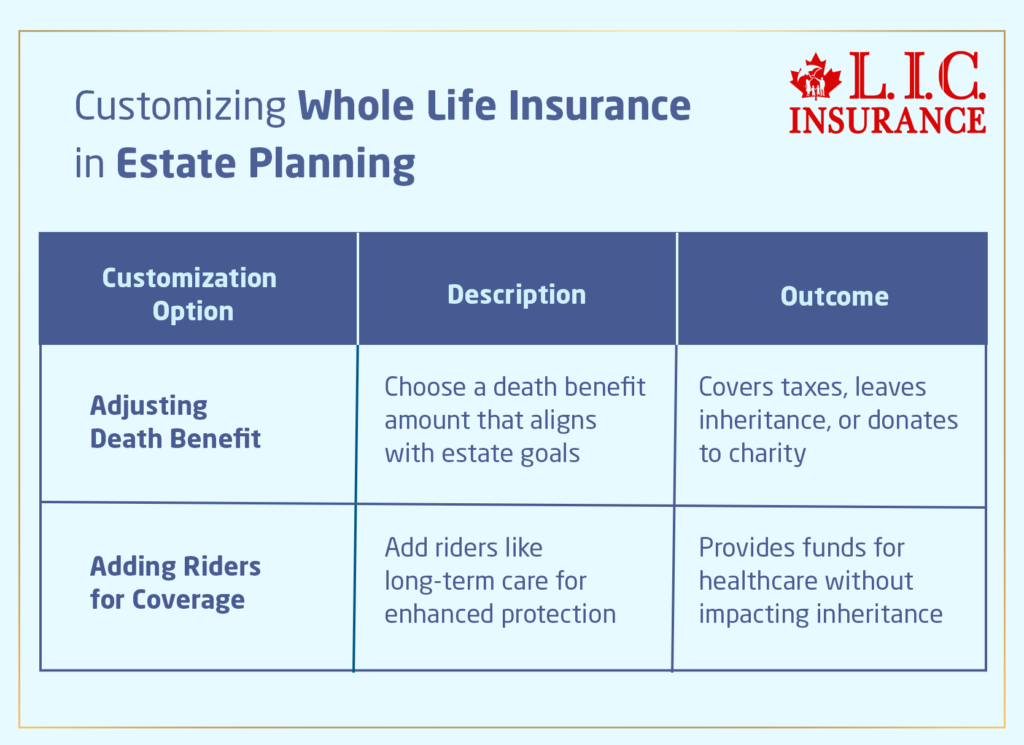

Customizing Whole Life Insurance to Fit Your Estate Plan

One of the greatest attractions of Whole Life Policies is their flexibility. You can customize a policy to fit your specific Estate Planning needs based on your Estate Planning goals. Here are ways we’ve helped clients at Canadian LIC customize their policies:

- Adjusting the Death Benefit: Depending on the size of your estate and your financial obligations, you can choose a death benefit that aligns with your goals. Whether you want to cover capital gains taxes, leave a significant inheritance, or donate to charity, the death benefit can be tailored to meet those needs.

- Adding Riders for Enhanced Coverage: Many Whole Life Insurance Policies allow for additional riders that can enhance the coverage. For example, you might want to add a rider that covers long-term care, ensuring you have funds to cover potential healthcare costs in your later years without dipping into your estate.

We had a client recently who wanted to ensure that their spouse would have access to long-term care funds, if needed, without affecting the inheritance of their children. Adding a long-term care rider was the solution. This gave them peace of mind, knowing that their estate plan was complete and addressed possible future needs.

Using Whole Life Insurance for Charitable Giving

One very important life insurance use is the one that many new estate planners tend to overlook: charitable giving. If you have an interest in helping a specific cause or organization, Whole Life Insurance can be a major tool for creating a lasting legacy. At Canadian LIC, we have supported numerous clients who wish to include charitable giving within an estate plan and utilized Whole Life Insurance as their flexible method.

- Naming a Charity as a Beneficiary: By naming a charity as a beneficiary of your Whole Life Insurance Policy, you can ensure that a portion of your wealth is directed towards a cause you care about. The beauty of this approach is that it allows you to make a significant donation without affecting the inheritances you leave to your family. The death benefit is paid directly to the charity upon your passing, providing them with much-needed financial support.

- Tax Benefits of Charitable Giving: Another reason Whole Life Insurance is a great vehicle for charitable giving is the potential tax benefits. In Canada, when you name a charity as a beneficiary, your estate could receive a tax credit, which helps offset taxes that might otherwise reduce the value of your estate. We often see clients concerned about minimizing taxes, and this strategy helps them give back while also benefiting their heirs financially.

One of the clients wanted the estate to pass on to their favourite charity, but they did not want to decrease what was left in the inheritance for their children. With a Whole Life Insurance Policy, the couple could split the death benefit between family and charity, thereby leaving behind both a personal and philanthropic legacy.

Selecting the Right Whole Life Insurance Policy for Your Estate Plan

The right Whole Life Insurance Policy for you is really very important in Estate Planning. Canadian LIC, we often assist clients in evaluating their options for the best Whole Life Insurance Quotes and policies that can align with their long-term goals. Here are some things that you should consider in selecting a policy:

- Death Benefit Amount: Determining the appropriate death benefit amount is the first step. You’ll want to consider your estate’s size, any outstanding debts you may leave behind, potential tax liabilities, and the financial needs of your beneficiaries. The death benefit should be large enough to cover these obligations while leaving a meaningful legacy.

- Premium Payments: Whole Life Insurance Policies require you to pay premiums throughout your lifetime, and it’s important to ensure that the premiums fit within your budget. Some policies offer flexible payment structures, allowing you to pay off the premiums over a shorter period, while others require lifetime payments. We’ve seen clients at Canadian LIC choose shorter payment terms to ensure their policy is fully funded before retirement.

- Cash Value Growth: As mentioned earlier, Whole Life Insurance Policies accumulate cash value over time. When choosing a policy, you’ll want to consider how quickly the cash value grows and whether you plan to access it during your lifetime. Some policies offer higher cash value accumulation, which can be beneficial if you plan to use it for retirement or gifting purposes.

For instance, one of our clients chose to have a policy with very high growth in cash value because they like helping to fund their grandchildren’s education while still having insurance protection in place for Estate Planning. This flexibility made Whole Life Insurance a great addition to their overall financial strategy.

Using Whole Life Insurance to Support Family Businesses

Whole Life Insurance is truly critical for family business owners in the event of the owner’s death, ensuring that the business is kept in the family and remains fiscally sound. Many of our clients in Canadian LIC work with family businesses they intend to pass down to subsequent generations, and Whole Life Insurance goes an incredibly long way in helping them do so.

- Providing Liquidity for Succession: When the owner of a family business passes away, the heirs may face significant taxes or debts that could strain the business’s financial health. The death benefit from a Whole Life Insurance Policy provides liquidity that can be used to pay off these debts, ensuring the business can continue to operate smoothly.

- Business Continuity: Whole Life Insurance can also be used to ensure the business remains in the family’s hands. By naming a successor as the policy beneficiary, the owner can provide them with the financial resources needed to buy out other shareholders or cover operational expenses during the transition. This is especially important for businesses where the cash flow might be tight following the owner’s death.

We have just worked with a business owner who wished for the simple comfort that his family business wouldn’t have to face financial strain upon his death. To be able to do so, they opted for a Whole Life Insurance Policy that provided a large enough death benefit to cover any taxes and buy out a minority shareholder. That way, the family was comfortable knowing that the business would continue without hitch or interruption.

The Importance of Reviewing Your Estate Plan Regularly

Estate Planning is not something that only makes it for one time. After all, you have to review your plan often just to make sure it still fits in with your goals. Life events such as the birth of a child, marriage, or a great change in your financial condition might need a full overhaul of your life insurance policy or general estate plan.

We always advise our clients at Canadian LIC to review their estate plans at least every few years or on major life events. It makes sure that your Whole Life Insurance Policy continues to be tailored to satisfy all of your changing needs, as well as those of your beneficiaries.

Conclusion: Take Control of Your Estate Planning with Whole Life Insurance

The integration of Whole Life Insurance Policies into your estate plan can turn out to be the best and most efficient way in order to achieve results like effective distribution of your assets according to your will, financial security for your loved ones, and coverage against tax liabilities. Besides that, Whole Life Insurance may help in many other respects: building liquidity to pay for taxes, equalizing inheritances, and supporting your charitable concerns.

We help hundreds of clients solve Estate Planning issues at Canadian LIC, the premier brokerage firm in the insurance industry. We provide Whole Life Insurance solutions that meet specific needs. You’ve come to the right place if you’re shopping to purchase life insurance online or maybe looking forward to getting Whole Life Insurance Quotes. This would help you protect a good future for your family and protect your legacy from those who might destroy it.

More on Whole Life Insurance

- Can I Name Multiple Beneficiaries for My Whole Life Insurance Policy?

- Can I Purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- How Can You Use Whole Life Insurance to Create Wealth?

- What Happens If I Take a Loan from My Whole Life Insurance Policy?

- Can the Cash Value of My Canadian Whole Life Policy Decrease?

- What Are Paid-Up Additions in Whole Life Insurance?

- Are There Any Circumstances Under Which the Death Benefit of Whole Life Insurance Would Not Be Paid?

- What Is the Impact of Smoking on Whole Life Insurance Premiums?

- Can I Adjust My Whole Life Insurance Policy?

- How Is the Cash Value of a Whole-Life Policy Taxed?

- How Can You Find the Best Whole Life Insurance Without a Medical Exam?

- What Age Does Whole Life Insurance End?

- What Are the 2 Disadvantages of Whole Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- How Many Years Do You Pay on a Whole Life Policy?

- At What Age Is Whole Life Insurance Good?

- Can I Buy Whole Life Insurance for My Child?

- Who Should Opt for Whole Life Insurance?

- Is Whole Life Insurance Expensive?

- What Is the Difference Between Money Back Policy and a Whole Life Policy?

- Can You Convert Universal Life to Whole Life?

- Understanding How Does a Whole Life Insurance Policy Work: A Comprehensive Guide

- Permanent Insurance: A Whole New Investment Class

- What Is the Biggest Risk for Whole Life Insurance?

- What Is True About Permanent Life Insurance?

FAQs about Whole Life Insurance Policies

A Whole Life Insurance Policy provides lifelong coverage and has a guaranteed payout when the policyholder passes away. Many clients at Canadian LIC choose Whole Life Insurance Policies because they want the certainty that their loved ones will receive financial support no matter when they pass away.

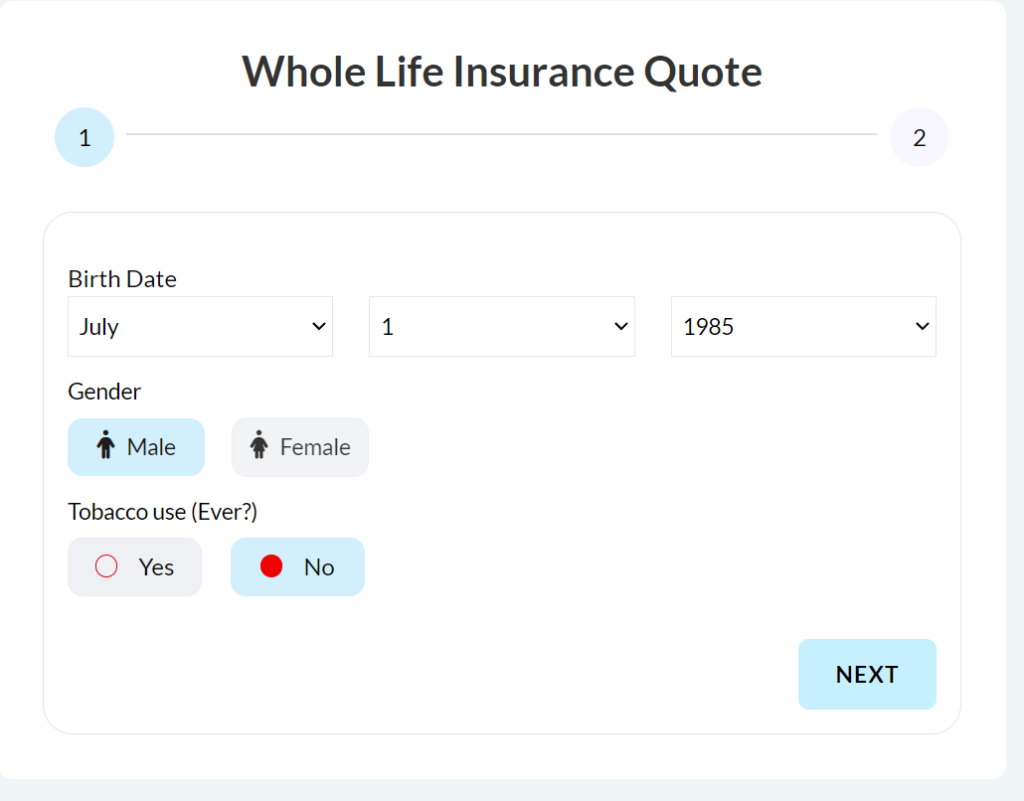

Yes, you can buy Whole Life Insurance online through Canadian LIC’s platform. This option has helped clients who want a quick, convenient way to secure their coverage without needing to visit an office in person.

You can get Whole Life Insurance Quotes from Canadian LIC. Our clients find this step helpful in comparing options and deciding which plan fits their needs best. Canadian LIC’s expert team of insurance advisor can guide you through this process easily.

The cash value in Whole Life Insurance Policies grows over time as you pay your premiums. At Canadian LIC, we’ve seen clients benefit from this growth because it acts as a form of savings that can be accessed later in life.

Yes, Whole Life Insurance Policies tend to cost more than Term Policies because they offer lifetime coverage. Canadian LIC experts and financial advisor often explain to clients that while the premiums are higher, Whole Life Insurance Policies build cash value, making them a long-term investment.

Yes, you can customize your Whole Life Insurance Policy with additional features or riders. At Canadian LIC, many clients appreciate this flexibility, allowing them to tailor their coverage to specific needs, like adding critical illness coverage.

If you stop paying your premiums, your policy may lapse, and you could lose your coverage. However, Canadian LIC helps clients understand options like using the cash value to cover missed payments, which has been a relief for those who have had financial difficulties.

Sometimes, yes. Depending on the amount of coverage you’re seeking, a medical exam might be needed. Canadian LIC’s clients often find this step to be a simple process, and it helps ensure they get the best rates.

Yes, you can use your Whole Life Insurance Policy’s cash value as collateral for a loan. Canadian LIC has helped clients utilize this feature when they needed funds for important life events like buying a home or starting a business.

Buying Whole Life Insurance Policies early helps lock in lower premiums for life. Many clients at Canadian LIC have benefitted from purchasing their policies while they were younger, securing affordable coverage for their entire lifetime.

You can easily get Whole Life Insurance Quotes online by visiting trusted insurance websites or speaking directly with brokers like Canadian LIC, who specialize in finding the right policies for you.

The cash value of Whole Life Insurance grows on a tax-deferred basis. However, if you withdraw funds from the cash value, you may be subject to taxes on the amount that exceeds the premiums paid.

Yes, you can change the beneficiaries of your Whole Life Insurance Policy at any time, ensuring that your estate plan remains aligned with your wishes.

These FAQs aim to put readers at ease as each question is approached with practical, easy-to-understand explanations and examples. They also demonstrate how Canadian LIC has helped clients who have encountered similar concerns.

Secure Whole Life Insurance for Estate Planning to ensure that your family’s future is well secured. Contact Canadian LIC today to discuss your options!

Sources and Further Reading

- Canada Life – Whole Life Insurance A detailed overview of how Whole Life Insurance Policies work in Canada and how they can be used for Estate Planning. Canada Life Whole Life Insurance

- Government of Canada – Estate Planning Information on the importance of Estate Planning and strategies for minimizing taxes on your estate. Estate Planning by Government of Canada

- Sun Life – Estate Planning with Life Insurance How Whole Life Insurance can play a key role in Estate Planning to reduce tax liabilities and provide financial security for beneficiaries. Sun Life Estate Planning

- Manulife – Whole Life Insurance for Estate Planning Insight into how Whole Life Insurance Policies help with tax-efficient Estate Planning in Canada. Manulife Whole Life Insurance

- Canadian Life and Health Insurance Association – Understanding Whole Life Insurance A comprehensive guide to Whole Life Insurance Policies and their benefits for Estate Planning. CLHIA Whole Life Insurance Guide

Key Takeaways

- Whole Life Insurance Policies provide lifetime coverage and can be a valuable tool for Estate Planning in Canada.

- These policies help cover estate taxes, equalize inheritances, and avoid probate fees.

- Whole Life Insurance offers a guaranteed death benefit and accumulates cash value, providing both protection and financial flexibility.

- It can support family businesses, ensure business continuity, and provide liquidity for smooth succession.

- Charitable giving through Whole Life Insurance offers tax benefits and leaves a lasting legacy.

- Regularly reviewing your estate plan is essential to ensure it aligns with your goals.

- You can buy Whole Life Insurance online and get quotes tailored to your financial and Estate Planning needs.

By Pushpinder Puri

CEO & Founder

Your Feedback Is Very Important To Us

We would love to hear about your experience with using Whole Life Insurance for Estate Planning. Your feedback will help us understand the struggles you face and improve our services. Please take a few moments to answer the following questions:

Thank you for taking the time to provide your feedback!

IN THIS ARTICLE

- Can I Use Whole Life Insurance for Estate Planning?

- Understanding Whole Life Insurance: The Basics

- How Whole Life Insurance Fits Into Estate Planning

- Minimizing Probate Fees

- Building Cash Value for Future Needs

- Customizing Whole Life Insurance to Fit Your Estate Plan

- Using Whole Life Insurance for Charitable Giving

- Selecting the Right Whole Life Insurance Policy for Your Estate Plan

- Using Whole Life Insurance to Support Family Businesses

- The Importance of Reviewing Your Estate Plan Regularly

- Conclusion: Take Control of Your Estate Planning with Whole Life Insurance