- Can I use Visitor Insurance for routine check-ups and preventive care?

- Coverage Details of Visitor Insurance

- The Limitations of Visitor Insurance for Routine Check-ups

- What Is Considered Preventive Care?

- Why Routine Check-ups and Preventive Care Aren’t Covered

- What Are Your Options?

- Working with Canadian LIC to Find the Right Coverage

- Preparing for Your Visit to Canada

- The Role of Visitor Insurance Agents in Canada

- Final Thoughts

Coming to Canada as a visitor is an exciting and fulfilling experience, whether you are here to explore the natural beauty, visit friends and family, or look towards professional opportunities. However, your journey’s excitement can soon become a worry if you face sudden health problems. Most of the time, this is the question that comes to mind for many visitors in Canada: “Can I use my visitor’s insurance for routine check-ups and preventive care?

This is a question we get asked quite frequently by clients working through the complexities of Visitor Insurance Policies. You are enjoying your time in Canada, but at the back of your mind, you worry about your health needs. Perhaps you have a chronic condition that requires regular monitoring, or maybe you just believe in keeping up with preventive care. Here is where the confusion sets in: what is it, exactly, that your Visitor Insurance Policy covers? Will it take care of the routine check-ups, or are you finding yourself out of pocket for these essentials? Our team at Canadian LIC has been helping clients with just these questions for a long time. We usually find visitors grappling with uncertainty about insurance coverage and, therefore, creating unpleasant moments of stress and concern at a time that is supposed to be most pleasant.

Coverage Details of Visitor Insurance

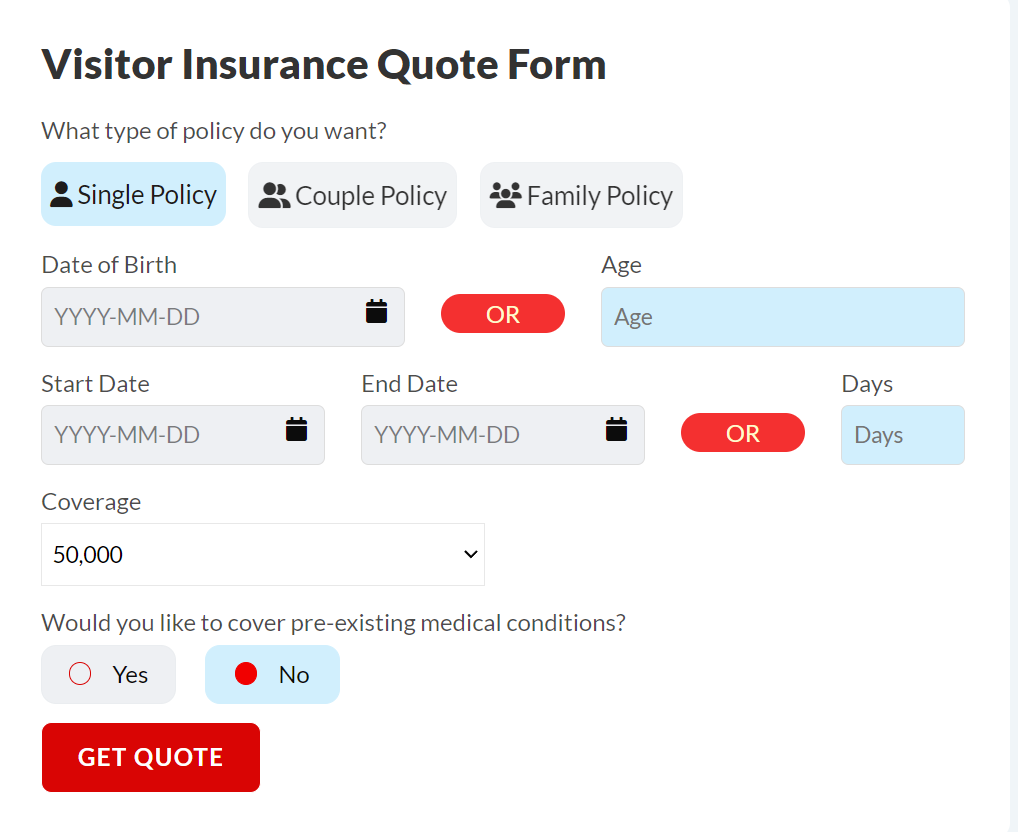

This would be most likely at the back of your mind when you buy visitors insurance policy; it should effectively take care of all of your health needs while in Canada. Not all policies are designed equal, though. Visitor Insurance primarily focuses on insuring against emergency medical needs resulting in hospitalization and surgery, including medical emergency room visits caused by an accident or acute unexpected illness. However, what about routine check-ups or preventive care?

From our observation at Canadian LIC, we experienced so many clients who keep on asking whether their insurance works just like their home country’s health coverage, but later they find that most of the routine medical services often fall outside the scope of their Visitor Insurance Policy. This indeed may be very alarming for those with existing health problems or those who prioritize preventive care as a means to maintain good health.

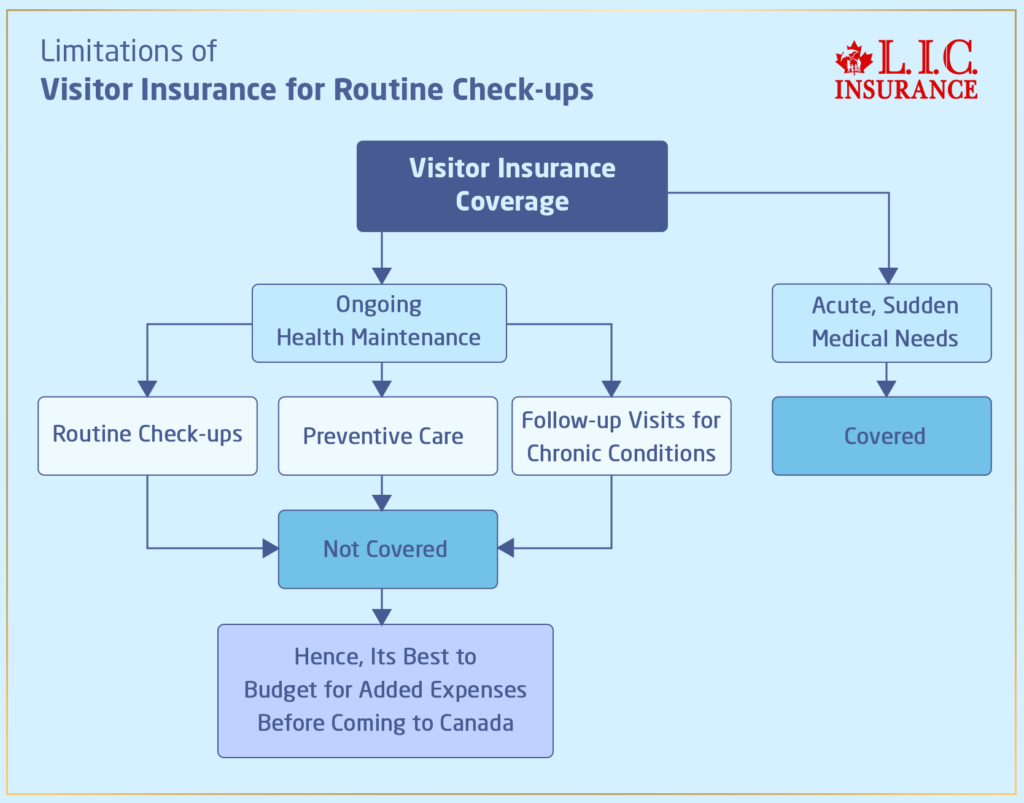

The Limitations of Visitor Insurance for Routine Check-ups

One of the key things we emphasize to our clients is that Visitor Insurance does not generally cover routine check-ups or any kind of preventive care. So if you are planning to visit a doctor for a general check-up, upgrade your vaccination, or get screenings for high blood pressure or cholesterol, for example, you might have to pay for it out of pocket. This is a significant difference from the comprehensive Health Insurance Plans that residents of Canada might have.

Thus, it has been designed to focus on acute, sudden medical needs rather than ongoing health maintenance. That would make sense given that visitors are in the country temporarily and visitors are supposed to deal with their routine healthcare needs either before arriving or after returning to their home country. This can be a tough pill to swallow for many, especially those who need regular medical attention.

What Is Considered Preventive Care?

Preventive care broadly refers to various healthcare services that help prevent illnesses or recognize certain health problems early in their course when they are more treatable. Services include, but are not limited to, vaccinations, routine physical examinations, cancer screenings, and blood tests. Although such services are considered important to long-term health, many Visitor Insurance Policies exclude them from coverage.

A common scenario we at Canadian LIC come across is the number of people wanting to get vaccinated or have screening tests done for a variety of genetic conditions. Once they find out these are not part of the Visitor Insurance Policy, it often leaves them feeling vulnerable and unsure about how to proceed. This lack of health monitoring may be especially detrimental to older visitors as they may require more frequent health monitoring.

Why Routine Check-ups and Preventive Care Aren't Covered

Visitor medical insurance policies are designed to protect you during your stay in Canada, but they often leave out routine check-ups and preventive care. Here’s why:

Focus on Emergency Care:

The main focus of the Visitor Insurance Policies is to provide emergency medical coverage. These insurance policies kick in when a visitor experiences an accident or sudden sickness. It is for this reason that the insurance providers put much concentration on emergencies so that the visitor may get urgent medical attention and will not have to incur high eligible medical expenses out of pocket. This is indeed the opposite; as routine check-ups are scheduled and are considered predictive, they do not fall under these categories. Many of these routine services are sought by clients at Canadian LIC who assume their Visitor Insurance Policy will cover it and end up surprised when they do not.

Cost Management for Insurers:

Insurance providers structure Visitor Insurance Policies to manage their financial risk. Routine check-ups and preventive care are regular, ongoing services that can lead to higher costs for insurers. By excluding these services, insurance companies can control their expenses and keep the overall cost of the insurance lower. This approach benefits visitors by making Visitor Insurance Policies more affordable, but it also means that visitors need to be prepared for out-of-pocket healthcare costs if they require routine care.

Affordability for Visitors:

It also lowers premiums, as the exclusion of routine check-ups is a cost-effective way to make Visitor Insurance cheaper for travellers. Most of the visitors who come to Canada in search of Visitor Insurance wish to invest in an affordable policy. As most of the policies cover emergency care while excluding routine services, insurance companies are able to sell policies at relatively lower costs. Affordability makes Visitor Insurance more accessible, but a little sacrifice in the form of comprehensive coverage is also required here. We have had clients who were thrilled with the low premiums, only to find themselves unexpectedly burdened at Canadian LIC when they required routine care while staying with us.

Temporary Nature of Visitor Insurance:

Visitor Insurance is designed for short-term stays. Insurers expect that visitors would have dealt with their routine health needs either before arriving in Canada or after returning home. It’s this temporary nature of Visitor Insurance that explains why preventive care and routine check-ups are usually excluded. For instance, a client who came expecting his Visitor Insurance to cover a routine physical exam was shocked when he received a bill after his visit. Of course, his experience only underscores the value of understanding what your Visitor Insurance Policy covers—and what it does not.

Understanding Coverage Limits:

Unfortunately, most visitors operate under the assumption that a Visitor Insurance Policy works just like their domestic Health Insurance in their home country. It is always frustrating when they find out that routine check-ups are excluded under the insurance policy. Quite often at Canadian LIC, we find this confusion among our clients who are not familiar with the limitations of Visitor Insurance. They often come to us after getting unexpected bills for routine services, seeking advice on their next course of action. This is an indication that clear communication and understanding of the specific terms of your Visitor Insurance Policy upfront before seeking emergency medical care are called for.

A Real Case from Canadian LIC:

A visitor from India came to us at Canadian LIC, thinking he needed to continue his routine diabetes check-up since he was in Canada. He thought his policy would cover him for this type of visit. Later, he found that his policy did not cover these services, which left him with an unexpected expense. This is just one of many examples we encounter where visitors are caught off guard by the exclusions in their Visitor Insurance Policies. All these situations could have been well avoided, provided the coverage limits had been understood better.

Importance of Working with Knowledgeable Agents:

It is important to work with knowledgeable agents working with Visitor Insurance in Canada to avoid surprises on what can be covered and what cannot. Canadian LIC assists the clientele in finding the right quotes for Visitor Insurance Policies online so that the client is assured of the terms of coverage and those that will not be necessary for the policy. You get to make an informed conversation with a representative and can then make a better decision by avoiding the pitfalls that result from a lack of understanding of your cover.

Tailoring Coverage to Your Needs:

Most Visitor Insurance Plans do not cover routine check-ups. There could be the possibility of adding supplementary coverage or an appropriate plan. These, however, are not very common, and the pricing varies. This is where agents may come in. They can help explore possibilities, enabling one to get a better Visitor Insurance Policy, complete with an adequate mix of both coverage and affordability. We often walk our clients through this process, helping them weigh the benefit of the added coverage with the cost in order to arrive at the most appropriate decision.

Budgeting for Out-of-Pocket Costs:

Since routine check-ups are not covered, it is crucial to set a budget for such expenses prior to the commencement of your trip. Knowing that your Visitor Insurance Policy won’t cover these emergency medical costs lets you strategically plan for such instances. We often recommend that our clients at Canadian LIC set aside money to accommodate any routine or preventive care they might need during their stay. The proactive approach here is to avoid the stress derived from surprise medical bills, especially when one really needs the care.

Visitor Insurance Policies are highly valuable in protecting one when in Canada, but one should understand their limitations. These can remain moderately priced since they generally focus on medical emergencies and exclude routine check-ups, but the visitor must also be prepared to incur expenses out-of-pocket. Therefore, with Canadian LIC, we try to make our customers understand all these nuances in finding the best Visitor Insurance Policy that fully covers them in areas of unexpectedness while being knowledgeable on what is not included.

What Are Your Options?

If you are concerned about check-ups and any preventive medical treatment during your stay in Canada, here are a few things you may do. One option is to pay for these services out of pocket. While this may not be the most economical choice, it provides peace of mind, knowing you can access the care you need without worrying about insurance limitations.

Otherwise, one should look for a visitor’s insurance policy with other coverage options. A few insurance companies may have additional plans that also cover check-ups or any form of preventive care, but these are fairly rare. At Canadian LIC, we work with Visitor Insurance Providers in Canada to assist our clients in finding the best coverage available, tailored to each and every one of their needs.

In some cases, the visitors may be eager to be signed up with the local Health Insurance scheme if his or her stay is extended or would otherwise be qualified due to his or her visa status. This, however, may lead to a somewhat cumbersome process, and not all of the visitors will be qualified for such a plan.

Working with Canadian LIC to Find the Right Coverage

Working through Visitor Insurance Policies can easily get overwhelming. Here at the Canadian LIC, we take pride in how we make it quite simple to understand what our client’s coverage is and what it covers. On a regular basis, we help people find Visitor Insurance Quotes Online and work with a network of Visitor Insurance providers across Canada.

The family from India was one of our clients. They were really concerned about their mother, who had a heart condition and needed regular health check-ups. We helped them choose the best Visitor Insurance among several comparisons. However, it was realized that routine check-ups would be paid for out of pocket. Making them aware of this in advance helped them to prepare their budget accordingly so as not to have financial surprises on their part.

Preparing for Your Visit to Canada

If you intend to take a trip to Canada, it is prudent that you plan not only for the journey but for health care as well. First, it is necessary that you check your health status and find out whether there is a scheduled check-up or even some preventive services you are due to receive by the time you are in the country. If you feel that you will require any related services, you may want to plan for the possible expenses of taking a trip.

It is equally important to read the terms and conditions of the Visitor Insurance Policy carefully; often, many visitors hurry to take the policy and thus ignore the details. Canadian LIC advises clients to take some time to ask us questions and get clarifications regarding any point of the policy where they are not clear. This proactive attitude can save a lot of hassle down the line.

The Role of Visitor Insurance Agents in Canada

The great factor in visiting Canada can be your experience with knowledgeable Visitor Insurance agents. These agents are well-versed in the nuances of different insurance policies and can help you identify the best coverage options based on your specific needs.

For instance, one client claimed that the plethora of Visitor Insurance Quotes Online overwhelmed her. Our recommended agent showed her only a few, and she found a policy that could provide her with sufficient emergency medical protection at an affordable price. Although it did not cover routine check-ups, she knew she did the best she could to afford the best protection in case of emergencies.

Managing Out-of-Pocket Costs

Since the Visitor Insurance Policies don’t necessarily cover for routine check-ups and preventive care, managing the out-of-pocket costs can become very important. It might include price research for the medical services around you, looking for community health clinics, or even considering the cheaper and convenient opportunity of using telemedicine services.

For those who require ongoing care, such as regular monitoring of chronic conditions, it’s also worth exploring the possibility of purchasing medications in bulk before travelling if allowed by your home country’s regulations. This can reduce the number of doctor visits needed during your stay in Canada.

Final Thoughts

Understanding the potential limitations of the Visitor Insurance Policy of your choice would be constructive in trying to avoid surprises while in Canada. While these policies are invaluable for covering unexpected emergencies, they often fall short when it comes to routine check-ups and preventive care. By being informed and planning appropriately, you can avoid unexpected expenses and enjoy your time in Canada without headaches.

At Canadian LIC, we have helped numerous clients overcome these problems by informing them and advising them on better decision-making regarding their insurance coverage. Whether you need to get Visitor Insurance Quotes Online or seek help from the best Visitor Insurance Agents in Canada, we are always there to guide you through the process. Don’t leave your health care to chance; instead, prepare and protect yourself properly with a sufficient Visitor Insurance Policy that fits your needs.

More on Visitor Visa and Visitor Visa Insurance

- What Is the Difference Between Visitor Insurance and Regular Health Insurance?

- Can a Visitor Visa Be Converted to a Super Visa?

- How Can I Verify If a Hospital or Clinic Accepts My Visitor Visa Insurance?

- Does Visitor Insurance Cover Mental Health Services?

- Can Family Members Visiting Together Get a Group Discount on Visitor Insurance?

- Are There Any Age Restrictions for Purchasing Visitor Insurance?

- What Documents Do I Need to Buy Visitor Insurance?

- What Happens If the Super Visa Insurance Expires While the Visitor Is Still in Canada?

- How Do You File a Claim for Visitor Insurance?

- Can I Extend My Visitor Insurance If I Decide to Stay Longer?

- Which Visitor Insurance is Best?

- Is Visitor Insurance Mandatory?

- Is Visitor Insurance the Same as Travel Insurance?

- Can I Get Visitor Insurance with Pre-Existing Conditions?

- What Can You Not Do with a Visitor Visa?

- Can I Buy Visitor Insurance After Arrival in Canada?

- Can I Get Insurance as a Visitor in Canada?

- Visitor Visa vs. Super Visa: Understanding the Differences

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs About Using Visitor Insurance for Routine Check-ups and Preventive Care in Canada

No, most Visitor Insurance does not cover routine check-ups. This type of policy is designed for emergency medical expenses that are unplanned and not scheduled events, such as physical exams or continued health monitoring. Quite often, when working at Canadian LIC, the client is surprised to hear this is an exclusion. They believe that their insurance should cover these costs, but they are taken aback if they receive a bill for a routine visit. It is really important to understand this limitation prior to seeking care.

Visitor Insurance Policies focus on emergency situations to keep costs low for both the insurance company and the policyholder. Regular preventive care, including immunizations or routine health screenings, is termed regular and is usually not under the purview. We often explain this to our clients, especially when they wonder if they can add on preventive measures to their coverage. Unfortunately, these services are usually almost certainly not included, and visitors should be warned when planning to get healthcare services in Canada.

Although it is very rare, a few Visitor Insurance providers offer other available plans that might allow routine check-ups to be covered; these are usually a little more expensive. At Canadian LIC, we help our clients find the most suitable options by cooperating with Visitor Insurance providers in Canada. If routine check-ups mean something to you, we propose that you discuss your needs with us, as we can take you through various online Visitor Insurance quotes to help you select the best policy that will answer your needs.

If you happen to need a regular check-up during your stay in Canada, you will likely have to pay out of pocket. At Canadian LIC, we advise that our customers always make a budget for such eventualities before the visit. Understanding that your Visitor Insurance Policy won’t cover routine care helps you plan ahead. We have seen many clients prevent financial surprises by taking major proactive initiatives on health costs.

In general, there can be no upgrading in a Visitor Insurance Policy with respect to routine check-ups. Most of the policies are designed with these exclusions in mind. However, you can best discuss your specific needs with concerned Visitor Insurance agents so they can advise if there are any possible options available. Canadian LIC often aids the clientele in locating the best possible coverage through online quotes, yet routine care would be typically excluded in these policies.

Avoid surprise medical bills: know what your Visitor Insurance Policy covers and what it does not cover before accessing any type of medical care. At Canadian LIC, we always encourage our clients to ask questions and learn where they are and where they are not covered. This approach is an easy way to avoid the surprise of an uncovered medical bill. We regularly help clients with a review of their Visitor Insurance Policy, clearly explaining what is covered and what is not covered.

The agents of visitors insurance plans in Canada are well aware of the varied available policies and can guide one in picking the best coverage. At Canadian LIC, we make sure our clients get the right Visitor Insurance Policy. Whether you need help to research Visitor Insurance Quotes Online or need to understand your coverage, an agent can provide valuable insights and support.

While choosing a policy, you should consider the type of medical coverage you might want to seek while being in the country. Most policies are usually designed for emergencies and do not provide routine and preventative care. Normally, we advise our clients here at Canadian LIC to weigh their general needs and determine if they are ready to pay out of pocket for routine services.

Visitor Insurance Policies normally do not cover chronic condition management, which includes routine check-ups and monitoring of a condition such as diabetes or hypertension. We have had clients come to us at Canadian LIC, fully expecting their insurance to provide this type of coverage, only to be unhappy when informed they did not. It is important to check before you purchase any policy and specifically discuss your health needs with your insurance agent.

Visitor Insurance would, in general, exclude the expenditure for dental check-ups. A Visitor Insurance Policy would normally exclude routine dental check-ups, as it would do with routine medical check-ups. We often have clients at Canadian LIC who inquire about dental coverage after experiencing a dental issue during their stay. If you think you might need dental care, it’s wise to discuss this with Visitor Insurance providers in Canada, who can advise on any additional coverage options.

Visitor Insurance Policy refunds vary according to the terms and conditions of your purchased policy. A few of them allow for partial refunds in the event of early termination of your policy with no filed claims, but that greatly varies, and not all allow the same. We here at Canadian LIC always suggest that one go through the policy carefully and even consult Visitor Insurance Agents in Canada before making any decisions. This helps to avoid surprises and ensures that all refund options are well-known.

Most Visitor Insurance Policies do not cover it, and it is the same for senior citizens. After all, senior people have a lot more requirements for medical services, and this is where disagreements and confusion come in, especially when seniors understand that their policy will not entail those services. Over the years, working at the Canadian LIC, we were able to help several senior clients know how to orient themselves with what their Visitor Insurance would cover; otherwise, one could never tell. Always discuss your health needs with an insurance agent to browse through the options available.

A Visitor Insurance Plan does not usually include routine lab tests. Such tests are considered part of routine care and are excluded. We often see clients come to Canadian LIC with a need for regular lab work and are very surprised to learn that this must be paid for out of pocket. If routine lab tests are part of your preventive health maintenance, it is best to plan for and actually budget these expenses.

Suppose you have a pre-existing medical condition that requires routine check-ups. In that case, you’ll need to prepare for these expenses, as they are unlikely to be covered by your Visitor Insurance Policy. At Canadian LIC, we often help clients with pre-existing medical conditions understand the limitations of the policies and explore any additional coverage that might be available. Discussing your specific health needs with Visitor Insurance Agents in Canada can provide valuable insights and help you make an informed decision.

In general, Visitor Insurance is not compatible with any other insurance model. However, some individuals pay for an additional private insurance provider from their home country to complement their Visitor Insurance. For instance, in the experience of Canadian LIC, some clients have inquired about purchasing additional private provider insurance to cover the cost of routine care not normally covered under their individual Visitor Insurance Policy. It is best to discuss this with an insurance agent who can help explain how different policies may work together.

Thus, all of these are common questions that answer the visitor’s doubts about their routine check-up, preventive care, and other inclusions using the Visitor Insurance. With this knowledge and collaboration with good insurance agents, you will be better prepared to make decisions for not accumulating undesired expenditures during your stay in Canada.

Sources and Further Reading

- Government of Canada – Health Care in Canada for Visitors

- Overview of healthcare services available to visitors in Canada, including what’s typically covered by insurance.

- Government of Canada Website

- Canadian Life and Health Insurance Association (CLHIA) – Travel Insurance Guidelines

- Detailed information on what travel and Visitor Insurance Policies usually cover, including exclusions.

- CLHIA Website

- Canadian Visitor Insurance Providers

- Comparative insights into different Visitor Insurance Policies available in Canada, focusing on coverage options and exclusions.

- Visitor Insurance Comparison

- Ontario Health Insurance Plan (OHIP) – Coverage for Non-Residents

- Details on what non-residents, including visitors, can expect in terms of healthcare coverage in Ontario.

- OHIP Website

These sources provide a deeper understanding of Visitor Insurance Policies in Canada, helping you make informed decisions about your healthcare needs during your visit.

Key Takeaways

- Routine Check-Ups Not Covered: Most Visitor Insurance Policies in Canada do not cover routine check-ups or preventive care. These services are typically out-of-pocket expenses.

- Focus on Emergencies: Visitor Insurance is designed primarily for emergency medical situations, such as accidents or sudden illnesses, rather than ongoing health maintenance.

- Temporary Coverage: Visitor Insurance is intended for short-term stays, with the expectation that visitors will handle routine healthcare needs before or after their trip.

- Budgeting is Essential: Since routine care isn’t covered, it’s important to budget for these expenses in advance to avoid unexpected financial burdens during your stay.

- Work with Insurance Agents: Collaborating with Visitor Insurance Agents in Canada can help you understand your policy’s limitations and find the best coverage options available.

- Review Policies Carefully: Always review your Visitor Insurance Policy thoroughly to ensure you are aware of what is and isn’t covered, especially regarding routine medical care.

Your Feedback Is Very Important To Us

This questionnaire is designed to gather insights into the challenges Canadians face with Visitor Insurance Policies, particularly regarding routine check-ups and preventive care. Your feedback will help us better understand your needs and work towards improving our services.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]