- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Reviews

Common Inquiries

BASICS

COMMON INQUIRIES

IN THIS ARTICLE

- Can I Use RESP Funds for Apprenticeship Programs?

- Struggling with Choices: Is Apprenticeship the Right Path?

- Eligibility of Apprenticeship Programs

- How RESP Withdrawals Work for Apprenticeships

- How to Maximize RESP Benefits for Apprenticeships

- The Flexibility of RESPs for a Changing Career Landscape

- Choosing the Right RESP Provider

- Conclusion: Why Choose Canadian LIC?

Can I Use RESP Funds for Apprenticeship Programs?

By Harpreet Puri

CEO & Founder

- 11 min read

- October 3rd, 2024

SUMMARY

The blog explains that RESP funds can be used for eligible apprenticeship programs in Canada. It details the criteria for qualifying programs, outlines the withdrawal process and tax rules, and offers tips to maximize RESP benefits. Real-life examples illustrate how families have successfully used their RESP for apprenticeships instead of traditional college or university paths, and the post also provides guidance on choosing the right RESP provider.

Planning for future education as a parent or guardian is overwhelming, to say the least. You may be focused on universities and colleges, but what if your child decides to pursue an apprenticeship instead? Apprentice programs are a fantastic, practical pathway for on-the-job experience and qualifications in all skilled trades. Thus, the relevant question is: Can you use your RESP for apprenticeship programs in Canada? Fortunately, RESP savings don’t have to be put towards only attending college or university. If they qualify, apprenticeship programs can also be paid using RESP savings. Let’s examine this in a bit more detail and see how Canadian LIC is here to help you navigate this process without any ado.

- 11 min read

- October 3rd, 2024

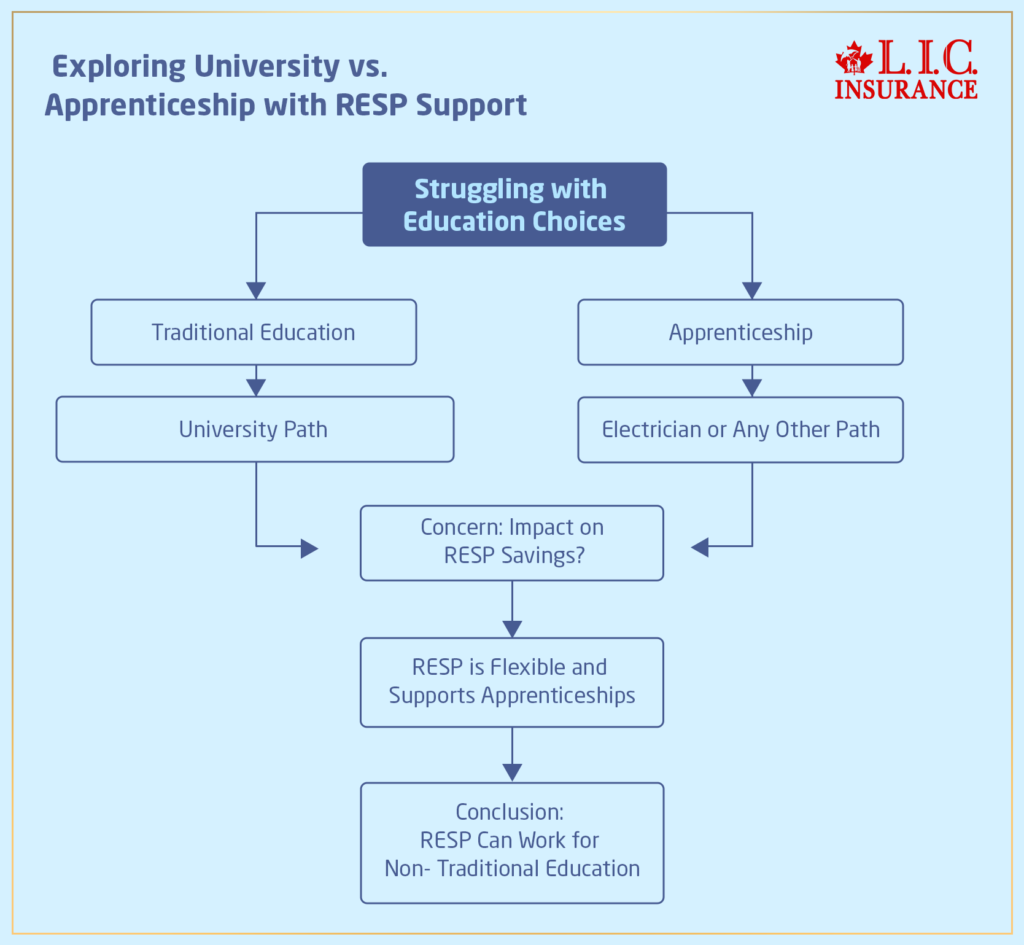

Struggling with Choices: Is Apprenticeship the Right Path?

These days, many students and parents are often confused about whether to go for more traditional routes of education or those that combine hands-on, learning-by-doing approaches through an apprenticeship. We very often meet families at Canadian LIC inquiring how such a choice will impact their educational savings. In fact, one of our clients is Chris. He always imagined that his daughter should go to university. However, she decided to become an electrician. So, is the money invested in RESP worth it? Is it just a waste? Chris did need some reassurance that the savings could work for her choice to pursue alternate education.

The RESP is a very popular savings tool for post-secondary education, and as luck would have it, this plan is quite flexible and can accommodate various types of learning, including eligible apprenticeship programs. Whether or not you’re still looking for a Registered Education Savings Plan Quote or are now already investing, learn how your RESP can work for non-traditional education.

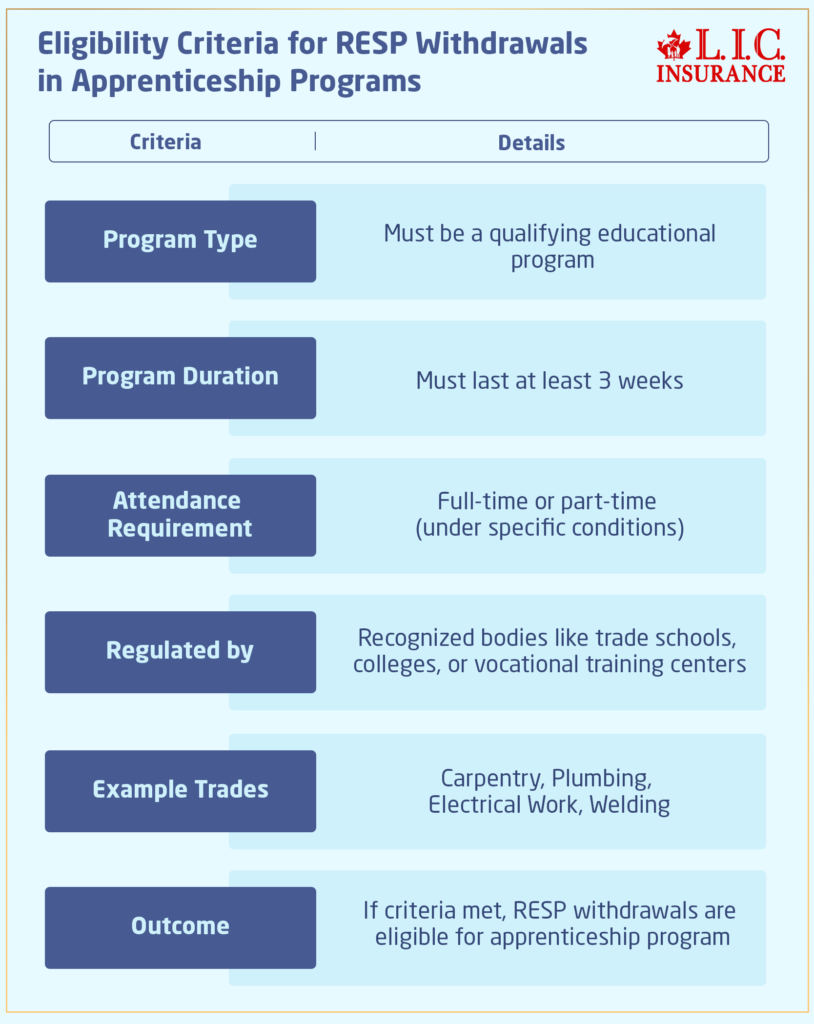

Eligibility of Apprenticeship Programs

One of the most common questions we get at Canadian LIC is: Which apprenticeship programs are eligible for RESP withdrawals? The best way to qualify is if the apprenticeship programs meet the definition of a qualifying program educationally in light of the rules for the RESP. Generally, these programs have to be at least full-time (or part-time under certain conditions) and last at least three weeks.

Qualified programs may include apprenticeships from regulated bodies such as trade schools, colleges, or even centers offering vocational training. For instance, carpentry, plumbing, and electrical work are all trades that come with predefined apprenticeship programs approved by provincial authorities. So, in case your child is enrolled in one of these, you’re well taken care of.

Again, another family that we served was the Larsons, and again, they posed this same very important question. The son in this family wants to be a welder and is planning on going into the trades. They did not know whether their RESP could be used for his apprenticeship. After consulting our office for only a few minutes, we were able to tell them not to worry because the son’s welding program was eligible and, therefore, withdrawable from the son’s RESP was possible. That’s exactly why many families have turned to Canadian LIC, the best insurance brokerage to serve all their RESP needs.

How RESP Withdrawals Work for Apprenticeships

Once you have confirmed that your child’s apprenticeship program is eligible, the process of using RESP funds becomes straightforward. Your RESP withdrawals are divided into two kinds: contributions (money you have deposited) and government grants or earnings such as the CESG.

- Contributions: These funds are withdrawn tax-free, as they were made using after-tax dollars.

- Earnings and Government Grants (Educational Assistance Payments or EAPs): These withdrawals are taxable in the hands of the student, who typically has little to no income, meaning they may owe little to no tax on these amounts.

Another example is another Canadian LIC client, Dana. This past year, she began an apprenticeship in plumbing. Dana’s parents had been saving in an RESP for her education since she was a toddler. Working with us, they were able to efficiently withdraw from the RESP to cover her tuition and related costs of this apprenticeship program. Thanks to their early planning and smart use of the RESP, Dana was able to pursue her dream career without having to worry about hefty tuition bills.

How to Maximize RESP Benefits for Apprenticeships

Strategic planning will help you optimize your RESP towards funding apprenticeship programs. One mistake a parent makes is underutilizing government grants, especially CESG, which might add significantly to your savings.

Here are some ways you might make sure you are getting the most for your money in an RESP.

- Max out the Canada Education Savings Grant (CESG): The government provides up to $7,200 in grants over the life of the RESP. By contributing at least $2,500 annually, you ensure you’re receiving the full 20% matching grant.

- Start Early: The earlier you start saving, the more your RESP funds will grow over time. Even if your child is only a few years away from finishing high school, starting an RESP today can make a huge difference.

- Buy Registered Education Savings Plan Online: You can easily set up an RESP online with the help of trusted Registered Education Savings Plan Providers like Canadian LIC, making it simple to start saving.

We have seen how early planning has benefitted many families at Canadian LIC. For instance, one of our clients started an RESP for their son at the age of five. When he decided to enroll in an apprenticeship program at 18, the RESP had grown significantly with the help of government grants. This gave him a solid financial footing to complete his training without needing student loans. This is the kind of forward-looking financial planning we just love to support families with.

The Flexibility of RESPs for a Changing Career Landscape

As the job market evolves, more young adults are opting for skilled trades and apprenticeships. The COVID-19 pandemic only accelerated this trend, as people sought out stable and in-demand careers that don’t necessarily require a university degree. So, in the case of non-traditional routes to education or employment, families might be concerned that an RESP wouldn’t be as valuable in this regard. That’s simply not true.

One of the attractions of an RESP is flexibility. It can support apprenticeships, vocational, and even part-time programs, provided such programs meet the eligibility criteria for RESP contributions. This means that no matter whether your child decides to be a journeyman carpenter or perhaps an automotive mechanic, savings in your RESP can help get him or her there.

The Thompsons are a Canadian LIC client family whose son wanted to become a machinist. His decision came as a shock to them as he wanted to leave university to pursue being a machinist. However, after meeting with our team and having proper consultation, he told his parents that his program qualified under the RESP rules and that he was able to finance his education using his RESP. So this brought him security with what he had chosen to pursue in his machining studies.

Choosing the Right RESP Provider

Not all RESP providers are the same, and there are differences in those that will be necessary for your family’s needs; if you are looking to just get started on saving, then look for competitive investment options, low fees, and excellent customer service from the provider.

Proud Canadian LIC providers have helped numerous families navigate some of the complexities surrounding RESP withdrawals for apprenticeships, universities, and other institutions. Our hands-on approach ensures that you get the most out of your RESP without unnecessary stress or confusion.

One good example that comes to mind is a single mother who looked overwhelmed at the prospect of running an RESP on her own. We counselled her so she could set up a plan for her child and start taking advantage of government grants like CESG. The client’s son ultimately decided to do an apprenticeship as a mechanic, so again, we assisted him through the withdrawal process to ensure that he had everything he needed to succeed.

Conclusion: Why Choose Canadian LIC?

If you’re still unsure about using RESP funds for an apprenticeship program, you’re not alone. That’s okay – many families we work with at Canadian LIC have that same kind of concern when they wonder whether their RESP will still be worthwhile if their child decides not to pursue a traditional route of post-secondary education. The good news here is that with the right support, RESPs can be flexible, powerful tools to help your child succeed along their specific post-secondary school path.

Suppose you’re looking to get a quote on Registered Education Savings Plans or to understand how withdrawals are processed. In that case, Canadian LIC is here to guide you through every step of the RESP process. Don’t leave your child’s education funding to chance—contact Canadian LIC today to discuss how we can help you make the most out of your RESP for apprenticeship programs and beyond.

More on Registered Education Savings Plan

- Can I Contribute to an RESP After My Child Turns 18?

- How Much Are RESP Maintenance Fees in Canada?

- What Is the Impact of Divorce or Separation on an RESP?

- What Are the Differences Between a Family Plan and an Individual Plan RESP?

- What Is the Uptake of RESPs Among Different Communities in Canada?

- What are RESP Rules and Contribution Limits in 2024?

- How Long Can an RESP Remain Open?

- What Happens If I Miss Contributing to an RESP for a Year?

- Can I Open an RESP for a Child Who Is Not My Own?

- Can RESP Be Used for Rent?

- What Are the Disadvantages of RESP?

- What Expenses Are Eligible for RESP in Canada?

- What Is The RESP Limit In Canada?

- How Do I Withdraw Money from RESP Canada?

- Does a RESP Beneficiary Need to Live in Canada?

- Can I Use My RESP Outside Canada?

- How Do I Check My RESP in Canada?

- What Happens to RESP If You Leave Canada?

- Can You Transfer an RESP to an RRSP?

FAQs: Can I Use RESP Funds for Apprenticeship Programs in Canada?

Yes, you can use your RESP for eligible apprenticeship programs. The program must meet specific criteria, such as being a full-time program and recognized by a provincial or federal authority. At Canadian LIC, we often see clients use their RESP for non-traditional educational paths like apprenticeships, and it’s a great way to fund your child’s career training.

The apprenticeship program must be full-time and last at least three weeks. It should be offered by a recognized financial institution or an accredited program. We regularly help families verify if their child’s program qualifies—this is something we handle day-to-day at Canadian LIC, ensuring our clients make informed decisions

The money you contributed to the RESP is tax-free when you withdraw it. However, government grants and earnings are taxable to the student. Since most apprentices have lower incomes, they usually pay little to no taxes. We often help parents make tax-efficient withdrawals based on their child’s income situation.

Yes, as long as the part-time program qualifies under RESP rules. These programs should meet the minimum duration and be recognized by a government body. At Canadian LIC, we’ve helped many clients use their RESP for part-time programs, ensuring they maximize their savings.

If your child decides not to complete the apprenticeship, the RESP funds can still be used for other eligible post-secondary education. We often advise clients in this situation to transfer the RESP to another program or even to another sibling, if possible.

You can easily buy Registered Education Savings Plan online through trusted providers like Canadian LIC. We guide families through the process, ensuring they choose the best plan for their needs. Many of our clients find this option convenient and easy to manage.

Yes, you can still receive government grants like the Canada Education Savings Grant (CESG) when your child enrolls in an eligible apprenticeship program. We help families track and claim these grants, maximizing their RESP benefits.

You can get a Registered Education Savings Plan Quote from Canadian LIC by contacting our team or visiting our website. We provide detailed quotes, considering your financial goals and your child’s educational plans.

Some RESP providers may charge withdrawal fees, but it varies. At Canadian LIC, we ensure our clients are aware of any potential fees and work with them to minimize costs. It’s important to choose the right provider who offers flexibility and low fees.

When choosing Registered Education Savings Plan Providers, consider fees, flexibility, investment options, and customer service. At Canadian LIC, we offer tailored solutions and personalized service, making us one of the best choices for RESP management.

Yes, you can transfer the RESP to another child, especially in a family plan. We often see families at Canadian LIC transfer RESP funds to siblings if one child chooses not to pursue post-secondary education, ensuring that the savings continue to benefit the family.

You can withdraw enough to cover your child’s tuition and other eligible education-related expenses. At Canadian LIC, we help clients plan their withdrawals carefully so they maximize both government grants and their own contributions.

Yes, it’s easy to buy a Registered Education Savings Plan online through Canadian LIC. We guide our clients through the process to ensure they choose the best options for their family’s needs. This convenience allows families to set up savings plans from the comfort of their homes.

You simply need to provide proof of enrollment in the apprenticeship program. At Canadian LIC, we assist families in submitting the required documents and ensure a smooth process when it’s time to withdraw funds.

Yes, RESP funds can be used to cover living expenses while your child is enrolled in an eligible apprenticeship program. We regularly help families use their RESP funds for both tuition and living costs, making it easier for their children to focus on their training.

You can easily request a Registered Education Savings Plan Quote from Canadian LIC by visiting our website or contacting us directly. We provide personalized quotes based on your financial situation and your child’s educational goals.

Yes, the CESG can still be applied as long as the RESP beneficiary is under 31 years old. We often see families use the CESG to help fund apprenticeship programs, regardless of whether their child initially pursued university or college.

Yes, you can still use your RESP, but government grants such as the CESG are usually only available until the beneficiary is 17. We often help clients with older children use the RESP for vocational or apprenticeship training without missing out on the benefits.

An RESP can stay open for up to 36 years, which gives plenty of time for children to decide on their educational paths. We see this often with clients at Canadian LIC, where children may explore different career paths before settling on an apprenticeship.

You can compare different Registered Education Savings Plan Providers by looking at fees, investment options, and customer service. At Canadian LIC, we offer personalized service, flexible investment options, and low fees to help our clients make the best choice for their family’s future.

These FAQs answer some of the most recurring questions families have when using RESP funds for apprenticeship programs. At Canadian LIC, we frequently help parents navigate these challenges by supporting and guiding them to make the process as smooth and stress-free as possible.

Sources and Further Reading

- Government of Canada – Registered Education Savings Plans (RESPs)

The official Canadian government website provides detailed information on how RESPs work, including eligibility for apprenticeship programs.

Government of Canada RESP Information - Canada Revenue Agency (CRA) – RESP Overview

This resource explains the tax implications, withdrawals, and government grants associated with RESPs.

CRA RESP Overview - Canada Apprenticeship Programs and Incentives

Learn more about eligible apprenticeship programs and government support for trades training.

Canada Apprenticeship Programs - Financial Consumer Agency of Canada (FCAC) – RESP Withdrawals

The FCAC provides guidance on how to withdraw from your RESP, including for apprenticeship programs.

FCAC RESP Withdrawals - Canadian Scholarship Trust (CST) Consultants

A comprehensive resource on managing RESPs and understanding how to apply funds toward post-secondary education.

CST RESP Information

These sources offer additional insights into how RESP funds can be used for apprenticeship programs and provide further information on managing your education savings plan.

Key Takeaways

- RESP funds can be used for apprenticeship programs as long as the program meets eligibility criteria, such as being full-time and recognized by the government.

- Contributions to an RESP are tax-free upon withdrawal, but earnings and government grants may be taxable in the student’s hands, usually at a lower tax rate.

- You can use RESP funds for tuition, living expenses, and other eligible costs related to apprenticeship programs.

- Government grants like the Canada Education Savings Grant (CESG) are still available for eligible apprenticeship programs.

- RESPs offer flexibility—if your child decides not to pursue an apprenticeship, you can transfer the funds to another eligible family member or educational program.

- Canadian LIC helps families manage RESP funds, ensuring they maximize grants, handle tax implications, and make smart withdrawals for apprenticeships.

- You can easily buy a Registered Education Savings Plan online and get a Registered Education Savings Plan Quote from trusted providers like Canadian LIC.

By Pushpinder Puri

CEO & Founder

Your Feedback Is Very Important To Us

We would love to hear your thoughts on using RESP funds for apprenticeship programs. Your feedback will help us understand the challenges families face and improve our services to better assist you.

Thank you for your feedback! Your insights help us improve our services and provide better support for Canadian families using RESP funds for apprenticeship programs.

IN THIS ARTICLE

- Can I Use RESP Funds for Apprenticeship Programs?

- Struggling with Choices: Is Apprenticeship the Right Path?

- Eligibility of Apprenticeship Programs

- How RESP Withdrawals Work for Apprenticeships

- How to Maximize RESP Benefits for Apprenticeships

- The Flexibility of RESPs for a Changing Career Landscape

- Choosing the Right RESP Provider

- Conclusion: Why Choose Canadian LIC?