- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Reviews

Common Inquiries

- Does Critical Illness Insurance Cover Diabetes?

- Can You Claim Twice for Critical Illness Coverage?

- Does Critical Illness Insurance Cover Broken Bones?

- Can I Cancel My Critical Illness Insurance?

- What Cancers Are Not Covered by Critical Illness Insurance?

- Does Critical Illness Insurance Cover Heart Failure?

- Does Critical Illness Insurance Cover Death?

Can I Use Critical Illness Insurance to Cover Mortgage Payments?

SUMMARY

You can name multiple beneficiaries for your whole life insurance policy, which means you have flexibility in how you distribute your death benefit. You could assign specific percentages to a group of family members, a charitable cause, or even close friends. Understanding the distinction between primary and contingent beneficiaries ensures your desires are fulfilled if life circumstances change.

We at Canadian LIC have guided our clients to overcome such frequent apprehensions as to how the benefits should be divided fairly between children, including non-traditional beneficiaries, or a portion left for charitable organizations. Whole life insurance policies can be amended in light of changing circumstances of life—be it marriage, births, or changes in financial situations.

The benefits of naming multiple beneficiaries include that it does not increase whole life insurance premiums. It is cost-effective in ensuring that all loved ones are cared for. Legal considerations, such as appointing trustees for minors, are also critical.

Canadian LIC works closely with their clients to customize whole life insurance policies to ensure your wishes are met. It also assists in setting up benefits to avoid family conflicts later. Whether it’s for the first time or an updated policy, Canadian LIC takes pride in personalized service, ensuring the future of your loved ones.

You can name multiple beneficiaries for your whole life insurance policy, which means you have flexibility in how you distribute your death benefit. You could assign specific percentages to a group of family members, a charitable cause, or even close friends. Understanding the distinction between primary and contingent beneficiaries ensures your desires are fulfilled if life circumstances change.

We at Canadian LIC have guided our clients to overcome such frequent apprehensions as to how the benefits should be divided fairly between children, including non-traditional beneficiaries, or a portion left for charitable organizations. Whole life insurance policies can be amended in light of changing circumstances of life—be it marriage, births, or changes in financial situations.

The benefits of naming multiple beneficiaries include that it does not increase whole life insurance premiums. It is cost-effective in ensuring that all loved ones are cared for. Legal considerations, such as appointing trustees for minors, are also critical.

Canadian LIC works closely with their clients to customize whole life insurance policies to ensure your wishes are met. It also assists in setting up benefits to avoid family conflicts later. Whether it’s for the first time or an updated policy, Canadian LIC takes pride in personalized service, ensuring the future of your loved ones.

- 11 min read

- September 13th, 2024

By Harpreet Puri

CEO & Founder

- 11 min read

- September 17th, 2024

Introduction

Life can change in a heartbeat. One day, everything is okay, and the next, you or someone close to you has some diagnosis that turns everything around in a moment. It is a scenario many of us fear, but it is a reality for many Canadian families during such times when paying for even the most basic living costs, including the mortgage payment, becomes burdensome. Many have sought an answer to this question: Can a Critical Illness Insurance Policy be of any help? And, yes, indeed, Critical Illness Insurance can become very useful in making sure that you continue to pay off your mortgage while you are recuperating. Let’s dig into how Critical Illness Insurance can secure your financial future and bring peace of mind to handling severe medical conditions.

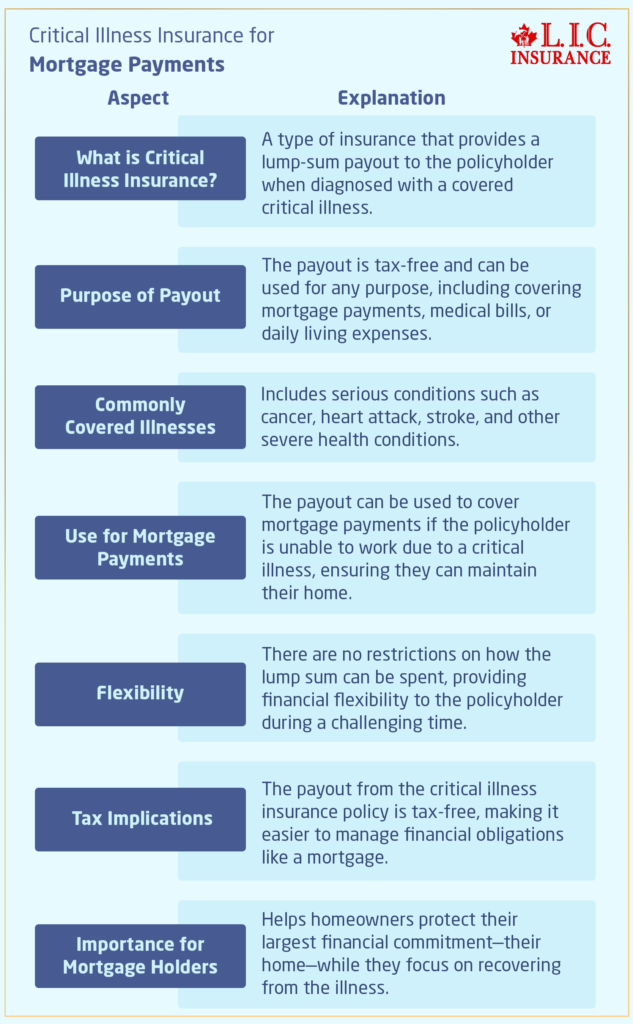

Critical Illness Insurance for Mortgage Payments

But before that, let’s understand what Critical Illness Insurance is and what it covers. Critical Illness Insurance Canada, in basic terms, represents a type of insurance designed to provide the policyholder with a lump sum of money when diagnosed with a critical illness, especially for any of those conditions that are covered. The covered critical illnesses usually involve cancer, heart attack, stroke, and many more severe conditions.

The payout from the Critical Illness Insurance Policy is tax-free and can be used for any purpose- there are no restrictions on how one spends the money. That means if you are diagnosed with a critical illness and need to cover your mortgage payments, this insurance can help.

Struggling with the Financial Burden of Mortgage Payments During Illness

Let us consider an example that we saw at Canadian LIC. Mark and Laura are a young couple who have just bought their dream home. Everything was well with the couple until Mark got diagnosed with cancer. Suddenly, their dual-income household became a single-income household, and on top of the emotional and physical toll, they were faced with a serious financial burden. In the months that passed, mortgage payments, day-to-day living expenses, and medical bills all started piling up, and Laura didn’t know how they were going to manage.

Mark and Laura are certainly not unique in the battle that they are waging. Many Canadians are in the same boat, that is, facing their very own financial problems due to a serious disease that totally handicapped them from generating any income and thus keeping up with mortgage payments. In this context, a critical illness policy saves them the day.

How Critical Illness Insurance Can Help You

One might not think about his or her mortgage payments if he or she falls seriously ill; after all, rather than considering how to maintain those mortgage payments, the patient has genuine reasons to be concerned about getting better. A Critical Illness Insurance Policy, therefore, provides a one-off payout after diagnosis, allowing you to use that money to pay off your mortgage without having to bother with maintaining mortgage payments.

Unlike other insurance products that may only cover specific expenses, Critical Illness Insurance gives you the freedom to decide how you want to use the money. It could be to pay off part or all of your mortgage, cover monthly installments while you’re not able to work, or whatever you need. The financial independence in this kind of situation can be relieving.

The Story of James: A Canadian LIC Client

James is a business owner who is 45 years old and a father of two. A few years back, he had discussed his options with one of our agents at Canadian LIC, and later, he purchased Critical Illness Insurance coverage. He never thought that he would ever need this insurance coverage; however, a few years later, he was hit by a heart attack. He needed to recover for a very long time and was unable to go to work for several months. Therefore, James was afraid his family would not be able to continue making mortgage payments since there would be no income.

Thankfully, his Critical Illness Insurance paid out a sufficient lump sum that was more than enough to pay for several months of mortgage payments and other living expenses. His financial security allowed him to be able to be fully focused on recovery without adding the stress of financial pressure to the equation. James is a case we often hear about in Canadian LIC.

Why Mortgage Protection Matters

Your mortgage is likely to be among the biggest items of any of your monthly expenses. For most Canadians, it is also an investment for the future. In the event that you become incapacitated by a serious illness and lose the ability to repay it, it can have a profoundly long-lasting effect. Missed mortgage payments may lead to foreclosure, and families who lost their homes due to an acute illness have a really tough time bouncing back.

This is why Critical Illness Insurance Quotes are something to consider, especially for people who make such a significant investment, like with a mortgage. A policy can act as a safety net, ensuring that even if you face a severe health issue, your home remains secure. Nobody likes thinking about what would happen when there is a serious illness, but with this kind of insurance policy in hand, it would secure your fortune at the worst of times.

How Much Critical Illness Insurance Coverage Do You Need?

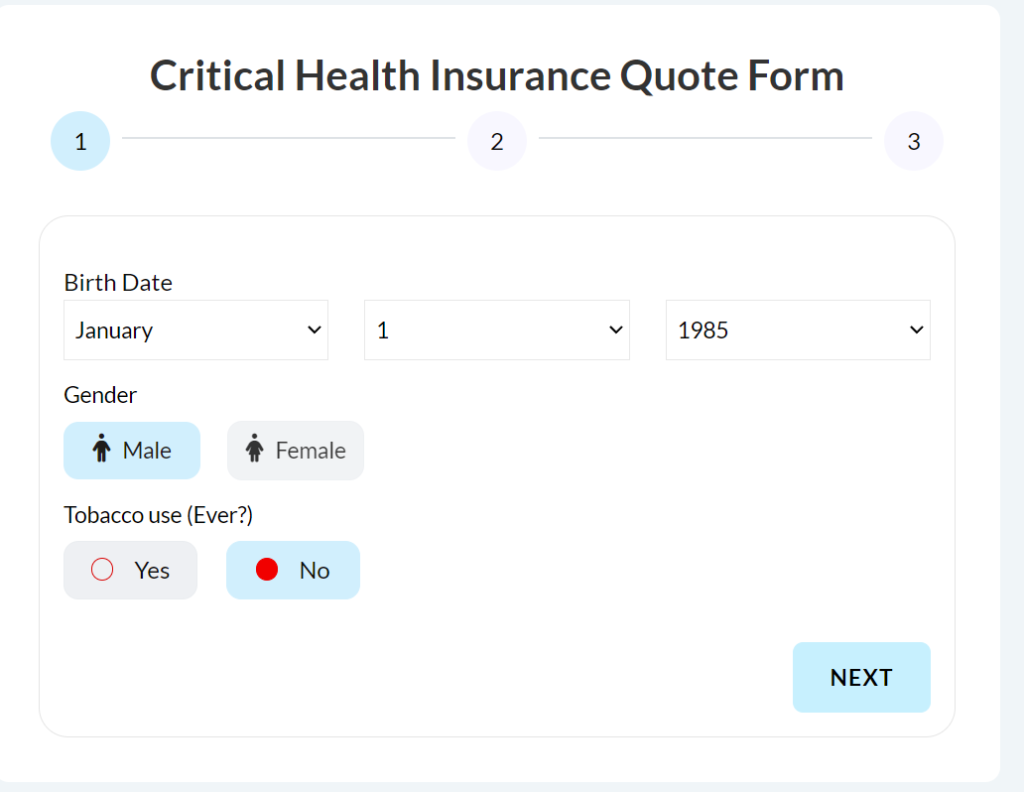

One of the questions we hear a lot at Canadian LIC is, “How much coverage do I need?” The answer depends on your individual financial situation, but if your prime concern in purchasing the coverage is to ensure that your mortgage will be paid off in case of your death, you will want to consider a policy that will provide enough of a payout to cover your mortgage payments for an extended period.

Start by working out what your monthly mortgage repayments would be and how long you would last if you got a serious illness. Do you think you’d need six months’ coverage? A year? More? Once you have an idea of how much you would need to keep your head above water, you can start to get quotes and compare policies for critical illness coverage.

Another thing is that most of the money to be paid for your mortgage might depend on several other expenses that would still be pending. Medical bills, household bills, and day-to-day living expenses might need to be considered in determining how much coverage you need.

What Illnesses Are Covered Under Critical Illness Insurance?

- Cancer

- Heart attack

- Stroke

- Organ transplants

- Multiple sclerosis

- Coronary artery bypass surgery

- Kidney failure

- Parkinson’s disease

Each policy will have specific definitions and exclusions, so reviewing precisely what is covered by way of what illnesses will be included when you compare your quotes for Critical Illness Insurance is important. The point here is to ensure that you are protected against the most likely harm to your health and finances.

Choosing the Right Critical Illness Insurance Policy

Indeed, choosing the best plan is a very time-consuming affair. The staff at Canadian LIC realizes their customers need professional advice while making an intelligent decision on what plan might fit them and their budget the best. Some key considerations in choosing a Critical Illness Insurance Policy include:

- Coverage Amount: Ensure the policy offers enough coverage to meet your financial needs, including your mortgage and other essential expenses.

- Premiums: Your monthly insurance premiums should be affordable and fit within your budget. It’s important to strike a balance between coverage and cost.

- Covered Illnesses: As mentioned earlier, review the list of covered illnesses to ensure that you’re protected against the most common and severe conditions.

- Waiting Period: Many policies have a waiting period before coverage kicks in. Make sure you’re aware of how long you’ll have to wait before you can make a claim.

The Value of Getting Expert Advice

Most individuals are afraid that wading through multiple insurance options is just too complicated to undertake. That’s where the experience of Canadian LIC steps in, given that many of our clients do not know how to get started or what type of insurance best fits their situation. Our experienced brokers take the time to walk through all of their options, including personalized advice for their financial situation and goals. To protect your home and your family’s future, as well as for many other purposes, it is the right insurance coverage that makes all the difference.

The Peace of Mind That Critical Illness Insurance Provides

Having a critical illness mortgage insurance policy really isn’t just about having a financial safety net; it’s more about having peace of mind, knowing that no matter what, your mortgage and the rest of your monthly essentials will be covered in case you suffer a serious illness.

More clients at Canadian LIC tell us that the added security their insurance provides is valueless. For those who have faced the uncertainty of a critical illness without coverage, the financial and emotional stress can be overwhelming. On the other hand, those with Critical Illness Insurance have the freedom to make decisions based on their health rather than their finances.

Taking the Next Step

If you are wondering whether Critical Illness Insurance would benefit you and how it would help pay your mortgages, then this is that time. Getting an insurance policy will let you face what you consider as almost never seen, and no surprise, knowing that your family and your house will be covered.

At Canadian LIC, we stand out as the best insurance brokerage by making sure you’re guided every step of the way toward having the right coverage with expert advice and promising that this is not a difficult process to explore when learning about Critical Illness Insurance Quotes for your protection.

More on Critical Illness Insurance

- What’s the Maximum Payout for Critical Illness Insurance in Canada?

- Can I purchase Critical Illness Insurance if I am already retired?

- What Happens If I Never Claim My Critical Illness Insurance?

- Does Critical Illness Insurance Cover Diabetes?

- How Does Inflation Affect My Critical Illness Insurance Coverage?

- Can I Switch Critical Illness Insurance Providers?

- Can I Purchase Critical Illness Insurance for My Children?

- Does Critical Illness Insurance Cover Broken Bones?

- Can I Cancel My Critical Illness Insurance?

- What is a Critical Illness Insurance Claim?

- What Cancers Are Not Covered by Critical Illness Insurance?

- Does Critical Illness Insurance Cover Heart Failure?

- Does Critical Illness Insurance Cover Death?

- What Age Should You Get Critical Illness Cover?

- What is the Difference between Life Insurance and Critical Illness Insurance?

- All About The Critical Illness Insurance Policy & The Benefits of Critical Illness Insurance

- Why is Critical Illness Insurance Coverage Important? And Do We Need It?

FAQs: Can I Use Critical Illness Insurance to Cover Mortgage Payments?

Yes, you can. When you are diagnosed with a covered illness, the Critical Illness Insurance Policy provides a lump-sum payment that you can use for any purpose, including covering your mortgage payments.

The amount depends on the coverage amount you choose when purchasing the policy. Many of our clients at Canadian LIC select Critical Illness Insurance plans that equal or exceed their mortgage to ensure they are fully protected.

Common illnesses covered by Critical Illness Insurance Canada include cancer, heart attack, stroke, and organ transplants, among others. It’s important to review the specific list of covered illnesses in your policy, as it can vary by provider.

Getting Critical Illness Insurance Quotes that cover your mortgage is simple. You can work with an insurance broker, like those at Canadian LIC, who can provide quotes based on your mortgage size and financial needs.

Once you are diagnosed with a covered critical illness and your claim is approved, the critical insurance company provides a lump-sum payout. You can use this payout immediately to cover regular mortgage payments or other expenses.

No, there is no extra charge for updating your beneficiaries. At Canadian LIC, we see clients regularly update their policies due to changes in family or financial situations. You can make these changes whenever needed, and it doesn’t affect your Whole Life Insurance Premiums.

The critical life coverage limit depends on the policy you choose. Some people opt for a Critical Illness Insurance Policy that only covers their Canadian mortgage, while others select a higher amount to cover additional expenses like medical bills and living costs.

No, you don’t. The payout is yours to use as you see fit. Some clients at Canadian LIC use a portion of the money for their mortgage and the rest for medical bills, household expenses, or even savings for the future.

Yes, you can apply for Critical Illness Insurance in Canada whether or not you already have a mortgage. Many people get insurance after taking out a mortgage to ensure they have financial protection in case of serious illness.

When selecting a Critical Illness Insurance Policy, make sure the coverage amount meets your mortgage needs. At Canadian LIC, we help our clients choose policies that match their financial situation, ensuring they can cover their mortgage payments and other essential costs.

You are not required to use the payout for your mortgage. Many clients at Canadian LIC choose to use the funds for other pressing needs like healthcare or home modifications, while others use it to cover daily living expenses during recovery.

Critical Illness Insurance gives you a lump sum payout that you can use for any purpose, including paying off your mortgage. In contrast, mortgage insurance only covers your mortgage and pays directly to the lender. With Critical Illness Insurance, you have more flexibility in how you use the funds.

First, calculate your mortgage balance and monthly payments. Then, consider how long you would need to cover those payments if you were diagnosed with a critical illness. Canadian LIC’s brokers can help you find the right Critical Illness Insurance Quotes to meet your needs.

Yes, many people add a Critical Illness Insurance Policy as a rider to their life insurance. This can provide additional coverage for your mortgage, giving you the protection you need in case of illness.

Most policies do not cover pre-existing conditions. It’s important to disclose your health history when applying for a Critical Illness Insurance Policy. If you’re unsure about coverage, Canadian LIC can help you find the right policy for your situation.

These FAQs address some of the most common concerns around using Critical Illness Insurance to cover mortgage payments, helping you make an informed decision and secure your financial future.

These are some of the common questions people have that will clear out all your misunderstandings and misconceptions about naming multiple beneficiaries for your Whole Life Insurance Policy. For further assistance in regard to your policy, Canadian LIC is always ready to guide and advise you through every step of the process.

Sources and Further Reading

- Canada Life: What is Critical Illness Insurance?

This page provides a detailed explanation of how Critical Illness Insurance works in Canada, including covered illnesses and common uses.

www.canadalife.com - Manulife: Critical Illness Insurance Overview

Manulife’s guide on Critical Illness Insurance explains how the policy works and the benefits it offers, including mortgage coverage.

www.manulife.ca - Sun Life Financial: Critical Illness Insurance in Canada

This resource discusses the conditions covered by Critical Illness Insurance and offers tips on choosing the right coverage for your needs.

www.sunlife.ca - Government of Canada: Protecting Your Mortgage

This government page explains various options for protecting your mortgage, including Critical Illness Insurance.

www.canada.ca - Canadian Life and Health Insurance Association (CLHIA): Understanding Critical Illness Insurance

The CLHIA provides an overview of the key aspects of Critical Illness Insurance and its importance for financial security.

www.clhia.ca

These sources offer valuable information on Critical Illness Insurance policies, quotes, and coverage options in Canada, helping readers gain a better understanding of the topic.

Key Takeaways

- Critical Illness Insurance provides a lump-sum payout upon diagnosis of a covered illness, which can be used for mortgage payments or other expenses.

- This insurance offers financial security during challenging times, allowing you to focus on recovery without worrying about losing your home.

- The payout from a Critical Illness Insurance Policy is flexible, meaning you can use it to cover mortgage payments, medical bills, or daily living costs.

- Getting Critical Illness Insurance Quotes tailored to your mortgage needs ensures that your family’s financial future is protected.

- Choosing the right Critical Illness Insurance in Canada is crucial for managing both your health and financial obligations.

By Pushpinder Puri

CEO & Founder

Your Feedback Is Very Important To Us

We would love to hear your feedback to better understand the challenges Canadians face when it comes to using Critical Illness Insurance to cover mortgage payments. Your responses will help us improve our services and offer better solutions.

Thank you for sharing your insights! Your feedback will help us understand the struggles Canadians face and improve our services around Critical Illness Insurance for mortgage protection.

IN THIS ARTICLE

- Can I Use Critical Illness Insurance to Cover Mortgage Payments?

- Critical Illness Insurance for Mortgage Payments

- Struggling with the Financial Burden of Mortgage Payments During Illness

- How Critical Illness Insurance Can Help You

- The Story of James: A Canadian LIC Client

- Why Mortgage Protection Matters

- How Much Critical Illness Insurance Coverage Do You Need?

- What Illnesses Are Covered Under Critical Illness Insurance?

- Choosing the Right Critical Illness Insurance Policy

- The Value of Getting Expert Advice

- The Peace of Mind That Critical Illness Insurance Provides

- Taking the Next Step