Have you ever had that nagging feeling that your current Critical Illness Insurance policy perhaps is not of such great value to your money? Maybe your health or your finances have changed; you’ve become aware of a new policy offering superior coverage or competitive rates. Whatever the reason, you are not the only one asking yourself if it is time to switch your Critical Illness provider. But how do you do it? What mistakes should you watch out for? And most importantly, is it worth all the hassle?

Let us now discuss the steps to switch Critical Illness Insurance providers in Canada, with concerns that crop up, with insights from Canadian LIC, which is probably one of the best insurance brokerages. By the end of this blog, you’ll have a clear understanding of whether switching your Critical Illness Insurance company is the right move for you.

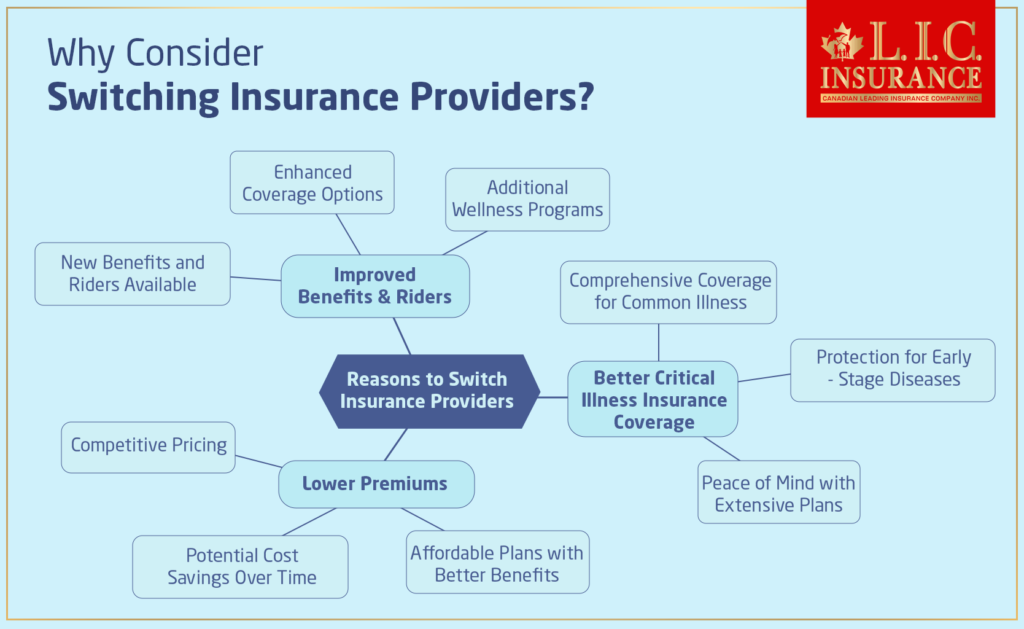

Why Consider Switching Providers?

Better Critical Illness Insurance Coverage

Another important reason people may want to switch to a different provider is to get better coverage. You could find that your current policy either does not provide for the things you are most likely to suffer from or has missed some of the benefits of other critical illness plans. For example, Emily, a Canadian LIC client, discovered how her present policy did not protect against early-stage cancer, a very common medical condition within her family. She consulted with a licensed insurance advisor and found a new plan that provided her with peace of mind, knowing she would have more comprehensive coverage.

Lower Premiums

Another major driving factor is the cost. In due course of time, new plans related to critical illness plan may appear that would offer similar, if not better, coverage at lower premiums than your current policy. You can receive updated Critical Illness Insurance Quotes and compare them with your present policy. Take the case of John, who had been continuing with an expensive policy taken out a decade ago. Comparing the quotes with those of other providers, he found a better price for a plan that suited his needs, saving him hundreds.

Improved Benefits and Riders

Insurers continuously update their products to remain competitive. Hence, a new policy may have certain benefits that may be more advantageous than your current one, like the return of premium riders or coverage against more illnesses. Take the case of another Canadian LIC client, Rita. The original policy only insured her for a few critical conditions. She moved to another insurer that can now provide her with much better coverage, including mental health and wellness programs that augment overall protection.

Steps to Switching Critical Illness Insurance Providers

Assess Your Current Policy

Before making any changes, it’s essential to understand your current policy thoroughly. What illnesses does it cover? What are the exclusions and limitations? How much are you paying in premiums? Analyze the fine print, and if you have any doubts, don’t hesitate to contact your insurance advisor for clarification.

Research and Compare New Policies

Research the many policies that are out in the market for critical illness policy. Many times, Canadian LIC will assist clients in navigating this tricky maze by offering what is called detailed comparisons of various plans. Use online facilities to obtain Critical Illness Insurance Quotes and compare those against your existing policy. Remember to compare things like covered critical illnesses, waiting periods, and survival periods.

Evaluate the Financial Stability of the New Provider

It’s crucial to ensure that the new insurance provider is financially stable and has a good reputation for paying claims. Canadian LIC always suggests that their clients go through the rated insurers and reviews among them for the simple reason that a sound financial company will help in the better and faster processing of claims.

Check for Pre-existing Conditions

An incredibly common problem with changing providers is a pre-existing condition clause. Those are likely to be excluded in new policies or their premium increased. If you have developed any new health issues since the last policy, discuss these with potential new providers to understand how they will impact your coverage.

Seek Professional Advice

Switching Critical Illness Insurance providers can be tricky, and one should consult experts in the field. Canadian LIC’s advisors have provided valued input for thousands of clients so that they get the most assured protection at reasonable rates. They guide you through the intricacies of the different policies and help you steer safe from the various pitfalls that may arise in your decisions.

Stories from Canadian LIC

Mark and His Unexpected Diagnosis

Mark, a 45-year-old engineer from Toronto, had a Critical Illness Insurance policy that he thought was sufficient. However, when he was unexpectedly diagnosed with a rare neurological condition, he realized his policy didn’t cover this illness. After a stressful period of managing his health and finances, Mark reached out to Canadian LIC. With their guidance, he found a new policy that not only covered his condition but also provided a substantial lump-sum benefit. This switch made a significant difference in his ability to manage his medical expenses and focus on recovery.

Linda’s Journey to Affordable Coverage

Linda, a single mother of two, had an old policy with high premiums, which was a strain on her budget. Through Canadian LIC, she discovered several new Critical Illness Insurance Plans offering better coverage at a fraction of the cost. By switching providers, Linda was able to secure a policy that protected her family’s future while saving her money each month.

Raj’s Comprehensive Coverage Upgrade

Raj had a basic Critical Illness Insurance policy through his employer. However, he wanted more comprehensive coverage that included illnesses prevalent in his family history, like diabetes and cardiovascular diseases. Canadian LIC helped Raj find a policy with broader coverage and additional benefits such as wellness programs and regular health check-ups. This upgrade gave Raj confidence that he was adequately protected against a range of potential health issues.

Potential Pitfalls and How to Avoid Them

Overlapping coverage

But you have to make sure there won’t be a gap in your protection while switching providers. One must match the start date of your new policy with the end date of the old one. Never find yourself unprotected for even a second. Canadian LIC can easily walk clients through such transitions to ensure uninterrupted coverage.

Policy Exclusions

New policies can have exclusions your old policy didn’t. Carefully review the terms and conditions to ensure that the new policy does indeed meet your needs and will not leave glaring gaps. Our Canadian LIC advisors are meticulous in their comparisons to avoid these pitfalls for their clients.

Misinterpreting New Words

Insurance terminology can be confusing. Clearly understand the terms of the new policy, which includes covered illness, waiting periods, and other additional riders. Canadian LIC has clear communication regarding helping a client understand every detail of a client’s policy.

How to Make the Switch Smoothly

Request for Multiple Quotes

Never accept the first quote. Request quotes from multiple sources on Critical Illness Insurance and compare their prices and coverage. Canadian LIC provides a platform for its clients to receive and compare quotes from multiple top-rated companies.

Check the Testimonials and Reviews

Check reviews and testimonials of other policyholders. This would give you an idea of the reputation of the insurer in terms of their ease of claims process and customer service.

Canadian LIC is strewn with clippings of client testimonials revealing victorious changes and prosperous outcomes

Negotiate Terms

Sometimes, insurers will bargain out terms or will even send out a promotion for new business. There is a chance to get a better deal if one requests the same thing. For example, Canadian LIC advisors are effective negotiators who are able to secure favourable terms for their clients.

Get a Broker

It’s much easier with a broker that offers these services, such as Canadian LIC. The brokers have a host of policies at their disposal; they may even offer personalized advice according to your needs. They handle most of the paperwork and coordination involved in the switch.

Summary

Switching providers of Critical Illness Insurance in Canada is very daunting, but it’s absolutely worth it to make sure you have the best possible coverage. Whether it be lower premium pricing, improved benefits, or better coverage, it pays to take adequate time reviewing options and making an informed decision.

Canadian LIC, considered to be one of the best brokerages available when talking of insurance, has directed so many people through this process to immense success. Their individual service and expertise make them very good at finding the best solution for all, hence making it an excellent brokerage that one can consider switching to.

It’s not a question of if; it’s a question of when. So be in control and get your Critical Illness Insurance cover right today. Contact the Canadian LIC to review options for updated Critical Illness Insurance Quotes and find a plan that truly suits your needs. Your health deserves nothing but the best, and likewise, your financial security. Get in touch with Canadian LIC now and protect yourself with the best.

More on Critical Illness Insurance

Can I Purchase Critical Illness Insurance For My Children?

Does Critical Illness Insurance Cover Broken Bones?

Can I Cancel My Critical Illness Insurance?

What Is A Critical Illness Insurance Claim?

What Cancers Are Not Covered By Critical Illness Insurance?

Does Critical Illness Insurance Cover Heart Failure?

Does Critical Illness Insurance Cover Death?

What Age Should You Get Critical Illness Cover?

What Is The Difference Between Life Insurance And Critical Illness Insurance?

Why Is Critical Illness Insurance Coverage Important? And Do We Need It?

How Critical Illness Insurance Can Be Your Lifesaver In Canada?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions (FAQs)

Switching Critical Illness Cover Providers can bring improved benefits and lower premiums for better Critical Illness Insurance Coverage. Our client, for example, at Canadian LIC, was able to switch over to a policy that covers early-stage cancer, which wasn’t covered under her previous policy. Comparing quotes provided by various providers in Critical Illness Insurance will help you find the most appropriate plan for your needs and budget.

Evaluate your current policy by checking the list of covered illnesses, premium costs, and exclusions. If you find that it either represents an outdated form of coverage or the premium has grown expensive, then it is probably time to start shopping for new Critical Illness Insurance Plans. Another client named John realized overpayment in his decade-old policy and switched to one with a similar cover but at an affordable cost.

While comparing new plans, the list of covered condition, waiting periods, survival periods, and some additional benefits, such as premium return riders, should be kept on board. For example, Sona made the most of a chance for better coverage by switching to a plan that catered more toward her wellness programs, including mental support. Critical Illness Insurance Quotes will help you to compare the cost of the plans better.

Yes, but be aware that new policies might exclude pre-existing conditions or charge higher premiums. Canadian LIC advisors can help you navigate this by finding plans that would give you the best possible Critical Illness Insurance Coverage despite pre-existing conditions. Raj, for example, was able to find another policy covering his diabetes and cardiovascular risks.

Ensure the new policy’s effective date is on the expiration date of your old policy. Canadian LIC coordinates these transitions for its clients. Mark, a client who needed immediate coverage for a newly diagnosed condition, benefited from their seamless coordination between old and new policies.

Yes, premiums may indeed vary based on the new provider’s rates and your current health status. Linda found a new policy through Canadian LIC that offered better coverage at a lower cost, significantly easing her financial burden. Always compare Critical Illness Insurance Quotes from various providers to find the best deal.

Check the rating of the new provider for its financial stability and reputation. Find out the ratings, reviews, and testimonials of other policyholders. Canadian LIC helps clients by recommending only top-rated insurers with proven reliability. For example, Raj found peace of mind by knowing that his new insurer was highly rated.

It can certainly be easier to deal with a broker like Canadian LIC. They have many different, important illness insurance plans at their disposal and can offer personal advice in this regard. They arrange the paperwork and make the transaction smooth. Both Linda and Mark were duly guided and supported by Canadian LIC.

Don’t be afraid to ask for better terms or discounts. Canadian LIC advisors are good negotiators, and quite often, they get very favourable terms for their clients. You will be in a better negotiating position to obtain a better deal by comparing many different Critical Illness Insurance Quotes.

Multiple quotes can give you a feel for the cost and what is covered. You then are able to make an informed decision. Canadian LIC offers its clients a place to obtain and compare quotes on Critical Illness Insurance from several of the top-rated insurance companies in Canada. That is how Linda found a plan that was both more affordable and also covered current potential problems.

Sometimes, it may be preferable to upgrade a currently held policy. Talk to your provider or broker about whether this is an option for you in your situation. Canadian LIC will also be able to help you determine if upgrading or switching will work best for you based on your specific needs.

First, contact your old provider to understand their process of cancellation. Make sure that the new policy is in effect before cancelling the old one. Canadian LIC guides and helps clients through this process to make it smooth. Raj effortlessly cancelled his old policy after securing a better one with Canadian LIC’s help.

Check for the cancellation terms, fees, or penalties involved in your current policy. Advisors at Canadian LIC can help you through all these terms and conditions your way, making the process hassle-free with minimal costs.

Go through the terms and conditions of a new policy in detail. Moreover, Canadian LIC advisers draw full comparisons and explain each and every feature of your new coverage to you. It was, for example, ensured on Emily’s behalf that her new policy covers the early stages of cancer to provide her with complete protection.

An insurance broker—like Canadian LIC—will help guide you through the headaches involved in changing providers. They provide access to various Critical Illness Insurance Plans, advise on which one to consider for your needs, take care of the paperwork, and make this transition seamless. Both Linda and Mark benefited from using a broker to change their policies.

Yes, but that may impact your premiums and options to quite a good extent. Talk about your situation with Canadian LIC. They will know what to do regarding the best approach for you. Mark had a recent diagnosis and rather quickly worked with Canadian LIC to find another provider who could take him on board with his condition.

Seek professional advice. Canadian LIC advisors can help assess your current policy and the new options available; they will provide a comprehensive comparison of Critical Illness Insurance Quotes. By consulting experts, you can make a highly informed decision that best fits your needs.

It’s always good to review your coverage either yearly or at events such as getting married, having a baby, or changing your health status. At Canadian LIC, we believe in encouraging clients to reassess their needs regularly. For example, when Lina expanded her family, she reviewed her policy and ensured she was well-covered in terms of protection for the growing family.

One can enhance their policy by availing riders through many available insurance providers, and it may include the return of premium, waiver of disability, or child coverage. On Sana’s request, Canadian LIC helped in wellness riders regarding her new policy, including regular health check-ups and mental health support.

Be sure to provide full, honest information about your health, lifestyle, and family medical history if you want to receive accurate quotes. Our Canadian LIC advisors will help the client fill in insurance application forms correctly so that they get the exact Critical Illness Insurance Quotes. The case of Raj was an example of how honest disclosure returned a realistic premium that was manageable for his new policy.

In case you need to claim soon after switching providers, you should ensure that your new policy’s waiting period has passed. So, in this case, Mark made the new policy active and waited for it to pass the waiting period before cancelling the old one so that he might not miss out on Critical Illness Insurance protection even for a single day.

Older people may have to pay higher premiums with tighter underwriting. A comparison of policies is, therefore, essential. Canadian LIC has assisted many clients like John, even those in their older age, in getting very affordable and comprehensive Critical Illness Insurance Plans.

Changing providers in the middle of treatment is very difficult. Most new policies will not cover treatments begun for conditions diagnosed before the policy is effective. Canadian LIC advisors can help you understand options, but most of the time, it is best to stay with the coverage you have until your treatment is complete.

A knowledgeable broker like Canadian LIC will help you compare different Critical Illness Insurance Plans in relation to their features and inclusions, the sum assured, additional coverage available at added premiums, and other such relevant factors. They help in tailoring a policy suited to your health history, budget, and future needs. She could get the best coverage for herself and the children only with the close help of advisors at Canadian LIC.

Ask about the list of covered illnesses, waiting periods, survival periods, premium costs, and any exclusions. Canadian LIC recommends cl

Yes, having a group plan can affect your individual coverage needs. It’s essential to compare both and see how they complement each other. Raj, who had basic coverage through his employer, added an individual plan to ensure comprehensive Critical Illness Insurance Coverage.

One can enhance their policy by availing riders through many available insurance providers, and it may include the return of premium, waiver of disability, or child coverage. On Sana’s request, Canadian LIC helped in wellness riders regarding her new policy, including regular health check-ups and mental health support.

Certain occupations might carry higher risks and, thus, higher premiums. Be honest about your job when seeking quotes. Canadian LIC helped Raj, a construction worker, find a plan that provided comprehensive coverage at a reasonable premium despite his high-risk job.

Generally, the benefits from a Critical Illness Insurance Plan are not taxable if premiums are paid with after-tax dollars. However, always check with a tax professional. Canadian LIC advisors often guide clients on these nuances to ensure they are fully informed.

Lifestyle changes such as quitting smoking, losing weight, or improving overall health can positively impact your premiums and coverage options. Liza, who quit smoking, was able to switch to a new policy with significantly lower premiums due to her healthier lifestyle.

Many insurers offer discounts for annual premium payments. Discuss payment options with your provider. Canadian LIC helped Sarah secure a discount on her premiums by choosing an annual payment plan.

Ensure that your new policy provides adequate coverage for your dependents. Canadian LIC helped Lara find a policy that included her children, providing comprehensive protection for her entire family.

You’ll typically need your current policy details, medical records, and personal identification. Canadian LIC advisors assist clients like Ram with gathering and submitting all necessary documentation for a smooth transition.

Most insurers do not allow pausing policies, but you can overlap your coverage to ensure there is no gap. Canadian LIC ensures clients like Mark have continuous coverage during the switch by coordinating the dates carefully.

Policies vary, but some plans offer coverage for a broader range of illnesses, including rare diseases. Canadian LIC helped Samaira find a policy that included coverage for less common conditions, giving her comprehensive protection.

Refund policies vary by insurer. Check your policy terms or ask your provider about their refund policy. Canadian LIC advisors can help you understand these terms before you cancel your old policy.

Switching Critical Illness Insurance providers may sound a bit challenging, but with proper guidance and support, better coverage and significant savings await you. Canadian LIC boasts expertise in tailoring policies to their customers’ best interests. Contact them today and discover how they can best protect your needs for adequate Critical Illness Insurance Coverage.

Sources and Further Reading

Canadian Life and Health Insurance Association (CLHIA)

Understanding Critical Illness Insurance

Offers comprehensive information on what Critical Illness Insurance covers, how it works, and why it’s important.

Government of Canada – Financial Consumer Agency of Canada

Provides an overview of different types of health insurance, including Critical Illness Insurance.

Insurance Bureau of Canada (IBC)

Explains various health insurance options available to Canadians, including Critical Illness Coverage.

Canadian LIC – The Best Insurance Brokerage

Expert Guidance on Critical Illness Insurance

Detailed articles and client testimonials about navigating Critical Illness Insurance Coverage and switching providers.

Investopedia

Detailed definitions and explanations of Critical Illness Insurance terms and concepts.

Sun Life Financial

Critical Illness Insurance Overview

Information on Critical Illness Insurance Plans, coverage options, and benefits.

Manulife Financial

Critical Illness Insurance Details

Provides insights into the types of Critical Illness Insurance policies available and their benefits.

Globe and Mail

Articles discussing how to choose the right Critical Illness Insurance Plan and what to consider.

Canada Protection Plan

Critical Illness Insurance Explained

Comprehensive guide on understanding Critical Illness Insurance Coverage and making informed decisions.

These sources will provide you with in-depth knowledge and further reading to help you understand and navigate the complexities of Critical Illness Insurance in Canada.

Key Takeaways

- Evaluate your existing policy's coverage, exclusions, and premiums.

- Research new plans for better coverage, lower premiums, and extra benefits.

- Ensure new providers are financially stable and reputable.

- Check how pre-existing conditions might affect new policy terms.

- Coordinate policy dates to avoid any coverage gaps.

- Seek advice from insurance brokers like Canadian LIC.

- Thoroughly understand new policy terms and exclusions

- Negotiate for discounts or better terms with new providers.

- Review your coverage annually or after major life changes.

- Compare multiple quotes to find the best and most cost-effective plan

Your Feedback Is Very Important To Us

We value your feedback and want to understand your experience with switching Critical Illness Insurance providers. Your responses will help us improve our services and better address your needs.

Thank you for taking the time to provide your feedback. Your insights are invaluable in helping us improve our services and better support Canadians in finding the best Critical Illness Insurance Coverage.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]