- Can I purchase a Joint Term Life Insurance Policy or a Whole Life Insurance Policy?

- The Struggles of Choosing the Right Insurance

- What Is a Joint Life Insurance Policy?

- The Pros and Cons: Joint Term Life Insurance vs. Joint Whole Life Insurance

- Real Struggles and Solutions

- Deciding Between Joint Term Life Insurance and Joint Whole Life Insurance

- Why Choose Canadian LIC?

Many Canadians are standing at an important crossroads when it comes to life insurance. Are they going to go with Term Life Insurance or Whole Life Insurance? And if they are thinking about coverage for themselves and their partner, the question gets even more complex: is a joint policy the way to go? These are common concerns that we see with clients at Canadian LIC every day, who weigh their options in order to make sure their loved ones are taken care of while keeping their finances on track.

The Struggles of Choosing the Right Insurance

Let’s face it: life insurance can be complicated. For a lot of couples, the conversation about life insurance starts out with good intentions and rapidly descends into confusion. You may wonder: “Should we get Term Life Insurance that covers us for a specified period, or would Whole Life Insurance be a better long-term investment?” And if you’ve resolved that, the next thing you often hear is the question: “Would it be more appropriate to get separate policies, or should we go for a joint policy?

These are not just ‘what if’ questions. At Canadian LIC, we come across day-in and day-out couples sailing in the same boat. Spoilt for choices and not having an idea where to start and what they really want. Be it newlywed couples wanting to start life on solid grounds, parents securing their children’s future, or older couples planning their retirement-the struggle is real.

So, let’s break it down together. We’ll go over what Joint Term Life Insurance is versus Joint Whole Life, explore the pros and cons of each, and how you might decide which may be right for you.

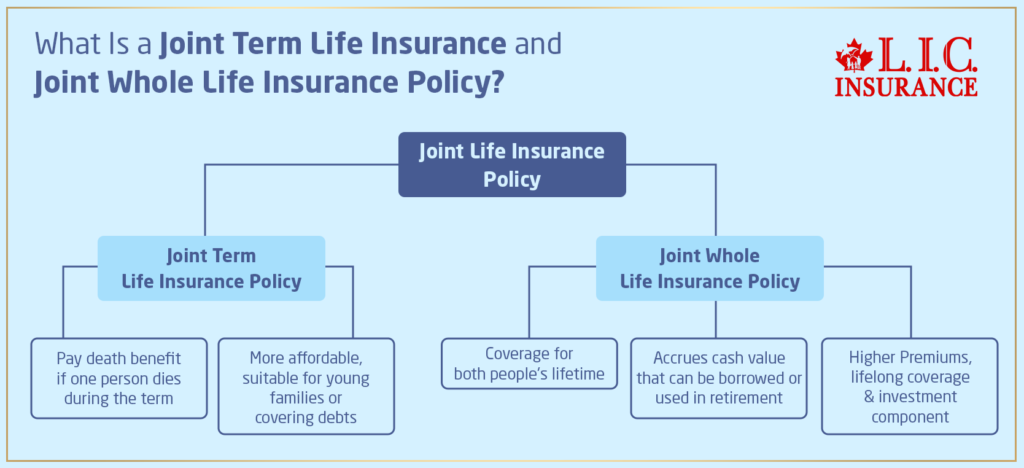

What Is a Joint Life Insurance Policy?

It’s when one policy covers two people, usually a married or common-law couple. In Canada, you could opt for either a Joint Term Life Insurance Policy or a Joint Whole Life Insurance Policy. But what does that really mean for you?

Joint Term Life Insurance Policy

Term Life Insurance Policy covers an individual for a specified period of time, usually 10, 20, 30 or 50 years. A joint policy would pay out the entire death benefit if one of those people covered under the insurance policy dies during the policy term. At the end of the term, your coverage will expire unless you choose to renew it, often for a higher price.

Couples are drawn towards Joint Term Life Insurance due to its affordability. In general, the rate for Term Life Insurance would turn out lower than in whole life, making it reasonable for young families or couples trying to cover their mortgage or other debts in the event of one partner’s sudden death.

Joint Whole Life Insurance Policy

On the contrary, a Joint Whole Life policy covers both people’s lifetimes as long as premiums are paid. It also accrues cash value that you can borrow against or use in retirement, in addition to the death benefit.

A Joint Whole Life Insurance Policy contains the magic of permanence and an investment component that is really attractive. Although premiums are way higher compared to Term Insurance Rates, the policy will provide lifelong coverage, and then the cash value growth will serve as a source of finance in later years.

The Pros and Cons: Joint Term Life Insurance vs. Joint Whole Life Insurance

Now that we have a basic understanding of what Joint Term Life Insurance and Joint Whole Life Insurance Policies entail, let’s delve into the advantages and disadvantages of each.

Advantages of Joint Term Life Insurance

- Affordability: Affordability seems to be one of the major reasons most couples would prefer Joint Term Life Insurance. Term Life Insurance is more affordable than Whole Life Insurance; thus, it has proved to be easier to accommodate in the budget of a young, growing couple.

- Simple and straightforward: Joint Term Life Insurance is simple to learn about and administer yourself. You pay premiums, and in the term, if one partner dies, the policy pays out a death benefit.

- Flexibility: The term length is at your discretion, based on your financial goals. For example, you could take a term that will give you coverage for the length of time your mortgage is taken out.

Disadvantages of Joint Term Life Insurance

- No Cash Value: As with many Term Life Insurances, Joint Term Life Insurance does not build up cash value. Once the term is over, you are left with no coverage unless you renew, often at a higher rate.

- Limited Coverage Period: If both partners outlive the term, then the policy expires, and inexpensive coverage may be difficult to find in later years.

Advantages of Joint Whole Life Insurance

- A lifetime of coverage: If you keep paying the premium, then the Joint Whole Life Insurance Policy will cover you for your whole life. You will have peace of mind, knowing that at whatever time you pass away, your family members are covered.

- Cash Value Accumulation: Over time, your Joint Whole Life Insurance Policy builds up a cash value that can serve as an added pot of money in retirement or whatever the need may be. This feature makes the product more than just insurance; it’s also an investment.

Potential for Dividends: There is a dividend potential wherein some Joint Whole Life Insurance in Canada pays dividends that one can use to lower premiums, increase coverage, or take the money in cash.

Disadvantages of Joint Whole Life Insurance

- Higher premiums: The only drawback to Joint Whole Life Insurance is the expense. The premiums are so much higher compared to Term Life Insurance. Such huge costs can be a burden, especially when someone is young or has other financial obligations.

- Simplicity: A Joint Whole Life Insurance Policy is more complex compared to a Term Life Insurance Policy. It requires a bit more knowledge and due consideration of the cash value aspect and how dividends work.

- One Payout: Just like joint term life, most Joint Whole Life plans pay out only once, upon the first death of the partners. That would leave the remaining partner uncovered unless a new policy was bought or the existing one converted if conversion is an option.

Real Struggles and Solutions

Let’s take a closer look at some of the common scenarios we see with our clients at Canadian LIC.

The Young Couple Building a Future

We often work with young couples who are just starting their journey together. They may have just purchased a home, started a family, or are planning for the future. For these couples, cost is often a major concern. They want to ensure that their mortgage and other debts are covered if something happens to one of them, but they also need to manage their budget.

For many of these clients, a Joint Term Life Insurance Policy is an attractive option. The Term Insurance Rates are lower, making it an affordable way to secure significant coverage during the years when they need it most. They can choose a term that matches the length of their mortgage, ensuring that their home is protected if the worst happens.

The Established Couple Planning for Retirement

On the other end of the spectrum, we have couples who are approaching retirement. They’re looking for ways to ensure they’re financially secure in their later years and want to leave something behind for their children or grandchildren. These clients often have a bit more disposable income and are interested in the investment component of life insurance.

For these clients, a Joint Whole Life Insurance Policy might be the better choice. While the premiums are higher, the policy’s cash value growth can serve as an additional financial resource in retirement. Plus, they like the idea of having lifelong coverage, knowing that their loved ones will receive a death benefit no matter when they pass away.

The Blended Family with Complicated Needs

We also see clients who have more complex family situations, such as blended families where both partners have children from previous relationships. These clients often struggle with how to ensure that all their loved ones are taken care of, especially if one partner passes away before the other.

For these families, the decision between a Joint Term Life Insurance Policy and a Joint Whole Life Insurance Policy can be particularly challenging. They need to consider not only their financial needs but also the potential impact on their family dynamics. In some cases, separate policies might make more sense, allowing each partner to tailor their coverage to their specific needs.

Deciding Between Joint Term Life Insurance and Joint Whole Life Insurance

So, how can you choose between the different types of joint life insurance policies available? Here are a few questions to point you in the right direction:

- What do you want to achieve financially from the cover? If you aim to cover a particular debt, such as your mortgage, then a Joint Term Life Insurance may be ideal. In case you need lifelong coverage and the accumulation of cash value, you are covered by a Joint Whole Life Insurance Policy.

- How much is your budget? Term Insurance Rates are relatively cheaper compared to Whole Life Insurance rates. If cost is the problem, a Joint Term Life Insurance Policy may be more affordable. On the other hand, if you have the ability to pay for more expensive premiums, the benefits of a Joint Whole Life Insurance Policy would be worth investing in.

- How long do you need coverage? If you only need coverage for a specific period of time, such as the duration of your mortgage, Joint Term Life Insurance might be the right choice. On the other hand, if you want lifelong coverage, then you need to look at a Joint Whole Life Insurance Policy.

- Are you interested in an investment component? If you like the idea of building cash value to utilize later in life, then a Joint Whole Life Insurance Policy is your route. If you’re more interested in straightforward coverage, a Joint Term Life Insurance Policy is simpler and cheaper for those purposes.

- What are the needs of your family? Imagine one partner dying before the other. If you have children or other dependents, ask yourself whether a single payout will be enough or whether you may need more cover in years to come.

Why Choose Canadian LIC?

Life insurance can be the toughest thing to decide on, but you absolutely do not have to go through it alone. Canadian LIC understands your challenges and is set to take you through every step. Our committed team of brokers will find the right solution for your needs, whether that be a Joint Term Life Insurance Policy, a Joint Whole Life Insurance Policy, or something entirely different.

We believe that life insurance is not just a financial product but a commitment towards the future of one’s family. We are dedicated to assisting you in making an optimal choice for yourself.

Whether you’re just getting started or looking to update your existing coverage, take the time to let Canadian LIC guide you in your search. Contact our team today to explore options and compare rates for life insurance so that you can find the perfect policy for you.

In the end, the decision between Joint Term Life Insurance and Joint Whole Life Insurance comes down to financial goals, budget, and coverage needs for Canadians. Each has its strengths and weaknesses, and what might work for one couple may not be as effective or appropriate for another. However, careful consideration and good guidance may lead you to get a policy that protects and gives peace to one’s mind for oneself and one’s loved ones.

More on Term Life Insurance and Whole Life Insurance

- Best Term Life Insurance Companies in Canada (2024)

- Can Both Husband and Wife Get Term Life Insurance?

- Underwriting in Term Life Insurance

- Changing Beneficiaries on My Canadian Term Life Policy

- What Does Term Insurance Cover and Not Cover?

- At What Age Should You Stop Purchasing Term Life Insurance?

- The advantages of Short-Term Life Insurance

- Whole Life Or Term Life Insurance- Which Is Better

- How To Buy Term Life Insurance?

- The Main Disadvantage of Term Life Insurance

- Term Insurance Rates Going Up

- How Do You Choose Term Life Insurance Policies?

- The Longest Term Life Insurance You Can Get

- Getting Money Back from Term Life Insurance

- Cashing Out a Term Life Insurance Policy

- How Can You Use Whole Life Insurance to Create Wealth?

- Taking a Loan from Whole Life Insurance Policy

- Is The Cash Value of My Whole Life Policy Decreasing?

- Understand Paid-Up Additions in Whole Life Insurance

- Circumstances Under Which the Death Benefit of Whole Life Insurance Would Not Be Paid?

- Impact of Smoking on Whole Life Insurance Premiums

- Adjusting My Whole Life Insurance Policy

- Finding the Best Whole Life Insurance Without a Medical Exam

- Age At Which Whole Life Insurance End

- The 2 Disadvantages of Whole Life Insurance

- Which Is Better, Whole Life Policy Or Term Life Insurance?

- Number Of Years You Pay on a Whole Life Policy

- The Age At Which Whole Life Insurance Good

- Buying Whole Life Insurance for My Child

- Opting for Whole Life Insurance

- Are Whole Life Insurance Policies Expensive?

- Difference Between Money Back Policies and a Whole Life Policies

- Converting Universal Life Policies to Whole Life Policies

- A Comprehensive Guide on How Does a Whole Life Insurance Policy Work

- The Biggest Risk for Whole Life Insurance in Canada

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions about Joint Term Life Insurance and Whole Life Insurance in Canada

Yes, you can purchase a Joint Term Life Insurance Policy in Canada. A joint policy will provide life insurance on the life of two individuals under one policy, often more economically than purchasing two single policies. Quite regularly at Canadian LIC, we assist couples looking for more affordable options to protect their family during those critical years of a mortgage or raising children.

Term Life Insurance coverage is less expensive to purchase as part of a joint policy than as two separate individual policies. That is because the policy is usually written to pay out only once, always upon the first death of the partner, and then it is settled. What’s important, though, is that once the payout has been made, the policy ends. We often see clients who are drawn to this cost-effective solution, especially when they’re managing other financial commitments.

A joint term would insure both of you for a set period, either 10, 20, 30 or even up to 50 years. At the end of that period, it expires unless you renew the policy, often at a higher rate. As its name implies, a Joint Whole Life Insurance Policy ensures you and your partner for your lifetime and has a cash value component that builds up over time. A large number of clients in Canadian LIC prefer Term Life Insurance as it is fairly economical in nature. On the other hand, there are numerous clients who prefer Whole Life Insurance due to its lifetime coverage and investment aspects.

In a Joint Term Life Insurance, on the death of one partner, the policy pays its death benefit while the coverage closes. If the surviving partner wants life insurance further, he or she has to look for new coverage. We often have to make many clients realize what this means for their long-term financial security.

Most of the time, you have the option to convert your Joint Term Life Insurance Policy to Whole Life, which will not require you to get re-examined by a doctor. Most of our clients at Canadian LIC first take Term Life Insurance because the rates are relatively lower, and then they convert it to their Whole Life Insurance once their financial situation changes.

Yes, in general, Canadian Term Insurance Rates for Joint Whole Life are higher compared to rates for Joint Term Life Insurance. This is because the Whole Life Insurance provides lifelong coverage and accrues cash value. Most clients at Canadian LIC weigh the higher cost of Whole Life Insurance against the long-term benefits, especially when planning retirement or leaving an inheritance.

Whether a Joint Life Insurance Policy is right for your family depends on your financial goals, budget, and coverage needs. If you need a reasonably priced way to provide coverage for a defined period of time, a Joint Term Life Insurance Policy may be the best option for you. If lifelong coverage and the possibility of cash value growth are what you’re after, you should seriously consider buying a Joint Whole Life Insurance Policy instead. At Canadian LIC, we help clients daily to look at their unique situations and make their best decisions.

The major disadvantage of the Joint Term Life Insurance Policy is that it pays out only once; when the first partner dies, coverage ends. This leaves the surviving partner with no coverage unless a new policy is bought. More often than not, many clients come to us out of concern for what happens after payout, and we help them explore their options for continued coverage.

Yes, you can buy a Joint Term Life Insurance Policy if you are unmarried. If you and your partner have a shared financial interest, such as a mortgage or dependents, then you would qualify for a combined life insurance policy or joint policy. At Canadian LIC, we work with many clients who are in a variety of different partnership arrangements and help them find the coverage that works best for them.

Term Life Insurance vs. life insurance in Canada: When it comes to choosing between these two types of policies, there are a few things you should look out for. Your financial goals, budget, and how many years you need the coverage are among some of them. Term Life Insurance insures you for a fixed number of years affordably, whereas Whole Life Insurance ensures your lifetime with guaranteed premiums and growth of cash values over time. At Canadian LIC, many of our clients choose Term Life Insurance for their short-term needs, while when it comes to long-term financial planning, they opt for Whole Life Insurance. We work with the client to find the best option in their particular situation.

In the unlikely event of both spouses dying at the same time, under a Joint Term Life Insurance Policy, the policy pays the death benefit according to its terms. At Canadian LIC, we have seen our share of apprehensive clients who did not quite understand how their policy would respond in the unlikely event of such a situation, and we help explain it.

Yes, most of the time, you can tailor-make a Joint Term Life Insurance Policy with riders or additional features to suit your needs. Examples are adding a critical illness rider or accidental death benefit. At Canadian LIC, we regularly assist our clients in tailoring their policies so that they get exactly what they need.

While a Joint Term Life Insurance Policy might cover only two, you can often add a child rider to the policy for an added cost. This rider would cover your child up until they reached adulthood. We find that here at Canadian LIC, many of our clients add this option when they have growing families.

In general, Term Insurance Rates in Canada are determined by several factors: your age, health, lifestyle, and the term length you choose. For example, smoking impacts greatly on your rate. We at Canadian LIC help clients understand such factors and how they will affect their insurance costs.

Your decision to go with either a Joint Term Life Insurance Policy or two separate policies, again, depends on your financial circumstances and needs. Joint policies are usually much cheaper than buying two separate ones, but they also come with the drawback of less flexibility. We have had numerous clients for whom we guide through the trade-offs of Joint Term Life Insurance Policies versus individual life insurance policies.

When you get a divorce and you have a Joint Term Life Insurance Policy, you will want to discuss what will be done with the policy. Some couples choose to cancel the policy and take out separate coverage, while others may keep the policy in force. At Canadian LIC, we often assist clients who are working through this tough situation to ensure they make an informed decision.

Generally speaking, the death benefit from a Joint Term Life Insurance Policy paid to your beneficiaries is usually considered tax-free in Canada. While this is a common benefit, we always advise our clients to consult with a tax professional to understand the full implications of their specific situation.

Most life insurance companies do allow for such changes, wherein you would be allowed to convert from a Joint Term Life Insurance to a Joint Whole Life Insurance. This kind of flexibility would be what we at Canadian LIC would be talking about with our clients, ones who actually consider getting the more affordable option and upgrading later when times get better in the financial aspects.

Suppose your Joint Term Insurance Rates increase upon renewal. In that case, you can shop around for a new policy, adjust your coverage, or consider converting to a Whole Life Insurance Policy if that option is available. At Canadian LIC, we help clients review their options to ensure they continue to have the best coverage at a price they can afford.

Finding out if a Term Life Insurance joint life policies is right for you will be based on your goals about your finances, coverage needs, and budget. First, consider the length of time you will need coverage if you are seeking an affordable way for a set amount of time. Canadian LIC will help you in all professional manners to determine and find a Term Life Insurance Policy that best fits your needs through our professional services.

These are some of the frequently asked questions that come up when a couple is trying to decide on buying Joint Term Life Insurance versus Whole Life Insurance in Canada. We encourage our clients to ask these questions to us and many others so they feel comfortable with their decisions.

Sources and Further Reading

- Government of Canada – Life Insurance Basics:

Provides an overview of different types of life insurance available in Canada, including Term Life Insurance and Whole Life Insurance.

Visit the Government of Canada’s Website - Insurance Bureau of Canada – Understanding Life Insurance:

Offers insights into the pros and cons of Term Life Insurance vs. Whole Life Insurance and what to consider when choosing a policy.

Read More on the Insurance Bureau of Canada’s Website - Canadian Life and Health Insurance Association (CLHIA):

Provides detailed information on life insurance products and the factors that influence life insurance rates in Canada.

Explore More on the CLHIA’s Website - Financial Consumer Agency of Canada – Comparing Insurance Options:

Helps consumers compare different life insurance options, including the differences between individual and joint policies.

Read the Guide on FCAC’s Website

These sources will provide you with further insights into life insurance in Canada, helping you make informed decisions about your coverage.

Key Takeaways

- Joint Term Life Insurance is more affordable but only covers a specific period, paying out when the first partner dies.

- Joint Whole Life Insurance offers lifelong coverage and builds cash value, making it ideal for long-term financial planning and estate protection.

- Individual policies provide flexibility but may be more expensive if purchased separately for both partners.

- Consider your financial goals and budget to determine whether a joint or individual policy, and whether term or Whole Life Insurance, is right for you.

- Consult with an insurance broker to understand your options and choose the best policy for your unique situation.

Your Feedback Is Very Important To Us

We want to understand your experience and challenges in purchasing a Joint Term Life Insurance Policy or a Whole Life Insurance Policy in Canada. Your feedback will help us improve our services and provide better support to Canadians like you.

Thank you for taking the time to share your experiences. Your feedback is invaluable in helping us understand the challenges Canadians face with changing mortgage rates and how we can better assist you.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]